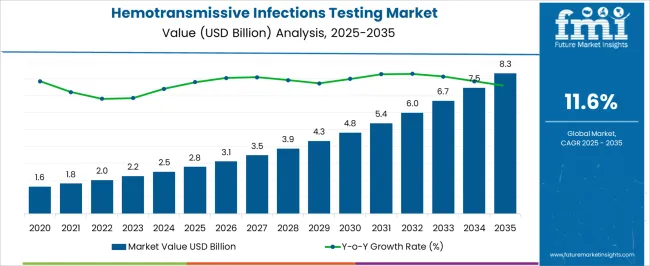

The Hemotransmissive Infections Testing Market is estimated to be valued at USD 2.8 billion in 2025 and is projected to reach USD 8.3 billion by 2035, registering a compound annual growth rate (CAGR) of 11.6% over the forecast period.

| Metric | Value |

|---|---|

| Hemotransmissive Infections Testing Market Estimated Value in (2025 E) | USD 2.8 billion |

| Hemotransmissive Infections Testing Market Forecast Value in (2035 F) | USD 8.3 billion |

| Forecast CAGR (2025 to 2035) | 11.6% |

The Hemotransmissive Infections Testing market is experiencing robust growth due to increasing awareness of bloodborne pathogens and the rising demand for accurate and rapid diagnostic testing. The current market landscape is being shaped by the adoption of molecular diagnostic technologies and nucleic acid testing, which enable early and precise detection of infections such as Hepatitis B and other transfusion-transmitted diseases.

Increasing investments in healthcare infrastructure and laboratory modernization have further supported market expansion. The growing focus on blood safety, driven by regulatory requirements and the need to prevent hospital-acquired infections, has encouraged widespread implementation of testing protocols across hospitals, blood banks, and diagnostic centers.

Future growth is expected to be influenced by advancements in automation, high-throughput testing platforms, and integration of software-driven diagnostic solutions, which allow for faster turnaround times and higher accuracy The market is also benefiting from increased public health initiatives, government programs for infectious disease control, and rising adoption of preventive healthcare measures, positioning hemotransmissive infections testing as a critical component of modern healthcare delivery.

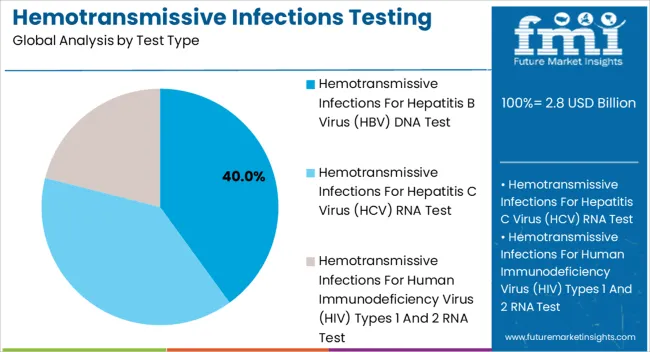

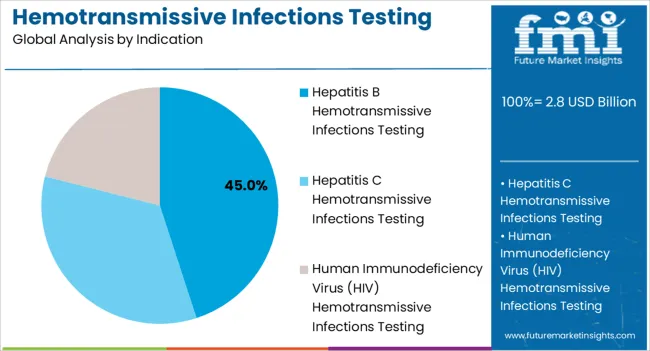

The hemotransmissive infections testing market is segmented by test type, indication, and geographic regions. By test type, hemotransmissive infections testing market is divided into Hemotransmissive Infections For Hepatitis B Virus (HBV) DNA Test, Hemotransmissive Infections For Hepatitis C Virus (HCV) RNA Test, and Hemotransmissive Infections For Human Immunodeficiency Virus (HIV) Types 1 And 2 RNA Test. In terms of indication, hemotransmissive infections testing market is classified into Hepatitis B Hemotransmissive Infections Testing, Hepatitis C Hemotransmissive Infections Testing, and Human Immunodeficiency Virus (HIV) Hemotransmissive Infections Testing. Regionally, the hemotransmissive infections testing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Hemotransmissive Infections for Hepatitis B Virus DNA test segment is projected to hold 40.0% of the market revenue share in 2025, making it the leading test type. The dominance of this segment is being driven by the high prevalence of Hepatitis B globally and the critical need for sensitive and early detection. These tests provide precise quantification of viral DNA, enabling timely intervention and monitoring of treatment efficacy.

Adoption has been accelerated by the ability of molecular diagnostic platforms to reduce false-negative results and improve patient outcomes. The segment’s growth has been reinforced by the integration of automated testing systems that allow laboratories to process a higher volume of samples with consistent accuracy.

In addition, the rising emphasis on preventive healthcare, routine blood screening, and regulatory mandates for screening transfusion-transmissible infections have contributed to increased deployment of these tests The flexibility of HBV DNA testing to be incorporated into multi-pathogen diagnostic panels further supports its widespread utilization and sustained growth.

The Hepatitis B indication segment is expected to account for 45.0% of the market revenue share in 2025, establishing it as the leading indication in hemotransmissive infections testing. This leadership is being attributed to the global burden of Hepatitis B infection and the associated risks of chronic liver disease, cirrhosis, and hepatocellular carcinoma. Testing is widely adopted for early diagnosis, vaccination monitoring, and treatment efficacy evaluation.

Growth has been supported by the deployment of high-sensitivity assays that allow for detection at low viral loads, ensuring timely clinical intervention. The segment has benefited from increased public health initiatives targeting Hepatitis B screening in high-risk populations and pre-transfusion blood donor testing.

The emphasis on standardization and regulatory compliance in clinical laboratories has further strengthened the uptake of Hepatitis B testing As governments and healthcare organizations continue to prioritize blood safety and preventive care, the Hepatitis B segment is expected to maintain its leading position in the hemotransmissive infections testing market.

The hospital end-use segment is projected to hold 50.0% of the market revenue share in 2025, making it the largest end-use category for hemotransmissive infections testing. This growth is being driven by the adoption of stringent blood safety protocols, the need for rapid diagnosis, and the requirement to prevent nosocomial infections. Hospitals have increasingly implemented centralized and automated diagnostic systems to enhance accuracy and efficiency, reducing the risk of infection transmission.

The segment has been reinforced by the demand for comprehensive testing panels covering multiple pathogens, allowing hospitals to manage patient safety effectively. Furthermore, regulatory mandates for mandatory screening of blood transfusions and adherence to infection control guidelines have significantly contributed to the segment’s expansion.

The growing focus on patient safety, rising hospitalizations, and increased awareness about the risk of bloodborne infections have collectively propelled the deployment of hemotransmissive infections testing in hospital settings As healthcare facilities continue to modernize, the hospital segment is expected to maintain its dominant share in the market.

Hemotransmissive infections are infections that spread through blood when an infected person comes into contact with another infected person. The most common diseases spread through blood are hepatitis C, hepatitis B, and the human immunodeficiency virus (HIV). It is critical to diagnose these diseases as soon as possible in order to treat or manage them.

The hemotransmissive infections testing market is undergoing regulatory changes from the government of the respective region or country, such as in December 2025, the government of the United States updated law regarding age and consent of diagnosis, i.e. minors aged 15 to 18 years can now be tested without the consent of their legal guardian or parents, which can increase the possibility of early diagnosis in patients under the age of 18 years.

According to the European Centre for Disease Prevention and Control and WHO, HIV infections have increased significantly in Eastern Europe, with over 130,000 people infected in 2025, whereas HIV infection has decreased by nearly 20.0% in Western Europe. Similarly, as the prevalence of hepatitis C and hepatitis B rises, hemotransmissive infections testing can play an important role in early diagnosis.

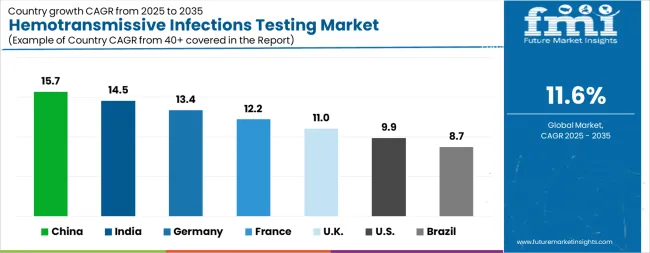

| Country | CAGR |

|---|---|

| China | 15.7% |

| India | 14.5% |

| Germany | 13.4% |

| France | 12.2% |

| UK | 11.0% |

| USA | 9.9% |

| Brazil | 8.7% |

The Hemotransmissive Infections Testing Market is expected to register a CAGR of 11.6% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 15.7%, followed by India at 14.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 8.7%, yet still underscores a broadly positive trajectory for the global Hemotransmissive Infections Testing Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 13.4%. The USA Hemotransmissive Infections Testing Market is estimated to be valued at USD 1.0 billion in 2025 and is anticipated to reach a valuation of USD 2.7 billion by 2035. Sales are projected to rise at a CAGR of 9.9% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 128.5 million and USD 93.3 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.8 Billion |

| Test Type | Hemotransmissive Infections For Hepatitis B Virus (HBV) DNA Test, Hemotransmissive Infections For Hepatitis C Virus (HCV) RNA Test, and Hemotransmissive Infections For Human Immunodeficiency Virus (HIV) Types 1 And 2 RNA Test |

| Indication | Hepatitis B Hemotransmissive Infections Testing, Hepatitis C Hemotransmissive Infections Testing, and Human Immunodeficiency Virus (HIV) Hemotransmissive Infections Testing |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

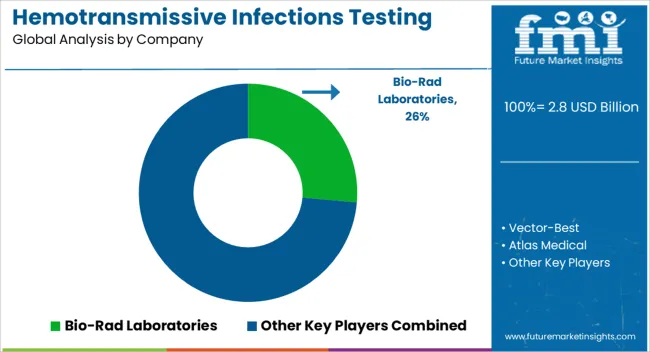

| Key Companies Profiled | Bio-Rad Laboratories, Vector-Best, Atlas Medical, Launch Diagnostics, Creative Diagnostics, Shanghai Chemtron Biotech, Oscar Medicare, ABON Biopharm, Trinity Biotech Manufacturing, and Adaltis |

The global hemotransmissive infections testing market is estimated to be valued at USD 2.8 billion in 2025.

The market size for the hemotransmissive infections testing market is projected to reach USD 8.3 billion by 2035.

The hemotransmissive infections testing market is expected to grow at a 11.6% CAGR between 2025 and 2035.

The key product types in hemotransmissive infections testing market are hemotransmissive infections for hepatitis b virus (hbv) DNA test, hemotransmissive infections for hepatitis c virus (hcv) rna test and hemotransmissive infections for human immunodeficiency virus (hiv) types 1 and 2 rna test.

In terms of indication, hepatitis b hemotransmissive infections testing segment to command 45.0% share in the hemotransmissive infections testing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Global Eye Infections Treatment Market Report - Trends & Forecast 2025 to 2035

Difficile Infections (Clostridium Difficile Associated Disease) Market Size and Share Forecast Outlook 2025 to 2035

Surgical Site Infections Market

Coxsackievirus Infections Treatment Market – Growth & Drug Innovations 2025 to 2035

Mosquito-borne infections Testing Market Size and Share Forecast Outlook 2025 to 2035

Helicobacter Pylori Infections Treatment Market Size and Share Forecast Outlook 2025 to 2035

Contact-lens Induced Infections Market Size and Share Forecast Outlook 2025 to 2035

Global Antibiotic-Resistant Infections Treatment Market Analysis – Size, Share & Forecast 2024-2034

Arthropod-borne Viral Infections Testing Market Size and Share Forecast Outlook 2025 to 2035

Complicated Urinary Tract Infections Treatment Market - Trends & Outlook 2025 to 2035

Catheter Associated Urinary Tract Infections (UTI) Treatment Market - Demand & Forecast 2025 to 2035

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

AB Testing Software Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HSV Testing Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HPV Testing and Pap Test Market Size and Share Forecast Outlook 2025 to 2035

GMO Testing Services Market Insights – Food Safety & Regulatory Compliance 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA