Top Brands like Bosch, De’Longhi, and Urnex lead the descaler market by delivering effective, eco-friendly solutions for maintaining household and commercial appliances. These companies focus on formulations that remove limescale buildup while ensuring safety for both appliances and users.

The market is projected to grow at a CAGR of 4.2% to reach USD 570.3 million by 2035. Brands prioritizing biodegradable and non-toxic descaling agents cater to growing consumer demand for sustainable cleaning products. Offering specialized solutions for coffee machines, dishwashers, and water heaters further differentiates market leaders.

| Attribute | Details |

|---|---|

| Projected Value by 2035 | USD 570.3 Million |

| CAGR during the period 2025 to 2035 | 4.2% |

E-commerce platforms play a pivotal role, allowing Brands to expand their reach with bundled product offerings and subscription services. Partnerships with appliance manufacturers enhance brand credibility and foster co-marketing opportunities.

With competition intensifying, Brands that combine innovation with affordability will secure a competitive edge. Expanding into emerging markets and educating consumers about the importance of regular maintenance will drive long-term growth.

The descaler market is growing as consumers and industries recognize the importance of descaling to reduce operational costs, save energy, and extend the lifespan of appliances. The integration of advanced chemical formulations and smart descaling systems enhances product efficacy while adhering to environmental standards.

Global Brand Share & Industry Share (%):

| Category | Industry Share (%) |

|---|---|

| Top 3 (Ecolab, Henkel, BWT) | 30% |

| Rest of Top 5 (GE Appliances, Chem-Aqua) | 20% |

| Next 5 of Top 10 (Procter & Gamble, Whirlpool, others) | 15% |

Type of Player & Industry Share (%):

| Type of Player | Industry Share (%) |

|---|---|

| Top 10 | 65% |

| Top 20 | 25% |

| Rest | 10% |

Year-over-Year Leaders:

Green Chemistry in Descaling Agents

Smart Descaling Systems

Tailored Industrial Solutions

Biodegradable and Non-Toxic Formulations

Water-Saving Initiatives

Recyclable Packaging

Increased Awareness of Preventive Maintenance

Demand for Eco-Friendly Products

Convenience and Versatility

Invest in Eco-Friendly Formulations:

Develop plant-based and biodegradable descalers to meet consumer demand for sustainability.

Enhance Smart Technology Integration:

Introduce IoT-enabled descaling systems for real-time monitoring and efficient maintenance.

Educate Consumers:

Launch awareness campaigns highlighting the benefits of preventive maintenance and eco-friendly solutions.

The descaler market will continue to grow as industries and consumers adopt advanced and sustainable solutions to address water scaling challenges. Companies investing in smart technologies, eco-friendly formulations, and regional expansions will lead the market. Emerging trends, such as AI-driven predictive maintenance and hybrid descaling agents, will further enhance growth potential.

Revenue and Share by Brand

Market leaders like Ecolab, Henkel, and BWT maintain dominance by offering innovative, scalable, and sustainable descaling solutions.

Figures/Visuals

| Brand | Ecolab |

|---|---|

| Market Contribution (%) | 12% |

| Key Initiatives | Focused on industrial-grade, sustainable descaling solutions |

| Brand | Henkel |

|---|---|

| Market Contribution (%) | 10% |

| Key Initiatives | Expanded eco-friendly product lines for residential users |

| Brand | BWT |

|---|---|

| Market Contribution (%) | 8% |

| Key Initiatives | Developed plant-based, non-toxic descaling agents |

Scope of Market Definition

The descaler market includes chemical and eco-friendly solutions designed to remove limescale from residential, commercial, and industrial appliances. This analysis excludes general-purpose cleaning agents and descalers for non-water-related applications.

Key Terms and Terminology

The primary research involved a combination of primary interviews, secondary data analysis, and industry-specific modelling. The data was cross-validated with market experts and industry stakeholders to validate the accuracy and relevance of the data.

The global descaler market will grow at a CAGR of 4.2% between 2025 and 2035.

The global descaler market will reach USD 570.3 million by 2035.

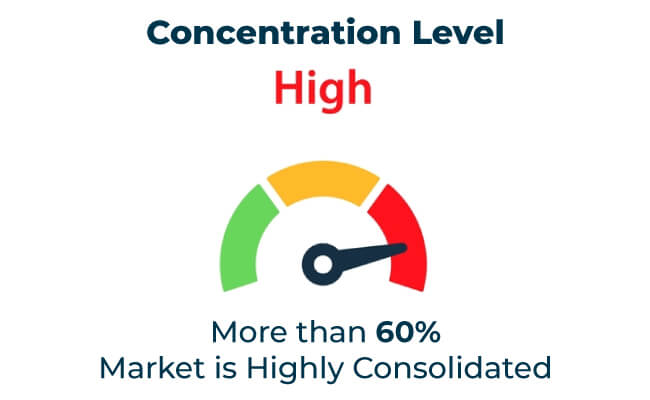

The top 10 players account for over 60% of the global market.

Key manufacturers include Bosch, De’Longhi, Procter & Gamble, Whirlpool, and Urnex among others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Descaler Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Pet Market Share & Industry Trends

Competitive Landscape of Hob Market Share

Leading Providers & Market Share in Kegs

Market Share Distribution Among Hops Manufacturers

Market Share Distribution Among Bran Manufacturers

Leading Providers & Market Share in the Straw Industry

Assessing Okara Market Share & Industry Trends

Analyzing Market Share & Industry Trends of Chitin Providers

Examining Shrimp Market Share Trends & Industry Leaders

Analyzing Pulses Market Share & Industry Trends

Competitive Overview of Labels Companies

Market Share Insights of Leading Mezcal Manufacturers

Market Share Breakdown of the IV Bag Market

Global MDO-PE Market Share Analysis – Trends, Growth & Forecast 2025–2035

Market Share Distribution Among Lactase Providers

Market Share Distribution Among Octabin Manufacturers

Competitive Breakdown of Lactose Providers

Global Pallets Market Share Analysis – Trends, Demand & Forecast 2025–2035

Competitive Landscape of Pickles Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA