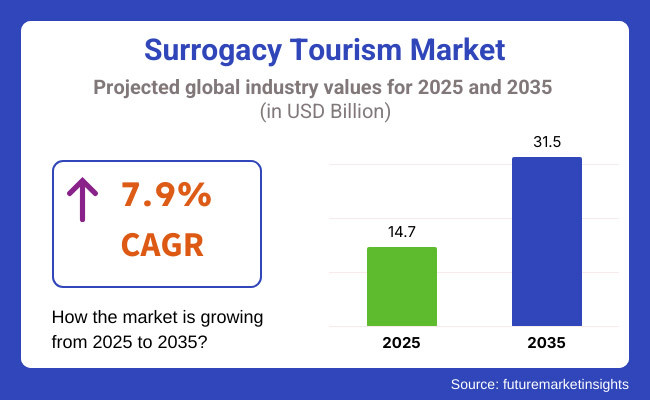

The surrogacy tourism industry globally is expected to rise from USD 14.7 billion in 2025 to USD 31.5 billion in 2035. The market is likely to grow at a CAGR of 7.9% through the forecast period due to growing infertility, changing legal scenarios, and rising adoption of assisted reproductive technologies (ART).

Those nations with good surrogacy legislation, like the United States, Ukraine, and Georgia, have emerged as top destinations for intended parents. Top agencies, like Circle Surrogacy, Growing Generations, and New Life Global, enable global surrogacy experiences. They provide full medical, legal, and logistical assistance.

Intended parents are increasingly looking for international surrogacy opportunities because of cost, better success rates, and the availability of more advanced medical facilities. For example, the services of USA surrogacy can be more than USD 150,000, whereas Mexico and Colombia offer similar services at much lesser costs. Additionally, LGBTQ+ individuals and single parents also increasingly look at international surrogacy programs because more jurisdictions increasingly recognize non-traditional family units.

Technology is also transforming the sector. Artificial intelligence-based matching software enables intended parents to find suitable surrogates, and blockchain technology provides secure transparency in payments and contracts. Telemedicine platforms facilitate pre- and post-natal checkups, enabling distant monitoring of the surrogate's health.

| Surrogacy Tourism | Fertility Tourism |

|---|---|

| 2020: USD 10.2 Billion (Rise in cross-border surrogacy arrangements) | 2020: USD 8.9 Billion (Growth in IVF and fertility treatment travel) |

| 2024: USD 13.6 Billion (Regulatory flexibility in certain countries) | 2024: USD 12.1 Billion (Advancements in ART techniques) |

| 2025: USD 14.7 Billion (Increase in intended parent demand) | 2025: USD 13.2 Billion (Rising egg and sperm donation services) |

| 2035: USD 31.5 Billion (Greater legal clarity and medical advancements) | 2035: USD 27.8 Billion (Wider accessibility of fertility treatments) |

Surrogacy tourism and fertility tourism serve distinct needs within the assisted reproductive market. Surrogacy tourism is mostly the case of intended parents traveling across borders to participate in legally sanctioned surrogacy schemes, frequently in locations such as the United States, Ukraine, and Mexico.

These parents desire legal guarantees, superior medical care, and affordable options not accessible in their native countries. For instance, French couples are often going to Ukraine because France has surrogacy bans, and German gay couples choose American surrogacy agencies that provide comprehensive legal protections.

Fertility tourism, however, is about patients traveling to receive specialized fertility procedures like IVF, egg donation, and sperm banking at reduced prices or with higher success rates than available in their resident country. Spain and Greece have become top fertility tourism destinations because of their top-notch reproductive facilities and easier egg donation options. British patients typically go to Spain for IVF procedures that avoid lengthy waiting lists in the UK, and Americans seek fertility tourism in Argentina for low-cost high-quality treatments.

Both industries are continuous, though surrogacy tourism is increasingly subject to regulatory control due to ethical concerns over surrogate health and parental rights. Fertility tourism, by contrast, thrives where legislations are tolerant of low-cost ART services. With changing legal landscapes, intended parents and fertility consumers will continue to pursue cross-border solutions that serve their interests.

Today, intended parents look for medical competence, legal assurance, and moral grounds in surrogacy destinations. The USA still holds its position in gestational surrogacy, thanks to the robust legal framework. Ukraine and Colombia are becoming popular among budget-conscious parents due to lower rates. India and Thailand, once the leaders, have witnessed a decline following regulatory setbacks, giving way to new surrogacy hubs in Georgia, Mexico, and Argentina.

Gestational surrogacy represents the largest share of the market because it has legal certainty and high success rates in comparison with traditional surrogacy. Intended parents all over the globe prefer this practice to escape intricate parental rights litigation.

The safest and most advanced nation for gestational surrogacy is the United States, particularly in California, Illinois, and Connecticut, where intended parents enjoy good laws on surrogacy. International trends are shaped by high-profile cases, including celebrities' utilization of gestational surrogacy in California, further cementing the state as a reproductive tourism leader.

Ukraine and Georgia are leading alternatives, with legally organized and low-cost surrogacy programs. Kyiv clinics, for example, BioTexCom, have experienced increased numbers of patients from Western Europe and Asia pursuing low-cost possibilities. Geopolitical uncertainty in Ukraine is, however, an issue, encouraging intended parents to seek out developing destinations like Argentina and Colombia, where legal procedures are increasingly becoming transparent.

Demand for gestational surrogacy is also increasing in Latin America. Mexico's surrogacy clinics in Cancun and Tabasco are drawing North American and European intended parents with lower prices and high medical standards. Argentina's expanding surrogacy industry is also gaining momentum after commercial surrogacy for foreign nationals was legalized in the country.

With the incorporation of AI-powered surrogate matching, blockchain-based contract protection, and telemedicine for prenatal services, gestational surrogacy will remain market leaders. Intended parents will make choices based on legal rights, costs, and medical professionals, thus ensuring continued growth in this sector.

Intended parents are the most significant segment in surrogacy tourism since they generate demand, shape destination choices, and define industry trends. The parents go abroad for surrogacy mainly because of cost considerations, legal safeguards, and availability of the best medical facilities.

Within the USA, both wealthy individuals and celebrities use surrogacy services within surrogacy-friendly California. The healthiness of legal precedent in this area means the intended parents gain all parental rights without a legal disputative proceeding. Similarly, Ukraine is inviting for European intended parents due to healthy-governing surrogacy programs from the likes of BioTexCom providing complete packages for surrogacy.

Latin America has also become a big destination for budget-mindful intended parents. Mexican clinics in Cancun and Mexico City provide surrogacy at close to half the price of USA programs with equivalent medical standards. Similarly, Argentina has seen an increase in surrogacy tourism since it legalized commercial surrogacy recently, and it has become a desirable solution for Spanish and Italian couples.

LGBTQ+ intended parents are also an important segment, especially in nations that embrace diverse family formations. Colombia and Canada are prime destinations because of their progressive laws and ethical surrogacy policies. Surrogacy agencies in these countries specifically design programs for LGBTQ+ couples to ensure legal recognition of both parents.

The power of intended parents also goes beyond where they go. They increasingly desire ethical surrogacy arrangements, which compel agencies to adopt clearer processes, AI-based surrogate matching, and blockchain-secured contract protection. With surrogacy demand still rising, the market will adapt to meet their legal, financial, and emotional needs, cementing their position as the most powerful market segment for surrogacy tourism.

The United States leads the surrogacy tourism market globally with unmatched legal certainty, advanced medical technology, and full surrogacy services. California, Illinois, and Florida have become the hub surrogacy destinations with well-defined laws protecting the intended parents' rights. They provide pre-birth orders for intended parents so that they are legally recognized even before the child's birth, and the complications are kept to the barest minimum.

High-profile celebrities, corporate executives, and overseas clients often opt for USA surrogacy agencies such as Circle Surrogacy and Growing Generations due to their established networks and success rates. One surrogacy process in the USA can cost anywhere from USD 120,000 to USD 180,000, but most intended parents are willing to spend it because of the high success rates of fertility procedures and strict medical regulations that ensure surrogate health and safety.

The USA also draws LGBTQ+ intended parents, as its legal framework is inclusive. In contrast to most nations where surrogacy is only available to heterosexual couples, California, for instance, provides for surrogacy arrangements by same-sex couples and unmarried individuals. Consequently, foreign clients, especially those from nations with surrogacy prohibitions, like France and Germany, actively pursue USA-based surrogacy services.

In addition, American medical technology renders surrogacy more efficient and reliable. The best fertility clinics employ genetic screening, AI-guided embryo selection, and advanced cryopreservation techniques to maximize IVF success. Telemedicine platforms allow for remote consultations for international clients, reducing logistical challenges.

With more and more intended parents valuing safety, legal security, and medical quality, the USA will remain at the forefront of the surrogacy tourism market, solidifying its position as the leading destination for cross-border reproductive services.

Ukraine has become a highly sought-after surrogacy destination in Europe because of its well-defined laws and comparatively less expensive process compared to Western countries. The surrogacy-friendly laws of the country permit only married heterosexual couples to undergo surrogacy, thereby ensuring legal parental rights are smoothly transferred. Intended parents from Germany, France, and China often opt for Ukraine due to its highly organized processes and high-tech fertility clinics.

Ukraine-based clinics like BioTexCom and VittoriaVita have a solid track record of providing high-quality surrogacy treatment, with all-inclusive packages comprising legal assistance, IVF treatment, and surrogate remuneration. Intended parents choose to go to Ukraine mainly because of affordability, as surrogacy will cost between USD 40,000 and USD 60,000 compared to the USD 150,000 or more needed in America.

Despite its appeal, the surrogacy market in Ukraine is not without its challenges. The current geopolitical tensions have had the effect of interrupting surrogacy arrangements, leading intended parents to look for other markets such as Georgia and Mexico. Agencies have moved operations to be able to continue their services, and Kyiv clinics continue with contingency plans.

Besides, Ukraine's surrogacy sector is increasingly facing pressure with calls for better regulation to end exploitation. The agencies have responded by making processes more transparent, employing blockchain-based contracts, and providing surrogate well-being schemes in order to make surrogacy ethical.

With its developed medical experience, cost benefits, and increasing international client base, Ukraine is still a top destination for surrogacy tourism. The industry, though, will need to contend with regulatory changes and geopolitical threats to maintain itself as a top European surrogacy center.

Mexico has become a top surrogacy destination for intended parents looking for affordability without sacrificing medical standards. The surrogacy cost in Mexico is between USD 50,000 and USD 80,000—much lower than the USD 150,000 or more charged in the United States. This cost savings has prompted many North American and European couples to look into Mexico's surrogacy programs.

Cancun, Mexico City, and Tabasco have emerged as major surrogacy centers, with intended parents being drawn to them because of their highly equipped fertility clinics and highly qualified medical practitioners. Ingenes and CARE Surrogacy Center Mexico are among the clinics that have been recognized globally for their high success rates in IVF and complete surrogacy packages that include legal assistance, surrogate medical services, and embryo transfer services.

Mexico's permissive surrogacy legislation also makes it attractive. Although surrogacy laws differ in each state, Tabasco and Colima provide straightforward legal structures that guarantee intended parents acquire parental rights without issue. Most European intended parents, especially from Spain and Germany, prefer Mexico because of the simplicity of legal procedures as opposed to more restrictive legislation in their own countries.

Despite its advantages, Mexico's surrogacy industry faces the problem of regulations. Foreign citizens have been barred from surrogacy in a number of states, forcing agencies to relocate operations to places where legislation is more open-minded. Intended parents must move cautiously within the judicial system, relying largely on expert legal guidance provided by surrogacy agencies.

With increasing demand, Mexico keeps streamlining its surrogacy business, taking the best from global practices and strengthening ethical principles. As the nation develops a more robust regulatory framework and expands healthcare services, it will be an industry leader among budget-friendly intended parents who seek safe surrogacy solutions.

The surrogacy tourism market is competitive, with major players that include everything from niche agencies to large-scale fertility clinics. The international agencies like Growing Generations and Circle Surrogacy prevail in high-end markets, with Mexican and Ukrainian clinics capturing affordability-driven markets.

Online platforms further redefine competition. SurrogacyMap and MySurrogateMatch are among the companies that offer AI-based matching services, allowing intended parents to match with surrogates more effectively. Blockchain-based contract platforms also increase transparency in cross-border surrogacy contracts.

Recent Developments in the Surrogacy Tourism Industry

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data | 2020 to 2024 |

| Market Analysis | USD Billion (Value) |

| Key Regions | North America; Latin America; Europe; East Asia; South Asia; Oceania; MEA |

| Key Segments | Service Type, End User, Tourist Type, Booking Channel |

| Key Players | Circle Surrogacy; Growing Generations; New Life Global; SurrogacyMap; MySurrogateMatch |

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Service Provider, 2018 to 2033

Table 6: Global Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Service Provider, 2018 to 2033

Table 12: North America Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 16: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Service Provider, 2018 to 2033

Table 18: Latin America Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 22: Western Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Service Provider, 2018 to 2033

Table 24: Western Europe Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 28: Eastern Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Service Provider, 2018 to 2033

Table 30: Eastern Europe Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 34: South Asia and Pacific Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Service Provider, 2018 to 2033

Table 36: South Asia and Pacific Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 40: East Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Service Provider, 2018 to 2033

Table 42: East Asia Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 46: Middle East and Africa Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Service Provider, 2018 to 2033

Table 48: Middle East and Africa Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Service Provider, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 16: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Service Provider, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Service Provider, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Service Provider, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 23: Global Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 24: Global Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 25: Global Market Attractiveness by Type, 2023 to 2033

Figure 26: Global Market Attractiveness by Tour Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Technology, 2023 to 2033

Figure 28: Global Market Attractiveness by Service Provider, 2023 to 2033

Figure 29: Global Market Attractiveness by Age Group, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Service Provider, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 36: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 46: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 47: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 48: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 49: North America Market Value (US$ Million) Analysis by Service Provider, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Service Provider, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Service Provider, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 55: North America Market Attractiveness by Type, 2023 to 2033

Figure 56: North America Market Attractiveness by Tour Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Technology, 2023 to 2033

Figure 58: North America Market Attractiveness by Service Provider, 2023 to 2033

Figure 59: North America Market Attractiveness by Age Group, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Service Provider, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 67: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 71: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 72: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 74: Latin America Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 75: Latin America Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 77: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 78: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Service Provider, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Service Provider, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Service Provider, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 83: Latin America Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 84: Latin America Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 85: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Tour Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Service Provider, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Age Group, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Service Provider, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 97: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 101: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 102: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 103: Western Europe Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 104: Western Europe Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 105: Western Europe Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 106: Western Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 107: Western Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 108: Western Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 109: Western Europe Market Value (US$ Million) Analysis by Service Provider, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Service Provider, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Service Provider, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 113: Western Europe Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 114: Western Europe Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 115: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Tour Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Technology, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Service Provider, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Age Group, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Service Provider, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 127: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 131: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 132: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 133: Eastern Europe Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 134: Eastern Europe Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 135: Eastern Europe Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 136: Eastern Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 137: Eastern Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 138: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 139: Eastern Europe Market Value (US$ Million) Analysis by Service Provider, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Service Provider, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Service Provider, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 143: Eastern Europe Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 144: Eastern Europe Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 145: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Tour Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Technology, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Service Provider, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Age Group, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Technology, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Service Provider, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 157: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 162: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 164: South Asia and Pacific Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 165: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 166: South Asia and Pacific Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 167: South Asia and Pacific Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 168: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 169: South Asia and Pacific Market Value (US$ Million) Analysis by Service Provider, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Service Provider, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Service Provider, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 173: South Asia and Pacific Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 174: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 175: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Tour Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Technology, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Service Provider, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Age Group, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Service Provider, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 191: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 192: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 193: East Asia Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 194: East Asia Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 195: East Asia Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 196: East Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 197: East Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 198: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 199: East Asia Market Value (US$ Million) Analysis by Service Provider, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Service Provider, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Service Provider, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 203: East Asia Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 204: East Asia Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 205: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Tour Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Technology, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Service Provider, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Age Group, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Technology, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Service Provider, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 217: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 221: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 222: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 223: Middle East and Africa Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 224: Middle East and Africa Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 225: Middle East and Africa Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 226: Middle East and Africa Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 227: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 228: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 229: Middle East and Africa Market Value (US$ Million) Analysis by Service Provider, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Service Provider, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Service Provider, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 233: Middle East and Africa Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 234: Middle East and Africa Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 235: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Tour Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Technology, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Service Provider, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Age Group, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

The global surrogacy tourism industry is valued at USD 13.6 billion in 2024. The market is expected to reach USD 14.7 billion by 2025 and grow to approximately USD 31.5 billion by 2035, expanding at a CAGR of 7.9%.

The demand for affordable surrogacy options, favorable legal frameworks in select countries, increasing infertility rates, and advancements in reproductive technology drive the growth of this industry.

Leading agencies include Circle Surrogacy, Growing Generations, New Life Global, BioTexCom, VittoriaVita, CARE Surrogacy Center Mexico, and Ingenes.

AI-powered surrogate-intended parent matching, blockchain-based legal contracts, telemedicine consultations, and embryo cryopreservation advancements enhance the efficiency and security of surrogacy arrangements.

Countries with clear legal protections, such as the USA, Ukraine, and Georgia, attract more intended parents, while nations with strict or unclear regulations push surrogacy seekers to alternative destinations.

Leading agencies implement surrogate welfare programs, ensure transparent contracts, and follow ethical guidelines to protect both surrogates and intended parents.

Intended parents prioritize destinations that offer legal security, affordable yet high-quality medical services, and streamlined processes. LGBTQ+ inclusivity and ethical surrogacy practices are becoming key considerations in destination selection.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA