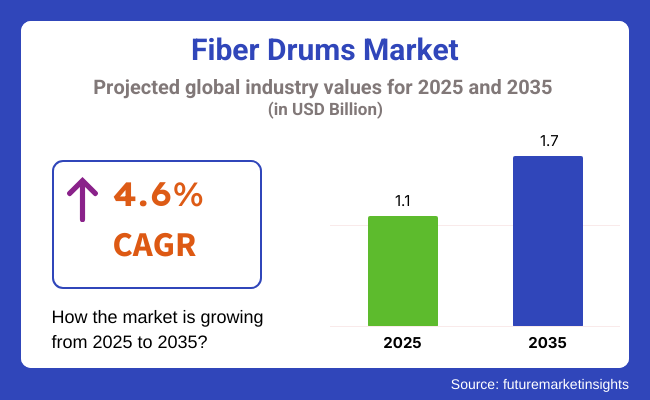

The global fiber drums market is valued at USD 1.1 billion in 2025 and is projected to reach USD 1.7 billion by 2035, expanding at a CAGR of 4.6% during the forecast period. This growth is largely driven by the increasing demand for eco-friendly, sustainable packaging solutions.

As industries prioritize reducing their environmental footprint, fiber drums, which are made from recyclable materials, are gaining popularity due to their lower environmental impact compared to traditional packaging options.

These drums offer superior durability, cost-effectiveness, and versatility in packaging a variety of products, including chemicals, food, and pharmaceuticals. With the global push for sustainability and green packaging, fiber drums are expected to capture a significant share of the market.

Looking ahead, the market is likely to continue its growth, especially in emerging regions such as Asia-Pacific, where demand for sustainable and low-cost packaging solutions is rapidly increasing. As environmental regulations tighten globally and consumer preferences shift towards more sustainable packaging options, industries such as food and beverages, chemicals, and pharmaceuticals are likely to adopt fiber drums in larger volumes.

The market will also witness further innovation in manufacturing processes, enhancing the performance and customization of fiber drums to meet diverse industry needs. These advancements will expand their use across various sectors, making fiber drums an attractive alternative for companies focused on sustainability.

Government regulations play a key role in the fiber drums market, focusing on ensuring safety, compliance, and environmental sustainability. Regulatory bodies such as the USA Environmental Protection Agency (EPA) and European Union’s REACH oversee the production and disposal of packaging materials.

Fiber drums are required to meet specific standards, including the use of recyclable, non-toxic materials in production. Labeling regulations also mandate accurate disclosure of the product’s recyclability and composition. As global sustainability efforts increase, fiber drums are expected to meet stricter environmental guidelines, further boosting their adoption across industries.

The market is segmented by capacity into below 25 gallons, 25-50 gallons, 50-75 gallons, and above 75 gallons. By closure type, the market includes metal closure, plastic closure, and fiber/cardboard closures.

In terms of end use, key segments include chemical industry, food & agro allied industry, pharmaceutical industry, building & construction industry, and others (textiles, personal care and cosmetics, adhesives and sealants, dyes and pigments, industrialcleaning agents). Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, and the Middle East & Africa.

The 50-75 gallons capacity segment is projected to be the fastest-growing in the market, registering a robust CAGR of 4.1% from 2025 to 2035. This growth is driven by its suitability for bulk packaging in chemicals, food ingredients, industrial oils, and construction materials, where durability and volume efficiency are critical.

These drums are ideal for transporting large quantities without compromising structural integrity, especially over long distances. Their standardized dimensions make them highly stackable and compatible with palletized shipping systems, enhancing logistics efficiency across the supply chain.

Industries prefer this segment due to its compatibility with both solid and semi-liquid contents, making it a flexible choice for various industrial applications. In the food and agro-allied sector, the 50-75 gallon drums are widely used for bulk storage of grains, flour, syrups, and edible oils.

The 25-50 gallons segment continues to see strong demand due to its versatility in medium-sized packaging, particularly across the agro-allied and industrial sectors. It offers a practical balance between capacity and handling ease. The below 25 gallons category is primarily used for niche applications such as pharmaceutical compounds and specialty chemicals, where compact, precise storage is essential. However, its market share remains relatively limited. Meanwhile, the above 75 gallons segment serves heavy-duty industrial needs but faces operational drawbacks, including transportation and storage inefficiencies, restricting its broader adoption despite its utility in large-scale logistics operations.

| Capacity | CAGR (2025 to 2035) |

|---|---|

| 50-75 gallons | 4.1% |

The metal closure segment is projected to be the fastest-growing in the market, with a CAGR of 4.3% from 2025 to 2035. Its dominance is fueled by its superior sealing strength, leak-proof protection, and compliance with stringent safety standards, making it ideal for transporting hazardous chemicals, syrups, edible oils, and pharmaceutical ingredients across long distances.

Metal closures provide enhanced structural rigidity, which ensures product safety during stacking, shipping, and rough handling, especially critical in international trade and industrial supply chains.

These closures are also favored for their resistance to temperature variations, chemical exposure, and pressure changes, which makes them well-suited for regulated environments such as chemical manufacturing, pharma logistics, and bulk food processing. In addition, metal closures support tamper-evident packaging, a feature increasingly demanded by regulatory bodies and quality-conscious end users.

The plastic closure segment serves applications where moderate protection is sufficient and weight reduction is a priority. It is commonly used in less sensitive shipments or in combination with internal liners to safeguard contents. Although cost-effective, plastic closures face limitations in terms of heat resistance and sealing integrity, which may hinder their broader use in regulated industries.

Meanwhile, the fiber/cardboard closure segment is primarily adopted in low-risk applications and for dry goods. These closures support the circular economy but offer lower durability and moisture resistance, making them less suitable for harsh logistics environments or liquid contents. However, they appeal to businesses prioritizing fully biodegradable and plastic-free packaging solutions.

| Closure Type | CAGR (2025 to 2035) |

|---|---|

| Metal Closure | 4.3% |

The food & agro allied industry is projected to be the fastest-growing end-use segment in the market, registering a CAGR of 4.3% from 2025 to 2035. This growth is fueled by increasing demand for sustainable, bulk packaging solutions for products such as grains, edible oils, syrups, and animal feed. The segment benefits from rising regulatory pressure to reduce plastic use in food packaging and the global push for eco-friendly agricultural practices.

The chemical industry continues to account for a significant share of the fiber drums market, as these drums are widely used for storing and transporting industrial solvents, resins, and powdered chemicals. Their compatibility with internal liners and ability to meet UN transport standards make them suitable for hazardous materials.

The pharmaceutical industry utilizes products for transporting large quantities of non-sterile raw materials and excipients, with a growing preference for recyclable packaging that complies with Good Manufacturing Practice (GMP) standards. The building and construction industry uses products for storing additives, pigments, and adhesives, especially in dry form; however, its adoption is somewhat limited by concerns over moisture.

The “others”end-use segment encompasses industries beyond the major verticals of chemicals, food, pharmaceuticals, and construction. This category includes applications in textiles, personal care and cosmetics, adhesives and sealants, dyes and pigments, and industrial cleaning agents. Companies in these sectors rely on products for the bulk transport of dry powders, granules, pastes, and semi-solid materials.

These drums are preferred for their lightweight, stackability, and eco-friendly nature, making them suitable for businesses that prioritize cost-effective and sustainable logistics. Additionally, the “Others” segment often adopts products in smaller production environments or for niche applications where metal or plastic alternatives are not cost-efficient or environmentally compliant.

| End Use | CAGR (2025 to 2035) |

|---|---|

| Food & Agro Allied Industry | 4.3% |

Rising Demand for Eco-friendly Packaging Drives Market Growth

The market is significantly driven by increased demand for eco-friendly packaging solutions. Growing environmental concerns and stringent regulations regarding packaging waste encourage businesses to adopt sustainable materials. Fiber drums, being lightweight, recyclable, and biodegradable, provide a competitive edge over plastic and metal alternatives.

Furthermore, the expansion of the pharmaceutical, chemical, and food sectors has increased the demand for cost-effective yet safe storage solutions, thereby enhancing demand. Additionally, fiber drums offer effective moisture resistance and durability, making them appealing to industries that transport sensitive or hazardous goods. Hence, the transition toward sustainable packaging practices, coupled with supportive government initiatives promoting recyclability, continues to propel the global fiber drums market forward.

Limited Durability and Moisture Resistance Hinders ExpansionDespite positive growth factors, the market faces key restraints, primarily their limited durability compared to metal drums.

Fiber drums are vulnerable to physical damage during handling and transportation, potentially compromising product integrity. Moreover, while offering moderate moisture resistance, they fall short compared to plastic or metal containers, restricting their application for certain moisture-sensitive or highly corrosive materials. Additionally, fluctuating raw material prices, particularly paperboard and adhesives, adversely affect manufacturing costs, squeezing profit margins for producers.

Concerns regarding fire safety and contamination risks associated with fiber drums also limit their widespread adoption, especially in industries dealing with hazardous chemicals. These factors collectively hinder the market’s expansion, particularly in specialized industrial segments.

Growth Opportunities from Innovations and Emerging Markets

Significant opportunities exist for manufacturers within the market through product innovation and technological advancements. Enhancing durability, water resistance, and fire retardancy through advanced coatings and liners could expand their applications significantly.

Moreover, tapping into rapidly growing economies in Asia-Pacific and Latin America presents substantial growth potential due to expanding industrial sectors and increased exports. The rising popularity of e-commerce also opens new avenues, as fiber drums offer practical packaging solutions for shipping bulk goods efficiently. Manufacturers can further capitalize on growing corporate sustainability goals by marketing fiber drums as greener alternatives, thus appealing to environmentally conscious brands.

Collaborations and partnerships with logistic companies and packaging firms could further facilitate market penetration.

Competitive Pressure and Substitute Products Pose Threats

The market faces considerable threats from intense competition and increasing availability of substitute packaging materials.

The widespread use of plastic and metal drums, offering higher durability and better moisture protection, remains a major competitive challenge. Additionally, technological advancements have led to improved plastic containers that are recyclable and sustainable, posing significant substitution threats.

Economic fluctuations and volatility in the cost of raw materials like paper and adhesive further threaten profitability for fiber drum manufacturers. Strict international standards for hazardous materials packaging also limit fiber drum applications in certain segments. Companies must proactively address these threats by emphasizing innovation and highlighting sustainability benefits, ensuring they remain competitive against alternate packaging options.

The United States fiber drums market is projected to reach a value of USD 264.3 million in 2025, expanding to USD 390.7 million by 2035, registering a CAGR of 4.0% during the forecast period. The market growth is primarily driven by the country’s robust manufacturing base in chemicals, food ingredients, and pharmaceuticals. These drums are increasingly replacing plastic and metal containers as regulatory agencies like the EPA and FDA push for sustainable and food-safe packaging materials.

Adoption is particularly high in bulk food storage and chemical logistics due to the enhanced barrier properties and tamper-evident features of modern products. The presence of well-established companies such as Greif Inc. and Sonoco Products Company, along with innovations in moisture-resistant coatings and reusability, has further accelerated market maturity.

Demand is particularly strong in the Midwest and Southern regions, where food processing and industrial chemical operations are concentrated. Increasing investment in sustainable packaging and favorable state-level regulations are expected to reinforce the market outlook. As USA consumers and industries become more environmentally conscious, products offer a cost-effective and compliant alternative, ensuring their continued relevance in the national logistics and packaging landscape.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.0% |

Germany’s fiber drums market is expected to be valued at USD 95.7 million in 2025 and will likely reach USD 137.3 million by 2035, registering a CAGR of 3.6%. Germany's strong presence in the chemical and pharmaceutical industries has historically relied on metal drums, but sustainability mandates under the EU Packaging and Packaging Waste Directive are catalyzing a transition to recyclable products.

The Extended Producer Responsibility (EPR) framework, mandatory recycling targets, and growing zero-waste manufacturing commitments have pushed companies toward fiber-based alternatives. Industrial zones in Bavaria and North Rhine-Westphalia are seeing increased usage of products for hazardous and bulk dry chemicals, supported by advanced coatings that offer resistance to moisture and chemical exposure. Local manufacturers are also investing in automation to deliver high-strength products in line with Germany’s emphasis on efficiency.

Demand is being further boosted by the rise of bio-based chemicals and food ingredients, where clean-label transport packaging is becoming standard. Germany’s push for circular economy compliance, combined with innovation in rigid packaging designs, makes the product an integral part of future-ready logistics across industrial, pharmaceutical, and food-grade applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.6% |

Japan’s fiber drums market is projected to reach USD 84.5 million in 2025 and grow to USD 119.7 million by 2035, registering a CAGR of 3.5%. The market is primarily driven by Japan’s advanced chemical and pharmaceutical industries, which prioritize high-performance and sustainable packaging.

The country’s Packaging Recycling Law and Circular Economy Promotion Strategy encourage the use of biodegradable and recyclable materials in industrial logistics. These drums are increasingly adopted for transporting food additives, resins, and specialty chemicals, especially in compliance-focused industries. Japan’s emphasis on high-quality and precision logistics aligns with the superior sealing and tamper-evident features of fiber drums. Major industrial regions such as Kansai and Kanto are reporting steady adoption due to infrastructure maturity and export-focused manufacturing. Innovations in waterproof fiber drum coatings and flame-retardant linings are gaining traction as companies seek performance upgrades without compromising recyclability.

The government’s push for zero-waste manufacturing and net-zero emissions by 2050 supports the shift from metal and plastic containers toward fiber-based formats. Additionally, Japanese companies value the reduced carbon footprint and stackability of the product, which complements the country’s compact and highly efficient warehousing systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.5% |

The United Kingdom’s fiber drums market is expected to reach USD 72.8 million in 2025 and rise to USD 106.6 million by 2035, growing at a CAGR of 3.9%. Sustainability goals outlined in the UK Plastics Pact and increasing regulatory restrictions on single-use plastics are fueling demand for biodegradable packaging alternatives like fiber drums.

The chemicals, personal care, and specialty food sectors are leading adopters, particularly for transporting dry bulk materials and powders. British companies are increasingly switching to products to meet Extended Producer Responsibility obligations and reduce landfill waste. The food and beverage processing industry, concentrated in England and Scotland, uses these drums for storing dry ingredients, syrups, and nutritional additives. Imports and exports involving Europe require strict compliance with recyclable packaging standards, further pushing demand.

Domestic packaging manufacturers are investing in high-performance coatings to enhance durability and cater to the variable UK climate conditions. As e-commerce logistics expand across the nation, especially for industrial supplies and food service, these drums are being recognized for their space-saving and recyclable features. The UK’s policy direction and corporate sustainability goals make products an integral part of future-ready logistics strategies.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.9% |

France’s fiber drums market is estimated at USD 68.9 million in 2025 and projected to reach USD 102.4 million by 2035, expanding at a CAGR of 4.1%. France’s strict enforcement of EU packaging and recycling directives has accelerated the shift from conventional drums to recyclable alternatives.

The French government’s anti-waste law for a circular economy mandates companies to prioritize sustainable packaging. As a result, these drums are increasingly favored for transporting bulk food ingredients, fine chemicals, and pharmaceuticals. Industrial clusters in Île-de-France and Auvergne-Rhône-Alpes are adopting these drums in response to evolving compliance norms and consumer expectations for eco-friendly supply chains. Domestic manufacturers are innovating with compostable linings and moisture barriers to expand fiber drum use in higher-risk sectors.

The agro-food industry, particularly for dairy powders, fruit concentrates, and animal feed, is one of the fastest-growing end-use segments for fiber drums. French exporters are also switching to products to improve ESG scores and meet cross-border packaging standards. With rising investment in green logistics, these drums are expected to play a central role in reducing the carbon footprint of France’s industrial packaging operations.

| Country | CAGR (2025 to 2035) |

|---|---|

| France | 4.1% |

The market features robust competition, driven by both global leaders and regional players. Prominent companies, such as Greif Inc., Mauser Packaging Solutions, and Schutz Container Systems, dominate the global landscape, leveraging strong distribution networks, extensive product portfolios, and strategic partnerships.

These key players continuously invest in R&D to develop fiber drums with enhanced moisture resistance, durability, and sustainability profiles, positioning themselves ahead of competitors. These companies benefit from extensive manufacturing capacities, strong international distribution networks, and integrated service offerings such as reconditioning, recycling, and custom packaging solutions.

Greif Inc. leads the segment, leveraging its diversified product portfolio and global presence across North America, Europe, and Asia. Sonoco and Mauser Group follow closely with established footprints in the industrial and food-grade packaging sectors.

These top-tier companies have adopted forward-looking strategies focused on sustainability, vertical integration, and technological innovation. For instance, Greif and Mauser Group are investing in recyclable coatings and multi-layered fiber constructions that improve barrier properties for moisture-sensitive contents. Schutz and C.L. Smith are prioritizing automated drum production lines and material optimization to reduce environmental impact. Strategic acquisitions have also shaped the competitive landscape, such as Greif’s recent acquisition of Ipackchem Group SAS, aimed at expanding its barrier packaging capabilities.

In contrast, Tier 2 and Tier 3 players, such as Fibrestar Drums Limited, Milford Barrel Co Inc., and Orlando Drum & Container Corporation, focus on regional demand, cost competitiveness, and niche applications.

These companies often cater to local food processors, agrochemical manufacturers, and mid-sized industrial users. Their primary strength lies in customization, quick turnaround times, and building long-term customer relationships within localized markets. Some of these players also partner with logistics firms or container reconditioning services to expand their value-added offerings.

Smaller companies are gradually embracing eco-compliant materials and modular designs to differentiate themselves from imported alternatives. While they may lack the R&D budgets of global firms, these players are agile in addressing specific client needs, such as drums designed for humidity-prone environments or customized branding for regional food exports.

Their adaptability positions them well in regions where packaging regulations are rapidly evolving but market entry barriers remain low. As demand for the product accelerates in Asia-Pacific and Latin America, these local firms are expected to grow through targeted investments in equipment and collaboration with sustainability-focused clients.

Recent Fiber Drums Industry News

| Attribute | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.1 billion |

| Projected Market Size (2035) | USD 1.7 billion |

| CAGR (2025 to 2035) | 4.6 % |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billion/ Volume in Units |

| By Capacity | Below 25 Gallons, 25-50 Gallons, 50-75 Gallons, and Above 75 Gallons |

| By Closure Type | Metal Closure, Plastic Closure, and Fiber/Cardboard Closure |

| By End Use | Chemical Industry, Food & Agro Allied Industry, Pharmaceutical Industry, Building & Construction Industry, and Others |

| Regions Covered | North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East & Africa |

| Countries Covered | United States, China, Germany, India, Japan, Saudi Arabia, Brazil, Russia, South Korea, Canada. |

| Key Players | Greif Inc., Sonoco Products Company, Mauser Group N.V., Schutz Container Systems, C.L.Smith Company, Orlando Drum & Container Corporation, Industrial Container Services, Inc., Fibrestar Drums Limited, Milford Barrel Co Inc., and Great Western Containers Inc. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

By capacity, the market is divided into below 25 gallons, 25-50 gallons, 50-75 gallons, above 75 gallons.

By closure type, the market is divided into metal closure, plastic closure, and fiber/cardboard closure.

The market is classified by end use such as chemical industry, food & agro allied industry, pharmaceutical industry, building & construction industry, others.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and the Middle East & Africa have been covered in the report.

The global market is projected to reach USD 1.7 billion by 2035, growing from USD 1.1 billion in 2025 at a CAGR of 4.6%.

The metal closure segment holds the largest share, accounting for 55.1% of the market in 2025 due to its superior sealing, strength, and leak-proof protection.

Key market leaders include Greif Inc., Sonoco Products Company, Mauser Group N.V., Schutz Container Systems, and C.L. Smith Company, collectively controlling over 47% of the market.

India is expected to witness the fastest growth, with a projected CAGR of 6.1% between 2025 and 2035, driven by industrial expansion and government support for sustainable packaging.

The main industries driving product demand are chemicals, food & agro allied, pharmaceuticals, construction, and other sectors such as textiles, personal care, and industrial cleaning agents.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Capacity, 2017 to 2033

Table 4: Global Market Volume (Units) Forecast by Capacity, 2017 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Closure Type, 2017 to 2033

Table 6: Global Market Volume (Units) Forecast by Closure Type, 2017 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 8: Global Market Volume (Units) Forecast by End Use, 2017 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2017 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Capacity, 2017 to 2033

Table 12: North America Market Volume (Units) Forecast by Capacity, 2017 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Closure Type, 2017 to 2033

Table 14: North America Market Volume (Units) Forecast by Closure Type, 2017 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 16: North America Market Volume (Units) Forecast by End Use, 2017 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2017 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Capacity, 2017 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Capacity, 2017 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Closure Type, 2017 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Closure Type, 2017 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End Use, 2017 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2017 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Capacity, 2017 to 2033

Table 28: Europe Market Volume (Units) Forecast by Capacity, 2017 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Closure Type, 2017 to 2033

Table 30: Europe Market Volume (Units) Forecast by Closure Type, 2017 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 32: Europe Market Volume (Units) Forecast by End Use, 2017 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 34: East Asia Market Volume (Units) Forecast by Country, 2017 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Capacity, 2017 to 2033

Table 36: East Asia Market Volume (Units) Forecast by Capacity, 2017 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Closure Type, 2017 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Closure Type, 2017 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 40: East Asia Market Volume (Units) Forecast by End Use, 2017 to 2033

Table 41: South Asia Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 42: South Asia Market Volume (Units) Forecast by Country, 2017 to 2033

Table 43: South Asia Market Value (US$ Million) Forecast by Capacity, 2017 to 2033

Table 44: South Asia Market Volume (Units) Forecast by Capacity, 2017 to 2033

Table 45: South Asia Market Value (US$ Million) Forecast by Closure Type, 2017 to 2033

Table 46: South Asia Market Volume (Units) Forecast by Closure Type, 2017 to 2033

Table 47: South Asia Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 48: South Asia Market Volume (Units) Forecast by End Use, 2017 to 2033

Table 49: Oceania Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 50: Oceania Market Volume (Units) Forecast by Country, 2017 to 2033

Table 51: Oceania Market Value (US$ Million) Forecast by Capacity, 2017 to 2033

Table 52: Oceania Market Volume (Units) Forecast by Capacity, 2017 to 2033

Table 53: Oceania Market Value (US$ Million) Forecast by Closure Type, 2017 to 2033

Table 54: Oceania Market Volume (Units) Forecast by Closure Type, 2017 to 2033

Table 55: Oceania Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 56: Oceania Market Volume (Units) Forecast by End Use, 2017 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2017 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Capacity, 2017 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Capacity, 2017 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Closure Type, 2017 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Closure Type, 2017 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End Use, 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Closure Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2017 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Capacity, 2017 to 2033

Figure 10: Global Market Volume (Units) Analysis by Capacity, 2017 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Closure Type, 2017 to 2033

Figure 14: Global Market Volume (Units) Analysis by Closure Type, 2017 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Closure Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Closure Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 18: Global Market Volume (Units) Analysis by End Use, 2017 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 21: Global Market Attractiveness by Capacity, 2023 to 2033

Figure 22: Global Market Attractiveness by Closure Type, 2023 to 2033

Figure 23: Global Market Attractiveness by End Use, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Closure Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Capacity, 2017 to 2033

Figure 34: North America Market Volume (Units) Analysis by Capacity, 2017 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Closure Type, 2017 to 2033

Figure 38: North America Market Volume (Units) Analysis by Closure Type, 2017 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Closure Type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Closure Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 42: North America Market Volume (Units) Analysis by End Use, 2017 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 45: North America Market Attractiveness by Capacity, 2023 to 2033

Figure 46: North America Market Attractiveness by Closure Type, 2023 to 2033

Figure 47: North America Market Attractiveness by End Use, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Closure Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Capacity, 2017 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Capacity, 2017 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Closure Type, 2017 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Closure Type, 2017 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Closure Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Closure Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End Use, 2017 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Capacity, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Closure Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Closure Type, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Capacity, 2017 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Capacity, 2017 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Closure Type, 2017 to 2033

Figure 86: Europe Market Volume (Units) Analysis by Closure Type, 2017 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Closure Type, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Closure Type, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 90: Europe Market Volume (Units) Analysis by End Use, 2017 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 93: Europe Market Attractiveness by Capacity, 2023 to 2033

Figure 94: Europe Market Attractiveness by Closure Type, 2023 to 2033

Figure 95: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 98: East Asia Market Value (US$ Million) by Closure Type, 2023 to 2033

Figure 99: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 102: East Asia Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Capacity, 2017 to 2033

Figure 106: East Asia Market Volume (Units) Analysis by Capacity, 2017 to 2033

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) Analysis by Closure Type, 2017 to 2033

Figure 110: East Asia Market Volume (Units) Analysis by Closure Type, 2017 to 2033

Figure 111: East Asia Market Value Share (%) and BPS Analysis by Closure Type, 2023 to 2033

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by Closure Type, 2023 to 2033

Figure 113: East Asia Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 114: East Asia Market Volume (Units) Analysis by End Use, 2017 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Capacity, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Closure Type, 2023 to 2033

Figure 119: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 122: South Asia Market Value (US$ Million) by Closure Type, 2023 to 2033

Figure 123: South Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 124: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 126: South Asia Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Market Value (US$ Million) Analysis by Capacity, 2017 to 2033

Figure 130: South Asia Market Volume (Units) Analysis by Capacity, 2017 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 133: South Asia Market Value (US$ Million) Analysis by Closure Type, 2017 to 2033

Figure 134: South Asia Market Volume (Units) Analysis by Closure Type, 2017 to 2033

Figure 135: South Asia Market Value Share (%) and BPS Analysis by Closure Type, 2023 to 2033

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by Closure Type, 2023 to 2033

Figure 137: South Asia Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 138: South Asia Market Volume (Units) Analysis by End Use, 2017 to 2033

Figure 139: South Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 141: South Asia Market Attractiveness by Capacity, 2023 to 2033

Figure 142: South Asia Market Attractiveness by Closure Type, 2023 to 2033

Figure 143: South Asia Market Attractiveness by End Use, 2023 to 2033

Figure 144: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 146: Oceania Market Value (US$ Million) by Closure Type, 2023 to 2033

Figure 147: Oceania Market Value (US$ Million) by End Use, 2023 to 2033

Figure 148: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: Oceania Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 150: Oceania Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) Analysis by Capacity, 2017 to 2033

Figure 154: Oceania Market Volume (Units) Analysis by Capacity, 2017 to 2033

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 157: Oceania Market Value (US$ Million) Analysis by Closure Type, 2017 to 2033

Figure 158: Oceania Market Volume (Units) Analysis by Closure Type, 2017 to 2033

Figure 159: Oceania Market Value Share (%) and BPS Analysis by Closure Type, 2023 to 2033

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by Closure Type, 2023 to 2033

Figure 161: Oceania Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 162: Oceania Market Volume (Units) Analysis by End Use, 2017 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 165: Oceania Market Attractiveness by Capacity, 2023 to 2033

Figure 166: Oceania Market Attractiveness by Closure Type, 2023 to 2033

Figure 167: Oceania Market Attractiveness by End Use, 2023 to 2033

Figure 168: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Closure Type, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Capacity, 2017 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Capacity, 2017 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Closure Type, 2017 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Closure Type, 2017 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Closure Type, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Closure Type, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End Use, 2017 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Capacity, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Closure Type, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Landscape of Fiber Drums Market Share

Fiber Optic Probe Hydrophone (FOPH) Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Centrifugal Fan Market Size and Share Forecast Outlook 2025 to 2035

Fiber to the Home Market Size and Share Forecast Outlook 2025 to 2035

Fiber Based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fiber Lid Market Forecast and Outlook 2025 to 2035

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiber Sorter Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer Panel and Sheet Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Tester Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Market Size and Share Forecast Outlook 2025 to 2035

Fiber Spinning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Plastic (FRP) Panels & Sheets Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Fabric Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Connectivity Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Collimating Lens Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Duct Wrap Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fiber-Based Blister Pack Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fiber Optics Testing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA