The Latin America chitin market is set to grow from an estimated USD 136 million in 2025 to USD 483.9 million by 2035, with a compound annual growth rate (CAGR) of 13.5% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Latin America Industry Size (2025E) | USD 136 million |

| Projected Latin America Value (2035F) | USD 483.9 million |

| Value-based CAGR (2025 to 2035) | 13.5% |

The local food market in the Latin American region is on a strong pace of growth which is largely due to the demand from consumers for natural and organic products. Chitin, which comes from the shells of crustaceans, has its new use as a food preservative through its antimicrobial properties, helping the food to store for a longer period of time.

Apart from that, discussing how it is present in functional foods, increased chitin further its the appeal1 to health-conscious consumers. The shift towards natural label products is contributing to the rise in and demand for chitin that manufacturers are finding it creative to meet changing of consumer preferences.

The expansion of chitin as organic biopesticide and as a soil condition-er is witnessed in the matter of agriculture, it is the result of the stress on the practice of good farming. Control of pests and diseases, and the resultant effect of synthetic chemicals are the natural traits of it.

In addition to this, chitin brings up soil health and microbial activity is beneficial, the nutrient availability is improved, and plant growth is promoted. With the increased adoption of organic agriculture in Latin America, a higher number of farmers are projected to use chitin-derived products thereby sustaining environmental-friendly practices in agriculture.

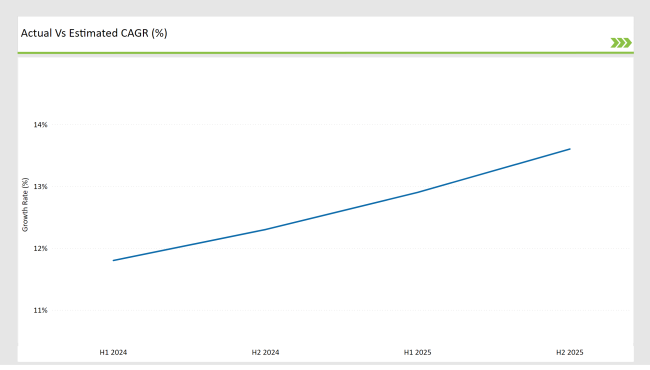

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Latin Americachitin market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

For the Latin Americachitin market, the is predicted to grow at a CAGR of 11.8% during the first half of 2024, with an increase to 12.3% in the second half of the same year. In 2025, the growth rate is anticipated to slightly increase to 12.9% in H1 and is expected to rise to 13.6% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

Transforming Skincare: The Benefits of Chitin in Cosmetic Formulations

The sector for cosmetics and toiletries in Latin America is experiencing a tremendous growth trend backed by the sign of consumers buying more products with natural and biodegradable ingredients. With the increase of the consciousness of the bad effects of the synthetic chemicals, the brands are looking for sustainable alternatives that meet the clean beauty product demand. The chitin being obtained from the crab shells, is being recognized for the first time because of its extraordinary moisturizing and skin-repairing powers.

The products that were added to various formulations, creams, lotions, and serums focused on the making of the skin hydration as well as promotion of healing through chitin. In addition to that, the fact that the chemical is biodegradable, along with the biocompatibility of chitin, makes them with a tie to the growing attention to green practices prevalent in the cosmetics business. This development not only toes the sales of chitin but also fortifies the trend of creating sustainable and responsible cosmetics.

Towards a Greener Future: Chitin in Waste Treatment Applications

The environment and climate are issues on a global scale which have led to the appearance of a greater interest in making waste management sustainable thus chitin is added as a valuable resource. The base of chitin is crustacean shells which is exactly what makes it a biodegradable and environmentally friendly material, and therefore it is suitable for use in waste and water treatment. This piece with its unique feature of binding pollutants such as heavy metals and organic contaminants is mostly used in the removal of wastewater.

Chitin means the materials of flocculants, and materials which are stable in filtration systems also mean the improvements in efficiency of filtration processes by water. Moreover, the aforementioned sustainability pivot aligns with recent trends that see the push for advanced technologies in waste management. The industries throwing chitin in consequential operations manage their economy with minimal adverse impact on the environment and thus become a part of the healed biotic and bigger biotic community.

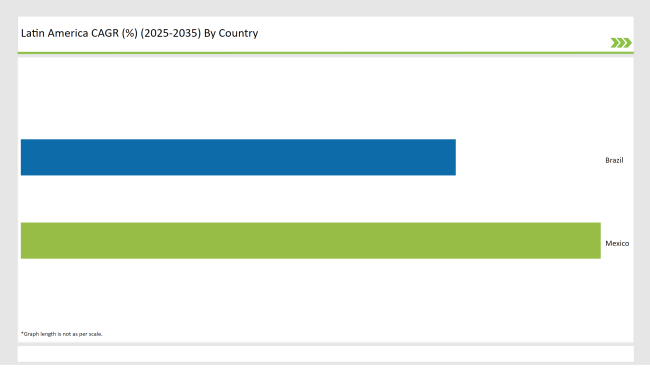

The following table shows the estimated growth rates of the top two markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

Brazil has begun to associate the promotion of sustainable agricultural practices with food security and environmental protection. This trend encompasses the promotion of biopesticides and natural fertilizers as more practical alternatives to the use of synthetic chemicals.

Chitin, a compound of crustacean shells, is an important part of this program not only because it is a biopesticide but also a soil conditioner. In this way, chitin makes the government's programs that intend to reduce chemical inputs in agriculture by providing a natural means of pest control and improving the soil health coincide.

The positive effects of these products on the environment are also recognized by farmers, who are looking for alternatives to traditional ones, so it is expected that the use of chitin-based products will increase, and this will lead to the widespread methods of farming being applied in Brazil.

Cosmetics manufacturers in Mexico are enjoying a period of growth, which in its turn is largely due to the customers going towards natural and organic options. As people contour on harmful substances in beauty products made from synthetic ingredients, brands are on the lookout for the more sustainable alternative to satisfy this demand.

A compound found in the shells of crustaceans, chitin, is becoming popular as it not only moisturizes the skin but also repairs it. It is added to various cosmetic products such as creams, serums, and masks to make the skin stay more hydrated and heal faster. This trend does not only raise the demand for chitin but also aligns it with the broader vision of eco-friendly and health-focused beauty products in the Mexican market.

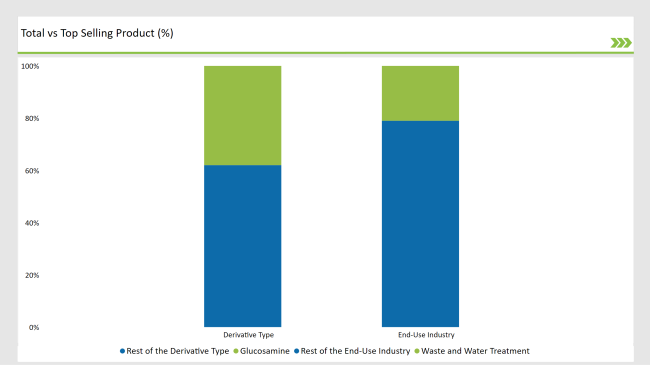

% share of Individual categories by Derivative Type and End-Use Industry in 2025

Latin America is undergoing significant demographic changes, with a growing share of the population aged 60 or more. This age group is looking more and more for solutions to joint health, increasing the demand for glucosamine, a well-known nutritional supplement that is supposed to reduce joint pain and even make you more mobile.

At the same time, the nutraceutical market in the region is growing super fast, because people are interested in functional foods and dietary supplements. Glucosamine is often the favorite among ingredients in formulas dedicated to joint health and it is particularly sought after by health enthusiasts concerned with natural alternatives.

The intersection of two trends, namely the aging population and the booming market of nutraceuticals, sets a strong demand for glucosamine, overall making it one of the crucial contributors in the health and wellness sector of Latin America.

Binding with pollutants and acting as an efficient sorbent for these pollutants, most notably heavy metals and organic matter, are some of the promising applications of chitin. This may result in better cleaning processes. In this sense, it could be a means for wastewater treatment plants to be armed with effective tools in their quest for less contamination in the water they are allowed to release into the environment and stricter regulations imposed on their practices.

Furthermore, chitin sourced from seafood waste is being tested as an economical alternative for wastewater treatment. The idea is to use shrimp waste and crab waste to produce chitin, which can then be used in the primary wastewater treatment of the local company.

The life-cycle approach of these companies is to create environmental benefits alongside economic gains. This trend of increased effectiveness in waste management and cost savings has made chitin a choice in the region's demand for sustainable solutions in waste management.

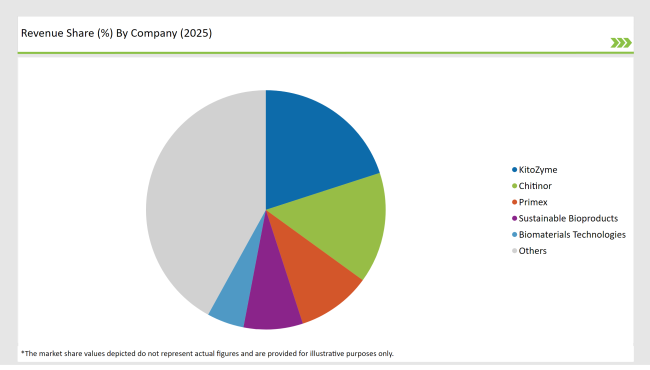

2025 Market share of Latin America Chitin Manufacturers

Note: above chart is indicative in nature

Within the Latin America chitin sector, there are a few giant players, like KitoZyme, Chitinor, and Primex. These companies rely on superior production capacities and the introduction of new technologies through research and development for development. They have built competitive advantages in the market with their trusted names and reliable supply chains.

Also, firms like Nutraceuticals International Group and AgroBio are fixed on targeted applications, establishing regional niches by selling tailor-made products for health, agriculture, and cosmetics. This model of operation not only benefits the local market but also allows the company to meet the challenge of providing the needed sustainable and natural solutions in most industries.

As per Derivative Type, the industry has been categorized into Glucosamine, Chitosan, and Others.

As per End-Use Industry, the industry has been categorized into Food and Beverages, Agrochemical, Healthcare, Cosmetics and Toiletries, Waste and Water Treatment, and Others.

Industry analysis has been carried out in key countries of Brazil, Mexico and Rest of Latin America.

The Latin America chitin market is projected to grow at a CAGR of 13.5% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 483.9 million.

The food industry in Latin America is witnessing significant growth, driven by consumer demand for natural and organic products.

Mexico and Brazil are key regions with high consumption rates in the Latin America chitin market.

Leading manufacturers include KitoZyme, Chitinor, Primex, Sustainable Bioproducts, and Biomaterials Technologies.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA