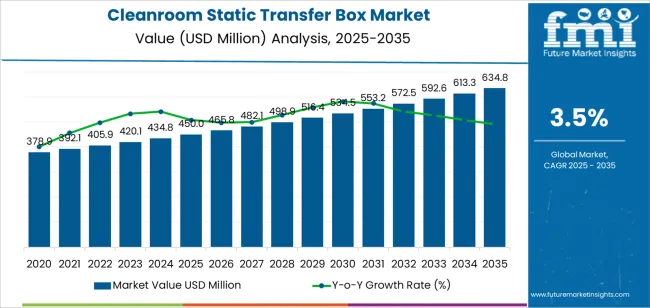

The global cleanroom static transfer box market is projected to grow from USD 450 million in 2025 to approximately USD 634.8 million by 2035, recording an absolute increase of USD 184.8 million over the forecast period. This translates into a total growth of 41.1%, with the cleanroom static transfer box market forecast to expand at a compound annual growth rate (CAGR) of 3.5% between 2025 and 2035. The overall market size is expected to grow by nearly 1.4X during the same period, supported by increasing pharmaceutical manufacturing investments, growing demand for contamination-free material transfer in sterile environments, and rising adoption of advanced cleanroom technologies across biotechnology facilities and electronics manufacturing operations requiring precise environmental control standards.

Technological development in the cleanroom static transfer box market centers on improving contamination control and operational reliability in regulated manufacturing environments. Design refinements focus on precision engineering, controlled airflow, and easy maintenance to meet strict cleanroom certification standards used in pharmaceutical, biotechnology, and electronics production.

A key advancement is the refinement of interlocking door systems. These mechanisms ensure that one door remains closed while the other is open, maintaining internal air pressure and preventing particle migration. Electromagnetic interlocks and smooth hinge assemblies now replace mechanical locks, reducing wear and lowering the risk of operator error. The shift supports consistent containment performance during material transfer between rooms of differing cleanliness levels.

Material selection continues to influence product performance. Stainless steel, particularly SS 316L, is widely used for its resistance to corrosion and chemical cleaning agents. Electropolished interiors reduce microbial adhesion and improve decontamination efficiency. Anti-static surface finishes are being applied in semiconductor and electronics manufacturing to limit electrostatic discharge that may damage sensitive components.

Digital integration has become a standard expectation in advanced units. Embedded sensors monitor pressure differentials, airflow velocity, and door cycles. The data can be logged locally or transmitted to a facility monitoring system, improving traceability and maintenance scheduling. Facilities benefit from improved compliance with ISO 14644 and Good Manufacturing Practice requirements without adding manual reporting procedures.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 450 million |

| Market Forecast Value (2035) | USD 634.8 million |

| Forecast CAGR (2025-2035) | 3.5% |

| PHARMACEUTICAL MANUFACTURING EXPANSION | CONTAMINATION CONTROL REQUIREMENTS | REGULATORY COMPLIANCE STANDARDS |

|---|---|---|

| Global Drug Production Growth Manufacturing capacity expansion across established and emerging pharmaceutical markets driving demand for contamination-free material transfer solutions. Biosimilar Production Facilities Development of specialized production facilities requiring controlled environment material handling and comprehensive contamination prevention systems. Contract Manufacturing Growth Expansion of pharmaceutical contract manufacturing organizations establishing cleanroom capabilities requiring reliable transfer equipment. | Sterile Processing Requirements Modern pharmaceutical manufacturing demands material transfer systems delivering absolute contamination prevention and validated performance. Cross-Contamination Prevention Facilities implementing strict protocols requiring specialized transfer equipment preventing environmental contamination during material movement. Environmental Control Standards Manufacturing operations maintaining controlled environments necessitating transfer systems preserving sterile conditions throughout material handling. | GMP Compliance Demands Good Manufacturing Practice regulations establishing performance benchmarks requiring validated material transfer systems. Quality Assurance Standards Quality protocols demanding documented contamination control and comprehensive validation supporting regulatory submissions. Facility Certification Requirements Cleanroom certification standards requiring proven transfer system performance and contamination prevention capabilities. |

| Category | Segments Covered |

|---|---|

| By Interlock Type | Mechanical Interlock Type, Electronic Interlock Type, Others |

| By Application | Medical, Electronics, Food, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

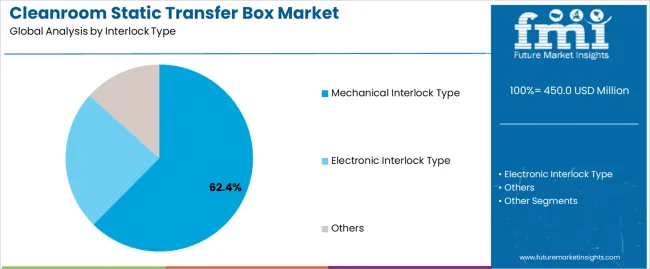

| Mechanical Interlock Type | Leader in 2025 with 62.4% market share; maintains leadership through 2035. Proven reliability in pharmaceutical facilities, established validation protocols, cost-effective implementation for standard cleanroom applications. Momentum: steady growth through facility expansion and replacement installations. Watchouts: limited automation integration, manual operation dependencies. |

| Electronic Interlock Type | Growing segment benefiting from automation trends and smart facility integration. Advanced monitoring capabilities, data logging functionality, integration with building management systems. Momentum: rising adoption in new facility construction and technology upgrades. Electronic controls provide enhanced security and operational tracking. Watchouts: higher initial costs, maintenance complexity, power reliability requirements. |

| Others | Niche segment including hybrid systems and specialized configurations. Custom applications for specific pharmaceutical processes and research facilities. Momentum: selective growth in specialized applications requiring unique contamination control approaches. Limited market presence due to standardization preferences. |

| Segment | 2025 to 2035 Outlook |

|---|---|

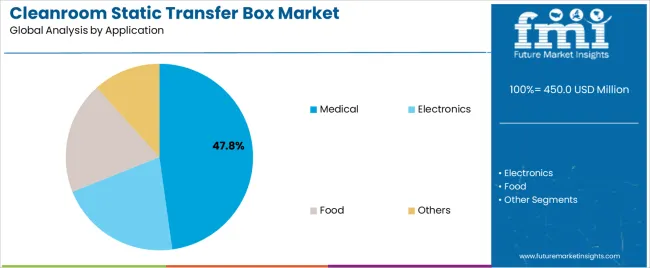

| Medical | Dominant application with 47.8% market share in 2025, driven by pharmaceutical manufacturing expansion and biotechnology facility development. Sterile drug production, biological material handling, and aseptic processing require absolute contamination prevention. Momentum: strong growth through pharmaceutical capacity expansion and biosimilar production development. Watchouts: stringent validation requirements, regulatory compliance complexity. |

| Electronics | Significant application segment for semiconductor manufacturing and precision electronics assembly requiring particle-free environments. Contamination control critical for microelectronics production and sensitive component manufacturing. Momentum: moderate growth tied to semiconductor facility investments and electronics manufacturing expansion. Watchouts: specialized size requirements, static control integration needs. |

| Food | Emerging application for food processing facilities implementing advanced hygiene protocols. Specialized food production requiring controlled environment material transfer and contamination prevention. Momentum: gradual adoption in premium food manufacturing and nutraceutical production facilities. Growth constrained by cost sensitivity and traditional transfer methods. |

| Others | Diverse applications including research laboratories, chemical processing, and specialized manufacturing operations. Custom contamination control requirements driving selective adoption across industrial segments. Momentum: stable demand from research institutions and specialty manufacturing facilities requiring controlled environment material handling. |

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Pharmaceutical Manufacturing Expansion Continuing growth of pharmaceutical production capacity across global markets driving demand for validated material transfer systems. Biosimilar Production Development Expansion of biosimilar manufacturing facilities requiring comprehensive contamination control and sterile material handling capabilities. Quality Standards Enhancement Increasing emphasis on manufacturing quality and contamination prevention supporting adoption of advanced transfer systems throughout pharmaceutical operations. | Capital Investment Requirements Initial equipment costs and facility integration expenses affecting adoption rates among smaller pharmaceutical manufacturers. Maintenance Complexity Validation maintenance requirements and periodic certification creating operational complexity and ongoing expenses. Alternative Technology Competition Pass-through chambers and alternative transfer methods providing competition in specific applications and cost-sensitive markets. | Automation Integration Development of electronically controlled systems with automated operation, data logging, and facility management integration capabilities. Validation Technology Enhancement Advanced monitoring systems providing real-time contamination control verification and comprehensive validation documentation support. Modular Design Development Standardized modular configurations enabling simplified installation, reduced customization costs, and faster facility deployment. Smart Manufacturing Integration Integration with Industry 4.0 concepts including predictive maintenance, performance monitoring, and operational analytics. |

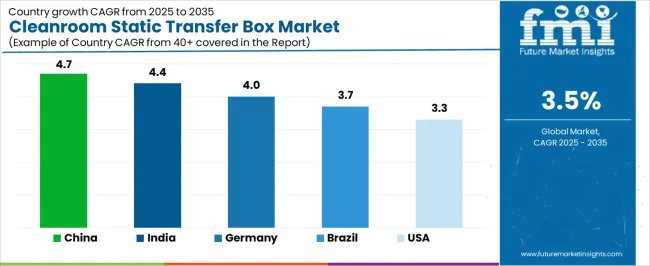

| Country | CAGR (2025-2035) |

|---|---|

| China | 4.7% |

| India | 4.4% |

| Germany | 4.0% |

| Brazil | 3.7% |

| United States | 3.3% |

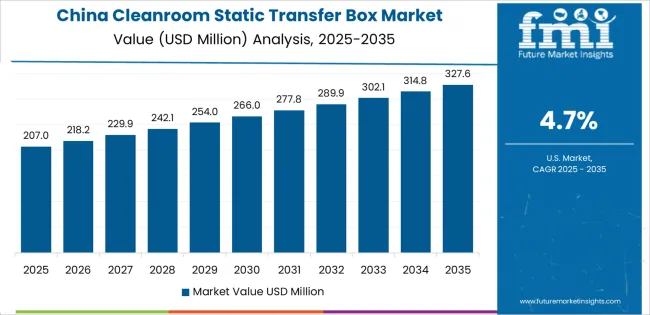

Revenue from cleanroom static transfer boxes in China is projected to exhibit strong growth with a market value of USD 166.1 million by 2035, driven by expanding pharmaceutical manufacturing infrastructure and comprehensive biosimilar production development creating substantial opportunities for contamination control equipment suppliers across pharmaceutical operations, biotechnology facilities, and electronics manufacturing requiring advanced cleanroom capabilities. The country's established pharmaceutical production tradition and expanding contract manufacturing capabilities are creating significant demand for both standard and customized transfer box solutions. Major pharmaceutical companies and electronics manufacturers are establishing comprehensive cleanroom facilities to support large-scale production operations and meet growing demand for validated material transfer systems.

Revenue from cleanroom static transfer boxes in India is expanding to reach USD 92.1 million by 2035, supported by extensive pharmaceutical manufacturing expansion and comprehensive generic drug production facility development creating sustained demand for reliable contamination control equipment across diverse pharmaceutical categories and biotechnology segments. The country's dominant generic pharmaceutical production position and expanding contract manufacturing capabilities are driving demand for transfer solutions that provide consistent contamination prevention while supporting cost-effective facility requirements. Equipment suppliers and pharmaceutical manufacturers are investing in facility development to support growing production operations and regulatory compliance demands.

Demand for cleanroom static transfer boxes in Germany is projected to reach USD 78.9 million by 2035, supported by the country's leadership in pharmaceutical manufacturing excellence and advanced contamination control technologies requiring sophisticated material transfer systems for sterile production and biotechnology applications. German pharmaceutical companies are implementing high-quality transfer systems that support advanced manufacturing techniques, operational efficiency, and comprehensive validation protocols. The cleanroom static transfer box market is characterized by focus on operational excellence, equipment reliability, and compliance with stringent pharmaceutical quality and environmental standards.

Revenue from cleanroom static transfer boxes in Brazil is growing to reach USD 55.3 million by 2035, driven by pharmaceutical manufacturing localization programs and increasing domestic production development creating sustained opportunities for equipment suppliers serving both pharmaceutical manufacturing operations and biotechnology facilities. The country's expanding pharmaceutical manufacturing base and growing biosimilar production awareness are creating demand for transfer equipment that supports diverse facility requirements while maintaining contamination control standards. Pharmaceutical manufacturers and equipment suppliers are developing installation strategies to support operational efficiency and regulatory compliance.

Demand for cleanroom static transfer boxes in United States is projected to reach USD 72.6 million by 2035, expanding at a CAGR of 3.3%, driven by pharmaceutical facility modernization excellence and biotechnology manufacturing capabilities supporting advanced drug development and comprehensive sterile production applications. The country's established pharmaceutical manufacturing tradition and growing specialty pharmaceutical market segments are creating demand for high-quality transfer equipment that supports operational performance and validation standards. Equipment manufacturers and pharmaceutical facility suppliers are maintaining comprehensive development capabilities to support diverse manufacturing requirements.

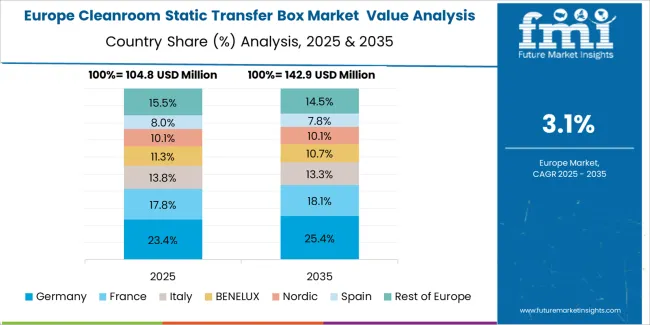

The cleanroom static transfer box market in Europe is projected to grow from USD 113.8 million in 2025 to USD 166.1 million by 2035, registering a CAGR of 3.9% over the forecast period. Germany is expected to maintain its leadership position with a 28.5% market share in 2025, declining slightly to 27.8% by 2035, supported by its advanced pharmaceutical manufacturing infrastructure and comprehensive biotechnology facilities.

France follows with a 19.6% share in 2025, projected to reach 20.1% by 2035, driven by pharmaceutical facility modernization programs and biosimilar production development. The United Kingdom holds a 16.8% share in 2025, expected to maintain 16.5% by 2035 through continued pharmaceutical manufacturing investments. Italy commands a 14.3% share, while Spain accounts for 11.2% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 9.6% to 10.3% by 2035, attributed to increasing pharmaceutical facility development in Nordic countries and emerging Eastern European contract manufacturing operations implementing advanced cleanroom standards.

European cleanroom static transfer box operations reflect regional pharmaceutical manufacturing excellence and stringent contamination control requirements. German facilities dominate through advanced technology integration and comprehensive validation protocols supporting major pharmaceutical production operations. French pharmaceutical manufacturers maintain strong positioning through biosimilar production development and facility modernization investments requiring validated transfer systems.

United Kingdom pharmaceutical operations continue substantial equipment procurement despite regulatory adjustments, with major pharmaceutical facilities maintaining contamination control standards. Italian pharmaceutical manufacturers demonstrate consistent adoption supporting sterile production requirements, while Spanish facilities expand through generic pharmaceutical production growth. Eastern European operations in Poland, Hungary, and Czech Republic capture increasing contract manufacturing business through pharmaceutical facility development and European regulatory compliance capabilities.

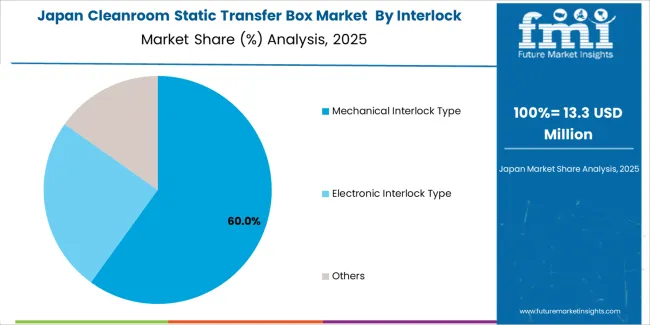

Japanese cleanroom static transfer box operations reflect the country's exacting pharmaceutical manufacturing standards and sophisticated contamination control expectations. Major pharmaceutical manufacturers including Takeda, Astellas, and Daiichi Sankyo maintain rigorous equipment qualification processes that exceed international standards, requiring extensive validation documentation, performance testing, and facility integration audits that can take 12-18 months to complete. This creates high barriers for new suppliers but ensures consistent contamination control that supports premium pharmaceutical production positioning.

The Japanese market demonstrates unique specification preferences, with significant demand for compact transfer box configurations and specialized interlocking mechanisms tailored to space-constrained cleanroom environments. Companies require specific dimensional specifications and contamination control performance that differ from Western applications, driving demand for customized equipment capabilities.

Regulatory oversight through the Pharmaceuticals and Medical Devices Agency emphasizes comprehensive contamination control and validation requirements that surpass most international standards. The pharmaceutical manufacturing system requires detailed equipment qualification documentation, creating advantages for suppliers with transparent validation processes and comprehensive performance documentation systems.

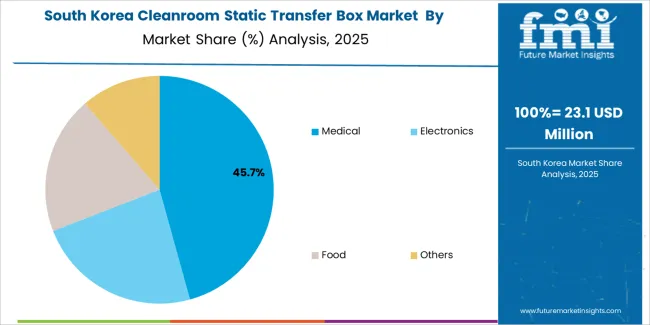

South Korean cleanroom static transfer box operations reflect the country's advanced pharmaceutical manufacturing sector and export-oriented business model. Major pharmaceutical companies including Samsung Biologics, Celltrion, and SK Bioscience drive sophisticated equipment procurement strategies, establishing relationships with global suppliers to secure consistent quality and performance for their biopharmaceutical production and contract manufacturing operations targeting both domestic and international markets.

The Korean market demonstrates particular strength in applying transfer box technology to biopharmaceutical manufacturing applications, with companies integrating advanced contamination control systems into facilities designed for biologics production. This specialization creates demand for specific performance specifications that differ from traditional pharmaceutical applications, requiring suppliers to provide enhanced validation capabilities and monitoring systems.

Regulatory frameworks emphasize pharmaceutical quality and validation requirements, with Korean Ministry of Food and Drug Safety standards often exceeding international requirements. This creates barriers for smaller equipment suppliers but benefits established manufacturers who can demonstrate comprehensive compliance capabilities. The regulatory environment particularly favors suppliers with complete validation documentation and proven contamination control performance.

Profit pools concentrate in pharmaceutical-grade systems with comprehensive validation documentation and proven contamination control performance. Value migrates from basic mechanical units to electronically controlled systems offering monitoring integration, data logging capabilities, and facility automation compatibility. Several competitive archetypes dominate: established pharmaceutical equipment suppliers with comprehensive validation protocols and regulatory expertise; specialized cleanroom technology manufacturers offering customized configurations and technical support; integrated facility solutions providers bundling transfer boxes with broader cleanroom systems; and regional manufacturers serving local pharmaceutical markets through cost-competitive positioning.

Switching costs remain substantial through validation requirements, facility integration complexity, and regulatory documentation dependencies, stabilizing market positions for established suppliers. Pharmaceutical facility expansion cycles and technology upgrade requirements create opportunities for suppliers offering enhanced automation capabilities and comprehensive monitoring systems. Consolidation continues among smaller regional suppliers while larger equipment manufacturers pursue vertical integration through facility design partnerships and turnkey cleanroom solutions.

Digital procurement emerges gradually for standard configurations while customized pharmaceutical applications remain relationship-driven through technical specification requirements and validation support needs. Market dynamics favor suppliers maintaining comprehensive technical capabilities, proven pharmaceutical manufacturing experience, and global service networks supporting international facility deployments.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| Established pharmaceutical equipment suppliers | Validation expertise, regulatory knowledge, proven track record | Long-term facility partnerships, comprehensive documentation, global service networks |

| Specialized cleanroom technology manufacturers | Customization capability, technical innovation, application expertise | Tailored configurations, advanced monitoring, technical support programs |

| Integrated facility solutions providers | Comprehensive system integration, facility design capabilities | Turnkey cleanroom projects, equipment bundling, lifecycle support |

| Regional manufacturers | Local market knowledge, cost-competitive positioning, responsive service | Domestic pharmaceutical facilities, standard configurations, rapid deployment |

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Interlock Type | Mechanical Interlock Type, Electronic Interlock Type, Others |

| Application | Medical, Electronics, Food, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | United States, Germany, China, India, Brazil, and other 40+ countries |

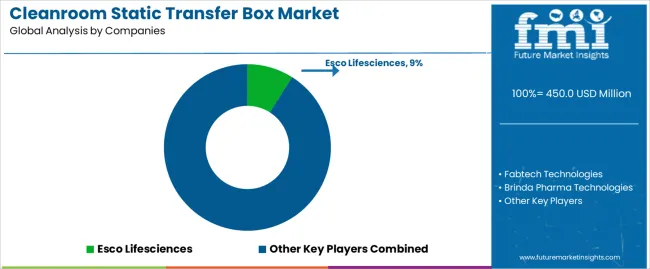

| Key Companies Profiled | Esco Lifesciences, Fabtech Technologies, Brinda Pharma Technologies, Easypharma, AIRTECH, Kleanlabs, Quality Clean Equipments, Willson Cleanroom, CMP Metal, Clean Air Systems, Eawayfilter |

| Additional Attributes | Dollar sales by interlock type/application, regional demand (NA, EU, APAC), competitive landscape, pharmaceutical vs. electronics adoption, facility integration capabilities, and contamination control innovations driving validation enhancement, manufacturing efficiency, and quality assurance |

The global cleanroom static transfer box market is estimated to be valued at USD 450.0 million in 2025.

The market size for the cleanroom static transfer box market is projected to reach USD 634.8 million by 2035.

The cleanroom static transfer box market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in cleanroom static transfer box market are mechanical interlock type, electronic interlock type and others.

In terms of application, medical segment to command 47.8% share in the cleanroom static transfer box market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cleanroom and Lab Surface Contamination Control Products Market Size and Share Forecast Outlook 2025 to 2035

Cleanroom Construction Market Size and Share Forecast Outlook 2025 to 2035

Cleanroom Technologies Market Growth – Trends & Forecast 2025 to 2035

Cleanroom Flooring Market Growth - Trends & Forecast 2024 to 2034

Cleanroom Lighting Market

Static VAR Compensator Market Forecast Outlook 2025 to 2035

Static Stability Control Sensors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Static Random Access Memory (SRAM) Market Size and Share Forecast Outlook 2025 to 2035

Static Synchronous Compensator (STATCOM) Market Size and Share Forecast Outlook 2025 to 2035

Static-Free Packaging Films Market Growth - Demand & Forecast 2025 to 2035

Isostatic Pressing Market Analysis by Component, Type, and Region: Forecast for 2025 to 2035

Diastatic Malt Market

Prostatic arterial embolization (PAE) Market

Hemostatic Gels Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Antistatic Brush Market Growth – Trends & Forecast 2024-2034

Metastatic Bone Tumor Treatment Market

Anti-Static Hair Care Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Anti-Static Liners Market Size and Share Forecast Outlook 2025 to 2035

Anti-Static Foam Pouch Market Size and Share Forecast Outlook 2025 to 2035

Anti-Static Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA