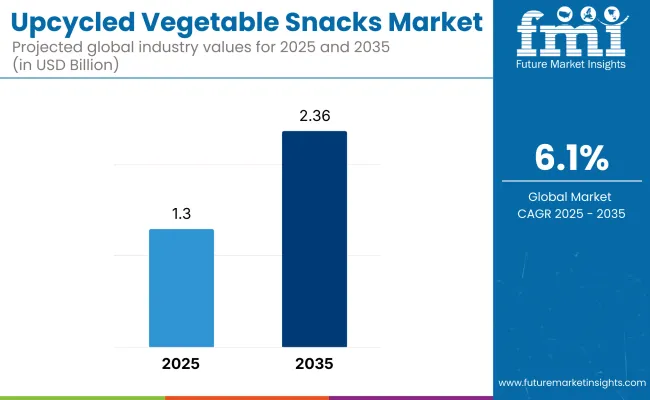

The Global Upcycled Vegetable Snacks Market is projected to be valued at USD 1.30 billion in 2025, reaching USD 2.36 billion by 2035, marking an absolute increase of USD 1.06 billion over the decade. This expansion reflects a CAGR of 6.13%, indicating a sustained upward trajectory driven by escalating consumer demand for sustainable snacking and regulatory momentum on food waste reduction.

Upcycled Vegetable Snacks Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 1.30 billion |

| Market Forecast Value in (2035F) | USD 2.36 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

Over the first half of the forecast period (2025-2030), the market is anticipated to grow from USD 1.30 billion to USD 1.76 billion, adding USD 0.46 billion, which will contribute approximately 43% of the decade’s total growth. This early-stage expansion is expected to be underpinned by mainstream retail adoption, increasing availability in supermarkets and hypermarkets, and heightened consumer awareness of the nutritional and environmental benefits of upcycled products.

During the latter half (2030-2035), the market is forecast to accelerate from USD 1.76 billion to USD 2.36 billion, adding USD 0.60 billion, which will account for about 57% of the total growth. This faster growth phase is expected to be powered by global scaling of production capabilities, greater penetration into emerging markets, and innovations in processing and packaging that enhance sensory quality while meeting circular economy targets.

Root-based snacks are projected to maintain leadership with around 40% market share in 2025, benefiting from abundant raw material availability and consumer familiarity, while sustainable packaging formats are anticipated to gain significant traction by 2035 as brand commitments to eco-friendly materials are fulfilled.

From 2020 to 2024, market momentum was steadily built as retailers and direct-to-consumer brands increased their focus on food-waste mitigation and nutrient-dense snacking. Root-based snacks were positioned as the category anchor, driven by reliable supply from processing side-streams and broad consumer familiarity. Competitive edge during this period was secured by companies able to verify their upcycled sourcing and deliver consistent sensory quality. Packaging innovation remained limited, with most products using conventional solutions rather than fully sustainable materials.

By 2025, the market value is projected to reach USD 1.30 billion, with shelf space increasingly dedicated to upcycled offerings that align with corporate sustainability goals. Over the next decade, revenue is expected to shift toward products featuring quantifiable environmental impact metrics, driving brand loyalty among eco-conscious consumers.

The competitive landscape is anticipated to intensify as the five leading players expand into new regions, integrate circular packaging formats, and leverage e-commerce subscription models to deepen customer engagement. Strategic partnerships with produce processors and investments in low-energy dehydration technologies are expected to be critical for maintaining cost efficiency and supply stability, ensuring scalability in a rapidly maturing market.

Growth in the Global Upcycled Vegetable Snacks Market is being driven by increasing consumer demand for sustainable, nutrient-rich snacking options and heightened awareness of food-waste reduction. Regulatory pressures on landfill diversion and corporate ESG commitments are encouraging adoption across mainstream retail and foodservice channels. Availability of consistent, high-quality side-stream inputs from produce processing facilities is enabling scalable production while maintaining nutritional integrity.

Advancements in low-energy dehydration and vacuum-frying technologies are improving texture, flavor retention, and color stability, enhancing consumer acceptance. E-commerce expansion and subscription-based delivery models are facilitating broader reach and higher repeat purchase rates. Packaging innovation, particularly in recyclable and compostable formats, is aligning with circular economy targets and brand differentiation strategies. Segment growth is expected to be led by root-based snacks due to raw material abundance, while emerging segments from leafy and legume sources are projected to accelerate as processing innovations mitigate bitterness and expand flavor versatility.

Vegetable Source Segment - Market Value Share, 2025

| Vegetable Source | 2025 Share |

|---|---|

| Root Vegetables | 28% |

| Carrot | 10% |

| Beetroot | 6% |

| Sweet Potato | 12% |

| Leafy Greens | 19% |

| Kale | 10% |

| Spinach | 9% |

| Legumes | 24% |

| Chickpeas | 15% |

| Lentils | 9% |

| Other Surplus Veg | 29% |

| Zucchini | 10% |

| Cauliflower | 10% |

| Broccoli stems | 9% |

| Vegetable Source | CAGR |

|---|---|

| Root Vegetables | 6.00% |

| Carrot | 5.90% |

| Beetroot | 6.10% |

| Sweet Potato | 6.00% |

| Leafy Greens | 6.30% |

| Kale | 6.40% |

| Spinach | 6.20% |

| Legumes | 6.60% |

| Chickpeas | 6.70% |

| Lentils | 6.50% |

| Other Surplus Veg | 6.80% |

| Zucchini | 6.70% |

| Cauliflower | 6.80% |

| Broccoli stems | 6.90% |

The root vegetables segment is projected to account for 28% of the market’s revenue in 2025, maintaining its position as the leading source category. This dominance is being supported by reliable availability from processing side-streams, consumer familiarity, and ease of processing into snackable formats. Nutrient density, color appeal, and versatility in flavoring are enhancing adoption across mainstream retail.

Growth is further being driven by efficient dehydration and baking processes that preserve both taste and nutritional integrity. While root vegetables will remain a core driver, leafy greens and legumes are expected to gain momentum as bitterness is mitigated through improved processing, enabling diversification of product offerings. By 2035, competitive pressure is anticipated to encourage hybrid formulations that combine multiple vegetable sources for both functional and sustainability claims.

Snack Format Segment - Market Value Share, 2025

| Snack Format | 2025 Share |

|---|---|

| Chips & Crisps | 34% |

| Puffs & Extruded Snacks | 30% |

| Crackers & Crispy Bites | 19% |

| Bars with Vegetable Incl. | 10% |

| Baked Snack Mixes | 7% |

| Snack Format | CAGR |

|---|---|

| Chips & Crisps | 6.30% |

| Puffs & Extruded Snacks | 6.50% |

| Crackers & Crispy Bites | 6.20% |

| Bars with Vegetable Incl. | 6.70% |

| Baked Snack Mixes | 6.40% |

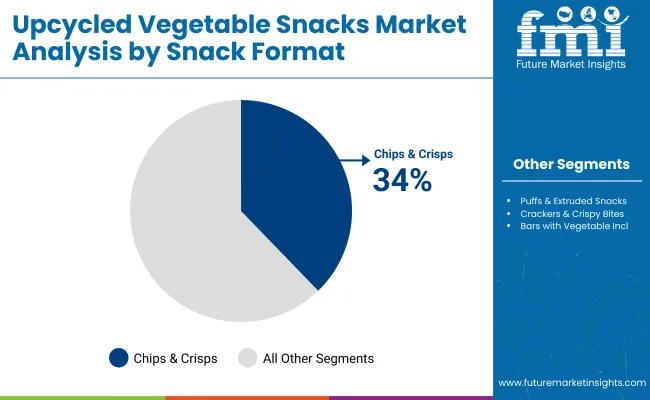

The chips and crisps segment is expected to represent 34% of market revenue in 2025, making it the most dominant snack format. This leadership is being reinforced by consumer preference for familiar formats with enhanced nutritional credentials and reduced waste impact. Processing improvements in baking and vacuum frying are delivering texture parity with conventional chips while retaining natural vegetable colors and flavors. Adoption is further supported by flexible packaging formats that cater to both single-serve and family packs, driving penetration across retail and foodservice channels.

Over the forecast period, growth in puffs and extruded snacks is projected to accelerate due to their versatility in flavor infusion and suitability for high-protein, clean-label positioning, challenging chips for share in emerging markets.

Processing Type Segment - Market Value Share, 2025

| Processing Type | 2025 Share |

|---|---|

| Baked | 46% |

| Air-Dried / Dehydrated | 24% |

| Vacuum-Fried | 18% |

| Extruded | 12% |

| Processing Type | CAGR |

|---|---|

| Baked | 6.40% |

| Air-Dried / Dehydrated | 6.20% |

| Vacuum-Fried | 6.80% |

| Extruded | 6.50% |

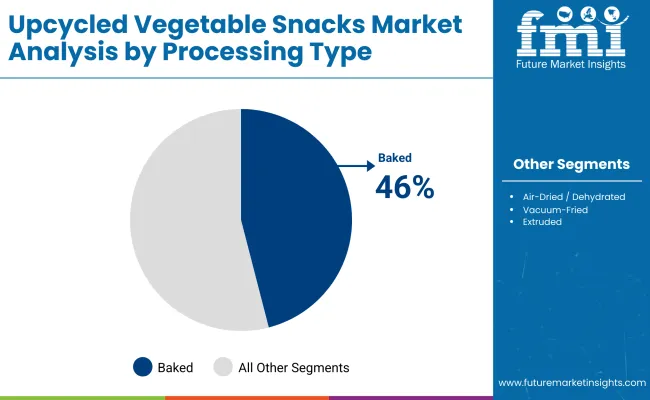

The baked processing segment is projected to hold 46% of market share in 2025, underlining its position as the preferred production method for upcycled vegetable snacks. This dominance is being supported by consumer perceptions of baked products as healthier, combined with operational efficiency in large-scale manufacturing. Baking enables consistent quality, lower oil usage, and compatibility with a wide range of vegetable sources. Market expansion is further being driven by advances in oven technology that improve throughput while preserving sensory qualities.

Vacuum-fried formats, although smaller in share, are forecast to achieve the fastest growth due to their ability to deliver indulgent textures with lower oil absorption. Over the next decade, multi-technology facilities are expected to become more common, enabling manufacturers to switch between processing methods based on ingredient type, seasonal supply, and targeted market positioning.

Rising ingredient procurement volatility and evolving sustainability regulations are influencing the Global Upcycled Vegetable Snacks Market, even as demand expands in mainstream retail, e-commerce, and foodservice due to consumer preference for sustainable, nutrient-rich snacks with traceable sourcing and measurable environmental impact.

Regulatory Support for Food Waste ReductionGlobal and regional regulations aimed at reducing food waste are expected to accelerate the adoption of upcycled vegetable snacks. Mandatory landfill diversion targets, extended producer responsibility (EPR) frameworks, and procurement incentives for products with verified upcycled content are anticipated to create a favorable operating environment. Brands meeting these compliance requirements are likely to gain preferential access to retail shelves and institutional contracts. In parallel, certification bodies validating upcycled claims are projected to strengthen consumer trust, driving purchase intent and repeat buying.

Shift Toward Circular Packaging SolutionsPackaging innovation is projected to emerge as a key differentiator, with recyclable, compostable, and mono-material solutions gaining adoption. This shift is being driven by retailer sustainability mandates, consumer environmental awareness, and the need to align with Scope 3 emission reduction targets. By integrating circular packaging into product design, brands are expected to capture premium positioning while meeting evolving regulatory requirements. Over the forecast period, advancements in barrier performance and cost optimization are anticipated to expand the adoption of eco-friendly formats without compromising product shelf life or sensory quality.

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 5.75% |

| India | 6.06% |

| Germany | 5.11% |

| France | 5.54% |

| UK | 6.91% |

| USA | 6.15% |

| Brazil | 6.54% |

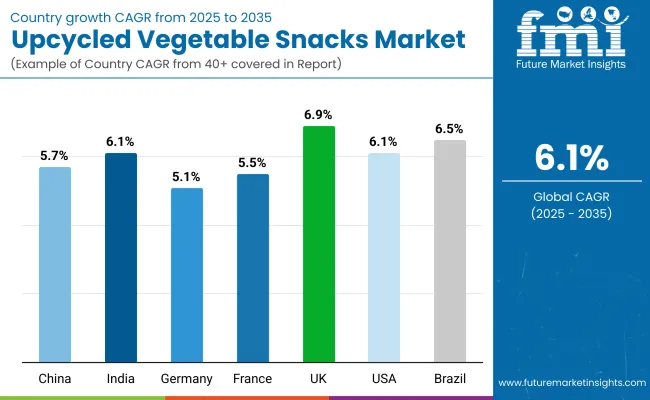

The Global Upcycled Vegetable Snacks Market demonstrates varying growth trajectories across key countries, shaped by sustainability legislation, consumer adoption patterns, and retail distribution maturity. Asia-Pacific is expected to lead expansion, anchored by China at a CAGR of 5.75% and India at 6.06%. In China, rising urban middle-class demand for healthy, eco-conscious snacks, combined with government-backed food waste reduction initiatives, is anticipated to strengthen mainstream retail penetration. India’s growth is being fueled by rapid e-commerce adoption, expansion of organized retail, and rising awareness of upcycled food benefits among health-conscious consumers.

Europe maintains steady growth, with Germany (5.11%), France (5.54%), and the UK (6.91%) benefiting from stringent food labeling regulations, zero-waste targets, and consumer readiness to pay premiums for sustainably sourced snacks. The UK is projected to be the fastest-growing European market due to strong plant-based consumption trends and rapid product innovation.

North America remains a key growth hub, with the USA at 6.15% CAGR, supported by scaling distribution through supermarkets, online channels, and health-focused retail chains. In Latin America, Brazil (6.54%) is expected to see robust expansion, driven by urbanization, retail modernisation, and increasing interest in functional, eco-friendly snacks. Across all these markets, sustainability-linked storytelling and certification-backed claims are expected to be decisive competitive levers.

| Year | USA Upcycled Vegetables Market (USD Million) |

|---|---|

| 2025 | 312.00 |

| 2026 | 331.6 |

| 2027 | 351.0 |

| 2028 | 369.9 |

| 2029 | 395.2 |

| 2030 | 422.5 |

| 2031 | 443.9 |

| 2032 | 472.2 |

| 2033 | 497.1 |

| 2034 | 530.2 |

| 2035 | 566.2 |

| Year | CAGR (2025-2035) |

|---|---|

| 2025 | 5.83% |

| 2026 | 6.27% |

| 2027 | 5.87% |

| 2028 | 5.38% |

| 2029 | 6.84% |

| 2030 | 6.90% |

| 2031 | 5.08% |

| 2032 | 6.38% |

| 2033 | 5.28% |

| 2034 | 6.65% |

| 2035 | 6.80% |

The USA Upcycled Vegetable Snacks Market is projected to expand at a CAGR of 6.1%, supported by growing consumer preference for sustainable, functional snacking and the scaling of mainstream retail distribution. Early-stage growth is being propelled by supermarket chains and health-focused retailers prioritizing shelf space for certified upcycled brands. The integration of sustainability metrics, such as CO₂e avoided per pack, is expected to strengthen consumer trust and increase repeat purchase rates. E-commerce and subscription services are forecast to play an increasingly critical role in market expansion, particularly for premium and niche flavors. Advancements in low-energy baking and vacuum-frying technologies are anticipated to improve product quality while optimizing production efficiency.

The UK Upcycled Vegetable Snacks Market is forecast to grow at a CAGR of 6.91%, driven by high consumer receptiveness to plant-based and zero-waste products. Strong alignment with national food waste reduction targets is expected to accelerate retail adoption, particularly within premium grocery chains. E-commerce penetration and direct-to-consumer models are anticipated to expand market accessibility, while innovations in flavor and texture will sustain repeat purchases. Sustainable packaging adoption is projected to increase sharply as retailers align with circular economy goals.

The India Upcycled Vegetable Snacks Market is projected to grow at a CAGR of 6.06%, underpinned by rapid urbanization, rising health awareness, and expansion of organized retail. E-commerce platforms and quick commerce services are expected to drive accessibility in Tier 1 and Tier 2 cities. Local sourcing of surplus produce is anticipated to reduce costs and improve supply chain resilience, supporting competitive pricing. Increased marketing around functional benefits and sustainability credentials is expected to strengthen brand loyalty.

The China Upcycled Vegetable Snacks Market is forecast to expand at a CAGR of 5.75%, supported by increasing middle-class demand for healthy, eco-conscious snacks. Government food waste reduction policies are anticipated to promote brand adoption in mainstream retail and foodservice. Cross-border e-commerce is expected to boost premium product imports, while domestic manufacturers invest in localized flavor development. Urban convenience store chains are projected to play a key role in category expansion.

The Germany Upcycled Vegetable Snacks Market is expected to grow at a CAGR of 5.11%, fueled by strict sustainability regulations and consumer preference for clean-label, traceable products. Organic-certified upcycled snacks are anticipated to gain a premium positioning, supported by specialty retail and bio stores. Private-label development by major retail chains is projected to accelerate category penetration. Technological advancements in air-drying and low-oil processing are expected to align with health-conscious consumer demand.

| Countries / Subregion | 2025 |

|---|---|

| UK | 20.54% |

| Germany | 20.77% |

| Italy | 11.28% |

| France | 13.50% |

| Spain | 11.14% |

| BENELUX | 6.28% |

| Nordic | 5.62% |

| Rest of Europe | 11% |

| Countries / Subregion | 2035 |

|---|---|

| UK | 19.96% |

| Germany | 21.17% |

| Italy | 11.99% |

| France | 14.47% |

| Spain | 11.68% |

| BENELUX | 5.56% |

| Nordic | 5.72% |

| Rest of Europe | 9% |

| Japan Processing Type | 2025 Share |

|---|---|

| Baked | 44% |

| Air-Dried / Dehydrated | 26% |

| Vacuum-Fried | 18% |

| Extruded | 12% |

| Japan Processing Type | CAGR |

|---|---|

| Baked | 6.50% |

| Air-Dried / Dehydrated | 6.30% |

| Vacuum-Fried | 6.90% |

| Extruded | 6.60% |

The Upcycled Vegetable Snacks Market in Japan is projected to be valued at USD 190 million in 2025, with baked products contributing the largest share at 44%, followed by air-dried/dehydrated formats at 26%. The dominance of baked processing reflects strong consumer preference for healthier, low-oil snack options that retain natural flavors and nutrients. Air-dried and dehydrated formats are also gaining momentum, driven by demand for minimally processed products with extended shelf life and clean-label positioning.

Vacuum-fried products, despite holding a smaller share, are expected to grow the fastest due to their ability to deliver indulgent textures while maintaining lower oil absorption. Extruded snacks are anticipated to expand steadily, benefiting from their versatility in flavor infusion and portion control. Increasing alignment with Japan’s food waste reduction policies and consumer interest in sustainable, locally sourced ingredients is expected to amplify adoption across all formats.

| S Korea Vegetable Source | 2025 Share |

|---|---|

| Root Vegetables | 30% |

| Carrot | 11% |

| Beetroot | 7% |

| Sweet Potato | 12% |

| Leafy Greens | 20% |

| Kale | 11% |

| Spinach | 9% |

| Legumes | 23% |

| Chickpeas | 15% |

| Lentils | 8% |

| Other Surplus Veg | 27% |

| Zucchini | 9% |

| Cauliflower | 9% |

| Broccoli stems | 9% |

| S Korea Vegetable Source | CAGR |

|---|---|

| Root Vegetables | 6.40% |

| Carrot | 6.30% |

| Beetroot | 6.50% |

| Sweet Potato | 6.40% |

| Leafy Greens | 6.80% |

| Kale | 6.90% |

| Spinach | 6.70% |

| Legumes | 7.00% |

| Chickpeas | 7.10% |

| Lentils | 6.90% |

| Other Surplus Veg | 7.20% |

| Zucchini | 7.10% |

| Cauliflower | 7.30% |

| Broccoli stems | 7.40% |

The Upcycled Vegetable Snacks Market in South Korea is projected to be valued at in 2025, with root vegetables leading at 30% of total market share. This dominance is being driven by strong consumer acceptance of familiar vegetables such as sweet potatoes and carrots, which are widely recognized for their flavor and nutritional benefits. Leafy greens, with a 20% share, are anticipated to expand steadily, benefiting from growing health consciousness and the popularity of nutrient-rich snacks like kale chips. Legumes are expected to capture 23% share, with chickpeas showing the highest CAGR at 7.10%, supported by their protein-rich profile. The 27% share of other surplus vegetables reflects South Korea’s strong alignment with food waste reduction policies, with cauliflower and broccoli stems forecast to achieve the fastest growth rates of 7.30% and 7.40% respectively.

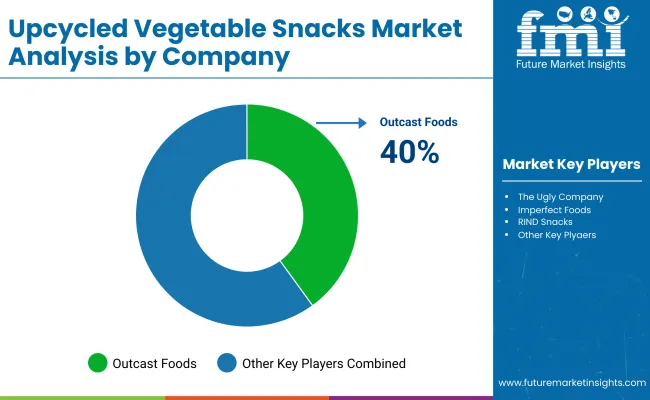

The Global Upcycled Vegetable Snacks Market is moderately fragmented, with established sustainability-focused brands, agile mid-sized innovators, and niche regional specialists competing across multiple distribution channels. Leading players such as The Ugly Company, Imperfect Foods, RIND Snacks, Barnana (Upcycled Banana & Veg Chips), and Outcast Foods collectively hold an estimated 38-42% of the global market share. These companies leverage strong sourcing networks, verified upcycling certifications, and brand storytelling to drive adoption in premium and mainstream retail segments. Their strategies increasingly emphasize transparent impact reporting, circular packaging solutions, and flavor innovation to strengthen consumer trust and repeat purchase behavior.

Mid-sized brands are focusing on category expansion through hybrid product formats, including vegetable-based chips blended with legumes or grains, targeting high-protein and functional snack segments. Regional specialists, often sourcing directly from local farms and processors, are building competitive positions through cost efficiency, cultural flavor profiles, and adaptability to localized retail ecosystems.

Competitive differentiation is shifting from purely ingredient sourcing toward integrated sustainability ecosystems combining certified upcycling, measurable environmental savings, and strong digital engagement channels. The next phase of competition is expected to be defined by operational scalability, climate-positive supply chains, and e-commerce-driven consumer engagement, positioning market leaders to capture accelerated growth over the coming decade.

Key Developments in Upcycled Vegetable Snacks Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1.30 billion in 2025 - USD 2.36 billion by 2035 |

| Core Segments (Vegetable Source) | Root Vegetables (Carrot, Beetroot, Sweet Potato), Leafy Greens (Kale, Spinach), Legumes (Chickpeas, Lentils), Other Surplus Veg (Zucchini, Cauliflower, Broccoli Stems) |

| Snack Format (Range analog) | Chips & Crisps, Puffs & Extruded Snacks, Crackers & Crispy Bites, Bars with Vegetable Inclusion, Baked Snack Mixes |

| Processing Type (Technology analog) | Baked, Air-Dried/Dehydrated, Vacuum-Fried, Extruded |

| Type (Go-to-Market/Positioning) | Clean-Label, Low-Sodium, High-Fiber/Protein, Gluten-Free, Verified Upcycled Content, Impact-Labeled (CO₂e avoided/pack; kg food saved) |

| End-Use / Channels | Supermarkets & Hypermarkets, Online Retail & Subscriptions, Convenience Stores, Foodservice & Vending, Specialty/Natural Stores, Private Label |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Korea, Spain, Italy, Australia |

| Key Companies Profiled | The Ugly Company, Imperfect Foods, RIND Snacks, Barnana (Upcycled Banana & Veg Chips), Outcast Foods |

| Regulatory Context | Food-waste reduction mandates, landfill-diversion targets, Extended Producer Responsibility (EPR) for packaging, upcycled-claim verification/certification standards |

| Packaging Scope | Recyclable, Compostable, Mono-Material, Lightweight Flexible Formats; barcode/QR-enabled impact disclosure |

| Data Cuts Included | Dollar sales by vegetable source, format, and processing type; channel mix; country-level growth; leader/long-tail brand splits; private-label penetration |

| Additional Attributes | Adoption drivers (sustainability demand, retailer ESG), pricing & margin levers (energy intensity, yield, packaging), tech enablers (low-energy drying, vacuum frying), risk factors (input variability, claim compliance), and KPI tracking (velocity vs. category, repeat rate, verified upcycled%). |

The global Upcycled Vegetable Snacks Market is estimated to be valued at USD 1.30 billion in 2025.

The market size is projected to reach USD 2.36 billion by 2035.

The market is expected to grow at a CAGR of ~6.13% over 2025-2035.

Key product types are recognized as Chips & Crisps, Puffs & Extruded Snacks, Crackers & Crispy Bites, Bars with Vegetable Inclusion, and Baked Snack Mixes.

Using snack format as the range analog, Chips & Crisps are expected to command ~34% share in 2025, reflecting strong consumer preference for familiar, better-for-you formats.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.