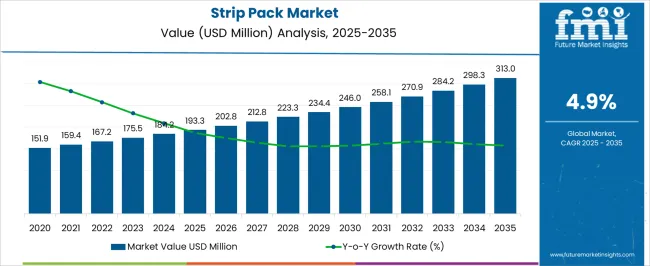

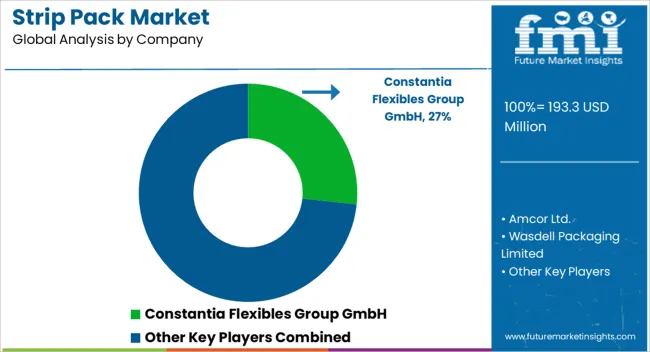

The Strip Pack Market is estimated to be valued at USD 193.3 million in 2025 and is projected to reach USD 313.0 million by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

| Metric | Value |

|---|---|

| Strip Pack Market Estimated Value in (2025 E) | USD 193.3 million |

| Strip Pack Market Forecast Value in (2035 F) | USD 313.0 million |

| Forecast CAGR (2025 to 2035) | 4.9% |

The Strip Pack market is experiencing steady growth driven by the increasing demand for secure and convenient pharmaceutical packaging solutions. The current market scenario reflects widespread adoption across prescription drugs and over-the-counter medicines, as strip packaging ensures dosage accuracy, tamper evidence, and extended shelf life.

Growth in the market has been influenced by rising pharmaceutical production, stringent regulatory requirements for drug safety, and the increasing focus on patient compliance. The ability of strip packs to protect sensitive medicines from moisture, light, and contamination has made them a preferred choice among manufacturers.

Advancements in packaging materials and automated packaging machinery have further enhanced efficiency and reduced production costs, promoting large-scale adoption As pharmaceutical companies continue to prioritize quality, safety, and cost-effectiveness, the Strip Pack market is expected to maintain strong growth, offering opportunities for innovation in material design, printing, and user-friendly packaging formats that cater to both patient convenience and regulatory compliance.

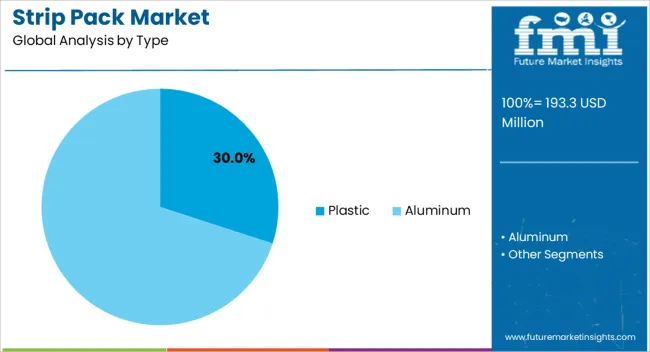

The Plastic type is projected to hold 30.00% of the Strip Pack market revenue in 2025, making it the leading type segment. This dominance is being driven by the widespread use of plastic due to its durability, flexibility, and moisture-resistant properties. Plastic strip packs offer superior protection to medicines compared with traditional paper-based or foil-only packaging, ensuring stability and extended shelf life for sensitive pharmaceutical products.

Adoption has been accelerated by the ability to manufacture lightweight and cost-effective packs that can be easily transported and stored. The segment’s growth has also been supported by compatibility with automated packaging machinery, which improves production efficiency and reduces human error. Additionally, plastic allows for clear visibility of the contents, enhancing patient confidence and compliance.

The flexibility to customize thickness, barrier properties, and printing on plastic materials has enabled manufacturers to meet diverse regulatory and branding requirements As pharmaceutical companies continue to prioritize safety, convenience, and cost-effectiveness, the Plastic type is expected to retain its leading position in the Strip Pack market.

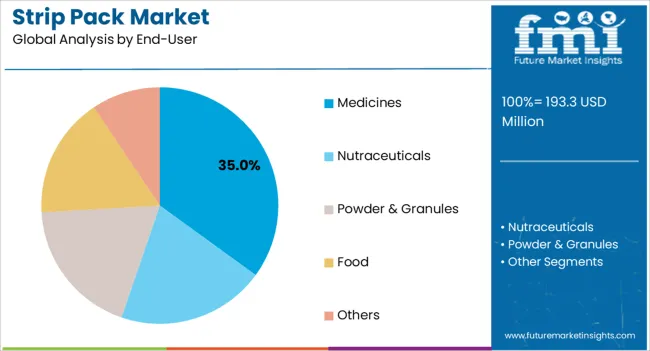

The Medicines end-user segment is expected to account for 35.00% of the Strip Pack market revenue in 2025, establishing it as the dominant end-use category. This leadership is being attributed to the high demand for secure, accurate, and tamper-evident packaging for prescription drugs and over-the-counter medicines. The segment has benefited from increasing awareness about drug safety and the need to maintain consistent dosage for patient compliance.

Strip packs provide an effective solution for protecting pharmaceuticals from environmental factors such as moisture, oxygen, and light, which is critical for maintaining drug efficacy. Growth has been further supported by regulatory guidelines emphasizing the importance of child-resistant and tamper-evident packaging.

The ease of carrying and dispensing individual doses from strip packs has made them highly favored among healthcare providers and patients alike As pharmaceutical production continues to expand globally and the need for safe and efficient packaging rises, the Medicines end-user segment is projected to sustain its market leadership.

Several factors are fueling the growth of the strip pack market. Some of the considerable driving factors are:

All these factors are driving the strip packs market on a large scale and are further bolstering growth opportunities in the global forum.

Although it has been anticipated that there are many drivers in the strip packs market that are likely to contribute to a bullish market expansion in the upcoming years, it is also identified that some of the factors may restrain the growth of the strip pack market.

The lack of reimbursement policies for strip packs and lack of awareness regarding preventive measures for non-bio-degradable properties of the product in developing countries can obstruct the growth of the strip pack market.

There is the unsuitability of strip packs identified for usage in heavy products, which is expected to curb the growth of the strip packs market during the forecast period.

Key market players are striving to create opportunities for the strip pack market which is likely to diminish the major restraints, and maintain their presence in the market. These factors are expected to determine the future of the market and increase consumer demand.

The North American regions are projected to be the supreme market players over the forecast period. Currently, they are accountable for 17% of the total market share of strip packs.

The market size of strip packs is expected to get further bolstered due to certain influential factors:

| Attributes | Details |

|---|---|

| Growth of the Food & Beverage Sector | It is witnessed that the North American region is having an expansion of the food & beverage sectors, that |

| Consumer Demand | The North American market can also be represented by consumers who are willing to pay for convenient packaging, owing to rising disposable income is likely to fuel the market size of strip packs n this region. |

| Country | Growth Factors |

|---|---|

| United States | The United States strip pack market is witnessing significant growth. Consumers in the United States are increasingly seeking convenience in product packaging. Strip packs provide easy-to-open, portable, and portion-controlled packaging, making them popular among busy consumers. This trend is particularly prominent in sectors including nutraceuticals, dietary supplements, and over-the-counter medications. The food and beverage industry plays a vital role in the market. The demand for single-serve packaging for snacks, candies, and other convenience foods is driving the adoption of strip packs. The consumer goods industry has also witnessed the adoption of strip packs for various products, such as breath fresheners, mint strips, and oral care products. The compact and portable nature of strip packs makes them suitable for on-the-go consumption. This also aligns with the changing consumer lifestyles and preferences. |

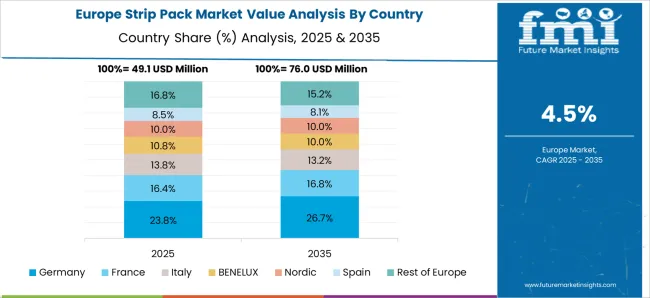

Europe is projected to follow North America and is anticipated to have a steady advancement in the strip packs market in the upcoming years. At present Europe is holding 14% of the total market share of strip packs.

Factors attributing to the moderate market growth in the European regions can be projected as:

| Attributes | Details |

|---|---|

| Well Establishment of Pharmaceutical Sectors | The pharmaceutical sector is having a rapid expansion in the European regions and therefore strip packs are largely being used as a convenient packaging solution for pharma products. |

| Favorable Government Policies | Assistance is being received from the government bodies, with grants for further research and development activities on how strip packs can be implemented in different verticals. |

| Country | Growth Factors |

|---|---|

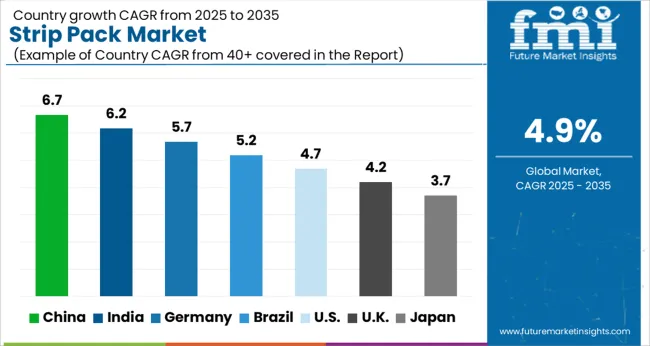

| United Kingdom | The United Kingdom strip pack market has witnessed significant growth in recent years. There is a growing emphasis on sustainability and environmental consciousness in the United Kingdom, which is influencing the strip pack industry. Manufacturers are increasingly adopting eco-friendly packaging materials and designs to reduce the environmental impact. The demand for recyclable and biodegradable strip packs has been on the rise, driven by consumer preferences and regulatory requirements. The growing interest in health and wellness among consumers has led to a rise in the nutraceutical and food supplement industry. Strip packs offer an ideal packaging format for these products. |

| Germany | Germany is one of the leading pharmaceutical markets in Europe, which directly influences the demand for strip packs. The country's aging population, increased focus on healthcare, and rising disposable income have contributed to the growth of the pharmaceutical industry and, subsequently, the Germany strip pack market. There is a growing preference for child-resistant packaging in Germany, especially for medications. This trend is driven by the need to enhance child safety and prevent accidental ingestion of medication. The confectionery sector in Germany has witnessed a shift towards portion-controlled and on-the-go packaging formats. |

The market in the Asia Pacific region has experienced robust growth over the past few years and is expected to continue its upward trajectory. The increasing demand for cost-effective and convenient packaging solutions, coupled with the rising prevalence of chronic diseases and the expanding pharmaceutical industry in the region, are driving the market growth.

The projected causes of the moderate market growth in the Asia Pacific regions can be identified as follows:

| Attributes | Details |

|---|---|

| Growing Pharmaceutical Industry | The expanding healthcare sector in the Asia Pacific region, driven by an aging population and rising healthcare expenditure, is fueling the demand for strip packs. |

| Shift toward Sustainable Packaging | With increasing environmental concerns, there is a growing trend toward sustainable packaging solutions, including the use of eco-friendly materials and recyclable strip packs. |

| Country | Growth Factors |

|---|---|

| China | The demand for unit-dose packaging solutions, including strip packs, is rising in China due to their convenience, portability, and accurate dosage delivery. Rapid urbanization has contributed to the growth of the China strip pack market. As more people migrate to urban areas, there is an increasing demand for compact and portable packaging solutions that are convenient for on-the-go consumption. The booming e-commerce industry in China has also positively impacted the strip pack industry. The rise of online shopping platforms has increased the demand for smaller-sized, lightweight packaging formats that are suitable for shipping and handling. |

| India | India's pharmaceutical industry has been witnessing steady growth, driven by factors such as a large population, increasing healthcare awareness, and rising disposable incomes. This growth has positively impacted the demand for strip packs. While the strip pack sector in urban areas is well-established, rural India has significant untapped potential. With the government's focus on improving healthcare infrastructure and expanding access to medicines in rural areas, the demand for strip packs is expected to rise. The overall growth of the packaging industry directly impacts the India strip pack market. While the market in urban areas is well-established, there is significant untapped potential in rural India. |

| Japan | In Japan, there is a strong emphasis on cleanliness, convenience, and efficiency. Strip packs align well with these cultural preferences as they offer individual dosages, ease of use, and tamper-evident features. The compact nature of strip packs also appeals to the limited storage spaces often found in Japanese households. Japan has one of the fastest aging populations globally, leading to a surge in healthcare expenditure. As a result, the pharmaceutical industry is witnessing substantial growth, driving the demand for strip-pack packaging solutions that ensure easy handling and dosage accuracy for elderly patients. |

The dominance of the plastic segment in the strip pack market can be attributed its flexibility and versatility. It allows for easy molding into various shapes and sizes to accommodate different product requirements. Additionally, plastic is a cost-effective option compared to alternatives like aluminum or paper. This makes it an attractive choice for manufacturers seeking affordable packaging solutions. Plastic strip packs also provide excellent barrier properties, preserving the quality and shelf life of sensitive products by offering moisture resistance, light protection, and oxygen barrier. The convenience factor plays a significant role as well, as plastic strip packs often feature individual compartments or pockets for easy access to each dose or unit, making them portable and suitable for travel. Finally, plastic strip packs allow for customization and branding, with the ability to print labels and logos, enhancing product identification and brand recognition.

The medicines segment holds a dominant position in the strip pack market by end users due to several key factors. Firstly, the high demand for medicines, driven by their wide usage for various health conditions, contributes to the significant market size of this segment. Additionally, the prevalence of chronic diseases and the aging population further bolster the demand for medications, as individuals require regular and organized doses. Strip packs offer convenience and aid in medication compliance, making them attractive for patients who need to manage multiple medications. Moreover, pharmacies and healthcare institutions prefer strip packs for efficient dispensing, enhancing workflow and patient safety. Regulatory guidelines and increased awareness of strip packs have also propelled the adoption of this packaging solution by pharmaceutical companies.

Key Start-Up Indulgences Bolstering the Strip Pack Market

The start-ups in the strip pack market are largely involved in making new market initiatives with frequent innovations. The market potential is being analyzed by the new entrants and they are investing in research and development activities to facilitate the production of high-quality, durable strip packs to meet the end-user requirements.

Three emerging start-ups to watch for:

| Company Name | Compack, Israeli Start-Up |

|---|---|

| Year of Foundation | 2024 |

| Total Funding | Undisclosed |

| Developments | They are providing facilities for on-demand custom packaging. The start-up’s online packaging vendor hub allows users to create custom strip packs with structural design flexibility and graphic personalization options. |

| Company Name | Cirqle, Danish Start-Up |

|---|---|

| Year of Foundation | 2024 |

| Total Funding | USD 1800000 |

| Developments | This start-up combines intelligent packaging and an online platform to track and tag companies’ packaging pools. Consumers are also able to return the package at the time of delivery or through pick-up services. |

| Company Name | Mushroom Material, New Zealand Start-Up |

|---|---|

| Year of Foundation | 2024 |

| Total Funding | USD 100000 |

| Developments | This start-up combines the vegetative part of mushrooms, mycelium, and fibrous agriculture waste to develop its material. Moreover, the resulting material is biodegradable and easily fits into existing processes while providing the same protective properties as polystyrene. |

Take of Key Market Players in the Strip Pack Market

Recent Development

Manufacturers in the global strip pack market are deploying unique strategies to increase the prominence and maximum adoption of strip packs in the coming years.

Strategy 1: Plastic Free Alternatives

In 2020, IUV developed consumer habits and corporate responsibility by encouraging the strip pack and packaging sector to remove plastic from the supply chain and reduce environmental pollution. His strategy has further aided the efficient replacement of conventional material without quality loss and is complying with the bio-based materials regulations imposed by the government.

Strategy 2: End-To-End Automation

In 2020, Plexiform Packaging Services indulged in mergers and acquisitions to develop automotive packaging. For specific products, automotive packaging services are tailored, which in turn would improve the part protection, and reduce in-transit damages.

Key companies proliferating in the strip pack market are:

Other market participants proliferating in the strip pack market are:

Key Companies Profiled

The global strip pack market is estimated to be valued at USD 193.3 million in 2025.

The market size for the strip pack market is projected to reach USD 313.0 million by 2035.

The strip pack market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in strip pack market are plastic, _polyethylene terephthalate (pet), _polyethylene (pe), _polypropylene (pp), _others, aluminum, _paper and _others.

In terms of end-user, medicines segment to command 35.0% share in the strip pack market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Strip Pack Laminates Market – Trends & Forecast 2025 to 2035

Market Share Breakdown of Leading Strip Pack Laminates Manufacturers

Strip Warmers Market - Precision Heating for Commercial Kitchens 2025 to 2035

Urea Strippers Market Size and Share Forecast Outlook 2025 to 2035

Removal Strips Market Size and Share Forecast Outlook 2025 to 2035

Brazing Strips Market Growth - Trends & Forecast 2025 to 2035

Magnetic Stripe Readers Market Size and Share Forecast Outlook 2025 to 2035

Pneumatic Strippers Market

Fine Line Striping Tape Market

Paper Waste Strippers Market Size and Share Forecast Outlook 2025 to 2035

Photoresist Stripper Market Analysis - Size, Share, and Forecast 2025 to 2035

Assessing Paper Waste Strippers Market Share & Industry Trends

Floor Transition Strips Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Automotive Weatherstrips Market Size and Share Forecast Outlook 2025 to 2035

Opening Trim Weatherstrips Market

Pharmaceutical Indicator Strips Market

Chloramphenicol Rapid Test Strip Market Size and Share Forecast Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA