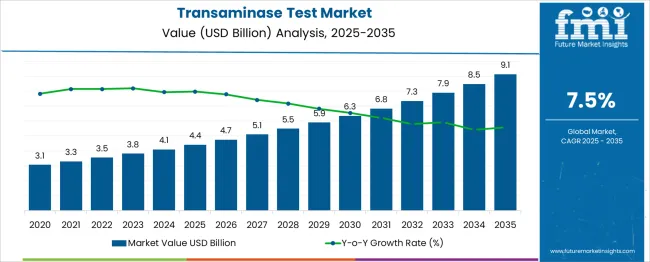

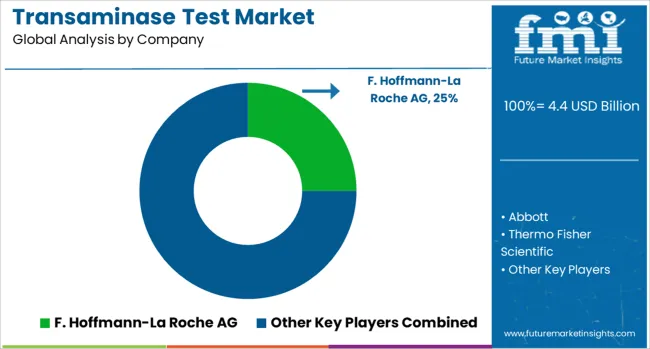

The global transaminase test market is forecasted to reach from USD 4.4 billion in 2025 to approximately USD 9.1 billion by 2035, recording an absolute increase of USD 4.7 billion over the forecast period. This translates into a total growth of 106.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 7.5% between 2025 and 2035. The overall market size is expected to grow by nearly 2.1X during the same period, supported by increasing prevalence of liver diseases, rising awareness about hepatitis screening, growing adoption of automated diagnostic systems, and expanding point-of-care testing applications.

Between 2025 and 2030, the transaminase test market is projected to expand from USD 4.4 billion to USD 6.3 billion, resulting in a value increase of USD 1.9 billion, which represents 40.4% of the total forecast growth for the decade. This phase of growth will be shaped by rising incidence of non-alcoholic fatty liver disease, increasing drug-induced liver injury monitoring, and growing penetration of automated testing platforms in emerging markets. Healthcare providers and diagnostic laboratories are expanding their transaminase testing capabilities to address the growing demand for comprehensive liver function assessment.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 4.4 billion |

| Forecast Value in (2035F) | USD 9.1 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

From 2030 to 2035, the market is forecast to grow from USD 6.3 billion to USD 9.1 billion, adding another USD 2.8 billion, which constitutes 59.6% of the overall ten-year expansion. This period is expected to be characterized by widespread adoption of point-of-care testing devices, integration of artificial intelligence in diagnostic interpretation, and development of home-based testing solutions. The growing emphasis on preventive healthcare and routine screening programs will drive demand for advanced transaminase testing platforms with enhanced accuracy and rapid turnaround times.

Between 2020 and 2025, the transaminase test market experienced steady expansion, driven by increasing awareness of liver health and growing adoption of automated diagnostic platforms. The market developed as healthcare systems recognized the critical importance of early liver disease detection and monitoring. The COVID-19 pandemic also highlighted the significance of liver function monitoring in critically ill patients, accelerating the adoption of rapid diagnostic solutions across healthcare facilities.

Market expansion is being supported by the increasing global burden of liver diseases, including hepatitis, non-alcoholic fatty liver disease (NAFLD), and drug-induced liver injury. Modern healthcare systems are increasingly focused on preventive screening and early detection strategies that can identify liver dysfunction before clinical symptoms appear. The proven clinical utility of transaminase tests (ALT and AST) in diagnosing and monitoring liver conditions makes them essential diagnostic tools in routine healthcare practice.

The growing emphasis on precision medicine and personalized treatment approaches is driving demand for comprehensive transaminase testing panels that provide detailed liver function profiles. Healthcare providers are increasingly adopting automated testing platforms that offer rapid results, improved accuracy, and enhanced workflow efficiency. The rising influence of evidence-based medicine and clinical guidelines recommending routine transaminase monitoring for various patient populations is also contributing to increased test utilization across different healthcare settings.

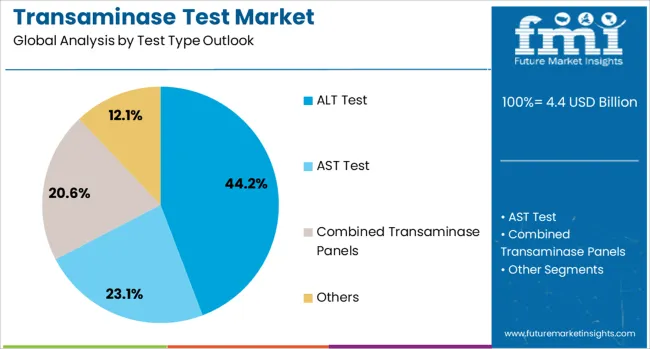

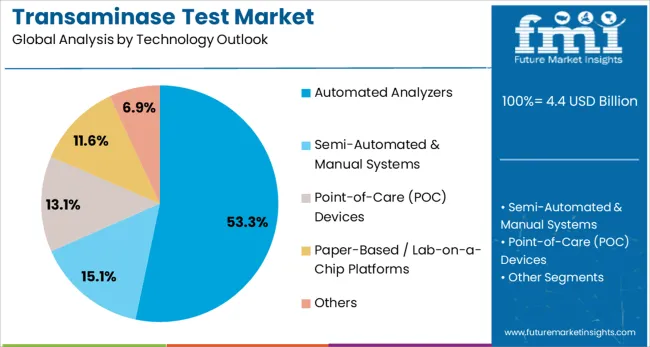

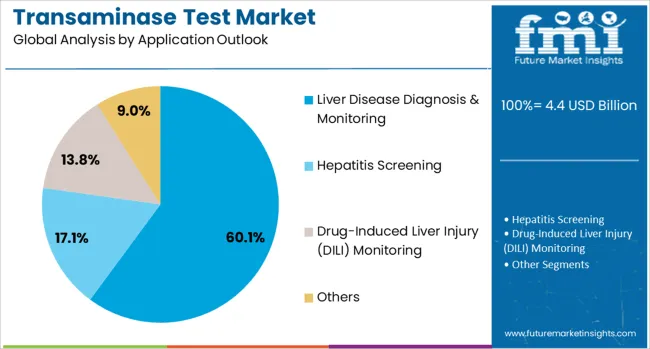

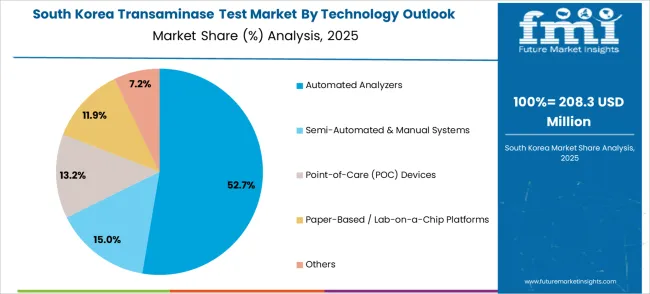

The market is segmented by test type, technology, application, end use, and region. By test type, the market is divided into ALT test, AST test, combined transaminase panels, and others. Based on technology, the market is categorized into automated analyzers, semi-automated & manual systems, point-of-care (POC) devices, paper-based/lab-on-a-chip platforms, and others. In terms of application, the market is segmented into liver disease diagnosis & monitoring, hepatitis screening, drug-induced liver injury (DILI) monitoring, and others. By end use, the market is classified into hospitals & clinics, diagnostic laboratories (centralized testing), research institutes, and home testing. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

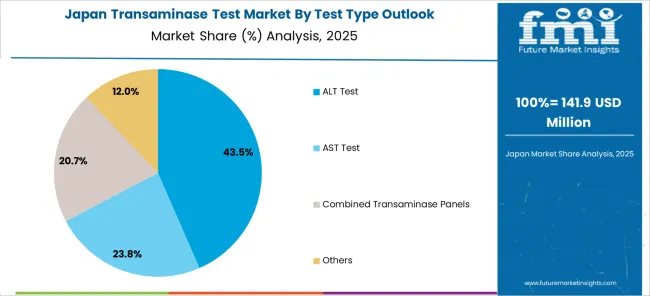

The ALT (Alanine Aminotransferase) test is projected to account for 44.2% of the transaminase test market in 2025, reaffirming its position as the most widely utilized liver enzyme marker. Healthcare providers increasingly rely on ALT testing as a primary screening tool for liver dysfunction due to its high specificity for hepatocellular injury. The test's ability to detect early-stage liver damage and monitor treatment response makes it indispensable in clinical practice.

This segment's dominance is reinforced by clinical guidelines that recommend ALT testing as part of comprehensive metabolic panels and routine health screenings. The widespread availability of ALT testing across various platforms, from high-throughput analyzers to point-of-care devices, ensures broad accessibility. With growing awareness of NAFLD and other liver conditions, ALT testing continues to serve as the cornerstone of liver function assessment, making it the primary driver of transaminase test market demand.

Automated analyzers are projected to represent 53.3% of transaminase test demand in 2025, underscoring their role as the preferred technology for high-volume diagnostic testing. Healthcare facilities gravitate toward automated systems for their ability to process large numbers of samples with consistent accuracy, minimal manual intervention, and rapid turnaround times. These platforms offer standardized testing protocols that ensure reliable results across different healthcare settings.

The segment is supported by ongoing technological advancements in analyzer design, including improved sample handling, enhanced reagent stability, and integrated quality control systems. Additionally, automated analyzers enable cost-effective testing through economies of scale and reduced labor requirements. As healthcare systems prioritize efficiency and standardization, automated transaminase testing platforms will continue to dominate market demand, reinforcing their critical role in modern diagnostic laboratories.

The liver disease diagnosis & monitoring application is forecasted to contribute 60.1% of the transaminase test market in 2025, reflecting the fundamental role of these tests in hepatology practice. Healthcare providers rely on transaminase measurements to diagnose various liver conditions, assess disease severity, and monitor treatment effectiveness. This application encompasses a broad spectrum of liver disorders, from viral hepatitis to metabolic liver disease.

The segment benefits from increasing recognition of liver disease as a major global health concern and growing implementation of screening programs for at-risk populations. Clinical protocols emphasizing regular monitoring of liver function in patients receiving potentially hepatotoxic medications further drive test utilization. With rising incidence of lifestyle-related liver diseases and aging populations, liver disease diagnosis & monitoring will remain the primary application driving transaminase test market growth.

The transaminase test market is advancing rapidly due to increasing prevalence of liver diseases, growing adoption of automated diagnostic platforms, and rising awareness about preventive healthcare. However, the market faces challenges including reimbursement limitations, competition from alternative biomarkers, and regulatory complexities for novel testing platforms. Innovation in point-of-care testing and artificial intelligence integration continue to influence product development and market expansion patterns.

The growing incidence of NAFLD, driven by rising obesity rates and sedentary lifestyles, is creating substantial demand for transaminase testing. NAFLD affects approximately 25% of the global population and often requires regular monitoring through liver enzyme measurements. Healthcare providers are implementing screening protocols for high-risk patients, including those with diabetes, obesity, and metabolic syndrome, driving consistent demand for ALT and AST testing.

The adoption of point-of-care transaminase testing devices is enabling rapid diagnosis and monitoring in various healthcare settings, including emergency departments, clinics, and remote locations. These portable systems provide results within minutes, facilitating immediate clinical decision-making and improving patient care. The convenience and speed of POC testing are particularly valuable in resource-limited settings and urgent care scenarios.

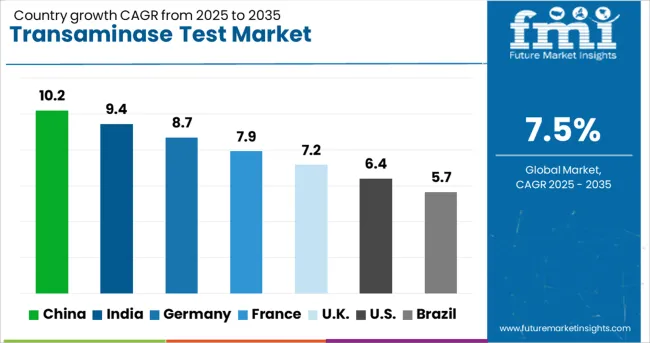

| Country | CAGR (2025-2035) |

|---|---|

| China | 10.2% |

| India | 9.4% |

| Germany | 8.7% |

| France | 7.9% |

| UK | 7.2% |

| USA | 6.4% |

| Brazil | 5.7% |

The transaminase test market is experiencing robust growth globally, with China leading at a 10.2% CAGR through 2035, driven by healthcare system modernization, increasing liver disease awareness, and expanding diagnostic infrastructure. India follows closely at 9.4%, supported by growing healthcare access, rising middle-class population, and government initiatives for disease prevention. Germany shows strong growth at 8.7%, emphasizing advanced diagnostic technologies and comprehensive healthcare coverage. France records 7.9%, focusing on clinical excellence and innovative testing platforms. The UK shows 7.2% growth, prioritizing evidence-based medicine and efficient diagnostic services. The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

Revenue from transaminase tests in China is projected to exhibit exceptional growth with a CAGR of 10.2% through 2035, driven by massive investments in healthcare infrastructure and increasing awareness of liver disease prevention. The country's expanding healthcare coverage and growing middle-class population are creating significant demand for comprehensive diagnostic testing services. Major international and domestic diagnostic companies are establishing extensive distribution networks to serve the rapidly growing patient population across tier-1 and tier-2 cities.

Revenue from transaminase tests in India is expanding at a CAGR of 9.4%, supported by improving healthcare access, growing disease awareness, and rising adoption of preventive screening programs. The country's large patient population and increasing prevalence of lifestyle-related liver diseases are driving demand for routine transaminase testing. International diagnostic companies and domestic manufacturers are establishing comprehensive testing capabilities to serve the growing demand for affordable and accessible liver function assessment.

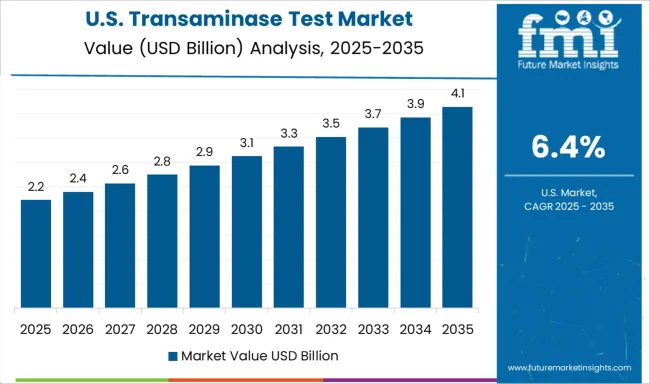

Demand for transaminase tests in the USA is projected to grow at a CAGR of 6.4%, supported by advanced healthcare infrastructure, comprehensive insurance coverage, and emphasis on evidence-based medicine. American healthcare providers are increasingly focused on precision diagnostics, comprehensive metabolic panels, and integrated testing solutions. The market is characterized by strong demand for automated high-throughput systems that deliver rapid, accurate results for diverse patient populations.

Revenue from transaminase tests in Germany is projected to grow at a CAGR of 8.7% through 2035, driven by the country's strong focus on clinical laboratory excellence, advanced diagnostic technologies, and comprehensive healthcare coverage. German healthcare providers consistently demand high-quality, standardized testing solutions that deliver reliable results for clinical decision-making.

Revenue from transaminase tests in the UK is projected to grow at a CAGR of 7.2% through 2035, supported by the National Health Service's emphasis on standardized care and evidence-based medicine. British healthcare providers value diagnostic accuracy, cost-effectiveness, and clinical utility, positioning transaminase tests as essential tools for liver function assessment and disease monitoring.

Revenue from transaminase tests in France is projected to grow at a CAGR of 7.9% through 2035, supported by the country's strong healthcare system, emphasis on clinical research, and adoption of innovative diagnostic technologies. French healthcare providers prioritize diagnostic accuracy and clinical utility, making transaminase tests fundamental components of comprehensive patient care.

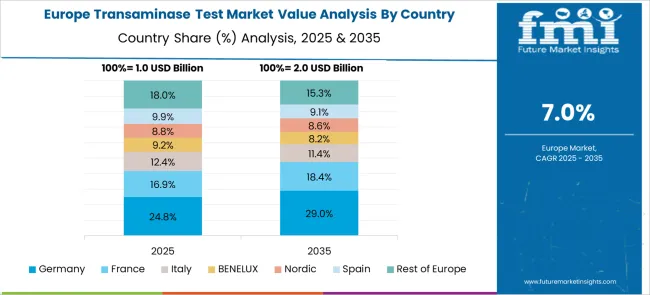

The European transaminase test market demonstrates sophisticated development across major economies with Germany leading through its precision diagnostic technology excellence and advanced healthcare infrastructure capabilities, supported by companies like F. Hoffmann-La Roche AG pioneering comprehensive transaminase testing solutions with focus on automated analyzers, liver disease diagnosis, and hospital applications while emphasizing clinical accuracy and regulatory compliance. The UK shows strength in diagnostic laboratory services and evidence-based testing protocols, with companies specializing in advanced transaminase testing technologies that meet strict clinical standards and provide consistent diagnostic outcomes.

France contributes through companies delivering integrated diagnostic solutions and healthcare technology excellence for comprehensive liver function testing applications. Italy and Spain demonstrate growth in specialized testing systems for hepatitis screening and drug-induced liver injury monitoring. The market benefits from stringent EU medical device regulations, established diagnostic infrastructure, and growing emphasis on automated testing systems positioning Europe as key center for advanced transaminase testing technologies.

The Japanese transaminase test market demonstrates steady growth driven by precision healthcare focus, advanced diagnostic technologies, and healthcare system preference for high-quality testing systems ensuring superior clinical accuracy and patient safety compliance throughout laboratory operations. International companies establish presence through cutting-edge diagnostic technologies aligning with Japan's sophisticated healthcare industry and stringent quality standards while incorporating automated analyzer capabilities and point-of-care testing innovations.

The market emphasizes automated diagnostic systems, precision laboratory excellence, and advanced testing innovations reflecting Japanese healthcare precision and attention to detail in diagnostic processes. Growing investment in digital health technologies supports intelligent testing systems with real-time analysis, predictive analytics, and optimized diagnostic performance. Japanese healthcare providers prioritize test reliability, consistent clinical outcomes, and regulatory compliance, creating opportunities for premium transaminase testing solutions delivering exceptional performance across hospitals, diagnostic laboratories, and research institutes requiring highest quality standards.

The South Korean transaminase test market shows exceptional growth potential driven by expanding healthcare infrastructure, increasing adoption of advanced diagnostic technologies, and growing awareness about liver health requiring efficient and comprehensive testing solutions. The market benefits from South Korea's technological advancement capabilities and increasing focus on healthcare innovation competitiveness driving investment in modern diagnostic technologies meeting international clinical standards and regulatory requirements.

Korean healthcare facilities increasingly adopt automated testing systems, advanced diagnostic equipment, and integrated laboratory technologies improving diagnostic accuracy and operational efficiency while ensuring clinical compliance. Growing influence of Korean healthcare innovations in global markets supports demand for sophisticated transaminase testing solutions ensuring clinical excellence while maintaining cost-effectiveness. Integration of digital health principles and smart diagnostic technologies creates opportunities for intelligent testing systems with connectivity features, predictive capabilities, and real-time clinical optimization across diverse healthcare applications.

The transaminase test market is characterized by competition among established diagnostic companies, clinical laboratory chains, and emerging point-of-care testing innovators. Companies are investing in advanced analyzer technologies, comprehensive testing panels, automated workflow solutions, and digital integration capabilities to deliver accurate, efficient, and accessible liver function testing solutions. Product innovation, clinical validation, and global distribution networks are central to strengthening market presence and competitive positioning.

F. Hoffmann-La Roche AG, Switzerland-based, leads the market with comprehensive diagnostic solutions, offering integrated transaminase testing platforms with advanced automation and quality management systems. Abbott, USA, provides diverse testing technologies spanning laboratory analyzers to point-of-care devices with focus on clinical accuracy and workflow efficiency. Thermo Fisher Scientific, USA, delivers high-performance analytical instruments and reagent systems with emphasis on laboratory productivity and result reliability. Siemens Healthineers, Germany, focuses on innovative diagnostic technologies that combine transaminase testing with comprehensive metabolic panels.

Danaher, USA, operating globally, provides integrated diagnostic solutions across multiple testing platforms and market segments. Randox Laboratories Ltd, UK, offers specialized testing solutions with focus on clinical utility and diagnostic innovation. ELITechGroup, France, emphasizes compact analyzer systems suitable for diverse laboratory environments. HORIBA Medical, Japan, provides advanced hematology and chemistry analyzers with integrated transaminase testing capabilities. Alpha Laboratories, UK, focuses on clinical laboratory solutions and specialized testing services.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 4.4 billion |

| Test Type | ALT test, AST test, Combined transaminase panels, Others |

| Technology | Automated analyzers, Semi-automated & manual systems, Point-of-care (POC) devices, Paper-based/lab-on-a-chip platforms, Others |

| Application | Liver disease diagnosis & monitoring, Hepatitis screening, Drug-induced liver injury (DILI) monitoring, Others |

| End Use | Hospitals & clinics, Diagnostic laboratories (centralized testing), Research institutes, Home testing |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | F. Hoffmann-La Roche AG, Abbott, Thermo Fisher Scientific, Siemens Healthineers, Danaher, Randox Laboratories Ltd, ELITechGroup, HORIBA Medical, Alpha Laboratories, Laboratory Corporation of America Holdings (LabCorp), Bio-Rad Laboratories Inc., bioMérieux |

| Additional Attributes | Revenue analysis by test methodology and automation level, regional demand patterns, competitive landscape analysis, healthcare provider preferences for integrated vs. standalone systems, adoption trends for point-of-care testing, innovations in rapid testing technologies, artificial intelligence integration, and regulatory compliance requirements |

The global transaminase test market is estimated to be valued at USD 4.4 billion in 2025.

The market size for the transaminase test market is projected to reach USD 9.1 billion by 2035.

The transaminase test market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in transaminase test market are alt test, ast test, combined transaminase panels and others.

In terms of technology outlook, automated analyzers segment to command 53.3% share in the transaminase test market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA