The stirrer market is experiencing steady growth driven by increasing demand across laboratory research, industrial processing, and chemical manufacturing sectors. Expansion is being supported by rising adoption of automated and precision mixing equipment that enhance efficiency and consistency. Market dynamics are influenced by the growing need for controlled agitation in pharmaceutical, food, and material sciences applications.

Manufacturers are focusing on product innovation, ergonomic design, and energy efficiency to meet evolving end-user requirements. The future outlook remains positive as industries prioritize equipment that supports higher accuracy, safety, and operational sustainability. Investment in advanced motor technologies and durable materials is enhancing product lifespan and performance reliability.

Growth rationale is centered on expanding R&D activities, rapid industrialization, and the shift toward customizable equipment suited for specialized applications These factors collectively strengthen the market’s potential for sustained expansion and technological advancement in the coming years.

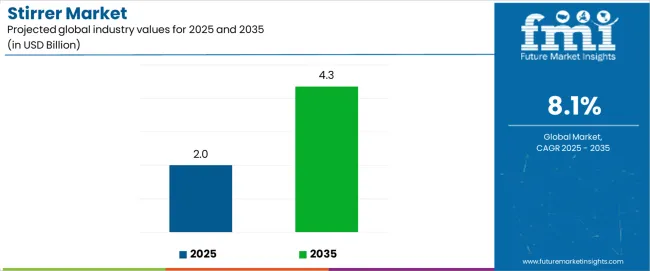

| Metric | Value |

|---|---|

| Stirrer Market Estimated Value in (2025 E) | USD 2.0 billion |

| Stirrer Market Forecast Value in (2035 F) | USD 4.3 billion |

| Forecast CAGR (2025 to 2035) | 8.1% |

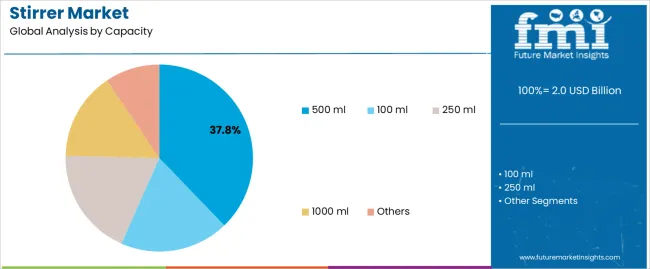

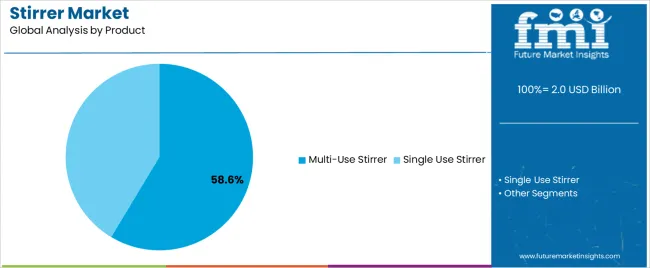

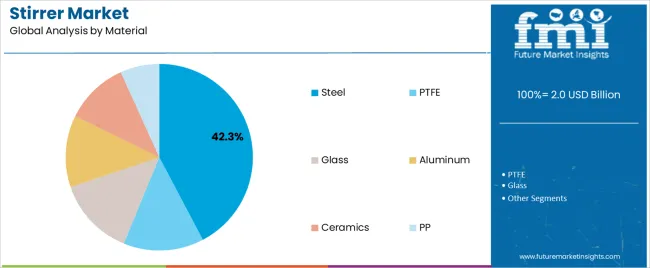

The market is segmented by Capacity, Product, and Material and region. By Capacity, the market is divided into 500 ml, 100 ml, 250 ml, 1000 ml, and Others. In terms of Product, the market is classified into Multi-Use Stirrer and Single Use Stirrer. Based on Material, the market is segmented into Steel, PTFE, Glass, Aluminum, Ceramics, and PP. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 500 ml segment, accounting for 37.80% of the capacity category, has remained dominant due to its suitability for small to medium-scale laboratory and industrial applications. Its wide usage in sample preparation, testing, and formulation development has ensured consistent demand.

The segment’s leadership is supported by versatility, ease of handling, and cost-effectiveness, making it the preferred choice for routine laboratory procedures. Manufacturers have focused on integrating variable speed control and enhanced temperature resistance to improve operational flexibility.

Growing investments in scientific research and laboratory automation are further strengthening the adoption of 500 ml stirrers The segment is expected to maintain its leading position as educational institutions, quality testing centers, and small-scale manufacturers continue to rely on this capacity for diverse experimental and production needs.

The multi-use stirrer segment, holding 58.60% of the product category, has emerged as the leading product due to its adaptability across different applications including laboratory testing, pharmaceutical formulation, and industrial mixing. Its dominance is being reinforced by features such as adjustable stirring speeds, compatibility with various container sizes, and enhanced durability.

Demand has been supported by end-users seeking cost-efficient solutions that eliminate the need for multiple specialized devices. Technological advancements in digital controls and safety features have improved precision and usability.

Market preference for multi-use designs is also being driven by space optimization and maintenance convenience Continuous development of portable and energy-efficient models is expected to further expand adoption across academic, medical, and industrial sectors, securing the segment’s sustained growth trajectory.

The steel segment, representing 42.30% of the material category, has maintained leadership due to its superior strength, corrosion resistance, and long operational life. Preference for steel-based stirrers has been reinforced by their ability to withstand high temperatures and harsh chemical environments, ensuring reliability in demanding laboratory and industrial settings.

Manufacturers have been leveraging stainless steel and alloy variants to enhance performance and reduce contamination risks. The segment’s dominance is also attributed to the material’s compatibility with magnetic and mechanical stirring mechanisms.

Increasing demand for durable, easy-to-clean, and compliant materials in regulated industries such as pharmaceuticals and biotechnology continues to drive growth As sustainability initiatives encourage recyclable and long-lasting components, steel stirrers are expected to remain the preferred choice for high-precision and high-frequency operations worldwide.

| Historical Value in 2020 | USD 1,250.3 million |

|---|---|

| Historical Value in 2025 | USD 1,701 million |

| Market Estimated Size in 2025 | USD 1,845.6 million |

| Projected Market Value in 2035 | USD 4,026.9 million |

Between 2020 and 2025, the stirrer market experienced steady growth driven by increased research activities and industrial applications. Advancements in technology, particularly the integration of IoT and automation, reshaped stirring processes, enhancing efficiency and accuracy. A rising emphasis on sustainability led to the development of ecofriendly stirrers, reflecting shifting industry norms.

Looking ahead from 2025 to 2035, industry forecasts anticipate accelerated growth propelled by continued technological innovations and expanding applications. The integration of artificial intelligence and machine learning algorithms further optimizes stirring processes, enabling predictive maintenance and adaptive control systems. The market sees increased adoption of compact and portable stirrers, catering to on the go research and fieldwork needs.

Rising environmental concerns drive demand for energy efficient and sustainable stirrers, prompting manufacturers to explore renewable materials and ecofriendly production processes. The emergence of smart sensors and remote monitoring capabilities enhances data collection and analysis, enabling real time insights and process optimization.

In the stirrer market, India leads with an impressive 8.7% growth rate, showcasing its growing prominence in manufacturing and research. China closely follows with 8.4%, reflecting its industrial innovation. Germany, the United States, and the United Kingdom exhibit steady growth rates, reflecting established market positions and technological advancements.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| India | 8.7% |

| China | 8.4% |

| Germany | 5.9% |

| United Kingdom | 5.7% |

| United States | 6.9% |

India emerges as a driving force in the stirrer industry, projecting an impressive 8.7% CAGR until 2035. Fueled by advancements in research, manufacturing, and innovation, India harnesses its growing technological prowess to meet evolving industry demands, positioning itself as a key player in the global market.

With a focus on precision engineering and cost effective solutions, its contributions drive efficiency and competitiveness across diverse sectors. Its proactive approach to industrial development and commitment to excellence cement its status as a leading force shaping the trajectory of the Stirrer Industry in the coming years.

China exerts significant influence in shaping the Stirrer Market, boasting an impressive 8.4% projected CAGR until 2035. Renowned for its manufacturing prowess and technological innovation, China drives market expansion with its vast industrial infrastructure and research capabilities.

With a focus on quality, efficiency, and innovation, Chinese manufacturers lead advancements in stirrer technology, catering to diverse industrial needs. Leveraging strategic partnerships and continuous research and development efforts, China cements its position as a frontrunner in the global stirrer market, driving growth, and setting industry standards for performance, reliability, and technological advancement.

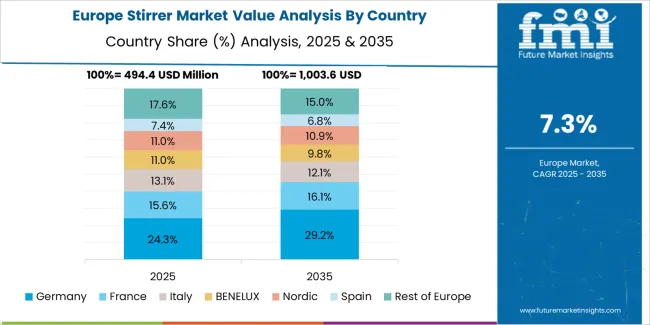

Germany plays a pivotal role in charting the stirrer market, projecting a steady 5.9% CAGR until 2035. Renowned for precision engineering and technological excellence, Germany leads in innovative stirrer designs. With a commitment to quality and reliability, German manufacturers set industry benchmarks, driving market advancements.

Leveraging research and development investments, as well as strong collaborations, Germany continues to deliver cutting edge solutions that meet evolving industry demands. As a leader in industrial innovation, its proactive approach ensures sustained growth and relevance in the dynamic stirrer market, maintaining its position as a key player in the global arena.

The United Kingdom emerges as a driving force in the stirrer market, projecting a steady 5.7% CAGR until 2035. Renowned for its innovation and industrial expertise, the United Kingdom leads advancements in stirring technology, focusing on precision, reliability, and sustainability.

With a commitment to excellence and forward thinking approaches, the United Kingdom ropels market expansion and sets new benchmarks for performance and reliability. Leveraging research, development, and strategic partnerships, the United Kingdom shapes the industry landscape, offering high quality stirrer solutions globally. Through its proactive approach and dedication to innovation, the United Kingdom paves the way for sustained growth in the stirrer market.

Innovative forces propel the United States to leadership in the stirrer market, boasting a 6.9% projected CAGR until 2035. Renowned for its technological prowess and industrial innovation, the United States drives advancements in stirring technology. With a focus on efficiency, durability, and sustainability, United States manufacturers pioneer cutting edge solutions tailored to diverse applications.

Leveraging research, development, and strategic partnerships, the United States remains at the forefront of stirrer innovation globally. Through forward thinking approaches and commitment to excellence, the United States continues to shape the stirrer market, driving growth and setting industry benchmarks for performance, reliability, and sustainability.

In 2025, the stirrer market was dominated by multi use stirrers, holding a significant market share of 66.00%. Plastic stirrers accounted for 30.00% of the market, reflecting their prevalence and versatility in various laboratory and industrial applications.

| Category | Market Share in 2025 |

|---|---|

| Multi use stirrer | 66.00% |

| Plastic | 30.00% |

Until 2025, multi use stirrers maintained a commanding presence in the stirrer market, holding a substantial 66.00% market share. This dominance underscores the versatility and reliability of multi use stirrers, which remain integral tools across diverse laboratory, research, and industrial settings for mixing and blending applications.

By 2025, the plastic segment is poised to secure a significant 30.00% market share in the stirrer industry. This anticipated growth reflects the widespread adoption of plastic stirrers, renowned for their versatility, affordability, and compatibility with various laboratory and industrial applications.

In the vibrant stirrer market, competition thrives as key players vie for market share and innovation leadership. Industry giants such as Labnet International, IKA Works, and Thermo Fisher Scientific dominate with advanced technologies and extensive product portfolios. Rising stars like Scilogex and Benchmark Scientific challenge incumbents with agile strategies and niche offerings.

The competitive landscape is characterized by continuous R&D investments, strategic collaborations, and product diversification. Customer centric approaches drive differentiation, with companies focusing on reliability, efficiency, and user friendly designs. Amidst evolving customer needs and technological advancements, competition remains fierce, fueling innovation and market dynamism.

Product Portfolio

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 2.0 Billion |

| Projected Industry Valuation in 2035 | USD 4.3 Billion |

| Value-based CAGR 2025 to 2035 | 8.10% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Industry Analysis | Value in USD million |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Industry Segments Covered | Capacity, Product, Material, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | D&W Fine Pack; Huhtamaki Oyj; SmartPack USA, Inc.; CHX Products; Royer Corporation; BioPak; Talivenda; Cosmos Eco Friends; GreenFeel; SILVER BIRCH Factory |

The global stirrer market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the stirrer market is projected to reach USD 4.3 billion by 2035.

The stirrer market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in stirrer market are 500 ml, 100 ml, 250 ml, 1000 ml and others.

In terms of product, multi-use stirrer segment to command 58.6% share in the stirrer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hotplate Stirrers Market Size and Share Forecast Outlook 2025 to 2035

Plastic Drink Stirrer Market Trends & Industry Growth Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA