The market for auto load floors in Korea remained steady in 2024, supported by growing demand for the Application of lightweight, durable materials in the manufacturing of vehicles. The growing industry for electric vehicles (EVs), which demands new load floor solutions for improved efficiency and organization, has helped these industries to grow.

In response, Korean car manufacturers were actively seeking new materials, such as composite and honeycomb structures, to enhance their cars' performance and sustainability. The rise in sales was supported by government incentives for the purchase of EVs, as carmakers geared up for increasing fuel efficiency and emission regulations.

Then, there was a change in consumer preferences in 2024 away from sedans and toward SUVs and crossovers that tend to have larger cargo areas and, therefore, drive more complex load floor designs. The growth of the e-commerce sector also propelled the demand for commercial vehicles, indirectly benefitting the automotive load floor industry.

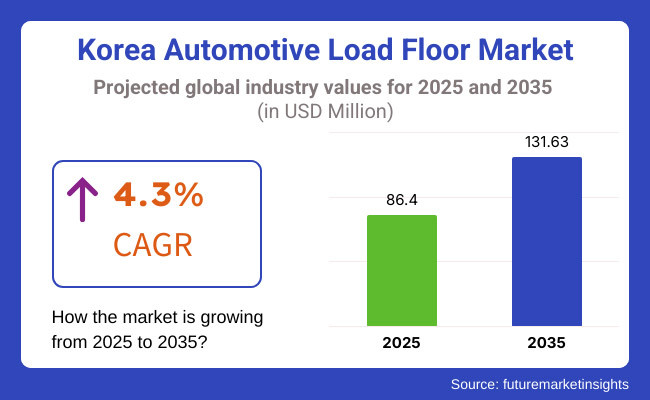

Projections indicate growth to USD 86.4 million by 2025. Growing EV production will complement technological progress in lightweight materials, supporting the industry's growth. By 2035, the industry is expected to reach USD 131.63 million with a CAGR of 4.3%. Sustainable and recyclable materials will also be an important trend in manufacturing, and these developments will affect the future of the Korean automotive load floor industry.

Insights on Korea's Automotive Load Floor Industry Trends The latest survey by Future Industry Insights (FMI) delivered the following insights from prospective stakeholders of Korea's Automotive Load Floor Industry.

The study included automotive manufacturers, material suppliers, and afterindustry service providers, as well as industry experts, providing insights into changing consumer expectations, technological developments, and regulatory developments.

Many people, 72% of those who answered, already use lightweight and strong materials like composites and honeycomb structures. This is because electrification and sustainable mobility are having a bigger impact on the sector as a whole.

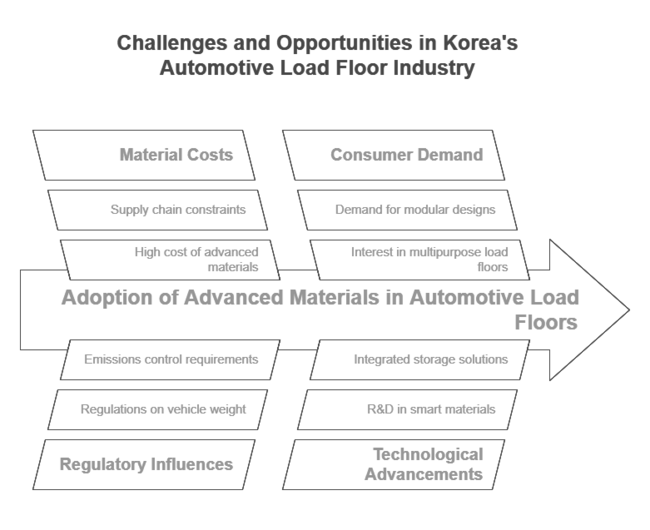

In the data, 60 percent of respondents identified the high cost of advanced materials as an obstacle to widespread adoption. Although OEMs are eager to incorporate recyclable and bio-based materials, many voiced concerns about supply chain constraints and cost pressures.

Government regulations for reducing vehicle weight and emissions control are also influencing material choice and production processes for more than 65 percent of respondents, the highest response to this question. Automakers and fleet operators pointed out that more and more people want modular and multipurpose load floors to fit their changing lifestyles.

This is an example of demand-side potential. Over 50% of the surveyed manufacturers plan to incorporate customizable and foldable load floors into their vehicle designs, especially for SUVs and commercial vans, which are expected to see increased demand.

The growth of e-commerce logistics has also fuelled the demand for loading floors in delivery vehicles that can withstand high impacts and heavy loads. Smart materials and integrated storage solutions are anticipated to dominate the industry in the coming years, with industry experts predicting further R&D investments in these materials over this decade.

The results imply that partnerships between automakers and material scientists will be necessary to tackle current obstacles and seize new opportunities. Korean automotive load floors will be reinvented as the industry shifts toward more innovation and sustainability in global mobility.

| Province/Region | Regulatory Impact on the Automotive Load Floor Industry |

|---|---|

| South Gyeongsang | Stricter passenger and commercial vehicular weight reduction requirements, accounting for the increased use of lightweight composite material. |

| North Jeolla | Faced with incentives for EV production, manufacturers are preparing to use sustainable and recyclable floor materials. |

| South Jeolla | With the investment in automotive R&D clusters, there is a push towards the development of modular and multifunctional designs of load floors. |

| Jeju | Zero-emission vehicle (ZEV) policies are propelling the transition to bio-based, environmentally friendly load floors for EVs. |

| Rest of Korea | National fuel efficiency and emission standards are driving the use of high-strength, lightweight materials across all vehicle segments. |

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Industry growth was consistent but came mainly from the manufacture of traditional vehicles. | The growth of DSM, EVs, and lightweight material innovations will drive the industry. |

| Automakers concentrated on inexpensive load floors based on conventional materials, including plywood and fiberboard. | Manufacturers are shifting toward composites, honeycomb structures, and recyclable materials to achieve sustainability objectives. |

| Sales of SUVs and commercial vehicles primarily drove demand. | Growth will be diversifying with modular and smart load floor solutions that capture increased share. |

| Regulations were relatively relaxed, focusing mainly on basic vehicle safety and durability. | Governments cracking down on emissions and weight reduction regulations will drive advanced material adoption. |

| R&D investment was modest, driving evolutionary changes in design and functionality. | More R&D spending is driving next-gen load floor efficiencies and durability. |

Composites are a leading material due to their high strength-to-weight ratio, durability, and increasing use in electric vehicles (EVs). Composite load floors are more popular for high-end vehicles like luxury cars, SUVs, and LCVs, owing to their appearance and performance.

The fastest growing segment is honeycomb polypropylene, thanks to demand for lightweight but impact-resistant solutions, such as cargo systems and load floor systems. While it is pricier than thermoplastics like textured PP, fluted polypropylene is becoming popular for cost-effective, flexible designs, primarily in midsize and compact vehicles. Despite the continued use of hardboard in cost-effective applications, its sales are declining in favor of more environmentally friendly and sustainable materials.

The largest and fastest-growing application segment is load floor systems, driven mainly by SUVs, LCVs, and commercial vans, which consistently require increasingly high-strength, lightweight, and modular designs. Cargo systems also capture a large industry share, with adjustable and sliding load floor innovations supporting e-commerce logistics and fleet vehicles.

Interior systems (such as rear seatbacks and trunk covers) exhibit moderate levels of demand but are being transformed by the replacement of traditional materials with composites and polypropylene honeycomb structures. The trend of prioritizing personalization and multi-utility across applications is changing the design landscape.

| Category | Industry Share in 2025 |

|---|---|

| Composites | 33% |

| Fixed | 81% |

Compact, midsize, and luxury vehicles prioritize durability and cost-effectiveness, making rigid load floors the most common and cost-effective solution. Nonetheless, the sliding load floor segment is growing fastest, especially in SUVs, LCVs, and vans, as individuals and fleets call for more accessible and easier-to-use cargo spaces-automakers are incorporating automated or modular sliding floor technologies to enable better storage efficiency in delivery and passenger vehicles. Urban mobility solutions and the need for space optimization in cars are driving this transition.

Strong consumer preference for spacious, premium, multifunctional SUVs has made them the vehicle of choice in the industry. These are heavy users of composite and honeycomb polypropylene for light, durable load floors. Light commercial vehicles (LCVs) and vans are the fastest-growing segment (by volume) of the commercial vehicle industry, especially in cargo and logistics, where the need for robust cargo spaces that can adjust load floors is increasing.

Luxury vehicles employ high-end composite materials for their appearance and lightweight performance. Meanwhile, compact and midsize cars have a steady share of the industry, and the introduction of affordable, eco-friendly materials is expected to drive adoption. In summary, mini-buses have a small but increasing demand, mainly in the commercial transport industry.

South Gyeongsang is a significant center for automobile production, with the region's automotive plants driving demand for advanced load floor systems. As such, the province has a large number of automotive OEMs or suppliers, resulting in a substantial uptake of composites and honeycomb polypropylene in SUVs, midsize cars, and commercial vehicles.

The government's emphasis on lightweight vehicle components to enhance fuel economy and sustainability is driving investments in R&D in material innovation. Also, production sites that are geared towards exporting are being replaced with ones that use modular and multifunctional load floors and follow the international rules for safety and weight reduction in the automotive industry.

North Jeolla's position as a hub for EV production and material innovation puts it in a strong position in the automotive load floor arena. The move is in line with the incentives being granted by the government to manufacture sustainable vehicles, and automakers in the region are working on adding more sustainable materials to their cars, such as recycled composites and fluted polypropylene.

As logistics and delivery demands increase, so too does the production of commercial vans, and load floors for cargo systems are quickly gaining adoption. This will also assist the province in investing in R&D clusters that focus on producing economical and light materials, thereby increasing the demand for honeycomb polypropylene and composite solutions.

There is an after-industry and vehicle modification industry growing more in South Jeolla, which has also increased the demand for customized and sliding load floors in SUVs, vans, and LCVs. The province's automotive export focus has driven the adoption of high-strength and lightweight materials, especially in luxury and midsize vehicles.

The demand for next-generation, modular load floors, particularly for electric SUVs and fleet vehicles, is growing even further due to government-backed EV initiatives. The region is also seeing greater investment in logistics and e-commerce-driven commercial vehicles, which require durable, impact-resistant cargo floors.

Jeju is influencing material choices in the automotive load floor industry with its efforts to promote zero-emission and electric vehicles (EVs). Manufacturers are increasingly focusing on bio-based composites and recyclable polypropylene for use in EV load floors due to the province's stringent sustainability rules.

The province also boasts a growing number of EV rental fleets, driving demand for robust yet lightweight loading floors that maximize vehicle efficiency. The fixed and sliding load floors are firmly positioned in the compact and midsize EV industry, which will expand significantly as Jeju rapidly turns into a carbon-neutral transportation hub.

The remainder of the country, including the major cities of Seoul, Incheon, and Busan, produces the bulk of automobiles and after-industry services for the automotive industry, contributing to its status as the biggest industry for automotive load floors. Demand for composite and honeycomb polypropylene load floors is high as SUVs and LCVs dominate sales. With Korea's drive to cut fuel usage and reduce emissions, these automakers are rapidly adopting lightweight, high-performance materials for cargo and interior systems. The need for sliding and multipurpose load floors is also growing because of changes in urban mobility trends and the growth of coasting and delivery vehicle fleets.

Local and foreign players compete with each other in the structure of the South Korean industry. Based on the current trends, here is the analysis of the best players with the approximate industry share in 2024.

Hyundai Mobis

Industry Share: ~35%

Hyundai Mobis, a subsidiary of Hyundai Motor Group, is a leading player in the South Korean industry, recognized for its strong domestic presence, commitment to innovation, and high-quality automotive solutions.

TS TECH Co., Ltd.

Industry Share: ~20%

TS TECH is a Japanese company with a significant presence in South Korea, specializing in the production of auto seats and interior parts, including load floors. TS TECH is known for manufacturing high-quality products with a focus on innovation.

Magna International Inc.

Industry Share: ~15%

Magna is one of the world's largest producers of automotive parts and systems, including load floors. Magna's South Korean footprint supports both local and global automakers.

Hanwha Advanced Materials

Industry Share: ~12%

Hanwha Advanced Materials is a Korean advanced materials manufacturer & supplier-its automotive load floor materials are among its automotive applications. Shunning traditional means of capital and investment, the company thrives on sustainability and innovation.

IAC Group

Industry Share: ~10%

IAC Group is a large supplier of auto components, including load floors. The company, which focuses on innovation and shopper fulfillment, has been increasing its footprint in South Korea.

Other Players

Industry Share: ~8%

The remaining industry share is held by smaller regional players and new entrants, many of whom are focused on targeting niche industries or high-spec materials.

Hyundai Mobis's Introduction of Lightweight Load Floors

Hyundai Mobis introduced a series of lightweight load floors made out of sophisticated composite materials. This innovation is designed to cater to the growing demand for fuel-efficient and electric cars in South Korea.

TS TECH's Expansion in Production Capacity

TS TECH declared increased production capacity in South Korea to serve the increasing demand for load floors in hybrid and electric vehicles. The new development will strengthen TS TECH's industry position.

Magna Strategic Partnership

Magna also made a strategic partnership with one of South Korea's major automobile manufacturers to produce new-age electric vehicle load floors. It aims to become innovative and popular as a supplier to South Korea by virtue of the tie-up.

Hanwha Advanced Materials' Green Load Floor

Hanwha Advanced Materials unveiled its new environmentally friendly load floor, which is recyclable. It's a solution toward making South Korea greener as per South Korean government mandates and, hence, likely to do better in the South Korean industry.

IAC Group's R&D Expansion

IAC Group increased its R&D facilities in South Korea to create sophisticated load floor solutions for the local industry. The expansion is likely to improve IAC Group's strength and industry standing.

The Korean automotive load floor industry is part of automotive components, which itself is part of automotive materials and components or the broader automotive manufacturing industry. This industry is sensitive and affected by macroeconomic factors, including GDP growth, industrial production, automotive exports, emission-related government regulations, and sustainability.

Korea is home to major global automotive manufacturers, which drives a constant requirement for high-end lightweight material solutions as vehicle componentry, including load floors. The growth of electric vehicles (EVs) is one of the main macroeconomic pushes of this industry.

As the Korean government aggressively promotes carbon neutrality by 2050, there is an increasing emphasis on using lightweight and high-strength materials for vehicle interiors, such as composites and polypropylene-based load floors, to accommodate the growing adoption of EVs. Material price volatility impacts production costs-driven by the prices of raw materials like plastics, carbon fiber, and polymers-and material innovation will be crucial for industry growth.

As Korea's export-driven automotive companies supply to North America, Europe, and Southeast Asia, the demand for automotive load floors remains constant. On the other hand, rapid urbanization, along with booming e-commerce logistics, will keep driving demand for cargo system load floors in light commercial vehicles (LCVs) and vans, adding long-term stability to the industry.

The automotive load floor industry in Korea is growing due to the increasing adoption of electric vehicles (EVs), the development of lightweight materials, and the growing demand for modular cargo solutions.

For applications such as load floors, manufacturers can take advantage of this trend by using composite and honeycomb polypropylene to help make vehicles more fuel-efficient and durable-customizable, multifunctional load floors for growing SUV and LCV segments. Also, in order to be aligned with Korea's sustainability regulations, the trend to use recyclable and bio-based materials can be a green source of advantage over competitors there.

New entrants should focus on niche opportunities in EVs, LCVs, and load floors for cargo systems, where demand is rapidly growing due to urban logistics and the expansion of last-mile delivery. Investing in research and development of unique, lightweight materials will separate the product from its conventional counterparts.

By installing production units close to the green field: the automotive core location of South Gyeongsang and North Jeolla, it improves supply chain efficiency and reduces costs. Partnerships with automakers and fleet operators will yield long-term contracts, and leveraging direct and indirect incentives for greening the vehicle fleet will mean a quicker industry entry. The emphasis on smart, modular, and high-durability designs will accommodate the continuous growth of this growing industry.

The industry is segmented into hardboard, fluted polypropylene, honeycomb polypropylene, and composites

It is segmented into interior systems, cargo systems, and load floor systems

It is divided into fixed and sliding

It is fragmented into compact, midsize, luxury, SUV, and LCV (mini-bus & van)

It is segmented into South Gyeongsang, North Jeolla, South Jeolla, Jeju, and Rest of Korea

What are the general materials used in Korea for automotive load floors?

EVs are making use of lighter, better materials, leading to greater use of composite and recyclable solutions for improved energy efficiency.

They enhance cargo accessibility and convenience, particularly in SUVs, light commercial vehicles, and delivery vehicles used in e-commerce logistics.

Tougher weight reduction and sustainability regulations push automakers toward cutting-edge, eco-friendly materials in vehicle interiors.

SUVs and commercial vans have been the primary drivers of adoption, while interest in electric and luxury vehicles continues to grow due to their modular and high-strength designs.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Industry Analysis and Outlook Volume (Unit) Forecast by Region, 2019 to 2034

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 4: Industry Analysis and Outlook Volume (Unit) Forecast by Material Type, 2019 to 2034

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2019 to 2034

Table 6: Industry Analysis and Outlook Volume (Unit) Forecast by Application, 2019 to 2034

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by Operation, 2019 to 2034

Table 8: Industry Analysis and Outlook Volume (Unit) Forecast by Operation, 2019 to 2034

Table 9: Industry Analysis and Outlook Value (US$ Million) Forecast by Vehicle Type, 2019 to 2034

Table 10: Industry Analysis and Outlook Volume (Unit) Forecast by Vehicle Type, 2019 to 2034

Table 11: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 12: South Gyeongsang Industry Analysis and Outlook Volume (Unit) Forecast by Material Type, 2019 to 2034

Table 13: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2019 to 2034

Table 14: South Gyeongsang Industry Analysis and Outlook Volume (Unit) Forecast by Application, 2019 to 2034

Table 15: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Operation, 2019 to 2034

Table 16: South Gyeongsang Industry Analysis and Outlook Volume (Unit) Forecast by Operation, 2019 to 2034

Table 17: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Vehicle Type, 2019 to 2034

Table 18: South Gyeongsang Industry Analysis and Outlook Volume (Unit) Forecast by Vehicle Type, 2019 to 2034

Table 19: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 20: North Jeolla Industry Analysis and Outlook Volume (Unit) Forecast by Material Type, 2019 to 2034

Table 21: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2019 to 2034

Table 22: North Jeolla Industry Analysis and Outlook Volume (Unit) Forecast by Application, 2019 to 2034

Table 23: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Operation, 2019 to 2034

Table 24: North Jeolla Industry Analysis and Outlook Volume (Unit) Forecast by Operation, 2019 to 2034

Table 25: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Vehicle Type, 2019 to 2034

Table 26: North Jeolla Industry Analysis and Outlook Volume (Unit) Forecast by Vehicle Type, 2019 to 2034

Table 27: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 28: South Jeolla Industry Analysis and Outlook Volume (Unit) Forecast by Material Type, 2019 to 2034

Table 29: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2019 to 2034

Table 30: South Jeolla Industry Analysis and Outlook Volume (Unit) Forecast by Application, 2019 to 2034

Table 31: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Operation, 2019 to 2034

Table 32: South Jeolla Industry Analysis and Outlook Volume (Unit) Forecast by Operation, 2019 to 2034

Table 33: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Vehicle Type, 2019 to 2034

Table 34: South Jeolla Industry Analysis and Outlook Volume (Unit) Forecast by Vehicle Type, 2019 to 2034

Table 35: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 36: Jeju Industry Analysis and Outlook Volume (Unit) Forecast by Material Type, 2019 to 2034

Table 37: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2019 to 2034

Table 38: Jeju Industry Analysis and Outlook Volume (Unit) Forecast by Application, 2019 to 2034

Table 39: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Operation, 2019 to 2034

Table 40: Jeju Industry Analysis and Outlook Volume (Unit) Forecast by Operation, 2019 to 2034

Table 41: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Vehicle Type, 2019 to 2034

Table 42: Jeju Industry Analysis and Outlook Volume (Unit) Forecast by Vehicle Type, 2019 to 2034

Table 43: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 44: Rest of Industry Analysis and Outlook Volume (Unit) Forecast by Material Type, 2019 to 2034

Table 45: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2019 to 2034

Table 46: Rest of Industry Analysis and Outlook Volume (Unit) Forecast by Application, 2019 to 2034

Table 47: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Operation, 2019 to 2034

Table 48: Rest of Industry Analysis and Outlook Volume (Unit) Forecast by Operation, 2019 to 2034

Table 49: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Vehicle Type, 2019 to 2034

Table 50: Rest of Industry Analysis and Outlook Volume (Unit) Forecast by Vehicle Type, 2019 to 2034

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Material Type, 2024 to 2034

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Application, 2024 to 2034

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Operation, 2024 to 2034

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Vehicle Type, 2024 to 2034

Figure 5: Industry Analysis and Outlook Value (US$ Million) by Region, 2024 to 2034

Figure 6: Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 7: Industry Analysis and Outlook Volume (Unit) Analysis by Region, 2019 to 2034

Figure 8: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 9: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 10: Industry Analysis and Outlook Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 11: Industry Analysis and Outlook Volume (Unit) Analysis by Material Type, 2019 to 2034

Figure 12: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 13: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 14: Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 15: Industry Analysis and Outlook Volume (Unit) Analysis by Application, 2019 to 2034

Figure 16: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 17: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 18: Industry Analysis and Outlook Value (US$ Million) Analysis by Operation, 2019 to 2034

Figure 19: Industry Analysis and Outlook Volume (Unit) Analysis by Operation, 2019 to 2034

Figure 20: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Operation, 2024 to 2034

Figure 21: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Operation, 2024 to 2034

Figure 22: Industry Analysis and Outlook Value (US$ Million) Analysis by Vehicle Type, 2019 to 2034

Figure 23: Industry Analysis and Outlook Volume (Unit) Analysis by Vehicle Type, 2019 to 2034

Figure 24: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Vehicle Type, 2024 to 2034

Figure 25: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Vehicle Type, 2024 to 2034

Figure 26: Industry Analysis and Outlook Attractiveness by Material Type, 2024 to 2034

Figure 27: Industry Analysis and Outlook Attractiveness by Application, 2024 to 2034

Figure 28: Industry Analysis and Outlook Attractiveness by Operation, 2024 to 2034

Figure 29: Industry Analysis and Outlook Attractiveness by Vehicle Type, 2024 to 2034

Figure 30: Industry Analysis and Outlook Attractiveness by Region, 2024 to 2034

Figure 31: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Material Type, 2024 to 2034

Figure 32: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Application, 2024 to 2034

Figure 33: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Operation, 2024 to 2034

Figure 34: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Vehicle Type, 2024 to 2034

Figure 35: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 36: South Gyeongsang Industry Analysis and Outlook Volume (Unit) Analysis by Material Type, 2019 to 2034

Figure 37: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 38: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 39: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 40: South Gyeongsang Industry Analysis and Outlook Volume (Unit) Analysis by Application, 2019 to 2034

Figure 41: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 42: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 43: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Operation, 2019 to 2034

Figure 44: South Gyeongsang Industry Analysis and Outlook Volume (Unit) Analysis by Operation, 2019 to 2034

Figure 45: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Operation, 2024 to 2034

Figure 46: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Operation, 2024 to 2034

Figure 47: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Vehicle Type, 2019 to 2034

Figure 48: South Gyeongsang Industry Analysis and Outlook Volume (Unit) Analysis by Vehicle Type, 2019 to 2034

Figure 49: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Vehicle Type, 2024 to 2034

Figure 50: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Vehicle Type, 2024 to 2034

Figure 51: South Gyeongsang Industry Analysis and Outlook Attractiveness by Material Type, 2024 to 2034

Figure 52: South Gyeongsang Industry Analysis and Outlook Attractiveness by Application, 2024 to 2034

Figure 53: South Gyeongsang Industry Analysis and Outlook Attractiveness by Operation, 2024 to 2034

Figure 54: South Gyeongsang Industry Analysis and Outlook Attractiveness by Vehicle Type, 2024 to 2034

Figure 55: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Material Type, 2024 to 2034

Figure 56: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Application, 2024 to 2034

Figure 57: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Operation, 2024 to 2034

Figure 58: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Vehicle Type, 2024 to 2034

Figure 59: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 60: North Jeolla Industry Analysis and Outlook Volume (Unit) Analysis by Material Type, 2019 to 2034

Figure 61: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 62: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 63: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 64: North Jeolla Industry Analysis and Outlook Volume (Unit) Analysis by Application, 2019 to 2034

Figure 65: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 66: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 67: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Operation, 2019 to 2034

Figure 68: North Jeolla Industry Analysis and Outlook Volume (Unit) Analysis by Operation, 2019 to 2034

Figure 69: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Operation, 2024 to 2034

Figure 70: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Operation, 2024 to 2034

Figure 71: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Vehicle Type, 2019 to 2034

Figure 72: North Jeolla Industry Analysis and Outlook Volume (Unit) Analysis by Vehicle Type, 2019 to 2034

Figure 73: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Vehicle Type, 2024 to 2034

Figure 74: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Vehicle Type, 2024 to 2034

Figure 75: North Jeolla Industry Analysis and Outlook Attractiveness by Material Type, 2024 to 2034

Figure 76: North Jeolla Industry Analysis and Outlook Attractiveness by Application, 2024 to 2034

Figure 77: North Jeolla Industry Analysis and Outlook Attractiveness by Operation, 2024 to 2034

Figure 78: North Jeolla Industry Analysis and Outlook Attractiveness by Vehicle Type, 2024 to 2034

Figure 79: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Material Type, 2024 to 2034

Figure 80: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Application, 2024 to 2034

Figure 81: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Operation, 2024 to 2034

Figure 82: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Vehicle Type, 2024 to 2034

Figure 83: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 84: South Jeolla Industry Analysis and Outlook Volume (Unit) Analysis by Material Type, 2019 to 2034

Figure 85: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 86: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 87: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 88: South Jeolla Industry Analysis and Outlook Volume (Unit) Analysis by Application, 2019 to 2034

Figure 89: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 90: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 91: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Operation, 2019 to 2034

Figure 92: South Jeolla Industry Analysis and Outlook Volume (Unit) Analysis by Operation, 2019 to 2034

Figure 93: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Operation, 2024 to 2034

Figure 94: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Operation, 2024 to 2034

Figure 95: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Vehicle Type, 2019 to 2034

Figure 96: South Jeolla Industry Analysis and Outlook Volume (Unit) Analysis by Vehicle Type, 2019 to 2034

Figure 97: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Vehicle Type, 2024 to 2034

Figure 98: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Vehicle Type, 2024 to 2034

Figure 99: South Jeolla Industry Analysis and Outlook Attractiveness by Material Type, 2024 to 2034

Figure 100: South Jeolla Industry Analysis and Outlook Attractiveness by Application, 2024 to 2034

Figure 101: South Jeolla Industry Analysis and Outlook Attractiveness by Operation, 2024 to 2034

Figure 102: South Jeolla Industry Analysis and Outlook Attractiveness by Vehicle Type, 2024 to 2034

Figure 103: Jeju Industry Analysis and Outlook Value (US$ Million) by Material Type, 2024 to 2034

Figure 104: Jeju Industry Analysis and Outlook Value (US$ Million) by Application, 2024 to 2034

Figure 105: Jeju Industry Analysis and Outlook Value (US$ Million) by Operation, 2024 to 2034

Figure 106: Jeju Industry Analysis and Outlook Value (US$ Million) by Vehicle Type, 2024 to 2034

Figure 107: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 108: Jeju Industry Analysis and Outlook Volume (Unit) Analysis by Material Type, 2019 to 2034

Figure 109: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 110: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 111: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 112: Jeju Industry Analysis and Outlook Volume (Unit) Analysis by Application, 2019 to 2034

Figure 113: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 114: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 115: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Operation, 2019 to 2034

Figure 116: Jeju Industry Analysis and Outlook Volume (Unit) Analysis by Operation, 2019 to 2034

Figure 117: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Operation, 2024 to 2034

Figure 118: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Operation, 2024 to 2034

Figure 119: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Vehicle Type, 2019 to 2034

Figure 120: Jeju Industry Analysis and Outlook Volume (Unit) Analysis by Vehicle Type, 2019 to 2034

Figure 121: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Vehicle Type, 2024 to 2034

Figure 122: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Vehicle Type, 2024 to 2034

Figure 123: Jeju Industry Analysis and Outlook Attractiveness by Material Type, 2024 to 2034

Figure 124: Jeju Industry Analysis and Outlook Attractiveness by Application, 2024 to 2034

Figure 125: Jeju Industry Analysis and Outlook Attractiveness by Operation, 2024 to 2034

Figure 126: Jeju Industry Analysis and Outlook Attractiveness by Vehicle Type, 2024 to 2034

Figure 127: Rest of Industry Analysis and Outlook Value (US$ Million) by Material Type, 2024 to 2034

Figure 128: Rest of Industry Analysis and Outlook Value (US$ Million) by Application, 2024 to 2034

Figure 129: Rest of Industry Analysis and Outlook Value (US$ Million) by Operation, 2024 to 2034

Figure 130: Rest of Industry Analysis and Outlook Value (US$ Million) by Vehicle Type, 2024 to 2034

Figure 131: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 132: Rest of Industry Analysis and Outlook Volume (Unit) Analysis by Material Type, 2019 to 2034

Figure 133: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 134: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 135: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 136: Rest of Industry Analysis and Outlook Volume (Unit) Analysis by Application, 2019 to 2034

Figure 137: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 138: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 139: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Operation, 2019 to 2034

Figure 140: Rest of Industry Analysis and Outlook Volume (Unit) Analysis by Operation, 2019 to 2034

Figure 141: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Operation, 2024 to 2034

Figure 142: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Operation, 2024 to 2034

Figure 143: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Vehicle Type, 2019 to 2034

Figure 144: Rest of Industry Analysis and Outlook Volume (Unit) Analysis by Vehicle Type, 2019 to 2034

Figure 145: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Vehicle Type, 2024 to 2034

Figure 146: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Vehicle Type, 2024 to 2034

Figure 147: Rest of Industry Analysis and Outlook Attractiveness by Material Type, 2024 to 2034

Figure 148: Rest of Industry Analysis and Outlook Attractiveness by Application, 2024 to 2034

Figure 149: Rest of Industry Analysis and Outlook Attractiveness by Operation, 2024 to 2034

Figure 150: Rest of Industry Analysis and Outlook Attractiveness by Vehicle Type, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Load Floor Market Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Korea Automotive Performance Tuning and Engine Remapping Service Industry Size and Share Forecast Outlook 2025 to 2035

Korea Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

Korea Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Korea Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Automotive Flooring Market Size and Share Forecast Outlook 2025 to 2035

Automotive Floor Mats Market

Floor-standing Brain Function Monitor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA