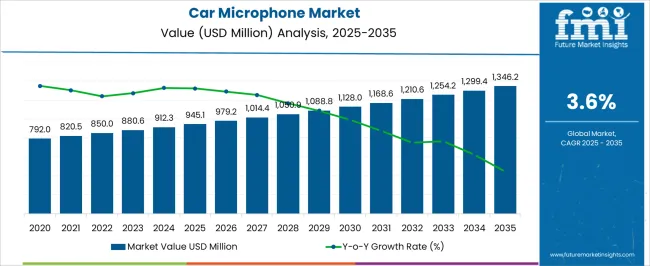

The car microphone market is projected to reach 945.1 USD million in 2025 and 1,346.2 USD million by 2035, advancing at a CAGR of 3.6% across the assessment period. Anticipated market growth reflects steady but critical integration of voice-enabled systems, in-car communication modules, and driver-assist functionalities that rely on high-clarity audio capture.

Growth Contribution Index shows incremental annual improvements driven largely by rising demand for connected infotainment systems and the integration of voice-command platforms in mid and premium segment vehicles. Automobile manufacturers are prioritizing cabin noise reduction technologies and improved call quality, which directly influences microphone adoption. Electric and hybrid vehicles are also fueling demand, as their quieter cabins emphasize the need for advanced noise-canceling microphones. From a regional perspective, North America and Europe see stable adoption in luxury cars, while the Asia Pacific region records stronger contributions through volume sales in mid-tier models.

Dollar sales growth is supported by premium component adoption, whereas share gains are influenced by supplier collaborations and software–hardware integration for adaptive speech recognition. In my opinion, the index highlights how even modest CAGR growth in this market creates significant value when tied to broader automotive digitization and the evolution of human-machine interfaces.

| Metric | Value |

|---|---|

| Car Microphone Market Estimated Value in (2025 E) | USD 945.1 million |

| Car Microphone Market Forecast Value in (2035 F) | USD 1346.2 million |

| Forecast CAGR (2025 to 2035) | 3.6% |

The car microphone market is shaped by several interconnected parent markets, each contributing uniquely to overall demand and expansion. The automotive infotainment and connectivity segment holds the largest share at 38%, as microphones are central to hands-free calling, in-car entertainment, and seamless integration with smartphones. The advanced driver-assistance systems (ADAS) and voice-command technology market contributes 27%, driven by growing reliance on speech recognition for navigation, vehicle control, and safety features.

The electric and hybrid vehicle segment accounts for 15%, where quieter cabins increase the need for noise-canceling and high-sensitivity microphones to enhance audio clarity. The luxury and premium vehicle market holds 12%, emphasizing multi-microphone arrays and directional audio for a superior cabin experience. The aftermarket accessories and retrofitting segment represents 8%, catering to consumers upgrading their vehicles with enhanced communication and entertainment systems.

The market is undergoing significant expansion driven by the rising integration of advanced communication systems and in-car voice-enabled technologies. The increasing demand for enhanced driver convenience and safety features is shaping the current market scenario.

Rapid adoption of hands-free communication, along with the growing penetration of connected vehicles, has accelerated the deployment of high-quality microphone technologies within automotive cabins. Furthermore, the advancement in noise-cancellation and voice recognition software is enabling superior sound capture in noisy environments, which is critical for driver assistance and infotainment systems.

The market’s future outlook is promising, with increasing investments from automobile manufacturers in smart cockpit solutions and seamless voice interaction capabilities. These trends are expected to boost further the demand for car microphones that can support clear communication and integrate with emerging vehicle-to-everything communication frameworks.

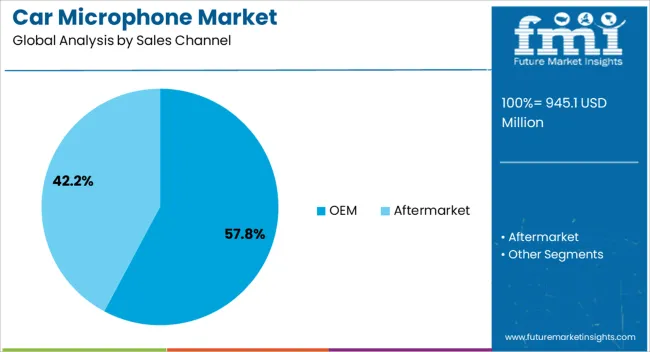

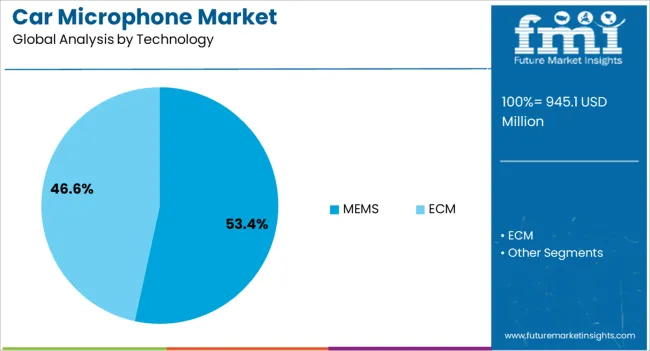

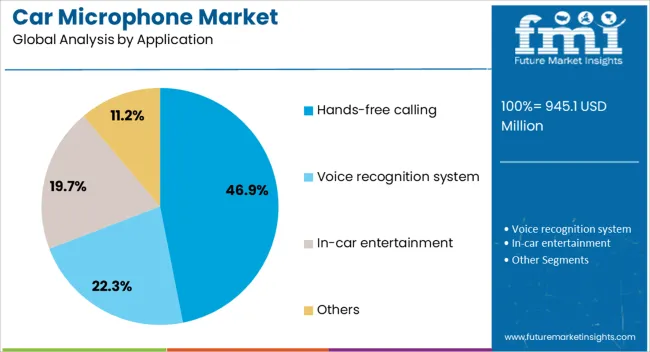

The car microphone market is segmented by sales channel, technology, application, car type, and geographic regions. By sales channel, car microphone market is divided into OEM and Aftermarket. In terms of technology, car microphone market is classified into MEMS and ECM. Based on application, car microphone market is segmented into Hands-free calling, Voice recognition system, In-car entertainment, and Others.

By car type, car microphone market is segmented into Standard and Luxury. Regionally, the car microphone industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The OEM sales channel segment is estimated to hold 57.8% of the Car Microphone market revenue share in 2025, making it the leading distribution method. This leadership is attributed to the direct integration of microphones into vehicles during the manufacturing process, ensuring better compatibility and optimized performance.

The OEM approach enables the deployment of microphones specifically designed to meet automotive standards and acoustic requirements. Additionally, vehicle manufacturers prefer OEM microphones to maintain system integrity and guarantee reliability throughout the product life cycle.

The growth of this segment has been further accelerated by the increasing trend of automakers incorporating voice-enabled controls and advanced driver assistance features directly into new vehicles. As a result, the OEM sales channel continues to dominate the market due to its alignment with vehicle production cycles and stringent quality demands.

The MEMS technology segment is projected to account for 53.4% of the Car Microphone market revenue share in 2025, positioning it as the foremost technology type. This predominance is driven by the miniature size, low power consumption, and high sensitivity of MEMS microphones, making them ideally suited for the compact and complex interior of modern vehicles.

The integration of MEMS microphones enables enhanced noise suppression and improved voice clarity, essential for hands-free communication and voice command systems. Additionally, MEMS technology supports easier mass production and cost efficiency, which has encouraged widespread adoption by automotive OEMs.

The versatility of MEMS microphones in addressing environmental challenges such as vibration and temperature variations further underpins their growing preference in the car microphone market.

The hands-free calling application segment is anticipated to hold 46.9% of the Car Microphone market revenue share in 2025, establishing it as the leading use case. This dominance is being fueled by increasing consumer demand for safer and more convenient communication methods while driving.

Regulatory mandates in many regions promoting hands-free phone use have also supported the widespread implementation of hands-free calling systems. Software advancements in voice recognition and noise cancellation have improved the effectiveness of microphones in capturing clear speech even in noisy automotive environments.

Consequently, the hands-free calling segment has expanded rapidly as vehicle infotainment systems increasingly incorporate voice-activated controls and communication functionalities. The ongoing trend toward connected and autonomous vehicles is expected to sustain this segment’s growth in the foreseeable future.

The car microphone market is expanding through infotainment integration, ADAS applications, EV adoption, and aftermarket upgrades. Growth is being fueled by demand for communication clarity, safety features, and premium in-cabin experiences.

The car microphone industry is experiencing increasing momentum due to growing reliance on in-car communication systems. Integration of voice commands, hands-free calling, and seamless smartphone connectivity has made microphones essential components in modern vehicles. Consumers expect clear and uninterrupted audio experiences, which pushes manufacturers to develop high-sensitivity microphones capable of filtering noise. Automobile brands emphasize communication efficiency as part of their infotainment strategies. The rising adoption of AI-based voice assistants in connected cars further enhances demand for advanced microphones. Dollar sales, share growth is driven by manufacturers that can supply adaptable, high-performance microphone arrays compatible with infotainment platforms, making this segment one of the most significant contributors to overall market expansion.

Microphones are playing a key role in advanced driver-assistance systems (ADAS) and safety applications. Features such as emergency calling, driver monitoring, and voice-activated controls rely heavily on precision audio capture. Automakers are incorporating multiple microphones across the vehicle cabin to detect driver fatigue, identify verbal cues, and support safety interventions. Acoustic sensors integrated with ADAS platforms help improve situational awareness by analyzing environmental sounds such as horns or sirens. This integration not only enhances driver convenience but also aligns with evolving safety standards. The contribution of this segment to dollar sales, share emphasizes the strategic role of microphones in supporting advanced safety frameworks, reinforcing long-term adoption across mainstream and premium vehicle categories.

The shift toward electric and hybrid vehicles has created unique opportunities for microphone adoption. With quieter cabins compared to combustion vehicles, the demand for advanced audio components has increased significantly. Microphones with noise-canceling features are being used to eliminate background sounds and enhance infotainment clarity. EV manufacturers emphasize creating premium cabin experiences, where communication and entertainment are core differentiators. Dollar sales, share contribution from EV-specific integration is rising steadily, with suppliers focusing on compact, energy-efficient microphone systems. This trend is expected to accelerate as EV penetration grows worldwide, positioning the segment as a long-term driver for microphone demand in both mass-market and luxury electric vehicles.

Beyond original equipment manufacturers (OEMs), aftermarket and retrofitting segments present notable growth avenues for the car microphone industry. Consumers often upgrade older vehicles with advanced infotainment systems, voice-control modules, and aftermarket accessories that require high-quality microphones. Regional suppliers and smaller brands are capitalizing on this trend by offering affordable, customizable solutions. Dollar sales and share growth are being fueled by widespread adoption across emerging economies, where vehicle upgrades are more frequent than new purchases. Online distribution and e-commerce platforms have further boosted the accessibility of aftermarket solutions, expanding penetration. This segment complements OEM integration and ensures recurring demand, reinforcing the overall market’s adaptability and growth resilience.

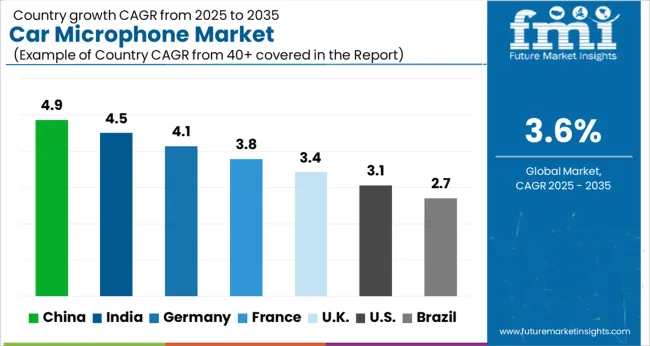

| Country | CAGR |

|---|---|

| China | 4.9% |

| India | 4.5% |

| Germany | 4.1% |

| France | 3.8% |

| UK | 3.4% |

| USA | 3.1% |

| Brazil | 2.7% |

The global car microphone market is projected to grow at a CAGR of 3.6% from 2025 to 2035. China leads at 4.9%, followed by India at 4.5%, Germany at 4.1%, France at 3.8%, and the UK at 3.4%, while the USA records 3.1%. Growth is driven by rising integration of voice-assist systems, in-car communication, and driver safety applications. Asia, particularly China and India, demonstrates faster adoption due to expanding automotive production and the rising demand for connected vehicles. Germany and France focus on premium cars with advanced infotainment and safety features, while the UK emphasizes mid-tier vehicle upgrades and aftermarket integration. North America, led by the USA, prioritizes EV and hybrid adoption, supporting demand for noise-canceling and multi-array microphones to enhance cabin experiences. Dollar sales, share indicate that OEM integration dominates revenues, while aftermarket upgrades and retrofitting solutions continue to provide incremental growth. The analysis spans over 40+ countries, with the leading markets highlighted above.

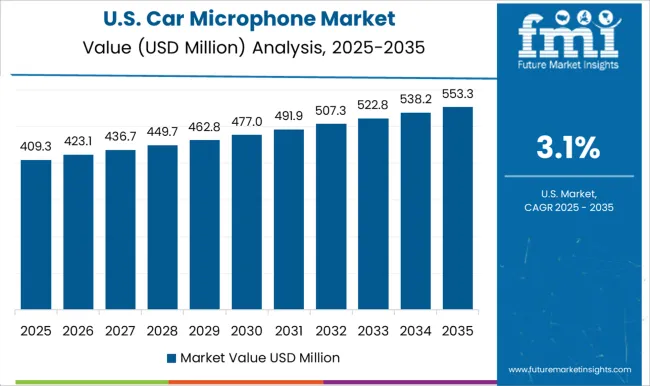

The car microphone market in the USA is projected to grow at a CAGR of 3.1% from 2025 to 2035, driven by rising adoption of connected cars, infotainment integration, and voice-assist systems. Automakers emphasize high-performance, noise-canceling, and array microphones to improve driver safety, convenience, and entertainment. EV manufacturers integrate advanced microphones to enhance cabin comfort in quieter vehicles, strengthening demand. Dollar sales, share reveal that OEM installations dominate, but aftermarket retrofits continue to contribute as consumers upgrade vehicles with advanced voice-enabled features. Collaborations between USA automakers and global component suppliers ensure innovation and compliance with automotive standards. Adoption is further enhanced by rising consumer preference for smart, interactive in-car experiences across premium and mainstream vehicles.

The car microphone market in China is projected to grow at a CAGR of 4.9% from 2025 to 2035, driven by surging demand for connected cars, advanced infotainment, and voice-assisted features. Automakers are integrating multi-array microphones to support in-car communication, noise cancellation, and driver-assist functions. Domestic production capacity is expanding, with suppliers collaborating with international technology providers to enhance performance, reliability, and regulatory compliance. Growth is further supported by China’s strong EV sector, where high-quality microphones play a role in enhancing quiet cabin acoustics. Dollar sales, share indicate that premium vehicles dominate revenue, while mid-tier and mass-market cars also witness adoption through cost-effective solutions. Aftermarket services contribute to incremental growth as consumers retrofit existing vehicles with voice-enabled features.

The car microphone market in India is expected to expand at a CAGR of 4.5% from 2025 to 2035, supported by rising vehicle sales, demand for infotainment systems, and adoption of in-car communication features. Manufacturers are focusing on cost-efficient microphone designs to meet the price-sensitive mass automotive segment. Increasing penetration of compact and mid-sized cars fuels widespread adoption, while premium cars drive growth with advanced noise-canceling and multi-microphone configurations. Dollar sales, share highlight significant contributions from OEM installations, complemented by a growing aftermarket for upgrades. Local suppliers collaborate with global players to enhance quality and ensure compliance with automotive standards, enabling scalability. Voice-assist integration and smartphone connectivity further boost adoption in both rural and urban areas.

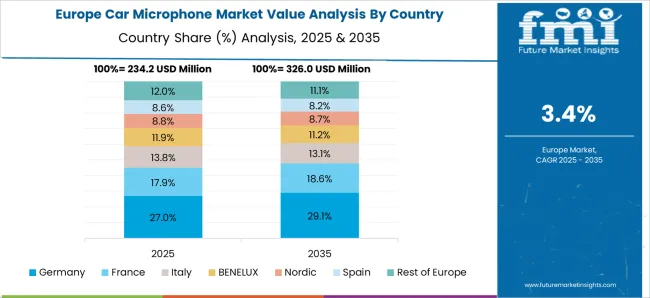

The car microphone market in France is projected to grow at a CAGR of 3.8% from 2025 to 2035, supported by strong automotive innovation and premium vehicle manufacturing. French automakers emphasize advanced infotainment, driver assistance, and voice-control integration, creating demand for high-fidelity microphones. Luxury and mid-range brands contribute significantly to dollar sales, share, while aftermarket upgrades appeal to tech-savvy consumers. Manufacturers are investing in enhanced noise-cancellation systems to improve cabin comfort and safety, especially in EVs where quiet cabin acoustics magnify audio needs. Partnerships with global microphone suppliers and R&D investments strengthen product innovation and compliance with EU safety standards. Growth is further supported by demand for voice-assist systems in urban commuting and fleet vehicles.

The car microphone market in the UK is expected to grow at a CAGR of 3.4% from 2025 to 2035, influenced by rising demand for infotainment, in-car voice commands, and connected vehicle features. Automakers are adopting microphones with high speech recognition accuracy to support safety and driver convenience. Mid-tier cars and fleet vehicles represent strong contributors to dollar sales, share, while premium models emphasize multi-array configurations and noise-canceling features. Growth is also linked to increasing EV adoption, requiring microphones optimized for quieter cabins. Aftermarket channels play a notable role, offering retrofit solutions for older models. Collaboration with technology providers ensures compliance with EU regulations and supports adoption across both domestic and imported vehicles.

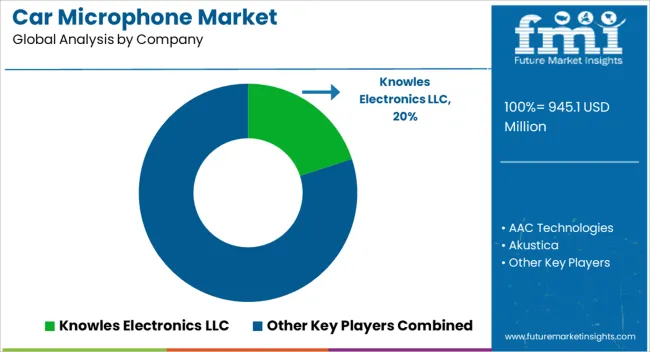

Competition in the car microphone market is shaped by audio clarity, integration with infotainment systems, and adaptability to advanced driver-assist functions. Knowles Electronics LLC leads with miniature, high-performance microphones tailored for noise cancellation, voice recognition, and multi-array configurations in premium vehicles. AAC Technologies and Akustica compete by offering compact MEMS microphones optimized for automotive use, focusing on durability, low power consumption, and consistent acoustic performance. Blaupunkt GmbH and Brüel & Kjær differentiate by emphasizing high-fidelity audio solutions, targeting luxury cars and advanced communication systems.

CUI Devices and DB Unlimited provide cost-effective, scalable solutions catering to mass-market vehicles, balancing affordability with reliability. Goertek Inc. and Harman International Inc. focus on seamless integration of microphones into infotainment and entertainment systems, enabling enhanced voice control and connectivity. Hosiden Corporation and Infineon Technologies emphasize sensor integration, noise suppression, and compliance with automotive safety standards, ensuring reliability across electric and connected vehicles. Kingstate Electronics Corp and PUI Audio compete in the mid-tier market with standardized automotive microphones suited for widespread adoption. STM Microelectronics and TDK InvenSense concentrate on MEMS-based solutions, integrating sensor technology and microelectronics to improve precision, accuracy, and performance under variable driving conditions.

| Item | Value |

|---|---|

| Quantitative Units | USD 945.1 Million |

| Sales Channel | OEM and Aftermarket |

| Technology | MEMS and ECM |

| Application | Hands-free calling, Voice recognition system, In-car entertainment, and Others |

| Car Type | Standard and Luxury |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Knowles Electronics LLC, AAC Technologies, Akustica, Blaupunkt GmbH, Brüel & Kjær, CUI Devices, DB Unlimited, Goertek Inc, Harman International Inc, Hosiden Corporation, Infineon Technologies, Kingstate Electronics Corp, PUI Audio, STM Microelectronics, and TDK Invense |

| Additional Attributes | Dollar sales, share by vehicle type, OEM vs aftermarket demand, adoption in infotainment and ADAS, regional growth hotspots, pricing benchmarks, competitor strategies, and regulatory compliance trends. |

The global car microphone market is estimated to be valued at USD 945.1 million in 2025.

The market size for the car microphone market is projected to reach USD 1,346.2 million by 2035.

The car microphone market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in car microphone market are OEM and aftermarket.

In terms of technology, mems segment to command 53.4% share in the car microphone market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Car OS Market Size and Share Forecast Outlook 2025 to 2035

Caramel Malt Market Size and Share Forecast Outlook 2025 to 2035

Carbon Capture and Sequestration Market Forecast Outlook 2025 to 2035

Cardiac Rehabilitation Market Size and Share Forecast Outlook 2025 to 2035

Carbon Dioxide Incubators Market Size and Share Forecast Outlook 2025 to 2035

Carboxymethyl Tamarind Gum (CMT) Market Size and Share Forecast Outlook 2025 to 2035

Car Cover Market Size and Share Forecast Outlook 2025 to 2035

Cardiology Information System Market Size and Share Forecast Outlook 2025 to 2035

Cardiopulmonary Functional Testing Platform Market Size and Share Forecast Outlook 2025 to 2035

Carbon Enhanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Car Bushing Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Cement Market Size and Share Forecast Outlook 2025 to 2035

Card Printer Ribbon Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tetrabromide Market Size and Share Forecast Outlook 2025 to 2035

Carbon Steel Market Size and Share Forecast Outlook 2025 to 2035

Carpet Spot Remover Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular CT Systems Market Size and Share Forecast Outlook 2025 to 2035

Carbon Brush Market Size and Share Forecast Outlook 2025 to 2035

Carpet and Rug Market Size and Share Forecast Outlook 2025 to 2035

Carbon Offset Platform Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA