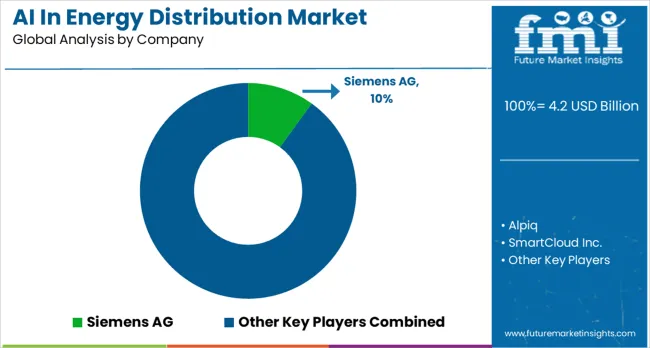

The global AI in energy distribution market is expected to expand from USD 4.2 billion in 2025 to USD 32.2 billion by 2035, reflecting a 23% CAGR and generating an absolute dollar opportunity of USD 28.0 billion. Growth is driven by increasing adoption of smart grid technologies, demand for energy efficiency, and the integration of renewable energy sources. AI technologies enable predictive maintenance, real-time load balancing, fault detection, and energy optimization, improving operational efficiency and reducing costs for utilities and industrial energy consumers. Advancements in machine learning, IoT integration, and grid automation further support global market expansion.

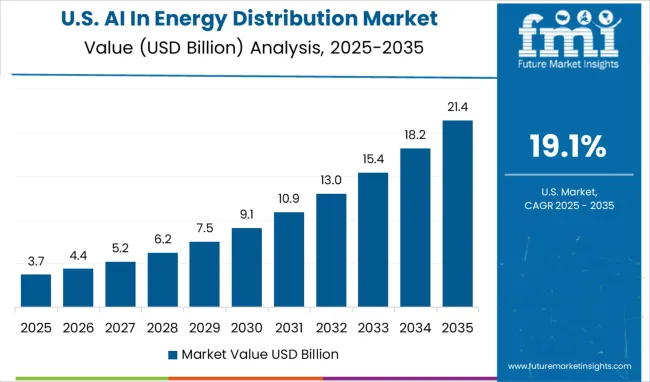

Year-on-year (YoY) growth analysis illustrates the market’s progression across the forecast period. From 2025 to 2027, YoY growth is exceptionally high as utilities in North America and Europe implement AI-based grid management solutions and modernize aging infrastructure. Between 2028 and 2031, YoY growth moderates slightly while adoption spreads to Asia Pacific and Latin America, driven by large-scale renewable integration, urbanization, and smart city initiatives.

From 2032 to 2035, YoY growth stabilizes at a robust level, supported by continuous technological upgrades, predictive analytics adoption, and enhanced grid resilience projects. The YoY analysis confirms a strong, high-velocity growth trajectory, highlighting the transformative impact of AI in energy distribution and its contribution to an absolute market expansion of USD 28.0 billion over the decade.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 4.23 billion |

| Forecast Value in (2035F) | USD 32.2 billion |

| Forecast CAGR (2025 to 2035) | 23% |

The AI in energy distribution market is driven by five primary parent markets with specific shares. Power utilities lead with 42%, using AI to optimize grid operations, forecast demand, and enhance outage management. Renewable energy integration contributes 23%, where AI balances variable generation from solar, wind, and hydro sources. Industrial energy consumers account for 16%, leveraging AI for predictive maintenance, efficiency, and operational optimization. Smart grids and microgrid projects represent 11%, employing AI for real-time monitoring, fault detection, and load management. Residential and commercial buildings hold 8%, integrating AI-based energy management systems for cost reduction and efficiency. These sectors collectively shape global demand.

Recent developments in AI in the energy distribution market focus on predictive analytics, automation, and grid resilience. Companies are deploying machine learning algorithms to forecast consumption, optimize energy dispatch, and prevent outages. Advanced sensors, IoT platforms, and digital twins are enabling real-time monitoring and enhanced decision-making. Utilities and industrial sectors are increasingly adopting AI-driven fault detection, predictive maintenance, and dynamic load balancing. Rising renewable energy penetration, smart grid projects, and the demand for energy efficiency are accelerating adoption.

Market expansion is being supported by the increasing need for intelligent grid management systems that can handle the complexity of modern energy distribution networks and the corresponding demand for real-time monitoring and optimization solutions. Modern energy companies are increasingly focused on predictive maintenance measures that can prevent equipment failures, reduce downtime, and optimize energy flow across distribution networks. AI's proven efficacy in pattern recognition and predictive analytics makes it a preferred technology in advanced energy management systems.

The growing focus on renewable energy integration and smart grid technologies is driving demand for AI solutions that can manage variable energy sources and optimize distribution efficiency. Energy companies' preference for multifunctional AI platforms that combine predictive maintenance, demand forecasting, and grid optimization benefits is creating opportunities for innovative technology solutions. The rising influence of government policies supporting smart infrastructure and the increasing focus on carbon reduction goals is also contributing to increased AI adoption across different energy sectors and applications.

The market is segmented by component, application, deployment, end use, and region. By component, the market is divided into solutions and services. Based on application, the market is categorized into smart grid management, predictive maintenance & equipment monitoring, energy demand forecasting, renewable energy integration, and others. In terms of deployment, the market is segmented into cloud and on-premises. By end use, the market is classified into industrial, commercial, residential, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

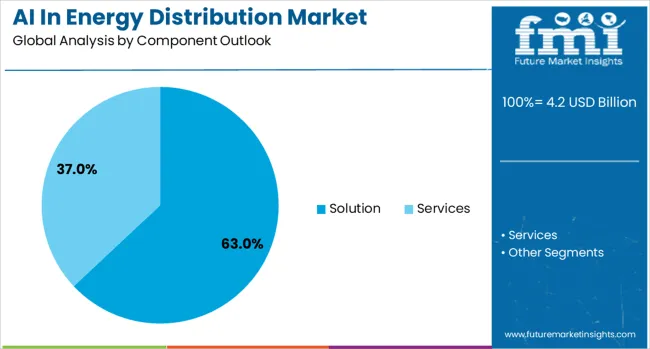

The solutions component is projected to account for 63% of the AI in energy distribution market in 2025, reaffirming its position as the category's primary offering. Energy companies increasingly understand the need for comprehensive AI platforms that can integrate multiple functionalities including predictive analytics, real-time monitoring, and automated decision-making capabilities. AI solutions' well-documented ability to optimize energy distribution networks directly addresses operational efficiency concerns by reducing costs, preventing failures, and improving system reliability.

This segment forms the foundation of most technology deployments, as it represents the most comprehensive and scalable benefit of AI in energy distribution. Industry endorsements and ongoing case study validation continue to strengthen trust in AI solution platforms. With energy infrastructure becoming more complex and interconnected, AI solutions align with both operational optimization and strategic modernization goals. Their broad applicability across different energy sectors ensures steady dominance, making them the central growth driver of AI in energy distribution demand.

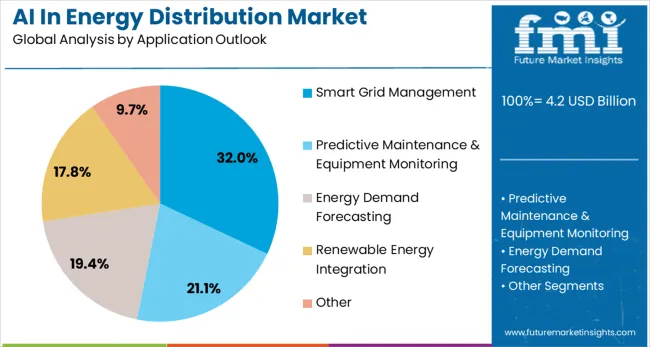

Smart grid management is projected to represent 32% of AI in energy distribution demand in 2025, underscoring its role as the primary application for intelligent energy infrastructure. Energy companies gravitate toward smart grid solutions for their ability to provide real-time monitoring, automated control, and predictive optimization capabilities that maximize distribution network efficiency. Positioned as essential infrastructure upgrades, smart grid systems offer both operational benefits, such as reducing energy losses and improving reliability, and strategic benefits, including enabling renewable energy integration and demand response programs.

The segment is supported by increasing government initiatives promoting smart infrastructure development, where AI-powered grid management plays a central role in modernization strategies. Additionally, utilities are increasingly combining smart grid technologies with complementary AI applications like predictive maintenance and demand forecasting, enhancing system performance and justifying infrastructure investment costs. As energy companies prioritize grid modernization and operational efficiency, AI-powered smart grid management will continue to dominate application demand, reinforcing its essential positioning within the energy distribution technology market.

The cloud deployment model is forecasted to contribute 84% of the AI in the energy distribution market in 2025, reflecting the growing preference for scalable and flexible technology infrastructure. Energy companies are increasingly adopting cloud-based AI solutions for their cost-effectiveness, scalability, and ability to provide real-time analytics without requiring significant on-premises hardware investments. This aligns with digital transformation initiatives that emphasize operational efficiency, reduced capital expenditure, and enhanced system flexibility.

Cloud deployment provides access to advanced AI capabilities, real-time data processing, and seamless integration with existing energy management systems. The segment also benefits from energy companies' willingness to embrace modern IT infrastructure that supports remote monitoring, predictive analytics, and automated decision-making capabilities. With growing focus on system interoperability and data-driven operations, cloud deployment serves as the preferred infrastructure choice, making it a critical driver of adoption and scalability in the AI in energy distribution category.

The industrial end-use segment is projected to account for 35% of the AI in energy distribution market in 2025, highlighting the significant demand from manufacturing and industrial facilities for intelligent energy management solutions. Industrial users require sophisticated AI systems to optimize energy consumption, reduce operational costs, and ensure reliable power distribution for critical manufacturing processes. These facilities benefit from AI's ability to predict energy demand patterns, optimize load distribution, and prevent costly power interruptions.

Industrial adoption is driven by the need for energy efficiency improvements, regulatory compliance with environmental standards, and competitive pressure to reduce operational costs. AI solutions enable industrial facilities to implement demand response programs, integrate renewable energy sources, and optimize energy usage during peak and off-peak periods. The segment's growth is supported by increasing awareness of AI's potential to deliver significant cost savings and operational improvements in energy-intensive industrial operations.

The AI in energy distribution market is advancing rapidly due to increasing demand for smart grid technologies and growing focus on energy efficiency optimization. The market faces challenges including high implementation costs, cybersecurity concerns, and integration complexity with legacy infrastructure systems. Innovation in machine learning algorithms and edge computing technologies continue to influence product development and market expansion patterns.

The growing adoption of cloud-based AI platforms is enabling energy companies to access advanced analytics capabilities without significant infrastructure investments. Cloud solutions offer scalability, real-time processing, and seamless integration with existing energy management systems. Edge computing technologies are enhancing local data processing capabilities, reducing latency, and improving real-time decision-making in distributed energy networks.

Modern AI energy distribution systems are incorporating Internet of Things (IoT) devices and advanced sensor technologies to enhance real-time monitoring and data collection capabilities. These technologies improve system visibility, enable predictive maintenance, and provide comprehensive insights into energy distribution network performance. Advanced sensor integration also enables automated response systems that can quickly address network anomalies and optimize energy flow patterns.

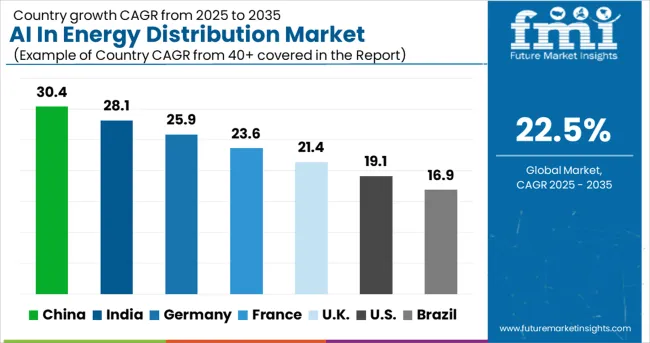

The AI in energy distribution market is projected to grow at a global CAGR of 23% between 2025 and 2035, driven by the integration of smart grids, predictive maintenance, and energy optimization solutions. China leads at 30.4%, a 1.32× multiple of the global rate, supported by BRICS-driven grid modernization, digital infrastructure expansion, and government-backed AI initiatives. India follows at 28.1%, 1.22× the global benchmark, reflecting rising investments in smart energy solutions, renewable integration, and industrial adoption. Germany records 25.9%, 1.13× the global rate, shaped by OECD-led innovation, advanced grid management, and regulatory compliance. France posts 23.6%, slightly above the global CAGR, supported by research and pilot projects in AI-driven distribution. The United Kingdom stands at 21.4%, slightly below the global rate, with selective adoption in commercial and industrial networks. The United States holds 19.1%, 0.83× the benchmark, with AI deployment concentrated in utility optimization and energy management sectors.

This report includes insights on 40+ countries; the top markets are shown here for reference.

China is growing at a CAGR of 30.4%, significantly above the global average, driven by government-backed smart grid initiatives and integration of AI for renewable energy management. Chinese utilities are deploying AI-enabled predictive analytics for load balancing, fault detection, and operational efficiency improvements. Companies such as State Grid Corporation and Huawei Digital Energy are expanding AI-powered control centers to manage increasingly complex distribution networks. AI algorithms are being integrated with IoT devices to optimize voltage regulation and minimize downtime. China’s large-scale renewable energy projects, including wind and solar farms, are boosting demand for AI-enabled energy distribution systems.

India is advancing at a CAGR of 28.1%, supported by government initiatives promoting smart grids and digital energy infrastructure. AI algorithms are deployed for demand response, real-time fault detection, and predictive maintenance across state and national grids. Delhi, Mumbai, and Bengaluru utilities are adopting AI-enabled energy distribution platforms to reduce energy losses and improve system efficiency. Indian technology providers are collaborating with global AI solution vendors to integrate machine learning models into renewable energy management. The market benefits from expanding renewable capacity and urban energy consumption patterns.

Germany is growing at a CAGR of 25.9%, driven by high integration of AI in smart grids and renewable energy management. German utilities are implementing predictive analytics for voltage optimization, anomaly detection, and fault prevention in distribution networks. Siemens and ABB are actively expanding AI-enabled energy management platforms to enhance grid stability and efficiency. Germany’s focus on wind and solar energy deployment increases the reliance on AI for real-time monitoring and predictive maintenance. The strategies focus on integration of AI with IoT sensors and digital twins to enable predictive energy management and reduce operational costs. Adoption is expected to be highly technology-driven, supporting Germany’s renewable energy targets and energy transition roadmap.

France is expected to expand at a CAGR of 23.6%, supported by AI integration in smart grid modernization and renewable energy management projects. French utilities are deploying AI for real-time load balancing, anomaly detection, and predictive maintenance in urban and regional distribution networks. Schneider Electric and Enedis are leading adoption of AI-driven grid optimization solutions, integrating machine learning with IoT sensors for improved operational efficiency. The growth is driven by enhanced predictive capabilities and automated decision-making to improve grid reliability. Focus is on renewable energy integration, reducing transmission losses, and providing intelligent energy solutions for industrial, commercial, and residential users.

The UK is growing at a CAGR of 21.4%, supported by adoption of AI for grid modernization and renewable energy management. Utilities are integrating AI for fault detection, predictive maintenance, and real-time monitoring of energy flow. London, Manchester, and Glasgow are key hubs for smart grid deployment. UK energy providers such as National Grid and SSE are implementing AI-based algorithms to reduce outages and improve efficiency. Adoption of AI is anticipated to improve resilience and energy security across urban and regional networks.

The US is expanding at a CAGR of 19.1%, driven by AI adoption for smart grid management and energy optimization. Utilities like Pacific Gas and Electric and Duke Energy are integrating AI algorithms for predictive maintenance, anomaly detection, and load balancing. Advanced metering infrastructure and IoT integration are enhancing grid visibility and operational efficiency. AI adoption supports renewable energy integration and provides actionable insights to utility operators, improving energy distribution efficiency.

Siemens AG, Germany-based, offers AI-driven energy distribution solutions, integrating machine learning and predictive analytics into smart grid systems to enhance efficiency, reliability, and real-time decision-making. Alpiq Holding AG, Switzerland, focuses on optimizing energy flow and load management using AI-enabled platforms that support renewable integration, demand forecasting, and operational intelligence. SmartCloud Inc., operating globally, delivers cloud-based AI solutions for energy utilities, enabling predictive maintenance, automated fault detection, and improved distribution network performance. ABB Ltd, Switzerland, integrates artificial intelligence into its grid automation and control systems, facilitating intelligent monitoring, adaptive load balancing, and energy optimization. General Electric Company (GE), USA, leverages AI-powered software and hardware platforms for grid modernization, predictive maintenance, and energy asset management, enabling utilities to maximize performance and minimize downtime.

Hazama Ando Corporation, Japan, provides AI-enabled energy distribution technologies that focus on operational efficiency, predictive diagnostics, and infrastructure resilience. Atos SE, France, delivers AI solutions for energy distribution, combining advanced analytics, cloud computing, and cybersecurity to support smart grid operations and industrial energy management. AppOrchid Inc., USA, specializes in AI-driven automation software for energy networks, enabling intelligent load forecasting, anomaly detection, and predictive control strategies. Zen Robotics Ltd., Finland, integrates AI with robotic systems for energy sector applications, optimizing waste-to-energy processes, system monitoring, and operational safety. Honeywell International Inc., USA, offers comprehensive AI solutions for energy distribution, combining advanced analytics, IoT integration, and real-time monitoring to enhance grid reliability, reduce energy losses, and support efficient operations.

| Items | Values |

| Quantitative Units (2025) | USD 4.2 billion |

| Component | Solutions, Services |

| Application | Smart grid management, Predictive maintenance & equipment monitoring, Energy demand forecasting, Renewable energy integration, Others |

| Deployment | Cloud, On-premises |

| End Use | Industrial, Commercial, Residential, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Siemens AG, Alpiq Holding AG, SmartCloud Inc, ABB Ltd, General Electric Company (GE), Hazama Ando Corporation, Atos SE, AppOrchid Inc, Zen Robotics Ltd, Honeywell International Inc |

| Additional Attributes | Dollar sales by AI technology type and implementation complexity, regional deployment trends, competitive landscape, buyer preferences for cloud versus on-premises solutions, integration with smart grid and IoT positioning, innovations in machine learning algorithms, edge computing, and scalable platform architectures |

Solutions

Services

Smart grid management

Predictive maintenance & equipment monitoring

Energy demand forecasting

Renewable energy integration

Others

Cloud

On-premises

Industrial

Commercial

Residential

Others

North America

United States

Canada

Mexico

Europe

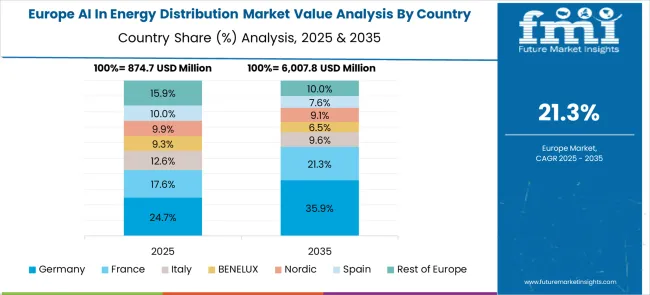

Germany

United Kingdom

France

Italy

Spain

Nordic

BENELUX

Rest of Europe

East Asia

China

Japan

South Korea

South Asia & Pacific

India

ASEAN

Australia & New Zealand

Rest of South Asia & Pacific

Latin America

Brazil

Chile

Rest of Latin America

Middle East & Africa

Kingdom of Saudi Arabia

Other GCC Countries

Turkiye

South Africa

Other African Union

Rest of Middle East & Africa

The global ai in energy distribution market is estimated to be valued at USD 4.2 billion in 2025.

The market size for the ai in energy distribution market is projected to reach USD 32.2 billion by 2035.

The ai in energy distribution market is expected to grow at a 22.5% CAGR between 2025 and 2035.

The key product types in ai in energy distribution market are solution and services.

In terms of application outlook, smart grid management segment to command 32.0% share in the ai in energy distribution market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

AI Document Generator Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

AI Platform Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Sleep Technologies Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Gait & Mobility Analytics Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Behavioral Therapy Market Size and Share Forecast Outlook 2025 to 2035

AI-Enabled Behavioral Therapy Market Size and Share Forecast Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

AIOps Platform Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered CRM Platform Market Forecast Outlook 2025 to 2035

AI Animation Tool Market Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

AI Image Editor Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA