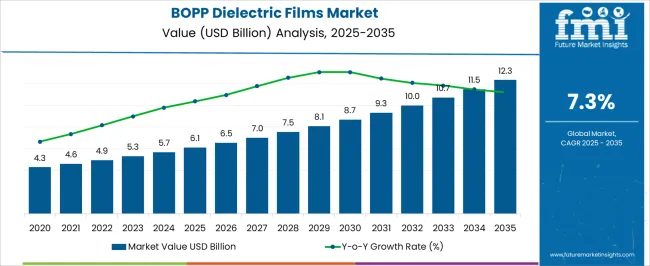

The BOPP dielectric films sector is projected to grow from USD 6.1 billion in 2025 to USD 12.3 billion in 2035, advancing at a CAGR of 7.3%. The 10-year growth comparison shows values increasing from 6.1 billion in 2025 to 7.5 billion in 2028 and 8.7 billion by 2030. This steady rise reflects their expanding role in capacitors, insulation materials, and electronic devices where performance stability and dielectric strength are critical.

Growth curve signals more than gradual adoption, as BOPP films are increasingly recognized for their reliability in energy storage, circuit protection, and industrial power systems. By 2031, the sector is expected to reach 9.3 billion, moving to 10.7 billion in 2033 and closing at 12.3 billion in 2035. The comparison highlights sustained expansion, supported by the rising production of electrical equipment and growing demand for reliable polymer-based films. Trajectory reflects a long-term opportunity for suppliers focusing on material innovation, extended product lifecycles, and global distribution. The decade-long curve confirms that BOPP dielectric films are securing a stronger position in the electronics and power segments, with steady value accumulation expected across multiple industrial and regional markets.

| Metric | Value |

|---|---|

| BOPP Dielectric Films Market Estimated Value in (2025 E) | USD 6.1 billion |

| BOPP Dielectric Films Market Forecast Value in (2035 F) | USD 12.3 billion |

| Forecast CAGR (2025 to 2035) | 7.3% |

The BOPP dielectric films segment is estimated to contribute nearly 24% of the dielectric films market, about 20% of the capacitor films market, close to 16% of the electrical insulation materials market, nearly 12% of the flexible packaging films market, and around 14% of the polymer films market. Collectively, this equals an aggregated share of approximately 86% across its parent categories. This proportion underscores the pivotal role of BOPP dielectric films in applications where electrical insulation, high voltage stability, and mechanical strength are required. Their presence has been firmly established in capacitors, transformers, and power electronics, where performance consistency and reliability directly shape operational efficiency.

Demand has been reinforced by growing deployment of renewable energy projects, expansion of electric mobility, and the rising need for miniaturized, high-performance electronic devices. BOPP dielectric films are also valued for their versatility, being applied beyond power systems into flexible packaging and industrial laminates. This breadth of application ensures that their share within parent markets remains substantial, positioning them as not only essential functional materials but also as enablers of innovation in electrical and industrial applications. As such, BOPP dielectric films are regarded as a defining category that shapes the direction of both energy infrastructure and advanced material usage worldwide.

The market is witnessing robust expansion driven by increasing demand for high-performance insulating materials in electrical and electronic applications. The growing deployment of energy-efficient systems, renewable energy integration, and advancements in power electronics supports current market momentum.

The capability of BOPP dielectric films to deliver superior thermal stability, excellent dielectric strength, and consistent performance under high-voltage stress is strengthening their adoption. Additionally, the trend toward miniaturization of components and the need for lightweight yet durable materials are influencing manufacturers to adopt BOPP films across various industrial sectors.

Increasing investments in smart grid infrastructure, electric mobility, and consumer electronics production are further shaping the market’s future outlook. With continuous material innovations and a shift toward sustainable manufacturing practices, the market is positioned to achieve sustained growth, supported by the rising preference for recyclable and high-durability film solutions across industries.

The bopp dielectric films market is segmented by type, application, end use industry, and geographic regions. By type, bopp dielectric films market is divided into metalized films and plain films. In terms of application, bopp dielectric films market is classified into AC & DC film capacitors, power capacitor, inverters & converters, cable wraps, and others (electronic circuits and battery separators). Based on end use industry, bopp dielectric films market is segmented into consumer electronics, power generation, automotive, industrial equipment, and others (aerospace, medical devices). Regionally, the bopp dielectric films industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

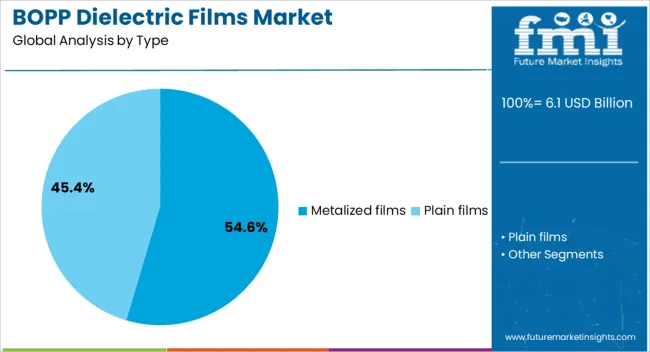

The metalized films segment is projected to account for 54.6% of the BOPP dielectric films market revenue in 2025, making it the leading type segment. This leadership position is being driven by the ability of metalized films to provide enhanced electrical conductivity while maintaining strong dielectric properties. Their lightweight structure, combined with high moisture resistance and thermal stability, makes them highly suitable for demanding capacitor applications.

The increasing use of high-performance capacitors in renewable energy systems, automotive electronics, and industrial equipment has supported the segment’s growth. The capability to achieve extended operational life with minimal degradation under high-voltage stress has strengthened their adoption.

Additionally, advancements in vacuum metallization technology have enabled improved coating uniformity and adhesion, enhancing performance reliability. The scalability of production and compatibility with a wide range of capacitor designs continue to position metalized films as the preferred choice for manufacturers seeking efficiency and performance consistency.

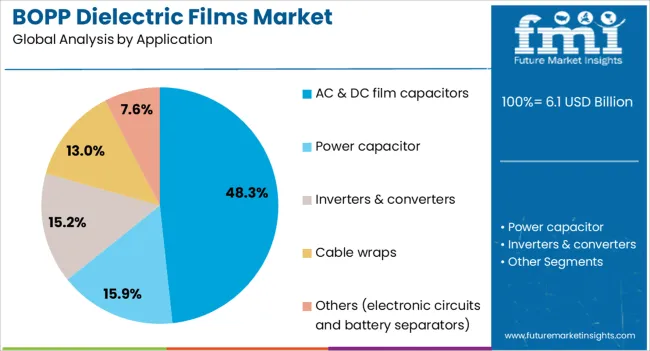

The AC & DC film capacitors segment is anticipated to hold 48.3% of the market revenue in 2025, emerging as the largest application category. This dominance is being attributed to the extensive use of these capacitors in power transmission, industrial drives, electric vehicles, and renewable energy systems.

BOPP dielectric films are preferred in this segment due to their low dielectric loss, excellent insulation resistance, and capability to operate reliably under fluctuating voltage and temperature conditions. The transition toward more energy-efficient electrical systems and the integration of renewable energy sources into the grid have further increased the need for durable and high-performance capacitors.

The capacity of BOPP films to ensure stable performance over long operational cycles without significant aging has reinforced their deployment. Moreover, their compatibility with both AC and DC voltage environments provides flexibility, making them indispensable in a broad range of electrical and electronic applications.

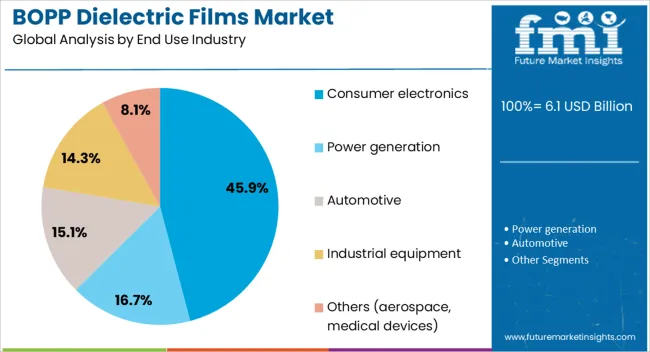

The consumer electronics segment is expected to represent 45.9% of the market revenue in 2025, making it the largest end-use industry. This segment’s growth is being fueled by the rising demand for compact, energy-efficient, and durable electronic devices. BOPP dielectric films play a critical role in improving the performance and reliability of capacitors used in televisions, audio systems, computers, smartphones, and other household electronics.

Their superior electrical insulation, resistance to humidity, and high breakdown strength ensure long-term functionality of components even in challenging environments. Increasing production of advanced consumer electronics, driven by lifestyle changes and technological innovation, has boosted the requirement for reliable dielectric materials.

The capacity of BOPP films to meet stringent quality and safety standards in mass production has made them the preferred material in this industry. As consumer electronics continue to evolve toward higher functionality and energy efficiency, the segment is expected to sustain its market leadership.

The BOPP dielectric films market is projected to grow steadily, supported by increasing applications in capacitors, electronics, and energy storage systems. Demand is reinforced by their superior electrical insulation, thermal stability, and mechanical strength. Opportunities are emerging in renewable energy integration, high-voltage equipment, and electric vehicle components. Trends highlight thinner films for compact devices, advanced coating technologies, and regional localization of supply chains. However, challenges such as fluctuating polypropylene prices, production complexity, and competition from alternative dielectric materials continue to shape the trajectory of the BOPP dielectric films industry globally.

Demand for BOPP dielectric films has been reinforced by their critical role in capacitors used across power transmission, consumer electronics, and automotive systems. Their superior dielectric strength, low dissipation factor, and high insulation resistance make them indispensable for high-voltage applications. Demand is strongest in renewable energy projects and grid infrastructure, where capacitors rely heavily on dielectric films for performance and durability. The rise of electric vehicles has further driven adoption, as BOPP films are essential in onboard power electronics and charging systems. With industries prioritizing compact, efficient, and reliable components, BOPP dielectric films have become a cornerstone material. This rising demand demonstrates why manufacturers and utilities view these films as strategic inputs in supporting long-term energy efficiency and reliability across multiple sectors.

Opportunities in the BOPP dielectric films market are being shaped by the rapid expansion of electric vehicles, renewable energy, and industrial electronics. EV manufacturers are adopting dielectric films for capacitors used in propulsion systems, power converters, and battery management units. Renewable energy projects, particularly wind and solar, present further opportunities as inverters and grid stabilizers require dielectric films for consistent performance. Opportunities also exist in developing thinner and more heat-resistant films to support miniaturization in consumer electronics. Regional localization of film production in Asia and Europe has created opportunities for suppliers to secure long-term contracts with capacitor manufacturers. These opportunities underscore how the market is evolving from traditional power applications into a broader role, supporting both industrial innovation and clean energy transitions.

Trends in the BOPP dielectric films market emphasize reduced film thickness, advanced coatings, and regional integration of supply chains. Thinner films are trending as manufacturers aim to deliver compact capacitors with higher efficiency. Coating technologies such as plasma treatment and nano-layer deposition are gaining prominence, improving dielectric performance and extending operational lifespans. Regionalization of supply chains is becoming a visible trend, with local production favored to reduce logistics costs and ensure stable supply. The shift toward films with enhanced heat resistance and moisture barriers has also shaped product development. Growing demand from consumer electronics and automotive industries reinforces these trends. Collectively, these shifts indicate a market driven by efficiency, performance, and strategic localization, positioning BOPP dielectric films as indispensable materials for modern electronic systems.

Challenges in the BOPP dielectric films market revolve around polypropylene price volatility, production complexity, and competition from alternative dielectric materials. Fluctuating raw material prices have directly impacted profitability, forcing manufacturers to manage margin pressures. Production of high-quality films with uniform thickness requires advanced equipment and stringent process control, limiting participation by smaller players. Competition from PET and PEN dielectric films is rising, especially in applications requiring higher thermal resistance. Meeting diverse regional regulatory standards for electrical components adds further cost and complexity. Supply chain disruptions in raw material sourcing and film processing have also delayed project timelines. These challenges highlight that while BOPP dielectric films offer significant performance advantages, sustained market growth will depend on overcoming structural hurdles related to cost efficiency, standardization, and competition.

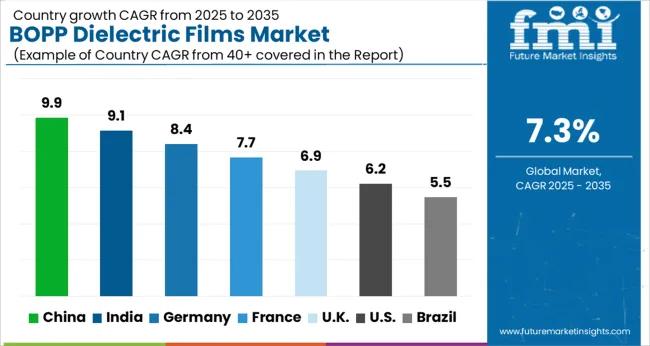

| Country | CAGR |

|---|---|

| China | 9.9% |

| India | 9.1% |

| Germany | 8.4% |

| France | 7.7% |

| UK | 6.9% |

| USA | 6.2% |

| Brazil | 5.5% |

The global BOPP dielectric films market is projected to grow at a CAGR of 7.3% between 2025 and 2035. China leads at 9.9%, followed by India at 9.1% and Germany at 8.4%. The United Kingdom is forecast at 6.9%, while the United States records 6.2%. Growth is supported by rising demand in capacitors, electrical insulation, and renewable power applications. Asian countries achieve faster adoption due to large scale electronics manufacturing and cost competitive production. Germany secures its role as a European hub for advanced film technologies with strict quality standards and strong industrial demand. The UK progresses through steady adoption in energy and electronics, while the USA reflects moderate growth, shaped by replacement cycles, innovation in high performance films, and adoption in renewable energy integration projects. This report includes insights on 40+ countries; the top markets are shown here for reference.

The BOPP dielectric films market in China is projected to grow at a CAGR of 9.9%. Expansion is driven by the country’s strong electronics manufacturing base, high demand from capacitor producers, and rapid integration of renewable energy systems. Domestic manufacturers scale production capacity to supply both local industries and global export markets. Investments in high voltage capacitor applications and advanced film technologies reinforce China’s dominance in the supply chain. Government backed infrastructure programs, including grid modernization and renewable integration, further support adoption. With cost competitiveness, strong industrial demand, and export capacity, China remains the largest global market for BOPP dielectric films.

The BOPP dielectric films market in India is forecast to expand at a CAGR of 9.1%. Growth is fueled by rising consumption in consumer electronics, power distribution, and capacitor manufacturing. Domestic firms expand capacity to meet local demand while reducing import dependence. Government programs supporting renewable energy projects, particularly solar and wind, increase deployment of dielectric films in grid applications. Rising urban demand for consumer electronics and industrial automation further strengthens adoption. India’s cost effective production capabilities and expanding electronics ecosystem position it as one of the fastest growing markets globally, with significant long term opportunities in both domestic and export markets.

The BOPP dielectric films market in Germany is projected to grow at a CAGR of 8.4%. Expansion is supported by strong demand from the automotive, industrial equipment, and energy sectors. German manufacturers emphasize premium quality, innovation in film thickness control, and compliance with EU safety standards. Capacitor production for electric vehicles and renewable energy storage strengthens adoption. Partnerships between film producers and capacitor manufacturers enhance performance and application in high voltage systems. With its industrial base and focus on precision, Germany remains a leader in premium dielectric films, ensuring a steady role in Europe’s renewable and automotive transitions.

The BOPP dielectric films market in the UK is forecast to grow at a CAGR of 6.9%. Growth is shaped by demand from renewable energy, electronics, and industrial applications. Utility projects and capacitor manufacturing for power distribution strengthen adoption. Import reliance remains significant, with European and Asian producers supplying advanced films to the domestic market. Demand for lightweight, durable, and high performance dielectric materials continues to expand as retrofitting of energy networks progresses. Although growth is slower than in Asia, steady adoption in renewable integration and commercial electronics sustains the UK’s contribution to the global market.

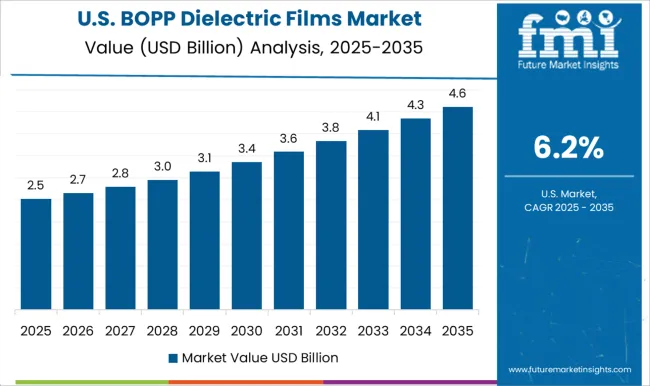

The BOPP dielectric films market in the US is projected to grow at a CAGR of 6.2%. Growth is moderate, reflecting a mature electronics and energy sector, but steady adoption is sustained by replacement cycles and expansion of renewable energy infrastructure. USA manufacturers emphasize innovation in high performance films designed for EV batteries, energy storage, and high frequency electronics. Federal support for clean energy and electrification creates opportunities for increased use of dielectric films in power distribution and storage projects. While growth lags Asia and Germany, the USA continues to hold strategic importance due to its high value innovation driven applications.

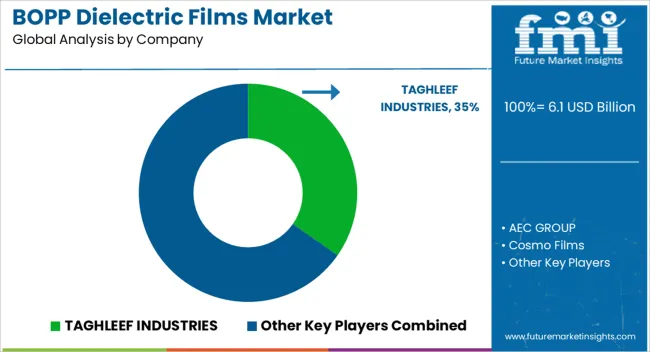

The global BOPP (Biaxially Oriented Polypropylene) dielectric films market is highly competitive, driven by growing demand from electronics, automotive, and power industries. These films are essential for capacitors, power inverters, and electric vehicle components due to their excellent dielectric strength, thermal stability, and mechanical durability. Competition is shaped by product quality, production capacity, pricing strategies, and technological differentiation.

Key players such as Taghleef Industries, Cosmo Films, JPFL Films, Toray Plastics, SRF Limited, Xpro India, Sichuan EM Technology, UFlex Limited, AEC Group, and Tatrafan dominate the market. Companies compete through investments in advanced film formulations, metallization processes, and expansion of manufacturing facilities. Long-term contracts with electronics and automotive manufacturers are leveraged to secure market share. Regional manufacturers also compete by offering cost-effective solutions and localized service, making the market moderately consolidated but with opportunities for new entrants to innovate and differentiate through specialized dielectric performance.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.1 billion |

| Type | Metalized films and Plain films |

| Application | AC & DC film capacitors, Power capacitor, Inverters & converters, Cable wraps, and Others (electronic circuits and battery separators) |

| End Use Industry | Consumer electronics, Power generation, Automotive, Industrial equipment, and Others (aerospace, medical devices) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | TAGHLEEF INDUSTRIES, AEC GROUP, Cosmo Films, HMC Polymers, JPFL Films, Sichuan EM, SRF, Tatrafan, Toray Plastics, and Xpro India |

| Additional Attributes | Dollar sales by film type (plain, metallized, specialty), Dollar sales by application (capacitors, cables, power electronics, packaging), Trends in high-voltage insulation and miniaturized capacitor designs, Role in enhancing dielectric strength and thermal stability, Growth driven by renewable energy and EV adoption, Regional consumption patterns across Asia Pacific, Europe, and North America. |

The global bopp dielectric films market is estimated to be valued at USD 6.1 billion in 2025.

The market size for the bopp dielectric films market is projected to reach USD 12.3 billion by 2035.

The bopp dielectric films market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in bopp dielectric films market are metalized films and plain films.

In terms of application, ac & dc film capacitors segment to command 48.3% share in the bopp dielectric films market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

BOPP Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

BOPP Film Market Analysis by Thickness, Packaging Format, and End-use Industry Through 2025 to 2035

Industry Share & Competitive Positioning in BOPP Packaging Tapes

BOPP Bag Market Insights & Key Trends 2024-2034

Plastic Dielectric Films Market Size and Share Forecast Outlook 2025 to 2035

TPE Films and Sheets Market Size and Share Forecast Outlook 2025 to 2035

Breaking Down PCR Films Market Share & Industry Positioning

PCR Films Market Analysis by PET, PS, PVC Through 2035

LDPE Films Market

Card Films Market

Mulch Films Market Size and Share Forecast Outlook 2025 to 2035

Nylon Films for Liquid Packaging Market from 2024 to 2034

Vinyl Films Market

MDO-PE Films Market Analysis by Cast Films and Blown Films Through 2035

Edible Films and Coatings Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Edible Films and Coatings

Retort Films Market

Tobacco Films Market Size and Share Forecast Outlook 2025 to 2035

Gelatin Films Market Size and Share Forecast Outlook 2025 to 2035

Lidding Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA