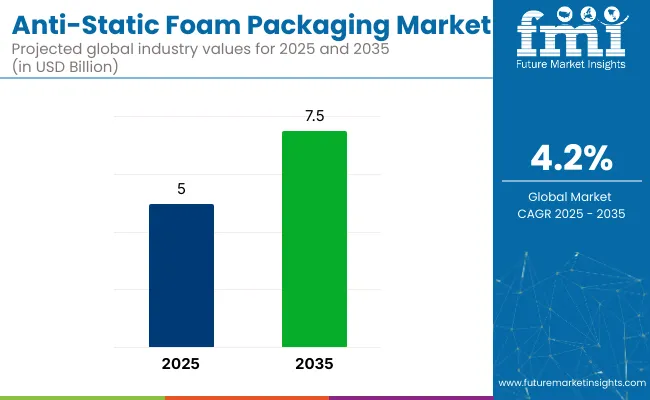

The global anti-static foam packaging market is projected to grow from USD 5.0 billion in 2025 to USD 7.5 billion by 2035, registering a CAGR of 4.2% during the forecast period. Sales in 2024 were recorded at USD 4.3 billion.

| Attributes | Description |

|---|---|

| Estimated Market Size (2025E) | USD 5.0 billion |

| Projected Market Value (2035F) | USD 7.5 billion |

| Value-based CAGR (2025 to 2035) | 4.2% |

This growth is primarily driven by the expanding consumer electronics industry and the rising need for ESD-safe packaging solutions in logistics and semiconductor sectors. Anti-static foam, typically made from polyethylene or polyurethane, protects delicate electronics from damage caused by electrostatic discharge during transit or assembly. The market is also benefitting from broader demand in medical device packaging, automotive electronics, and aerospace components.

In February 2024, Pregis, a global protective packaging leader, introduced a new certified-circular polyethylene (PE) foam solution in collaboration with ExxonMobil. The foam is manufactured at ISCC PLUS-certified facilities in Kentucky and California and is aimed at helping brands meet circularity goals. Additionally, in its 2024 Sustainability Report, Kevin Baudhuin, CEO of Pregis, stated: “In 2024, we made progress that matters.

The engine behind this momentum is our people. Their creativity, passion, and persistence power every milestone. In 2024 alone, our teams helped achieve measurable reductions in carbon emissions, diverted more waste from landfills, and scaled production of circular materials. Recent innovations in the market include recyclable pink anti-static foam and conductive foam variants designed for circuit boards and server components.

Smart traceability features such as printed QR codes and batch-specific conductivity metrics are being integrated to meet OEM and compliance requirements.The Asia-Pacific region is expected to remain dominant due to its strong semiconductor manufacturing base in China, Taiwan, and South Korea. Companies are expected to focus on automation, lightweight foams, and regulatory-compliant packaging materials to meet evolving global standards and ESG benchmarks.

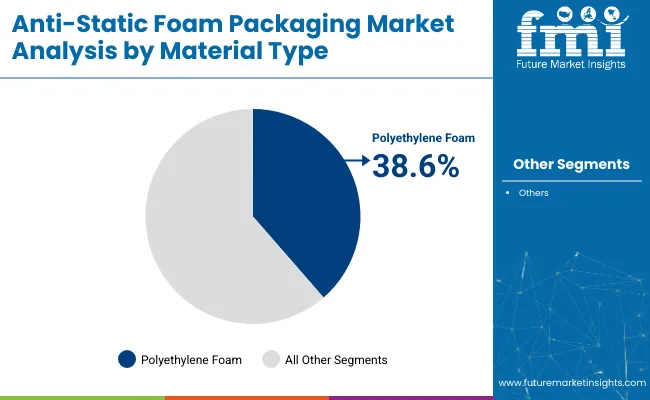

The market has been segmented based on material type, packaging type, end use industry, density, and region. By material type, polyethylene foam, polyurethane foam, polystyrene foam, and polyvinyl chloride foam are utilized for their cushioning properties, electrostatic discharge protection, and compatibility with sensitive components.

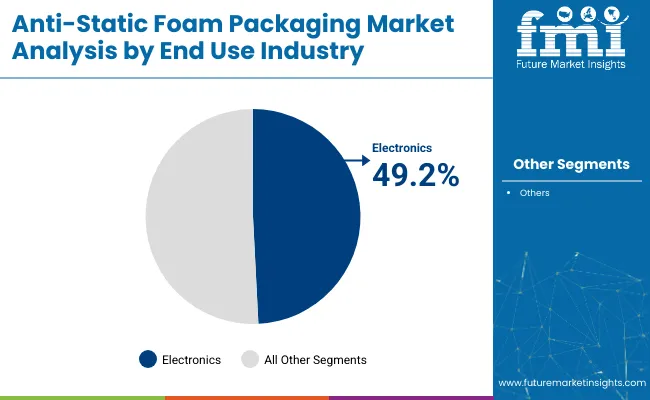

Packaging formats such as bags, trays, sheets, and rolls have been adopted to suit a range of protective applications in storage, shipping, and display. End use industries include electronics, aerospace, automotive, medical, and consumer goods, reflecting increasing demand for static-sensitive packaging in high-value product categories.

Density-based segmentation low, medium, and high addresses performance requirements related to impact resistance, compressibility, and material strength. Regional segmentation covers North America, Europe, South America, Asia Pacific, and the Middle East & Africa to capture variations in electronics manufacturing hubs, export-oriented industries, and packaging innovation ecosystems.

The polyethylene foam segment is expected to capture the highest share of 38.6% in the anti-static foam packaging market by 2025, primarily due to its lightweight nature, strong cushioning ability, and broad applicability across sensitive electronic and consumer goods packaging.

Polyethylene foam provides a balance between softness and durability, making it ideal for shock absorption and vibration dampening essential for transporting fragile devices and instruments. Its closed-cell structure enhances resistance to moisture, dust, and most chemicals, which is critical in protective packaging for high-value electronics, automotive components, and industrial sensors.

Polyethylene foam also offers superior flexibility, allowing it to be easily cut, laminated, and thermo-formed into customized profiles for trays, inserts, and corner pads. The anti-static variant of polyethylene foam prevents the buildup of electrostatic discharge (ESD), which can damage microprocessors, semiconductors, and circuit boards during transit.

As e-commerce accelerates the global movement of sensitive products, packaging that assures ESD protection, impact resistance, and sustainability is in high demand. Given its lower cost compared to polyurethane or polystyrene alternatives, polyethylene foam remains the preferred material for both high-volume and specialized applications across multiple regions.

The electronics segment is projected to dominate the end-use industry category with a 49.2% share in 2025, as the global surge in semiconductor, consumer electronics, and smart device shipments fuels the need for robust ESD-safe packaging.

Anti-static foam packaging plays a vital role in safeguarding critical components such as integrated circuits (ICs), PCBs, displays, and sensors from electrostatic discharge during manufacturing, assembly, and logistics. The rapid expansion of sectors like 5G infrastructure, wearable tech, electric vehicles (EVs), and industrial automation has intensified the need for protective packaging solutions that meet ISO and ANSI ESD compliance standards.

Manufacturers across APAC, North America, and Europe are increasingly integrating anti-static foam in tray-based shipping systems, protective clamshells, and die-cut inserts to ensure product integrity from plant to end-user.

Anti-static foam packaging supports lean inventory and just-in-time (JIT) practices in electronics manufacturing by enabling component organization and secure in-process storage. As OEMs and electronics exporters face mounting quality assurance demands, this segment is projected to remain the cornerstone of the anti-static foam packaging market, with innovation focusing on recyclability, flame resistance, and cleanroom compatibility.

High Production Costs and Limited Recycling Infrastructure

Challenges exist within the anti-static foam packaging market for production costs and sustainability. Specialty materials used for ESD, like conductive or dissipative polyethylene (PE) and polyurethane (PU) foams, have a higher cost of manufacturing than conventional packaging solutions.

This cost consideration results in anti-static foam being less available for small and mid-sized enterprises (SMEs), who may resort to lower cost options with the risk of damage incurred by static.

Anti-static foam is made of poly plastic, which has a limited recycling infrastructure. Anti-static packaging is essential for safeguarding sensitive electronic components, yet the disposal and recyclability of these materials are still significant challenges.

Many foam-based solutions are non-biodegradable and hard to process in typical recycling plants. Moreover, the chemical additives of conductive and dissipative foam also pose a problem during the recycling, resulting in more waste.

To overcome these challenges, producers will have to invest in up to date production systems migrating to cost-effective production approaches such as automation and optimizing materials to reduce their manufacturing costs.

By using biodegradable or recyclable materials to produce the foams, developing environmentally safe anti-static foams is going to help with sustainability without sacrificing anti-static foams' efficiency. Building programs with waste management companies so more programs can be recycled can also improve the circular economy for anti-static forms of packaging.

Growing Demand from the Electronics and Automotive Sectors

Anti-static foam packaging is becoming increasingly popular as the use of electronic devices from consumer products to industrial equipment grows. The evolution of semiconductors, printed circuit boards (PCBs), and other sensitive electronic components drives the demand for adequate ESD protection.

As 5G networks, IoT (Internet of Things) devices, and high-performance computing continue to proliferate, manufacturers need dependable packaging solutions to avoid static-induced failures.

Apart from electronics, the automotive sector is one of the major contributors to the anti-static foam packaging market. The increasing demand for electric vehicles (EVs) has created a growing need for lithium-ion battery protection, which necessitates the use of specialized ESD-safe packaging to mitigate short circuits and component failures.

Automotive Manufacturers also use anti-static foam for transporting electrical control modules, sensors, and other vulnerable components.

Covered by ESD protective materials, products and people are at the forefront of ESD protection and awareness, and as customers look for innovative solutions, so too should ESD protection particularly in the areas of material science, for instance there will be an increase in bio-based conductive foams and hybrid packages that bring ESD protection together with other forms of protection such as barrier protection and mechanical robustness.

Strengthening of supply chain networks by expanding coverage and upgrading distribution networks would play an equally important role in catering to the rising demand from global electronics and automotive markets.

The USA anti-static foam packaging market is anticipated to witness significant growth due to the proliferation of the channels of protective packaging in the electronics sector, automotive sector, and aerospace sector. Demand for ESD-safe packaging is increasing as semiconductor manufacturing processes multiply and e-commerce sales of electronic components (including semiconductors) rise dramatically.

In addition, the healthcare industry is using anti-static foam packing to shield sensitive medical devices and equipment. With stricter regulation on Sustainable Packaging, the demand for recyclable and biodegradable anti-static foam materials is also on the rise.

| Country | CAGR (2025 to 2035) |

|---|---|

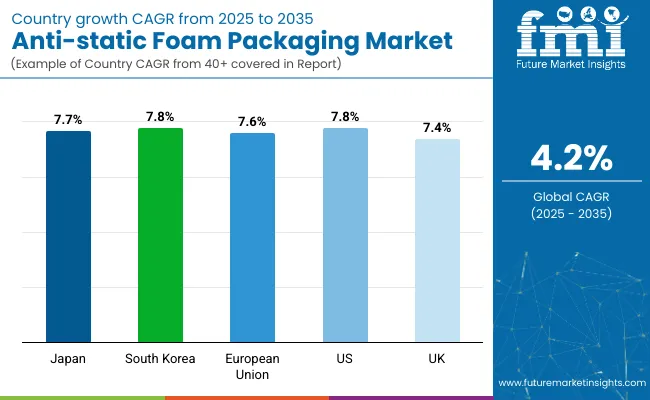

| USA | 7.8% |

The high-tech manufacturing sector (electronics, defence, and telecommunications) in the UK is largely driving the demand for anti-static foam packaging in the UK. The emergence of industry along with the growing emphasis on data centres and semiconductor manufacturing is fuelling the demand for electrostatic discharge (ESD) protection solutions.

Moreover, sustainable initiatives and plastic waste reduction strategy are motivating companies to come up with eco-friendly alternatives like biodegradable and reusable anti-static foam materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.4% |

Because of their robust electronics, automotive, and aerospace sectors, Germany, France, and the Netherlands dominate the market for anti-static foam packaging in the EU. With the EU placing an increasingly emphasis on sustainability and circular economy principles, companies are becoming much more interested in recyclable anti-static foam solutions.

German and French production of electric vehicles (EVs) and semiconductors is also driving demand for ESD-safe packaging. Moreover, the growth of e-commerce across Europe is further increasing the demand for secure packaging solutions for electronic goods.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.6% |

Japan's market for anti-static foam packaging is expanding as the country leads in semiconductor technology, consumer electronics, and precision manufacturing. These industries need to implement advanced packaging solutions that effectively protect high value electronics components from Electric Discharge Damage.

The need for ultra-thin and high-performance ESD foam materials in Japan is being propelled by its commitment to technological advancement. Further driving market growth is the automotive industry's growing adoption of electronic elements, such as EV battery systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.7% |

Running major semiconductor and electronics companies, South Korea is stimulating the growth of anti-static foam packaging market. The growing requirements for robust ESD protection strategies in turning out high-performance electronic devices are in line with the country’s global leadership in display panel manufacturing and advanced computing technologies.

Moreover, the growing production of electric vehicles and batteries in South Korea is also driving demand for anti-static foam packaging with properties to protect lithium-ion batteries and electronic components.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.8% |

Antistatic foam packaging market has been projected to witness a soaring demand across various applications where electronics components require packaging. Important changes include sustainable, biodegradable foam materials, a better shock-absorbing process, and improved electrostatic discharge (ESD) protection.

Companies are targeting high-performance conductive and dissipative foam solutions to ensure product safety and adherence to ESD regulations.

The Anti-static Foam Packaging Market was valued at approximately USD 5.0 billion in 2025.

The market is projected to reach USD 7.5 billion by 2035, growing at a compound annual growth rate (CAGR) of 4.2% from 2025 to 2035.

The demand for Anti-static Foam Packaging Market is expected to be driven by the rising need for electrostatic discharge (ESD) protection in consumer electronics, expanding use in industrial applications for sensitive components, and growing demand for secure and damage-resistant packaging solutions in global supply chains.

The top 5 countries contributing to the Anti-static Foam Packaging Market are the United States, China, Germany, Japan, and South Korea.

The Consumer Electronics and Industrial Applications segment is expected to lead the Anti-static Foam Packaging market, driven by the increasing demand for protective packaging in semiconductors, circuit boards, and precision electronic devices, along with heightened focus on safe transportation of industrial components.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Anti-static Packaging Film Market

Anti-Static Foam Pouch Market Size and Share Forecast Outlook 2025 to 2035

Foam Type Vacuum Gripping System Market Size and Share Forecast Outlook 2025 to 2035

Foam Mixing Machine Market Size and Share Forecast Outlook 2025 to 2035

Foam Market Size and Share Forecast Outlook 2025 to 2035

Foam-Free Pad Formers Market Size and Share Forecast Outlook 2025 to 2035

Foam Cups Market Size and Share Forecast Outlook 2025 to 2035

Foam Bottle Technology Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Foam Glass Granulate Market Size and Share Forecast Outlook 2025 to 2035

Foam Plastics Market Size and Share Forecast Outlook 2025 to 2035

Foaming Creamer Market Size and Share Forecast Outlook 2025 to 2035

Foam Tape Market Size and Share Forecast Outlook 2025 to 2035

Foam Glass Market Size and Share Forecast Outlook 2025 to 2035

Foamer Pump Market Size, Share & Forecast 2025 to 2035

Foam Food Container Market Size and Share Forecast Outlook 2025 to 2035

Foam Mesh Sleeves Market Growth - Demand & Forecast 2025 to 2035

Foam Edge Protectors Market Size and Share Forecast Outlook 2025 to 2035

Foamer Bottle Market Size and Share Forecast Outlook 2025 to 2035

Foam Cap Liners Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA