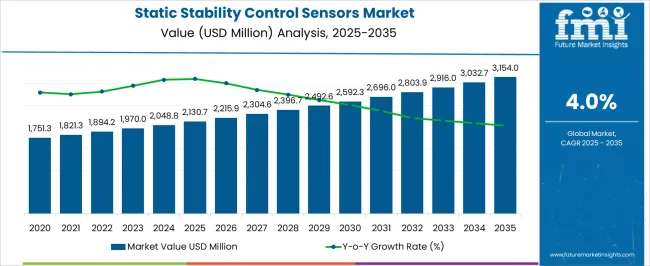

The global static stability control sensors market is projected to grow from USD 2.13 billion in 2025 to approximately USD 3.16 billion by 2035, reflecting an absolute increase of USD 1.03 billion over the forecast period. This translates into a cumulative growth of approximately 48.4% over the ten-year span. The market is expected to expand at a compound annual growth rate (CAGR) of 4.0% between 2025 and 2035, with the overall market size projected to grow by nearly 1.48X during this period.

The market is growing due to rising emphasis on road safety, stricter regulations, and increasing consumer demand for advanced vehicle technologies. Governments across regions are mandating the integration of electronic stability control systems, which rely on sensors such as yaw rate, steering angle, wheel speed, and accelerometers to enhance vehicle stability and prevent accidents. The rapid adoption of electric and autonomous vehicles further drives demand, as these platforms require highly precise motion and stability monitoring. At the same time, advances in sensor miniaturization, accuracy, and cost efficiency make integration easier, accelerating market expansion globally.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.13 billion |

| Industry Size (2035F) | USD 3.16 billion |

| CAGR (2025 to 2035) | 4.0% |

Between 2025 and 2030, the static stability control sensors market is projected to expand from USD 2.13 billion to USD 2.59 billion, adding approximately USD 0.46 billion during this period. This phase of growth will be driven by increasing adoption of advanced driver assistance systems across passenger vehicles and commercial fleets. Regulatory mandates for vehicle safety systems and the rising integration of electronic stability programs in mid-range vehicle segments are expected to fuel demand for sophisticated sensor technologies.

From 2030 to 2035, the market is forecast to grow from USD 2.59 billion to USD 3.16 billion, registering a value addition of USD 0.57 billion. This growth phase will be characterized by the proliferation of autonomous driving technologies and the integration of multiple sensor arrays within single control units. The development of smart sensor hubs and the adoption of MEMS-based solutions will drive innovation during this period.

Between 2020 and 2025, the static stability control sensors market expanded from USD 1.84 billion to USD 2.13 billion, recording steady growth supported by increasing vehicle production and mandatory safety regulations across major automotive markets. Growth during this period was influenced by the automotive industry's recovery from supply chain disruptions and the accelerated adoption of electronic stability control systems in emerging markets.

Market development was largely driven by original equipment manufacturers integrating stability control as standard equipment rather than optional features. The shift toward electric vehicles and hybrid powertrains also contributed to growth as these platforms require sophisticated sensor systems for optimal performance and safety management.

The growth of the static stability control sensors market is being driven by increasingly stringent vehicle safety regulations worldwide and the automotive industry's transition toward autonomous driving technologies. Government mandates requiring electronic stability control systems in new vehicles have created a substantial baseline demand for static stability sensors across all vehicle categories.

The rising complexity of modern vehicle dynamics, particularly in electric and hybrid vehicles, requires more sophisticated sensor arrays to monitor and control vehicle stability in real-time. Consumer awareness of vehicle safety features and insurance incentives for vehicles equipped with advanced safety systems are further accelerating adoption across market segments.

Technological advancements in MEMS sensor manufacturing and the integration of multiple sensing functions within single units are reducing costs while improving performance. The automotive industry's shift toward platform sharing and modular architecture is also driving standardization of sensor specifications across vehicle lineups.

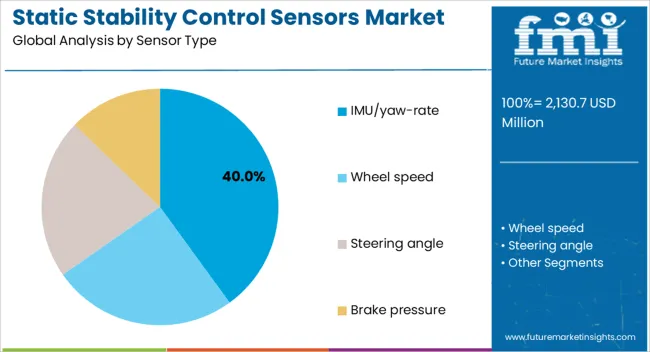

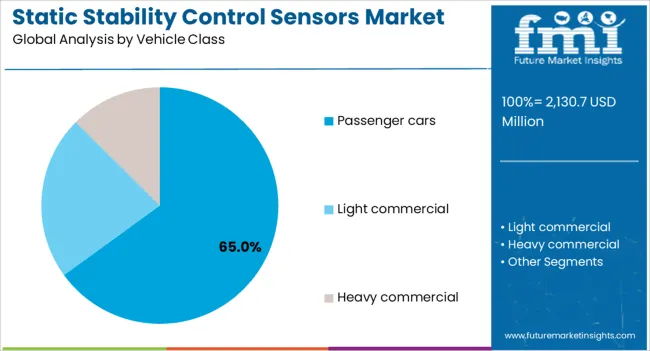

The market is segmented by sensor type, vehicle class, integration level, channel, and region. By sensor type, the market is divided into IMU/yaw-rate sensors, wheel speed sensors, steering angle sensors, and brake pressure sensors. Based on vehicle class, the market is segmented into passenger cars, light commercial vehicles, and heavy commercial vehicles. By integration level, the market is classified into integrated IMU controllers, standalone sensors, and smart hub configurations. Based on channel, the market is bifurcated into OEM fitment and aftermarket. Regionally, the market is classified into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

IMU/yaw-rate sensors are estimated to hold a 40% market share in 2025, representing the largest sensor category due to their ability to provide comprehensive vehicle motion data. These sensors combine multiple measurement functions including angular velocity, linear acceleration, and orientation sensing within a single unit. Their dominance reflects the automotive industry's preference for integrated solutions that reduce system complexity while improving reliability and reducing installation costs.

Passenger cars are projected to account for 65% of the static stability control sensors market in 2025, driven by high production volumes and universal adoption of stability control systems. Light commercial vehicles contribute 20% of demand, supported by commercial fleet operators' focus on safety and insurance cost reduction. Heavy commercial vehicles represent 15% of the market, with specialized sensor requirements for larger vehicle dynamics and load variations.

The static stability control sensors market is experiencing steady growth driven by regulatory requirements and technological advancement in vehicle safety systems. However, cost pressures from automotive manufacturers and the complexity of integrating multiple sensor types within existing vehicle architectures present ongoing challenges. The market continues to evolve toward more sophisticated sensing solutions while balancing performance requirements with cost constraints.

Static stability control sensors are increasingly being integrated with broader ADAS platforms, enabling multiple safety functions to share sensor data and processing resources. This integration reduces overall system costs while improving performance through sensor fusion algorithms. Manufacturers are developing sensors capable of supporting both traditional stability control and newer autonomous driving functions within unified hardware platforms.

The adoption of MEMS technology is enabling significant miniaturization of stability control sensors while improving accuracy and reducing power consumption. These advances allow for easier integration into space-constrained vehicle environments and support the development of distributed sensor networks. MEMS-based solutions also offer improved durability and reduced maintenance requirements compared to traditional mechanical sensors.

Next-generation stability control systems are incorporating predictive algorithms that anticipate stability issues before they occur, requiring more sophisticated sensor arrays with higher sampling rates and improved precision. This evolution is driving demand for advanced IMU sensors capable of detecting subtle changes in vehicle dynamics that indicate potential stability problems.

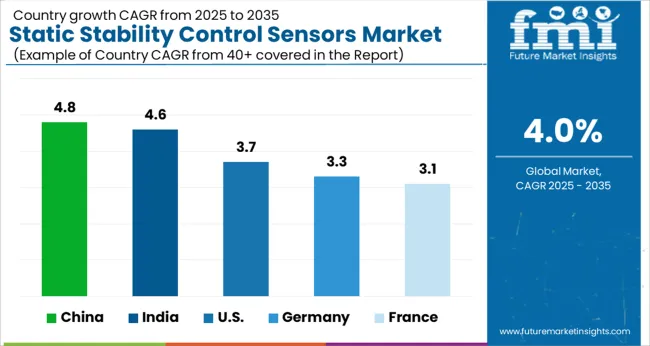

| Country | CAGR |

|---|---|

| China | 4.8 |

| India | 4.6 |

| USA | 3.7 |

| Germany | 3.3 |

| France | 3.1 |

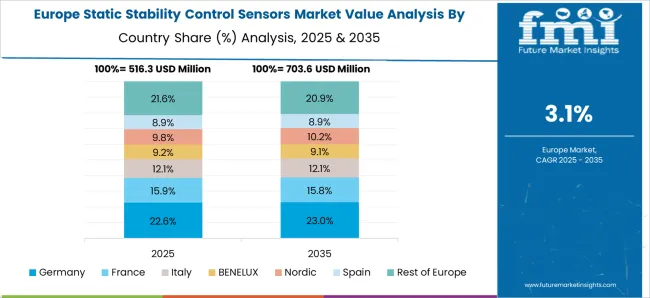

China leads global growth in the static stability control sensors market with the highest CAGR of 4.8% from 2025 to 2035, supported by its position as the world’s largest automotive production base and rapid expansion of domestic vehicle ownership. India follows closely with a strong CAGR of 4.6%, driven by safety regulation upgrades, growing middle-class demand, and its role as a global manufacturing hub. The United States maintains steady growth at 3.7%, reflecting mature safety regulations and innovation leadership in EV and autonomous technologies. Germany records a CAGR of 3.3%, supported by its premium vehicle focus, advanced sensor development, and regulatory influence in Europe. France shows consistent growth at 3.1%, with stable automotive production and rising EV initiatives driving specialized sensor requirements.

The report covers an in-depth analysis of 40+ countries; five top-performing countries are highlighted below.

Revenue from static stability control sensors in China is projected to lead global growth, recording a CAGR of 4.8% from 2025 to 2035. China’s position as the world’s largest automotive producer and the rapid rise in domestic vehicle ownership create unmatched demand for advanced safety technologies. The government’s regulatory environment increasingly mandates electronic stability systems across all vehicle segments, making them standard equipment even in low-cost models. China’s global leadership in electric vehicle manufacturing adds another layer of opportunity, as EVs require highly sophisticated stability and safety sensors to manage battery weight, torque distribution, and regenerative braking. Local suppliers are scaling production to serve both domestic and export needs, while global sensor manufacturers are expanding partnerships and facilities to meet accelerating demand.

Revenue from static stability control sensors in India is forecast to grow at a CAGR of 4.6%, supported by the country’s modernizing automotive industry, rapid vehicle adoption, and tightening safety regulations. India’s large and growing middle-class population is increasingly seeking cars equipped with advanced safety features, which is driving original equipment manufacturers to integrate electronic stability systems as standard. The government’s commitment to improving road safety through stronger regulations and awareness campaigns is accelerating adoption across passenger and commercial vehicle categories. India’s status as a major automotive manufacturing hub for domestic and export markets is attracting leading global suppliers, who are investing in local production facilities to serve rising demand. Together, these factors are positioning India as one of the fastest-growing markets globally.

Demand for static stability control sensors in the USA is set to grow at a CAGR of 3.7%, reflecting the country’s established vehicle safety regulations, technology leadership, and ongoing shift toward electrification. The USA market benefits from both replacement demand in its large vehicle fleet and steady new vehicle production incorporating advanced electronic safety systems. Innovation leadership among USA-based automakers and suppliers supports the development of new sensor integration strategies, improving precision and reliability. The transition to electric and autonomous vehicles is creating additional opportunities, as these platforms require specialized sensors designed for unique powertrain layouts, weight distribution, and system redundancies. Consumer demand for comprehensive safety features remains strong, ensuring stable growth while reinforcing the USA position as a technology driver.

Revenue from static stability control sensors in Germany is projected to expand at a CAGR of 3.3% from 2025 to 2035, supported by the country’s role as Europe’s leading automotive innovator and major manufacturing base. German automakers, known for their premium and performance-focused vehicles, demand advanced stability systems that deliver high levels of precision, responsiveness, and reliability. Local suppliers are global leaders in micro-electromechanical systems (MEMS) and advanced sensor fusion algorithms, setting standards for innovation across Europe. Germany’s influence on European automotive regulations also shapes stability control adoption throughout the region. The strong emphasis on quality and safety, coupled with the expansion of electric and hybrid vehicles, is fueling consistent demand for next-generation stability control sensors across multiple vehicle platforms.

Demand for static stability control sensors in France is expected to grow at a steady CAGR of 3.1%, reflecting balanced demand from passenger and commercial vehicles and a stable automotive manufacturing base. The country hosts leading automakers and suppliers that continue to integrate electronic stability systems across their product ranges. Regulatory leadership in Europe ensures that French vehicles meet high safety standards, supporting reliable demand for sensor technologies. France is also prioritizing electric vehicle development, which is creating new requirements for specialized stability sensors tailored to innovative powertrain and chassis designs. Growth in light commercial vehicles adds another dimension to market demand, as manufacturers balance cost-effectiveness with safety. Together, these drivers establish France as a stable yet evolving contributor to regional market expansion.

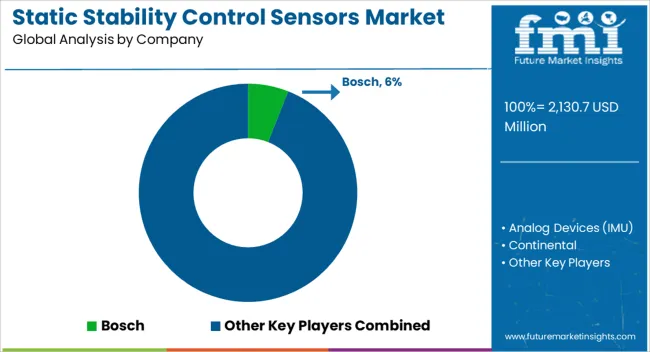

The static stability control sensors market is characterized by established automotive suppliers focusing on technological advancement and manufacturing efficiency. Leading companies are investing in MEMS technology development and sensor fusion capabilities to maintain competitive advantages. Market competition centers on product reliability, cost efficiency, and integration capabilities with existing vehicle electronic systems.

Bosch maintains a strong position in the German market through comprehensive sensor portfolios and advanced manufacturing capabilities. The company's focus on integrated solutions and MEMS technology development supports its competitive position across global markets. Continental leverages its automotive systems expertise to provide integrated sensor solutions for stability control applications.

Denso and Hitachi Astemo represent strong Japanese technology leadership in sensor development, with particular strengths in precision manufacturing and quality control. These companies focus on advanced sensor technologies for both traditional and electric vehicle applications. ZF TRW contributes specialized expertise in vehicle dynamics and control systems integration.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 2.13 Billion |

| Sensor Type | IMU/Yaw-rate, Wheel Speed, Steering Angle, Brake Pressure |

| Vehicle Class | Passenger Cars, Light Commercial, Heavy Commercial |

| Integration Level | Integrated IMU Controller, Standalone Sensors, Smart Hubs |

| Channel | OEM Fitment, Aftermarket |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Bosch, Continental, Denso, Hitachi Astemo, ZF TRW, Analog Devices, Murata, NXP Semiconductors, STMicroelectronics, TDK InvenSense |

| Additional Attributes | Dollar sales by sensor type and vehicle class, regional demand growth, OEM competition, buyer preference for advanced safety, integration with ADAS, innovations in MEMS, and sustainable automotive applications |

The global static stability control sensors market is estimated to be valued at USD 2,130.7 million in 2025.

The market size for the static stability control sensors market is projected to reach USD 3,154.0 million by 2035.

The static stability control sensors market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in static stability control sensors market are imu/yaw-rate, wheel speed, steering angle and brake pressure.

In terms of vehicle class, passenger cars segment to command 65.0% share in the static stability control sensors market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Static VAR Compensator Market Forecast Outlook 2025 to 2035

Static Random Access Memory (SRAM) Market Size and Share Forecast Outlook 2025 to 2035

Static Synchronous Compensator (STATCOM) Market Size and Share Forecast Outlook 2025 to 2035

Static-Free Packaging Films Market Growth - Demand & Forecast 2025 to 2035

Isostatic Pressing Market Analysis by Component, Type, and Region: Forecast for 2025 to 2035

Diastatic Malt Market

Prostatic arterial embolization (PAE) Market

Hemostatic Gels Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Antistatic Brush Market Growth – Trends & Forecast 2024-2034

Metastatic Bone Tumor Treatment Market

Anti-Static Hair Care Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Anti-Static Liners Market Size and Share Forecast Outlook 2025 to 2035

Anti-Static Foam Pouch Market Size and Share Forecast Outlook 2025 to 2035

Anti-Static Agents Market Size and Share Forecast Outlook 2025 to 2035

Anti-Static Foam Packaging Market Size, Share & Forecast 2025 to 2035

Anti-static Backing Paper Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Anti-Static Bubble Pouch Market – Trends & Forecast 2025 to 2035

Anti-Static Fibres Market Growth – Trends & Forecast 2025 to 2035

Hydrostatic Testing Market - Trends & Forecast 2025 to 2035

Hydrostatic Transmission Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA