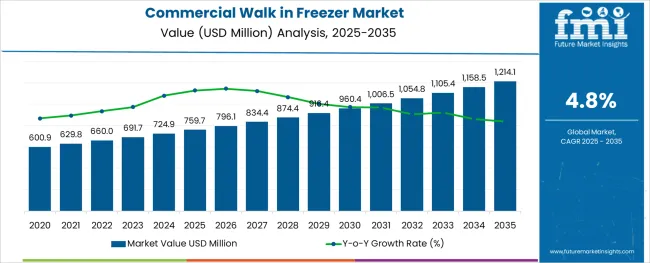

The Commercial Walk in Freezer Market is estimated to be valued at USD 759.7 million in 2025 and is projected to reach USD 1214.1 million by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

The commercial walk in freezer market is experiencing stable growth supported by rising demand from foodservice, hospitality, and pharmaceutical industries seeking efficient cold storage solutions. Increasing regulatory focus on food safety and stringent temperature control standards are driving adoption across small and large commercial establishments.

Manufacturers are focusing on improving energy efficiency and ease of maintenance, which is enhancing the appeal of advanced freezer solutions. Future growth is anticipated to benefit from innovations in insulation materials, smart temperature monitoring systems, and modular designs that allow easier customization and faster installation.

A growing emphasis on sustainability and reducing operational costs is paving the path for long term adoption across diverse end-use industries.

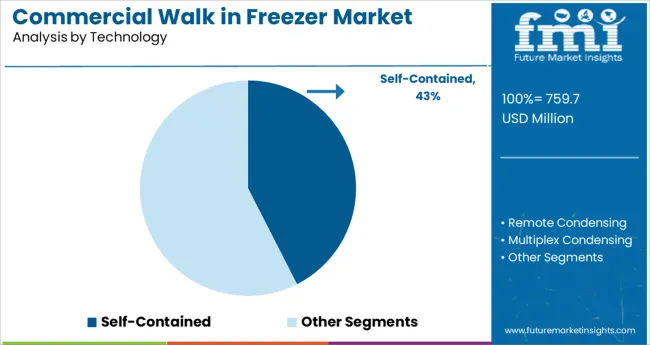

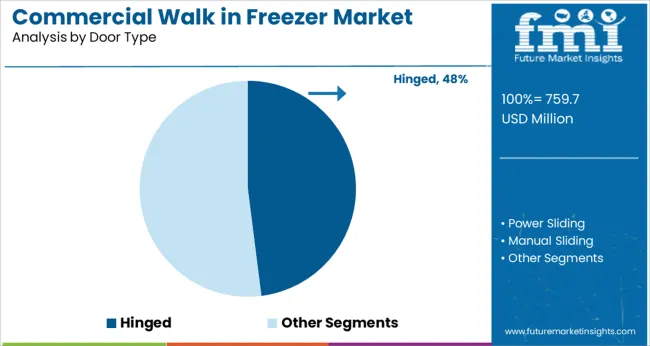

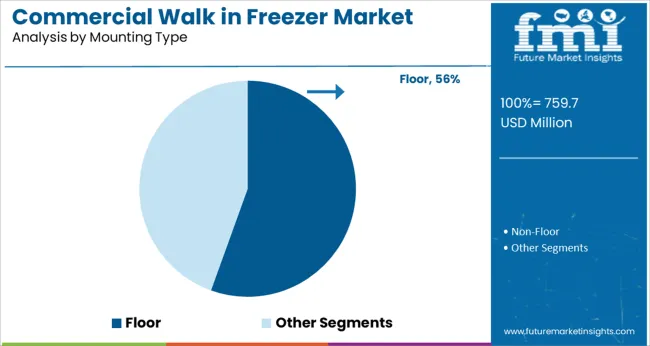

The market is segmented by Technology, Door Type, Mounting Type, and Sales Channel and region. By Technology, the market is divided into Self-Contained, Remote Condensing, and Multiplex Condensing. In terms of Door Type, the market is classified into Hinged, Power Sliding, and Manual Sliding. Based on Mounting Type, the market is segmented into Floor and Non-Floor. By Sales Channel, the market is divided into OEM and Aftermarket. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Technology, Door Type, Mounting Type, and Sales Channel and region. By Technology, the market is divided into Self-Contained, Remote Condensing, and Multiplex Condensing. In terms of Door Type, the market is classified into Hinged, Power Sliding, and Manual Sliding. Based on Mounting Type, the market is segmented into Floor and Non-Floor. By Sales Channel, the market is divided into OEM and Aftermarket. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by technology, the self contained segment is expected to account for 42.5% of the total market revenue in 2025, establishing itself as the leading technology choice. This leadership is being reinforced by its compact design and plug and play installation, which have reduced downtime and made it more attractive for businesses with space and time constraints.

The ease of relocation and minimal site preparation requirements have increased its adoption, particularly in settings that prioritize flexibility and quick deployment.

Enhanced energy efficiency and reduced maintenance demands have further contributed to its growth, as businesses increasingly seek solutions that lower total cost of ownership while maintaining reliable performance.

Segmented by door type, the hinged segment is projected to hold 48.0% of the market revenue in 2025, maintaining its position as the most preferred configuration. This dominance is being supported by its simplicity, durability, and cost effectiveness compared to alternative designs.

Hinged doors offer superior sealing capabilities, which have improved energy efficiency and temperature consistency inside the freezer. The lower maintenance and repair costs associated with this design have appealed to operators seeking long term reliability.

Its proven functionality in high traffic environments and compatibility with a variety of locking and safety mechanisms have further established its leadership in the market.

When segmented by mounting type, the floor segment is anticipated to capture 55.5% of the market revenue in 2025, confirming its position as the dominant mounting solution. This prominence is being driven by its robustness and ability to support heavy loads, making it ideal for high volume storage needs.

The floor mounted configuration has been preferred for its superior insulation properties, which help maintain consistent internal temperatures and reduce energy consumption. Its compatibility with sanitary and easy to clean surfaces has also aligned with hygiene requirements in foodservice and healthcare applications.

The capacity to withstand frequent movement of goods and personnel without compromising performance has further reinforced its market leadership.

Natural refrigerants are frequently utilized globally for environmental sustainability. Furthermore, it has been observed that older commercial walk-in freezer technology was less effective than it is now. This equipment is getting more efficient and saves a lot of energy as a result of the usage of LED lighting systems, high-performance glass doors, and high-efficiency motors, which is considered a crucial factor in propelling the expansion of the commercial walk in freezer market globally. The global market for commercial walk-in freezers is growing exponentially due to rising disposable income in both developed and developing countries, as well as rising demand for ready-to-eat meals and other goods including eggs, milk, and meat.

The most significant application for the global commercial walk in freezer market has always been food service. Equipment for commercial walk-in freezers is in higher demand across all application fields. But among all of these categories, the food service application sector has been the most significant, and it is anticipated that it is likely to continue to lead the industry's growth.

The high energy consumption of this system has also been noted to prevent small firms from using it, which is expected to restrain the growth of the commercial walk-in freezer market globally. So, these are some major factors that are preventing this market's expansion. The commercial walk-in freezer market has been significantly impacted by COVID-19. Operations have been suspended, production and demand have declined, and supply has been impacted.

Manufacturers have all reduced capital, spending, and capacity by 30 to 50 percent. The labor shortage is one of the main causes of the decline. Production has decreased on a global scale. The demand for commercial walk-in freezer equipment has decreased as a result of consumers' caution while making new purchases.

With a share of 5.6%, the self-contained walk in freezers segment is anticipated to dominate the commercial walk in freezer market. Self-contained walk-in coolers and freezers have several benefits, including being more portable, and handy, and requiring less maintenance and servicing. During the projection period, the market for walk-in coolers and freezers will continue to develop due to the rising use of self-contained walk-in coolers and freezers for longer-term food storage.

Remote condensing units are anticipated to see the fastest sales increase over the projected period. Plug cases and remote instances are further split into the display cases category. Plug-in cases have made up a higher portion of the global display case market than remote cases. During the anticipated timeframe, it is also anticipated that the market expansion of commercial walk-in freezers is anticipated to be stronger.

In 2025, the North American commercial walk in freezer market is led by the United States, with a share of 25.7%. With a CAGR of 3.7%, the USA is anticipated to continue to be the most lucrative market for commercial walk-in freezers holding a share of USD 1214.1 million by 2035. Sales of commercial walk in freezers in the United States are likely to be aided by the presence of established retail sectors, increased hotel development, rising demand for commercial walk in coolers, and the presence of major market participants.

In restaurants or at home, a significant portion of Americans eats frozen meals. The American Frozen Food Institute (AFFI) estimates that retail sales of frozen food increased by 21% to about USD 724.9 billion in 2024. The market for commercial walk in freezers is expanding favorably across the nation as a result.

To preserve the best possible condition for frozen and refrigerated goods, the majority of restaurants and commercial kitchens in the USA feature well-maintained commercial walk-in freezers and coolers. Additionally, expanding use of portable commercial walk in freezers, in addition to conventional ones, in the pharmaceutical and clinical research industries, as well as rising food product sales through online channels, is projected to assist the expansion of the USA commercial walk in freezer market.

Europe's commercial walk in freezer market generated USD 724.9 billion in 2024 as the retail, healthcare, and food service industries expanded. Additionally, the expansion of bakeries, restaurants, and hotels throughout the United Kingdom, Germany, France, and Italy is likely to promote regional development.

The commercial walk in freezer market in the United Kingdom is predicted to register at a CAGR of 4.6% during the forecast period, reaching 1214.1 million by 2035. This is due to customers' strong desire for takeout options and restaurant meals. In addition, the region's expanding non-residential construction activities are probably going to increase demand for commercial walk-in coolers and freezers.

South Korea is anticipated to dominate the Korean commercial walk in freezer market with a CAGR of 5.5% during the forecast period, reaching a valuation of USD 1214.1 million by 2035.

Governments in South Korea are making significant investments in the retail sector, which is anticipated to support market growth. As an example, the largest retailer in the world, Wal-Mart Stores Inc., committed nearly USD 179 million to acquire a majority stake in four and six-store locations in South Korea. This move is likely to accelerate the expansion of the commercial walk in freezer market throughout the forecast period. Therefore, it is projected that the rising number of retail establishments across the highly developing nations is anticipated to fuel market expansion.

According to FMI, the Japan commercial walk in freezer market is anticipated to rise at a CAGR of 6.0% during the forecast period, reaching USD 1214.1 million by 2035. The increase in the use of indoor and outdoor commercial walk in freezers by a variety of industries, including food & beverage, healthcare, and chemicals, is responsible for the country's growth. Food preservation has become essential to support such a large population.

Throughout the projection period, Japan is anticipated to expand considerably, mostly as a result of factors including steady employment rates, improving economic conditions, growing gross disposable income, and increased expenditure on leisure activities like traveling and dining out.

One of the primary objectives of Arctic Walk in Coolers & Walk in Freezers is to increase the penetration of their products into the commercial refrigeration sector. To increase its sales around the globe, the firm is also implementing several marketing methods, including flexible production with the most space possible and custom-made items. For instance, the business provides walk-in coolers with bespoke shelving for beverage, culinary, and flower applications. This is projected to make it easier for its walk-in goods to enter an untapped market.

Arctic Walk in Coolers & Walk in Freezers is offering a quick-ship COVID-19 vaccine cold storage solution as of November 2024. The walk-in freezers and coolers made by the firm are designed to -40° C for vaccinations that need to be frozen.

To broaden its expertise in commercial refrigeration for the benefit of clients, Viessmann acquired IAC Vestcold AS (a refrigeration and service partner in Norway) in June 2020.

Key players in the commercial walk in freezer market are leaning toward offering effective and dependable specialized commercial refrigeration equipment for a variety of applications, including restaurants, cold storage facilities, restaurants, and floral storage. It is so because each industrial application calls for a distinct product depending on the amount of available space, and equipment like commercial walk-in refrigerators is specially intended to promote convenience and ease of use for applications.

Custom walk-in freezers and coolers are becoming more popular because they offer greater versatility than stand-in coolers and freezers do. Bilt2spec commercial walk in freezers are offered by manufacturers like Master-Bilt Products, LLC, and are custom-made to accommodate practically any size or form.

Top companies in the commercial walk in freezer markets like Viessmann, Danfoss A/S, and others have well-established subsidiaries that are greatly enhancing market penetration in China. For instance, Beijing Viessmann Heating Technology Co., Ltd., a Chinese affiliate of Viessmann, offers cutting-edge freezers with assembly and central refrigeration designs.

Whirlpool Corporation announced in November 2024 that it will invest more than USD 65 million over the following several years in its manufacturing in Ottawa, Ohio, to make it the Premium Refrigeration Factory in North America. The firm will enlarge its Ottawa facility as part of this strategic drive to support the production of high-end refrigeration goods, such as Built-In refrigerators (BIR).

To control the market, they have used a variety of organic and inorganic techniques, including mergers, partnerships, collaborations, the development of new products, and acquisitions.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | billion for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Oceania; Middle East and Africa (MEA) |

| Key Countries Covered | India, The USA, Germany, China, The United Kingdom, Japan, Denmark, Canada, Thailand, Malaysia, Mexico, Poland, Turkey, Vietnam, Indonesia, Cambodia, France, Italy, Spain, South Korea, Russia, Australia, Brazil, Argentina, South Africa |

| Key Segments Covered | Technology, Door Type, Mounting type, Sales Channel, Region |

| Key Companies Profiled | SRC Refrigeration; Parker Hannifin Corp.; TMP Manufacturing Company; Panasonic Corporation; American Panel Corporation; Others |

| Report Coverage | DROT Analysis, Market Forecast, Company Share Analysis, Market Dynamics and Challenges, Competitive Landscape, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global commercial walk in freezer market is estimated to be valued at USD 759.7 million in 2025.

It is projected to reach USD 1,214.1 million by 2035.

The market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types are self-contained, remote condensing and multiplex condensing.

hinged segment is expected to dominate with a 48.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA