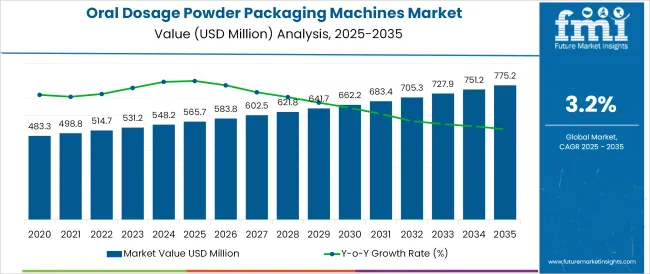

The Oral Dosage Powder Packaging Machines Market is estimated to be valued at USD 565.7 million in 2025 and is projected to reach USD 775.2 million by 2035, registering a compound annual growth rate (CAGR) of 3.2% over the forecast period.

The oral dosage powder packaging machines market is currently experiencing significant momentum, propelled by increasing demand within pharmaceutical and food industries for high-speed, precise, and hygienic packaging solutions. Manufacturers are prioritizing smart technologies such as PLC driven automation, IoT-enabled real-time monitoring, and AI supported predictive maintenance to boost throughput, reduce human error, and enhance traceability.

Sustainability concerns and regulatory pressures are prompting the adoption of eco-friendly packaging and efficient changeover capabilities. Furthermore, packaging platforms are being designed for quick format shifts to support growing product diversity from single-dose sachets to nutraceutical powders. Emerging-market infrastructure expansion, especially in Asia-Pacific, combined with rising healthcare investments and e-commerce driven packaging logistics, is opening new avenues for growth.

Future opportunities are expected to reside in modular, scalable systems compliant with evolving safety standards, enabling manufacturers to optimize operations, lower costs, and respond rapidly to market needs.

The market is segmented by Automation, Capacity, and End-Use and region. By Automation, the market is divided into Automatic, Semi-Automatic, and Manual. In terms of Capacity, the market is classified into 100-200 Packs/min, 201-400 Packs/min, Above 400 Packs/min, and Below 100 Packs/min. Based on End-Use, the market is segmented into Pharmaceuticals, Food & Beverage, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

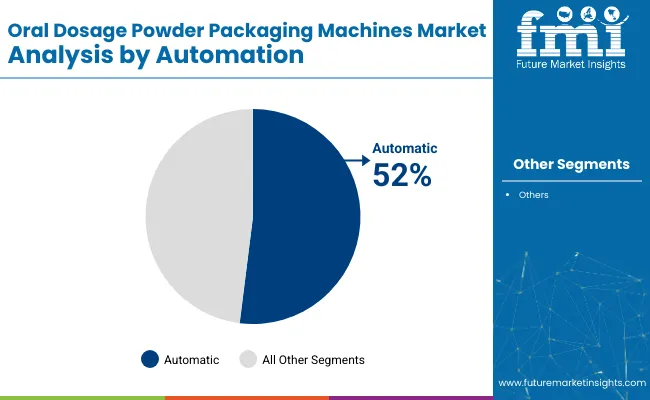

A 52.0% revenue share is projected to be held by the automatic category in 2025, marking it as the leading automation type. This dominance is being driven by seamless integration of robotics, vision systems, and advanced sensors which has automated powder fill, seal, and pack operations. Efficiency gains have been realized through reduced labour requirements minimized downtime, and increased accuracy.

Smart factory implementations, employing Industry 4.0 protocols, are favouring fully automatic machines for their predictive maintenance and data‑driven monitoring capabilities.

Cost efficiencies in long run production and compliance with hygiene protocols have further reinforced adoption, particularly in pharmaceutical and nutraceutical environments where precision is non-negotiable. Plug‑and‑play interfaces and remote diagnostics are being increasingly demanded, cementing automatic equipment as the standard for high‑throughput, compliant packaging lines.

When evaluated by capacity, the 100-200 packs per minute segment is expected to lead with a 35.0% revenue share in 2025. This segment’s leadership is attributed to its optimal balance between speed and cost, making it ideal for mid‑scale pharmaceutical and food producers.

The capacity range accommodates volume requirements without committing to the complexity and capital expense of high‑capacity lines, providing swift ROI. Machines within this bracket often support quick changeover and modular customization, facilitating flexible production across multiple SKUs.

They are also easier to validate and qualify under GMP standards, shortening time‑to‑market. These factors combined with the growing preference for nutraceutical formats and e‑commerce distribution have reinforced the segment’s status as the cornerstone of powder packaging operations.

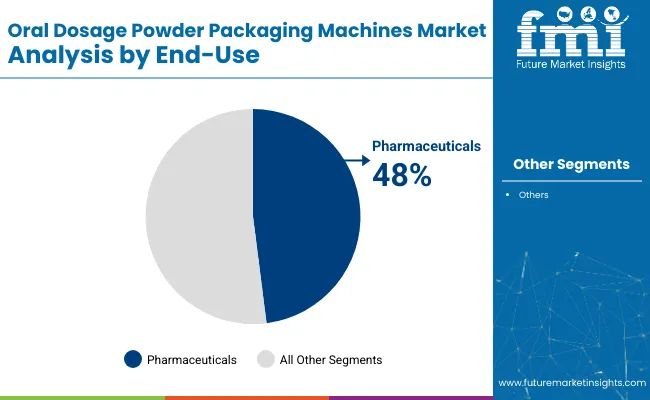

The pharmaceuticals end use segment is anticipated to capture 48.0% of market share in 2025, securing its position as the dominant sector. This is being driven by the global increase in oral dosage powder formulations, including prescription drugs, over the counter remedies and nutraceuticals.

Regulatory demands for hygiene control, dosage accuracy, and batch traceability in pharmaceutical packaging have necessitated advanced machine adoption with features like clean in place (CIP) design, integrated weighing, and tamper‑evident sealing. Furthermore, the rise of personalized medicine and unit‑dose formats is prompting demand for modular, scalable machines that can handle variable formats at moderate speeds.

Investment by pharmaceutical producers in intelligent packaging platforms providing remote monitoring, batch validation, and compliance reporting has further boosted the segment’s share and will continue to influence growth through 2025 and beyond.

Packaging has been considered the essential part of the product give rise to innovative and new packaging solutions. The packaging machinery plays a vital role to make the product attractive and providing it with a cover. The oral dosage powder packaging machines are used to pack the pouches, bags, or other packaging formats used to pack the oral dosage powder.

The oral dosage powder packaging machines are been used by various end-use industries such as food, beverages, pharmaceuticals, and others. The end-use industries desire to offer their oral dosage powder products to the consumer in a short period which requires the machinery to pack the product. This fuels the demand for oral dosage powder packaging machines.

The oral dosage powder packaging machines makes it easy to pack the oral dosage powder in any packaging format along with specific production speed which increases the attractiveness of machines among the end-use industries. Overall, along with the various benefit offered by the machines, the increasing usage of powder by end-user is anticipated to propel the demand for oral dosage powder packaging machines during the forecast period.

The food & beverage and pharmaceutical industries drive the demand for oral dosage powder packaging machines. The oral dosage powder packaging machines help the end-use industry manufacturer to customize their packaging solutions as per their requirement which increases the popularity of oral dosage powder packaging machines among the end-use industries.

Also, the increasing food items which are made available in powder format boost the demand for oral dosage powder packaging machines.

The rising need for technological advancement to stay ahead of the competitor propel the demand for oral dosage powder packaging machines among the end-use industries. Overall, the future outlook for oral dosage powder packaging machines is anticipated to rise on the back of various benefits offered by the machine such as customizable, production speed, aesthetic packaging look, and others.

The introduction of new variants in food items gives rise to the need for proper packaging solutions. This need for packaging solutions creates growth opportunities for the packaging machinery market. The addition in the product portfolio propels the demand for oral dosage powder packaging machines in order to increase and expand the production capacity.

Overall, the launch of a new variant in powder food items creates growth opportunities for the oral dosage powder packaging machines.

The instalment cost and maintenance cost for the oral dosage powder packaging machines may hinder the market growth. The cost factor may be the obstacle for the small or medium scale industries which may affect the oral dosage powder packaging machines market.

The technical failure can hamper the productivity of the end-use industries which limits the market growth for oral dosage powder packaging machines market share.

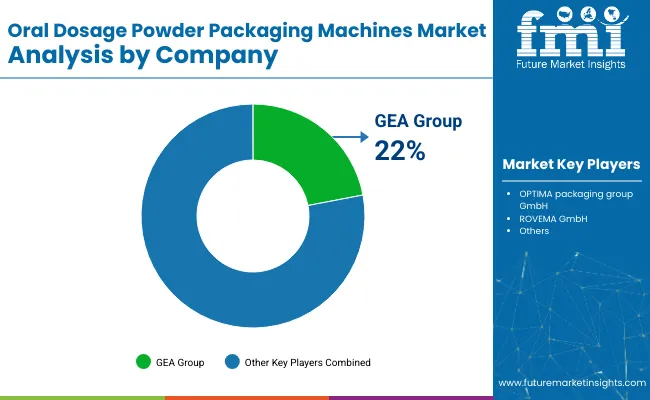

The global key players for oral dosage powder packaging machines are

The manufacturers of oral dosage powder packaging machines are trying to expand their production capacity in order to cater for the demand. Also, the key players are focusing on strengthening their capacity through acquisition.

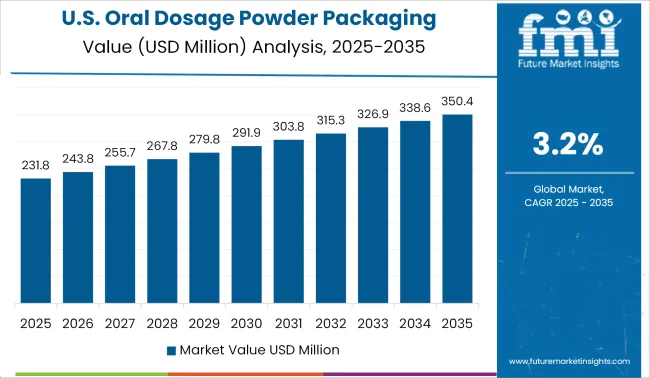

The expanding food & beverage industry in the United States will create growth opportunities for the oral dosage powder packaging machines market. Also, the adoption of advanced technology by the end-use industries in the United States propel the demand for advanced machinery which pushes the sales of oral dosage powder packaging machines in the United States.

The rising trade activities in India and China especially in the pharmaceutical and food & beverage industry generate the demand for proper packaging solutions.

This gives rise to the demand for oral dosage powder packaging machines in India and China. Also, the low labour and production cost in China attracts the major manufacturers to expand their facilities which fuel the demand for oral dosage powder packaging machines to set up the new facility in China.

The global oral dosage powder packaging machines market is estimated to be valued at USD 565.7 million in 2025.

The market size for the oral dosage powder packaging machines market is projected to reach USD 775.2 million by 2035.

The oral dosage powder packaging machines market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in oral dosage powder packaging machines market are automatic, semi-automatic and manual.

In terms of capacity, 100-200 packs/min segment to command 35.0% share in the oral dosage powder packaging machines market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.