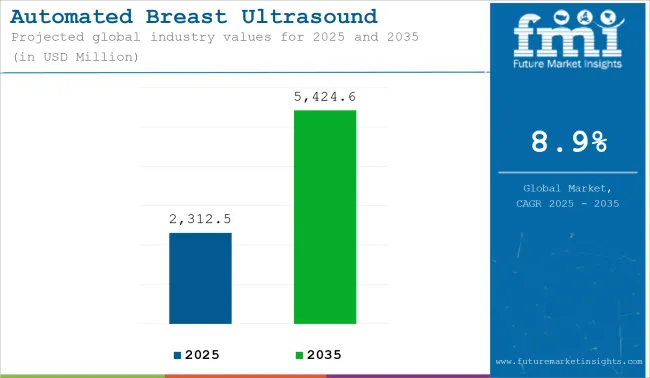

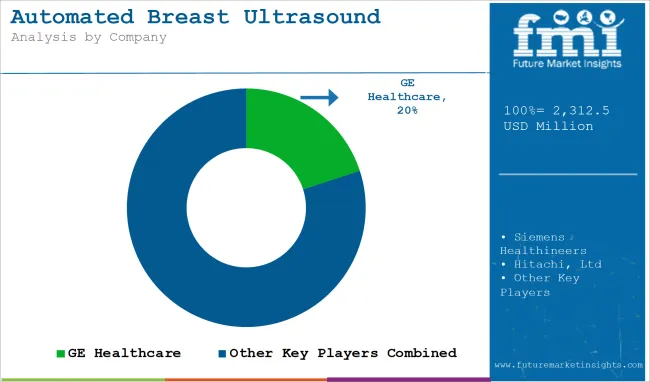

The global automated breast ultrasound systems market is estimated to be valued at USD 2,312.5 million in 2025 and is projected to reach USD 5,424.5 million by 2035, registering a CAGR of 8.9% over the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2,312.5 million |

| Industry Value (2035F) | USD 5,424.6 million |

| CAGR (2025 to 2035) | 8.9% |

The automated breast ultrasound systems market has been experiencing steady expansion, driven by increasing breast cancer prevalence and the limitations of conventional mammography in women with dense breast tissue. A notable rise in the adoption of supplemental imaging modalities to improve early detection rates and enhance diagnostic confidence. Healthcare providers are prioritizing capital investments in automated solutions that deliver standardized, reproducible imaging outcomes while reducing operator dependency.

Several regulatory approvals and supportive reimbursement policies in developed markets have further encouraged the integration of automated breast ultrasound systems into routine screening protocols. The combination of demographic trends, awareness campaigns, and supportive clinical guidelines is expected to sustain momentum and open new avenues for commercialization.

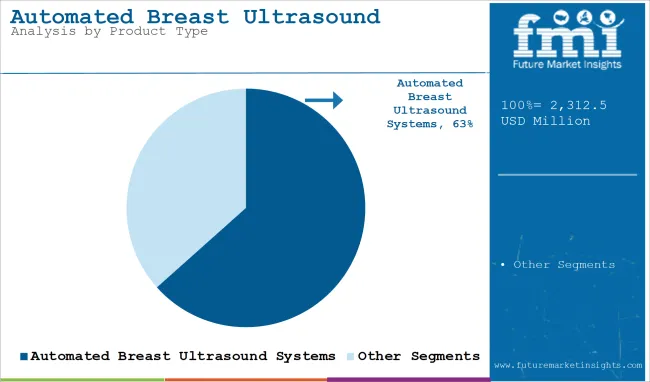

Automated breast ultrasound systems have maintained a leading revenue share of 63.4% in 2025, attributed to their capacity to standardize breast imaging and improve lesion characterization in dense breast tissue. The segment’s expansion has been supported by a growing recognition among clinicians that operator-dependent handheld ultrasound often results in variability of interpretation and incomplete breast coverage.

A significant emphasis has been placed on technological innovations that enhance volumetric image acquisition and automated reconstruction, enabling radiologists to interpret comprehensive datasets with higher confidence. Investments in system ergonomics and integration with PACS have contributed to more efficient workflows and reduced exam times, encouraging broader adoption across both screening and diagnostic settings.

The preference for these systems has been reinforced by their compatibility with established screening pathways, which has created opportunities for cross-modality utilization in hospitals and imaging centers.

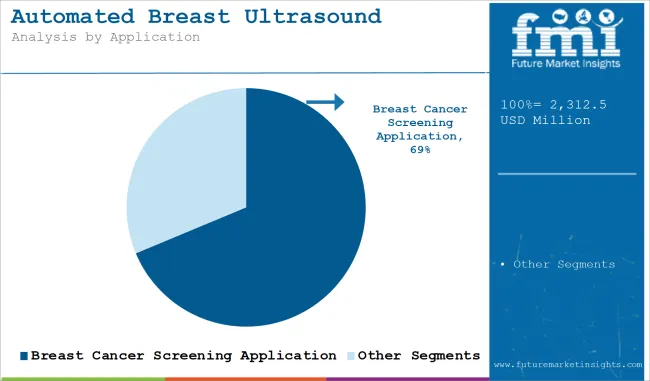

The breast cancer screening application has held a dominant revenue share of 68.7% due to the rising incidence of cancer diagnoses and the clinical necessity to improve detection sensitivity, particularly in women with dense breast composition. A sustained focus has been placed on improving early-stage cancer identification, which has been acknowledged by professional guidelines supporting adjunctive ultrasound screening for high-risk populations.

Government-sponsored awareness initiatives and non-profit advocacy have amplified patient demand for comprehensive screening approaches, driving higher procedure volumes across diagnostic facilities. The segment’s growth has also been reinforced by healthcare systems increasingly recognizing the economic and clinical value of detecting malignancies at earlier, more treatable stages. The inclusion of automated breast ultrasound systems in structured screening programs has created sustained revenue streams, with reimbursement policies in developed markets further incentivizing utilization.

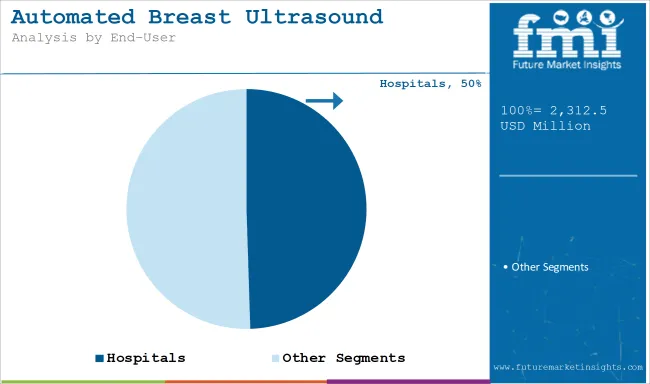

Hospitals have accounted for a 49.5% share of the market, supported by their established infrastructure, capital resources, and multidisciplinary care pathways. Adoption in these settings has been propelled by the integration of automated breast ultrasound into comprehensive breast health programs that combine digital mammography, MRI, and biopsy services. Decision-makers in hospitals have prioritized investments in automated imaging platforms to address increasing patient volumes and reduce diagnostic bottlenecks.

The segment’s expansion has been facilitated by strategic collaborations with technology vendors offering tailored training and service agreements that support long-term operational continuity. In addition, hospitals have benefited from economies of scale in negotiating procurement contracts and securing reimbursement for adjunctive screening procedures. These factors have established hospitals as the leading end-user segment and are expected to sustain their leadership position in the foreseeable future.

Limited Awareness and Training Requirements of Healthcare Workers is Limiting the Product Adoption

One major impediment restraining the Automated Breast Ultrasound Systems (ABUS market is ignorance and the absence of specialization in the training of medical professionals. While ABUS provides standardized and automated imaging, interpreting high-resolution 3D ultrasound images requires skill sets distinct from those used in conventional 2D ultrasound or mammography.

Most radiologists and sonologists are not sufficiently trained to differentiate between benign and malignant lesions on ABUS scans, resulting in some possible misinterpretations with very low diagnostic confidence. This knowledge gap holds back acceptance, as medical professionals most likely would be reluctant to incorporate ABUS into regular breast cancer screening programs.

Besides the limited awareness, the lack of knowledge on the part of physicians and patients is said to be another aspect restricting market growth. Large numbers of general practitioners and gynecologists remain unaware of the benefits of ABUS for dense breast tissue screening, and so continue to rely solely on mammography.

Patients, too, lack knowledge about other options for breast imaging and hence do not demand ABUS-based screening. Factors like these lead to poor consolidation of ABUS technology, especially in developing regions, where there is little training and awareness initiated with respect to ABUS technology. Unless these constraints are addressed through training, awareness campaigns, and collaboration in academics, the full potential of ABUS for breast cancer detection and diagnosis will remain unlocked.

A significant market opportunity for the Automated Breast Ultrasound Systems (ABUS) market lies in its ability to advance early breast cancer detection.

Over time, people have realized that mammography is not compatible with the kind of tissue they might have in their breasts. People, especially women, have become increasingly demanding about what complementary screening technologies should be able to offer. More so, such technology should give a better diagnosis for women who have dense breast tissue and thus may have a higher risk for undetected tumors.

ABUS, among other things, identifies smaller, earlier-stage lesions that could otherwise have been missed, providing earlier intervention and better patient outcomes.

But even increasing ABUS uptake, which surely offers an opportunity for more accurate detection in initial diagnosis, is not all that is possible; it stands to improve diagnosis itself. Adding ABUS into routine screenings would therefore reduce false positives and unnecessary biopsies along the diagnostic pathway.

As more healthcare systems prioritize preventive care and early intervention, ABUS provides an invaluable tool for upgrading screening programs, particularly for high-risk and underserved populations.

The ABUS industry has been experiencing significant growth due to technological advancements and the increasing value placed on patient-centered imaging solutions. An example of this is automated 3D imaging systems, which provide spatially comprehensive views of breast tissue to improve diagnostic accuracy.

Portability and easy-to-use devices in ABUS will also provide wider access to advanced diagnostics in many healthcare settings, be it in underserved or remote areas.

Another emerging trend in this field is the integration of artificial intelligence algorithms to assist in image analysis, thereby reducing the time required to interpret images and increasing confidence in diagnoses. Again, combined with some other imaging modalities such as mammography, overall screening efficiencies have improved, which is a testimony to the broadening application and benefit of such innovations.

One of the major trends accelerating the growth of the Automated Breast Ultrasound Systems (ABUS) market is the increasing expansion of regulatory approvals and reimbursement assurance.

Regulatory bodies like the FDA and European CE authorities have been increasingly recognizing the role of ABUS as an adjunctive screening tool that adds to screening for the density of breast tissue, making it acceptable for widespread use. These approvals have encouraged healthcare facilities to adopt ABUS in their regular protocols of screening for breast cancer.

Concurrently, the widening scope of reimbursement policies has rendered ABUS fairly accessible to a wider patient pool. Insurers, in general, have been extending cover for ABUS scans, making it a viable option for patients, especially for the high-risk category of individuals.

This not only encourages healthcare practices to adopt ABUS but also enables the majority of patients to seek early detection for malignant states, leading to improved clinical outcomes. The result of regulatory support, along with reimbursement availability, is allowing the market to grow at a rapid pace.

Market Outlook

The market in the USA for Automated Breast Ultrasound Systems (ABUS) is growing rapidly with the increasing incidence of breast cancer and the problems faced by mammogram-based methods in detecting tumors in dense breast tissue.

It is when ABUS is introduced that the images can be as clear of a quality conducive to providing adequate detection rates. The high price and the need for special training are obstacles to mass acceptance.

Market Growth Factors

Market Forecast

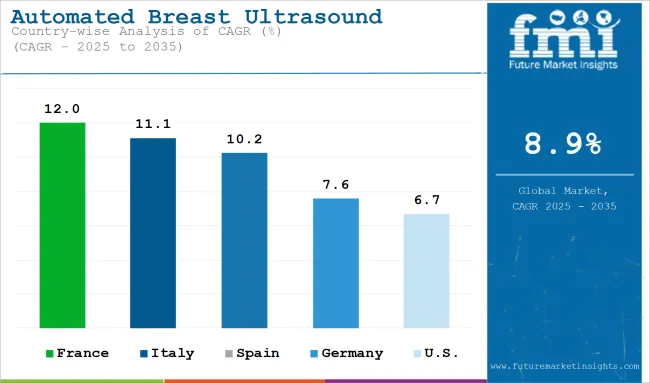

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 2.8% |

Market Outlook

The expansion of the ABUS market in Germany is greatly supported by a sound healthcare infrastructure and the promotion of the early detection of cancer. The limitations of conventional mammography in the case of women with dense breast tissue have opened a wider space for using the ABUS system, while strong regulatory requirements and exorbitant costs may shadow its growth.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 4.0% |

Market Outlook

The ABUS market for China is experiencing rapid growth because of increasing incidence rates of breast cancer and the growing awareness of early detection methods. Developments and improvements in economic conditions and the healthcare infrastructure shall contribute to the convenience of access to advanced diagnostic technologies.

However, the disparity in healthcare access for urban and rural residents can hinder market growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.1% |

Market Outlook.

India's ABUS market is on the threshold of growth due to increasing awareness of breast cancer and a growing focus on its early detection. The development of healthcare facilities and rising healthcare expenditure, meanwhile, aid the market's growth. Nevertheless, challenges such as limited resources in rural areas and variations in the quality of healthcare may act as deterrents to growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.9% |

Market Outlook

Brazil's ABUS market is experiencing growth, supported by improvements in healthcare infrastructure and increased focus on women's health. The prevalence of breast cancer necessitates the availability of advanced diagnostic technologies. Economic disparities and regional differences in healthcare access may pose challenges to market growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 5.6% |

Key market players in the automated breast ultrasound system market are focusing on installing ABUS in hospitals and diagnostics centers to expand their global footprint. They are also working towards developing the accuracy of automated breast ultrasound systems for faster cancer screening assessment and getting government approval for their products.

Key players are investing heavily in research and development activities to develop essential and improved products. These players are adopting various market methodologies such as mergers, acquisitions, product launches, collaborations, and partnerships. They are distributing their products with local and international suppliers to reach relevant audiences to increase sales volume.

The global Automated Breast Ultrasound Systems industry is projected to witness CAGR of 8.9% between 2025 and 2035.

The global Automated Breast Ultrasound Systems industry stood at USD 2,123.6 million in 2024.

The global rare neurological disease treatment industry is anticipated to reach USD 5,424.5 million by 2035 end.

China is expected to show a CAGR of 6.1% in the assessment period.

The key players operating in the global automated breast ultrasound systems industry are GE Healthcare, Siemens Healthineers, Hologic, Inc., Canon Medical Systems, Hitachi Ltd., Delphinus Medical Technologies, Inc. and others.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.