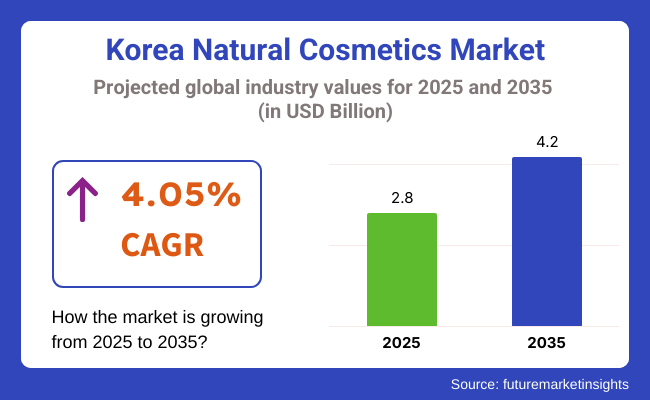

The Korea natural cosmetics market is poised to register a valuation of USD 2.8 billion in 2025. The industry is slated to grow at 4.05% CAGR from 2025 to 2035, witnessing USD 4.2 billion by 2035. The market is seeing continued growth as consumers become more aware of health, sustainability, and the composition of personal care products.

South Korean consumers are known for their skincare insight and perfectionism, and they are gravitating toward products that do not contain bad chemicals, synthetic scents, and artificial preservatives. This has seen a big demand for natural and organic cosmetic options that resonate with a clean and sustainable lifestyle.

Concerns over the environment have further contributed to this transition. The younger generations, specifically Gen Z and millennials, are focusing on sustainability, prompting companies to adopt cruelty-free testing, ethical sourcing, and sustainable packaging.

Social media influence, particularly beauty influencers and K-beauty trends, also drives the trend for clean and natural products. Social media facilitates the establishment of an educated consumer base that is more careful about what it applies to its skin.

Government laws favoring safer cosmetics and greater transparency have spurred companies to innovate in naturals. Today, consumers are focusing on ingredient labels and looking for certifications like vegan, EWG-verified, or organic, making natural cosmetics a more mainstream category.

All these forces-cultural heritage, health awareness, green consciousness, and digital impact-are coming together to make the natural cosmetics category one of the most rapidly growing niches in the Korean beauty market.

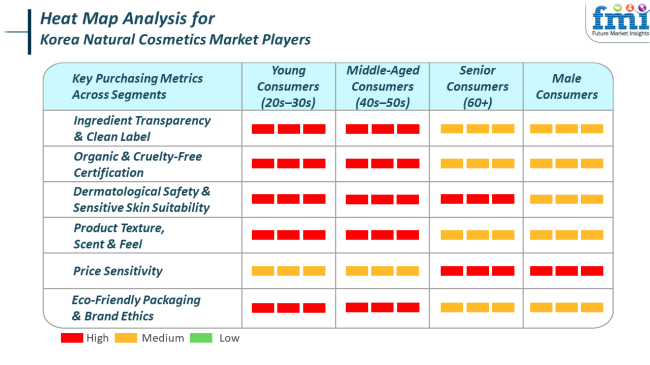

Korea natural cosmetics industry is experiencing multi-faceted trends and shifting buying criteria for various end-use segments, topped by skincare. Skincare users in Korea's beauty culture hold clean formulations containing natural ingredients such as centellaasiatica, mugwort, and green tea in high regard.

Transparency, fewer ingredients on the label, and certifications such as EWG-verified or vegan are preferred. In the haircare category, scalp health and environmental concerns have propelled consumers towards sulfate-free, paraben-free, and silicone-free products that contain botanical extracts. Likewise, personal hygiene items-particularly body washes, deodorants, and feminine hygiene-are sought after for their hypoallergenic and dermatologically safe ingredients, frequently combined with environmentally friendly packaging and cruelty-free certifications.

The cosmetics category is also moving towards natural, multi-purpose products that bring makeup and skin benefits together, echoing the popularity of the "no-makeup" makeup phenomenon. Consumers desire lightweight, ventilating textures with natural color, and shun synthetic dyes or strong scents.

Through all categories, the buying habits are influenced by a health-and-wellness-conscious, ecologically conscious, digitally savvy consumer. Korean consumers are ever more educated, discerning, and loyal to brands that prove themselves to have ingredient transparency, ethical sourcing, and sustainable production, and these elements are key to the expansion of the natural cosmetics market in Korea.

From 2020 to 2024, the Korea natural cosmetics market underwent significant changes influenced by shifting consumer values, the COVID-19 pandemic, and technological innovation. Throughout the pandemic, there was a sharp turn toward self-care, with greater expenditure on skincare and personal wellness products.

Consumers became more ingredient-savvy, prompting brands to shift away from synthetic chemicals and toward natural, plant-based ingredients. The growth of e-commerce and social media speeded up access to specialist and indie natural beauty brands, and bigger companies responded by rewriting formulas and getting more transparent. Sustainability also picked up speed, with brands embracing recyclable packaging, cruelty-free formulations, and clean beauty badges to respond to increasing environmental expectations.

During the forecast period, Korea's natural cosmetics market will keep on growing, spurred by developments in biotech-derived ingredients, customized skincare, and beauty tools driven by artificial intelligence.

Consumers will look for increasingly customized solutions according to their skin type, environment, and way of life, combining nature and technology. Market demand will increase for sustainable, locally harvested ingredients, zero-waste packaging, and carbon-neutral manufacturing.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Consumers grew more demanding, seeking products wit h clean, minimalist ingredients free of parabens, sulfates , and synthetic additives. This trend compelled brands to rethink formulations and get more transparent about what goes into them. | The market will go beyond simple clean beauty to more advanced natural products that blend botanical ingredients with biotech innovations to increase performance, safety, and personalization. |

| Lockdowns and prolonged home time fueled a boom in skincare routines as individuals turned to soothing, natural products emphasizing hydration, repair, and barrier care. | Beauty will be seen by consumers more and more as part of overall well-being, with natural cosmetics taking center stage for their ability to enhance skin health, mental state, and underpin lifestyle-based self-care routines. |

| Sustainability awareness brought increased demand for environmentally friendly packaging, cruelty-free testing, and ethical manufacturing habits, prompting companies to switch to greener technologies and sustainability brand messaging. | The next ten years will see more companies engaging in greater depths of sustainability effort-waterless products, refilling packaging, biodegradables, c arbon-neutral manufacturing, and others. |

| Amazon and social networ king sites aided small , natural products brands to market to mass purchasers, and virtual reviews affected shopper decisions | Artificial intelligence-facilitated skincare analysis, digital consultations, and data-backed product suggestions will enable consumers to obtain personalized natural beauty solutions that respond to their evolving skin concerns. |

While the Korea natural cosmetics market has high growth potential, it is not without risks. One major concern is regulatory uncertainty and changing standards regarding what is considered "natural" or "organic."

The absence of a single global definition or standardized certification process can result in confusion, in which companies promote themselves as natural without adhering to strict standards. This erodes consumer trust and puts additional pressure from both regulators and consumers, leading potentially to brand reputation damage.

Another critical risk is the extremely competitive and saturated market environment. The Korean natural cosmetics market has been flooded with both local startups and foreign entrants, creating more competition.

Established K-beauty companies are also entering natural lines, which makes it increasingly difficult for smaller or new players to gain traction. Saturation compresses prices and margins, particularly since consumers demand premium-quality ingredients and environmentally friendly packaging without substantially higher prices.

In Korea, natural cosmetics are dominated by skin and sun care products, owing to the nation's skincare culture. Korean consumers are famous for their multi-step skincare regimens, which frequently consist of cleansing, toning, moisturizing, and sun protection. Natural skincare products, particularly those that use calming ingredients such as green tea, ginseng, and centellaasiatica, are a perfect fit with the trend for gentle yet effective products.

Sun care products like natural sunscreens that contain SPF protection are also in demand since sun protection is an essential component of the daily skincare routine to keep the skin safe from damage and aging. The clean beauty trend which is void of toxic chemicals and artificial ingredients further spurs the popularity of natural skin and sun care products among Koreans.

Hair care is yet another important category for natural cosmetics in Korea. Customers are increasingly concerned about the effects of harsh chemicals in traditional shampoos and conditioners. As a consequence, the market demand for sulfate-free, paraben-free, and silicone-free natural hair care products that use botanical extracts and essential oils to moisturize and shield the hair and scalp has been on the rise.

Shampoos, conditioners, and scalp treatments that are natural are viewed as promoting general hair well-being, particularly for individuals who reside in urban areas where environmental stressors and pollution can affect hair health.

The online sales channel has become the primary sales channel for natural cosmetics in Korea, fueled by the nation's highly networked and technologically advanced population. With the growth of e-commerce websites and the growing popularity of mobile shopping, Korean consumers have found the convenience of buying beauty products online appealing.

Online sites enable consumers to compare products easily, read reviews, and find new natural cosmetics brands from the comfort of their homes. Social media, especially sites such as Instagram and YouTube, have a major influence on purchasing decisions, as beauty bloggers and influencers often endorse natural beauty and skincare products. This has helped fuel the fast expansion of online shopping, and it is now the preferred channel for most beauty consumers in Korea.

In addition, the greater emphasis on convenience and the move towards a digital-first shopping experience have compelled brands to maximize their online presence. Most natural cosmetics brands and retailers provide direct-to-consumer e-commerce sites, which improve customer interaction and loyalty through personalized product suggestions, loyalty programs, and targeted advertising.

This digital transition also fits into the larger trend of direct-to-consumer business models within the beauty space, where brands are able to engage directly with consumers, cutting out intermediating retailers and providing competitive pricing.

The natural cosmetics market in Korea is a mix of both global beauty giants and niche players that meet the nation's increasing need for clean, green, and effective beauty solutions. Large global brands such as L'Oréal SA, Amway Corporation, and Beiersdorf offer mass-market credibility, broad product lines, and large distribution channels, whereas new brands such as Sourcing-Lab, Cosmedique, and Nutricare target more niche consumers with natural and sustainable ingredients. This blend of established players and new entrants guarantees that the market caters to the varied tastes of health-conscious, ingredient-savvy, and environmentally friendly consumers.

Key Company Share Analysis

| Company Name | Estimated Industry Share (%) |

|---|---|

| L'Oréal SA | 12-14% |

| Amway Corporation | 8-10% |

| Beiersdorf | 7-9% |

| Chanel S.A. | 5-7% |

| Clarins Group | 4-6% |

| Coty Inc. | 3-5% |

| Kolmar Korea | 2-4% |

| Cosmedique | 2-4% |

| Nutricare | 1-3% |

| Sourcing-Lab | 1-3% |

| Company Name | Key Offerings & Activities |

|---|---|

| L'Oréal SA | As a global beauty and skincare leader, L'Oréal provides a variety of natural-based cosmetics and skincare products in Korea with clean formulations. The company couples science-proven skincare with natural ingredients to appeal to environmentally conscious and health-conscious consumers. |

| Amway Corporation | Amway is noted for its Nutrilite -branded products, which stress plant-based ingredients for skin care. The company plays on its direct-selling platform in Korea to reach a niche customer base of health-conscious consumers looking for natural cosmetics and nutritional beauty products. |

| Beiersdorf | Famous for the Nivea brand, Beiersdorf's natural cosmetics line in Korea targets sensitive skin care products with naturally sourced ingredients like shea butter and aloe vera. The quality reputation and dermatological testing of the brand guarantee confidence among Korean consumers. |

| Chanel S.A. | Chanel brings together luxury and nature by coupling upscale formulations with nature-based ingredients in their cosmetic and skincare ranges. As the company targets premium customers, the brand stays true to environmentally friendly manufacturing, meeting the increasing trend of sustainability. |

| Clarins Group | Clarins , with deep roots in plant-inspired beauty, is dedicated to natural and organic skincare products, providing solutions for hydration, anti-aging, and protection from the environment. It supports sustainability through earth-friendly packaging and sourcing of ingredients. |

| Coty Inc. | Coty provides natural beauty cosmetics under such brands as CoverGirl and Rimmel , which have extended their product lines to contain vegan, cruelty- free, and naturally sourced ingredients. Coty stands well-placed to attract Korea's younger generation, which is growing more health-focused. |

| Kolmar Korea | As a leading player in the K-beauty industry, Kolmar Korea provides products that range from natural to functional cosmetics with international and domestic brands through the production of plant-based skincare products. It is important in fulfilling the demand for high-performance natural formulas at volume. |

| Cosmedique | Cosmedique offers clean beauty products emphasizing sensitive skin. It utilizes natural plant-based botanical extracts to produce successful skincare regimens for Korean consumers in search of mild, plant-derived solutions. |

| Nutricare | Nutricare emphasizes natural cosmetics that combine health supplements and skincare. They are becoming popular in Korea for their unique strategy for beauty that incorporates nutritional assistance along with topical skincare products, specifically for wellness and longevity. |

| Sourcing-Lab | This firm specializes in the sourcing of high-quality, ethically manufactured natural ingredients globally. In Korea, they serve premium and eco-aware consumers by providing customized, ingredient-driven solutions that highlight purity and sustainability. |

The Korean natural cosmetics market is fast becoming competitive with global behemoths and specialty players vying to address the growing consumer need for clean and green beauty products. Players such as L'Oréal SA and Amway Corporation are riding on their massive distribution networks, brand image, and sophisticated R&D to ensure a strong footing.

At the same time, new entrants like Sourcing-Lab and Cosmedique are making a niche for themselves with a focus on natural ingredients, transparency, and sustainable sourcing, appealing to the increasing health-conscious and eco-aware Korean consumer base.

In terms of product type, the industry is classified into skin and sun care, hair care, bath & shower, men’s grooming (only shaving), color cosmetic, fragrances & deodorants, and oral care.

With respect to consumer orientation, the market is classified into male, female, unisex, and baby & kids.

Based on packaging, the industry is divided into bottles & jars, tubes, pouches & sachets, and pencils & sticks.

In terms of sales channel, the market is classified into supermarkets/hypermarkets, department stores, specialty stores, online sales channels, mono brand stores, and others.

Regionally, the industry is divided into South Gyeongsang, North Jeolla, South Jeolla, Jeju, and the rest of Korea.

The industry is expected to reach USD 2.8 billion in 2025.

The industry is projected to witness USD 4.2 billion by 2035.

The industry is slated to grow at 4.05% CAGR during the study period.

Online stores are widely preferred.

Leading companies include Sourcing-Lab, Cosmedique, Nutricare, Kolmar Korea, L’Oréal SA, Amway Corporation, Beiersdorf, Benefit Cosmetics LLC, Chanel S.A., Clarins Group, and Coty Inc.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Industry Analysis and Outlook Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 4: Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 6: Industry Analysis and Outlook Volume (Units) Forecast by Consumer Orientation, 2019 to 2034

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging, 2019 to 2034

Table 8: Industry Analysis and Outlook Volume (Units) Forecast by Packaging, 2019 to 2034

Table 9: Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 10: Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 11: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 12: South Gyeongsang Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 13: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 14: South Gyeongsang Industry Analysis and Outlook Volume (Units) Forecast by Consumer Orientation, 2019 to 2034

Table 15: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging, 2019 to 2034

Table 16: South Gyeongsang Industry Analysis and Outlook Volume (Units) Forecast by Packaging, 2019 to 2034

Table 17: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 18: South Gyeongsang Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 19: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 20: North Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 21: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 22: North Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Consumer Orientation, 2019 to 2034

Table 23: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging, 2019 to 2034

Table 24: North Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Packaging, 2019 to 2034

Table 25: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 26: North Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 27: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 28: South Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 29: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 30: South Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Consumer Orientation, 2019 to 2034

Table 31: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging, 2019 to 2034

Table 32: South Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Packaging, 2019 to 2034

Table 33: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 34: South Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 35: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 36: Jeju Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 37: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 38: Jeju Industry Analysis and Outlook Volume (Units) Forecast by Consumer Orientation, 2019 to 2034

Table 39: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging, 2019 to 2034

Table 40: Jeju Industry Analysis and Outlook Volume (Units) Forecast by Packaging, 2019 to 2034

Table 41: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 42: Jeju Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 43: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 44: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 45: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 46: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Consumer Orientation, 2019 to 2034

Table 47: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging, 2019 to 2034

Table 48: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Packaging, 2019 to 2034

Table 49: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 50: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2019 to 2034

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Packaging, 2024 to 2034

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 5: Industry Analysis and Outlook Value (US$ Million) by Region, 2024 to 2034

Figure 6: Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 7: Industry Analysis and Outlook Volume (Units) Analysis by Region, 2019 to 2034

Figure 8: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 9: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 10: Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 11: Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 12: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 13: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 14: Industry Analysis and Outlook Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 15: Industry Analysis and Outlook Volume (Units) Analysis by Consumer Orientation, 2019 to 2034

Figure 16: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 17: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 18: Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging, 2019 to 2034

Figure 19: Industry Analysis and Outlook Volume (Units) Analysis by Packaging, 2019 to 2034

Figure 20: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging, 2024 to 2034

Figure 21: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging, 2024 to 2034

Figure 22: Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 23: Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 24: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 25: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 26: Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 27: Industry Analysis and Outlook Attractiveness by Consumer Orientation, 2024 to 2034

Figure 28: Industry Analysis and Outlook Attractiveness by Packaging, 2024 to 2034

Figure 29: Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 30: Industry Analysis and Outlook Attractiveness by Region, 2024 to 2034

Figure 31: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 32: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 33: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Packaging, 2024 to 2034

Figure 34: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 35: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 36: South Gyeongsang Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 37: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 38: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 39: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 40: South Gyeongsang Industry Analysis and Outlook Volume (Units) Analysis by Consumer Orientation, 2019 to 2034

Figure 41: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 42: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 43: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging, 2019 to 2034

Figure 44: South Gyeongsang Industry Analysis and Outlook Volume (Units) Analysis by Packaging, 2019 to 2034

Figure 45: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging, 2024 to 2034

Figure 46: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging, 2024 to 2034

Figure 47: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 48: South Gyeongsang Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 49: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 50: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 51: South Gyeongsang Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 52: South Gyeongsang Industry Analysis and Outlook Attractiveness by Consumer Orientation, 2024 to 2034

Figure 53: South Gyeongsang Industry Analysis and Outlook Attractiveness by Packaging, 2024 to 2034

Figure 54: South Gyeongsang Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 55: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 56: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 57: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Packaging, 2024 to 2034

Figure 58: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 59: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 60: North Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 61: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 62: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 63: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 64: North Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Consumer Orientation, 2019 to 2034

Figure 65: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 66: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 67: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging, 2019 to 2034

Figure 68: North Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Packaging, 2019 to 2034

Figure 69: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging, 2024 to 2034

Figure 70: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging, 2024 to 2034

Figure 71: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 72: North Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 73: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 74: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 75: North Jeolla Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 76: North Jeolla Industry Analysis and Outlook Attractiveness by Consumer Orientation, 2024 to 2034

Figure 77: North Jeolla Industry Analysis and Outlook Attractiveness by Packaging, 2024 to 2034

Figure 78: North Jeolla Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 79: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 80: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 81: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Packaging, 2024 to 2034

Figure 82: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 83: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 84: South Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 85: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 86: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 87: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 88: South Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Consumer Orientation, 2019 to 2034

Figure 89: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 90: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 91: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging, 2019 to 2034

Figure 92: South Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Packaging, 2019 to 2034

Figure 93: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging, 2024 to 2034

Figure 94: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging, 2024 to 2034

Figure 95: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 96: South Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 97: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 98: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 99: South Jeolla Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 100: South Jeolla Industry Analysis and Outlook Attractiveness by Consumer Orientation, 2024 to 2034

Figure 101: South Jeolla Industry Analysis and Outlook Attractiveness by Packaging, 2024 to 2034

Figure 102: South Jeolla Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 103: Jeju Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 104: Jeju Industry Analysis and Outlook Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 105: Jeju Industry Analysis and Outlook Value (US$ Million) by Packaging, 2024 to 2034

Figure 106: Jeju Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 107: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 108: Jeju Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 109: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 110: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 111: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 112: Jeju Industry Analysis and Outlook Volume (Units) Analysis by Consumer Orientation, 2019 to 2034

Figure 113: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 114: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 115: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging, 2019 to 2034

Figure 116: Jeju Industry Analysis and Outlook Volume (Units) Analysis by Packaging, 2019 to 2034

Figure 117: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging, 2024 to 2034

Figure 118: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging, 2024 to 2034

Figure 119: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 120: Jeju Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 121: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 122: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 123: Jeju Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 124: Jeju Industry Analysis and Outlook Attractiveness by Consumer Orientation, 2024 to 2034

Figure 125: Jeju Industry Analysis and Outlook Attractiveness by Packaging, 2024 to 2034

Figure 126: Jeju Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 127: Rest of Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 128: Rest of Industry Analysis and Outlook Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 129: Rest of Industry Analysis and Outlook Value (US$ Million) by Packaging, 2024 to 2034

Figure 130: Rest of Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 131: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 132: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 133: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 134: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 135: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 136: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Consumer Orientation, 2019 to 2034

Figure 137: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 138: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 139: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging, 2019 to 2034

Figure 140: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Packaging, 2019 to 2034

Figure 141: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging, 2024 to 2034

Figure 142: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging, 2024 to 2034

Figure 143: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 144: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 145: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 146: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 147: Rest of Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 148: Rest of Industry Analysis and Outlook Attractiveness by Consumer Orientation, 2024 to 2034

Figure 149: Rest of Industry Analysis and Outlook Attractiveness by Packaging, 2024 to 2034

Figure 150: Rest of Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Korea Automotive Performance Tuning and Engine Remapping Service Industry Size and Share Forecast Outlook 2025 to 2035

Korea Smart Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Korea Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Korea Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Korea Isomalt Industry – Market Trends & Industry Growth 2025 to 2035

Korea Probiotic Supplement Industry – Industry Insights & Demand 2025 to 2035

Korea Calcium Supplement Market is segmented by form,end-use, application and province through 2025 to 2035.

The Korea Non-Dairy Creamer Market in Korea is segmented by form, nature, flavor, type, base, end-use, packaging, distribution channel, and province through 2025 to 2035.

Korea Women’s Intimate Care Market Analysis - Size, Share & Trends 2025 to 2035

Korea Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Korea Visitor Management System Market Growth – Trends & Forecast 2025 to 2035

Korea fiber optic gyroscope market Growth – Trends & Forecast 2025 to 2035

Korea Event Management Software Market Insights – Demand & Growth Forecast 2025 to 2035

Korea Submarine Cable Market Insights – Demand & Forecast 2025 to 2035

Last-mile Delivery Software Market in Korea – Trends & Forecast through 2035

Korea HVDC Transmission System Market Trends & Forecast 2025 to 2035

Korea Base Station Antenna Market Growth – Trends & Forecast 2025 to 2035

Smart Space Market Analysis in Korea-Demand & Growth 2025 to 2035

Korea Banking-as-a-Service (BaaS) Platform Market Growth – Trends & Forecast 2025 to 2035

Korea I2C Bus Market Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA