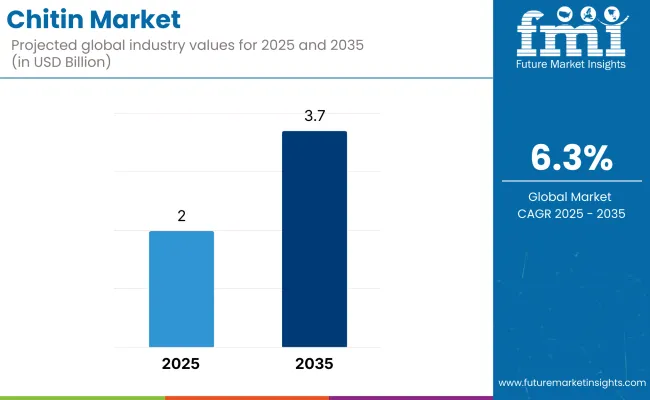

The global chitin market is estimated to reach a valuation of USD 2 billion by 2025. By 2035, the market is projected to expand further to USD 3.7 billion, driven by a CAGR of 6.3% from 2025 to 2035. Growth has been underpinned by rising utilization across biomedical, agricultural, and environmental sectors. The demand has been increasingly influenced by the global shift toward biodegradable and renewable biomaterials, where chitin is gaining attention for its structural versatility and non-toxic properties.

In the biomedical sector, chitin scaffolds have been actively trialed for tissue engineering and chronic wound treatment. According to a 2024 clinical update published by the Biomaterials Research Department at the University of Tokyo, chitin-based hydrogels demonstrated accelerated keratinocyte proliferation and epithelialization in full-thickness wound models.

During the Q1 2024 strategy review, Dr. Hiroshi Nakamura, Chief Innovation Officer at Nitta Gelatin Inc., highlighted the adoption of chitin biofilms as "core to our wound care pipeline, specifically due to their hemostatic and anti-inflammatory response."

In 2025, agritech adoption expanded, particularly in European Union member states, where chitin-based biopesticides gained regulatory approval under Annex I of the Sustainable Use of Pesticides Directive.

The International Federation of Organic Agriculture Movements reported in its 2024 sustainability bulletin that chitin-treated soil exhibited a 25% increase in beneficial mycorrhizal activity and up to 32% reduction in pathogen-induced plant mortality. Agronutris CEO Éric Bonnet stated in a March 2025 investor briefing that “production of black soldier fly-derived chitin has been scaled by 45% to meet the green agriculture pivot across Europe and Latin America.”

Water purification systems have integrated chitin derivatives in filtration membranes and flocculants. In February 2025, Chitosan Lab of France formalized a technology-sharing alliance with a Nordic municipal utility to implement chitin-based filters. Field data from pilot facilities in Malmö and Uppsala recorded 91.2% lead removal efficiency and a 39% decrease in sludge volume. These results were disclosed in the firm’s internal environmental impact report dated April 2025.

On the production front, enzymatic deacetylation methods introduced by the Bioengineering Institute at the University of Copenhagen in 2023 have demonstrated a 46% improvement in yield efficiency while reducing chemical effluents.

These findings, published in a 2024 peer-reviewed journal by the Danish Society of Biotechnology, have led to scaled adoption across manufacturing clusters in Southeast Asia. In Vietnam, the Food Industry Alliance confirmed a 30% year-on-year increase in shrimp shell waste recovery for chitin conversion as of March 2025, citing reduced transportation losses and process automation.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global industry. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year.

The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H12024 | 5.9% (2024 to 2034) |

| H22024 | 6.5% (2024 to 2034) |

| H12025 | 6.2% (2025 to 2035) |

| H22025 | 6.6% (2025 to 2035) |

The global industry's predicted compound annual growth rate (CAGR) over a semi-annual period from 2025 to 2035 is shown in the above table. The business is anticipated to grow at a CAGR of 5.9% in the first half (H1) of 2024 and then slightly faster at 6.5% in the second half (H2) of the same year.

The CAGR is anticipated to decrease somewhat to 6.2% in the first half of 2025 and continues to grow at 6.6% in the second half. The industry saw a decline of 27 basis points in the first half (H1 2025) and an increase of 34 basis points in the second half (H2 2025).

| Segment | Value Share (2025) |

|---|---|

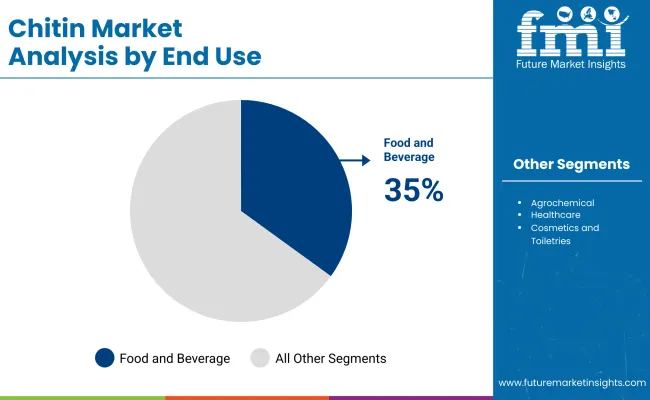

| Food and Beverage (End Use Application) | 35% |

The Food and Beverage segment remains the largest player in the chitin market owing to its soaring use in food preservation, dietary fiber fortification, and probiotic formulations. Chitin and its derivative chitosan are utilized comprehensively as natural antimicrobial agents in food packaging and as stabilizers in dairy and beverage formulations.

Manufacturers like Golden-Shell Pharmaceutical Co., Ltd. and Bio21 Co., Ltd. are coming up with high purity, food-grade chitin for the use of low-calorie functional foods, plant-based meat substitutes, and biodegradable food coatings. Aside from this, the increasing demand for clean-label and natural preservatives is facilitating chitin’s incorporation into beverages and processed foods.

The approved policies in Japan, the USA, and the EU are also a contributing factor to the fast adoption. This profound change will also see manufacturers focusing on chitin-derived dietary fibers as gut health and weight loss become more appealing.

| Segment | Value Share (2025) |

|---|---|

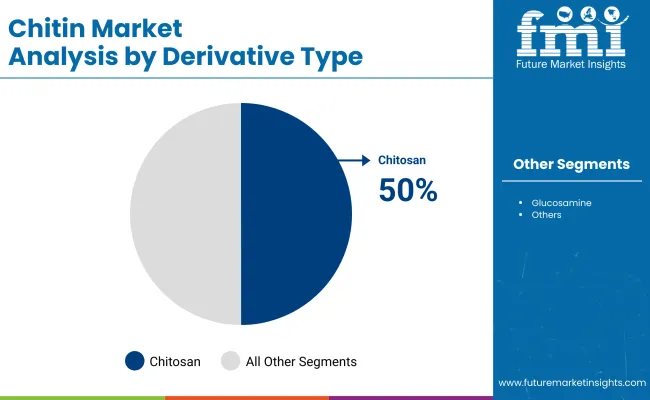

| Chitosan (Derivative Type) | 50% |

The current chitosan prevalence in the market comprises about 50% of the entire global chitin market. It stands out as the most widely used chitin derivative with multiple applications in pharmaceuticals, water treatment, cosmetics, and food preservation.

Its non-toxicity and bioactive properties make it the top choice for being used as a chemical substance in many sectors. The top players such as Heppe Medical Chitosan GmbH and Advanced Biopolymers AS are striving to create ultra-pure chitosan which could be used in drug delivery systems, fabric for wound healing and coated with a layer of microbes.

Moreover, chitosan has been pivotal in solid and liquid wastewater treatment, with a particular focus on industrial effluent. In the food market, chitosan-based coatings eat up the supply chain trend due to extending the shelf life and increasing food safety.

Bioengineered Chitin for High-Value Medical Applications

The need for bioengineered chitin in the medical field is continually increasing, and its applications include tissue regeneration, wound healing, and drug delivery. Chitin, with its biocompatibility, biodegradability, and antimicrobial properties, perfectly fits its application as surgical sutures, hydrogels, and scaffolds for tissue engineering.

The producing companies are now targeting high purity and optimized molecular weight to produce pharmaceutical-grade chitin, which is in line with the rigorous medical standards. Heppe Medical Chitosan GmbH and Advanced Biopolymers AS, among others, are moving in this direction, which is responsible for the building of a molecular structure for drug eluting and biomedical coatings.

The market is moving upward as a consequence of the increase in R&D funding, the partnerships with biotech firms, and the results of clinical trials which evidenced the success of chitin in new therapies. A major obstacle is still the effective and low-cost mass production, which drives the investments in precision fermentation and enzyme-assisted extraction technology rental leading to the improvement of yield and scalability.

Chitin-Based Bioplastics as an Alternative to Petroleum-Based Polymers

Chitin-based bioplastics and films are coming out with the increase of eco-friendly packaging and are seen as a credible replacement to petroleum-derived plastics. As a biopolymer chitin is naturally biodegradable, strong, and has water resistance properties that make it an optimal choice for food packaging, agricultural films, and biomedical applications.

Some companies are involved in the value addition of chitin by developing biodegradable composites that ensure durability but have eco-friendly characteristics. The blending of chitin with polylactic acid (PLA), starch, and cellulose is the strategy being adopted by manufacturers to enhance mechanical properties and promote natural decomposition of the products.

The key hindrance is the high cost as plastics that are chitin-based still have a higher price than conventional ones. By scaling up the production to more economic levels, companies are focusing on the use of government benefits for biodegradable products and they are searching the entirely new and state-of-the-art technologies, such as solvent-free extrusion and the addition of nanocomposites to get rid of the old conventional way to ramp the product market.

Emergence of Non-Crustacean Chitin Sources

Though crustaceans have traditionally been the primary material for chitin extraction, other non-crustacean sources such as fungi and insects are progressively becoming more popular due to supply chain difficulties, allergen issues, and seasonal constraints. Kitozyme S.A., a forerunner in this field, is initiating fungal chitin with both sustainable and scalable advantages and a better allergenic profile.

Moreover, newly discovered startups that are going for a black soldier fly larvae chitin are integrating this material into cosmetics, agriculture as well as pharmaceuticals. Instead of reliant on marine-based raw materials, manufacturers are switching to enzyme-assisted extraction to boost the yield from sources that are non-crustacean.

Such a switch will continue to avail investors from the biotech sector, for instance, fungal chitin is formed in closed fermentation systems that are easier to standardize and control and thus it can be used in drugs and nutraceuticals. The market is particularly booming in Europe where the regulations favour non-allergenic and vegan-friendly chitin sources.

Regulatory Push for Chitin in Agricultural Bio stimulants

Expanded use of chitin in agriculture due to the promotion of biostimulants is a move to minimize the incidence of agrochemical pesticides as mandated by governments and regulatory bodies. Chitin, by improving plant resistance, soil microbiota, and crops is an important input to sustainable farming.

Firms like G.T.C. Bio Corporation and Panvo Organics Pvt. Ltd. are making it possible to introduce chitin-based fertilizers and coatings which will improve soil structure, water retention, and pest resistance within the environment. Their introduction of easy methods for plant root penetration, disease, and water stress were of great value to the EU and North America campaigns promoting chitin as a biological alternative to synthetic agrochemicals.

The manufacturers are putting their main focus on micro-encapsulation and it is the making of the products more cost-effective for the farmers with these slow-release efficiencies. The company's biggest hurdle is the lack of knowledge and acceptance which they are dealing with by teaming up with agricultural research bodies, carrying out tests in the field, and promoting products specifically for diverse soil types.

Pharmaceutical-Grade Chitin in Novel Drug Formulations

What is more, chitin finds its application in drug delivery, as well as, pharmaceutical coatings as researchers become interested in nanotechnology-based applications. Chitin derivatives such as chitosan nanoparticles are under development for targeted drug delivery, vaccine carriers, and controlled release formats.

Heppe Medical Chitosan GmbH and Golden-Shell Pharmaceutical Co., Ltd. are both concentrating on creating ultra-pure chitosan with a designated molecular weight for the purpose of better bioavailability and therapy effectiveness. The interest in nanomedicine is driving the market with the invention of chitosan-based hydrogels and microspheres that have been effective in antimicrobial wound dressings, cancer treatment, and gene therapy.

But, standardization and the approval of the regulatory bodies are the major problems that are urged by the manufacturers who are forcing them into clinical trials and the installation of the good manufacturing practices. Also being worked on are new-the-packaging-technologies like the modern electrospinning and the drying methods which fit also for pharmaceuticals that lack solubility and suffer from low rates of absorption.

Chitin Waste Valorisation Strategies in Marine and Food Industries

The seafood industry being a major producer of chitin-rich waste is the driving force behind the technological advancements related to waste valorisation. By the implementation of circular economy principles, manufacturers are seeking to derive a high-value chitin product by recycling shrimp, crab, and lobster shells rather than just disposing of them.

Chitin-rich waste being an end product in an integrated zero-waste processing scheme is used by firms like FMC Corporation and Maruha Nichiro Corporation as functional ingredients for the food, pharmaceutical, and agricultural industries. The primary fields of interest include enzyme-assisted extraction, membrane separation, and fermentation technologies, which respectively enhance yield and purity.

The movement towards the government being the distributor of environment-rej. waste management is also leading to increased investments in automatic shell processing. The moves are getting completed by the partnership between seafood processors and manufacturers that are for the creation of the closed-loop supply chain, which is targeted for cost-efficiency while ensuring sustainability adherence, especially in places like Japan and Norway where seafood waste management is a concern.

The global chitin market has been witnessing a compound growth of about 5% from 2020 to 2024, primarily due to the increasing demand from the pharmaceutical, agricultural, food processing, and bioplastic sectors.

The rising research into chitin’s antimicrobial, biodegradable, and biocompatible properties has led to its application in wound care, drug delivery, and sustainable packaging. Nevertheless, the market was faced with some issues of slow growth on account of supply chain disruptions, the lack of raw materials, and the high costs of production.

From 2025 to 2035, a larger size demand is forecasted to attain significant growth, as the progress in biotechnology, water treatment, and the formulation of functional foods will contribute to the relationship. The use of chitin sourced chitosan in the cosmetics industry and biomedical fields would also trigger further growth.

Under these circumstances, it is anticipated that Manufacturers will place their emphasis on extraction process efficiency, environmental friendliness, and industrial partnerships to optimize production quality. The market will be moving towards the production of more specialized and sophisticated applications of chitin, thus it is still going to be in a state of growth.

The Global Chitin Market platform is divided into three tiers; Tier 1 manufacturers are the leading players in the high-value applications segment, while Tier 2 and Tier 3 manufacturers are major players in the niche and regional markets.

Dominating the high-value chitin sector are the Tier 1 players such as Golden-Shell Pharmaceutical Co., Ltd., Heppe Medical Chitosan GmbH, Primex Ehf, Advanced Biopolymers AS, and FMC Corporation, owing to their exclusive commitment to high-purity chitin for pharmaceuticals, biomedical applications, and premium food formulations.

These companies allocate most of the resources to research & development, proprietary extraction technologies, and global distribution networks thus, enabling them to achieve medical-grade chitosan and bioengineered chitin nanomaterials that are superior in quality. Moreover, they can hold the ground in high-growth sectors due to strategic partnerships with pharmaceutical and biotech companies.

Tier 2 players like G.T.C. Bio Corporation, Panvo Organics Pvt. Ltd., Bio21 Co., Ltd., and Kunpoong Bio Co., Ltd. are focusing on agriculture, wastewater treatment, and industrial biopolymers to expand their operations.

Their main emphasis is on adoption of cost-effective production techniques, the establishment of regional distribution networks, and the development of new products, especially in the fields of production of biopesticides, film disposal, and cosmetic applications. A number of these firms team up directly or indirectly with agribusinesses and water treatment companies as a part of their efforts to achieve wider acceptance.

Basically, Tier 3 players are mainly the regional extractors and the seafood waste processors who operate within the unorganized markets which are not organized, they mostly supply raw and semi-processed chitin for industrial and agricultural uses.

They are the most crucial part of the value-chain, which is the waste valorization in the seafood processing industry but they almost never scale or get the permits required to compete with those already established in the business. In the case of wastewater treatment, regulations turn tighter and Tier 3 suppliers frequently ally with Tier 2 manufacturers for enhancing capacity and processing.

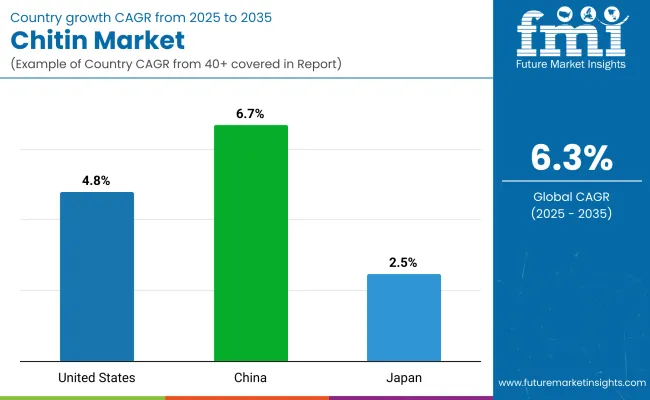

The following table shows the estimated growth rates of the top three countries. USA, China and Japan are set to exhibit high consumption, and CAGRs of 4.8%, 6.7% and 2.5% respectively, through 2035.

| Country | CAGR, 2025 to 2035 |

|---|---|

| United States | 4.8% |

| China | 6.7% |

| Japan | 2.5% |

The chitin nanomaterials market is a priority for China's pharmaceutical industry, investing heavily in chitin nanomaterials for targeted drug and regenerative medicine. The main manufacturers are Golden-Shell Pharmaceutical Co., Ltd. and G.T.C. Bio Corporation, which have set their sights on the use of nanotechnology in the chitin derivatives to achieve higher bioavailability, controlled release, and fewer adverse effects in pharmaceuticals.

These companies are working with biotech startups and research institutions to produce chitosan nanoparticles used in cancer treatment, insulin delivery, and antimicrobial coatings. Meanwhile, the Chinese government’s thrust towards biopharmaceuticals innovation is driving this movement, traditional modular R&D funding, and regulatory approvals that prefer the use of biopolymer drug carriers are accelerating this trend.

Also, local drug manufacturers are opting to a larger extent's synthetic excipients by switching to chitin-based bio-carriers, which attributes China with market leadership in the development of biodegradable and functional drug encapsulation products.

As the USA shifts to precision agriculture, the longing for custom-made chitin-based biopesticides and soil enhancers is swarming. Companies, for instance, Panvo Organics Pvt. Ltd. and Heppe Medical Chitosan GmbH are leading in the manufacture of .

Unlike the traditional products which they are being that with real-time data integration, farmers can remotely adjust dosages based on soil microbiome analysis and health conditions. The Environmental Protection Agency (EPA) expedited the approval processes for organic pest control methods that use the chitin manufacturers.

Besides, farm operations using AI and collaborations with agritech are maximizing the benefits of chitin-based biofertilizers and nematicides. This situation is consequently balancing the market of the USA in targeting specific crop protection using sustainable methodology.

The Japanese cosmetics segment is our top request for the chitin market target.A tremendous capacity has been created in anti-aging and skin repair formulas that rest on marine-derived chitin. Companies such as Kunpoong Bio Co., Ltd. and Maruha Nichiro Corporation are generously using chitin’s moisture-attaining, collagen-increase, and anti-inflammatory characteristics in high-end brands.

The main focus here lies on enzymatically modified chitosan, which is considerably more easily absorbed and more effective for the restoration of deep skin hydration and UV damage. The love of Japanese consumers for marine-derived actives is undeniably the driving force of this innovation which, in turn, leads to the rapid adoption of these in sheet masks, serums, and dermal patches.

Furthermore, the leading beauty brands are protecting their wellness lines from competition through the patenting of the chitin-based microencapsulation technology that they have developed to boost shelf life and the effectiveness of active ingredients. With the demand for anti-aging skincare driven by Japan's population that is aged negatively, marine-derived chitin is evolving into a premium biomaterial in the cosmetic sector.

The Global Chitin Market is an arena of tough battle in which leading industries are in the race of creativity, forming collaborations, and enlargement of facilities to obtain the highest possible market share.

Among these frontrunners are Golden-Shell Pharmaceutical Co., Ltd., Heppe Medical Chitosan GmbH, Primex Ehf, and Advanced Biopolymers AS they allocate their revenues in the development of high-purity chitin extraction methods to the needs of the pharmaceutical and biomedical sectors. Besides, firms are setting their sights on alternative sources to the crustaceans, such as fungal and insect-derived chitin, to deal with the allergen issue and at the same time, fulfil the sustainability requirement.

New product development is the key trend in the market; for instance, Kitozyme S.A. launched a non-animal chitosan for nutraceuticals, and FMC Corporation has extended its catalogue of bio pesticides with the addition of chitosan-based solutions. Additionally, the manufacturers are joining their forces with agritech and biotech companies to carry out the development of chitin-based food preservatives and antimicrobial coatings that would ensure their involvement in the fast-evolving food safety market regulations.

Chitosan holds the largest share in the market due to its extensive applications in healthcare, cosmetics, and water treatment.

The food industry leads in demand, primarily due to the use of glucosamine.

Chitosan is widely used for wastewater purification, heavy metal removal, and as a natural coagulant in industrial and municipal water treatment processes.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Derivative Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Derivative Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by End-Use Industry, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Derivative Type, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Derivative Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by End-Use Industry, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Derivative Type, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Derivative Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by End-Use Industry, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Derivative Type, 2018 to 2033

Table 22: Western Europe Market Volume (Tons) Forecast by Derivative Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 24: Western Europe Market Volume (Tons) Forecast by End-Use Industry, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Derivative Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Tons) Forecast by Derivative Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 30: Eastern Europe Market Volume (Tons) Forecast by End-Use Industry, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Derivative Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Tons) Forecast by Derivative Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Tons) Forecast by End-Use Industry, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Derivative Type, 2018 to 2033

Table 40: East Asia Market Volume (Tons) Forecast by Derivative Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 42: East Asia Market Volume (Tons) Forecast by End-Use Industry, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Derivative Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Derivative Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Tons) Forecast by End-Use Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Derivative Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Derivative Type, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Derivative Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Derivative Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Derivative Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by End-Use Industry, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 16: Global Market Attractiveness by Derivative Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Derivative Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Derivative Type, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Derivative Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Derivative Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Derivative Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by End-Use Industry, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 34: North America Market Attractiveness by Derivative Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Derivative Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Derivative Type, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Derivative Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Derivative Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Derivative Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by End-Use Industry, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Derivative Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Derivative Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Derivative Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Tons) Analysis by Derivative Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Derivative Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Derivative Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 67: Western Europe Market Volume (Tons) Analysis by End-Use Industry, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Derivative Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Derivative Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Derivative Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Tons) Analysis by Derivative Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Derivative Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Derivative Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Tons) Analysis by End-Use Industry, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Derivative Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Derivative Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Derivative Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Tons) Analysis by Derivative Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Derivative Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Derivative Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Tons) Analysis by End-Use Industry, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Derivative Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Derivative Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Derivative Type, 2018 to 2033

Figure 117: East Asia Market Volume (Tons) Analysis by Derivative Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Derivative Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Derivative Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 121: East Asia Market Volume (Tons) Analysis by End-Use Industry, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Derivative Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Derivative Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Derivative Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Tons) Analysis by Derivative Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Derivative Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Derivative Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Tons) Analysis by End-Use Industry, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Derivative Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Analyzing Market Share & Industry Trends of Chitin Providers

United Kingdom Chitin Market Trends – Size, Share & Forecast 2025–2035

United States Chitin Market Analysis - Size, Growth & Forecast 2025 to 2035

ASEAN Chitin Market Analysis – Trends, Demand & Forecast 2025–2035

Europe Chitin Market Insights – Demand, Growth & Forecast 2025–2035

Australia Chitin Market Analysis – Growth, Size & Forecast 2025–2035

Latin America Chitin Market Growth – Trends, Demand & Innovations 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA