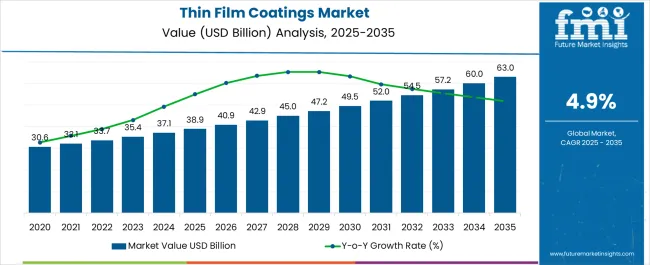

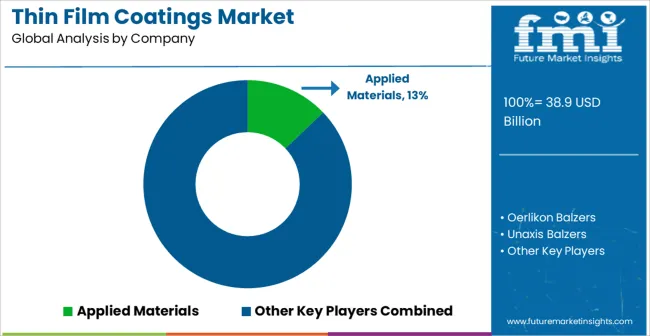

The Thin Film Coatings Market is estimated to be valued at USD 38.9 billion in 2025 and is projected to reach USD 63.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

| Metric | Value |

|---|---|

| Thin Film Coatings Market Estimated Value in (2025 E) | USD 38.9 billion |

| Thin Film Coatings Market Forecast Value in (2035 F) | USD 63.0 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The Thin Film Coatings market is witnessing robust growth, driven by the increasing demand for high-performance coatings across electronics, optical devices, and industrial applications. Advances in deposition technologies and material engineering have enabled the production of coatings with superior durability, thermal stability, and optical properties. The adoption of thin film coatings is being accelerated by their ability to enhance product performance, reduce energy loss, and improve resistance to wear, corrosion, and environmental stress.

Growing investments in consumer electronics, renewable energy systems, and precision optical instruments are creating additional demand. Furthermore, the rising focus on miniaturization, high-efficiency components, and improved energy efficiency is shaping market dynamics.

The market is also benefiting from technological innovations such as chemical vapor deposition, physical vapor deposition, and atomic layer deposition, which improve coating uniformity and functionality As industries continue to prioritize product quality, sustainability, and long-term reliability, the Thin Film Coatings market is expected to maintain steady growth, with materials and coating solutions that offer multi-functional performance continuing to lead adoption globally.

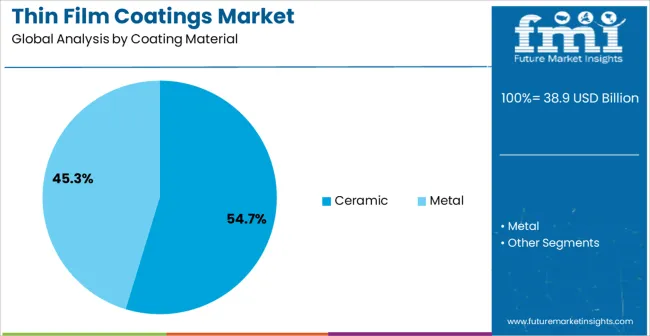

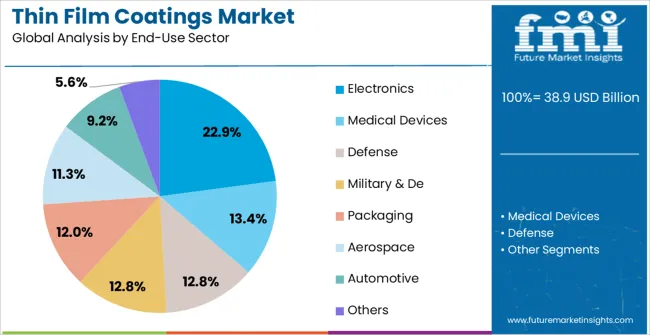

The thin film coatings market is segmented by coating material, end-use sector, type of coatings, and geographic regions. By coating material, thin film coatings market is divided into Ceramic and Metal. In terms of end-use sector, thin film coatings market is classified into Electronics, Medical Devices, Defense, Military & De, Packaging, Aerospace, Automotive, and Others.

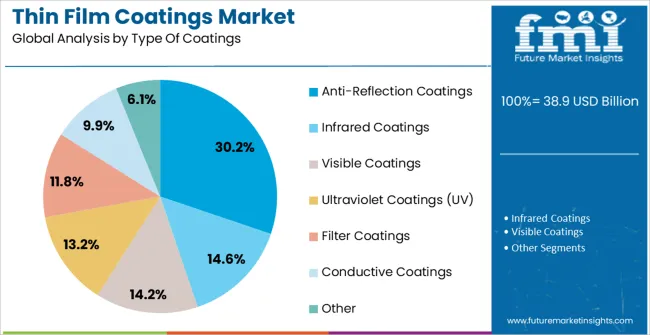

Based on type of coatings, thin film coatings market is segmented into Anti-Reflection Coatings, Infrared Coatings, Visible Coatings, Ultraviolet Coatings (UV), Filter Coatings, Conductive Coatings, and Other. Regionally, the thin film coatings industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ceramic coating material segment is projected to hold 54.7% of the market revenue in 2025, making it the leading material type. Growth in this segment is being driven by the superior mechanical strength, chemical stability, and thermal resistance of ceramic coatings, which enable their use in demanding environments. Ceramic coatings are widely utilized to enhance the durability and longevity of components in electronics, aerospace, automotive, and industrial machinery.

These coatings provide protection against wear, corrosion, and extreme temperatures while maintaining optical clarity in certain applications. Their adaptability for high-precision deposition techniques, such as sputtering and chemical vapor deposition, further supports widespread adoption.

The ability to improve energy efficiency and reduce maintenance costs has strengthened the preference for ceramic materials As industries increasingly seek coatings that combine durability, reliability, and multi-functional performance, the ceramic segment is expected to sustain its leading market position, supported by ongoing innovations in material composition and deposition technology.

The electronics end-use sector segment is expected to account for 22.9% of the market revenue in 2025, positioning it as the leading application sector. Growth is being driven by the rising demand for high-performance electronic components, semiconductors, displays, and sensors that require thin film coatings to enhance conductivity, insulation, and durability. Thin film coatings provide essential functionalities such as improved optical clarity, anti-corrosion protection, thermal stability, and wear resistance, enabling reliable and long-lasting electronic devices.

The proliferation of smart devices, IoT components, and renewable energy electronics has further accelerated adoption. Manufacturers are increasingly leveraging advanced coating technologies to achieve precision, uniformity, and multi-layer functionality.

Regulatory standards and quality benchmarks in electronics production are reinforcing the adoption of coatings that ensure consistent performance As the global electronics industry continues to grow, driven by increasing consumer demand and technological innovation, thin film coatings are expected to remain a critical enabling technology, maintaining the electronics sector as the leading end-use market.

The anti-reflection coatings segment is projected to hold 30.2% of the market revenue in 2025, making it the leading coating type. Growth in this segment is being driven by the increasing requirement for enhanced optical performance in applications such as displays, lenses, photovoltaic cells, and precision instruments. Anti-reflection coatings reduce surface reflection, improve light transmission, and enhance visual clarity and efficiency, which is critical for high-performance optical systems.

The ability to apply these coatings using advanced deposition techniques ensures uniformity and long-term durability. Rising adoption of consumer electronics, optical devices, and solar energy solutions is further supporting market growth.

Manufacturers are leveraging these coatings to improve product efficiency, minimize energy losses, and enhance user experience As the demand for high-quality imaging, display, and energy-efficient devices continues to grow, anti-reflection coatings are expected to maintain their leadership, driven by technological innovation, precision deposition methods, and multi-functional performance requirements across industries.

Thin film coatings are applied on the optical surface to modify the reflectance and transmittance properties of the substrate on which these thin film coatings are applied. Thin film coatings are deposited by various depositing techniques, such as CVD (Chemical Vapor Deposition), PVD (Physical Vapor Deposition), and Sputtering, among other techniques. Thin films coatings are coated on the substrate to increase the conduction or insulation, and provide protection from light by creating a reflective surface.

Most of the companies are manufacturing anti-reflective coatings that are mechanically & chemically durable, meet the international optics specifications, and available in standard and large dimensions. For instance, MATERION is a company that manufactures anti-reflective optical coatings with the above-said properties.

Photovoltaic cells need a protective layer of glass in order to increase the efficiency by minimizing the light being reflected form the substrate surface, to do this anti-reflective thin film coatings are applied. Thin film coatings are also used in reflectors and dichroic filters that allow the light of specific wavelength to pass as well as they find application in fluorescence and lighting microscopy.

Thus, with a wide range of applications of thin film coatings, it is expected that thin film coatings market will rise during the forecast period.

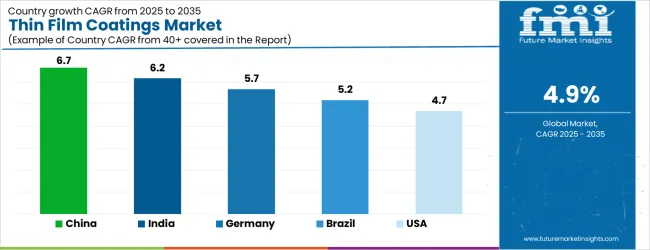

| Country | CAGR |

|---|---|

| China | 6.7% |

| India | 6.2% |

| Germany | 5.7% |

| Brazil | 5.2% |

| USA | 4.7% |

| UK | 4.2% |

| Japan | 3.7% |

The Thin Film Coatings Market is expected to register a CAGR of 4.9% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.7%, followed by India at 6.2%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates.

Japan posts the lowest CAGR at 3.7%, yet still underscores a broadly positive trajectory for the global Thin Film Coatings Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.7%.

The USA Thin Film Coatings Market is estimated to be valued at USD 13.4 billion in 2025 and is anticipated to reach a valuation of USD 13.4 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 1.9 billion and USD 1.0 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 38.9 Billion |

| Coating Material | Ceramic and Metal |

| End-Use Sector | Electronics, Medical Devices, Defense, Military & De, Packaging, Aerospace, Automotive, and Others |

| Type Of Coatings | Anti-Reflection Coatings, Infrared Coatings, Visible Coatings, Ultraviolet Coatings (UV), Filter Coatings, Conductive Coatings, and Other |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Applied Materials, Oerlikon Balzers, Unaxis Balzers, Veeco Instruments, Canon Anelva Corporation, IHI Ionbond AG, CemeCon AG, Sulzer Metco, Leybold Optics, EV Group, Cambridge Vacuum Engineering, Platit AG, Denton Vacuum LLC, Ionbond, and AJA International |

The global thin film coatings market is estimated to be valued at USD 38.9 billion in 2025.

The market size for the thin film coatings market is projected to reach USD 63.0 billion by 2035.

The thin film coatings market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in thin film coatings market are ceramic and metal.

In terms of end-use sector, electronics segment to command 22.9% share in the thin film coatings market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thin Insulation Market Size and Share Forecast Outlook 2025 to 2035

Thin Wall Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thin Wafer Processing and Dicing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thin Wall Plastic Container Market Analysis - Size, Share, and Forecast 2025 to 2035

Thinned Starch Market Size, Growth, and Forecast for 2025 to 2035

Thin Wafers Market Analysis - Size, Demand & Growth 2025 to 2035

Market Share Breakdown of Thin Wall Plastic Container Providers

Thin Client Market

Thin Paper Market

Thin Wall Mould Market

Thin Wall Glass Container Market

Thin-film Platinum Resistance Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Platinum Resistance Temperature Sensor Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Solar Cells Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Photovoltaics Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Solar PV Backsheet Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Encapsulation TFE Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Battery Market Size and Share Forecast Outlook 2025 to 2035

Thin Film and Printed Batteries Market Trends - Growth & Forecast 2025 to 2035

Thin Film Photovoltaic Modules Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA