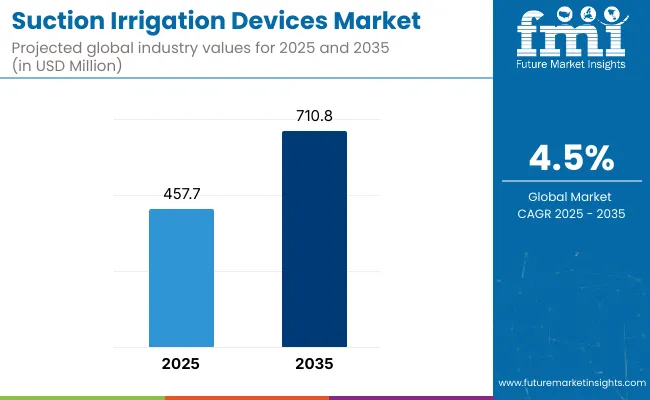

The suction irrigation devices market is expected to record a valuation of USD 457.7 million in 2025 and USD 710.8 million in 2035, with reflecting a growth of USD 253.1 million across the ten-year span. The overall expansion represents a CAGR of 4.5% and a 1.55X increase in market value.

| Metric | Value |

|---|---|

| Suction Irrigation Devices Market in (2025E) | USD 457.7 million |

| Suction Irrigation Devices Market in (2035F) | USD 710.8 million |

| Forecast CAGR (2025 to 2035) | 4.5% |

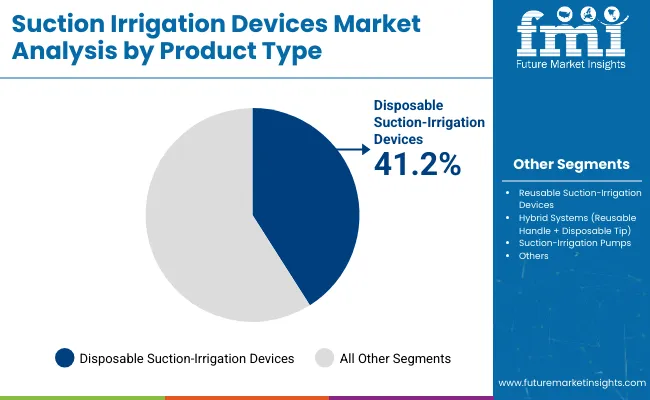

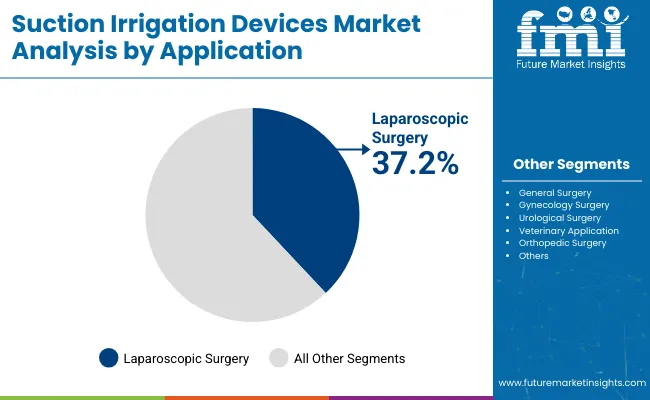

During the first five-year period from 2025 to 2030, the suction irrigation devices market grows from USD 457.7 million to USD 570.4 million, adding USD 112.7 million which accounts for 44.5% of the total decade growth. This period reflects steady adoption in laparoscopic surgery holds around 37.2% share in overall application segment, also general surgery, and gynecology surgery, driven by the rising global preference for minimally invasive procedures and enhanced intraoperative fluid management. Disposable suction-irrigation devices lead the market by product segment during this phase with a 41.2% share, supported by hospital procurement policies prioritizing sterility and reduced turnaround times.

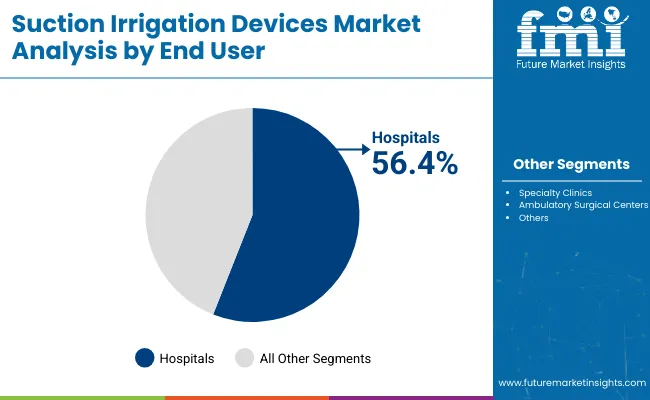

From 2030 to 2035, the market accelerates, contributing USD 140.4 million which is 55.5% of total growth as it climbs from USD 570.4 million to 710.8 million. Expansion is driven by the broader adoption in urological, orthopedic, and veterinary surgeries, as irrigation-flow precision, reduced tissue trauma, and workflow efficiency become key procurement criteria. Specialty clinics and ambulatory surgical centers increase their combined share which around 69.6% beyond one-third of the market, while technology-enabled devices create recurring revenue streams through consumables and system integration with advanced surgical platforms.

Between 2020 and 2024, the suction irrigation devices market grew from USD 378.9 million to USD 443.5 million, adding USD 64.6 million. Growth was steady, supported by consistent procedural volumes in laparoscopic and general surgeries. Hospitals favored manual control disposable systems for their simplicity and predictable sterilization processes, while adoption of smart sensor-controlled devices was slowed by 2020 to 2021 supply chain disruptions and postponed elective surgeries.

The market is moderately concentrated, with Stryker, Olympus Corporation, and CONMED Corporation holding about 52.2% of global revenue, leveraging broad product portfolios, strong distribution in mature and emerging markets, and multi-tier offerings spanning disposables, hybrids, and pumps. In 2025, the market is projected at USD 457.7 million, up 3.2% from 2024. A shift from 1.5% share from manual devices to hybrid systems and sensor-enabled pumps is anticipated, fueled by hospital investments in infection control and efficiency, alongside gradual growth in specialty clinic and ASC adoption for outpatient MIS procedures.

The suction irrigation devices market is growing due to the rising global volume of minimally invasive surgeries (MIS), where effective fluid management is critical for visibility and safety. High adoption in laparoscopic procedures including bariatric, gastrointestinal, and gynecologic surgeriesis driving consistent demand, especially in hospitals and high-acuity surgical centers. The shift toward infection control compliance has accelerated the use of disposable and hybrid systems, reducing cross-contamination risks and improving operating room turnover times.

Surgeons are increasingly preferring ergonomically designed devices with precise flow regulation to minimize tissue trauma and enhance procedural efficiency. Integration of smart sensor technologies and compatibility with robotic-assisted surgery platforms is also influencing purchasing decisions in advanced markets. Additionally, expanding healthcare infrastructure in emerging economies and the introduction of cost-optimized devices by both global and regional manufacturers are broadening access, creating a dual growth push from technological innovation and geographic market penetration.

The market is segmented by product, application, technology, and end user. Product categories include disposable suction-irrigation devices, reusable suction-irrigation devices, hybrid systems (reusable handle + disposable tip), and suction-irrigation pumps, reflecting varied preferences for sterility, reusability, and operational efficiency.

Applications span laparoscopic surgery, general surgery, gynecology surgery, urological surgery, veterinary application, orthopedic surgery, and other specialized procedures, addressing diverse clinical needs. Technology segmentation covers manual control devices, foot/hand-switch activated devices, and smart sensor-controlled devices, catering to different levels of precision, automation, and surgeon control. End user segments comprise hospitals, specialty clinics, ambulatory surgical centers, and other healthcare facilities, each with distinct procurement priorities, procedural volumes, and infrastructure capabilities influencing device adoption.

| By Product | Market Value Share, 2025 |

|---|---|

| Disposable Suction-Irrigation Devices | 41.2% |

| Reusable Suction-Irrigation Devices | 18.5% |

| Hybrid Systems (Reusable Handle + Disposable Tip) | 26.4% |

| Suction-Irrigation Pumps | 13.8% |

In 2025, disposable suction-irrigation devices lead the market with a 41.2% share, driven by their critical role in infection prevention and operational efficiency. Hospitals and ambulatory surgical centers increasingly prefer single-use systems to eliminate cross-contamination risks, comply with stringent sterilization guidelines, and avoid downtime associated with reprocessing reusable devices.

Procurement decisions are further influenced by predictable per-procedure costs and the ability to maintain consistent performance without degradation over multiple uses. High adoption is seen in high-volume laparoscopic and general surgeries, where rapid turnover is essential. Leading manufacturers such as Stryker and Olympus have expanded their disposable portfolios with ergonomically designed, flow-controlled hand pieces, meeting surgeon demand for both precision and ease of use solidifying disposables as the preferred choice in modern surgical settings.

| By Application | Market Value Share, 2025 |

|---|---|

| Laparoscopic Surgery | 37.2% |

| General Surgery | 17.6% |

| Gynecology Surgery | 11.3% |

| Urological Surgery | 7.5% |

| Veterinary Application | 8.6% |

| Orthopedic Surgery | 6.1% |

| Others | 11.8% |

In 2025, laparoscopic surgery accounts for the largest share at 37.2%, reflecting the procedure’s central role in driving suction-irrigation device demand. Laparoscopic interventions require continuous suction to clear blood and debris, paired with controlled irrigation to maintain visibility in minimally invasive fields. The global shift toward minimally invasive techniques driven by faster recovery times, reduced postoperative complications, and shorter hospital stays has amplified device usage.

Hospitals prioritize advanced suction-irrigation systems with precise flow regulation to minimize tissue trauma and enhance surgical accuracy. High adoption in bariatrics, gastrointestinal procedures, and gynecology within the laparoscopic category further reinforces dominance. Manufacturers such as CONMED and Olympus are targeting this segment with procedure-specific hand pieces and hybrid solutions, cementing its position as the primary demand driver in the market.

| By End User | Market Value Share, 2025 |

|---|---|

| Hospitals | 56.4% |

| Specialty Clinics | 13.2% |

| Ambulatory Surgical Centers | 20.9% |

| Others | 9.5% |

In 2025, hospitals dominate the suction irrigation devices market with a 56.4% share, driven by their high surgical volumes, advanced infrastructure, and capacity to perform complex, multidisciplinary procedures. Hospitals handle a majority of laparoscopic, general, and specialty surgeries, where suction-irrigation devices are essential for maintaining a clear operative field and ensuring patient safety.

Centralized procurement systems allow hospitals to invest in premium disposable and hybrid systems, often bundled with laparoscopic towers and visualization equipment from leading manufacturers like Stryker and Karl Storz. Additionally, hospitals have the sterilization capacity and trained personnel to manage reusable systems efficiently. The push toward infection control compliance, coupled with growing adoption of minimally invasive techniques in inpatient surgical units, further strengthens hospitals’ position as the largest and most consistent demand center.

The suction irrigation devices market sees rising adoption of laparoscopic and minimally invasive surgeries, where efficient fluid evacuation and targeted irrigation are essential for safety and visibility. Restraints include the high sterilization, reprocessing, and maintenance demands of reusable and hybrid models, which increase operational costs and limit adoption in resource-constrained facilities. A key trend is the shift toward smart, sensor-enabled, and ergonomically advanced devices that improve surgical control, reduce fatigue, and integrate with other operating room systems. Such innovations are influencing procurement decisions, especially in high-acuity centers seeking workflow efficiency and precision.

Growing Adoption of Laparoscopic and Minimally Invasive Surgeries Requiring Efficient Fluid Management

The increasing shift toward minimally invasive surgeries (MIS) is a primary growth driver for suction irrigation devices, as these instruments play a critical role in both fluid evacuation and targeted irrigation during laparoscopic procedures. According to product catalogs from leading manufacturers like Stryker, Olympus Corporation, and CONMED Corporation, modern suction irrigation devices integrate ergonomic hand pieces, interchangeable tips, and variable flow control senabling precise visibility and thermal safety in delicate anatomical zones.

MIS adoption is rising in specialties such as general surgery, gynecology, urology, and bariatrics due to reduced patient trauma, faster recovery, and lower infection risk. Surgeons increasingly prefer devices that combine high suction flow rates with adjustable irrigation pressure to manage intraoperative bleeding and maintain a clear surgical field without tissue damage. Furthermore, hospital procurement teams are prioritizing reusable or hybrid systems with disposable tips to balance cost-efficiency with sterility requirements.

The driver’s strength lies in the fact that suction irrigation devices are not optional in these procedures they are integral to intraoperative safety and efficiency, making demand directly proportional to the global laparoscopic surgery volume. This is reinforced by procedural growth data from hospital supply chain records and procurement contracts in major surgical centers.

High Sterilization and Maintenance Burden in Multi-Use Surgical Environments

While reusable and hybrid suction irrigation devices offer cost savings over time, their adoption is restrained by the operational complexities of sterilization, reprocessing, and maintenance in high-volume surgical departments. Device manuals from companies like Karl Storz and Richard Wolf GmbH specify detailed cleaning protocols involving disassembly, ultrasonic washing, and autoclaving to ensure lumen sterility. These processes are time-intensive and require specialized staff training to avoid cross-contamination risks.

In hospitals where surgical throughput is high, delays in reprocessing can cause inventory shortages, forcing facilities to maintain larger device fleets or revert to disposable systems. This increases total cost of ownership (TCO) and puts pressure on operating budgets. Additionally, improper reprocessing can cause lumen blockage, O-ring deterioration, and compromised suction flow impacting surgical safety and leading to unplanned device replacements.

In emerging markets, the challenge is amplified due to limited access to compliant sterilization infrastructure and skilled biomedical technicians. This barrier is not simply a cost issue it directly affects the availability and readiness of suction irrigation systems during critical surgeries, making it a major constraint for market penetration, particularly for reusable and hybrid models in cost-sensitive geographies.

Shift Toward Smart, Sensor-Enabled and Ergonomically Advanced Devices

A notable trend in the suction irrigation devices market is the integration of smart sensor technologies and ergonomic enhancements to improve surgical control, reduce fatigue, and enable real-time performance monitoring. Recent product announcements by Medtronic, Olympus, and CONMED highlight devices with programmable flow rate presets, tactile feedback triggers, and digital flow sensors that alert surgeons if suction or irrigation parameters deviate from set thresholds.

This evolution addresses two critical pain points: maintaining consistent visibility during prolonged laparoscopic procedures and reducing manual adjustments that distract from surgical precision. Additionally, advancements in hand piece design lighter materials, balanced weight distribution, and low-activation-force triggers are being developed to mitigate surgeon hand fatigue, particularly during multi-hour operations.

Hospitals are increasingly evaluating procurement not just on per-unit cost but on total surgical workflow efficiency. Devices that can integrate with electrosurgical systems or laparoscopic camera platforms for centralized control are gaining traction in procurement decisions. Early adoption patterns are visible in high-acuity centers in North America and Europe, with manufacturers positioning these innovations as premium-tier offerings. This trend represents a functional leap from purely mechanical devices toward integrated, data-supported surgical tools.

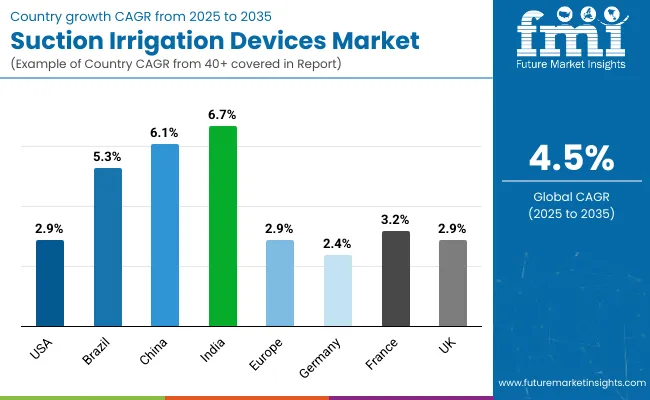

| Country | CAGR (%) |

|---|---|

| United States | 2.9% |

| Brazil | 5.3% |

| China | 6.1% |

| India | 6.7% |

| Europe | 2.9% |

| Germany | 2.4% |

| France | 3.2% |

| United Kingdom | 2.9% |

Asia-Pacific is emerging as the fastest-growing region in the suction irrigation devices market, propelled by rapid adoption of minimally invasive surgeries and increased investment in surgical infrastructure. India is expected to grow at a CAGR of 6.7%, driven by expanding laparoscopic procedure volumes in tier-2 and tier-3 cities, along with rising hospital capacity in private healthcare chains. China will grow at a CAGR of 6.1%, supported by aggressive procurement of surgical equipment in public hospitals and increasing surgeon training in advanced MIS techniques. The region’s growth is further strengthened by government-led healthcare modernization programs and local manufacturing initiatives that reduce device costs.

Europe is set for steady growth, with Germany at a CAGR of 2.4%, France at 3.2%, and the United Kingdom at 2.9%. Germany’s growth is supported by its high surgical throughput and hospital modernization initiatives. France benefits from strong public healthcare investment in MIS infrastructure, while the United Kingdom sees growth from increasing adoption of hybrid systems in NHS facilities.

North America remains a mature but expanding market, with the United States expected to grow at a CAGR of 2.9%. Growth is driven by high surgical volumes, early adoption of sensor-enabled suction irrigation devices, and strong presence of global market leaders. Favorable reimbursement policies and hospital preference for integrated surgical platforms further support market expansion.

| Year | USA Suction Irrigation Devices Market (USD Million) |

|---|---|

| 2025 | 142.6 |

| 2026 | 146.6 |

| 2027 | 150.7 |

| 2028 | 155.0 |

| 2029 | 159.5 |

| 2030 | 164.1 |

| 2031 | 168.8 |

| 2032 | 173.7 |

| 2033 | 178.8 |

| 2034 | 184.1 |

| 2035 | 189.7 |

The United States suction irrigation devices market is projected to grow at a CAGR of 2.9% from 2025 to 2035, reaching steady expansion despite being a mature market. Sales are supported by the country’s high volume of minimally invasive surgeries, strong hospital budgets for capital and consumable surgical products, and early adoption of advanced surgical technologies.

Hospitals and Ambulatory Surgical Centers (ASCs) increasingly integrate suction irrigation systems into standardized laparoscopic sets, ensuring consistent availability across specialties. The Centers for Medicare & Medicaid Services (CMS) reimbursement for certain MIS procedures incentivizes facilities to maintain up-to-date, high-performance equipment.

Additionally, the growing use of robotic-assisted platforms has created demand for compatible suction irrigation instruments with sensor-based flow regulation. The United States market also benefits from well-established domestic manufacturing and distribution networks, reducing lead times and ensuring compliance with FDA-mandated sterility requirements. Rising bariatric surgery rates, coupled with aging demographics requiring gastrointestinal and urological interventions, further sustain device demand.

The German suction irrigation devices market is projected to grow at a CAGR of 2.4% from 2025 to 2035, supported by the country’s high surgical throughput, advanced hospital infrastructure, and strong commitment to adopting precision-driven medical devices. Germany’s healthcare system emphasizes quality and safety, which drives procurement of devices with enhanced ergonomics, consistent flow control, and superior sterility assurance.

The rise in complex oncologic and gastrointestinal laparoscopic surgeries in university hospitals is fueling demand for premium hybrid and reusable systems that can withstand repeated sterilization cycles without performance loss. In addition, strict Robert Koch Institute (RKI) guidelines for infection prevention have encouraged facilities to invest in advanced reprocessing-compatible devices.

Procurement contracts in Germany often favor suppliers with proven local service networks, ensuring quick maintenance and device availability. Growth is further reinforced by a high proportion of surgeries performed in specialized surgical centers, where demand for customized device configurations is higher. The focus on total cost of ownership, rather than upfront price, has also encouraged adoption of higher-end systems that deliver long-term reliability and consistent performance in high-volume environments.

The United Kingdom suction irrigation devices market is projected to grow at a CAGR of 2.6% from 2025 to 2035, driven by the NHS’s modernization of surgical suites and a push toward expanding minimally invasive surgery capacity across regional hospitals. A significant share of procurement is influenced by centralized NHS tenders, where suppliers with proven cost efficiency, compliance with NICE surgical equipment guidelines, and strong after-sales support gain an advantage.

Growth is further supported by the United Kingdom’s rising adoption of day-case laparoscopic procedures, particularly in gallbladder, hernia, and gynecologic surgeries, where high-flow disposable systems improve turnover efficiency. Academic medical centers are also incorporating hybrid systems into robotic-assisted laparoscopic programs, increasing demand for sensor-enabled irrigation control. Additionally, the emphasis on reducing hospital-acquired infections (HAIs) has increased disposable usage in high-risk surgical environments.

United Kingdom device adoption trends also benefit from a strong focus on ergonomic design, driven by surgeon feedback collected through NHS procurement evaluations, encouraging the uptake of devices with reduced trigger force and improved handling during prolonged cases.

| Europe Countries Share | 2025 % Share |

|---|---|

| Germany | 27.9% |

| United Kingdom | 16.8% |

| France | 15.0% |

| Italy | 11.3% |

| Spain | 8.5% |

| BENELUX | 6.9% |

| Nordic Countries | 5.9% |

| Rest of Western Europe | 7.7% |

| Europe Countries Share | 2035 % Share |

|---|---|

| Germany | 27.3% |

| United Kingdom | 16.5% |

| France | 14.7% |

| Italy | 11.1% |

| Spain | 8.3% |

| BENELUX | 6.8% |

| Nordic Countries | 5.8% |

| Rest of Western Europe | 9.6% |

India’s suction irrigation devices market is projected to grow at a CAGR of 6.7%, underpinned by three India‑specific forces includes rising procedure volumes in public and private networks as PM‑JAY continues to scale inpatient admissions; its live dashboard reports 650+ lakh (6.5M) authorized hospital admissions cumulatively, signaling robust surgical demand funnels.

A quality push NABH accreditation and standards updates are tightening infection‑control expectations, nudging hospitals toward disposable and hybrid systems with predictable sterility and faster OR turnovers. supply‑side tailwinds “Make in India” policies and the PLI scheme for medical devices are encouraging local assembly of surgical hardware/consumables, improving availability and lead times for laparoscopic accessories, including suction/irrigation sets. Regulatory clarity also helps procurement: CDSCO classifies irrigation/aspiration catheters and related accessories under the Medical Device Rules, streamlining registrations for domestic and imported SKUs that pair with laparoscopic towers.

The China suction irrigation devices market is projected to grow at a CAGR of 5.6%,fueled by the rapid expansion of surgical capacity under the Healthy China 2030 framework. Large tertiary hospitals in tier-1 cities are upgrading to advanced hybrid and sensor-enabled devices to support complex laparoscopic oncology and gastrointestinal surgeries.

Provincial government investments in minimally invasive surgery (MIS) training programs are increasing surgeon proficiency, expanding device usage beyond top-tier hospitals into regional medical centers. Domestic manufacturers, supported by localization and procurement preferences, are producing cost-competitive systems that meet National Medical Products Administration (NMPA) requirements, reducing reliance on imports.

Additionally, high patient demand for shorter hospital stays is encouraging hospitals to adopt efficient disposable systems that reduce OR turnover times. The combination of strong public hospital funding, rapid MIS adoption in lower-tier cities, and the rise of domestic innovation positions China as one of the most dynamic growth markets for suction irrigation devices in Asia-Pacific.

| Japan Suction Irrigation Devices Market By Product, Market Share (%) Analysis, 2025 | 2025 Share (%) |

|---|---|

| Japan Disposable Suction-Irrigation Devices | 42.1% |

| Japan Reusable Suction-Irrigation Devices | 18.9% |

| Japan Hybrid Systems (Reusable Handle + Disposable Tip) | 27.0% |

| Japan Suction-Irrigation Pumps | 12.1% |

Japan will account for 3.1% of the global suction irrigation devices market in 2025 and is projected to grow at a steady CAGR of 2.4% through 2035. The market’s growth is underpinned by Japan’s precision-driven surgical culture and strong integration of advanced digital technologies into operating rooms. Software-enabled capabilities such as real-time irrigation flow analytics, pressure regulation, and integration with laparoscopic imaging systems lead slightly over hardware (50.2% vs. 49.8%), reflecting the country’s focus on data-supported surgical decision-making.

Adoption is also driven by digital twin simulations used in preoperative planning, allowing surgeons to model fluid management strategies before procedures. AI-based intraoperative monitoring tools are increasingly paired with suction irrigation devices to automatically adjust parameters during surgery, enhancing precision and reducing manual adjustments. Government investment in smart OR infrastructure, coupled with the country’s rapidly aging population requiring gastrointestinal, urological, and oncologic interventions, sustains demand. Japanese manufacturers are further contributing by developing compact, ergonomically refined hybrid devices that optimize space efficiency in ORs without compromising functionality.

| South Korea Suction Irrigation Devices Market By Technology Used, Market Share (%) Analysis, 2025 | 2025 Share (%) |

|---|---|

| South Korea Manual Control Devices | 51.1% |

| South Korea Foot/Hand-Switch Activated | 32.0% |

| South Korea Smart Sensor-Controlled Devices | 16.9% |

South Korea’s suction irrigation devices market is projected to grow at a CAGR of 5.9% from 2025 to 2035, driven by its rapid adoption of advanced minimally invasive surgery (MIS) techniques and strong government backing for surgical technology innovation. The country’s well-developed hospital infrastructure, particularly in tertiary care centers, is enabling widespread use of hybrid and smart sensor-controlled systems that offer precise irrigation flow and improved visibility in complex procedures. South Korea’s Ministry of Health and Welfare (MOHW) initiatives to expand robotic-assisted surgery programs in public and private hospitals have further increased demand for compatible suction irrigation devices, especially in urology, gynecology, and gastrointestinal oncology.

Medical device procurement in South Korea is also influenced by the country’s high digital health readiness, with hospitals integrating suction irrigation systems into networked OR platforms for central monitoring and maintenance. Domestic manufacturers are gaining ground by producing competitively priced devices tailored for the local market, while international players are focusing on premium models with ergonomic enhancements and automation features. Rising demand for shorter hospital stays and faster recovery rates has made high-performance disposable systems a preferred choice for high-volume surgical centers.

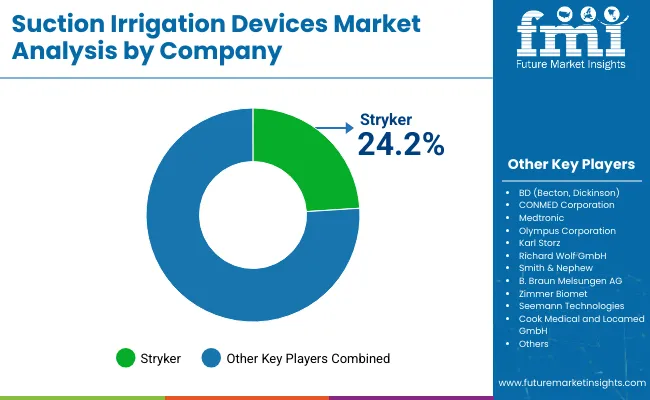

| Key Players | Global Value Share (%) 2025 |

|---|---|

| Stryker | 24.2% |

| Other Players | 75.9% |

The suction irrigation devices market is moderately consolidated, with Stryker holding the largest share at 24.2% in 2024, supported by its extensive laparoscopic portfolio, ergonomic disposable systems, and strong hospital contracting channels. Global surgical technology leaders such as Olympus Corporation, Karl Storz, and CONMED Corporation leverage deep expertise in MIS instrumentation, integrating suction irrigation hand pieces with their laparoscopic towers and imaging platforms to offer bundled procurement solutions. Medtronic and BD (Becton, Dickinson) strengthen their positions through cross-portfolio synergies, coupling suction irrigation systems with complementary surgical and infection prevention products.

Mid-sized players like Richard Wolf GmbH and B. Braun Melsungen AG focus on reusable and hybrid systems, emphasizing durability, reprocessing compatibility, and specialty-specific designs for gynecology and urology. Niche innovators such as Locamed GmbH, Seemann Technologies, and Cook Medical compete through customized devices tailored for regional hospital preferences and cost-sensitive markets.

Across the competitive landscape, differentiation is shifting toward workflow efficiency, infection control compliance, and integration with robotic-assisted and sensor-enabled surgical platforms, as well as service-driven models that enhance long-term customer retention.

Key Developments

| Item | Value |

|---|---|

| Quantitative Units (2035) | USD 710.8 million |

| Product | Disposable Suction-Irrigation Devices, Reusable Suction-Irrigation Devices, Hybrid Systems (Reusable Handle + Disposable Tip) and Suction-Irrigation Pumps |

| Application | Laparoscopic Surgery, General Surgery, Gynecology Surgery, Urological Surgery, Veterinary Application, Orthopedic Surgery and Others |

| Technology User | Manual Control Devices, Foot/Hand-Switch Activated and Smart Sensor-Controlled Devices |

| End User | Hospitals, Specialty Clinics, Ambulatory Surgical Centers and Others |

| Regions Covered | North America, Latin America, Western & Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Brazil, China, India, Germany, France, United Kingdom etc. |

| Key Companies Profiled | Stryker, BD (Becton, Dickinson), CONMED Corporation, Medtronic, Olympus Corporation, Karl Storz, Richard Wolf GmbH, Smith & Nephew, B. Braun Melsungen AG, Zimmer Biomet, Seemann Technologies, Cook Medical and Locamed GmbH |

| Additional Attributes | Dollar sales in the suction irrigation devices market are led by laparoscopic surgery and general surgery applications, with hospitals in North America and Europe generating the highest revenue, while Asia-Pacific shows the fastest percentage growth due to rising MIS adoption. Uptake trends indicate a shift from purely manual devices toward hybrid systems and smart sensor-controlled technologies, reflecting surgeon demand for precision fluid management and infection control compliance. |

The global suction irrigation devices is estimated to be valued at USD 457.7 million in 2025.

The market size for the suction irrigation devices market is projected to reach approximately USD 710.8 million by 2035.

The suction irrigation devices market is expected to grow at a CAGR of 4.5% between 2025 and 2035.

The key products in the suction irrigation devices market include disposable suction-irrigation devices, reusable suction-irrigation devices, hybrid systems (reusable handle + disposable tip) and suction-irrigation pumps.

In terms of end user, the hospitals segment is projected to command the highest share at 56.4% in the suction irrigation devices market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Suction Pump Market

Suction Road Sweeper Market

Liposuction Market Size and Share Forecast Outlook 2025 to 2035

End Suction Pump Market - Size, Share, and Forecast 2025 to 2035

The Liposuction Surgery Devices Market is segmented By Technology and End User from 2025 to 2035

Flat Suction Cup Market Size and Share Forecast Outlook 2025 to 2035

Foot Suction Valve Market Forecast and Outlook 2025 to 2035

Foot Suction Unit Market Size and Share Forecast Outlook 2025 to 2035

Dental Suction Systems Market Size and Share Forecast Outlook 2025 to 2035

Surgical Suction Instruments Market

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in the Packaging Suction Cups Sector

Flat Vacuum Suction Cup Market Size and Share Forecast Outlook 2025 to 2035

Bellow Vacuum Suction Cup Market Size and Share Forecast Outlook 2025 to 2035

Irrigation Syringe Market Size and Share Forecast Outlook 2025 to 2035

Irrigation testing kit Market

Irrigation Liners Market

Micro Irrigation System Market Size and Share Forecast Outlook 2025 to 2035

Sinus Irrigation Systems Market Size and Share Forecast Outlook 2025 to 2035

Wound Irrigation Systems Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA