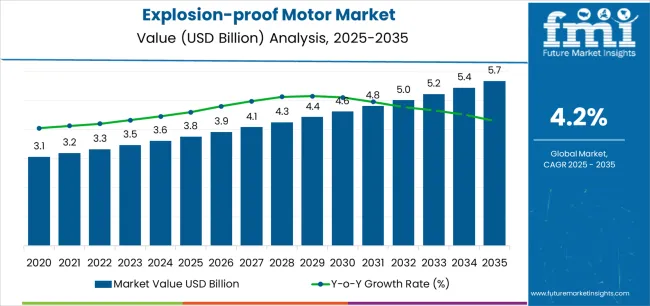

The Explosion-proof Motor Market is estimated to be valued at USD 3.8 billion in 2025 and is projected to reach USD 5.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period.

The explosion-proof motor market is experiencing steady growth driven by rising industrial safety standards, increasing demand from hazardous environment operations, and the expansion of oil and gas, mining, and chemical processing sectors. Market participants are focusing on innovation in motor design, thermal protection, and enclosure integrity to enhance reliability under extreme conditions. Global regulatory mandates aimed at ensuring operational safety and compliance with IEC and ATEX certifications are further boosting product adoption.

The current market landscape is shaped by technological advancements in materials, improved insulation, and integration of energy-efficient systems. Future growth is anticipated through the modernization of industrial facilities and increased automation across sectors that operate in volatile environments.

Growing investment in petrochemical and refining industries in developing regions is expected to sustain long-term demand The growth rationale is underpinned by the necessity for reliable, high-performance motors that ensure operational continuity, reduce downtime, and comply with strict safety norms across critical infrastructure projects.

| Metric | Value |

|---|---|

| Explosion-proof Motor Market Estimated Value in (2025 E) | USD 3.8 billion |

| Explosion-proof Motor Market Forecast Value in (2035 F) | USD 5.7 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

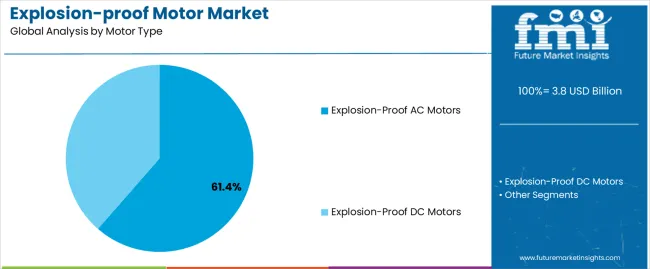

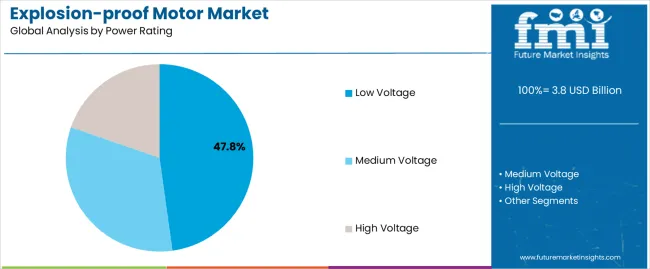

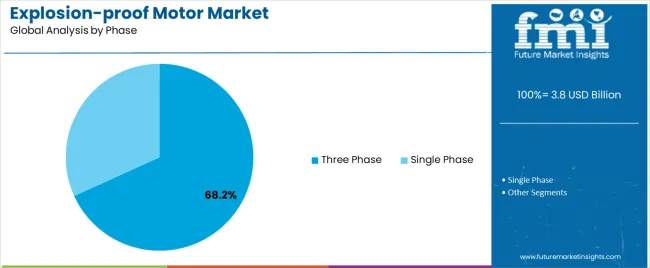

The market is segmented by Motor Type, Power Rating, Phase, Application, and End-Use and region. By Motor Type, the market is divided into Explosion-Proof AC Motors and Explosion-Proof DC Motors. In terms of Power Rating, the market is classified into Low Voltage, Medium Voltage, and High Voltage. Based on Phase, the market is segmented into Three Phase and Single Phase. By Application, the market is divided into Class I, Class II, and Class III. By End-Use, the market is segmented into Oil And Gas, Chemicals And Petrochemicals, Metals And Mining, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The explosion-proof AC motors segment, accounting for 61.40% of the motor type category, has emerged as the leading segment due to its extensive use across industrial and manufacturing facilities. Its dominance is supported by high efficiency, robust performance, and adaptability to diverse hazardous applications.

The segment’s growth has been reinforced by advancements in enclosure materials and insulation systems that enhance durability and thermal resistance. Consistent investments in automation and industrial safety compliance have strengthened product deployment across oil refineries, gas plants, and chemical facilities.

Manufacturers are emphasizing design optimization and digital monitoring to improve performance and predictive maintenance The segment is expected to retain its leadership as industries continue to prioritize explosion protection and operational reliability in high-risk environments.

The low voltage segment, representing 47.80% of the power rating category, has been leading due to its suitability for general-purpose industrial applications that require high safety at moderate energy consumption levels. Adoption has been reinforced by its compatibility with standard equipment and ease of integration into existing electrical infrastructures.

Increasing emphasis on energy-efficient motors and cost-effective installation has boosted the preference for low voltage configurations. The segment’s performance has been strengthened by improved insulation and heat dissipation technologies that enhance operational stability under fluctuating loads.

Continuous upgrades in compliance standards and the growing demand for compact, reliable motors in confined industrial environments are expected to sustain its leading market share.

The three-phase segment, holding 68.20% of the phase category, has maintained its leadership due to its superior power efficiency and ability to deliver consistent torque in heavy-duty applications. Its dominance is attributed to broad usage in oil and gas plants, mining operations, and manufacturing units where robust and reliable performance is essential.

Three-phase motors provide operational stability, reduced maintenance requirements, and lower energy losses, making them ideal for explosion-prone zones. Advancements in variable frequency drive compatibility and improved motor protection technologies have enhanced efficiency and control.

With industries increasingly adopting high-capacity electrical systems, the segment is expected to sustain its leading position, supported by continuous investment in industrial safety modernization and performance optimization.

Market to Expand around 1.5X through 2035

East Asia Takes the Lead in the Explosion-proof Motor Market

Explosion-proof AC Motors to Gain Traction Globally

Global sales of explosion-proof submersible sump pumps grew at a CAGR of 2.4% between 2020 and 2025. Total market revenue reached about USD 3,450.4 million in 2025. In the forecast period, the worldwide explosion-proof motors industry is set to thrive at a CAGR of 4.4%.

| Historical CAGR (2020 to 2025) | 2.3% |

|---|---|

| Forecast CAGR (2025 to 2035) | 4.4% |

Future Scope of the Explosion-proof Motor Market

Stainless steel flame-proof pumps are becoming increasingly popular as a result of the continuous growth of the oil & gas exploration sector. These motors are critical parts that are designed to function safely in dangerous conditions.

Exploration efforts are stepping into more difficult environments as the world's energy needs rise. Hence, specific equipment that can endure harsh circumstances is needed in order to prioritize safety and maintain operational continuity.

In the oil & gas sector, where combustible gases and volatile substances are omnipresent, explosion-proof motors play a pivotal role. These meticulously designed motors are crafted to withstand and prevent the ignition of flammable materials.

These can also help in safeguarding operations on offshore platforms and remote onshore sites alike.

Ongoing technological advancements are enhancing the efficiency and durability of these motors, strengthening their essential status across the industry. These motors play a critical role in sustaining global energy exploration efforts. This is mainly due to the symbiotic relationship between the oil & gas exploration sector and escalating demand for explosion-proof motors.

Through innovation and safety-focused engineering, flameproof motors are not only meeting but exceeding the stringent demands of the modern energy landscape. They are expected to help in ensuring the continued progress and safety of exploration endeavors worldwide.

Explosion-proof motor demand is rising due to the new wave of industrial automation. It is making these motors essential to vital manufacturing processes.

Robust and safety-compliant equipment has become essential as companies adopt automation to improve efficiency and precision. At the forefront of this technological evolution are explosion-proof motors.

These are made to function in dangerous conditions and guarantee both the dependability and security of automated processes.

In the landscape of modern manufacturing, where intricate machinery and automated systems dominate, explosion-proof motors play a pivotal role. These motors are tailored to withstand potentially explosive atmospheres. These are likely to offer a secure operational environment in facilities where the risk of combustion is inherent.

As industries strive to optimize their production capabilities through automation, demand for explosion-proof motors continues to soar. The synergy between rising industrial automation and the proliferation of explosion-proof motors extends beyond mere functionality.

It represents a paradigm shift toward a safe and more efficient industrial landscape. These motors, equipped with cutting-edge technologies, help meet the rigorous demands of automated manufacturing. At the same time, these contribute to the overarching goal of creating smarter, safer, and more sustainable industrial processes.

Surging explosion-proof motor demand is emblematic of a progressive era where automation and safety converge for the advancement of critical manufacturing operations.

Evolution of Alternative Technologies Challenges Explosion-proof Motor Adoption

The table below highlights explosion-proof motor market revenues of several countries. China, the United States, India, and Germany are expected to remain the key customers of explosion-proof motors, with expected valuations of USD 5.7 million, USD 810.8 million, USD 451.8 million, and USD 423.2 million, respectively, in 2035.

| Countries | Explosion-proof Motor Market Revenue (2035) |

|---|---|

| China | USD 5.7 million |

| United States | USD 810.8 million |

| India | USD 451.8 million |

| Germany | USD 423.2 million |

| Japan | USD 335.4 million |

| United Kingdom | USD 228.4 million |

The table below shows the estimated growth rates of several countries. India, China, and the United States are set to record considerable CAGRs of 4.1%, 3.4%, and 2.7%, respectively, through 2035.

| Countries | Projected Explosion-proof Motor Market CAGR (2025 to 2035) |

|---|---|

| India | 4.1% |

| China | 3.4% |

| United States | 2.7% |

| Japan | 2.1% |

| Germany | 1.7% |

| United Kingdom | 1.4% |

The United States explosion-proof motor market is projected to soar at a CAGR of around 2.7% during the assessment period. Total valuation in the country is anticipated to reach USD 810.8 million by 2035.

China’s explosion-proof motor market size is projected to reach USD 5.7 million by 2035. Over the forecast period, demand for explosion-proof motors in the country is set to rise at 3.4% CAGR.

India’s explosion-proof motor market is poised to exhibit a CAGR of 4.1% during the estimated period. It is expected to attain a market valuation of USD 451.8 million by 2035.

The section below shows the explosion-proof AC motor segment dominating based on motor type. It is anticipated to thrive at 5.3% CAGR between 2025 and 2035.

Based on end-use, the oil and gas segment is anticipated to hold a leading share in 2035. It is set to exhibit a CAGR of 4.9% during the forecast period.

| Top Segment (Motor Type) | Explosion-proof AC Motor |

|---|---|

| Predicted CAGR (2025 to 2035) | 5.3% |

| Top Segment (End-use) | Oil and Gas |

|---|---|

| Projected CAGR (2025 to 2035) | 4.9% |

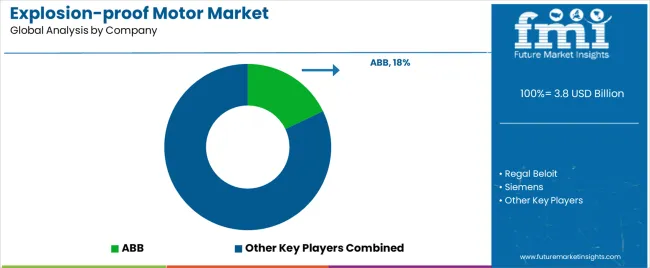

The global explosion-proof motor market is consolidated, with leading players accounting for about 40% to 45% share. ABB Group, Regal Beloit, Siemens, Auma GmbH, Emerson Electric Co., Rotork plc, Exlar Corp., Nidec, and Toshiba are the leading manufacturers and suppliers of explosion-proof motors listed in the report.

Key explosion-proof motor manufacturers are investing huge sums in research & development activities to come up with innovative products. They are also focusing on expanding their production lines by building new hubs in emerging countries.

A handful of companies are aiming to strengthen their position by engaging in mergers, collaborations, and acquisitions.

Recent Developments in Explosion-proof Motor Market

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 3.8 billion |

| Projected Market Size (2035) | USD 5.7 billion |

| Anticipated Growth Rate (2025 to 2035) | 4.2% |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Value (USD million) and Volume (units) |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Market Segments Covered | Motor Type, Power Rating, Phase, Application, End-use, Region |

| Regions Covered | North America; Latin America; Eastern Europe; Western Europe; East Asia; South Asia Pacific; Middle East Africa |

| Key Countries Covered | United States, Canada, Mexico, Brazil, Germany, Italy, France, United Kingdom, Spain, BENELUX, NORDICS, Poland, Hungary, Balkan and Baltics, Russia, India, Association of Southeast Asian Nations, Australia and New Zealand, China, Japan, South Korea, Kingdom of Saudi Arabia, Other GCC Countries, Türkiye, Other African Union, South Africa |

| Key Companies Profiled | ABB; Regal Beloit; Siemens; Auma Gmbh; Emerson Electric Co.; Rotork plc; Exlar Corp; Nidec; Toshiba; WEG; Welco; Bernard Controls; Schneider Electric; Nanyang Explosion Protection; Jiamusi Electric Machine; Xianda Explosion-proof; Dazhong Electric Motor; General Electric; Rockwell Automation; Marathon; Leeson |

The global explosion-proof motor market is estimated to be valued at USD 3.8 billion in 2025.

The market size for the explosion-proof motor market is projected to reach USD 5.7 billion by 2035.

The explosion-proof motor market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in explosion-proof motor market are explosion-proof ac motors and explosion-proof dc motors.

In terms of power rating, low voltage segment to command 47.8% share in the explosion-proof motor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Motor Bearing Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Fuel Hoses Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Drive Chain Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Wheels Market Size and Share Forecast Outlook 2025 to 2035

Motorized Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Motorhome Market Size and Share Forecast Outlook 2025 to 2035

Motor Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Airbag Jacket Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Helmet Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Diagnostic Scan Tools Market Size and Share Forecast Outlook 2025 to 2035

Motorized Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Motorized Pool Tube Market Size and Share Forecast Outlook 2025 to 2035

Motor Generator Set Market Size, Growth, and Forecast 2025 to 2035

Motorized Decoiler Machine Market Growth - Trends & Forecast 2025 to 2035

Motorcycle Chain Market Analysis - Size, Share, and Forecast 2025 to 2035

Motor Protector Market Size, Growth, and Forecast for 2025 to 2035

Motorcycle Suspension System Market Growth - Trends & Forecast 2025 to 2035

Motor Control IC Market by Type, Industry, and Region – Growth, Trends, and Forecast through 2025 to 2035

Motorcycle Lead Acid Battery Market - Trends & Forecast 2025 to 2035

Motor Winding Repair Service Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA