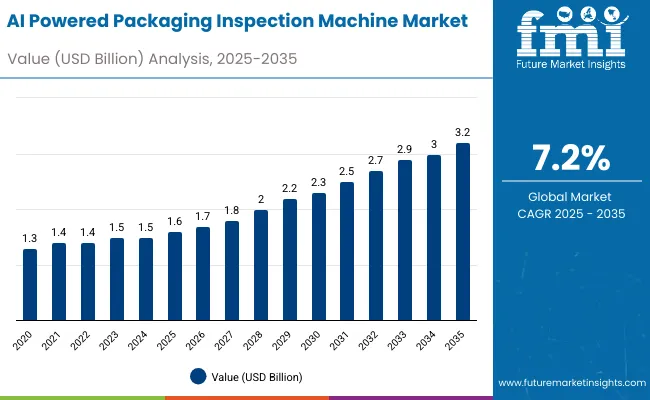

The AI powered packaging inspection machine market is expected to grow from USD 1.6 billion in 2025 to USD 3.2 billion by 2035, resulting in a total increase of USD 1.6 billion over the forecast decade. This represents a 100.0% total expansion, with the market advancing at a compound annual growth rate (CAGR) of 7.2%. Over ten years, the market grows by 2.0 times.

| Metric | Value |

|---|---|

| AI Powered Packaging Inspection Machine Market Estimated Value in (2025 E) | USD 1.6 billion |

| AI Powered Packaging Inspection Machine Market Forecast Value in (2035 F) | USD 3.2 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

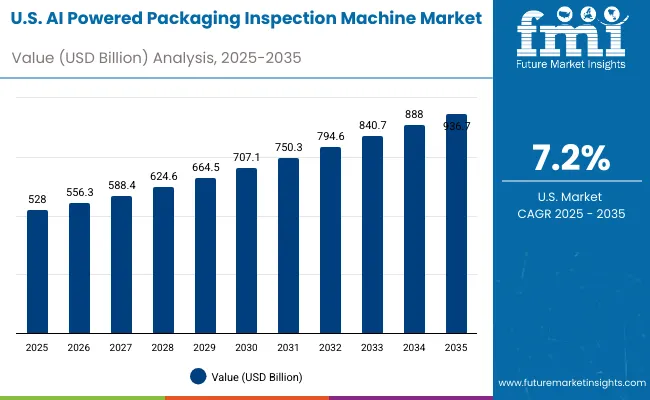

In the first half (2025 to 2030), the market progresses from USD 1.6 billion to USD 2.3 billion, contributing USD 0.7 billion, or 43.8% of total decade growth. This phase is shaped by food, beverage, and pharmaceutical companies adopting AI-driven systems for defect detection and labelling accuracy. The integration of machine vision and predictive analytics enhances quality assurance and reduces wastage.

In the second half (2030 to 2035), the market grows from USD 2.3 billion to USD 3.2 billion, adding USD 0.9 billion, or 56.2% of the total growth. This acceleration is supported by deep learning, edge AI, and cloud-based inspection platforms that deliver real-time analytics. Expansion into flexible packaging and emerging markets further amplifies growth, solidifying AI-powered inspection machines as essential to smart packaging lines.

From 2020 to 2024, the AI powered packaging inspection machine market grew from USD 1.2 billion to USD 1.5 billion, driven by automation demand in food, beverage, and pharmaceutical sectors. Nearly 70% of revenue was dominated by OEMs integrating vision systems, deep learning, and defect detection tools into high-speed lines.

Leaders such as Cognex, Omron, and Keyence emphasized seal integrity checks, contamination detection, and label verification accuracy. Differentiation relied on machine vision precision, adaptability across packaging formats, and real-time analytics, while predictive inspection remained secondary. Service models such as AI model training and calibration contributed under 20% of market share, with capital deployment leading investments.

By 2035, the AI powered packaging inspection machine market will reach USD 3.2 billion, growing at a CAGR of 7.20%, with software-led analytics and predictive quality systems representing over 40% of revenues. Competition will intensify as providers deliver cloud-based inspection platforms, IoT-linked traceability, and AI-driven autonomous adjustments.

Established players are pivoting toward hybrid business models that combine equipment hardware with subscription-based software upgrades. Emerging companies such as Pleora Technologies, Scortex, and Inspekto are scaling with modular AI inspection kits, low-code model retraining, and sustainability-focused solutions, addressing growing global demand for higher accuracy, compliance, and cost-efficient packaging validation.

The rising need for accuracy, efficiency, and compliance in packaging quality control is driving growth in the AI powered packaging inspection machine market. These systems minimize human error, ensure defect-free products, and support regulatory standards across food, beverage, pharmaceutical, and cosmetic industries. Increasing automation and demand for real-time monitoring further fuel adoption.

Machines integrated with deep learning algorithms, machine vision, and edge computing are gaining traction for their ability to detect defects with high precision. Features such as predictive analytics, cloud-based reporting, and fast adaptability to diverse packaging formats enhance operational efficiency. Sustainability benefits from reduced waste and rework also strengthen market appeal globally.

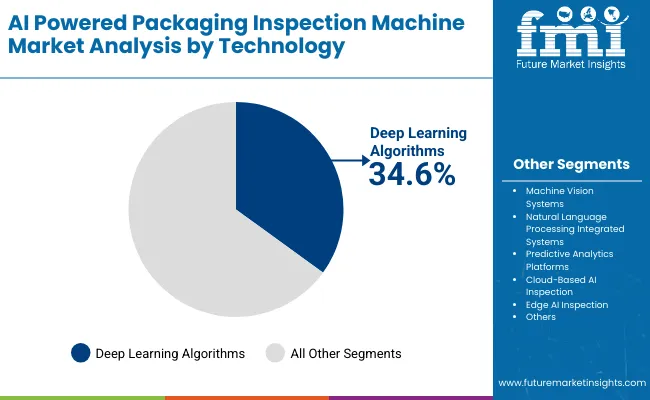

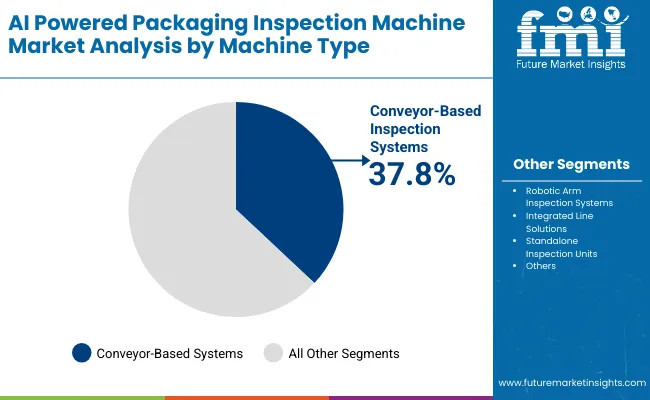

The market is segmented by technology, machine type, inspection type, packaging type, end-use industry, and region. Technology segmentation includes machine vision systems, deep learning algorithms, natural language processing integrated systems, predictive analytics platforms, cloud-based AI inspection, and edge AI inspection, enhancing accuracy and automation. Machine type covers conveyor-based inspection systems, robotic arm inspection systems, integrated line solutions, and standalone inspection units, providing scalable solutions across production environments.

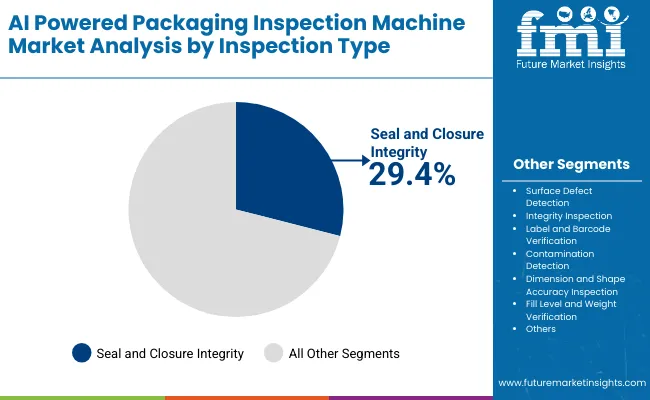

Inspection type includes surface defect detection, seal and closure integrity inspection, label and barcode verification, contamination detection, dimension and shape accuracy inspection, and fill level and weight verification, ensuring stringent quality control. Packaging type segmentation spans bottles and containers, cans, cartons and boxes, flexible pouches, and trays and blisters. End-use industries include food and beverages, pharmaceuticals and healthcare, cosmetics and personal care, electronics and semiconductors, logistics and e-commerce, and industrial goods. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Deep learning algorithms are forecast to hold 34.6% of the market in 2025, driven by their ability to learn complex defect patterns and continuously improve accuracy. These models can detect subtle anomalies that traditional vision systems may overlook, reducing false rejects and ensuring quality consistency. Their application is particularly strong in industries with high product diversity.

Adoption is supported by the scalability of AI frameworks and their compatibility with edge and cloud-based deployment. Real-time learning enables inspection systems to adapt to new packaging designs without reprogramming. The integration of AI with predictive analytics further enhances process efficiency and decision-making in packaging lines.

Conveyor-based systems are projected to account for 37.8% of the market in 2025, as they align directly with automated production environments. These systems provide continuous, inline inspection without disrupting packaging flows, ensuring high throughput and operational efficiency.

They are widely adopted in food, beverage, and pharmaceutical industries where speed and accuracy are critical. Integration with machine vision and AI modules allows these systems to identify defects at full line speed. Their modular design also enables customization for diverse product formats and quick changeovers.

Seal and closure integrity inspection is expected to represent 29.4% of the market in 2025, due to its importance in ensuring product safety, sterility, and shelf life. These inspections detect micro-leaks, improper sealing, or closure misalignments that can compromise product integrity.

Adoption is particularly strong in food and pharmaceutical industries where contamination risks must be minimized. AI-driven tools improve detection sensitivity and reduce reliance on destructive testing. As regulatory compliance tightens, this inspection type remains a priority investment for manufacturers.

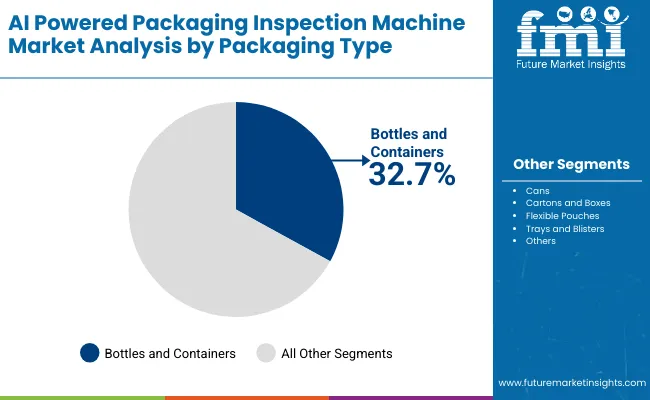

Bottles and containers are forecast to hold 32.7% of the market in 2025, reflecting their widespread use in beverages, personal care, and pharmaceuticals. Inspection systems in this category verify fill levels, cap alignment, label accuracy, and potential contamination.

High-speed bottle filling lines demand inspection systems capable of operating at thousands of units per minute without performance loss. AI-powered tools enhance precision, reduce waste, and ensure brand reputation by avoiding mislabelling or underfilled products. Their adoption continues to expand as demand for bottled products grows globally.

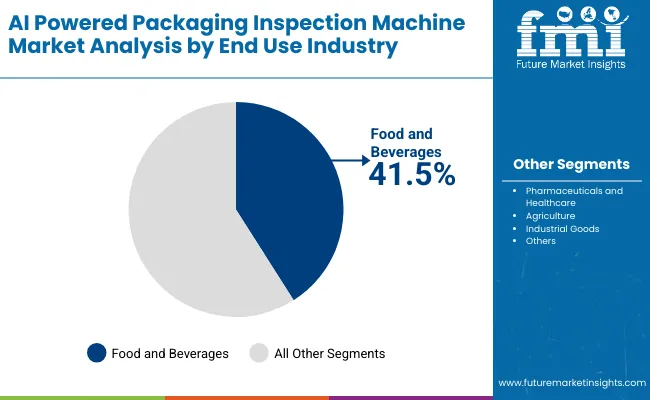

The food and beverages industry is projected to account for 41.5% of the market in 2025, as strict safety standards and high-volume production drive adoption of AI inspection. Automated systems verify packaging integrity, labelling compliance, and product quality at scale, reducing the risk of recalls and waste.

This segment benefits from rapid SKU diversification and consumer demand for flawless packaging. AI inspection ensures compliance with global regulations while enhancing operational efficiency. As major food and beverage companies prioritize automation, this industry remains the anchor for market demand.

The AI powered packaging inspection machine market is growing as manufacturers seek automation to improve quality control, reduce human error, and ensure compliance with safety standards. Rising demand in food, pharmaceuticals, and consumer goods is driving adoption. However, high costs and integration challenges hinder small-scale adoption. Advances in deep learning, machine vision, and cloud-based analytics are shaping future innovations.

Automation, Accuracy, and Compliance Driving Adoption

AI-powered inspection machines deliver real-time defect detection, seal verification, and label accuracy checks with unmatched precision. Food and beverage producers benefit from reduced contamination risks, while pharmaceutical firms rely on these systems for tamper-proof packaging verification. By minimizing reliance on human inspection, they reduce labour costs and error rates. Their ability to comply with stringent quality regulations positions them as critical tools for global packaging operations. Adoption is especially strong among companies prioritizing consumer trust and export readiness.

High Capital Costs, Complex Integration, and Skill Gaps Restraining Growth

Adoption is slowed by the high cost of AI-enabled hardware, machine vision systems, and software licensing. Integration into existing packaging lines often requires infrastructure upgrades and IT adaptation, raising upfront expenses. Skilled personnel are required to program, train, and maintain AI models, creating workforce challenges. Additionally, reliance on large datasets for accurate defect recognition poses hurdles for smaller manufacturers. These factors limit market reach in price-sensitive or fragmented industries.

Deep Learning, IoT Connectivity, and Cloud-based Analytics Trends Emerging

Key trends include the use of deep learning algorithms for adaptive defect detection and predictive maintenance. IoT-enabled machines now provide real-time monitoring, connecting directly with enterprise systems for end-to-end visibility. Cloud-based analytics platforms are streamlining data collection, enabling global quality control benchmarking. Integration with robotic arms and conveyor automation is creating fully automated inspection solutions. As sustainability gains importance, AI-powered inspection is being used to optimize packaging material usage and reduce waste, aligning with eco-conscious manufacturing practices.

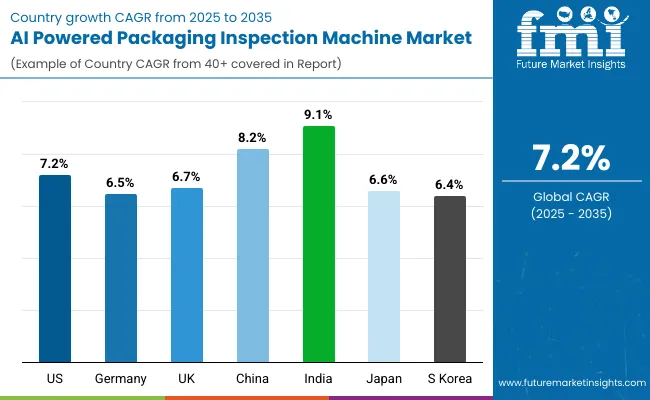

The global AI powered packaging inspection machine market is expanding rapidly, driven by automation, food safety regulations, and rising demand for zero-defect packaging. Asia-Pacific is leading growth, with India and China at the forefront due to fast industrialization and high-volume food and beverage production. Developed regions such as the USA, Germany, and Japan are focusing on AI-driven defect detection, predictive analytics, and cloud integration to enhance compliance, reduce waste, and maintain efficiency across large-scale manufacturing environments.

The USA market is projected to grow at a CAGR of 7.2% from 2025 to 2035, supported by stringent FDA food safety mandates and advanced manufacturing standards. Demand is rising in food, pharmaceuticals, and beverages where zero-defect packaging is critical. OEMs are integrating AI algorithms with machine vision and IoT connectivity for real-time defect detection. Growth is further accelerated by automation upgrades in e-commerce logistics and high-capacity packaging plants.

Germany’s market is expected to grow at a CAGR of 6.5%, driven by strict EU regulations and demand for precision in pharmaceuticals, chemicals, and beverages. German OEMs are developing AI-based modular inspection systems integrated with robotics for higher efficiency. Adoption is strong in breweries and processed food industries where labeling accuracy and seal integrity are critical. Sustainability-focused packaging further fuels innovation in automated inspection systems.

The UK market is projected to grow at a CAGR of 6.7%, supported by strong adoption in food, beverage, and consumer goods. SMEs are increasingly investing in AI-powered inspection systems to ensure compliance with safety regulations and reduce product recalls. Cloud-based platforms and subscription models are gaining traction to improve accessibility. E-commerce growth is also accelerating demand for accurate and automated inspection to maintain packaging integrity during distribution.

China’s market is forecast to grow at a CAGR of 8.2%, driven by government initiatives for smart manufacturing and strong domestic demand for packaged goods. AI inspection systems are being deployed in beverages, processed food, and pharmaceuticals to ensure compliance and improve operational efficiency. Local OEMs are scaling production with cost-efficient AI-powered inspection units. Growing e-commerce and cold chain distribution are further fueling adoption across large-scale manufacturing hubs.

India is projected to record the fastest growth at a CAGR of 9.1%, supported by rapid expansion in FMCG, pharmaceuticals, and dairy sectors. AI-powered inspection machines are being adopted for contamination detection, barcode validation, and real-time quality monitoring. SMEs are increasingly investing in affordable AI-integrated systems. Government food safety initiatives and export compliance standards are reinforcing adoption, making India a key hotspot for AI-enabled packaging inspection technologies.

Japan’s market is expected to grow at a CAGR of 6.6%, driven by demand for high precision and defect-free packaging in electronics, beverages, and healthcare. Manufacturers are emphasizing compact, automated inspection systems integrated with AI vision technology. Sustainability and waste reduction targets are pushing adoption of AI inspection to minimize errors. Japanese OEMs are also innovating with AI-enabled predictive analytics for preventive maintenance and reliability.

South Korea’s market is projected to grow at a CAGR of 6.4%, driven by applications in semiconductors, cosmetics, and beverages. AI-powered packaging inspection is gaining traction in export-driven industries requiring strict quality assurance. Compact, automation-ready solutions are being deployed in mid-sized firms. Growth is also driven by partnerships between local manufacturers and global AI technology providers, enhancing innovation and integration.

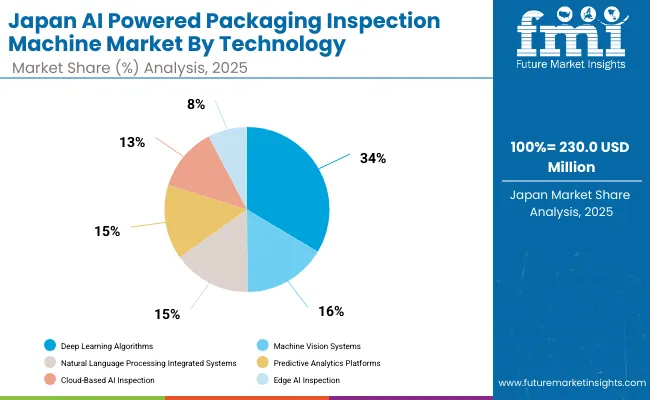

Japan’s AI powered packaging inspection machine market is valued at USD 230 million in 2025, with deep learning algorithms leading at 34.3% share. Machine vision systems follow with 16.4%, while natural language processing systems hold 15.8%. Predictive analytics account for 13.6%, cloud-based AI inspection 12.5%, and edge AI inspection 7.5%.

Deep learning leads due to superior accuracy in defect detection and pattern recognition. The adoption of machine vision and predictive analytics reflects demand for speed and reliability. Cloud-based and edge AI solutions are growing, highlighting Japan’s increasing integration of smart technologies for automated packaging quality assurance.

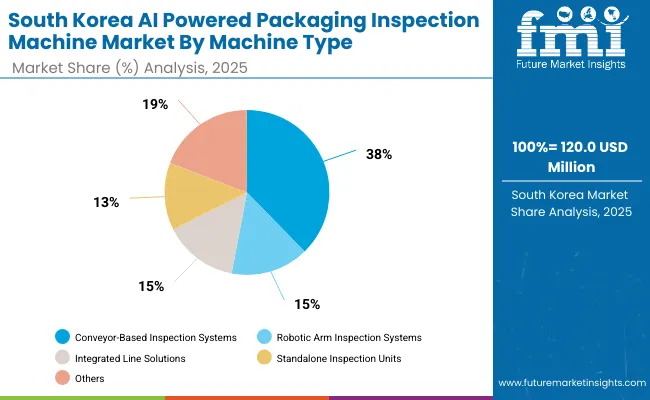

South Korea’s AI powered packaging inspection machine market in 2025 is valued at USD 120 million, with conveyor-based inspection systems dominating at 38.5% share. Robotic arm inspection systems hold 14.8%, integrated line solutions account for 15.1%, and standalone inspection units contribute 13.4%. Conveyor-based systems lead due to widespread adoption in high-speed food and beverage packaging. Robotic arms are increasingly utilized for precision inspection tasks in electronics and healthcare sectors. Integrated line solutions support end-to-end automation, while standalone systems serve small-scale packaging lines. This distribution reflects South Korea’s focus on automation efficiency, precision, and adaptability in diverse industrial applications.

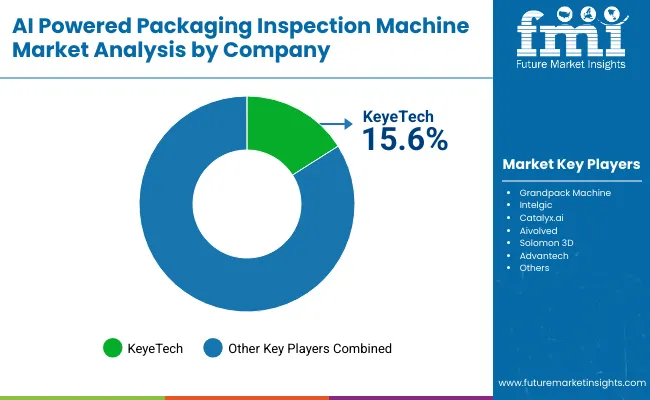

The AI powered packaging inspection machine market is moderately fragmented, with inspection system specialists, AI innovators, and automation solution providers competing across food, pharmaceutical, and consumer goods sectors. Global leaders such as KeyeTech, Grandpack Machine, and Intelgic hold notable market share, driven by deep learning algorithms, high-resolution vision systems, and compliance with international quality and safety standards. Their strategies increasingly emphasize defect detection accuracy, speed, and seamless integration with smart factories.

Established mid-sized players including Catalyx.ai, Aivolved, and Solomon 3D is supporting adoption of modular inspection platforms featuring 3D imaging, adaptive learning, and predictive analytics. These companies are especially active in labeling, seal integrity, and contamination detection for high-value packaging, offering cloud-based reporting, customizable workflows, and real-time insights to improve operational efficiency and reduce recalls.

Specialized technology providers such as Advantech focus on tailored AI inspection systems for regional markets and niche packaging lines. Their strengths lie in IoT connectivity, edge AI deployment, and scalable architectures, enabling clients to integrate inspection with broader automation ecosystems while achieving regulatory compliance, reduced waste, and enhanced consumer trust in product safety and quality.

Key Development

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| By Technology | Machine Vision Systems, Deep Learning Algorithms, Natural Language Processing Integrated Systems, Predictive Analytics Platforms, Cloud-Based AI Inspection, Edge AI Inspection |

| By Machine Type | Conveyor-Based Inspection Systems, Robotic Arm Inspection Systems, Integrated Line Solutions, Standalone Inspection Units |

| By Inspection Type | Surface Defect Detection, Seal and Closure Integrity Inspection, Label and Barcode Verification, Contamination Detection, Dimension and Shape Accuracy Inspection, Fill Level and Weight Verification |

| By Packaging Type | Bottles and Containers, Cans, Cartons and Boxes, Flexible Pouches, Trays and Blisters |

| By End-Use Industry | Food and Beverages, Pharmaceuticals and Healthcare, Cosmetics and Personal Care, Electronics and Semiconductors, Logistics and E-commerce, Industrial Goods |

| Key Companies Profiled | Keye Tech, Grandpack Machine, Intelgic, Catalyx.ai, Aivolved, Solomon 3D, Advantech |

| Additional Attributes | Rapid adoption of AI-powered vision systems for defect detection and quality control, integration of deep learning algorithms for real-time anomaly recognition, cloud-based and edge AI platforms enhancing scalability and responsiveness, strong uptake across food, pharma, and electronics sectors, and increasing demand for robotic inspection units ensuring high accuracy, reduced downtime, and compliance with stricter regulatory standards. |

The global AI powered packaging inspection machine market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the AI powered packaging inspection machine market is projected to reach USD 3.2 billion by 2035.

The AI powered packaging inspection machine market is expected to grow at a CAGR of 7.2% between 2025 and 2035.

The key technologies in the AI powered packaging inspection machine market include machine vision systems, deep learning algorithms, NLP-integrated systems, predictive analytics platforms, cloud-based AI inspection, and edge AI inspection.

The deep learning algorithms segment is expected to account for the highest share of 34.6% in the AI powered packaging inspection machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

AI-Enabled Behavioral Therapy Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

AI-defined Vehicle Market Forecast and Outlook 2025 to 2035

AI in Oil and Gas Market Forecast and Outlook 2025 to 2035

AIOps Platform Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

AI Trading Platform Market Forecast Outlook 2025 to 2035

AI-driven Predictive Maintenance Market Forecast and Outlook 2025 to 2035

AI Animation Tool Market Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

AI Waste Sorting Robots Market Forecast and Outlook 2025 to 2035

AI Image Editor Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

AI Demand Forecasting Software Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA