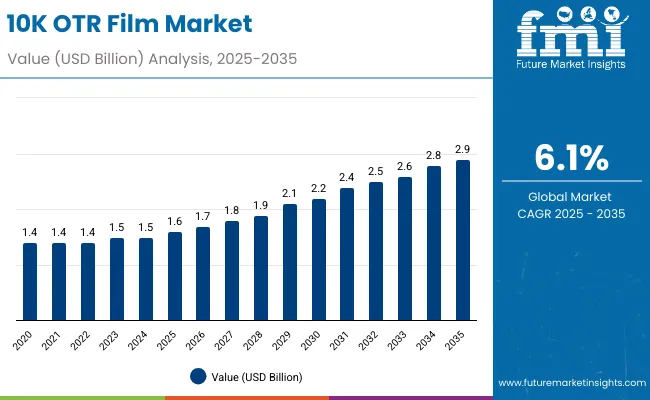

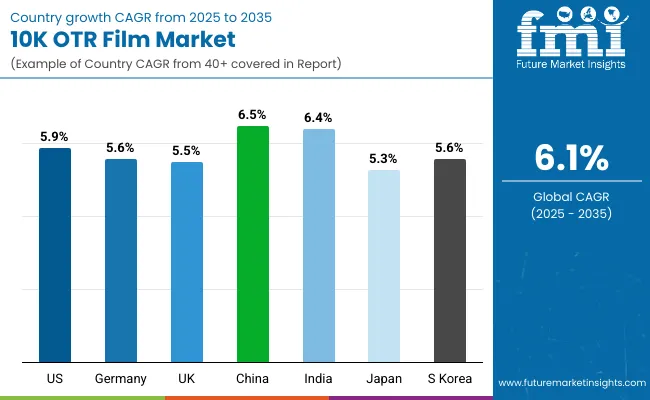

The 10K OTR film market is expected to grow from USD 1.6 billion in 2025 to USD 2.9 billion by 2035, resulting in a total increase of USD 1.3 billion over the forecast decade. This represents an 81.3% total expansion, with the market advancing at a compound annual growth rate (CAGR) of 6.1%. Over ten years, the market grows by a 1.8 multiple.

| Metric | Value |

|---|---|

| 10K OTR Film Market Estimated Value in (2025 E) | USD 1.6 billion |

| 10K OTR Film Market Forecast Value in (2035 F) | USD 2.9 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

In the first five years (2025 to 2030), the market progresses from USD 1.6 billion to USD 2.1 billion, contributing USD 0.5 billion, or 38.5% of total decade growth. This phase is shaped by rising adoption in fresh produce and meat packaging, where high oxygen transmission rates help maintain freshness. Strong demand in Europe and Asia supports early momentum.

In the second half (2030 to 2035), the market grows from USD 2.1 billion to USD 2.9 billion, adding USD 0.8 billion, or 61.5% of the total growth. This acceleration is supported by multilayer film innovation, improved recyclability, and applications in dairy and ready-to-eat meals. Expanding e-commerce in temperature-sensitive goods further strengthens growth, positioning 10K OTR films as vital in advanced food packaging.

From 2020 to 2024, the 10K OTR film market grew from USD 1.2 billion to USD 1.5 billion, driven by demand in fresh produce, meat, and pharmaceutical packaging where controlled oxygen permeability is essential. Nearly 70% of revenue came from packaging majors advancing high-barrier multilayer films.

Leaders such as Amcor, Sealed Air, and Mitsubishi Chemical focused on uniform gas exchange, moisture control, and puncture resistance. Differentiation centered on film thickness precision, machinability, and recyclability, while smart sensor integration remained secondary. Service-based models like shelf-life audits contributed under 15% of value, with most processors favoring direct procurement of engineered films.

By 2035, the 10K OTR film market will reach USD 2.9 billion, growing at a CAGR of 6.10%, with bio-based and recyclable barrier films representing over 40% of market value. Competitive intensity will rise as suppliers introduce nanocomposite layers, AI-modeled permeability controls, and IoT-enabled freshness tracking.

Established players are adapting with hybrid models combining advanced films with digital traceability platforms. Emerging entrants such as Uflex, Innovia Films, and Cosmo Films are gaining share through biodegradable multilayers, enhanced sealing performance, and flexible solutions tailored to evolving sustainability mandates across food, pharmaceutical, and industrial packaging industries.

The increasing demand for high-barrier packaging that ensures product freshness and extended shelf life is driving growth in the 10K OTR film market. These films provide controlled oxygen transmission rates, making them ideal for fresh produce, dairy, and ready-to-eat meals. Expanding global food exports and stricter packaging standards further accelerate adoption.

Multi-layer 10K OTR films with advanced polymers, high puncture resistance, and moisture control are gaining traction for their ability to balance protection and flexibility. Compatibility with automated packaging lines enhances efficiency, while lightweight and recyclable structures align with sustainability initiatives. Their effectiveness in reducing spoilage and maintaining product integrity boosts global market demand.

The market is segmented by material, film type, thickness, application, end-use industry, and region. Material segmentation includes polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), ethylene vinyl alcohol (EVOH), polyamide (PA), and multi-layer laminates, providing varying oxygen barrier performance and flexibility. Film type covers single layer and multi-layer films, addressing cost-effectiveness and advanced protection needs. Thickness segmentation includes up to 50 microns, 51-100 microns, and above 100 microns, supporting diverse food and pharmaceutical packaging requirements.

Applications comprise fresh produce packaging, meat, poultry and seafood packaging, dairy and cheese packaging, baked goods and confectionery, ready-to-eat meals, and pharmaceutical packaging, ensuring extended shelf life and safety. End-use industries include food and beverages, pharmaceuticals and healthcare, agriculture, and industrial goods. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

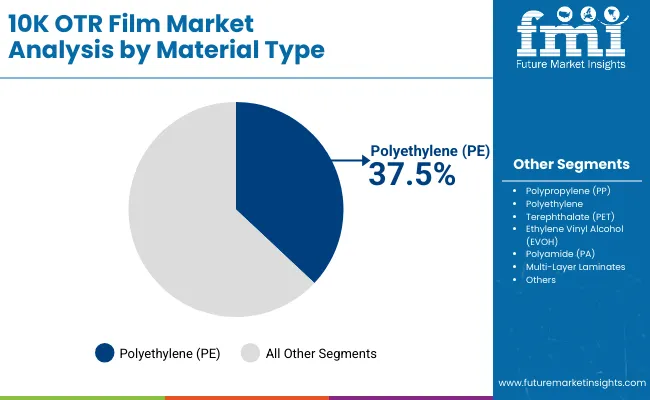

Polyethylene (PE) films are projected to account for 37.5% of the market in 2025, supported by their versatility, clarity, and cost-effectiveness. PE films provide excellent sealability and flexibility, making them suitable for packaging fresh produce, meat, and dairy products where oxygen regulation is essential. Their adaptability across food categories reinforces their widespread use.

Adoption is also driven by compatibility with multi-layer structures, where PE acts as a sealing or moisture-barrier layer. Its recyclability aligns with sustainability trends, encouraging food processors and retailers to adopt PE-based films. Continuous innovations in bio-based PE further strengthen its position as the leading material in 10K OTR films.

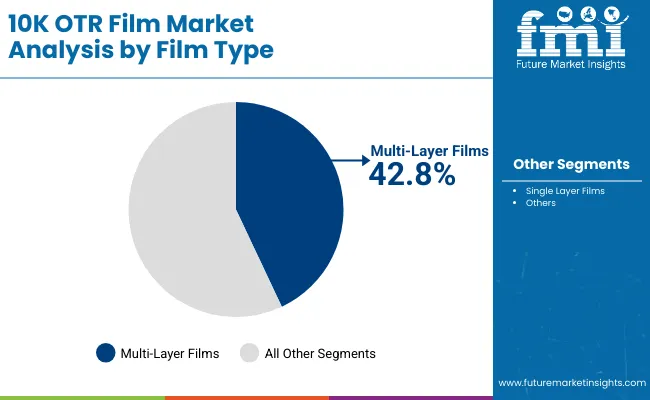

Multi-layer films are forecast to capture 42.8% of the market in 2025, as they combine polymers such as EVOH, PA, and PE to optimize gas permeability and mechanical strength. These films allow fine-tuning of oxygen transmission rates, enabling tailored solutions for different perishable goods.

Their growing adoption reflects demand for longer shelf life in high-value food categories. Multi-layer films also enhance puncture resistance and sealing integrity, ensuring product safety through extended distribution chains. Their performance versatility positions them as the preferred choice in modern packaging.

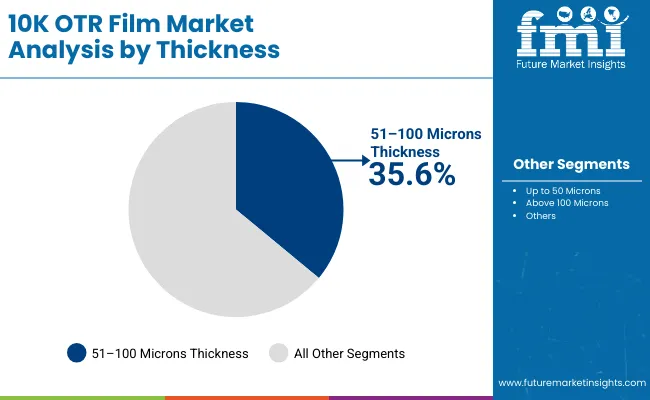

Films with 51-100 microns thickness are expected to hold 35.6% of the market in 2025, offering an optimal balance between strength and workability. This range provides durability for heavy or sharp-edged food products while maintaining flexibility for wrapping and sealing applications.

Their use is widespread in meat, dairy, and ready-meal packaging. Mid-range thickness ensures compatibility with both manual and automated packaging systems, making it a preferred standard. Manufacturers value this category for cost-efficiency without compromising protective properties.

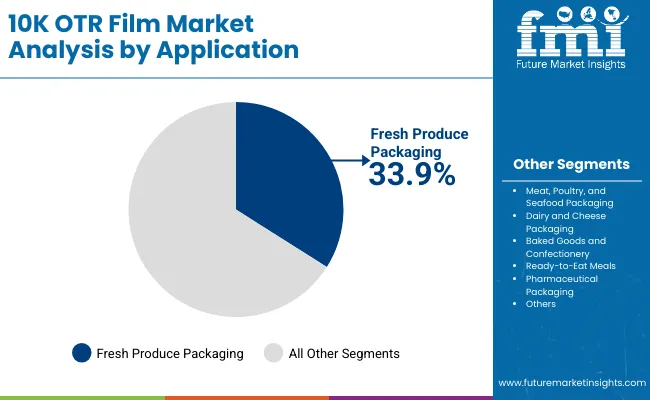

Fresh produce packaging is projected to account for 33.9% of the market in 2025, as controlled oxygen permeability prevents spoilage while maintaining freshness. These films slow down respiration rates, extending the shelf life of fruits and vegetables during storage and transport.

Retailers and exporters favor this application to reduce food waste and improve distribution efficiency. Clear film structures also enhance product visibility, supporting consumer appeal in retail settings. With global demand for fresh produce rising, this segment remains the primary driver of adoption.

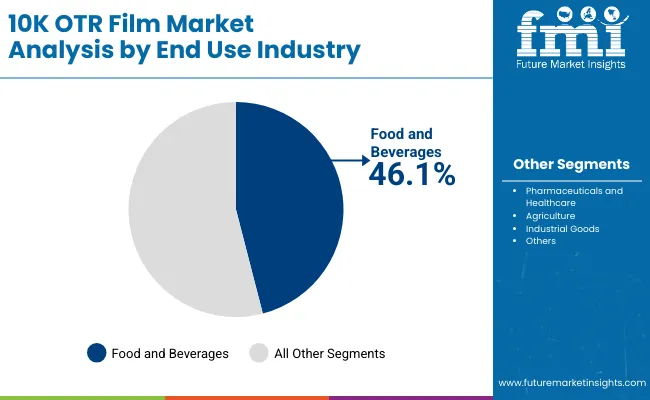

The food and beverages sector is forecast to represent 46.1% of demand in 2025, reflecting its reliance on high-barrier films for perishable goods. 10K OTR films support extended distribution chains by balancing permeability with protection, ensuring quality and safety.

This sector benefits from the versatility of films across diverse packaging formats, including pouches, trays, and wraps. As consumer expectations for fresher and longer-lasting food grow, food and beverage manufacturers remain the anchor customers for 10K OTR films.

The 10K OTR film market is growing as demand for high-barrier packaging solutions increases across fresh produce, dairy, meat, and pharmaceutical sectors. These films provide controlled oxygen transmission rates (OTR) that preserve freshness and extend shelf life. However, high production costs and recycling challenges limit adoption. Innovations in multi-layer films, eco-friendly materials, and automated packaging compatibility are driving future growth.

Shelf-life Extension, Food Safety, and Pharmaceutical Applications Driving Adoption

10K OTR films are widely used to maintain product quality by regulating oxygen flow, which helps slow microbial growth and oxidation. Fresh produce, dairy products, and meat packaging benefit from these films as they extend shelf life while retaining visual appeal. Pharmaceutical applications also rely on OTR films to protect sensitive drugs from oxygen degradation. Retailers and exporters prefer these films for ensuring safe, long-distance transportation. These attributes make 10K OTR films a vital tool for industries where freshness and safety are paramount.

High Manufacturing Costs, Recycling Barriers, and Limited Compatibility Restraining Growth

Despite strong demand, high production costs associated with advanced barrier materials such as EVOH and polyamides restrict affordability for cost-sensitive businesses. Recycling remains a major challenge, as these films often comprise multi-layer laminates that are difficult to separate and process. Limited compatibility with certain automated packaging systems further hinders adoption. Volatile raw material prices add additional uncertainty for manufacturers. These factors restrain growth, particularly in developing markets where sustainability regulations are tightening.

Multi-layer Laminates, Eco-friendly Polymers, and Automation Integration Trends Emerging

Key trends include the development of advanced multi-layer films that balance oxygen permeability with durability and mechanical strength. Manufacturers are investing in recyclable and bio-based polymers to align with sustainability targets and regulatory mandates. Automation-compatible OTR films are gaining traction, enabling faster packaging operations with minimal waste. Enhanced printability for branding and traceability is also emerging as a value-added feature. Together, these innovations are transforming 10K OTR films into sustainable, high-performance packaging materials for global supply chains.

The global 10K OTR (Oxygen Transmission Rate) film market is expanding steadily, driven by growing demand for high-barrier packaging across food, pharmaceuticals, and electronics. Asia-Pacific is emerging as the fastest-growing region, with India and China leading adoption due to rising packaged food consumption and pharmaceutical exports. Developed markets such as the USA, Germany, and Japan are prioritizing innovations in multilayer films, recyclable materials, and advanced coatings, ensuring compliance with safety standards while meeting sustainability and shelf-life extension goals.

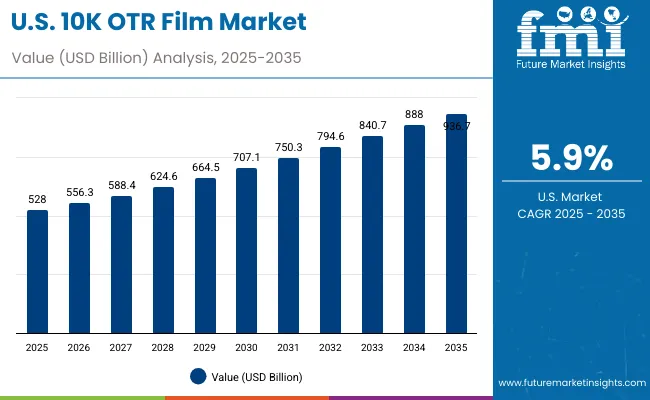

The USA market is projected to grow at a CAGR of 5.9% from 2025 to 2035, driven by strong adoption in fresh produce, dairy, and pharmaceutical packaging. Rising demand for high-barrier films that extend product shelf life is accelerating market growth. Manufacturers are investing in multilayer film technologies with improved oxygen resistance, recyclability, and cost efficiency. The focus on FDA-compliant materials and sustainable packaging solutions further supports steady adoption across food and healthcare sectors.

Germany’s market is expected to grow at a CAGR of 5.6%, supported by strict EU packaging regulations and strong demand in meat, cheese, and pharmaceutical sectors. German manufacturers are pioneering high-performance OTR films that balance sustainability with barrier protection. Innovation in multilayer recyclable films and energy-efficient production systems is a key trend. Adoption is being driven by both premium food processors and pharmaceutical exporters, making Germany a central hub for OTR film innovation within Europe.

The UK market is projected to grow at a CAGR of 5.5%, supported by growth in convenience food, seafood, and healthcare packaging. Demand is rising for recyclable and biodegradable barrier films to comply with packaging waste reduction targets. Startups and SMEs are playing a key role by adopting affordable multilayer solutions. Export-focused industries, particularly seafood and pharmaceuticals, are integrating 10K OTR films to preserve quality while ensuring compliance with international standards.

China’s market is forecast to grow at a CAGR of 6.5%, driven by rapid expansion of food processing, e-commerce, and pharmaceutical exports. Domestic manufacturers are scaling production of affordable high-barrier films to serve both domestic and international demand. Government policies supporting sustainable packaging are reinforcing adoption. The shift toward online food retail and expanding cold chain infrastructure is further accelerating demand for durable, recyclable OTR films across urban and rural markets.

India is forecast to grow at a CAGR of 6.4%, supported by strong growth in dairy, frozen food, and pharmaceutical exports. SMEs and large firms alike are investing in high-barrier OTR films to meet international compliance standards. Rising demand for shelf-stable ready-to-cook meals is further boosting adoption. Government initiatives supporting food safety and packaging innovation are reinforcing demand for cost-effective, recyclable solutions that cater to both domestic and export markets in India.

Japan’s market is expected to grow at a CAGR of 5.3%, led by demand in electronics, seafood, and ready-to-eat food packaging. Manufacturers are emphasizing precision-engineered OTR films with superior oxygen resistance and clarity. Compact packaging formats and sustainable multilayer films are key trends. The market is also driven by premium seafood exports and high-value consumer goods, where maintaining product integrity and compliance with strict safety standards are critical to packaging adoption.

South Korea’s market is projected to grow at a CAGR of 5.6%, supported by adoption in seafood, cosmetics, and pharmaceutical industries. Export-driven demand for K-food and premium consumer goods is fueling growth. Local manufacturers are developing recyclable OTR films with enhanced durability to align with global sustainability standards. The emphasis on automation and smart manufacturing is also boosting efficiency in large-scale packaging operations.

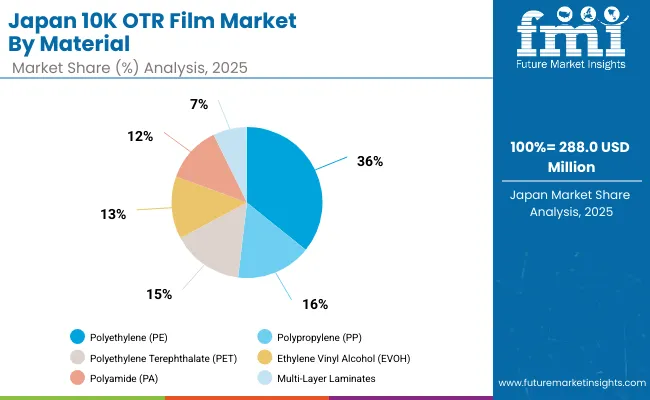

Japan’s 10K OTR film market, valued at USD 288 million in 2025, is led by polyethylene (PE), which holds 38.6% share due to its lightweight structure and reliable barrier properties. Polypropylene (PP) follows with 15.7%, while polyethylene terephthalate (PET) accounts for 14.8%. Ethylene vinyl alcohol (EVOH) captures 13.0%, polyamide (PA) 11.4%, and multi-layer laminates 6.6%. The dominance of PE reflects its broad use in food, beverage, and pharmaceutical packaging. However, EVOH and laminates are gaining traction, reflecting demand for advanced films with stronger oxygen barrier performance and durability to meet Japan’s rising standards for product protection and shelf life.

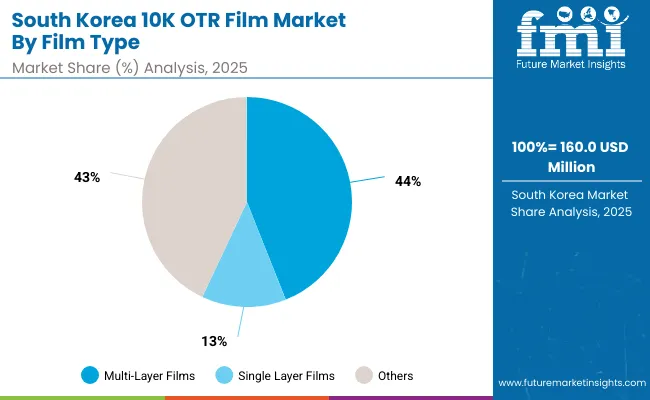

South Korea’s 10K OTR film market in 2025, valued at USD 160 million, is dominated by multi-layer films, which hold 44.6% of share. Single-layer films account for 14.1%, highlighting their limited role compared to more advanced multi-layer structures. The leadership of multi-layer films reflects their superior barrier protection against oxygen, moisture, and contaminants, making them suitable for perishable goods. Adoption is particularly strong in food, pharmaceuticals, and electronics packaging. Single-layer films remain relevant for low-cost or short-term packaging solutions. This distribution demonstrates South Korea’s strong preference for advanced protective materials that enhance storage efficiency, product safety, and overall sustainability.

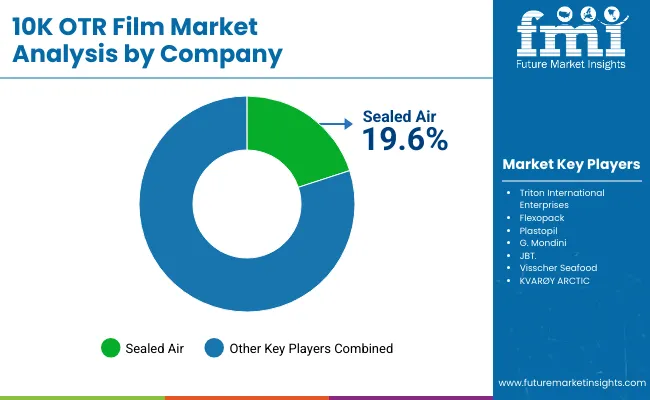

The 10K OTR film market is moderately fragmented, with global packaging leaders, specialty film producers, and application-specific solution providers competing across fresh produce, seafood, meat, and dairy sectors. Global leaders such as Sealed Air, Triton International Enterprises, and Flexopack hold notable market share, driven by advanced breathable film technology, high oxygen transmission rates, and compliance with global food safety standards. Their strategies increasingly emphasize shelf-life extension, sustainability, and compatibility with automated packaging lines.

Established mid-sized players including Plastopil, G. Mondini, and JBT are supporting adoption of multi-layer OTR films featuring controlled permeability, enhanced sealing strength, and tailored barrier properties. These companies are especially active in protein packaging and ready-meal applications, offering flexible solutions that balance freshness, convenience, and efficiency while catering to evolving retailer and consumer requirements.

Specialized regional providers such as Visscher Seafood and KVARØY ARCTIC focus on niche applications in seafood and aquaculture packaging. Their strengths lie in developing customized breathable film systems designed to maintain product quality during long-distance transport, ensuring optimal oxygen exchange while reducing spoilage, meeting sustainability goals, and supporting premium positioning in international markets.

Key Development

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| By Material | Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), Ethylene Vinyl Alcohol (EVOH), Polyamide (PA), Multi-Layer Laminates |

| By Film Type | Single Layer Films, Multi-Layer Films |

| By Thickness | Up to 50 Microns, 51-100 Microns, Above 100 Microns |

| By Application | Fresh Produce Packaging, Meat, Poultry, and Seafood Packaging, Dairy and Cheese Packaging, Baked Goods and Confectionery, Ready-to-Eat Meals, Pharmaceutical Packaging |

| By End-Use Industry | Food and Beverages, Pharmaceuticals and Healthcare, Agriculture, Industrial Goods |

| Key Companies Profiled | Sealed Air, Triton International Enterprises, Flexopack, Plastopil, G. Mondini, JBT, Visscher Seafood, KVARØY ARCTIC |

| Additional Attributes | Increasing demand for multi-layer laminates to enhance oxygen barrier properties, rising use of 10K OTR films in fresh produce and seafood packaging, growing preference in pharmaceuticals for extended shelf life, expanding applications in ready-to-eat meals driven by convenience trends, and strong adoption in agriculture and industrial goods to protect product integrity and meet sustainability-focused packaging standards. |

The global 10K OTR film market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the 10K OTR film market is projected to reach USD 2.9 billion by 2035.

The 10K OTR film market is expected to grow at a CAGR of 6.1% between 2025 and 2035.

The key film types in the 10K OTR film market include single layer films and multi-layer films.

The multi-layer films segment is projected to account for the highest share of 42.8% in the 10K OTR film market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe OTR Tire Market Growth – Trends & Forecast 2024-2034

Nootropic Energy Bars Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Nootropic Supplement Market Growth, Trends and Forecast from 2025 to 2035

Isotropic Films Market Size and Share Forecast Outlook 2025 to 2035

Hemotransmissive Infections Testing Market Size and Share Forecast Outlook 2025 to 2035

Tocotrienol Market Size and Share Forecast Outlook 2025 to 2035

Amyotrophic Lateral Sclerosis Market Size and Share Forecast Outlook 2025 to 2035

Endotracheal Tube Market - Growth & Demand Outlook 2025 to 2035

Endotracheal Tube Cuffs Market

Benzotrifluoride Market Size and Share Forecast Outlook 2025 to 2035

Lithotripsy Devices Market Size and Share Forecast Outlook 2025 to 2035

Neurotrophic Keratitis Treatment Market Analysis – Size, Share & Forecast 2025 to 2035

Hydrotreated Vegetable Oil Market Analysis by Type and Application Through 2035

The Neurotrophins Market is segmented by product type, application, end-user, and region from 2025 to 2035.

Leukotriene Modifiers Market Growth - Demand, Innovations & Forecast 2025 to 2035

Global Methotrexate Drug Market Analysis – Size, Share & Forecast 2024-2034

Psychotropic Drugs Market Growth - Industry Trends & Outlook 2025 to 2035

Synchrotron Instrumentation Market Size and Share Forecast Outlook 2025 to 2035

Folliculotropic Mycosis Fungoides Treatment Market - Trends & Forecast 2025 to 2035

Medical Cyclotron Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA