The Cleanroom Construction Market is estimated to be valued at USD 6.2 billion in 2025 and is projected to reach USD 12.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.9% over the forecast period. In the early adoption phase from 2020 to 2024, the market expanded from USD 4.4 billion to USD 5.8 billion. During this period, adoption was primarily driven by pharmaceutical, semiconductor, and biotechnology firms seeking controlled environments to meet regulatory compliance and quality standards. Early adopters focused on customized cleanroom designs, advanced filtration systems, and precision construction techniques, establishing proof of value and setting industry benchmarks.

From 2025 to 2030, the market enters the scaling phase, growing from USD 6.2 billion to USD 8.6 billion. This period is marked by broader adoption across industries such as healthcare, food processing, and electronics. Standardization of cleanroom modules, modular construction solutions, and cost-efficient designs enables faster deployment, driving market expansion. Partnerships with engineering, procurement, and construction (EPC) firms accelerate large-scale projects, while increasing regulatory compliance encourages investment in modern facilities.

The consolidation phase begins from 2030 to 2035, as the market reaches USD 12.0 billion. Leading players capture the majority of market share, leveraging operational efficiency, advanced technologies, and long-term service contracts. Smaller firms consolidate or focus on niche applications, and growth stabilizes, reflecting a mature market with widespread adoption across key industrial sectors.

Regulatory landscapes vary significantly between regions, with FDA cGMP guidelines in North America differing from EU GMP requirements in scope and implementation specifics. These variations create procurement complications where facility design teams must navigate competing standards that influence everything from air filtration specifications to personnel flow patterns. Quality assurance departments frequently clash with project management teams over compliance interpretations, particularly when ISO 14644-1 standards intersect with local building codes that weren't originally designed for cleanroom applications.

Market consolidation trends reflect operational pressures where specialized cleanroom contractors acquire smaller competitors to expand geographic coverage and technical capabilities. These acquisitions create integration challenges where different companies' design philosophies and construction methodologies must merge while maintaining quality standards that pharmaceutical and semiconductor clients demand. Client relationships become critical differentiators where long-term partnerships provide competitive advantages over purely cost-based selection processes.

Workforce development challenges affect project execution where skilled cleanroom construction technicians represent limited labor pools that multiple projects compete to secure. Training programs for cleanroom-specific construction techniques require investments that smaller contractors cannot easily justify, yet larger contractors face capacity constraints when multiple projects demand specialized personnel simultaneously. These labor market dynamics create project scheduling risks that general contractors must navigate while maintaining quality standards that regulatory validation processes require.

| Metric | Value |

|---|---|

| Cleanroom Construction Market Estimated Value in (2025 E) | USD 6.2 billion |

| Cleanroom Construction Market Forecast Value in (2035 F) | USD 12.0 billion |

| Forecast CAGR (2025 to 2035) | 6.9% |

The cleanroom construction market is witnessing strong growth, driven by the expanding requirements of highly regulated industries such as pharmaceuticals, biotechnology, microelectronics, and advanced material manufacturing. Rising investments in high-precision production environments have intensified the need for contamination-free facilities that comply with ISO and GMP standards. The adoption of cleanrooms has been further accelerated by technological advancements in nanotechnology, increasing biologics production, and the growth of regional semiconductor fabrication plants.

Additionally, government-led initiatives focused on boosting domestic pharmaceutical and electronics production have elevated demand for cleanroom infrastructure. Cleanroom construction is increasingly being shaped by the need for quick deployment, energy efficiency, and lifecycle sustainability, prompting a shift toward modular and reconfigurable systems.

The integration of smart HVAC systems, remote environment monitoring, and anti-microbial surface materials is also contributing to the market's modernization Looking ahead, evolving compliance requirements and continuous innovation in cleanroom materials and layouts are expected to create new opportunities for scalable, cost-effective construction models.

The cleanroom construction market is segmented by type, material, class, application, and geographic regions. By type, the cleanroom construction market is divided into Modular cleanroom, Soft wall cleanroom, Hard wall cleanroom, and Others (hybrid cleanroom, etc.). In terms of material, the cleanroom construction market is classified into Aluminum, Steel, Glass, and Others (PVC, vinyl, etc.). Based on class, cleanroom construction market is segmented into Class 100, Class 10, Class 1,000, Class 10,000, and Class 100,000.

By application, the cleanroom construction market is segmented into Pharmaceutical, Biotechnology, Aerospace and defense, Semiconductor, Healthcare, and Others (automotive, etc.). Regionally, the cleanroom construction industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Modular cleanrooms are expected to account for 39.5% of the cleanroom construction market revenue in 2025, making them the most dominant type segment. This leading position is being attributed to their flexibility, ease of installation, and rapid scalability which are critical in time-sensitive production environments. Modular systems are widely preferred for their ability to be expanded, reconfigured, or relocated with minimal disruption to operations.

These cleanrooms support faster deployment cycles while maintaining strict compliance with cleanroom classification standards. Their pre-engineered components enhance construction efficiency and reduce dependency on specialized labor, which is especially valuable in regulated manufacturing sectors. Additionally, modular cleanrooms support integration with automated airflow control, particle monitoring systems, and energy-efficient filtration units.

The reduction in construction lead time, combined with cost predictability and minimal facility downtime, has led to increased adoption across pharmaceutical, semiconductor, and contract manufacturing applications. As industries continue to prioritize operational agility and capital efficiency, modular cleanroom systems are expected to remain a preferred solution.

Aluminum-based cleanroom structures are projected to represent 41.3% of the cleanroom construction market revenue in 2025, leading the material segment. The dominance of aluminum is being driven by its lightweight nature, high corrosion resistance, and structural rigidity, which are essential for controlled environment applications. Aluminum framing systems offer superior dimensional stability, enabling precise alignment and robust sealing performance necessary to meet stringent contamination control requirements.

These materials are also compatible with cleanroom-grade wall panels, HEPA housing, and integrated lighting systems. The non-particulating and non-porous properties of aluminum make it ideal for supporting easy-to-clean surfaces and long-term hygienic performance. Additionally, aluminum construction supports both modular and stick-built configurations, allowing versatility across varied industry needs.

The recyclability and lower lifecycle maintenance cost of aluminum have further reinforced its preference in cleanroom construction projects. Its favorable strength-to-weight ratio and adaptability to advanced air control systems have ensured sustained relevance in high-tech manufacturing and laboratory environments.

Class 100 cleanrooms are anticipated to contribute 36.9% of the cleanroom construction market revenue in 2025, holding the top share among the classification segments. The demand for Class 100 environments has been significantly influenced by the growth of advanced manufacturing processes that require extremely low levels of airborne particulates. These cleanrooms are widely used in semiconductor fabrication, aerospace component production, and sterile pharmaceutical compounding, where the margin for contamination is near zero.

The construction of Class 100 spaces involves strict design protocols, including high-efficiency air filtration systems, pressurized airflow, and fully enclosed structural envelopes. Continuous monitoring, laminar flow designs, and precision temperature and humidity controls are integrated to maintain particulate counts below 100 particles per cubic foot.

The rise in microelectronics and nanofabrication demand, especially in Asia and North America, has fueled the need for such high-grade cleanroom environments. The emphasis on precision, regulatory compliance, and reliability has positioned Class 100 as a critical component in next-generation cleanroom infrastructure.

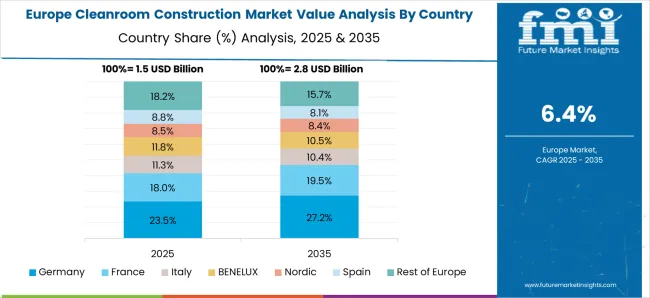

The cleanroom construction market is experiencing steady growth driven by increasing demand in pharmaceuticals, biotechnology, semiconductor manufacturing, and healthcare sectors. Cleanrooms provide controlled environments that minimize contamination, ensuring product quality and regulatory compliance. Technological advancements in modular and prefabricated cleanroom designs, air filtration, and HVAC systems enhance efficiency and reduce construction timelines. North America and Europe dominate due to stringent regulatory requirements and advanced manufacturing facilities, while Asia-Pacific shows rapid growth with expanding electronics and pharmaceutical industries. Market players focus on energy-efficient systems, compliance with ISO and GMP standards, and turnkey construction solutions. Strategic collaborations with engineering firms, equipment suppliers, and research institutions are fostering innovation and customization for industry-specific applications, ranging from microelectronics to biologics.

Compliance with strict regulatory and industry standards is a critical challenge in cleanroom construction. Cleanrooms must meet ISO 14644, GMP, FDA, and regional standards for particulate control, airflow, and contamination levels. Different industries impose unique requirements: pharmaceutical facilities prioritize sterility, semiconductor fabs require ultra-low particle counts, and food-grade cleanrooms demand hygiene and chemical safety. Ensuring compliance necessitates precise planning of airflow, filtration, and material selection, as well as rigorous validation and certification processes. Non-compliance can result in project delays, fines, or operational shutdowns. Companies investing in expert engineering teams, quality assurance protocols, and testing equipment can navigate these regulatory complexities effectively. Until global harmonization of cleanroom standards is achieved, contractors must design flexible solutions tailored to specific regulatory frameworks while maintaining operational efficiency and reliability.

Technological advancements are reshaping cleanroom construction, particularly through modular, prefabricated, and scalable designs. Modular cleanrooms reduce construction time, lower costs, and offer flexibility for future expansion. Advanced HVAC systems, HEPA/ULPA filtration, and real-time environmental monitoring improve air quality, temperature, and humidity control. Automation and smart building technologies enable predictive maintenance, energy efficiency, and operational optimization. Use of durable, easy-to-clean materials such as antimicrobial surfaces and chemical-resistant panels enhances hygiene and longevity. Integration of sustainable construction practices, including energy-efficient lighting and low-emission materials, aligns with environmental regulations. Companies leveraging cutting-edge technologies and modular approaches differentiate themselves by delivering cost-effective, scalable, and high-performance cleanrooms that meet evolving industry demands.

Cleanroom construction involves significant capital expenditure, making cost management a key market challenge. Specialized materials, filtration systems, and precision engineering increase upfront investment, especially for ultra-clean environments required in semiconductor or pharmaceutical sectors. Complex design requirements, including airflow management, contamination control, and integration of utilities, further add to project costs. Installation must minimize operational downtime and align with production schedules, often requiring phased construction or retrofit solutions. Skilled labor, engineering expertise, and stringent quality control measures are essential for successful project delivery. Companies that optimize design, utilize prefabricated components, and implement efficient project management can reduce costs and construction timelines. Until cost-effective and scalable solutions become standard, high capital requirements and technical complexity remain significant barriers for new entrants and facility expansions.

The cleanroom construction market is competitive, with global engineering firms, specialized contractors, and regional players offering turnkey or modular solutions. Differentiation relies on expertise in regulatory compliance, innovative design, and project execution efficiency. Supply chain stability for critical components, including HEPA filters, panels, and HVAC equipment, is essential for timely project delivery. Fluctuations in raw material availability, transportation disruptions, and specialized equipment shortages can impact timelines and costs. Companies investing in local sourcing, strategic partnerships, and inventory management gain resilience and reliability. Competitive advantage is increasingly achieved through integrated services, digital monitoring solutions, and energy-efficient construction practices. Until supply chain robustness and standardization improve, market growth will depend on reliability, technological innovation, and reputation for delivering compliant and efficient cleanroom projects.

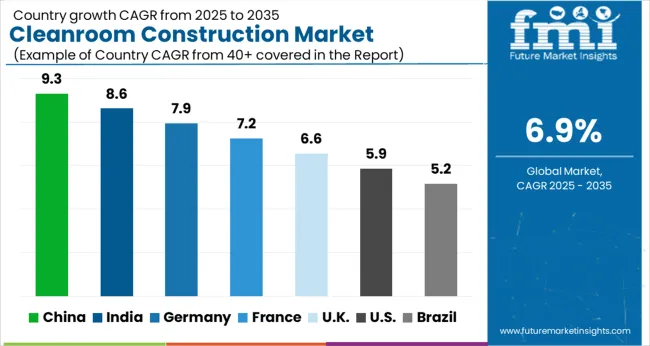

| Country | CAGR |

|---|---|

| China | 9.3% |

| India | 8.6% |

| Germany | 7.9% |

| France | 7.2% |

| UK | 6.6% |

| USA | 5.9% |

| Brazil | 5.2% |

The global Cleanroom Construction Market is projected to grow at a CAGR of 6.9% through 2035, supported by increasing demand across pharmaceutical, semiconductor, and biotechnology applications. Among BRICS nations, China has been recorded with 9.3% growth, driven by large-scale construction and deployment in pharmaceutical and semiconductor facilities, while India has been observed at 8.6%, supported by rising utilization in biotech and cleanroom projects. In the OECD region, Germany has been measured at 7.9%, where production and adoption for pharmaceutical, semiconductor, and biotechnology cleanrooms have been steadily maintained. The United Kingdom has been noted at 6.6%, reflecting consistent use in industrial and research cleanroom facilities, while the USA has been recorded at 5.9%, with construction and utilization across pharmaceutical, biotech, and semiconductor sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The cleanroom construction market in China is growing at a CAGR of 9.3%, driven by the expansion of pharmaceutical, semiconductor, and biotechnology industries. Increasing demand for contamination-free environments in manufacturing and research facilities fuels the adoption of advanced cleanroom solutions. Strict quality standards and regulatory compliance in healthcare and electronics sectors encourage investment in modular, energy-efficient, and high-performance cleanroom systems. Local and international contractors are collaborating to deliver large-scale projects, supporting market growth. Rising R&D activities, particularly in biopharma and precision electronics, increase demand for specialized cleanroom designs and materials. E-commerce and technology-driven construction management systems enhance project efficiency. The market is further supported by government initiatives to promote high-tech manufacturing and innovation clusters. Growing adoption of modular construction methods reduces setup time and operational costs, strengthening China’s position as a key cleanroom construction market globally.

The cleanroom construction market in India is expanding at a CAGR of 8.6%, fueled by growth in pharmaceuticals, biotechnology, and electronics manufacturing. Demand for sterile and contamination-free production environments drives adoption of advanced cleanroom systems. Contractors and solution providers are offering modular, energy-efficient, and scalable designs to meet industry-specific requirements. Regulatory enforcement in healthcare and electronics sectors ensures strict adherence to quality standards. Rising investments in R&D facilities and smart manufacturing hubs further contribute to market growth. The adoption of prefabricated panels, controlled airflow systems, and advanced filtration technologies enhances operational efficiency. Government initiatives promoting high-tech manufacturing, biotechnology parks, and medical device production support infrastructure development. As Indian industries focus on global competitiveness, the demand for cleanroom construction services and integrated solutions is expected to rise steadily.

The cleanroom construction market in Germany is growing at a CAGR of 7.9%, driven by pharmaceutical, medical device, and electronics sectors. High-quality standards and regulatory compliance requirements are major factors influencing demand for advanced cleanroom designs. Companies are investing in modular systems, energy-efficient materials, and sophisticated air filtration solutions to maintain contamination-free environments. R&D centers and production facilities in biotechnology and semiconductor industries are key adopters of cleanroom construction services. Germany’s strong engineering expertise ensures precise installation and long-term operational reliability. Continuous technological advancements, such as automation, monitoring systems, and prefabricated cleanroom modules, improve efficiency and reduce setup time. Export-oriented manufacturing further drives investment in high-standard cleanrooms. The market benefits from government incentives for innovation clusters, ensuring Germany remains a leading region for specialized cleanroom construction.

The cleanroom construction market in the United Kingdom is expanding at a CAGR of 6.6%, driven by pharmaceutical, biotechnology, and electronics industries. Increasing regulatory requirements and focus on contamination-free environments encourage investment in modular and high-efficiency cleanroom systems. Contractors are offering prefabricated solutions, advanced filtration, and controlled airflow technologies for scalable construction projects. R&D centers and manufacturing facilities are key adopters, ensuring compliance with quality and safety standards. Growth is supported by government initiatives for life sciences and medical technology hubs. Integration of digital construction management tools improves project execution and reduces costs. The UK market also emphasizes energy efficiency and sustainable materials in cleanroom projects. Rising industrial demand for contamination-free spaces ensures steady market growth, positioning the United Kingdom as a significant market in Europe.

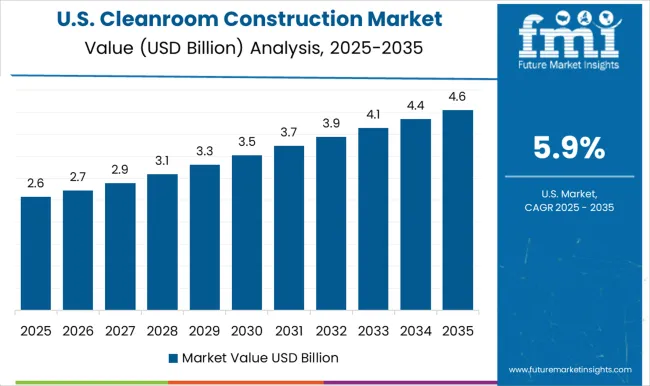

The cleanroom construction market in the United States is growing at a CAGR of 5.9%, driven by healthcare, pharmaceutical, and electronics sectors. Strict regulatory requirements for sterile and contamination-free environments increase demand for advanced cleanroom systems. Adoption of modular, energy-efficient, and prefabricated cleanrooms reduces construction time and operational costs. Large-scale R&D facilities, semiconductor fabs, and medical manufacturing plants are key consumers. Technological innovations, such as automated monitoring, controlled airflow, and advanced filtration, enhance performance and compliance. Government initiatives supporting high-tech manufacturing and life sciences infrastructure further fuel market growth. The USA market also emphasizes sustainability and cost-effective designs in cleanroom construction. Increasing awareness of safety, quality, and efficiency among end-users ensures continued adoption, making the United States a significant contributor to global cleanroom construction expansion.

The Cleanroom Construction Market is expanding rapidly, driven by growing demand from the pharmaceutical, biotechnology, semiconductor, and healthcare industries. Cleanrooms are critical environments that control airborne particles, temperature, humidity, and pressure—essential for maintaining product integrity and regulatory compliance in precision manufacturing. Market growth is being fueled by the global expansion of pharmaceutical production, the rise of biologics and advanced medical devices, and increased semiconductor fabrication activity across Asia, North America, and Europe.

Leading players such as AES Clean Technology Inc., Exyte GmbH (M+W Group), and Lindner Group dominate the global market with turnkey cleanroom design, engineering, and modular construction solutions. AES Clean Technology specializes in modular cleanroom systems with rapid installation capabilities for life sciences and pharmaceutical facilities, while Exyte GmbH provides large-scale integrated cleanroom projects for semiconductor and electronics manufacturing. Lindner Group focuses on sustainable, energy-efficient cleanroom solutions incorporating advanced HVAC, ceiling, and wall systems.

Mid-tier companies such as Clean Air Products Inc., Angstrom Technology Ltd., and Performance Contracting Group Inc. deliver custom cleanroom solutions for industrial, aerospace, and research applications, emphasizing compliance with ISO and GMP standards. ACH Engineering Inc., AdvanceTEC LLC, and American Cleanroom Systems Inc. offer specialized expertise in high-containment and cGMP cleanrooms tailored for pharmaceutical and biotechnology operations.

Connect 2 Cleanrooms Ltd., Total Clean Air Ltd., and Allied Cleanrooms are expanding their presence in Europe and North America with modular, prefabricated systems that reduce build time and lifecycle costs. Hodess Cleanroom Construction, Cleanroom Design & Construction Ltd., and Terra Universal Inc. focus on turnkey, high-specification projects integrating advanced filtration, automation, and environmental monitoring technologies.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.2 Billion |

| Type | Modular cleanroom, Soft wall cleanroom, Hard wall cleanroom, and Others (hybrid cleanroom etc.) |

| Material | Aluminum, Steel, Glass, and Others (PVC, vinyl etc.) |

| Class | Class 100, Class 10, Class 1,000, Class 10,000, and Class 100,000 |

| Application | Pharmaceutical, Biotechnology, Aerospace and defense, Semiconductor, Healthcare, and Others (automotive etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled |

AES Clean Technology Inc., Exyte GmbH (M+W Group), Clean Air Products Inc., Lindner Group, Angstrom Technology Ltd., Performance Contracting Group Inc., ACH Engineering Inc., AdvanceTEC LLC, American Cleanroom Systems Inc., Connect 2 Cleanrooms Ltd., Total Clean Air Ltd., Allied Cleanrooms, Hodess Cleanroom Construction, Cleanroom Design & Construction Ltd., Terra Universal Inc. |

| Additional Attributes | Dollar sales vary by cleanroom type, including modular, prefabricated, and conventional cleanrooms; by application, such as pharmaceuticals, biotechnology, electronics, healthcare, and food & beverage; by construction type, spanning turnkey, design-build, and retrofit solutions; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising demand for contamination-free environments, regulatory compliance, and expanding high-tech manufacturing sectors. |

The global cleanroom construction market is estimated to be valued at USD 6.2 billion in 2025.

The market size for the cleanroom construction market is projected to reach USD 12.0 billion by 2035.

The cleanroom construction market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in cleanroom construction market are modular cleanroom, soft wall cleanroom, hard wall cleanroom and others (hybrid cleanroom etc.).

In terms of material, aluminum segment to command 41.3% share in the cleanroom construction market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cleanroom Static Transfer Box Market Size and Share Forecast Outlook 2025 to 2035

Construction Material Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Industry Analysis in United Kingdom Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Cleanroom and Lab Surface Contamination Control Products Market Size and Share Forecast Outlook 2025 to 2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Fleet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Risk Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Waste Market Size and Share Forecast Outlook 2025 to 2035

Construction Design Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Punch List Software Market Size and Share Forecast Outlook 2025 to 2035

Construction ERP Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Textile Market Size and Share Forecast Outlook 2025 to 2035

Construction Worker Safety Market Size and Share Forecast Outlook 2025 to 2035

Construction Software As A Service Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA