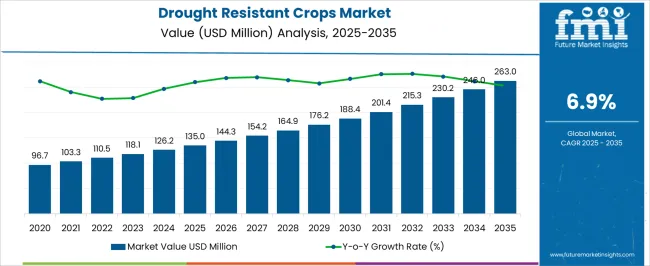

The global drought resistant crops market is expected to advance from USD 135.0 million in 2025 to USD 263.0 million by 2035, reflecting a CAGR of 6.9%. A compound absolute growth analysis highlights the cumulative impact of consistent adoption, technological innovation, and regional expansion over the decade. Between 2025 and 2030, the market grows from USD 135.0 million to USD 188.4 million, reflecting an early-stage absolute growth of USD 53.4 million. This phase is primarily driven by the increasing deployment of genetically modified and hybrid drought-tolerant crop varieties, government initiatives promoting climate-resilient agriculture, and rising awareness of sustainable farming practices.

Adoption is concentrated in Asia-Pacific and North America, where technological infrastructure and supportive policies enable accelerated implementation. From 2030 to 2035, the market further expands from USD 188.4 million to USD 263.0 million, with absolute growth of USD 74.6 million, representing the late-stage acceleration phase. Growth is fueled by broader adoption in emerging regions, scaling of high-yield drought-tolerant varieties, and integration of precision agriculture technologies such as remote sensing, automated irrigation, and soil monitoring.

| Metric | Value |

|---|---|

| Drought Resistant Crops Market Estimated Value in (2025 E) | USD 135.0 million |

| Drought Resistant Crops Market Forecast Value in (2035 F) | USD 263.0 million |

| Forecast CAGR (2025 to 2035) | 6.9% |

The drought resistant crops market is primarily driven by the agricultural seeds market, which accounts for approximately 40–45% of total demand, as drought-tolerant seed varieties are increasingly adopted to ensure crop resilience and stable yields under water-scarce conditions. The crop biotechnology market contributes around 20–22%, reflecting the role of genetic modification, marker-assisted breeding, and seed treatment technologies in enhancing drought tolerance and stress resistance.

The irrigation and water management market holds roughly 15–17%, driven by the adoption of drought-resistant crops that optimize water usage and reduce dependency on extensive irrigation. The food and beverage processing market contributes approximately 10–12%, as stable production of cereals, pulses, and other drought-tolerant crops ensures a reliable supply for processed foods and beverages. Lastly, government agricultural subsidy and support programs account for 5–6%, supporting adoption through policy incentives, grants, and farmer education initiatives.

The drought resistant crops market is positioned for robust growth as global agricultural production faces increasing challenges from climate variability and water scarcity. Current market momentum is being supported by heightened adoption of resilient crop varieties in regions prone to erratic rainfall and prolonged dry spells.

Investment from both public and private sectors in breeding programs, biotechnology advancements, and seed distribution networks has strengthened supply capabilities and expanded farmer access. The integration of advanced genetic tools and agronomic practices has enhanced the yield stability and adaptability of these crops under adverse conditions, reducing the risk of crop loss and improving food security.

Regulatory frameworks are gradually evolving to accommodate innovative crop development technologies, further supporting market expansion. Over the forecast period, demand is expected to be driven by rising global population, increasing pressure on arable land, and the strategic need to secure agricultural productivity in water-limited environments, positioning drought resistant crops as a cornerstone in sustainable farming strategies worldwide.

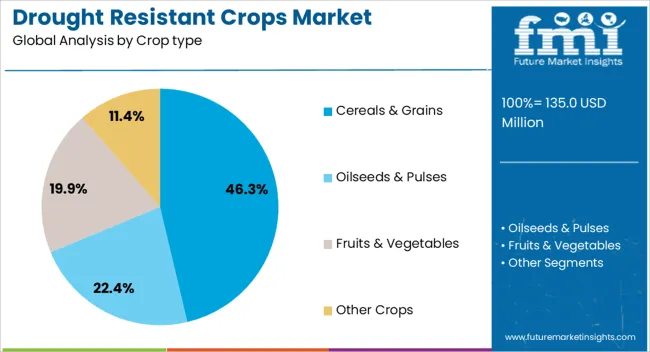

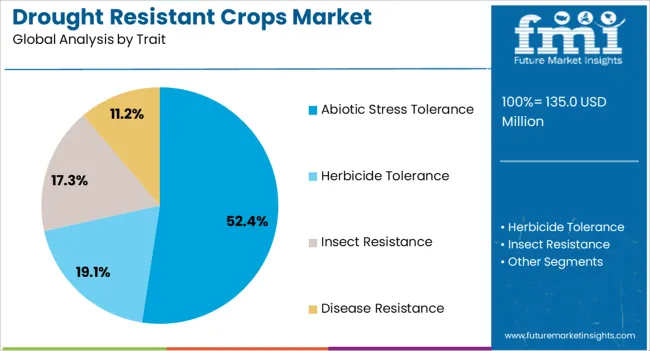

The drought resistant crops market is segmented by crop type, trait, technology, and geographic regions. By crop type, drought resistant crops market is divided into Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, and Other Crops. In terms of trait, drought resistant crops market is classified into Abiotic Stress Tolerance, Herbicide Tolerance, Insect Resistance, and Disease Resistance.

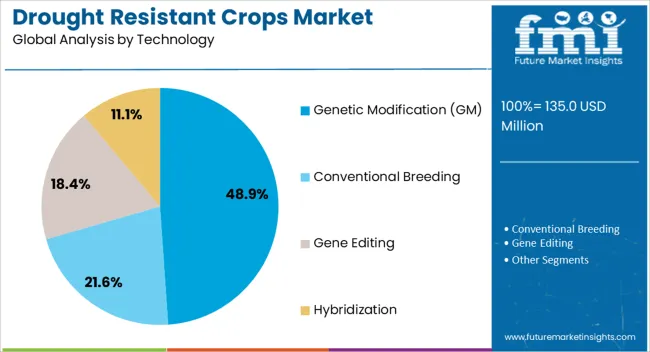

Based on technology, drought resistant crops market is segmented into Genetic Modification (GM), Conventional Breeding, Gene Editing, and Hybridization. Regionally, the drought resistant crops industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cereals & grains segment, holding 46.3% of the crop type category, has retained its leadership due to its critical role in global food supply and its adaptability to drought-resistant breeding programs. This category benefits from significant research investments aimed at improving resilience and yield stability under limited water availability.

High adoption rates in both subsistence and commercial farming systems have reinforced its market dominance, supported by well-established distribution channels and seed availability. Production scalability, coupled with strong demand from food, feed, and biofuel industries, has maintained consistent market growth.

Enhanced crop varieties with improved water-use efficiency and stress tolerance traits have secured farmer confidence, particularly in drought-prone regions. Strategic government programs and subsidies promoting resilient cereal and grain production are expected to strengthen this segment’s competitive positioning further, ensuring its continued role as the primary driver of market expansion within the drought-resistant crops sector.

The abiotic stress tolerance segment, accounting for 52.4% of the trait category, has emerged as the leading focus in drought-resistant crop development due to its direct impact on plant survival and productivity under extreme environmental conditions. This dominance is supported by advanced breeding techniques and biotechnology applications that target enhanced physiological and metabolic responses in plants.

The segment’s growth is reinforced by increasing demand for crops capable of withstanding multiple stress factors, including drought, heat, and salinity. Widespread adoption has been facilitated by field-proven performance and measurable yield improvements, which have been crucial in farmer decision-making.

Policy frameworks and research collaborations between governments, universities, and agribusiness companies are driving innovation in this trait category, enabling faster development and deployment of improved varieties. The ability of abiotic stress tolerance traits to provide consistent production outcomes in variable climates positions this segment as a key enabler of food security and long-term agricultural resilience.

The genetic modification (GM) segment, representing 48.9% of the technology category, has maintained its market lead due to its effectiveness in incorporating targeted traits that significantly improve drought resistance. GM technology enables precise genetic alterations that enhance water-use efficiency, root structure, and stress-responsive metabolic pathways, resulting in higher productivity under water-limited conditions.

Adoption has been accelerated by proven performance in large-scale commercial farming and favorable cost-benefit ratios for producers. The segment benefits from ongoing R&D investment by global seed companies and biotechnology firms, leading to a steady pipeline of improved crop varieties.

While regulatory landscapes vary across regions, progressive policy changes in several markets are enabling broader acceptance and commercialization of GM drought-resistant crops. Continued advancements in gene-editing techniques, coupled with strategic partnerships for technology transfer, are expected to reinforce the GM segment’s competitive edge, ensuring it remains at the forefront of innovation in drought-resistant crop production.

The drought resistant crops market is expanding as farmers, agribusinesses, and governments seek crops that can withstand water scarcity, climate variability, and erratic rainfall. These crops are critical for maintaining yields, food security, and operational efficiency in regions prone to drought or water stress. Key priorities include high germination rates, robust growth under limited water conditions, and compatibility with existing farming practices. Adoption is driven by rising demand for staple grains, pulses, and commercial crops, along with government incentives and support for climate-resilient agriculture. Suppliers providing high-quality seeds, regional adaptability data, and agronomic support are best positioned to capture long-term adoption among commercial farmers, cooperatives, and large-scale agricultural enterprises.

Farmers are increasingly adopting drought resistant crops to mitigate losses caused by inconsistent rainfall and prolonged dry spells. These crops ensure consistent yield, reduce dependency on irrigation, and enhance profitability in water-stressed regions. Staple grains such as maize, wheat, rice, and sorghum, along with pulses and oilseeds, are prioritized for drought resilience. Governments and NGOs support adoption through awareness programs, subsidies, and extension services. The market growth is further fueled by the need to stabilize supply chains and minimize the economic impact of crop failures. Suppliers offering region-specific, high-performance seed varieties with technical guidance and cultivation best practices are well positioned to support farmers in achieving yield stability and operational resilience.

Market constraints include high costs of research, development, and commercialization of drought tolerant varieties. Seed production requires specialized agronomic practices and controlled environments to maintain genetic integrity and performance. Supply chain limitations, particularly in developing regions, can impact seed availability and timely delivery. Compliance with regional agricultural regulations, varietal approval processes, and intellectual property protections adds complexity. Technical challenges include breeding crops with both drought tolerance and high yield potential, as well as ensuring resistance to pests and diseases. Buyers increasingly prefer suppliers offering certified seeds, detailed cultivation guidelines, and consistent supply to reduce operational risks and optimize productivity under water-limited conditions.

Opportunities are emerging in specialty crops, high-value grains, and genetically improved seeds tailored for drought-prone regions. Rising population, urbanization, and demand for climate-resilient agriculture in Asia-Pacific, Africa, and Latin America support market expansion. Collaboration between seed developers, agronomists, and local cooperatives creates potential for higher adoption and effective knowledge transfer. Suppliers offering high-quality, region-adapted seeds, agronomic training, and post-sale technical support are well-positioned to capture growth. Innovations such as marker-assisted breeding, hybrid varieties, and integration with modern irrigation techniques further strengthen the value proposition and drive adoption among commercial farmers and large-scale agricultural enterprises.

The market is trending toward advanced breeding technologies, including marker-assisted selection, genomic tools, and hybrid development, to produce drought resistant crops with multiple desirable traits. Varieties combining drought tolerance with pest resistance, nutrient efficiency, and high yield are gaining preference. Regional adaptation studies are increasingly emphasized to match crops with local soil and climatic conditions. Suppliers providing well-documented performance data, agronomic guidance, and robust support systems help farmers achieve better productivity and minimize risks. Those delivering multi-trait, technically validated, and region-specific drought resistant seeds are best positioned to meet the evolving demands of modern agriculture and ensure sustainable yield performance in water-scarce regions.

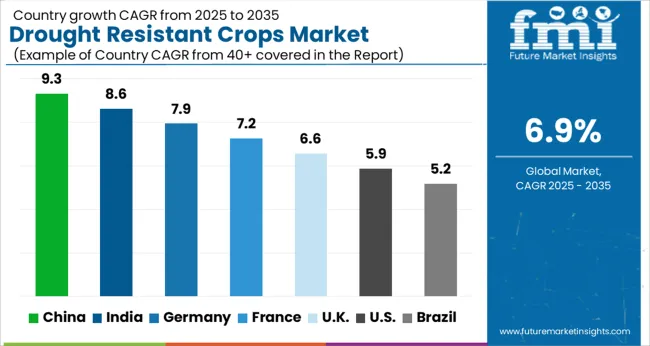

| Country | CAGR |

|---|---|

| China | 9.3% |

| India | 8.6% |

| Germany | 7.9% |

| France | 7.2% |

| UK | 6.6% |

| USA | 5.9% |

| Brazil | 5.2% |

The global drought resistant crops market is projected to grow at a CAGR of 6.9% from 2025 to 2035. China leads at 9.3%, followed by India at 8.6%, France at 7.2%, the UK at 6.6%, and the USA at 5.9%. Growth is driven by adoption of genetically improved, drought-tolerant seeds, precision irrigation, and climate-adaptive farming practices. Government initiatives, technological integration, and R&D collaborations accelerate adoption. Major markets emphasize water-efficient agriculture, crop resilience, and sustainable yield management, while export demand and global partnerships further strengthen market expansion. The analysis includes over 40+ countries, with the leading markets detailed below.

The drought resistant crops market in China is projected to grow at a CAGR of 9.3% from 2025 to 2035, driven by increasing water scarcity, rising agricultural mechanization, and government initiatives promoting resilient crop varieties. Farmers are adopting genetically improved seeds for wheat, maize, and rice that tolerate prolonged dry periods, ensuring consistent yields and food security. Investments in precision agriculture, drip irrigation, and smart farming technologies further support market expansion. Domestic seed companies are collaborating with global biotech firms to enhance crop resistance and improve productivity. Rising awareness of climate change impacts and the need for sustainable water use are boosting adoption in arid and semi-arid regions. Export opportunities for drought-tolerant crops also contribute to market growth.

The drought resistant crops market in India is expected to expand at a CAGR of 8.6% from 2025 to 2035, supported by increasing incidences of drought, water stress, and climate variability. Adoption of improved seed varieties for rice, wheat, and pulses enables farmers to maintain yield stability during dry spells. Government programs promoting agricultural resilience, such as subsidies for drought-tolerant seeds and modern irrigation systems, accelerate market penetration. Private seed companies are investing in R&D for region-specific crop varieties, addressing soil conditions and climatic challenges. Integration of technology-driven monitoring, soil moisture sensors, and weather forecasting enhances adoption. Export demand for resilient crops and the growing focus on sustainable productivity in semi-arid regions further bolster growth.

The drought resistant crops market in France is projected to grow at a CAGR of 7.2% from 2025 to 2035, driven by the need for climate-adaptive agriculture and yield stability. French farmers are increasingly adopting drought-tolerant cereals, oilseeds, and forage crops to mitigate water stress, particularly in southern regions. Research institutions and seed companies are investing in breeding programs to improve crop resilience without compromising quality. Advanced irrigation methods and precision farming technologies support efficient water utilization. Policies supporting agricultural innovation and climate adaptation encourage adoption. Export-oriented production for high-value crops further strengthens market growth, while partnerships with global agritech providers facilitate knowledge transfer and technology integration.

The UK drought resistant crops market is expected to grow at a CAGR of 6.6% from 2025 to 2035, driven by climate variability and the need for consistent agricultural yields. Adoption of resilient wheat, barley, and maize varieties helps mitigate drought-related losses. Technological interventions, including smart irrigation, soil moisture sensors, and weather-adaptive farming practices, are enhancing crop productivity. Research collaborations between seed companies and agricultural institutes accelerate development of region-specific drought-tolerant seeds. Government programs promoting climate-resilient agriculture and incentives for innovative crop solutions further boost adoption. Farmers’ increasing awareness of water-efficient farming practices, coupled with demand for high-quality domestic produce, underpins market expansion.

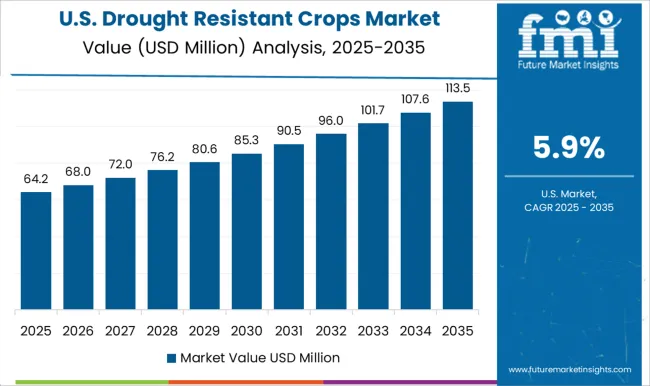

The USA drought resistant crops market is projected to grow at a CAGR of 5.9% from 2025 to 2035, driven by frequent droughts, climate variability, and water resource management challenges. Farmers are adopting drought-tolerant corn, soy, wheat, and cotton to maintain yield stability in arid regions such as the Midwest and Southwest. Investment in biotech seeds, precision irrigation, and farm management software supports efficient water use and operational efficiency. Research partnerships between private agritech firms and universities enable development of high-performing crop varieties tailored to local conditions. Government programs providing incentives for resilient crop adoption further promote market growth. Export demand for high-quality resilient crops contributes to long-term opportunities, while awareness of climate risks accelerates adoption across commercial and small-scale farms.

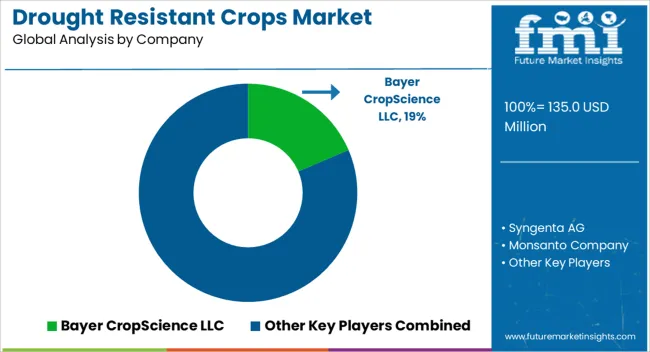

Competition in the drought resistant crops market is driven by seed yield, stress tolerance, and genetic innovation. Bayer CropScience LLC leads with hybrid seeds engineered for high drought tolerance and broad environmental adaptability. Syngenta AG emphasizes advanced genomics and precision breeding to enhance crop resilience while maintaining yield stability. Monsanto Company focuses on proprietary biotechnology traits, including water-use efficiency and pest resistance, supporting large-scale commercial agriculture. BASF SE differentiates through multi-trait platforms combining drought tolerance with disease resistance for cereals, oilseeds, and legumes.

Nuseed Pty Ltd. and MAHYCO target regional adaptation, developing crops suitable for local climates and smallholder farming. Stine Seed Farm Inc. and Cyanamid Agro Ltd. specialize in corn and soybean varieties optimized for arid zones. Calyxt Inc. integrates gene-editing technologies to accelerate trait development and commercialization. Strategies revolve around genomics, field testing, and regulatory compliance. Marker-assisted selection, CRISPR-based editing, and hybridization are employed to improve water efficiency, root architecture, and osmotic tolerance. Partnerships with agritech firms, cooperatives, and government research bodies help expand field trials and distribution. Licensing agreements and joint ventures accelerate market penetration across North America, Asia-Pacific, and Africa. Seed coatings, nutrient formulations, and advisory services are provided to enhance germination and crop establishment under water-limited conditions.

| Item | Value |

|---|---|

| Quantitative Units | USD 135.0 Million |

| Crop type | Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, and Other Crops |

| Trait | Abiotic Stress Tolerance, Herbicide Tolerance, Insect Resistance, and Disease Resistance |

| Technology | Genetic Modification (GM), Conventional Breeding, Gene Editing, and Hybridization |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bayer CropScience LLC, Syngenta AG, Monsanto Company, BASF SE, Nuseed Pty Ltd., Maharashtra Hybrid Seed Company (MAHYCO), Stine Seed Farm Inc., Cyanamid Agro Ltd., Calyxt Inc., and Monsanto Company |

| Additional Attributes | Dollar sales by crop type (cereals, oilseeds, pulses, specialty crops), technology (genetically modified, hybrid, conventionally bred), and application (commercial farming, smallholder farms). Demand is driven by climate change, water scarcity, and the need for sustainable agriculture. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, with Asia-Pacific leading due to high agricultural activity and frequent drought conditions. |

The global drought resistant crops market is estimated to be valued at USD 135.0 million in 2025.

The market size for the drought resistant crops market is projected to reach USD 263.0 million by 2035.

The drought resistant crops market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in drought resistant crops market are cereals & grains, oilseeds & pulses, fruits & vegetables and other crops.

In terms of trait, abiotic stress tolerance segment to command 52.4% share in the drought resistant crops market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Resistant Starch Market Analysis by Product Type, Source, End Use and Region Through 2035

PD1 Resistant Head and Neck Cancer Market Size and Share Forecast Outlook 2025 to 2035

Oil Resistant Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Oil-Resistant Packaging Providers

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Fire Resistant Cable Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Fire-resistant Paint Market Size and Share Forecast Outlook 2025 to 2035

Slip Resistant Shoes Market Insights - Trends & Forecast 2025 to 2035

Heat Resistant Glass Market Size & Trends 2025 to 2035

Heat Resistant LED Light Market Analysis by End Use Industry, Material, and Region: Forecast for 2025 to 2035

Heat-Resistant Ceramic Tableware Market Analysis – Growth & Trends 2025 to 2035

Fire Resistant Hydraulic Fluid Market Growth – Trends & Forecast 2024-2034

Heat Resistant Polymer Market

Drug Resistant Pulmonary Tuberculosis Market

Fuel Resistant Sealant Market

Fire Resistant Fluids Market

Pest Resistant Crops Market

Water Resistant Packaging Market Size and Share Forecast Outlook 2025 to 2035

Child resistant Zipper Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA