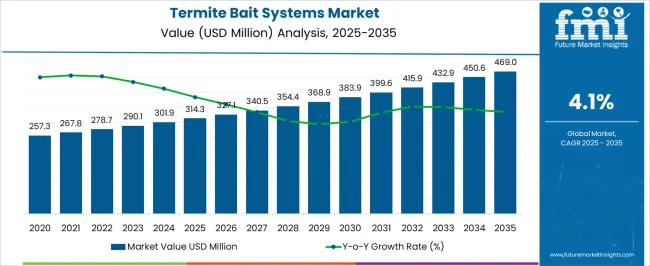

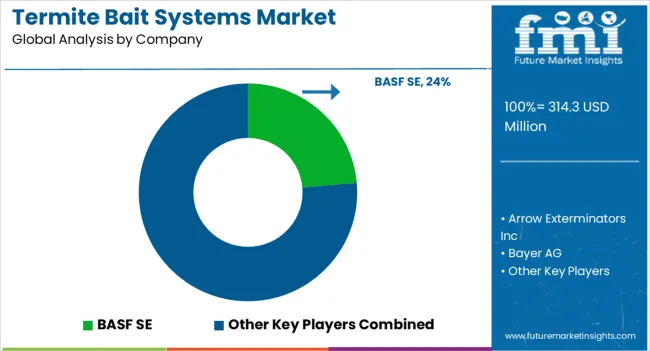

The Termite Bait Systems Market is estimated to be valued at USD 314.3 million in 2025 and is projected to reach USD 469.0 million by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

| Metric | Value |

|---|---|

| Termite Bait Systems Market Estimated Value in (2025 E) | USD 314.3 million |

| Termite Bait Systems Market Forecast Value in (2035 F) | USD 469.0 million |

| Forecast CAGR (2025 to 2035) | 4.1% |

The termite bait systems market is witnessing robust growth. Increasing awareness of termite-related structural damage, rising adoption of integrated pest management solutions, and regulatory emphasis on environmentally safe pest control methods are driving demand.

Current market dynamics are characterized by the growing need for preventive termite management in residential, commercial, and industrial properties. Technological advancements in bait formulations and delivery systems are enhancing efficacy and operational convenience.

The future outlook is shaped by expanding urban infrastructure, stricter building codes, and increased investment in pest control services, which collectively are expected to boost adoption of termite bait systems Growth rationale is founded on the proven effectiveness of bait systems in long-term termite management, growing preference for low-toxicity solutions, and strategic distribution through professional pest control service providers, which ensures consistent market penetration and sustainable revenue growth over the forecast period.

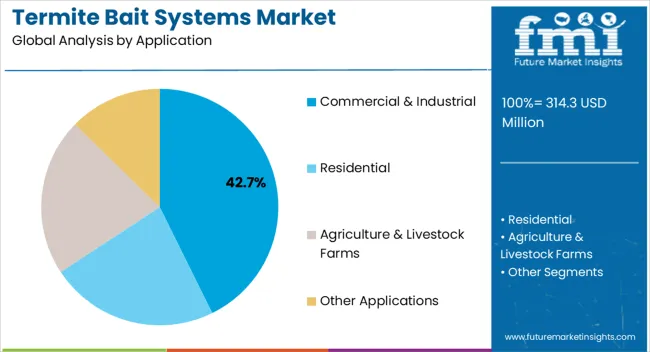

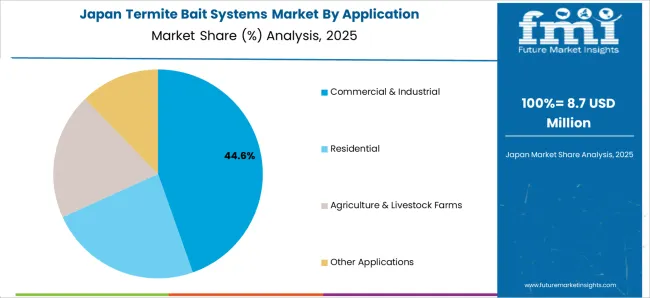

The commercial and industrial application segment, accounting for 42.70% of the application category, has emerged as the leading segment due to high demand for termite prevention in large-scale facilities. Adoption has been driven by the need to protect high-value assets and infrastructure from termite-related damage.

Implementation by professional pest control services has reinforced reliability and operational efficiency. Regulatory compliance and safety standards have supported widespread adoption in commercial settings.

Continuous improvements in bait system technology and monitoring practices have enhanced effectiveness and reduced maintenance requirements The segment’s market share is further supported by ongoing urban development and industrial expansion, which sustain demand and reinforce its leading position within the market.

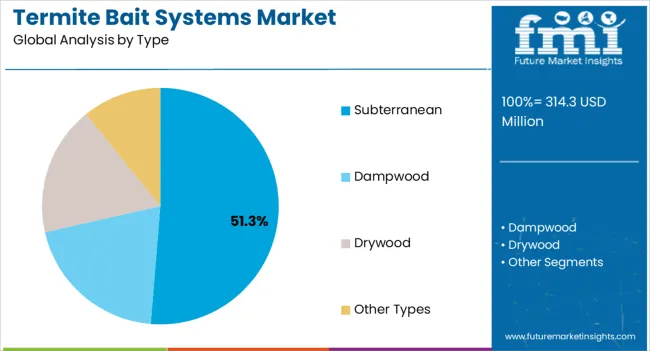

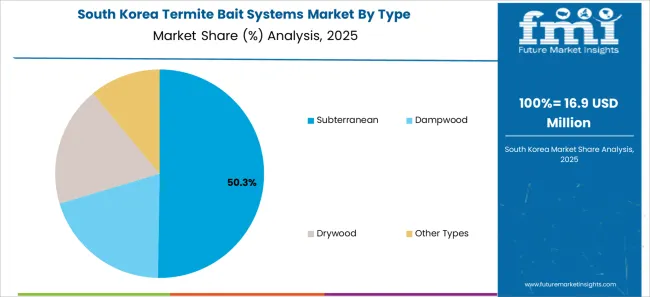

The subterranean type segment, holding 51.30% of the type category, has maintained dominance due to its effectiveness against soil-dwelling termite species and compatibility with integrated pest management programs. Adoption has been facilitated by targeted delivery mechanisms, ease of installation, and long-term monitoring capabilities.

The segment benefits from high performance in diverse environmental conditions and sustained efficacy over repeated application cycles. Research and development efforts have enhanced bait formulations, increasing termite attraction and reducing active ingredient usage.

Its leading share is further strengthened by professional adoption in both commercial and residential projects, ensuring consistent market preference and continued growth potential within the termite bait systems market.

The global termite bait systems market registered an astonishing CAGR of 5.6% in the historical period between 2020 and 2025. It is projected to rise at a decent CAGR of 4.3% in the assessment period.

| Historical Value (2025) | USD 288.9 million |

|---|---|

| Historical CAGR (2020 to 2025) | 5.6% |

The global termite bait systems market has grown steadily over the past few years. This growth is primarily due to increased awareness about termites and the adoption of more ecologically friendly pest control methods. There is increasing awareness of the potential damage termites can cause to buildings and infrastructure. This has led to an increasing demand for operational termite control methods.

Environmental concerns have led to a shift to environmentally friendly pest control methods. Termite baiting systems, which use non-toxic baits to mark termite colonies, have become more popular than traditional chemical actions. The termite bait system industry has seen technological advancements. This includes developing more effective bait designs, improved monitoring systems, and better delivery approaches.

Government guidelines and strategies regarding chemical pesticides have played an essential role in the termite bait systems market growth. Severe regulations on using certain chemicals have further increased the adoption of priming systems. Rapid urbanization and growing construction activities, particularly in high termite-risk areas, are factors driving the development of the termite bait system market.

Market trends can vary meaningfully by region due to differences in climate, building practices, and local regulations. For instance, areas with high levels of termite activity, such as parts of the United States, Southeast Asia, and Australia, are vital markets for termite baiting systems. As the economies of regions such as Asia Pacific and Latin America continue to grow, the need for effective termite control measures is increasing, driving demand for termite bait systems.

| Attributes | Key Factors |

|---|---|

| Latest Trends |

|

| Growth Hindrances |

|

| Upcoming Opportunities |

|

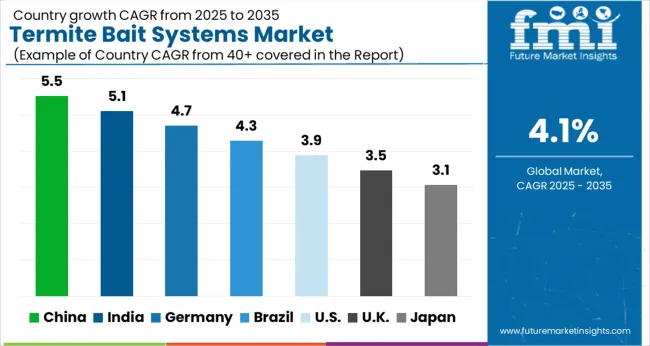

The below table explains the termite bait systems market size and CAGRs of the top 5 countries for 2035. Among them, the United States is projected to remain at the forefront by reaching USD 469 million by 2035.

Japan is expected to surge to around USD 47.8 million by 2035, less than China’s USD 68.8 million. Japan is anticipated to be followed by South Korea, with a value of USD 23.9 million.

| Country | Market Value (2035) |

|---|---|

| United States | USD 469 million |

| United Kingdom | USD 19.0 million |

| China | USD 68.8 million |

| Japan | USD 47.8 million |

| South Korea | USD 23.9 million |

In the table below, CAGRs of top 5 countries are given for the review period 2025 to 2035. South Korea and Japan are expected to remain dominant by exhibiting a 5.0% and 4.7% CAGR, respectively. The United States and the United Kingdom will likely follow with CAGRs of 4.5% and 4.6%, respectively.

| Country | Value-based CAGR (2025 to 2035) |

|---|---|

| United States | 4.5% |

| United Kingdom | 4.6% |

| China | 4.4% |

| Japan | 4.7% |

| South Korea | 5.0% |

The United States termite bait system market is projected to reach USD 469 million in the forecast period. It expanded at a CAGR of 5.9% in the historical period. The USA termite bait systems market is experiencing steady development driven by growing awareness about termites and a shift towards environmentally friendly pest control methods.

Subterranean termites are common in the United States, especially in the South and Southeast. This has contributed to the use of termite bait systems as an operative termite control method. Consumer environmental awareness and regulatory pressure have played a key role in adopting termite bait systems instead of traditional chemical treatments.

Strict regulations and limitations on using conventional chemical pesticides in some USA states have continued to promote the adoption of alternative termite control methods, such as bait. There is an increasing focus on sustainable and environmentally friendly pest control solutions. Termite bait systems, which use targeted baits instead of chemical sprays, are well suited to this trend.

The USA market witnessed the integration of technology into termite bait systems. This contains intelligent monitoring systems and data analytics for effective termite control. Rapid urbanization and amplified construction activities, especially in termite-infested areas (such as the Southeastern United States), have driven demand for termite control solutions.

The United Kingdom termite bait system market is projected to be valued at USD 19.0 million by 2035. It expanded at a CAGR of 6.6% in the historical period. Industry stakeholders, comprising pest control businesses and government agencies, have engaged in educational campaigns to increase awareness of the dangers of termites and their benefits.

The United Kingdom market is highly competitive, and companies continuously innovate to gain a competitive advantage. This includes the growth of new bait formulations and enhanced monitoring systems. Pest control regulations and practices can vary widely from state to state due to termite species, alterations in climate, and local laws. This affects the adoption and implementation of termite bait systems. Homeowners and businesses are progressively choosing preventative termite control measures, including installing termite bait systems as a proactive method.

China's termite bait system market is projected to total USD 68.8 million by 2035. It expanded at a CAGR of 6.4% in the historical period. It is the leading and prominently growing termite bait systems market globally.

China has a strong research and development sector, including in pest control. China-based companies and organizations have been at the forefront of emerging new and effective termite control technologies. In China, there is a robust culture of education and awareness. This spreads to pest control, with efforts to educate homeowners and businesses about the perils of termite infestation and the welfare of using termite bait systems.

Like several developed countries, China increasingly favors non-chemical pest control solutions. The termite bait system is suitable for this trend. China's exclusive cultural and architectural heritage needs specific termite control methods that may differ from those in other regions. China-based firms have actively engaged in research and development efforts to advance termite control methods, developing more effective bait preparations and monitoring systems.

Japan's termite bait system market is projected to reach USD 47.8 million by 2035. It expanded at a CAGR of 6.9% in the historical period. Japan is at high risk of termite infestation, primarily due to its climate and the predominance of wooden construction in residential buildings.

Japan is a well-developed pest control business with advanced technologies and approaches to managing termite populations. Japan is identified for its technological advancements in several different fields, including pest control. This has led to the growth of advanced termite bait systems with advanced features.

Japan has severe regulations on pest control and chemical use. This has led to the adoption of alternative and environmentally friendly methods, such as termite bait systems. Japan's densely populated urban areas, with its high incidence of wooden structures, make the country a leading market for termite control solutions, including bait systems. Japan takes the preservation of its cultural heritage very seriously, which often includes temples and historic wooden buildings. This makes effective termite control essential.

South Korea termite bait system market is estimated to register USD 23.9 million by 2035. It expanded at a CAGR of 7.5% in the historical period. Korea is increasingly aware of the termite problem, especially in urban areas with high construction density.

Rapid construction and urbanization in Korea have augmented the risk of termite infestation, making the market ripe for termite control solutions. South Korea is identified for its technological developments and receptiveness to innovative solutions. This comprises adopting an advanced termite bait system with integrated monitoring technology.

South Korea has implemented environmental regulations that influence the adoption of environmentally friendly termite control methods, such as termite bait systems, instead of traditional chemical treatment systems. Korea, like Japan, has a rich cultural heritage with several wooden structures. Preserving these historic and cultural assets from termite harm is a crucial concern. There is rising interest in green building practices and sustainable design in Korea. Termite bait systems fit this trend because they are more environmentally friendly than chemical treatments.

The table below signifies leading sub-categories application and type categories in the termite bait systems market. Commercial and industrial are expected to dominate the market for termite bait systems by exhibiting a 4.1% CAGR in the evaluation period. Under the type segment, the subterranean category is projected to lead the global termite bait system market at a 3.8% CAGR.

| Category | Forecast CAGR (2025 to 2035) |

|---|---|

| Commercial & Industrial (Application) | 4.1% |

| Subterranean (Type) | 3.8% |

Based on application, the commercial and industrial sectors are projected to account for a significant termite bait systems market share through 2035. It registered an average CAGR of 5.4% from 2020 to 2025.

Commercial and industrial properties are often significant investments, and owners are vested in protecting their property from termite damage. Termite bait systems provide an effective preventative measure. The commercial and industrial sectors are subject to various regulations, including ecological and safety standards. Termite bait systems, with less reliance on chemical pesticides, comply with legal necessities and environmental concerns.

Commercial and industrial properties are constructed to last, and homeowners often seek long-term termite control solutions. When correctly installed and maintained, termite bait systems can offer adequate protection over a long period. Establishing and maintaining a termite bait system is often less disruptive than other termite control approaches, essential for industries and businesses that must maintain continuous operations.

Each commercial or industrial property may have exclusive characteristics that affect termite activity. Pest control service providers often tailor their treatment plans to meet each area's needs and risks. Commercial and industrial properties are grander in scale and require robust monitoring systems. Termite bait systems can be equipped with advanced real-time monitoring and broadcasting technology, which is particularly beneficial for managing large properties.

Commercial and industrial sectors often seek integrated pest management (IPM) practices, prioritizing non-chemical solutions and highlighting targeted treatments like a termite bait system.

Regarding type, subterranean is expected to generate a noteworthy share in the termite bait systems market by 2035. It expanded at 5.2% CAGR in the historical period from 2020 to 2025.

Subterranean termites are an important target of termite bait systems in the pest control sector. These termites are identified to cause significant damage to arrangements and are the most common and destructive sorts of termites worldwide. Termite bait systems are specifically designed to control underground termite colonies.

Subterranean termites are found in several parts of the world and are especially common in areas with moderate to high temperatures and humidity. Underground termite colonies can be vast and complex, often comprising thousands or millions of individual termites. The bait system aims to target and eradicate these colonies.

Subterranean termites build nests underground and search for food sources that contain cellulose, such as wood. Termite bait stations are placed strategically on the ground, near zones where termites are likely to feed. Termite bait systems use a particularly designed bait formula to attract underground termites. These baits often contain cellulose mixed with slow-acting poisons or insect growth regulators.

The goal of a termite bait system is to eliminate termite colonies. During foraging, termites determine bait stations, consume the bait, and transmit it back to the colony. This eventually affects the entire termite population. Regular monitoring and inspection of bait stations is vital for success. Pest control specialists check bait stations for termite action and replenish bait if necessary.

Termite bait systems are often considered more ecologically friendly than some chemical treatments because they use lower sums of active ingredients and have less influence on non-target organisms. Termite bait systems are designed to utilize subterranean termites' natural foraging behavior. They rely on termites to find and eat their prey, which is then dispersed throughout the colony.

Leading players in the termite bait systems market are introducing new and innovative goods to meet the growing demand. International companies are inflowing new markets in developing regions to expand their customer base and increase their presence. Key players and suppliers likewise adopt several strategies, including joint ventures, acquisitions, mergers, new product development, and geographic expansion.

For instance:

| Attribute | Details |

|---|---|

| Estimated Termite Bait Systems Market Size (2025) | USD 288.9 million |

| Projected Termite Bait Systems Market Valuation (2035) | USD 465.0 million |

| Value-based CAGR (2025 to 2035) | 4.3% |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Value (USD million) |

| Segments Covered | Type, Application |

| Regions Covered | North America; Latin America; East Asia; South Asia Pacific; Western Europe; Eastern Europe; Middle East & Africa |

| Key Companies Profiled | Arrow Exterminators Inc; BASF SE; Bayer AG; Dow Inc; DuPont de Nemours Inc |

The global termite bait systems market is estimated to be valued at USD 314.3 million in 2025.

The market size for the termite bait systems market is projected to reach USD 469.0 million by 2035.

The termite bait systems market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in termite bait systems market are commercial & industrial, residential, agriculture & livestock farms and other applications.

In terms of type, subterranean segment to command 51.3% share in the termite bait systems market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Termite Bait Products Market Trends - Growth & Forecast 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Hi-Fi Systems Market Size and Share Forecast Outlook 2025 to 2035

Cough systems Market

Backpack Systems Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Systems Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Catheter Systems Market

Reporter Systems Market

Aerostat Systems Market

Cryogenic Systems Market Size and Share Forecast Outlook 2025 to 2035

Air Brake Systems Market Growth & Demand 2025 to 2035

Metrology Systems Market

Fluid Bed Systems Market

Cognitive Systems Spending Market Report – Growth & Forecast 2016-2026

Nurse Call Systems Market Insights - Size, Share & Forecast 2025 to 2035

Excitation Systems Market Analysis – Growth, Demand & Forecast 2025 to 2035

Fire Alarm Systems Market by Solution by Application & Region Forecast till 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA