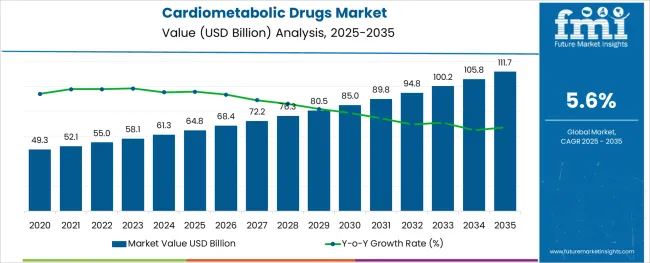

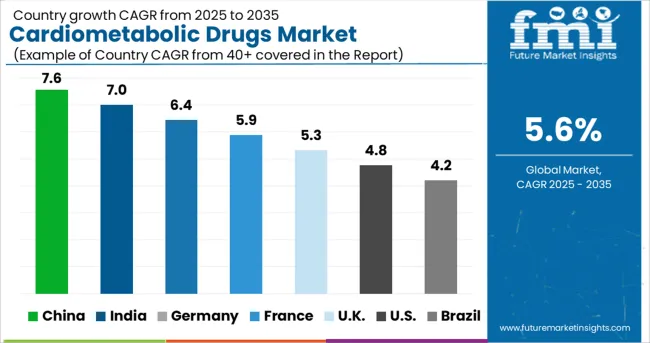

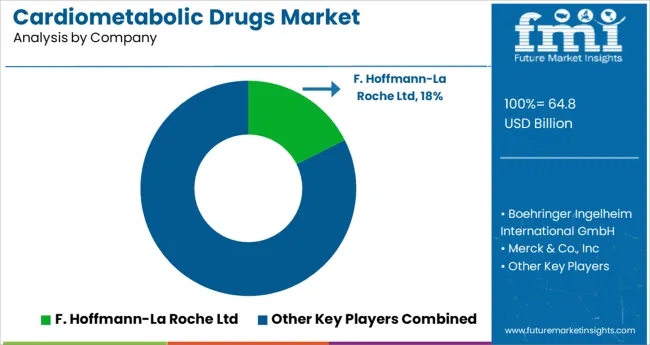

The Cardiometabolic Drugs Market is estimated to be valued at USD 64.8 billion in 2025 and is projected to reach USD 111.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

The cardiometabolic drugs market is expanding due to the rising prevalence of conditions linked to cardiovascular and metabolic health. Growing awareness of the health risks associated with obesity, diabetes, and cardiovascular diseases has increased demand for effective therapeutic options. Healthcare systems are focusing on comprehensive disease management strategies, which include medication adherence and lifestyle modifications.

Advances in drug formulations and targeted therapies have improved patient outcomes, fueling market growth. The rise in elective procedures such as plastic surgery has created new opportunities for cardiometabolic drugs, particularly for managing associated metabolic conditions pre- and post-operation.

Additionally, hospitals remain the primary channel for drug distribution, supported by the increasing number of inpatient and outpatient treatments involving cardiometabolic conditions. As chronic disease prevalence continues to increase globally, the market outlook remains strong with innovations expected in drug delivery and patient care integration.

The market is segmented by Indication and Distribution Channel and region. By Indication, the market is divided into Plastic Surgery, Cardiothoracic Surgery, General Surgery, Orthopedic Surgery, and Other Indications. In terms of Distribution Channel, the market is classified into Hospitals, Ambulatory Surgical Centers, Clinics, Medical Institutions/Laboratories, and Others Distribution Channel. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

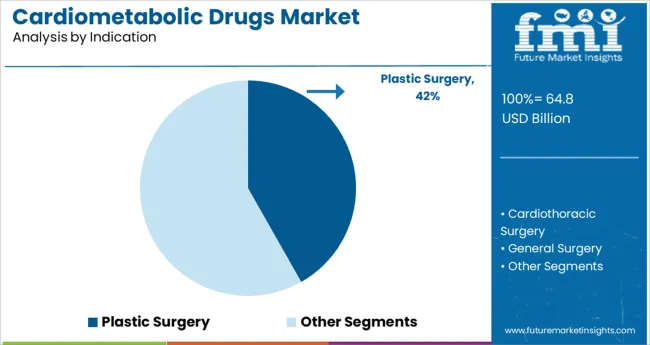

The Plastic Surgery indication segment is projected to hold 41.8% of the cardiometabolic drugs market revenue in 2025. This growth is linked to the increasing integration of cardiometabolic drug therapies in preoperative and postoperative care to improve surgical outcomes and patient safety. The demand for these drugs in plastic surgery is driven by the need to manage underlying metabolic conditions that can affect healing and recovery.

Surgeons and healthcare providers are placing greater emphasis on optimizing cardiometabolic health to reduce complications and enhance aesthetic results. The segment benefits from rising elective cosmetic procedures worldwide and increased patient awareness about overall health maintenance in conjunction with surgery.

These factors collectively contribute to the strong market position of cardiometabolic drugs within the plastic surgery indication.

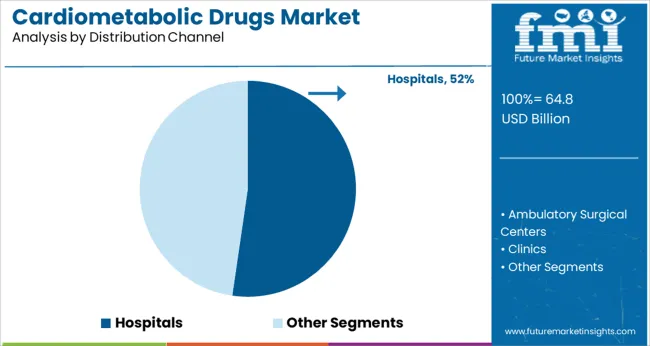

The Hospitals distribution channel segment is expected to account for 52.3% of the cardiometabolic drugs market revenue in 2025, maintaining its dominance as the preferred point of care. Growth in this segment has been supported by hospitals’ central role in diagnosing, prescribing, and managing cardiometabolic conditions.

Hospitals provide comprehensive care that includes medication administration, monitoring, and patient education, which increases reliance on hospital-based drug distribution. The rise in hospital admissions for cardiovascular and metabolic disorders, combined with enhanced hospital infrastructure and care pathways, has further fueled this segment’s expansion.

Moreover, hospitals often serve as key centers for plastic surgery procedures, integrating cardiometabolic drug therapies into surgical patient management. Given these dynamics, hospitals are expected to remain the primary distribution channel driving market growth.

Due to increasing fast-paced lifestyles, changing eating habits, and rising stress levels, a substantial rise in the burden of lifestyle diseases such as diabetes, obesity, hypertension, and others is being witnessed, creating demand for treatment drugs.

For instance, according to the International Diabetic Foundation, nearly 111.7 million adults between the age of 20 to 79 are living with diabetes across the world and the number is estimated to reach 643 million by 2035.

As cardiometabolic disorders are extensively used by diabetic patients for diverse applications, such as insulin resistance, growing diabetic population is projected to create high remunerative opportunities in the global market.

There are number of side effects associated with the consumption of cardiometabolic drugs such as antidiabetics, anticoagulants, hypertension, dyslipidemia drug, and others such as dyspepsia, vomiting, nausea, prolonged nosebleeds, passing of blood in urine, and others. Hence, rising awareness regarding such severe adverse effects on health is hindering the sales of cardiometabolic drugs in the market.

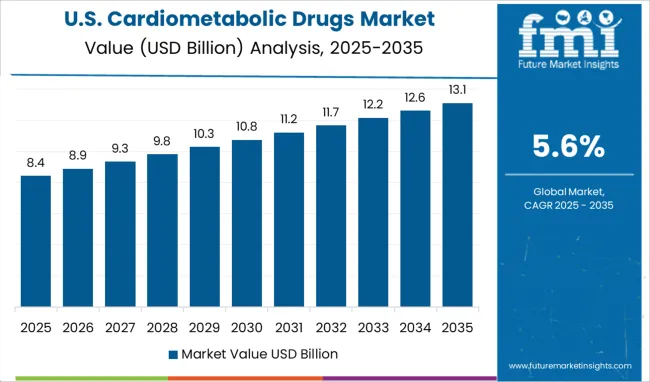

As per Future Market Insights, North America is forecast to account for the lion’s share in the global cardiometabolic drugs market between 2025 and 2035.

Cardiometabolic disorders and conditions involve a group of abnormalities that are interrelated, leading to a diverse constellation of cardiometabolic drugs used for each indication to limit the disease effect.

The prevalence of cardiovascular diseases is rising at a rapid pace across North America, due to the increasing pollution, smoking, opioid use, and others. According to the Centers for Disease Control and Prevention, nearly 18.2 million adults or around 6.7% of the population across the USA have coronary heart disease.

As cardiometabolic drugs play a crucial role in limiting the effect of these diseases along with their treatments, increasing burden of cardiovascular diseases is estimated to bolster the sales in the North America market.

FMI reveals that South Asia is anticipated to emerge as a highly lucrative market for cardiometabolic drugs during the forecast period 2025 to 2035.

With growing trend of personalized medication and rising demand for more effective drugs with minimal to no side effects, key manufacturers are focusing on research and development activities for the development of novel drugs.

For instance, in 2024, Natco Pharma, an Indian multinational pharmaceutical company announced launching a novel anti-blood clot medication, Rivaroxaban, under the brand name Xarelto. A multiplicity of such new product launches are expected to favor the demand for cardiometabolic drugs in the South Asia market.

Some of the leading players in the cardiometabolic drugs market are AbbVie Inc,, Besins Healthcare SA., Natco Pharma, Gilead Sciences Inc, Sanofi, InovoBiologic Inc, Carmel Biosciences Inc, Genfit SA, Kochi Prefecture, Cardax Pharmaceuticals, Inc., Abeille Pharmaceuticals, Inc., and others.

Attributed to the presence of such high number of participants and increasing emphasis on the development and launch of for novel drugs, the market is highly competitive.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4% to 5% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Drug Class, Indication Type, Distribution Channel, Region |

| Countries Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Companies Profiled | Novartis; GlaxoSmithKline Plc.; Merck & Co., Inc.; Pfizer Inc; Bayer HealthCare Pharmaceuticals Inc.; Par Pharmaceutical; Romark Laboratories, L.C.; Lupin Pharma; Schering Corporation; Others |

| Customization | Available Upon Request |

The global cardiometabolic drugs market is estimated to be valued at USD 64.8 billion in 2025.

It is projected to reach USD 111.7 billion by 2035.

The market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types are plastic surgery, cardiothoracic surgery, general surgery, orthopedic surgery and other indications.

hospitals segment is expected to dominate with a 52.3% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Drugs Glass Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Orphan Drugs Market Size and Share Forecast Outlook 2025 to 2035

Topical Drugs Packaging Market Growth & Forecast 2025 to 2035

Retinal Drugs And Biologics Market

Antiviral Drugs Market Size and Share Forecast Outlook 2025 to 2035

Cytotoxic Drugs Market Analysis – Growth, Trends & Forecast 2025-2035

3D Printed Drugs Market Outlook – Growth, Demand & Forecast 2025-2035

Depression Drugs Market

Parenteral Drugs Packaging Market

Brain Tumor Drugs Market Forecast & Analysis: 2025 to 2035

Infertility Drugs Market Analysis - Size, Share & Forecast 2025 to 2035

Expectorant Drugs Market Trend Analysis Based on Drug, Dosage Form, Product, Distribution Channel, and Region 2025 to 2035

Cannabinoid Drugs Market

Clot Busting Drugs Market Size and Share Forecast Outlook 2025 to 2035

Psychotropic Drugs Market Growth - Industry Trends & Outlook 2025 to 2035

Critical Care Drugs Market Analysis – Trends, Demand & Forecast 2024-2034

Anti-Malarial drugs Market

Antimetabolite Drugs Market Size and Share Forecast Outlook 2025 to 2035

Fish-Oil Based Drugs Market Analysis – Trends, Share & Growth Forecast 2024-2034

Plasma-Derived Drugs Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA