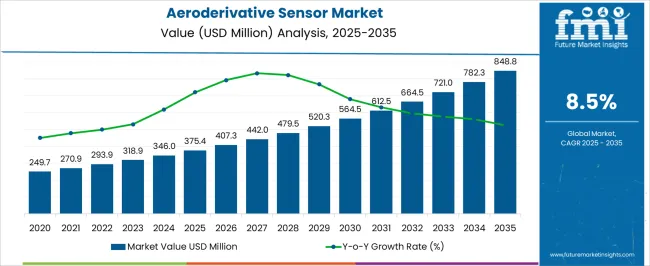

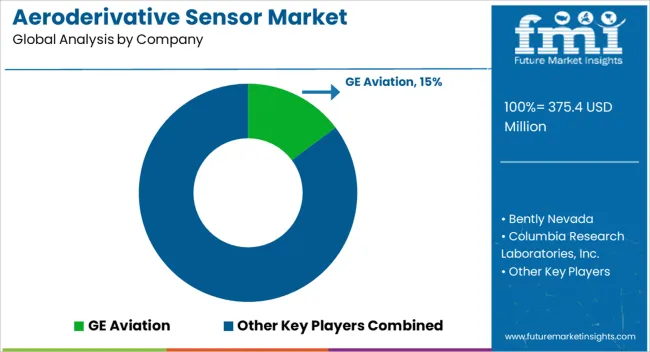

The aeroderivative sensor market is estimated to be valued at USD 375.4 million in 2025 and is projected to reach USD 848.8 million by 2035, registering a compound annual growth rate (CAGR) of 8.5% over the forecast period. A compound absolute growth analysis reveals substantial growth, driven by increasing demand for advanced sensors in various industries, particularly in aerospace, automotive, and industrial applications.

Between 2025 and 2030, the market grows from USD 375.4 million to USD 564.5 million, contributing USD 189.1 million in growth, with a CAGR of 9.0%. This phase reflects a strong acceleration as industries increasingly rely on high-performance sensors for improved operational efficiency, reliability, and precision in mission-critical applications. Innovations in aeroderivative sensor technologies, such as enhanced sensitivity, miniaturization, and connectivity, contribute to this early-phase growth. From 2030 to 2035, the market continues to expand from USD 564.5 million to USD 848.8 million, adding USD 284.3 million in growth, with a slightly lower CAGR of 8.0%. This deceleration is indicative of the market maturing, where the demand stabilizes as key industries have already adopted aeroderivative sensors. Despite this, continued technological advancements, integration with IoT and smart systems, and increasing adoption in emerging sectors maintain steady growth. The compound absolute growth analysis highlights robust early-phase acceleration followed by steady expansion, driven by ongoing innovations and the increasing reliance on sensors across diverse applications.

| Metric | Value |

|---|---|

| Aeroderivative Sensor Market Estimated Value in (2025 E) | USD 375.4 million |

| Aeroderivative Sensor Market Forecast Value in (2035 F) | USD 848.8 million |

| Forecast CAGR (2025 to 2035) | 8.5% |

Current market momentum is being influenced by the increasing deployment of aeroderivative gas turbines in decentralized energy systems and mobile power units, as highlighted in corporate press releases and investor briefings. The need for real-time monitoring, enhanced reliability, and predictive maintenance has led to broader adoption of advanced sensor technologies.

Regulatory standards related to emissions, energy efficiency, and safety are also accelerating sensor integration within turbine assemblies. Industry publications indicate that OEMs are focusing on modular sensor platforms capable of remote diagnostics and software-defined functionality, supporting scalable and cost-effective upgrades.

Technological advancements in sensor miniaturization, materials, and data analytics capabilities strengthen the future outlook. These drivers are positioning the market for continued growth, especially as industrial operators and utility providers invest in digitized and resilient infrastructure.

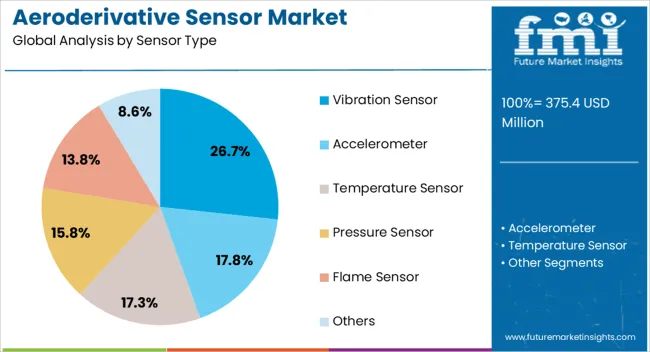

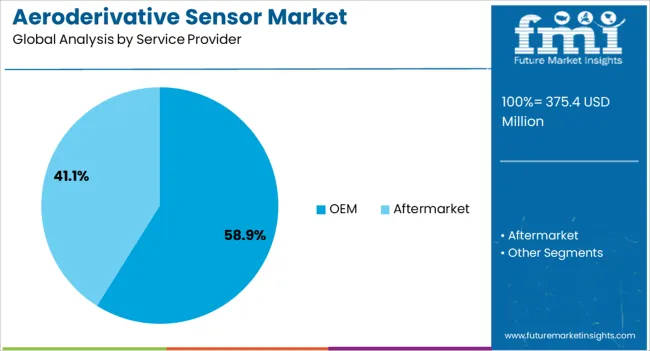

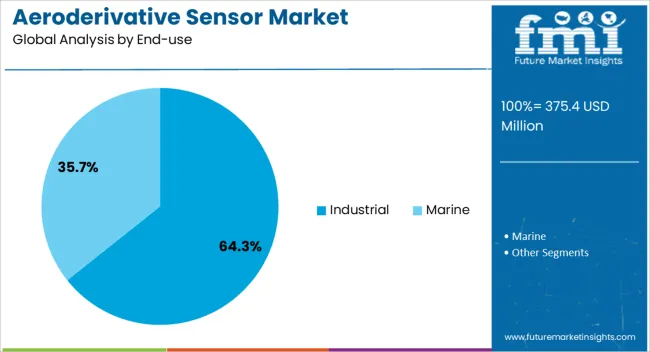

The aeroderivative sensor market is segmented by sensor type, service provider, end-use, and geographic regions. By sensor type, the aeroderivative sensor market is divided into Vibration Sensor, Accelerometer, Temperature Sensor, Pressure Sensor, Flame Sensor, and Others. In terms of service provider, the aeroderivative sensor market is classified into OEM and Aftermarket. Based on end-use, the aeroderivative sensor market is segmented into Industrial and Marine. Regionally, the aeroderivative sensor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The vibration sensor segment is projected to account for 26.7% of the Aeroderivative Sensor Market revenue share in 2025, making it a key subsegment under sensor type. This leading position is being attributed to the critical role vibration monitoring plays in maintaining turbine performance and preventing mechanical failures. Vibration sensors are being widely used for continuous condition monitoring and early fault detection in rotating machinery.

Their application has gained importance due to increasing emphasis on predictive maintenance strategies that minimize unplanned downtime and extend equipment life cycles. Investor presentations from industrial equipment manufacturers have outlined that demand is being supported by the integration of AI and edge computing in sensor systems, enabling real-time diagnostics.

Compliance requirements for operational safety and performance optimization in high-speed turbines further drive the segment’s growth. These factors have contributed to the segment’s prominence within the overall sensor landscape.

The OEM segment is anticipated to hold 58.9% of the Aeroderivative Sensor Market revenue share in 2025, establishing it as the dominant service provider category. This dominance is being supported by the increasing trend of direct sensor integration during the manufacturing and assembly phases of aeroderivative turbines.

OEMs are focusing on embedding high-precision sensors to offer turnkey solutions that comply with performance and regulatory standards, as observed in engineering bulletins and product development announcements. Partnerships between OEMs and technology providers are enabling the deployment of proprietary sensor systems optimized for specific turbine models, enhancing system compatibility and reducing post-installation calibration needs.

OEM service offerings also typically include data analytics platforms, remote monitoring, and predictive maintenance tools that provide end-users with a complete lifecycle management solution. This end-to-end approach has positioned OEMs as the preferred service provider for customers seeking integrated and reliable sensor solutions.

The industrial segment is projected to contribute 64.3% of the Aeroderivative Sensor Market revenue share in 2025, making it the leading end-use category. This leadership is being driven by the widespread use of aeroderivative turbines in industries such as oil and gas, manufacturing, and energy utilities. Industrial users are adopting advanced sensor systems to monitor turbine health, reduce energy consumption, and ensure uninterrupted operations in demanding environments.

Company announcements and technology news sources indicate that rising investments in digital transformation and smart manufacturing are reinforcing sensor adoption at scale. The need for high system availability, compliance with environmental standards, and data-driven maintenance planning has encouraged industrial operators to prioritize sensor-enabled solutions.

Furthermore, the compatibility of sensors with remote diagnostics and analytics platforms supports real-time performance tracking, which aligns with the operational efficiency goals of industrial enterprises. These factors have reinforced the segment’s strong market position in 2025.

The aeroderivative sensor market is expanding as industries such as aerospace, automotive, and industrial manufacturing increasingly rely on advanced sensor technologies for improved performance and safety. These sensors, derived from gas turbines, offer high efficiency and compact designs, making them ideal for demanding applications that require precise monitoring and real-time data collection. The growing need for better fuel efficiency, safety standards, and operational optimization is driving the demand for aeroderivative sensors. As sensor technologies continue to evolve, the market is expected to experience sustained growth, offering solutions to enhance system performance across various industries.

The aeroderivative sensor market is driven by the growing demand for increased efficiency and safety in industries like aerospace and power generation. These sensors play a crucial role in enhancing the performance of gas turbines, providing real-time monitoring of critical parameters such as temperature, pressure, and vibration. In the aerospace industry, aeroderivative sensors are essential for optimizing fuel consumption and ensuring the safe operation of engines under extreme conditions. Additionally, as industries focus on improving their operational efficiency, the need for advanced sensor technologies that provide accurate, real-time data is rising. These factors are propelling market growth, as companies increasingly adopt aeroderivative sensors to meet regulatory standards and enhance overall system performance.

Despite their advantages, aeroderivative sensors face several challenges that hinder widespread adoption. One of the primary challenges is the high cost of these sensors, which can be prohibitive for small and medium-sized enterprises (SMEs) or companies with limited budgets. Additionally, the technical complexity involved in integrating aeroderivative sensors into existing systems can be a barrier. These sensors often require specialized knowledge for installation, calibration, and maintenance, making it difficult for companies to fully utilize their potential. Furthermore, while aeroderivative sensors are highly effective, their performance can be influenced by extreme environmental conditions, such as temperature fluctuations and high vibrations, which may reduce their accuracy and reliability. Addressing these issues is key to unlocking the full potential of aeroderivative sensors.

The aeroderivative sensor market presents significant opportunities for growth, particularly with advancements in sensor technology and their integration into new industries. One of the key opportunities lies in the development of more affordable, high-performance sensors that offer better accuracy and reliability. The continuous improvement of materials, such as advanced ceramics and composites, is enhancing the durability and performance of aeroderivative sensors. Additionally, the growing trend toward automation and digitalization across industries presents an opportunity for integrating these sensors into IoT (Internet of Things) and Industry 4.0 environments, enabling real-time data collection and predictive maintenance. The increasing adoption of aeroderivative sensors in applications such as electric vehicles, renewable energy, and advanced manufacturing processes offers new avenues for growth, with the potential to revolutionize operational efficiency and system optimization across various sectors.

A key trend shaping the aeroderivative sensor market is the increasing integration of sensors with IoT (Internet of Things) and AI (Artificial Intelligence) technologies. This integration enables more advanced data analysis, real-time monitoring, and predictive maintenance capabilities, allowing businesses to optimize operations and reduce downtime. Sensors embedded in turbine engines or other critical systems can now provide continuous data streams, which are analyzed by AI algorithms to detect potential issues before they cause system failures. The trend toward automation and smart systems is also driving the demand for sensors that can work seamlessly with digital platforms. As these technologies continue to advance, aeroderivative sensors will become more integral to a wide range of industries, driving the need for more precise, cost-effective, and intelligent sensor solutions.

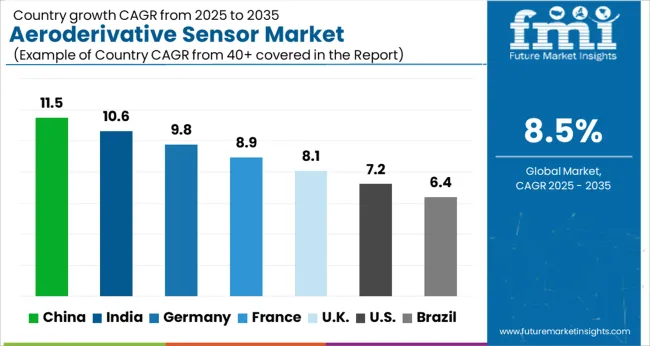

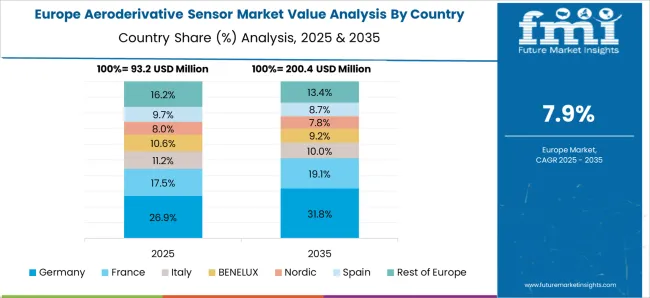

The global aeroderivative sensor market is projected to grow at a CAGR of 8.5% from 2025 to 2035. China leads at 11.5%, followed by India at 10.6%, and France at 8.9%, while the United Kingdom records 8.1% and the United States posts 7.2%. These rates translate to a growth premium of +35% for China, +25% for India, and +5% for France versus the baseline, while the United States and the United Kingdom show slower growth. Divergence reflects local catalysts: rapid adoption of aeroderivative sensors in industries such as aerospace, automotive, and energy in China and India, while more mature markets like the United States and the United Kingdom experience more moderate growth due to established infrastructure. The analysis includes over 40+ countries, with the leading markets detailed below.

China is experiencing significant growth in the aeroderivative sensor market, projected at a 11.5% CAGR through 2035. As a global manufacturing hub and leader in the automotive and aerospace sectors, China is increasingly adopting advanced sensor technologies to improve performance, precision, and reliability in critical systems. The country’s growing demand for high-performance sensors, driven by technological advancements in electric vehicles (EVs) and aerospace engineering, is contributing to the rapid growth of the aeroderivative sensor market. The government’s investments in the development of smart manufacturing and industrial automation further accelerate this market’s expansion.

The aeroderivative sensor market in China is projected to grow at a 10.6% CAGR through 2035. The market is driven by India’s rapidly expanding aerospace, automotive, and manufacturing sectors, all of which increasingly rely on high-quality sensors for enhanced system performance. India’s growing focus on industrial automation, smart manufacturing, and electric vehicles is pushing the adoption of aeroderivative sensors. Additionally, government initiatives to improve infrastructure and boost the manufacturing sector further promote the market for high-performance sensor technologies. India’s growing consumer electronics sector, particularly in wearables, is also contributing to market expansion.

Demand for aeroderivative sensors in France is growing at an 8.9% CAGR through 2035. France’s strong aerospace and automotive sectors, coupled with an emphasis on automation and energy efficiency, are contributing to the increasing demand for high-performance aeroderivative sensors. The country’s focus on precision engineering, particularly in aerospace and military applications, is driving the growth of advanced sensor technologies. Additionally, France’s growing electric vehicle market and the need for efficient, reliable sensor systems in automotive manufacturing are further accelerating the market for aeroderivative sensors.

The UK market for aeroderivative sensors is expected to grow at a 8.1% CAGR through 2035. The UK’s strong automotive and aerospace industries are major drivers of market growth, with an increasing demand for sensors that enhance system performance and efficiency. The country’s ongoing investments in smart manufacturing, automation, and renewable energy technologies are further supporting the adoption of high-quality sensor systems. The UK’s growing emphasis on improving transportation efficiency and sustainability in both the automotive and aerospace sectors drives the need for advanced aeroderivative sensors.

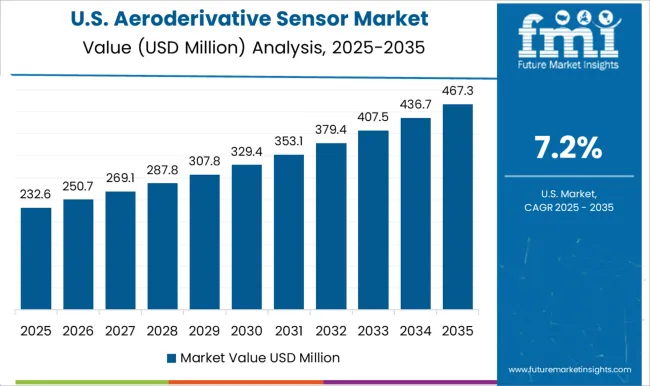

Demand for aeroderivative sensors in the USA is projected to grow at a 7.2% CAGR through 2035. The USA market is driven by the increasing demand for precision sensors in industries such as aerospace, automotive, and industrial manufacturing. The growing adoption of electric vehicles, automation, and smart manufacturing technologies is accelerating the use of advanced sensor solutions. The USA government’s push for cleaner and more efficient transportation systems, along with advancements in defense and aerospace technologies, further supports the demand for high-performance aeroderivative sensors.

The aeroderivative sensor market is driven by a range of key players providing high-performance sensors that enhance the efficiency, safety, and monitoring of gas turbines, primarily in the aerospace and industrial sectors. Leading companies focus on developing advanced sensor technologies to improve system performance and reduce maintenance costs. GE Aviation is a significant player, providing advanced sensor solutions designed for optimal performance in aerospace and energy applications. Bently Nevada, a part of Baker Hughes, delivers high-quality vibration monitoring sensors used in the aerospace and industrial sectors for monitoring turbine health. Columbia Research Laboratories, Inc. specializes in precision sensors and instrumentation for gas turbine performance optimization, catering to both aviation and industrial gas turbine markets. Conax Technologies offers specialized temperature and pressure sensors that play a critical role in aeroderivative turbine applications.

EthosEnergy provides robust sensor solutions focused on turbine diagnostics and performance optimization. KISTLER INSTRUMENT CORP. delivers high-precision sensors and measurement systems that improve turbine performance, particularly in aerospace applications. Kulite is known for its high-performance pressure sensors, which are widely used in aerospace and gas turbine industries. Meggitt PLC provides specialized sensors that monitor pressure, temperature, and vibration in turbine systems, helping to enhance turbine performance and safety. PCB Piezotronics, Inc. manufactures accelerometers, pressure, and vibration sensors widely used in turbine monitoring. RWG offers sensors designed for turbine monitoring and optimization, providing precision measurements to improve operational efficiency. Scanivalve Corporation develops high-accuracy pressure sensors and systems, which are crucial for turbine diagnostics. Sensonics Ltd. specializes in turbine health monitoring sensors used in the aerospace and industrial sectors. Smith Systems, Inc. offers advanced instrumentation for gas turbine performance monitoring, focusing on data collection and system optimization. Thermocoax, Inc. provides temperature sensors used for gas turbine applications, ensuring efficient and accurate temperature measurement. TurbineAero, Inc. designs specialized sensors for turbine systems, focusing on operational safety and performance. Unison, LLC is known for providing turbine sensor solutions that enhance operational efficiency and safety. Honeywell International Inc. provides advanced sensor technologies that improve system monitoring and operational efficiency in aerospace applications.

Eaton Corporation offers a variety of sensors used in turbine systems, with a focus on pressure and temperature measurement. Parker Hannifin Corporation delivers sensor solutions for turbine applications that optimize performance and extend system life. TE Connectivity offers a range of sensors for turbine systems, emphasizing precision and reliability. Woodward, Inc. provides sensor systems that enhance turbine performance, offering products focused on vibration, pressure, and temperature measurement. Rockwell Collins, Safran, and Thales Group offer sensor technologies focused on improving system monitoring, while Moog Inc. provides specialized sensors for turbine performance and diagnostics.

| Item | Value |

|---|---|

| Quantitative Units | USD 375.4 Million |

| Sensor Type | Vibration Sensor, Accelerometer, Temperature Sensor, Pressure Sensor, Flame Sensor, and Others |

| Service Provider | OEM and Aftermarket |

| End-use | Industrial and Marine |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | GE Aviation, Bently Nevada, Columbia Research Laboratories, Inc., Conax Technologies, EthosEnergy, KISTLER INSTRUMENT CORP., Kulite, Meggitt PLC, PCB Piezotronics, Inc., RWG, Scanivalve Corporation, Sensonics Ltd., Smith Systems, Inc., Thermocoax, Inc., TurbineAero, Inc., Unison, LLC, Honeywell International Inc., Eaton Corporation, Parker Hannifin Corporation, TE Connectivity, Woodward, Inc., Rockwell Collins, Safran, Thales Group, and Moog Inc. |

| Additional Attributes | Dollar sales by product type (pressure sensors, temperature sensors, vibration sensors, accelerometers) and end-use segments (aerospace, industrial gas turbines, power generation). Demand dynamics are influenced by the increasing need for advanced turbine monitoring solutions, the rise in predictive maintenance, and the growing adoption of aeroderivative turbines in energy and aerospace applications. Regional trends show significant growth in North America and Europe, driven by high demand in aerospace and energy sectors, while Asia-Pacific expands due to rising industrial applications and infrastructure development. Innovation trends focus on improving sensor accuracy, reliability, and high-temperature efficiency, while predictive maintenance continues to drive market growth. |

The global aeroderivative sensor market is estimated to be valued at USD 375.4 million in 2025.

The market size for the aeroderivative sensor market is projected to reach USD 848.8 million by 2035.

The aeroderivative sensor market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in aeroderivative sensor market are vibration sensor, accelerometer, temperature sensor, pressure sensor, flame sensor and others.

In terms of service provider, oem segment to command 58.9% share in the aeroderivative sensor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aeroderivative Gas Turbine Service Market Size and Share Forecast Outlook 2025 to 2035

Open Cycle Aeroderivative Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Sensor Testing Market Forecast Outlook 2025 to 2035

Sensor Fusion Market Size and Share Forecast Outlook 2025 to 2035

Sensor Based Glucose Measuring Systems Market Size and Share Forecast Outlook 2025 to 2035

Sensor Development Kit Market Size and Share Forecast Outlook 2025 to 2035

Sensory Modifier Market Size and Share Forecast Outlook 2025 to 2035

Sensor Bearings Market Insights - Growth & Forecast 2025 to 2035

Sensor Hub Market Analysis - Growth, Demand & Forecast 2025 to 2035

Sensor Patches Market Analysis - Growth, Applications & Outlook 2025 to 2035

Sensors Market Analysis by Type, Technology, End User & Region - Forecast from 2025 to 2035

Sensor Data Analytics Market Growth - Trends & Forecast through 2034

Sensor Cable Market

Sensormatic Labels Market

3D Sensor Market Size and Share Forecast Outlook 2025 to 2035

Biosensors Market Trends – Growth & Future Outlook 2025 to 2035

UV Sensors Market Analysis by Type, End User, and Region from 2025 to 2035

CP Sensor for Consumer Applications Market – Growth & Forecast 2025 to 2035

Nanosensors Market Size and Share Forecast Outlook 2025 to 2035

NOx Sensor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA