In barrel liner market, increasing need of hygienic and contaminant free storage and transportation facilities in applications such as food & beverage, pharmaceuticals, chemicals, waste management will account for steady growth in barrel liner market between 2025 to 2035.

Basically, a barrel liner (or a drum liner) is a barrier between a barrel/drum and the materials being stored. That, in turn, means cleaner products, reduced cleaning costs, and longer barrel life.

Strong focus on regulatory compliance and adherence to safety standards, primarily in pharmaceuticals and food processing sectors, is fueling a significant share of the market.

Instead, we can beef up the hygiene measures throughout food-grade processes, making use of only edible plastic barrel liners that are FDA compliant and ideally recyclable, provided strict hygiene, cross-contamination prevention, and green packaging standards are followed. In the chemical industry, high-performance barrel liners are also indispensable for safely storing and transporting hazardous or corrosive materials.

The use of anti-static, conductive, and flexible barrel liners in the electronics, pharmaceutical, and hazardous waste management industries is also growing in popularity. Furthermore, growing need for environment friendly and sustainable barrel liners that minimize environmental impacts is also promote the growth of this industry.

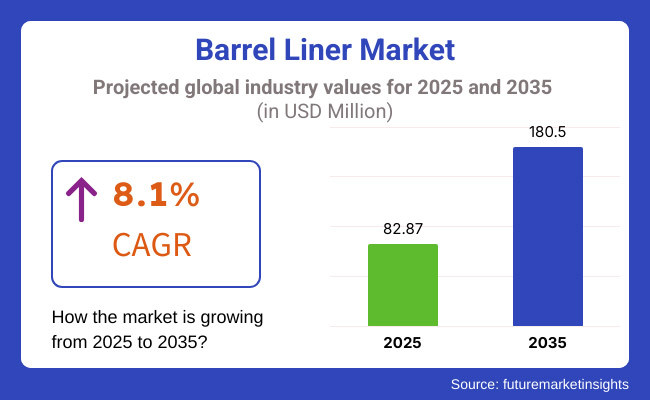

The barrel liner market accounted for USD 82.87 million in the year 2025 and is expected to reach USD 180.5 million by the year 2035, at a CAGR of 8.1% during the forecast period.

North America will occupy a pile of the demand for generations due as its want to thrust ahead in the food safety, pharmaceutical business, and suicidal improvement in packaging solutions. The adoption of high-performance barrel liners in factories in the food and chemical sectors is experiencing growth in both the USA and Canada.

Value chain analysis of the composite market shows that most of the demand in Europe comes from Germany, the UK, and France owing to the industrial domination in this area and sustainability initiatives. EU environmental policies are promoting the use of biodegradable and recyclable liners.

Asia-Pacific is expected to be the fastest-growing market due to the rapid growth of chemical production, food processing, and medicament industry in China, India, and Japan. Rising industrialization and exports in the region has increased the demand for cost-effective and durable end products are expected to contribute towards liner market growth.

Latin America continues its steady performance, driven by increasing food exports, pharmaceutical volume growth, and stronger standards for industrial waste treatment in Brazil, Mexico, and elsewhere. The market will witness an increase in anti-leak and heavy-duty liners.

Middle East & Africa market is emerging, and a growing demand for industrial packaging solutions, chemical processing, and waste management has been observed in countries such as UAE, Saudi Arabia, and South Africa. The oil & gas applications of barrel liners are additionally growing in demand.

Challenge

Material Compatibility and Regulatory Compliance

The barrel liner market is heading some challenges regarding material compatibility with different factors and also compliance with stringent regulations. Barrel liners need to withstand chemicals and food products, pharmaceuticals, and industrial liquids.

Regulatory requirements such as FDA and EU regulations, and thus compliance with international safety standards, add to the manufacturing costs and reduce market accessibility for smaller players. Moreover, environmental issues surrounding the disposal of plastic-based barrel liners have created a need for sustainable alternatives.

Opportunity

Growth in Sustainable and High-Performance Barrel Liners

Barrel liners in and effort to combat the environmental damages most liners create, companies are taking it upon themselves to invest in biodegradable and/or recyclable liners. Moreover, sectors including food and beverage, pharmaceuticals, and specialty chemicals require liners with superior barrier characteristics more recently to protect product integrity and shelf life.

The market will benefit over the upcoming years from improvements in multi-layered liner technology, customizability options, and the seamless integration of automated barrel-filling processes.

From 2020 to 2024, the barrel liner market has grown steadily, primarily due to increased adoption in food processing, pharmaceutical, and chemical use. Manufacturers worked to enhance liner durability and chemical resistance, ensuring compliance with industry regulations.

However, factors such as volatile raw material prices, supply chain disruptions, and concerns pertaining to single-use plastic waste, hampered the market growth. Companies responded by using recyclable materials and designing anti-contamination liners.

Looking forward 2025 to 2035, there will process innovation with material innovations, sustainability, and automation integration. The key will be the drive towards biodegradable and compostable barrel liners, meeting environmental regulations and consumer preferences. Along with advanced lining leak detection, temperature regulation through smart liner technology will add to their industrial applications.

This will ensure that the companies at the forefront of the market will be those which are focused on closed-loop recycling systems, cost-effective production, and customization for industry-specific needs.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with basic food-grade and industrial safety norms |

| Material Innovation | Use of polyethylene and polypropylene liners |

| Industry Adoption | Demand from food, pharma, and chemical industries |

| Supply Chain and Sourcing | Dependence on traditional plastic liners |

| Market Competition | Presence of regional manufacturers |

| Market Growth Drivers | Hygiene, contamination prevention, and industrial safety |

| Sustainability | Initial adoption of recyclable materials |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of sustainability regulations, stricter disposal guidelines, and incentives for eco-friendly liners |

| Material Innovation | Increased adoption of biodegradable, recyclable, and high-barrier multi-layer liners |

| Industry Adoption | Expansion into new sectors, including biotechnology and specialty manufacturing |

| Supply Chain and Sourcing | Shift towards bio-based materials and closed-loop recycling solutions |

| Market Competition | Growth in global players offering customized and smart liner solutions |

| Market Growth Drivers | Technological advancements, sustainability focus, and high-performance liner coatings |

| Sustainability | Large-scale implementation of compostable and zero-waste barrel liners |

The United States is growing at a stable pace, where chemicals, pharmaceuticals and food processing industries are giving rise to the growth of barrel liners.

As the focus on safe handling, avoidance of contamination and relatively newer concepts like environmental sustainability gain momentum, there is a widespread need for high-quality barrel liners to maximize the lifespan of drums, enhance efficiency and ensure regulatory compliance.

Strict FDA and EPA regulations regarding the handling of food-grade and hazardous materials are boosting the uptake of barrel liners with strong, chemical-resistant, and environmentally friendly materials, including polyethylene, polypropylene, and biodegradable plastics.

Increasing number of industrial packaging solutions in oil & lubricants, paints & coatings, specialty chemicals are also expected to propel the demand for custom-fit, anti-static and moisture-resistant liners.

Moreover, increasing implementations of circular economy initiatives is leading the manufacturers to create recyclable and reusable barrel liners, minimizing waste and enhancing cost efficiency across various manufacturing and logistics sectors. With a rapid growth of e-commerce and bulk shipping, the demand for protective inner lining to secure products' safety during long distance transport increases.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.4% |

Owing to the increasing industrial production, rising sustainability initiatives, and stringent waste management and food safety regulations, the United Kingdom barrel liner market is growing continuously. The UK’s new approach to reduce plastic waste is prompting businesses to transition to recyclable and biodegradable barrel liners, which are made from environmentally friendly polymers and compostable materials.

Furthermore, development in pharmaceuticals and chemicals is also fuelling demand for composite made high performance, contamination-free, REACH and HACCP compliant liner solutions. The trend of specialty food processing and beverage manufacturing is also contributing to the demand for FDA-compliant, food-grade barrel liners that preserve product quality and hygiene.

As hazardous waste disposal in industrial drums becomes more common, manufacturers are creating multi-layer, leak-proof liners that are more durable and provide better chemical resistance. Additionally, the surge in export-oriented industries is propelling the demand for protective liners for cross-border bulk trips.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 8.2% |

The EU barrel liner market is prospering due to stringent environmental laws, growing industrial automation, and increasing acceptance & demand for sustainable & eco-friendly packaging solutions.

The EU Circular Economy Action Plan, barrel liners, such as those made from glass fibers that are environmentally, chemical, and thermally recyclable, are in demand due to the need for their eco-friendly, recyclable, and reusable characteristics to reduce plastic waste and improve supply chain efficiency.

A clastic future of international barrel packaging advanced barrel liners with anti-static, moisture-resistant, and chemical-proof properties are the demand high-performance industrial packaging is needed in the fields of automotive, chemicals, pharmaceuticals, food processing, and more.

Germany, France, and Italy have been at the forefront of custom-fit liners that reduce cross-contamination for specialty chemicals, lubricants, and paints, thus helping prevent degradation.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 8.1% |

The Japan barrel liner market is on an upward trajectory, supported by the development of novel barrel liner solutions for demanding chemical applications, industrial packaging innovations, and stringent food safety regulations.

Manufacturers from Japan’s electronics, and pharmaceutical industries are increasingly employing custom-engineered barrel liners that deliver a secure fit, superior chemical resistance, and longer product shelf life, that were previously unachievable from more conventional liners.

Japan’s focus on quality and hygiene, the demand for high-grade food and pharmaceutical-grade packaging solutions is on the rise. This has led manufacturers to invest heavily in the development of advanced polymer materials, multi-layered liners, and intelligent packaging solutions that not only improve product protection but also help minimize material waste.

The miniaturization trend in high-tech industries is also driving demand for precision-fit liners for small-scale industrial applications.

At the same time, the need for sustainable manufacturing in Japan is fuelling the growth of the biodegradable and recyclable barrel liner, in line with government guidelines regarding carbon neutrality and green packaging. Moreover, growing automation support in industrial packaging is resulting in need for personalized, tamper-free liners for bulk transportation.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.3% |

The South Korean barrel liner market is booming due to various factors such as the prevalence of industry automation, growing exports of specialty chemicals, and demand for environmental friendly packaging solution.

Given the strength of South Korea’s chemicals, pharmaceuticals and high-tech manufacturing, demand for high-performance barrel liners that provide better chemical resistance and anti-contamination protection is increasing.

The South Korean government's emphasis on sustainable packaging solutions is driving the trend for biodegradable and recyclable barrel liners to reduce industrial plastic waste. Also, with the booming semiconductor and electronics manufacturing, the demand for anti-static, dust-proof, and precision-engineered liners that guarantee the safe handling of sensitive materials is on the rise.

To secure the global supply chain, South Korean manufacturers are also investing in smart packaging technologies to combine RFID tracking and tamper-proof sealing with growing exports of industrial goods.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.2% |

The barrel liner market has been segmented into LDPE and HDPE segments, where industries are increasingly preferring flexible, thicker packaging solutions that help to store liquid, chemicals, and powders without leakage, leading the two segments. These materials provide extended product shelf life and contamination-free storage for a wide range of applications.

The LDPE segment witness high growth due its lightweight nature, superior elasticity, and moisture resistance. LDPE barrel liners are commonly used packaging for food, chemicals and pharmaceutical products, where content should be protected from contamination during storage and transportation.

Food-grade LDPE barrel liners, being non-toxic and BPA-free, have contributed to the growth of the market, as they comply with international safety regulations for food processing and handling.

Market adoption has been raised through the increasing preference for high-clarity LDPE liners, which are characterized by their transparency as well as their lightweight composition material, this was essential for product identification and reduction in the cost incurred due to packaging.

The biodegradable LDPE liners, consisting of plant-based additives under development, and recyclability of material structures have strengthened the growth of the market, thereby providing sustainable packaging solutions.

Increasing end use of heat-sealable LDPE barrel liners with fragrances and puncture resistance has bolster growth of LDPE barrel liners market to ensure safe and leak proof storage.

LDPE is less chemically resistant than other materials, despite its advantages. But multi-layer LDPE technology is evolving to make these more durable, which means broader industrial applications.

The HDPE segment commands the largest market share on account of its high tensile strength, better impact resistance, and good barrier properties. These liners are commonly used in chemical, pharmaceutical, and industrial packaging for product safety and use.

However, the rapid inclination toward heavy-duty HDPE barrel liners with layering and anti-leak characteristics has driven the demand in the market, promising protection for harmful and corrosive materials. Due to advancements in polymer stabilizers, there is a growing interest in UV resistant HDPE liners primarily due to ability of liners to provide longer lifespan in outdoor storage and thus driving the market growth.

The adoption of anti-static HDPE liners with electro-static dissipative properties ensures safety in flammable and electronic packages, thus propelling market expansion. The market growth has been up surging owing to increases in the demand of customized HDPE liners with different variations in thickness and heat-sealed edges ensuring they can fit to various sizes of barrels and storage requirements.

The market for barrel liners is segmented into flexible barrel liner and rigid barrel liner, as industries look for packaging solutions that provide flexibility as well as strength.

Flexible barrel liner segment is growing on account of its lightweight design, ease of disposal and its cost-effective nature. They are often used for hygienic and non-contaminated storage of food, pharmaceutical, and chemicals.

This has been beneficial for the market, primarily, the multi-layer flexible barrel liner with polymer-reinforced layers for greater leak resistance and shelf life.

The mounting demand for vacuum-sealable flexible liners with gas-tight closures has bolstered the market as it ensures higher product freshness and minimizes oxidation risks. The widespread availability of flexible liners with dispensing spouts, which are designed to be user-friendly, has boosted market demand, which allows assured control over product dispensing with no risk of spillage.

The increased utilization of sustainable flexible liners, consisting of biodegradable and recyclable materials, has propelled market growth while adhering to global ecological regulations.

Flexible liners offer more savings and ease-of-use, but are typically not as durable as rigid liners. But, new advanced polymer blends are providing them with better strength properties which are equipped for give them more extensive mechanical applications.

The barrel liner market is projected to grow at a steady rate, owing to the rising demand for industrial packaging solutions that protect products from damage, contamination and enhance storage efficiency.

The growing need to maintain hygiene standards and extend the shelf life of stored materials is propelling barrel liners demand in various industries including food & beverages, chemicals, pharmaceuticals, oil & lubricants. Other trends facilitating the competitive outlook include a move towards biodegradable and recyclable liners, as well as innovations in multi-layer polymer technologies.

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Greif, Inc. | 20-24% |

| Berry Global Inc. | 14-18% |

| Protective Lining Corp. | 10-14% |

| CDF Corporation | 8-12% |

| International Plastics, Inc. | 6-10% |

| Others | 22-30% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Greif, Inc. | Specializes in industrial packaging, including high-performance polyethylene barrel liners for hazardous and non-hazardous materials. |

| Berry Global Inc. | Manufactures custom-engineered barrel liners with anti-static, UV-resistant, and recyclable materials. |

| Protective Lining Corp. | Provides multi-layer, chemical-resistant drum and barrel liners for industrial applications. |

| CDF Corporation | Develops innovative flexible liners for food, pharmaceutical, and chemical storage with a focus on sustainability. |

| International Plastics, Inc. | Offers custom-fit polyethylene and high-barrier film liners for diverse industrial needs. |

Key Market Insights

Greif, Inc. (20-24%)

Greif remains the market leader due to its strong industrial packaging portfolio, offering barrel liners with enhanced puncture resistance, food-grade certification, and high chemical compatibility.

Berry Global Inc. (14-18%)

Berry Global leverages its polymer expertise to produce durable, eco-friendly barrel liners with enhanced moisture barriers, catering to food processing and pharmaceutical sectors.

Protective Lining Corp. (10-14%)

This company focuses on high-strength, corrosion-resistant liners, particularly serving chemical, lubricant, and industrial liquid packaging industries.

CDF Corporation (8-12%)

CDF’s flexible, form-fit liners provide cost-effective, sustainable alternatives to rigid industrial packaging, making them popular among small-to-medium enterprises (SMEs).

International Plastics, Inc. (6-10%)

With a specialization in custom-fit liners, International Plastics serves diverse industries, including agriculture, food storage, and hazardous waste containment.

The overall market size for barrel liner market was USD 82.87 million in 2025.

The barrel liner market is expected to reach USD 180.5 million in 2035.

The expansion of the barrel liner market will be driven by increasing demand for contamination-free storage and transportation solutions across food, chemical, and pharmaceutical industries.

The top 5 countries which drives the development of barrel liner market are USA, European Union, Japan, South Korea and UK

Flexible and Rigid Barrel Liners to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rain Barrels Market Size and Share Forecast Outlook 2025 to 2035

Wine Barrel Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Rain Barrel Manufacturers

Wooden Barrels Market Growth - Demand & Forecast 2025 to 2035

Hogshead Barrel Market

Puncheon Barrel Market

Wine, Scotch, and Whiskey Barrels Market Size and Share Forecast Outlook 2025 to 2035

Linerless Label Market Size and Share Forecast Outlook 2025 to 2035

Linerless Closures Market Size and Share Forecast Outlook 2025 to 2035

Market Positioning & Share in Linerless Label Industry

Liner Bag Market Report – Key Trends & Forecast 2024-2034

Liner Hanger Market

Eyeliner and Kajal Sculpting Pencil Packaging Market Trends and Forecast 2025 to 2035

Evaluating Eyeliner and Kajal Sculpting Pencil Packaging Market Share & Provider Insights

Eyeliner Pen Market

Box Liners Market Size and Share Forecast Outlook 2025 to 2035

IBC Liner Market Size and Share Forecast Outlook 2025 to 2035

Pan Liner Market Insights – Demand, Growth & Industry Trends 2025-2035

EPE Liner Market Analysis – Size, Growth & Demand 2025 to 2035

Examining Market Share Trends in the Cap Liner Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA