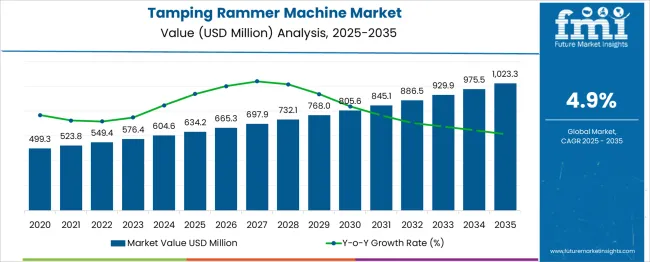

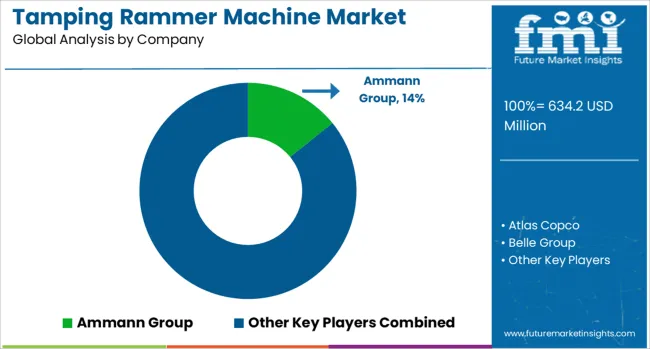

The Tamping Rammer Machine Market is estimated to be valued at USD 634.2 million in 2025 and is projected to reach USD 1023.3 million by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period. During the first five years (2025–2030), the market is expected to expand from USD 634.2 million to USD 805.6 million, adding USD 171.4 million, which accounts for 44.1% of the total incremental growth, with a 5-year multiplier of 1.27x. The second phase (2030–2035) contributes USD 217.7 million, representing 55.9% of incremental growth, reflecting continued demand driven by infrastructure development, urbanization, and mechanization of smaller-scale construction tasks.

Annual increments rise from USD 31.7 million in early years to USD 43.3 million by 2035, signaling stronger growth driven by innovations in efficiency, fuel consumption, and operator comfort. Manufacturers focusing on energy-efficient, compact, and user-friendly tamping rammers will capture the largest share of this USD 389.1 million opportunity.

| Metric | Value |

|---|---|

| Tamping Rammer Machine Market Estimated Value in (2025 E) | USD 634.2 million |

| Tamping Rammer Machine Market Forecast Value in (2035 F) | USD 1023.3 million |

| Forecast CAGR (2025 to 2035) | 4.9% |

The tamping rammer machine market is experiencing robust growth fueled by rising infrastructure development and urbanization across emerging and developed regions. The need for efficient soil compaction in road construction, foundation laying, and landscaping has amplified the adoption of tamping rammers, particularly in confined spaces where manual handling is essential. Advances in machine design, such as improved ergonomics and vibration control, have increased operator comfort and productivity, further supporting market expansion.

Gasoline-powered machines dominate the market due to their superior mobility, power output, and ease of refueling in remote or off-grid locations. Manual category machines continue to be preferred for their simplicity, cost-effectiveness, and adaptability in small to medium-scale projects.

The market outlook remains positive as ongoing investments in transportation infrastructure and commercial construction are expected to boost demand. Environmental regulations and the drive toward fuel efficiency are also guiding innovation in machine powertrains and emissions control.

The tamping rammer machine market is segmented by product type, power source, category, end use, distribution channel, and geographic regions. By product type, the tamping rammer machine market is divided into Vibratory rammers, Percussion rammers, Walk-behind rammers, and Remote-controlled rammers. In terms of power source, the tamping rammer machine market is classified into Gasoline-powered, Electric-powered, and Battery-powered. The tamping rammer machine market is segmented into Manual, Automatic, and Semi-automatic. By end use, the tamping rammer machine market is segmented into Construction, Infrastructure, Mining, Landscaping and gardening, Agriculture, and Others. The distribution channel of the tamping rammer machine market is segmented into Direct sales and Indirect sales. Regionally, the tamping rammer machine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

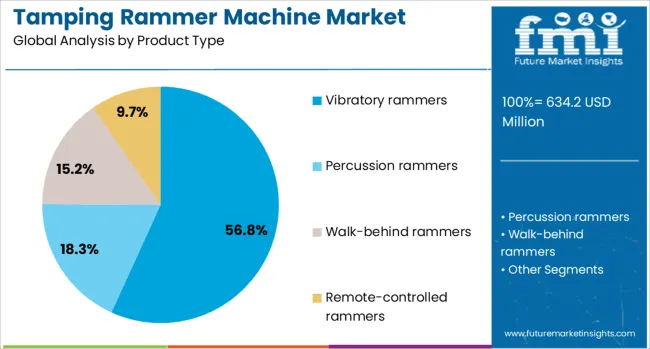

Vibratory rammers are forecasted to capture 56.8% of the total revenue share in the tamping rammer machine market by 2025, reflecting their position as the leading product type. This prominence is supported by their ability to deliver consistent and high-impact soil compaction in both granular and cohesive soils, which is critical for infrastructure durability.

Enhancements in vibration frequency control, shock absorption, and operator safety features have driven the segment’s growth. Their versatility across diverse construction applications, including trench backfilling and pipeline laying, has broadened their use.

Additionally, improvements in fuel efficiency and machine weight optimization have enabled easier maneuverability and reduced operator fatigue. These factors combined have established vibratory rammers as the preferred solution in construction projects requiring reliable compaction and operational efficiency.

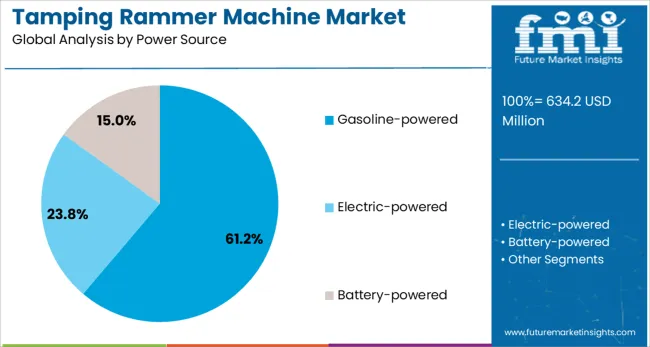

The gasoline-powered segment is expected to hold 61.2% of the market revenue share by 2025, dominating the power source category. This leadership is attributed to the inherent advantages of gasoline engines, such as portability, high power-to-weight ratio, and rapid refueling capabilities, which are critical in remote or off-site construction areas.

Gasoline-powered tamping rammers offer operational flexibility, allowing use in regions lacking reliable electricity access. The development of cleaner and more efficient gasoline engines has further bolstered this segment by aligning with evolving emission standards.

Maintenance simplicity and widespread availability of gasoline fuel continue to support adoption, especially among small contractors and rental service providers. These advantages collectively reinforce gasoline-powered machines’ standing as a practical and dependable power source in the market.

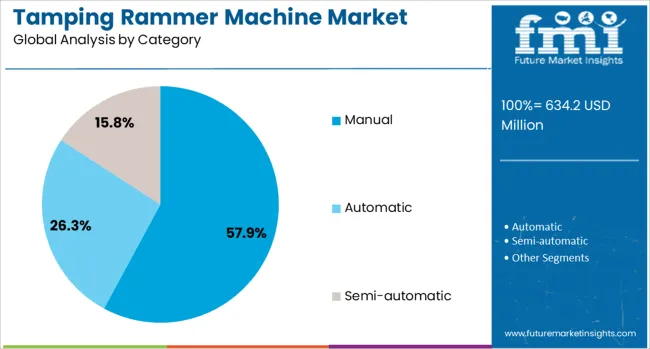

The manual category segment is projected to account for 57.9% of the revenue share in the tamping rammer machine market by 2025, underscoring its dominance in the market. The preference for manual tamping rammers arises from their operational simplicity, affordability, and suitability for small to medium-scale projects.

Their lightweight and compact design allows use in confined spaces and areas with limited mechanization options. Furthermore, manual machines require lower capital investment and less maintenance compared to automated alternatives, making them accessible to a broader range of contractors, particularly in developing economies.

The segment’s growth is also supported by the increasing number of construction projects with budget constraints and the continued reliance on manual labor in certain regions. These factors have collectively driven sustained demand for manual tamping rammer machines.

The tamping rammer machine market is driven by increasing demand for compact, efficient construction equipment. Opportunities in expanding infrastructure and road construction projects are fueling growth, while emerging trends in battery-powered and eco-friendly models are reshaping the market. However, high initial investment and maintenance costs remain significant challenges. By 2025, overcoming these barriers with cost-effective solutions and more sustainable equipment will be crucial for continued market expansion.

The tamping rammer machine market is growing due to the increasing demand for compact and efficient construction equipment. Tamping rammers are essential for compacting soil, gravel, and asphalt in confined spaces, such as trenches or narrow construction sites. Their ability to provide excellent compaction performance in small areas is driving market growth, particularly in urban construction projects. By 2025, this demand for versatile, easy-to-operate compaction equipment is expected to continue boosting the market.

Opportunities in the tamping rammer machine market are growing with the expansion of infrastructure and road construction projects. Tamping rammers are widely used in road construction for base and sub-base compaction, ensuring strong foundations for highways and pavements. The increasing need for road repairs and new infrastructure projects will drive demand for these machines. By 2025, the growing construction sector, especially in developing regions, will offer significant opportunities for growth in tamping rammer machine sales.

Emerging trends in the tamping rammer machine market include the growing adoption of battery-powered and eco-friendly models. As regulations on emissions become stricter, the demand for machines that reduce environmental impact is increasing. Battery-powered tamping rammers, which eliminate the need for fuel, are gaining traction for their quiet operation and lower emissions. By 2025, these eco-friendly models are expected to dominate the market, as more construction companies prioritize sustainable equipment solutions.

Despite growth, challenges such as high initial investment and maintenance costs persist in the tamping rammer machine market. The upfront cost of high-quality tamping rammers can be significant, especially for smaller construction companies with limited budgets. Additionally, the need for regular maintenance and repair can add to the overall cost of ownership. These factors may limit adoption, particularly in price-sensitive markets. By 2025, addressing these challenges through affordable solutions and improved service options will be essential for broader market penetration.

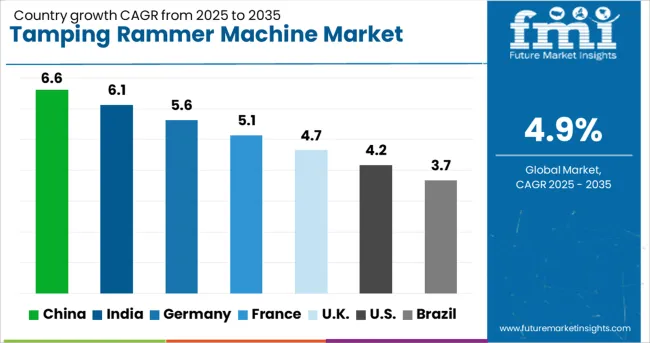

| Country | CAGR |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

| USA | 4.2% |

| Brazil | 3.7% |

The global tamping rammer machine market is projected to grow at a 4.9% CAGR from 2025 to 2035. China leads with a growth rate of 6.6%, followed by India at 6.1%, and Germany at 5.6%. The United Kingdom records a growth rate of 4.7%, while the United States shows the slowest growth at 4.2%. These varying growth rates are driven by factors such as the increasing demand for construction machinery, industrial development, and advancements in infrastructure projects. Emerging markets like China and India are experiencing higher growth due to rapid industrialization, urbanization, and expanding construction activities, while more mature markets like the USA and the UK show steady growth driven by technological advancements and demand for efficient construction equipment. This report includes insights on 40+ countries; the top markets are shown here for reference.

The tamping rammer machine market in China is growing at a robust pace, with a projected CAGR of 6.6%. China’s rapid industrialization and booming construction sector are driving significant demand for tamping rammer machines, which are essential for soil compaction in road construction, foundation work, and other infrastructure projects. The country’s large-scale urbanization, government investments in infrastructure, and increasing focus on sustainable construction practices further contribute to the market’s growth. Additionally, China’s focus on adopting modern construction machinery and technologies is driving the demand for more efficient, durable tamping rammers.

The tamping rammer machine market in India is projected to grow at a CAGR of 6.1%. India’s growing construction and infrastructure sectors are driving the demand for tamping rammer machines, particularly in road construction, residential and commercial projects, and foundation work. The government’s push for infrastructure development, urbanization, and industrialization are key factors supporting the market’s growth. Additionally, India’s focus on adopting modern construction equipment and machinery that enhance productivity and efficiency further accelerates the demand for tamping rammer machines in the market.

The tamping rammer machine market in Germany is projected to grow at a CAGR of 5.6%. Germany’s strong industrial base, particularly in construction and infrastructure, continues to drive steady demand for tamping rammer machines. The country’s focus on technological innovation, sustainability, and high-quality machinery in the construction industry supports the adoption of advanced tamping rammers. Furthermore, Germany’s commitment to green building standards and reducing construction time further fuels the demand for efficient and reliable compaction equipment, ensuring continued market growth.

The tamping rammer machine market in the United Kingdom is projected to grow at a CAGR of 4.7%. The UK’s established construction and infrastructure sectors continue to support steady demand for tamping rammer machines, particularly for roadwork, foundation projects, and compacting materials in commercial and residential developments. The growing focus on sustainability, energy efficiency, and reducing construction time is driving the adoption of advanced tamping rammer machines. Additionally, the UK’s commitment to enhancing infrastructure and urbanization further supports the demand for efficient, durable compaction equipment.

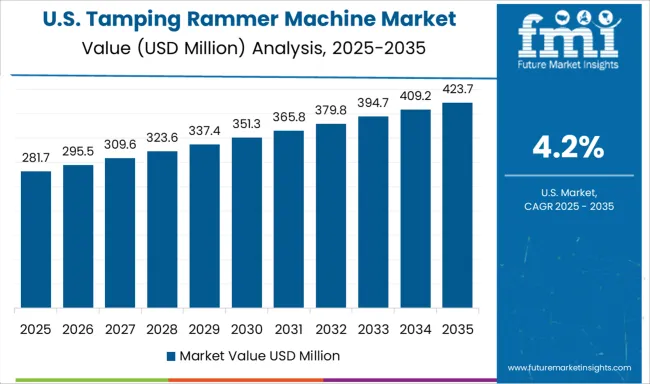

The tamping rammer machine market in the United States is expected to grow at a CAGR of 4.2%. Despite being a mature market, the USA continues to see steady demand for tamping rammer machines driven by the construction industry’s need for efficient and reliable compaction equipment. The growing focus on energy-efficient construction practices, the rise in infrastructure development, and the adoption of modern machinery further support the demand for tamping rammers. However, the growth rate in the USA is slower compared to emerging markets due to market maturity and the established infrastructure in the construction sector.

Companies such as Wacker Neuson SE, Mikasa Sangyo, Bomag GmbH, Ammann Group, Atlas Copco, Chicago Pneumatic, Doosan Portable Power, JCB, Husqvarna, MBW Inc., Multiquip, and Belle Group have taken distinctive approaches to strengthen their position. Wacker Neuson has emphasized four-stroke rammer models, introducing BS62-4Ab and BS68-4Ab in 2024, which focus on superior shoe stroke, percussion rate, and impact energy, thereby targeting performance differentiation. Ammann Group has adopted an uncommon strategy by launching the ATR 68 electric rammer in 2023, a battery-driven machine designed to eliminate emissions while providing precise control, an approach that caters to urban construction restrictions and environmental norms. Mikasa and Bomag have shifted focus to connectivity by embedding Bluetooth features that allow contractors to monitor usage hours, machine stress, and predictive maintenance schedules, creating value beyond traditional compaction performance.

Atlas Copco and Husqvarna have invested in ergonomic designs and vibration-reduction technology to enhance operator comfort while extending the life cycle of the machine. Telematics and GPS tracking are increasingly being integrated into high-end models, particularly by European players, giving contractors access to data that improves project management and fleet control, a strategy uncommon among smaller regional suppliers. Another defining move is geographic expansion, with companies like Wacker Neuson and Mikasa aggressively targeting Asia and Africa, where infrastructure development remains intense. Their strategy is reinforced by expanding dealer networks and after-sales services to increase customer retention. The competitive differentiation in this market is defined by smart connectivity, eco-friendly models, operator-centric design, and regional penetration, setting apart global leaders from traditional manufacturers.

| Item | Value |

|---|---|

| Quantitative Units | USD 634.2 Million |

| Product Type | Vibratory rammers, Percussion rammers, Walk-behind rammers, and Remote-controlled rammers |

| Power Source | Gasoline-powered, Electric-powered, and Battery-powered |

| Category | Manual, Automatic, and Semi-automatic |

| End Use | Construction, Infrastructure, Mining, Landscaping and gardening, Agriculture, and Others |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ammann Group, Atlas Copco, Belle Group, Bomag GmbH, Caterpillar Inc., Chicago Pneumatic, Doosan Corporation, Husqvarna Group, JCB, MBW Inc., Mikasa Sangyo Co., Ltd., Multiquip Inc., Toro Company, Wacker Neuson, and Weber MT |

| Additional Attributes | Dollar sales by machine type and application, demand dynamics across construction, roadwork, and landscaping sectors, regional trends in tamping rammer machine adoption, innovation in vibration control and fuel-efficient technologies, impact of regulatory standards on safety and environmental concerns, and emerging use cases in compacting soil for foundations and trench work. |

The global tamping rammer machine market is estimated to be valued at USD 634.2 million in 2025.

The market size for the tamping rammer machine market is projected to reach USD 1,023.3 million by 2035.

The tamping rammer machine market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in tamping rammer machine market are vibratory rammers, percussion rammers, walk-behind rammers and remote-controlled rammers.

In terms of power source, gasoline-powered segment to command 61.2% share in the tamping rammer machine market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.