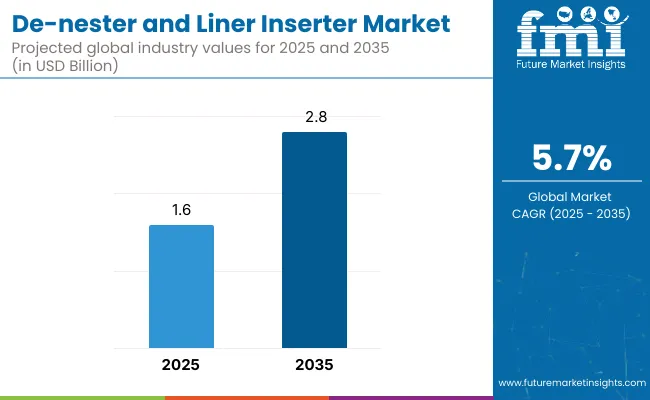

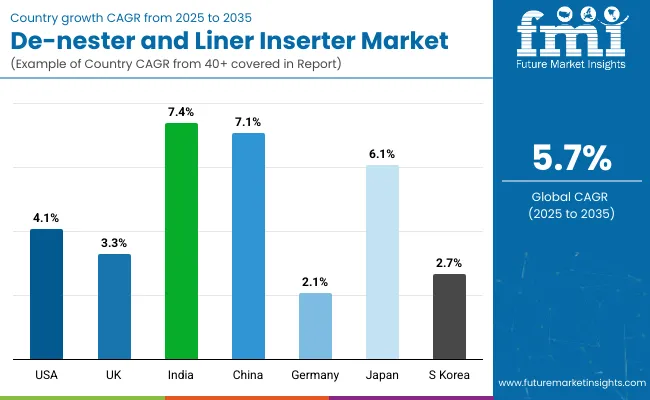

The de-nester and liner inserters market is forecast to grow from USD 1.6 billion in 2025 to USD 2.8 billion by 2035, recording an increase of USD 1.2 billion over the ten-year period. This growth represents a 75.0% total expansion, with the market achieving a compound annual growth rate (CAGR) of 5.7%. Over the decade, the market scales up by a 1.7 multiple.

In the first five-year phase (2025 to 2030), the market expands from USD 1.6 billion to USD 2.1 billion, contributing USD 0.5 billion, which accounts for 41.7% of the total decade’s growth. This period is marked by increasing automation across ready-to-eat food, dairy, and baked goods segments, where precise de-nesting and hygienic liner placement are critical to productivity and food safety compliance.

From 2030 to 2035, the market accelerates from USD 2.1 billion to USD 2.8 billion, contributing USD 0.7 billion, or 58.3% of the total growth. Growth is driven by adoption in automated packaging lines and robotic filling systems across both food and pharmaceutical industries. Modular, servo-driven de-nesters with integrated liner feeders gain traction, supported by the demand for faster changeovers, minimal manual intervention, and compliance with evolving food-contact packaging regulations.

From 2020 to 2024, the de-nester and liner inserters market grew from USD 1.2 billion to USD 1.5 billion, driven by hardware-centric adoption in food packaging, pharma trays, and industrial container lining applications. During this period, the competitive landscape was dominated by equipment manufacturers controlling nearly 70% of total revenue, with leaders such as SEALPAC, Kaupert Marburg, and Chunlai Packing Machinery Co. focusing on precision automation systems for container separation, cup de-nesting, and hygienic liner placement.

Competitive differentiation relied on quick changeovers, format flexibility, and sanitation compliance, while automation software was often bundled within core systems rather than monetized separately. Service-based models such as predictive maintenance and remote monitoring accounted for less than 10% of total market value, as demand remained primarily hardware-driven.

Demand for de-nesters and liner inserters will expand to USD 2.8 billion in 2035, and the revenue mix will shift as digital services and software integration grow to over 40% share. Traditional hardware players face increasing competition from automation-native vendors offering IoT-based productivity dashboards, AI-powered alignment tools, and digital commissioning.

Major manufacturers are transitioning to hybrid models by embedding remote diagnostics, smart calibration, and modular design into their systems. Emerging entrants such as Farmo Res SRL, Millitec Food Systems, Captel Industries LLP, Zhangjiagang U Tech Machine Co., Ltd., Aoqite Automatic Equipment, OKI, and Calmus Machinery are gaining share by specializing in compact, application-specific, and compliance-certified automation. The competitive advantage is moving away from mechanical speed alone to digital adaptability, platform intelligence, and recurring revenue through lifecycle management services.

Rising automation in food packaging, bakery, dairy, and ready-to-eat segments is driving the growth of the de-nester and liner inserters market. These machines streamline the process of separating nested containers and inserting liners or papers with speed and precision, enabling high-throughput packaging while ensuring hygiene and product separation. The demand for consistent portion control and reduced manual handling is reinforcing the integration of these systems in production lines.

Servo-driven de-nesters and programmable liner inserters have gained popularity due to their adaptability to various container shapes and sizes. These systems enable accurate placement of liners, films, or pads into trays, cups, and clamshells critical in applications requiring product freshness and contamination control. Their integration into existing conveyors and thermoforming lines enhances operational efficiency and reduces labor dependency.

Industries such as baked goods, processed meat, fresh produce, and convenience meals are driving demand for packaging systems that improve shelf life, protect against leakage, and maintain visual appeal. These machines support sanitary design standards, reduce packaging waste, and increase consistency in high-speed food-grade operations.

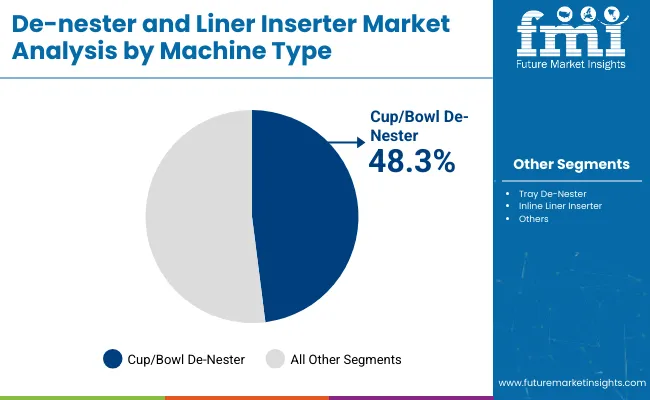

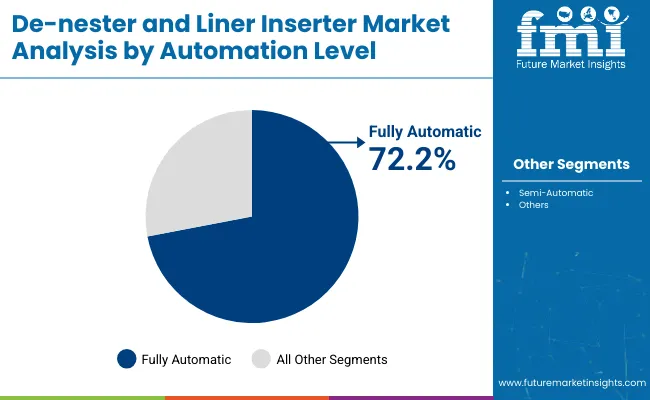

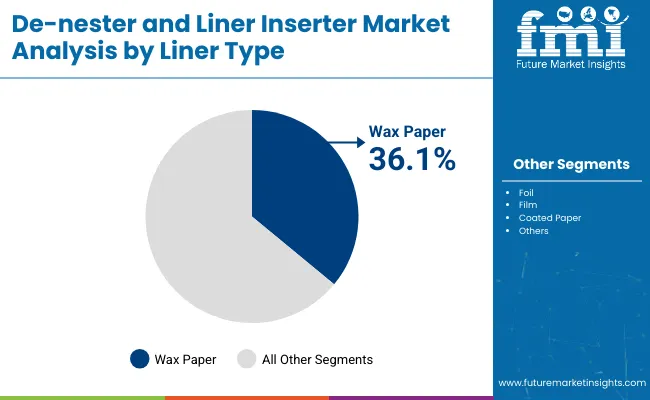

The market is segmented by machine type, automation level, liner type, application, end-use industry, and region. Machine type includes cup/bowl de-nester, tray de-nester, and inline liner inserter, each tailored for specific container formats used in food and medical packaging lines. Automation level segmentation comprises semi-automatic and fully automatic systems, offering flexibility based on production scale, labor availability, and integration requirements. By liner type, the market is divided into wax paper, foil, film, and coated paper, addressing different barrier, sealing, and product preservation needs.

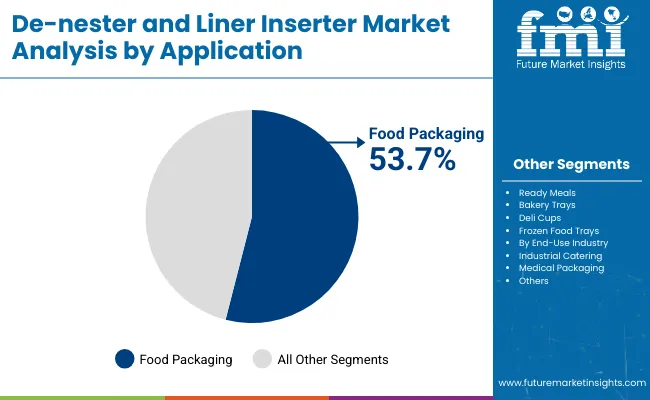

Application areas include ready meals, bakery trays, deli cups, and frozen food trays, supporting convenience packaging for perishable and heat-sensitive items. End-use industries include food packaging, industrial catering, and medical packaging, where hygiene, speed, and accuracy are critical operational factors. Regionally, the market is segmented into North America, Europe, Asia-Pacific, and Latin America.

The cup/bowl de-nester segment is expected to account for the highest share of 48.3% in 2025 in the de-nester and liner inserters market. This leadership is attributed to the widespread demand for high-efficiency, servo-controlled de-nesting systems in ready-to-eat and dairy food processing lines. Cup and bowl containers are used extensively across yogurt, dessert, sauces, and instant meal categories, making their rapid separation and positioning critical for minimizing downtime and manual handling.

Modern cup/bowl de-nesters are designed to handle multiple formats and stacking orientations, with vacuum-assisted or mechanical pick systems that ensure gentle handling and accurate placement. As food manufacturers continue investing in modular and flexible packaging lines, the ability of these systems to support quick format changes and high-output operations further solidifies their market position. With hygiene compliance and automation becoming non-negotiable, the segment will maintain dominance across fast-paced food manufacturing environments globally.

The food packaging segment is projected to lead the end-use industry category with a 53.7% share in 2025. This dominance is driven by the increasing need for contamination-free and consistent de-nesting and liner placement processes across diverse food applications. Industries such as bakery, frozen meals, dairy, and condiments are rapidly integrating de-nester and liner inserter systems to reduce labor dependency, minimize human contact, and ensure precision in container preparation.

liner inserters play a vital role in maintaining freshness and extending product shelf life, especially for high-value perishables and semi-moist products. The integration of vision-guided robotics, IoT sensors, and hygienic frame designs are also transforming food packaging lines into intelligent systems capable of real-time error correction and performance monitoring. In a sector that prioritizes both speed and safety, automated de-nesting and liner inserting solutions are set to remain foundational technologies throughout the forecast horizon.

The fully automatic segment is projected to dominate the de-nester and liner inserters market with a 72.2% share in 2025. This leadership stems from rising adoption in high-volume food processing and packaging lines where speed, precision, and labor savings are critical. Fully automatic systems offer seamless integration with conveyor-fed production lines, enabling uninterrupted operations, consistent placement accuracy, and reduced manual intervention factors essential for meeting food safety and hygiene regulations.

These systems are increasingly favored in frozen meals, dairy, bakery, and ready-to-eat packaging due to their ability to handle high SKUs with minimal changeover time.

The wax paper liner segment is expected to account for the highest share of 36.1% in 2025. Wax-coated paper liners offer excellent resistance to moisture and grease, making them particularly suitable for food trays used in ready meals, baked goods, and deli items. They are biodegradable, compostable, and align with sustainability mandates driving their uptake in eco-conscious packaging setups across North America and Europe.

Their compatibility with high-speed liner inserters and custom-cut formats further enhances operational convenience.

The ready meals application segment is projected to lead with a 38.2% share in 2025. The dominance is driven by the surging demand for convenient, pre-portioned meals amid changing consumer lifestyles, urbanization, and increasing dual-income households. Ready meals require precise and hygienic tray handling and lining, making them a top application area for de-nester and liner inserter technologies.

These systems enable quick de-nesting of uniform trays and fast liner placement, ensuring compliance with food safety standards while supporting high-volume production throughput.

Space limitations and changeover inflexibility challenge broader deployment, even as demand rises in food processing, pharmaceutical packaging, and industrial automation for contactless, high-speed container separation and liner insertion that ensure hygiene, sealing integrity, and line efficiency.

Rising Need for Hygienic Automation in Food and Pharma Industries

De-nester and liner inserter systems are increasingly adopted in sectors requiring sterile, high-throughput packaging environments such as ready-meal production, dairy, bakery, pharmaceuticals, and cosmetics. De-nesters automate the separation and placement of stacked containers (cups, trays, tubs) onto conveyor belts, while liner inserters apply protective films or foil membranes to ensure product safety and freshness. These machines reduce labor dependency, enhance cleanliness, and enable consistent output on high-speed lines. In pharmaceuticals, precise liner placement helps meet regulatory standards for tamper-evidence and moisture protection. As global demand rises for pre-filled, portioned, and sealed packaging formats, these machines are becoming integral to modern packaging line automation.

Footprint Constraints and Limited Format Flexibility

Despite their advantages, de-nesters and liner inserters face deployment constraints due to their physical footprint and configuration rigidity. In compact production environments, integrating these machines into existing lines without layout reengineering can be challenging. Many systems are format-specific and require mechanical adjustment or change parts when shifting between container sizes, shapes, or liner types. This limits flexibility for short production runs or multi-SKU operations. The initial investment cost including tooling, maintenance, and line customization can deter small manufacturers or co-packers operating on tight margins. As a result, adoption remains concentrated among high-volume, standardized packaging applications.

Integration with Vision Systems and Modular, Servo-driven Designs

A key trend shaping the market is the transition toward smart, modular systems equipped with servo motors and vision technology. Advanced de-nesters now use camera-guided alignment to ensure accurate pick-and-place of irregularly shaped or transparent containers, while liner inserters are evolving with real-time feedback to verify placement accuracy and seal uniformity. Servo-driven components reduce mechanical wear and enable smoother format transitions. Modular configurations allow easy scaling or replacement of sub-units, supporting agile production strategies. As demand for quality assurance, contamination control, and flexible automation intensifies, de-nester and liner inserter systems are being redesigned to align with smart factory and Industry 4.0 standards.

The global de-nester and liner inserters market is expanding steadily due to increasing automation across foodservice packaging, pharmaceuticals, industrial pails, and rigid containers. The shift toward hygienic, touch-free, and high-speed operations in filling lines is driving demand for these machines. Asia-Pacific is leading the growth curve with India, China, and Japan investing heavily in automation to support FMCG and food export logistics. In contrast, developed economies such as the USA, UK, and Germany are focused on system upgrades, line retrofits, and labor cost optimization. Liner inserters are increasingly integrated with robotic arms, vision systems, and adaptive tooling to reduce downtime and increase throughput.

The de-nester and liner inserters market in the United States is forecast to grow at a CAGR of 4.1% between 2025 and 2035. Demand is driven by industrial-scale food processors, rigid packaging converters, and pharmaceutical filling lines prioritizing automation and contamination control. Manufacturers are investing in robotic de-nesting with auto-adjusting arms and vacuum-based liner inserters to minimize manual handling.

The de-nester and liner inserters market in the United Kingdom is projected to grow at a CAGR of 3.3%, supported by automation upgrades in food trays, personal care containers, and e-commerce-ready packaging. British firms are replacing legacy pick-and-place systems with vision-guided de-nesters and programmable liner applicators to reduce packaging waste and labor reliance.

India’s de-nester and liner inserters market is forecast to grow at a CAGR of 7.4%, the highest globally. Rapid industrialization, growth in packaged foods, and hygiene mandates in pharmaceuticals are key drivers. Indian packaging lines are increasingly automating container handling for dairy cups, PET jars, and laminated pouches. Affordable, scalable machine designs by local OEMs are enabling broader access to automation.

The de-nester and liner inserters market in China is projected to grow at a CAGR of 7.1%, supported by large-scale production of instant meals, dairy products, and household goods. The growing middle class, urban meal prep trends, and food exports are triggering automation across primary packaging lines. Domestic machinery companies are introducing inline de-nesting with liner roll feeds for minimal operator intervention.

Germany’s de-nester and liner inserters market is expected to grow at a CAGR of 2.1%, driven by established automation maturity and regulatory requirements for hygienic primary packaging. German manufacturers are refining liner insertion precision through real-time sensor calibration and incorporating auto-cleaning modules for pharmaceutical GMP compliance. Adoption is focused on efficiency gains and production flexibility.

Japan’s de-nester and liner inserters market is projected to grow at a CAGR of 6.1%, fueled by demand for cleanroom-compatible automation in clinical nutrition, premium ready meals, and export-focused cosmetic packaging. Japanese manufacturers prefer minimalistic, high-efficiency machines capable of precision tray orientation and contamination-free liner placement.

The de-nester and liner inserters market in South Korea is projected to grow at a CAGR of 2.7%, supported by smart factory initiatives and the rise of clean-label packaging in beauty, food, and pharma. While adoption remains moderate in smaller plants, demand is increasing for hygienic, inline-ready machines that support compact operations and frequent SKU changeovers.

The de-nester and liner inserters market is moderately fragmented, with global automation leaders, food-grade equipment manufacturers, and regional machine builders competing across food processing, pharmaceutical, and industrial packaging lines. Global players such as SEALPAC, Kaupert Marburg (Germany), and OKI hold significant market share, driven by high-speed de-nesting accuracy, hygienic design standards, and inline integration with thermoforming and filling systems. Their strategies increasingly emphasize washdown compatibility, format versatility, and smart servo-driven motion control for trays, cups, and thermoformed cavities.

Established mid-sized companies such as Chunlai Packing Machinery Co. (China), Farmo Res SRL (Italy), and Millitec Food Systems (Australia) support automated packaging throughput by offering modular de-nester heads, robotic pick-and-place inserters, and multi-format liner applicators. These companies are accelerating adoption in mid-scale food, bakery, and dairy plants through quick-changeover tooling and CE/GMP compliant architecture.

Specialized regional providers including Captel Industries LLP (India), Zhangjiagang U Tech Machine Co., Ltd., Aoqite Automatic Equipment (China), and Calmus Machinery focus on cost-effective, application-specific solutions tailored for disposable food containers, ready-meal trays, and industrial component liners. Their strength lies in offering localized support, customizable feed mechanisms, and scalable automation for regional converters and co-packers.

Competitive differentiation is shifting away from basic mechanical handling systems toward integrated robotic de-nesting and liner feeding ecosystems that offer IoT-based fault monitoring, multi-lane synchronization, and tool-less changeover flexibility tailored to hygiene-critical and fast-paced production environments.

Key Development of De-Nester and Liner Inserters Market

The global de-nester and liner inserters market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the de-nester and liner inserters market is projected to reach USD 2.8 billion by 2035.

The de-nester and liner inserters market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in the de-nester and liner inserters market include cup/bowl de-nesters, tray de-nesters, container liner inserters, and pouch inserters.

In terms of product type, the cup/bowl de-nester segment is expected to command the highest share of 48.3% in the de-nester and liner inserters market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Linerless Label Market Size and Share Forecast Outlook 2025 to 2035

Linerless Closures Market Size and Share Forecast Outlook 2025 to 2035

Market Positioning & Share in Linerless Label Industry

Liner Bag Market Report – Key Trends & Forecast 2024-2034

Liner Hanger Market

Eyeliner and Kajal Sculpting Pencil Packaging Market Trends and Forecast 2025 to 2035

Evaluating Eyeliner and Kajal Sculpting Pencil Packaging Market Share & Provider Insights

Eyeliner Pen Market

Cap Liner Market Size and Share Forecast Outlook 2025 to 2035

Box Liners Market Size and Share Forecast Outlook 2025 to 2035

IBC Liner Market Size and Share Forecast Outlook 2025 to 2035

Pan Liner Market Insights – Demand, Growth & Industry Trends 2025-2035

EPE Liner Market Analysis – Size, Growth & Demand 2025 to 2035

Examining Market Share Trends in the Cap Liner Industry

IBC Liner Market Share Insights & Industry Leaders

Industry Share Analysis for Box Liners Companies

Cap Liner Films Market

Testliner Market

Pan Liners Market

Pulp Liner Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA