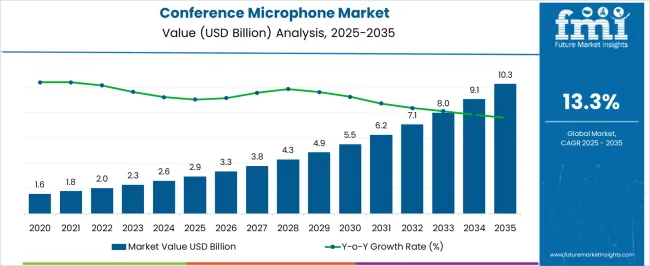

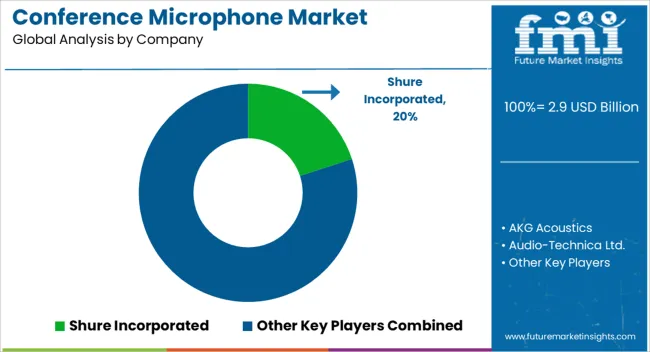

The conference microphone market is projected at USD 2.9 billion in 2025 and anticipated to reach USD 10.3 billion by 2035, advancing at a CAGR of 13.3%. The long-term value accumulation curve in this sector demonstrates a steep upward trajectory, with growth driven by rising investments in corporate communication systems, hybrid work models, and government-backed digital infrastructure initiatives.

Early-stage expansion from 2025 to 2029 reflects steady adoption across mid-sized enterprises, education, and institutional setups, with value rising from USD 2.9 billion to nearly USD 4.3 billion. The mid-phase from 2030 to 2032 signals accelerated uptake as multinational corporations, legislative assemblies, and large organizations integrate advanced audio systems for global communication. This period also benefits from the inclusion of AI-enabled noise suppression and wireless connectivity features. From 2033 to 2035, the curve sharpens further, highlighting rapid value accumulation as digital conferencing becomes a baseline requirement across industries and regions.

The adoption of professional-grade solutions in emerging economies adds weight to the latter curve, reflecting both volume growth and premiumization. In my opinion, the market’s compounding expansion illustrates not just short-term adoption but the creation of a structural demand cycle where conferencing equipment evolves from a discretionary purchase to a critical infrastructure investment.

| Metric | Value |

|---|---|

| Conference Microphone Market Estimated Value in (2025 E) | USD 2.9 billion |

| Conference Microphone Market Forecast Value in (2035 F) | USD 10.3 billion |

| Forecast CAGR (2025 to 2035) | 13.3% |

The conference microphone market is structured across several interconnected parent categories that shape its revenue base and long-term expansion outlook. Corporate conferencing systems account for the largest share at nearly 38%, driven by multinational enterprises, boardrooms, and hybrid meeting setups where professional-grade audio solutions are a necessity.

The education sector contributes around 24%, supported by universities, training institutions, and remote learning platforms that rely on clear voice capture for lectures and interactive sessions. Government and legislative assemblies represent close to 16%, where the need for secure, reliable, and regulation-compliant conferencing infrastructure influences adoption.

The events and hospitality industry holds nearly 12%, with conferences, conventions, and hotel-based meetings generating recurring demand for high-capacity and portable microphone solutions. The remaining 10% is attributed to niche applications such as judicial systems, non-profits, and community institutions where structured communication requires dependable conferencing equipment.

This layered share distribution highlights that the conference microphone industry is not a stand-alone category but part of a broader ecosystem tied to professional collaboration, institutional operations, and large-scale event management. Corporate and education applications dominate through scale and necessity, while government and events drive premium adoption, making the sector resilient and positioned for compounding growth.

The market is expanding steadily, driven by the increasing demand for high-quality audio communication in corporate, educational, and government settings. The market growth is being supported by the rising adoption of advanced conferencing technologies and a global shift towards hybrid work models that require reliable audio equipment.

Enhanced focus on seamless collaboration, remote communication, and virtual meetings is propelling investments in conference microphone solutions. Technological advancements such as noise cancellation, echo reduction, and integration with unified communication platforms are shaping the future landscape.

Additionally, growing infrastructure development in emerging regions and increased spending on modernizing conference rooms are contributing to market expansion. The convergence of audio hardware with software-based features offers opportunities for innovative product offerings and scalable deployments, positioning the market for sustained growth.

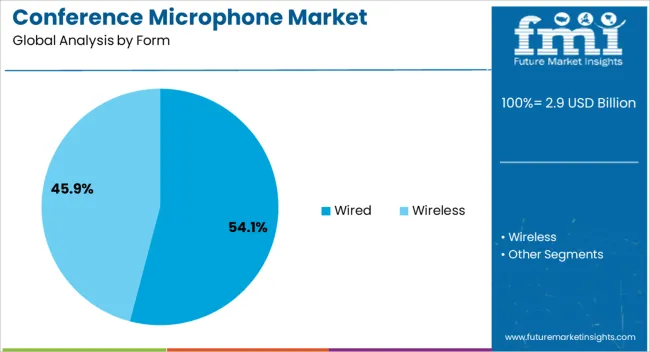

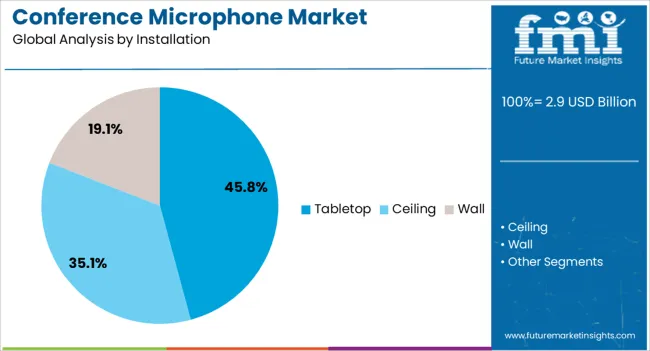

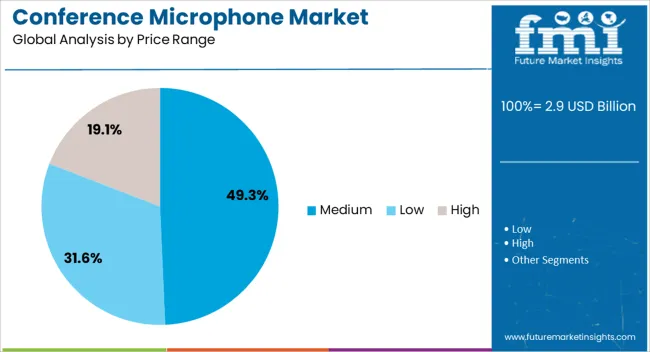

The conference microphone market is segmented by form, installation, price range, application, distribution channel, and geographic regions. By form, conference microphone market is divided into Wired and Wireless. In terms of installation, conference microphone market is classified into Tabletop, Ceiling, and Wall. Based on price range, conference microphone market is segmented into Medium, Low, and High.

By application, conference microphone market is segmented into Medium conference room, Small conference room, and Large conference room. By distribution channel, conference microphone market is segmented into Online and Offline. Regionally, the conference microphone industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The wired form segment is estimated to hold 54.1% of the Conference Microphone market revenue share in 2025, making it the leading form factor. This dominance can be attributed to the reliability and consistent audio quality offered by wired microphones, especially in environments where stable connections are critical.

Wired systems are favored in corporate and institutional settings where interference and connectivity issues can undermine communication effectiveness. The ease of installation, lower latency, and reduced dependency on battery life have further contributed to the sustained preference for wired solutions.

Moreover, wired conference microphones typically support advanced audio processing features that ensure clear sound capture, which is essential for professional communication. The continued demand for dependable and cost-effective audio solutions is expected to uphold the leadership of the wired segment.

The tabletop installation segment is projected to capture 45.8% of the market revenue share in 2025, emerging as the most preferred installation type. This prominence is driven by the convenience and flexibility offered by tabletop microphones in meeting rooms and conference halls.

The portability and ease of repositioning enable seamless adaptation to varying room sizes and participant numbers. Tabletop systems also support plug-and-play capabilities and compatibility with multiple conferencing platforms, enhancing user experience.

The aesthetic integration with modern conference room designs and the ability to minimize cabling clutter further drive adoption. As organizations continue to prioritize efficient meeting setups and user-friendly equipment, the tabletop installation segment is expected to maintain its significant market share.

The medium price range segment is forecasted to account for 49.3% of the Conference Microphone market revenue share in 2025, reflecting its dominant position. This segment benefits from offering a balance between affordability and advanced features, making it attractive for a wide range of end-users.

Medium-priced conference microphones typically provide high-quality audio performance, essential for professional communication, without the premium costs associated with top-tier products. The segment appeals particularly to small and medium enterprises, educational institutions, and government organizations seeking cost-effective yet reliable audio solutions.

Additionally, the growing availability of feature-rich products within this price range, including noise suppression and multi-device compatibility, supports market growth. The focus on value-for-money and expanding procurement budgets is expected to sustain the growth of the medium price range segment.

The conference microphone market is driven by corporate hybrid adoption, education digitalization, government compliance needs, and events sector demand. Companies focusing on integration, flexibility, and reliability are expected to secure leadership.

The conference microphone market has experienced strong momentum from the corporate sector, where hybrid meeting formats have become standard practice. Global companies are investing in advanced audio systems to ensure seamless communication between in-office employees and remote teams. High-quality microphones are increasingly integrated with video conferencing platforms, making clarity, noise cancellation, and scalability critical purchase factors. Boardrooms, large meeting halls, and training spaces are adopting wireless and beamforming microphones to improve flexibility and reduce installation complexity. Procurement is often guided by IT managers and facility planners, who emphasize reliability and integration with existing infrastructure. This consistent adoption cycle ensures that the corporate segment remains the largest contributor to market revenue.

The education sector has emerged as a key adopter of conference microphones, supported by the expansion of blended learning models and remote teaching frameworks. Universities, colleges, and professional training institutes rely on high-performance microphones to ensure that lectures and interactive sessions are delivered with clarity. Portable and ceiling-mounted microphones are increasingly preferred to serve large classrooms and auditoriums where sound coverage is essential. The shift toward digital classrooms and recorded lectures has further boosted the need for reliable audio capture systems. Instructors and administrators prioritize microphones that are easy to set up, integrate with learning platforms, and offer consistent performance. As education continues to digitize, this segment is expected to be a long-term demand driver.

Government bodies and legislative assemblies represent a critical demand base for conference microphones, where secure, accurate, and reliable communication is essential. Parliamentary halls, municipal councils, and judicial systems use structured microphone systems to manage discussions, record proceedings, and ensure compliance with procedural standards. These installations often require large-scale, custom-configured systems capable of handling multiple speakers simultaneously. Regulatory compliance, service agreements, and long lifecycle expectations heavily influence procurement. Vendors serving this segment gain credibility through certifications and strong aftersales support networks. The long-term contracts and replacement cycles in government projects provide stability, making this sector a consistent revenue stream within the broader market.

The events and hospitality industry also plays an important role in driving demand for conference microphones, with adoption linked to conventions, exhibitions, and large-scale professional gatherings. Hotels, convention centers, and event management companies invest in flexible and portable microphone systems that can cater to varying audience sizes and settings. Wireless and modular solutions are preferred for their ease of setup and adaptability across multiple events. Seasonal demand spikes are often observed during peak conference and exhibition periods, creating cyclical revenue opportunities for manufacturers and rental providers. In my view, this segment adds dynamism to the overall market, combining recurring professional use with rapid deployment needs in hospitality and event-driven contexts.

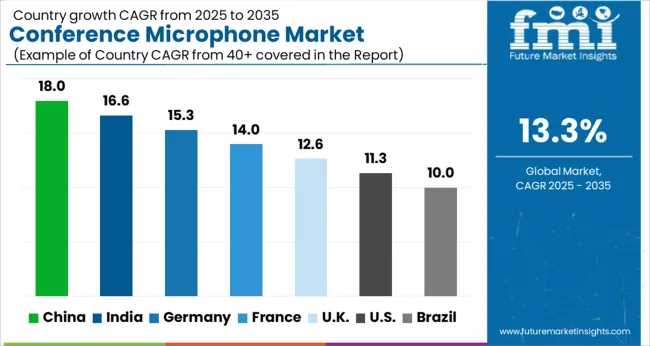

| Country | CAGR |

|---|---|

| China | 18.0% |

| India | 16.6% |

| Germany | 15.3% |

| France | 14.0% |

| UK | 12.6% |

| USA | 11.3% |

| Brazil | 10.0% |

The global conference microphone market is projected to grow at a CAGR of 13.3% between 2025 and 2035. China leads with 18.0%, supported by large-scale adoption in corporate offices, government institutions, and expanding digital infrastructure. India follows at 16.6%, fueled by rapid digitization of education, growth in hybrid workplaces, and increased demand from public sector projects. Germany, with 15.3%, benefits from strong regulatory standards, advanced engineering adoption, and widespread use in legislative assemblies and industrial organizations. France records 14.0%, supported by modernization of universities, expansion of corporate conference facilities, and steady adoption across event management companies. The UK, at 12.6%, emphasizes growth from retrofitting legacy buildings, hospitality sector adoption, and rising demand for hybrid communication tools. The USA, at 11.3%, shows consistent progress, reflecting a mature but evolving market driven by corporate replacement cycles, university upgrades, and federal investments in digital communication. Asia dominates with scale and speed of adoption, while Europe drives compliance-led quality standards, and North America sustains growth through steady modernization of conferencing infrastructure. The analysis spans 40+ countries, with the leading markets highlighted below.

The conference microphone market in China is projected to expand at a CAGR of 18.0% from 2025 to 2035, positioning it as the fastest-growing market worldwide. Growth is fueled by large-scale adoption in corporate offices, legislative assemblies, and government institutions where secure and reliable communication is vital. Massive investments in digital infrastructure and smart city projects are creating opportunities for integrated audio systems in public facilities. The education sector is another major driver, as universities and training centers implement digital classrooms that require high-quality microphones. Domestic manufacturers benefit from scale and cost competitiveness, while international brands focus on premium installations in boardrooms and convention centers. In my view, China’s combination of infrastructure expansion, strong policy support, and rapid digital adoption will ensure its leadership role in shaping the global conference microphone market.

The conference microphone market in India is expected to grow at a CAGR of 16.6% between 2025 and 2035, supported by the expansion of hybrid workplaces, education digitization, and government-backed modernization initiatives. Public institutions and large corporations are increasingly investing in advanced audio systems to ensure clear communication across distributed teams. The education sector, particularly universities and private training centers, is adopting microphones for lecture capture, hybrid classes, and online learning. Growing activity in event management and hospitality adds further demand for portable and flexible systems. Local suppliers are collaborating with global brands to balance affordability with quality standards. In my opinion, India’s rapid digital transformation, paired with rising service-sector demand, makes it a key emerging hub for conference microphone adoption.

The conference microphone market in France is projected to expand at a CAGR of 14.0% from 2025 to 2035, driven by modernization of universities, renovation of government buildings, and strong adoption in corporate environments. Legislative assemblies and municipal councils require secure systems for structured debates, ensuring steady demand for premium microphones. France’s event and hospitality industry further supports growth, with conferences, conventions, and professional gatherings depending on reliable audio solutions. Regulatory emphasis on quality and compliance has created opportunities for manufacturers offering certified and durable systems. Online distribution platforms are helping suppliers reach small institutions and businesses beyond major cities. In my perspective, France will remain a steady but strong market, shaped by compliance-driven upgrades and demand from professional events.

The conference microphone market in the UK is anticipated to grow at a CAGR of 12.6% between 2025 and 2035, supported by retrofitting of aging infrastructure, expansion in the hospitality sector, and rising preference for hybrid communication solutions. Corporate clients are prioritizing upgrades to existing facilities with wireless and modular microphone systems. Public institutions and local councils are also integrating digital systems for governance and community communication. Universities and training centers are adopting microphones to support hybrid learning environments. Event venues, including hotels and convention centers, are increasingly investing in portable solutions for flexible deployment. In my opinion, the UK market demonstrates steady demand, driven by retrofit activity and the professional services sector’s reliance on reliable conferencing equipment.

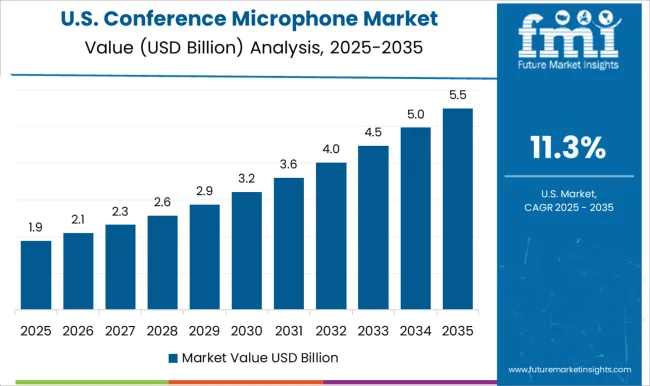

The conference microphone market in the USA is expected to grow at a CAGR of 11.3% from 2025 to 2035, reflecting steady expansion in a mature but evolving ecosystem. Corporations remain the largest buyers, upgrading boardrooms and collaborative spaces with advanced systems. Universities and research institutions are adopting digital-ready solutions to meet the demand for remote and hybrid education. Federal and state government projects also contribute significantly, with courtroom audio systems and legislative assemblies requiring certified equipment. Growth in event management and corporate conventions adds another layer of consistent demand. Established brands dominate through strong dealer networks and premium product portfolios. In my opinion, the USA market will remain steady, with replacement cycles and premium adoption shaping its long-term trajectory.

Competition in the conference microphone market is defined by factors such as sound quality, integration with conferencing platforms, wireless adaptability, and brand credibility across professional environments. Shure Incorporated continues to dominate the space with a reputation for premium-grade conferencing solutions that provide reliability in corporate, government, and educational sectors. Audio-Technica Ltd., Beyerdynamic GmbH, and Sennheiser Electronics GmbH emphasize German and Japanese precision engineering, delivering microphones that combine superior sound performance with durable build quality, making them highly valued in legislative and institutional use cases. AKG Acoustics and Rode Microphones have carved out significant positions by focusing on versatile, cost-effective systems designed to attract both professionals and semi-professional users seeking affordability without compromising performance. Bosch Security Systems and Yamaha Corporation stand out for their ability to integrate microphones with broader AV and security ecosystems, positioning them as preferred suppliers for large-scale institutions, parliaments, and public facilities.

Sony Corporation and Panasonic Corporation leverage their wide consumer and enterprise electronics presence, ensuring broad market coverage through extensive distribution and product diversification. Clear One and MXL Microphones appeal to small and mid-sized organizations by offering scalable solutions that balance cost efficiency with functionality. Logitech International has become a key innovator in hybrid workplaces by delivering USB and wireless microphones that seamlessly integrate with collaboration platforms such as Zoom and Microsoft Teams. TOA Corporation and Bose Corporation bring expertise in audio integration, catering strongly to event venues, hospitality, and convention centers. The competitive environment will favor companies that successfully combine precision audio engineering with digital compatibility, ergonomic designs, and widespread channel networks.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.9 Billion |

| Form | Wired and Wireless |

| Installation | Tabletop, Ceiling, and Wall |

| Price Range | Medium, Low, and High |

| Application | Medium conference room, Small conference room, and Large conference room |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Shure Incorporated, AKG Acoustics, Audio-Technica Ltd., Beyerdynamic GmbH, Bosch Security Systems, Bose Corporation, Clear One, Logitech international, MXL Microphones, Panasonic Corporation, Rode Microphones, Sennheiser Electronics GmbH, Sony Corporation, TOA Corporation, and Yamaha Corporation |

| Additional Attributes | Dollar sales, share, adoption by corporate, education, and government sectors, competitor positioning, pricing trends, distribution networks, technology integration, and regional demand growth. |

The global conference microphone market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the conference microphone market is projected to reach USD 10.3 billion by 2035.

The conference microphone market is expected to grow at a 13.3% CAGR between 2025 and 2035.

The key product types in conference microphone market are wired and wireless.

In terms of installation, tabletop segment to command 45.8% share in the conference microphone market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Conference Room Solutions Market Analysis – Size, Share & Trends 2025 to 2035

Korea Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Japan Conference Room Solution Market Growth - Trends & Forecast 2025 to 2035

Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

China Outbound Meetings, Incentives, Conferences, Exhibitions (MICE) Tourism to Europe Market Size and Share Forecast Outlook 2025 to 2035

Microphone Market Trends - Growth & Forecast 2025 to 2035

Car Microphone Market Size and Share Forecast Outlook 2025 to 2035

MEMS Microphones Market Size and Share Forecast Outlook 2025 to 2035

Wireless Microphone Market Report – Trends & Forecast 2018-2028

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA