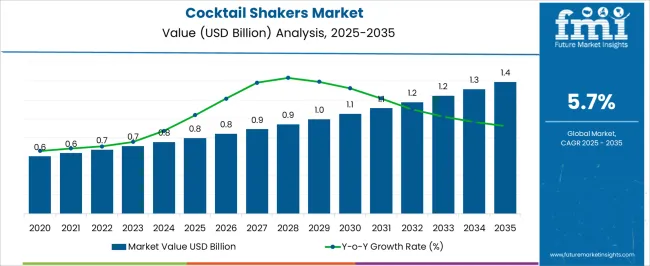

The cocktail shakers market is projected to grow from USD 0.8 billion in 2025 to USD 1.4 billion by 2035, representing a CAGR of 5.7%. This growth corresponds to an absolute dollar opportunity of USD 0.6 billion over the decade. Expansion is driven by increasing demand from bars, restaurants, and home entertainment segments. Companies can capitalize on this growth by optimizing production, expanding distribution channels, and enhancing product variety to meet evolving customer preferences.

Early investments in marketing and partnerships with hospitality suppliers allow stakeholders to capture a meaningful share of the expanding market while ensuring steady revenue growth. Over the next ten years, the USD 0.6 billion opportunity highlights a consistent growth trajectory for the cocktail shakers market. By 2035, revenue will be supported by both new purchases and the replacement of existing products across commercial and residential sectors. The CAGR of 5.7% indicates moderate yet reliable expansion, enabling firms to scale operations and strengthen market reach. Companies can align sales, supply chain, and distribution strategies with market demand to maximize returns. The absolute growth potential provides strong incentives for businesses to maintain operational efficiency while capturing incremental revenue throughout the forecast period.

| Metric | Value |

|---|---|

| Cocktail Shakers Market Estimated Value in (2025 E) | USD 0.8 billion |

| Cocktail Shakers Market Forecast Value in (2035 F) | USD 1.4 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

In the early growth phase of the cocktail shakers market, revenue expands gradually from USD 0.8 billion in 2025, reflecting a CAGR of 5.7%. Growth during this period is primarily driven by initial demand from bars, restaurants, and home entertainment consumers. Companies focus on establishing distribution networks, building brand presence, and forming partnerships with hospitality suppliers. The absolute dollar opportunity in this phase is moderate, allowing firms to refine production, optimize operations, and respond to market feedback. Early growth lays the foundation for scaling, enabling businesses to secure market share and ensure steady revenue capture before entering the late growth stage. In the late growth phase, approaching 2035 and a market size of USD 1.4 billion, the cocktail shakers market experiences more significant revenue expansion due to broader adoption and replacement of existing products. Market strategies shift toward scaling production, expanding regional reach, and leveraging established customer relationships. The absolute dollar opportunity in this stage is substantial, representing most of the USD 0.6 billion growth over the decade. Companies benefit from operational efficiencies and stronger brand recognition, ensuring the 5.7% CAGR translates into consistent, profitable growth. Late growth reflects a mature stage where market share optimization and product availability are key for long-term success.

The cocktail shakers market is expanding steadily, driven by rising global cocktail culture, at-home bartending trends, and increased hospitality industry investments. Consumers are becoming more engaged with mixology, influenced by social media, online tutorials, and premium spirits.

As demand for professional-grade tools grows beyond commercial use, manufacturers are focusing on design, ease of use, and material quality to cater to both casual users and professional bartenders. Retail channels, including e-commerce and specialty kitchenware outlets, are further amplifying accessibility and product diversity.

The push toward stainless steel, sustainable packaging, and customizable aesthetics is also transforming how cocktail shaker sets are positioned in the lifestyle and gifting segments.

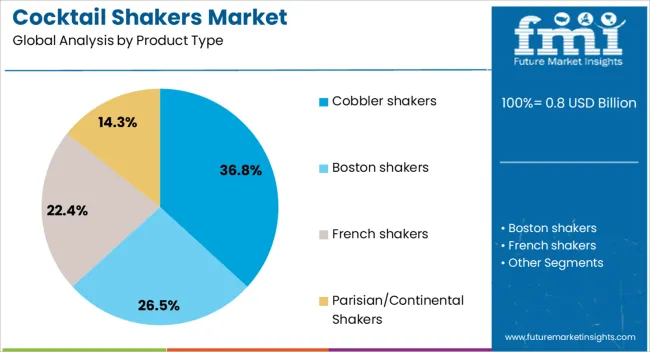

The cocktail shakers market is segmented by product type, material, capacity, price range, application, distribution channel, and geographic regions. By product type, cocktail shakers market is divided into Cobbler shakers, Boston shakers, French shakers, and Parisian/Continental Shakers. In terms of material, cocktail shakers market is classified into Steel, Plastic, Glass, Acrylic, Aluminium, Ceramic, and Others (Silicone, etc.).

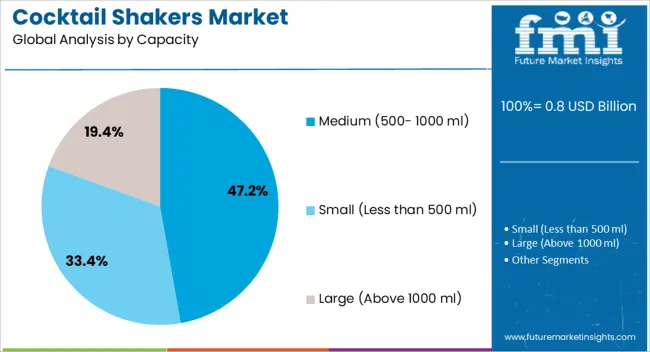

Based on capacity, cocktail shakers market is segmented into Medium (500- 1000 ml), Small (Less than 500 ml), and Large (Above 1000 ml). By price range, cocktail shakers market is segmented into Medium (USD 20 - USD 50), Low (Under USD 20), and High (Above USD 50). By application, cocktail shakers market is segmented into Commercial and Individual. By distribution channel, cocktail shakers market is segmented into Online and Offline. Regionally, the cocktail shakers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Cobbler shakers are anticipated to lead the market with a projected 36.80% share in 2025. Their integrated three-piece design, which includes a built-in strainer and cap, enhances user convenience and appeals to home users and mixology beginners.

The segment’s popularity is also supported by their widespread availability across retail formats and the ease with which they allow for single-handed use. Aesthetic variety, ranging from brushed steel to colored finishes, adds to their appeal as both functional and giftable barware.

As consumer interest in crafting cocktails at home grows, cobbler shakers remain the preferred option due to their simplicity and compact design.

cocktail-shakers-market-analysis-by-product-type

Steel is projected to hold a dominant 41.50% market share by 2025, driven by its durability, resistance to corrosion, and professional appeal. Stainless steel shakers provide superior temperature retention and are easier to clean, making them a favorite among both amateur and seasoned bartenders.

Their compatibility with dishwashers and immunity to odor retention adds practical value for regular use. Steel shakers also align with growing preferences for sustainable, long-lasting kitchen tools.

As premium bar accessories gain traction in both residential and commercial settings, steel-based designs are expected to continue dominating the material preference landscape.

The medium capacity range is expected to lead the market with a 47.20% share by 2025, reflecting the ideal balance between home and professional use. This segment caters well to individual and small group servings, offering enough volume for mixing 1–3 drinks efficiently.

The segment's dominance is reinforced by its adaptability across bar environments, whether in compact home setups or high-volume hospitality venues. Consumers also perceive medium-sized shakers as more ergonomic and easier to control, especially when shaking multiple ingredients or ice-heavy mixtures.

Their scalability and storage convenience further cement their lead in the capacity segment.

The cocktail shakers market is expanding as the global beverage and hospitality industry grows, fueled by rising consumer interest in home mixology, professional bartending, and craft cocktails. Cocktail shakers, including Boston, Cobbler, and French types, are essential tools for mixing, chilling, and serving beverages efficiently. Increasing demand from bars, restaurants, hotels, and home consumers is driving adoption. Manufacturers offering durable, stylish, and ergonomically designed shakers in stainless steel, glass, and premium alloys are well-positioned to capture market opportunities. Rising trends in premium spirits, mixology workshops, and social media-driven cocktail culture are further boosting demand for innovative and customizable cocktail shakers worldwide.

Market growth is constrained by the cost of premium materials and the complexity of innovative designs. High-quality cocktail shakers made from stainless steel, copper, or glass increase production costs. Ergonomic, leak-proof, and multi-piece designs require precise manufacturing and quality control, adding to expenses. Small-scale retailers or home consumers may opt for low-cost alternatives, limiting market penetration for premium products. Additionally, improper sealing, material corrosion, or design flaws can reduce performance and customer satisfaction. Manufacturers are addressing these challenges by using cost-effective alloys, standardized production processes, and durable coatings to balance aesthetic appeal, functionality, and affordability, enabling wider adoption across commercial and residential segments.

Market trends are shaped by the growth of home bartending, mixology education, and premium spirit consumption. Cocktail enthusiasts increasingly seek professional-grade shakers for crafting cocktails at home. Bars and restaurants adopt stylish and ergonomic shakers to improve service efficiency and presentation. Social media platforms and mixology workshops promote cocktail culture, increasing interest in innovative shaker designs. Customizable, branded, and themed cocktail shakers are becoming popular among consumers and hospitality businesses. These trends highlight the growing demand for functional, durable, and visually appealing shakers that support precise mixing, temperature control, and professional-grade drink preparation in both home and commercial settings globally.

Opportunities in the cocktail shakers market arise from the expanding hospitality sector, growing cocktail culture, and e-commerce penetration. Hotels, bars, restaurants, and nightclubs require high-quality shakers to maintain operational efficiency and elevate customer experience. Rising interest in home mixology, gifting trends, and online availability of premium cocktail tools increases consumer adoption. E-commerce platforms facilitate easy access to diverse shaker styles, materials, and brands worldwide. Manufacturers offering innovative, durable, and ergonomically designed cocktail shakers with branding or customization options are positioned to benefit from this growth. Emerging markets with expanding hospitality infrastructure and increasing disposable incomes further contribute to the demand for high-quality cocktail shakers.

Market growth is restrained by intense competition, the prevalence of imitation products, and durability concerns. Numerous manufacturers and private-label brands offer low-cost, low-quality shakers, affecting premium product sales. Material wear, leakage, or corrosion in inferior shakers can harm brand reputation and reduce consumer trust. Maintaining product quality, ergonomics, and aesthetic appeal while controlling costs is challenging. Additionally, fluctuating raw material prices, especially stainless steel and copper, impact production expenses. Until manufacturers ensure superior durability, reliable performance, and brand differentiation, adoption may remain concentrated among professional bartenders, high-end hospitality establishments, and dedicated home mixology enthusiasts.

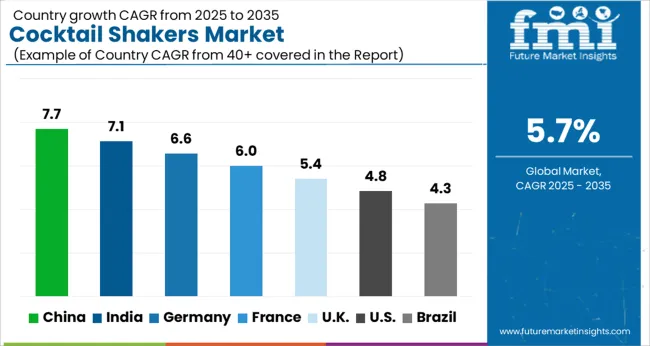

| Country | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

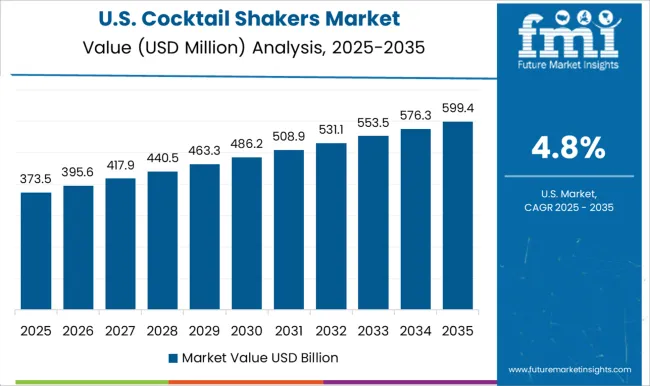

| USA | 4.8% |

| Brazil | 4.3% |

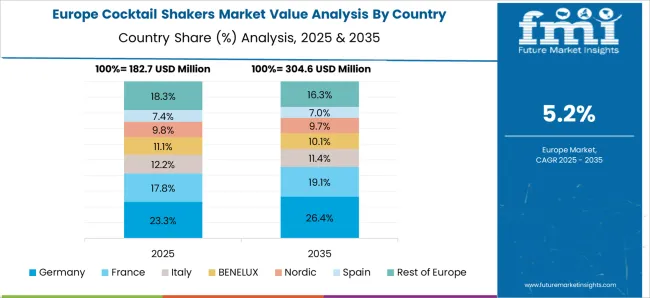

The global cocktail shakers market is projected to grow at a CAGR of 5.7% through 2035, driven by demand across bars, restaurants, hotels, and home beverage preparation. Among BRICS nations, China has been recorded with 7.7% growth, where production and distribution of stainless steel, glass, and professional bar cocktail shakers have been extensively carried out by companies such as Winco, Barcraft, and Tablecraft. India has been observed at 7.1%, supported by rising adoption in hotels, restaurants, and home entertainment sectors. In the OECD region, Germany has been measured at 6.6%, where production for commercial bars and hospitality establishments has been steadily maintained. The United Kingdom has been noted at 5.4%, reflecting consistent use in bars, restaurants, and catering services, while the USA has been recorded at 4.8%, with deployment in hospitality, retail, and professional mixology being steadily increased. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market for cocktail shakers in China is expanding at a CAGR of 7.7%, driven by the growth of the hospitality industry, bar culture, and home bartending trends. Manufacturers supply stainless steel, glass, and premium cocktail shakers for bars, restaurants, hotels, and residential consumers. Government programs promoting tourism, urban leisure, and beverage industry development encourage adoption. Pilot deployments in urban bars and hotels demonstrate operational benefits including efficient cocktail preparation, improved presentation, and enhanced customer experience. Collaborations between manufacturers, hospitality chains, and mixology schools are enhancing shaker design, ergonomics, and durability. Increasing interest in craft cocktails and premium beverage experiences continues to drive the Chinese cocktail shakers market.

The market for cocktail shakers in India is growing at a CAGR of 7.1%, supported by expanding urban nightlife, bar and restaurant growth, and increasing home bartending interest. Manufacturers supply stainless steel, glass, and professional-grade shakers for commercial bars, hotels, and home consumers. Government initiatives promoting tourism, hospitality infrastructure, and beverage industry development encourage market adoption. Pilot projects in urban bars and luxury hotels demonstrate benefits including efficient cocktail preparation, better mixing quality, and improved presentation. Partnerships between shaker manufacturers, hospitality chains, and mixology schools enhance product design, material quality, and durability. Rising urban leisure activities and interest in mixology continue to drive growth in the Indian market.

The market for cocktail shakers in Germany is recording a CAGR of 6.6%, driven by the hospitality sector, home bartending, and craft cocktail culture. Manufacturers provide high-quality stainless steel, glass, and premium cocktail shakers for bars, restaurants, hotels, and residential consumers. Government initiatives promoting tourism, food and beverage services, and urban leisure support market growth. Pilot implementations in bars and hotels demonstrate operational benefits including better cocktail consistency, improved aesthetics, and efficient preparation. Collaborations between manufacturers, hospitality chains, and mixology institutions enhance shaker ergonomics, material quality, and usability. Germany’s craft cocktail culture and high-end hospitality sector sustain growth in the cocktail shakers market.

The market for cocktail shakers in the United Kingdom is growing at a CAGR of 5.4%, supported by the hospitality industry, home bartending trends, and cocktail culture. Manufacturers supply stainless steel, glass, and premium shakers for bars, restaurants, hotels, and residential consumers. Government initiatives promoting tourism, hospitality services, and urban leisure encourage adoption. Pilot deployments in hotels, bars, and cocktail events demonstrate benefits including consistent mixing, improved drink presentation, and enhanced operational efficiency. Collaborations between shaker manufacturers, hospitality chains, and mixology schools improve product design, durability, and functionality. Expanding interest in craft cocktails and home bartending continues to drive market growth in the United Kingdom.

The market for cocktail shakers in the United States is expanding at a CAGR of 4.8%, driven by home bartending, the craft cocktail movement, and bar and restaurant growth. Manufacturers provide stainless steel, glass, and premium shakers for commercial hospitality establishments and residential consumers. Government initiatives promoting tourism, urban leisure, and hospitality development support adoption. Pilot projects in bars, hotels, and home mixology programs demonstrate operational benefits including consistent mixing, efficient preparation, and improved presentation. Collaborations between shaker manufacturers, hospitality chains, and mixology institutions enhance product ergonomics, durability, and usability. Rising interest in mixology and home cocktail preparation sustains growth in the USA cocktail shakers market.

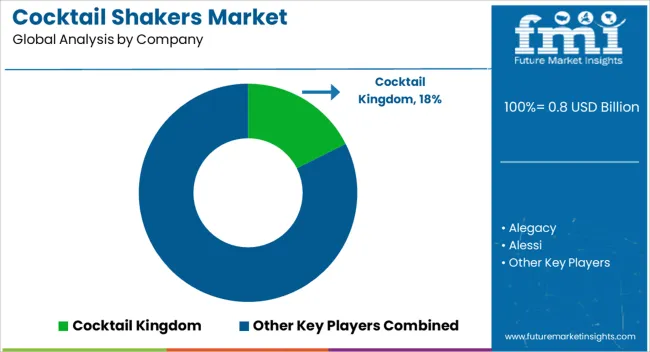

Cocktail Kingdom, Alegacy, and Alessi supply cocktail shakers for professional bars and home use, with brochures highlighting stainless steel construction, shaker volume, and ergonomic design. Barfly by Mercer and Blomus provide shaker sets with technical literature detailing airtight seals, capacity options, and material finish. Bormioli Rocco and Crafthouse by Fortessa offer glass and metal hybrid shakers, with brochures presenting measurement markings, durability, and dishwasher compatibility.

Final Touch and Houdini focus on compact and portable shaker designs, with datasheets emphasizing spill-proof lids, capacity, and grip design. Libbey, Mixology & Craft, and Norpro supply shaker units optimized for commercial and residential usage, with brochures highlighting ease of cleaning, balance, and weight distribution. OXO, Rabbit, and Tablecraft offer stainless steel and coated metal shakers, with literature detailing volume capacity, lid fit, and non-slip surfaces. True Brands, Viski, Winco, and Zulay Kitchen provide premium or ergonomic shaker options, with brochures highlighting construction material, design aesthetics, and durability.

Other regional players compete through cost-efficient sets, varied designs, and targeted home-bartender collections. Market strategies focus on design ergonomics, durability, and ease of use. Development is directed toward leak-proof seals, optimized weight distribution, and compatibility with standard cocktail accessories. Partnerships with barware distributors, specialty retailers, and hospitality chains are leveraged to expand market penetration. Observed industry patterns indicate emphasis on shaker volume standardization, material quality, and usability for both professional and home bartenders. Product roadmaps frequently include sets with integrated strainers, measuring guides, or hybrid glass-metal construction. Differentiation is achieved through verified performance under repeated use, corrosion-resistant materials, and detailed guidance in brochures. Brochures and datasheets are used to communicate shaker capacity, material composition, lid type, and cleaning instructions.

| Item | Value |

|---|---|

| Quantitative Units | USD 0.8 Billion |

| Product Type | Cobbler shakers, Boston shakers, French shakers, and Parisian/Continental Shakers |

| Material | Steel, Plastic, Glass, Acrylic, Aluminium, Ceramic, and Others (Silicone, etc.) |

| Capacity | Medium (500- 1000 ml), Small (Less than 500 ml), and Large (Above 1000 ml) |

| Price Range | Medium (USD 20 - USD 50), Low (Under USD 20), and High (Above USD 50) |

| Application | Commercial and Individual |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cocktail Kingdom, Alegacy, Alessi, Barfly by Mercer, Blomus, Bormioli Rocco, Crafthouse by Fortessa, Final Touch, Houdini, Libbey, Mixology & Craft, Norpro, OXO, Rabbit, Tablecraft, True Brands, Viski, Winco, and Zulay Kitchen |

| Additional Attributes | Dollar sales by type including Boston shakers, cobbler shakers, and Parisian shakers, material such as stainless steel, glass, and plastic, application across bars, restaurants, and home use, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising cocktail culture, increasing bar and restaurant establishments, and growing interest in home mixology. |

The global cocktail shakers market is estimated to be valued at USD 0.8 billion in 2025.

The market size for the cocktail shakers market is projected to reach USD 1.4 billion by 2035.

The cocktail shakers market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in cocktail shakers market are cobbler shakers, boston shakers, french shakers and parisian/continental shakers.

In terms of material, steel segment to command 41.5% share in the cocktail shakers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cocktail Syrup Market Analysis by Product Type, Flavor, and Region Through 2035

RTD Cocktail Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

RTD Cocktail Shots Market Analysis by Type, Packaging Type, and Distribution Channel Through 2035

Premixed Cocktail Shots Market Growth - Consumer Trends 2024 to 2034

RTD Canned Cocktail Market Growth - Convenience & Mixology Trends 2025 to 2035

RTD Bottled Cocktail Market - Size, Share, and Forecast Outlook 2025 to 2035

Premix Bottled Cocktails Market Trends - Growth & Consumer Shifts 2025 to 2035

Ready-to-Serve Cocktails Market Trends - Innovation & Demand 2025 to 2035

Ready To Drink Cocktails Market Growth – Size, Trends & Forecast 2025-2035

Orbital Shakers Market Growth – Trends & Forecast 2018-2027

Laboratory Shakers Market Size and Share Forecast Outlook 2025 to 2035

Automated Cell Shakers Market Analysis by Product, Cell Culture Type, Application, End User, and Region through 2035

Laboratory Rockers and Shakers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA