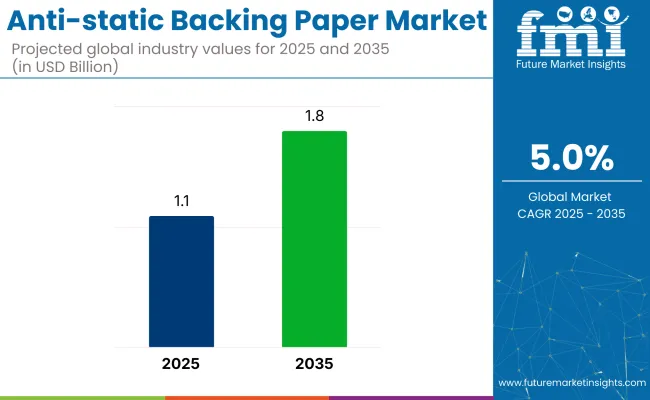

Global demand for anti-static backing paper is projected to rise from USD 1.1 billion in 2025 to USD 1.8 billion by 2035, reflecting a 5% CAGR. Electrostatic discharge risks have been mitigated through this paper, which forms a protective layer around circuit boards, semiconductors, and connectors during storage and shipment.

Key Industry Attributes

| Attribute | Detail |

|---|---|

| Market Size (2025) | USD 1.1 billion |

| Market Size (2035) | USD 1.8 billion |

| CAGR (2025 to 2035) | 5% |

Output in consumer electronics has been accelerated, intensifying requirements for electrostatic shielding across smartphone, laptop, and wearable supply chains. Direct-to-consumer logistics have been reshaped by e-commerce, prompting adoption of packaging that secures components and meets strict ESD protocols. Growth is therefore anchored in continual semiconductor fabrication expansion and stricter performance benchmarks across global networks.

The anti-static backing paper segment comprises niche functionality within several broader categories, accounting for distinct shares based on its electrostatic control role in packaging. Within the anti-static and ESD packaging materials market, it represents nearly 6-8%, driven by its limited use compared to bags and foams.

In the overall ESD packaging market, it forms approximately 4-5%, as trays and molded plastics dominate volume. For the anti-static films and tapes segment, backing paper contributes 7-9%, mainly in lamination and adhesive liner applications. In the anti-static agent’s market, its share remains below 3%, since coatings span a broader set of substrates. Within barrier and functional paper products, it accounts for about 6%, used in semiconductor and electronics packaging where both insulation and static resistance are critical.

In 2024, Sherwin-Williams launched CM0485115, a conductive aerospace coating that converts composites and aluminum into anti-static surfaces without compromising integrity-critical for EV and aviation components. Cortec’sEcoSonic VpCI-125 ESD film combines corrosion inhibition with static dissipation, eliminating oils and reducing cleaning steps in aerospace and automotive packaging.

Meanwhile, nano-enhanced PET films using graphene and carbon nanotubes achieved 10⁶-10⁸ Ω/sq resistivity, exceeding MIL-PRF-81705D standards. These films protect sensitive devices like foldable OLEDs and semiconductor components. Together, these innovations reflect the shift toward multifunctional anti-static materials that meet both performance and regulatory demands across electronics, aerospace, and EV applications.

Kraft substrates, polymer-coated surfaces, and semiconductor-specific applications define investment hotspots for 2025. Electronics packaging remains the anchor for volume, while Asia-Pacific’s manufacturing footprint consolidates its consumption lead. High-growth niches attract upgrades in cleanroom conversion and coating lines.

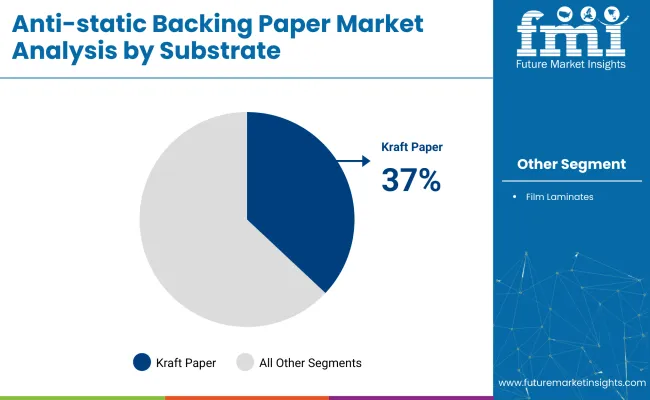

Kraft paper leads the substrate segment with a 37% share in 2025, owing to its mechanical resilience and compatibility with anti-static coatings. Manufacturers prefer its balance between tensile strength and charge dissipation. Soy-based coatings on kraft allow ESD protection while enabling recyclability-vital for bulk shipments of circuit boards and diagnostic tools. Sheet converters offer precision die-cutting, minimizing material waste. Paper mills in Asia have scaled kraft-based antistatic rolls to meet bulk supply agreements

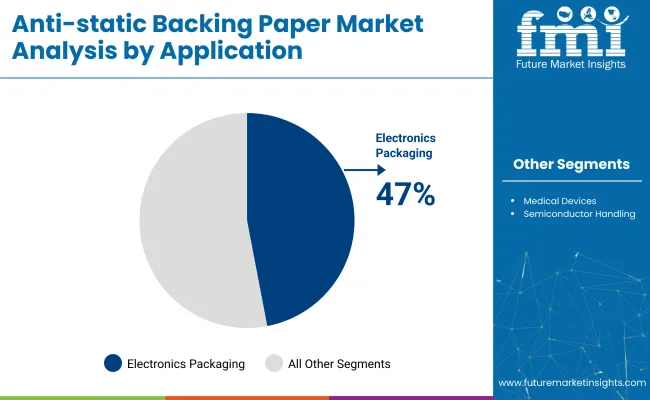

Electronics packaging controls 47% of anti-static backing paper usage, driven by circuit board and chip assembly processes. Static-sensitive components demand layered protection during shipping, and anti-static paper liners help prevent failures.

Packaging suppliers offer sheeted formats that comply with ESD and IPC standards, easing certification for export. Rollstock paper formats are used inside molded trays and corrugated boxes.

Anti-static polymer coatings capture 53% of the market by offering reliable electrostatic dissipation across humidity variations. Unlike carbon-based alternatives, polymer coatings deliver transparent finishes and uniform conductivity.

Coating lines have shifted toward water-based polymers with embedded anti-static agents, reducing migration and surface wear. Paper treated with polymer coatings retains discharge performance over multiple handling cycles, making it suitable for long-haul logistics.

Asia-Pacific accounts for 49% of global anti-static backing paper consumption in 2025, anchored by China’s electronics production and South Korea’s semiconductor sector. Sheet converters and packagers in the region serve laptop, smartphone, and chip manufacturing clusters.

Domestic mills produce kraft paper with ESD coatings tailored for export electronics, reducing dependency on film-based imports. Wafer handling and circuit board exports continue to drive demand for coated paper liners.

Semiconductor handling emerges as the fastest-growing segment at a 12% CAGR through 2035. As chip dimensions’ shrink and packaging becomes denser, wafer-level ESD protection grows more critical. Paper sheets designed for wafer cassettes reduce scratch risk and prevent latent electrostatic damage.

Manufacturers provide round-cut pads and slit rolls for fab use, with surface treatments that meet cleanroom standards. Rising investments in AI and automotive chips have increased per-fab consumption of anti-static packaging paper

The anti-static backing paper market is being shaped by multi-functional product development, aerospace-grade material enhancements, and integration into semiconductor handling systems. With rising global electronics output and logistics demand, suppliers are aligning toward smarter coatings and composite layering to meet precise ESD compliance requirements.

New coating technologies and substrate blends reshape product strategy

Raw material volatility limits pricing flexibility and supply stability

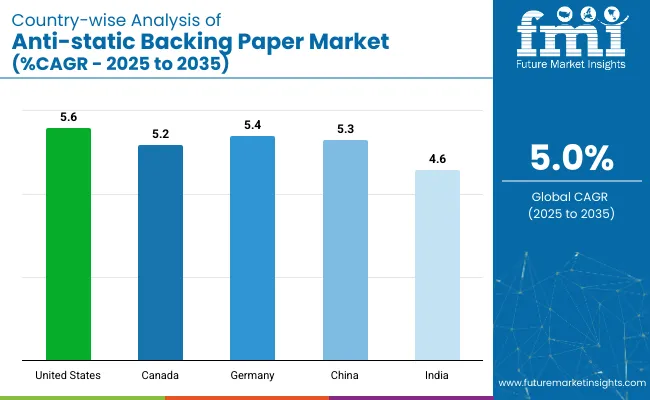

| Countries | Projected CAGR (2025 to 2035) |

|---|---|

| United States | 5.6% |

| Canada | 5.2% |

| Germany | 5.4% |

| China | 5.3% |

| India | 4.6% |

Global demand for anti-static backing paper is projected to grow at a 5.4% CAGR from 2025 to 2035. Among the five profiled markets out of 40 covered, the United States leads at 5.6%, followed by Germany at 5.4%, China at 5.3%, Canada at 5.2%, and India at 4.6%. These growth rates translate to a +4% premium for the United States, 0% for Germany, -2% for China, -4% for Canada, and -15% for India compared to the baseline.

Divergence in growth is driven by factors such as strong demand for anti-static backing paper in the United States, industrial growth in Germany, and moderate growth in China, Canada, and India, with India showing slower growth due to emerging market dynamics.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

The USA market is forecast to grow at a CAGR of 5.6% from 2025 to 2035. Demand has remained centered on ESD-compliant packaging within electronics distribution and semiconductor fabrication. Anti-static liner formats are widely adopted by firms engaged in RFID label production, laser-cut films, and precision optics.

Material innovation in PE-coated kraft backers and humidity-resistant rolls has contributed to wider procurement by cleanroom suppliers. Investment in high-volume die-cutting equipment by Midwestern converters is boosting domestic capacity and response times for custom format orders.

Canada is anticipated to expand at 5.2% CAGR by 2035. Adoption has been rising among aerospace subcontractors and electronics recyclers requiring anti-static separation layers. The prevalence of anti-scuff and conductive packaging formats in Toronto’s 3PL warehouses supports consistent demand.

Provinces with strict EPR packaging rules have accelerated transition from polywrap to paper-based liners. Quebec’s flexo printing segment is using static-resistant backers for high-speed label runs. Government procurement norms for ESD-compliant packaging materials further support use in public-sector electronics supply.

Demand in Germany is likely to grow at a CAGR of 5.4% through 2035, This reflects high penetration in automotive electronics, pharma logistics, and additive manufacturing. Static-free liners are mandated for sensitive component packaging by Tier-1 automotive suppliers.

Baden-Württemberg-based packaging houses are installing slitters customized for conductive coated kraft rolls. Pharma majors rely on anti-static liners to prevent packaging surface charge buildup in moisture-controlled environments. In 3D printing hubs, anti-static backers are included in filament spools to avoid particle clumping and static ignition risk.

China is expected to grow at a CAGR of 5.3% between 2025 and 2035. Electronics manufacturing hubs in Suzhou, Shenzhen, and Chongqing are driving usage across printed circuit board (PCB) logistics and LED exports. Converter networks are scaling static-safe liner production for consumer electronics shipments.

National directives on ESD-sensitive component exports have widened adoption of conductive kraft papers. Major packaging providers are integrating slitting and coating lines in-house to lower reliance on import-grade materials.

India’s market is projected to post a CAGR of 4.6% through 2035. Domestic ESD packaging infrastructure remains in development, but demand has risen from telecom, solar module, and capacitor supply chains. Bengaluru’s semiconductor startups and contract manufacturers have started using static-resistant liners in outbound shipments.

Tamil Nadu-based label producers and automotive component packagers are trialing PE-laminated kraft liners to meet export packaging standards. Growth is tempered by the limited availability of conductive coating facilities.

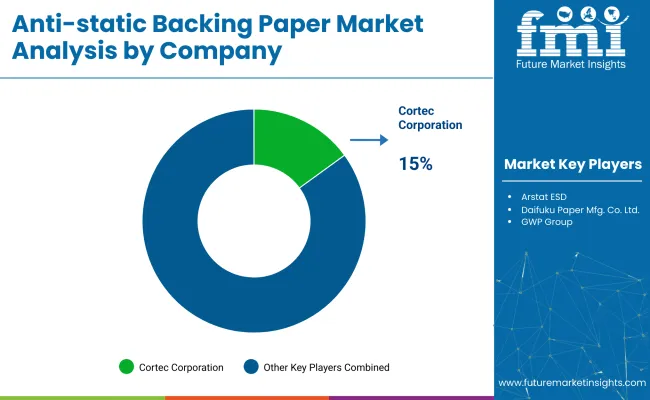

Cortec Corporation has extended its anti-static backing paper portfolio by introducing variants designed for electronic and aerospace applications. The company focuses on proprietary coating technologies and offers customized solutions to meet export packaging demands. Arstat ESD has upgraded its manufacturing capabilities in North America and launched anti-static paper with consistent surface resistivity, targeting circuit board and IC packaging segments.

Daifuku Paper Mfg. Co., Ltd. has refined its kraft paper base to suit sensitive electronic components, positioning itself in precision packaging. GWP Group rolled out die-cut anti-static liners tailored for semiconductor exporters, supporting compliance with regional safety and handling requirements.

The anti-static backing paper market is moderately consolidated, with leading players holding long-term contracts in medical, electronics, and aerospace packaging. Entry is restricted by specialized coating equipment, resistivity compliance standards, and stringent client audits. Smaller firms serve niche orders, but face challenges scaling due to technical and quality validation requirements.

Recent Anti-Static Backing Paper Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.1 billion |

| Projected Market Size (2035) | USD 1.8 billion |

| CAGR (2025 to 2035) | 5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Coating Types Analyzed | Anti-static Polymer Coating, Conductive Layered Coating |

| Substrate Types Analyzed | Kraft Paper, Film Laminates |

| Applications Analyzed | Electronics Packaging (PCB Storage, IC Transport Trays), Medical Devices (Static-sensitive Diagnostic Tools), Semiconductor Handling (Wafer Protection, Cleanroom Sheets) |

| End-Use Industries Analyzed | Electronics, Aerospace, Medical Devices, Semiconductor |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, China, India, Japan, South Korea, Brazil, Mexico, UAE, South Africa |

| Leading Players | Cortec Corporation, Arstat ESD, Daifuku Paper Mfg. Co., Ltd., GWP Group |

| Additional Attributes | Dollar sales growth by coating type, regional demand trends, competitive landscape, pricing strategies, packaging innovations, supply chain insights. |

The segment includes Anti-static Polymer Coating and Conductive Layered Coating

This category comprises Kraft Paper and Film Laminates

The market includes Electronics Packaging(PCB Storage, IC Transport Trays), Medical Devices (Static-sensitive Diagnostic Tools), Semiconductor Handling(Wafer Protection, Cleanroom Sheets)

Segmented into Electronics, Aerospace, Medical Devices, and Semiconductor sectors.By RegionIndustry performance assessed across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

The market size is projected to be USD 1.1 billion in 2025 and USD 1.8 billion by 2035.

The expected CAGR is 5% from 2025 to 2035.

Kraft paper dominates the substrate segment with a 37% share in 2025.

Cortec Corporation is the leading company in the market, holding a 15% market share.

India is projected to grow at a CAGR of 4.6% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tape Backing Materials Market Analysis by Material Type, Application, and Region through 2025 to 2035

Competitive Overview of Tape Backing Materials Companies

Automotive Backing Plate Market Growth – Trends & Forecast 2025 to 2035

Latex Paper Backing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Antistatic Brush Market Growth – Trends & Forecast 2024-2034

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Paper Pallet Market Size and Share Forecast Outlook 2025 to 2035

Paper and Paperboard Packaging Market Forecast and Outlook 2025 to 2035

Paper Wrap Market Size and Share Forecast Outlook 2025 to 2035

Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Market Size and Share Forecast Outlook 2025 to 2035

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Paper Processing Resins Market Size and Share Forecast Outlook 2025 to 2035

Paper Tester Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkin Converting Lines Market Size and Share Forecast Outlook 2025 to 2035

Paper Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkins Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Binders Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA