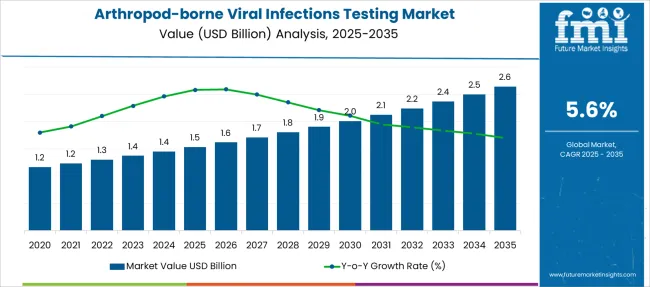

The Arthropod-borne Viral Infections Testing Market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 2.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

| Metric | Value |

|---|---|

| Arthropod-borne Viral Infections Testing Market Estimated Value in (2025 E) | USD 1.5 billion |

| Arthropod-borne Viral Infections Testing Market Forecast Value in (2035 F) | USD 2.6 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The arthropod-borne viral infections testing market is experiencing steady growth due to increased incidence of vector-borne diseases and heightened focus on early diagnosis and disease control. The rising prevalence of infections transmitted by mosquitoes and ticks has driven demand for reliable and rapid diagnostic solutions.

Healthcare providers are placing emphasis on timely and accurate detection to contain outbreaks and improve patient outcomes. Advances in molecular diagnostics have made RT-PCR based tests the preferred method due to their high sensitivity and specificity.

Additionally, public health initiatives and surveillance programs have expanded testing capacity in hospitals and clinical centers. Growing awareness among healthcare practitioners about the importance of early testing has further fueled market expansion. The integration of testing with disease monitoring systems supports prompt intervention and resource allocation. Segment growth is expected to be led by RT-PCR based tests for their diagnostic accuracy and hospitals as the primary end users, reflecting the critical role of institutional healthcare settings in managing infectious diseases.

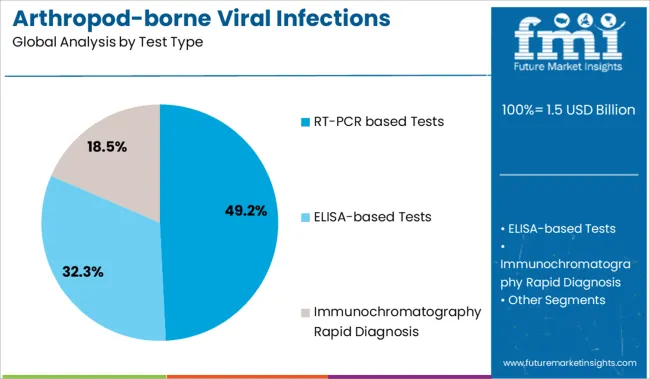

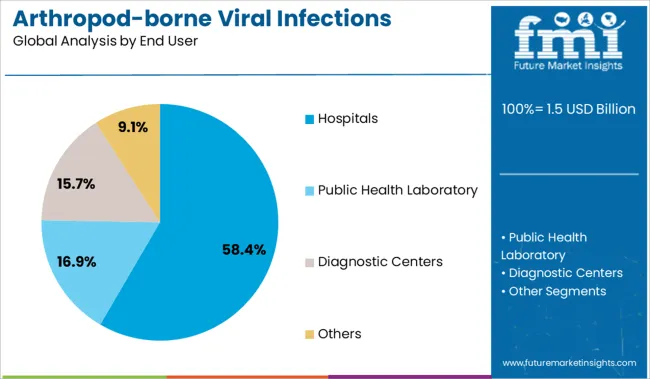

The market is segmented by Test Type and End User and region. By Test Type, the market is divided into RT-PCR based Tests, ELISA-based Tests, and Immunochromatography Rapid Diagnosis. In terms of End User, the market is classified into Hospitals, Public Health Laboratory, Diagnostic Centers, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The RT-PCR based tests segment is projected to hold 49.2% of the market revenue in 2025, positioning it as the leading test type. Growth has been driven by the superior diagnostic performance of RT-PCR technology in detecting viral RNA with high precision. These tests allow for early detection during the acute phase of infection and can differentiate between closely related viral strains.

The ability to process multiple samples with automated platforms has increased throughput and testing efficiency. Furthermore, RT-PCR tests have become standard practice in hospital laboratories for confirmation of arthropod-borne viral infections, supporting rapid clinical decision-making.

As emerging viral strains continue to pose diagnostic challenges, the reliance on RT-PCR technology is expected to remain strong.

Hospitals are projected to represent 58.4% of the market revenue in 2025, maintaining their position as the primary end users of arthropod-borne viral infections testing. The growth in this segment is attributed to the critical need for institutional testing facilities equipped with advanced molecular diagnostic capabilities.

Hospitals serve as frontline centers for patient care during viral outbreaks and require reliable diagnostic tools to manage and isolate infected individuals promptly. The availability of specialized laboratory infrastructure and trained personnel in hospital settings supports the widespread use of RT-PCR and other advanced tests.

Additionally, hospitals play a key role in public health surveillance and reporting, further driving demand for efficient diagnostic testing. With continuous investment in healthcare infrastructure and growing disease burden, hospitals are expected to sustain their lead as the main consumers of arthropod-borne viral infections tests.

| Particulars | Details |

|---|---|

| H1, 2024 | 5.64% |

| H1, 2025 Projected | 5.63% |

| H1, 2025 Outlook | 3.83% |

| BPS Change - H1, 2025 (O) - H1, 2025 (P) | (-) 180 ↓ |

| BPS Change - H1, 2025 (O) - H1, 2024 | (-) 181 ↓ |

The variation between the BPS values observed within the arthropod-borne viral infections testing market in H1, 2025 - outlook over H1, 2025 projected reflects a decline by 180 BPS units. Additionally, a value BPS decline in H1-2025 over H1-2024 by 181 Basis Point Share (BPS) is demonstrated by the market.

The market observes a decline in the BPS values owed to the poor accessibility of detection methods in low-income economies with a large disease burden. As a result, high costs of healthcare facilities along with a lack of awareness about infectious diseases are expected to restrain the market's growth.

The market is subjected to several macro economical and industry variables, which include disease epidemiology, biologics licensing, product patenting and distribution licensing.

Factors such as climate change, urbanization, and global trade can expand the geographic distribution of vectors and associated arboviruses, thus increasing the potential disease burden in susceptible hosts. This factor can present an opportunity for a positive growth outlook for the market

Healthcare has become an area of prime concern across the world and this is due to the rising diseases and infections across the world. There has been a substantial rise in arboviral diseases over the past few years and this has influenced demand for arthropod-borne viral infections testing.

Arthropod-borne viral infections testing demand rose at a CAGR of 4.9% from 2014 to 2024 and ended up with a market worth of USD 1.4 Billion in 2024.

Most common arthropod-borne viral infection in the world according to WHO (World Health Organization) is dengue, with the potential risk to infect more than 30% of the world’s population.

Rising focus on public healthcare, increasing travel and trade activities on a global scale, changing lifestyle trends, environmental and climatic changes, rapid urbanization across the world, etc. are some major factors that influence arthropod-borne viral infections testing market potential on a global scale.

The market for arthropod-borne viral infections testing is anticipated to rise at a CAGR of 5.6% over the forecast period of 2025 to 2035.

Re-emergence of Arthropod-borne Viral Infections to Drive Demand

Arthropod-borne infections have proven to be responsible for widespread epidemics across the world. Some of the notable arboviral epidemics are of dengue and Zika virus which led to further complications in the population infected.

These epidemics have been dealt with to a certain extent but have proven their re-emergence in recent times which is a major factor that drives demand for arthropod-borne viral infections testing on a global level. The unpredictable nature of these infections promotes arthropod-borne viral infections testing providers to develop better diagnostic solutions to detect and avoid a community spread of these infections.

Increasing Government Initiatives to Limit Risk of Arboviral Infections

Governments across the world are working in sync with health organizations to mitigate the risk of arthropod-borne viral infections. As a matter of public safety, the focus on these diseases is increasing in the past few years with severe outbreaks being recorded across the world. The emergence of coronavirus in 2024 has further bolstered the importance of government inclusion in matters of public health.

For instance, a pilot program funded by Global Emerging Infectious Surveillance (GEIS) a division of Armed Forces Health Surveillance Branch of the USA is set to launch in spring of 2025 to identify emerging infectious diseases and mitigate risk. This is expected to be attained by a global laboratory network that is designed to enhance global health security.

MEA and Latin America to Provide Major Opportunities for Market Players

This FMI industry analysis provides metrics for the arthropod-borne viral infections testing market across regions such as North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa (MEA).

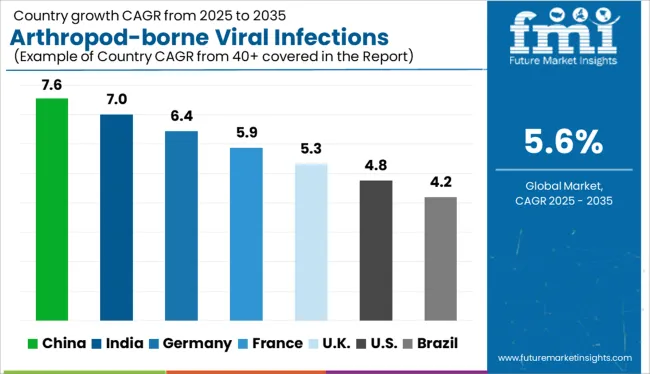

The market for arthropod-borne viral infections testing in Latin America is anticipated to see high demand over the forecast period as it accounts for a notable number of infections across the world.

Developing healthcare infrastructure and rising awareness about arthropod-borne infections is anticipated to influence arthropod-borne viral infections testing demand in this region.

Demand for arthropod-borne viral infections testing in North America is expected to be low as the incidence of arboviral infections and diseases in this region is low. Advanced healthcare infrastructure and proper preventive care reduce the chances of infection in this region.

East Asia and South Asia are expected to see high demand for arthropod-borne viral infections testing over the forecast period. Implementation of stringent regulations to curb the spread of infectious diseases in this region is anticipated to drive market potential in these regions.

Densely populated countries like India and China are expected to emerge as highly lucrative markets for arthropod-borne viral infections testing vendors.

Rising instances of arboviral infections and epidemics in the MEA region are expected to majorly drive demand for arthropod-borne viral infections testing in this region. This region is expected to be one of the most important markets on a global level owing to the re-emergence of multiple infections like Zika virus and others.

Underdeveloped healthcare infrastructure is a major restraining factor for arthropod-borne viral infections testing market in the MEA region.

Increasing Threat of Arboviral Infections Augmenting Market Expansion

Instances of arthropod-borne viral infections have been increasing in the UK in recent times and this is anticipated to drive arthropod-borne viral infections testing demand in the nation. Lyme disease has become a prominent issue in the UK over recent years and other arthropod-borne diseases have also seen an increase in incidence.

Increasing global travel and trade are expected to fuel the adoption of arthropod-borne viral infections testing in the UK

Developing Healthcare Infrastructure to Provide Lucrative Market Opportunities

Brazil is anticipated to be a highly rewarding market for arthropod-borne viral infections testing vendors due to high incidence of multiple arthropod-borne viral infections like Zika virus and dengue. Brazil is a developing economy and has an emerging healthcare infrastructure that has a lot of untapped potential that arthropod-borne viral infections testing providers can unlock if they enter this market.

High Preference for ELISA-based Test Kits to Drive Sales through 2035

Enzyme-linked immunosorbent assay (ELISA)-based tests have been immensely popular in the arthropod-borne viral infections testing marketplace over the past few years and currently account for a dominant market share of 52% in the global landscape.

Increasing preference for use of ELISA-based test kits by patients, healthcare professionals, researchers, etc. is expected to propel its popularity further.

In 2025, reverse-transcription polymerase chain reaction (RT-PCR) kits hold a market share of 33.5% in the global arthropod-borne viral infections testing industry. The COVID-19 pandemic boosted demand for RT-PCR test kits and this trend is expected to be prevalent over the forecast period as well.

Arthropod-borne viral infections testing providers are investing in the research and development of rapid test kits that are effective in diagnosing infections in a short period of time with minimal error.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2014 to 2024 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; Middle East & Africa (MEA) |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, UK, France, Spain, Italy, China, Japan, South Korea, India, Indonesia, Malaysia, Singapore, Australia, New Zealand, Turkey, South Africa, and GCC Countries |

| Key Market Segments Covered | Test Type, End User, Region |

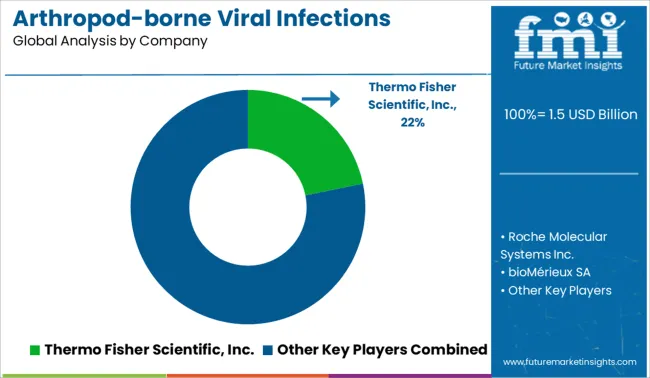

| Key Companies Profiled | Thermo Fisher Scientific Inc.; Roche Molecular Systems Inc.; bioMérieux SA; InBios International Inc.; NovaTec Immundiagnostica GmbH; Euroimmun AG (Sub. PerkinElmer); Quest Diagnostics; Certest Biotec S.L.; Response Biomedical Corp.; Chembio Diagnostic Systems Inc.; Abbott Laboratories |

| Pricing | Available upon Request |

The global arthropod-borne viral infections testing market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the arthropod-borne viral infections testing market is projected to reach USD 2.6 billion by 2035.

The arthropod-borne viral infections testing market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in arthropod-borne viral infections testing market are rt-pcr based tests, elisa-based tests and immunochromatography rapid diagnosis.

In terms of end user, hospitals segment to command 58.4% share in the arthropod-borne viral infections testing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Viral Molecular Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Viral Vector Development Market – Growth & Demand 2025 to 2035

Viral RNA Extraction Kit Market - Trends & Forecast 2025 to 2035

Viral Pneumonia Treatment Market

Viral Safety Testing Market Size and Share Forecast Outlook 2025 to 2035

Antiviral Drugs Market Size and Share Forecast Outlook 2025 to 2035

Antiviral Immunoglobulin Market Growth – Trends & Forecast 2025 to 2035

Antiviral Drug Packaging Market Insights - Growth & Trends 2025 to 2035

Antiviral Polymers for Packaging Market

HIV Antivirals Market Size and Share Forecast Outlook 2025 to 2035

Swab and Viral Transport Medium Market Insights - Demand & Forecast 2025 to 2035

Key Players & Market Share in Swab and Viral Transport Medium Industry

Influenza Antiviral Market

China Swab and Viral Transport Medium Market Trends – Size, Demand & Industry Outlook 2025-2035

Sterile and Antiviral Packaging Market Forecast and Outlook 2025 to 2035

France Swab and Viral Transport Medium Market Report - Growth, Trends & Forecast 2025 to 2035

Germany Swab and Viral Transport Medium Market Insights - Demand, Size & Industry Trends 2025 to 2035

Direct-acting Antiviral Medicines Market

United States Swab and Viral Transport Medium Market Outlook - Size, Share & Industry Trends 2025 to 2035

United Kingdom Swab and Viral Transport Medium Market Analysis - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA