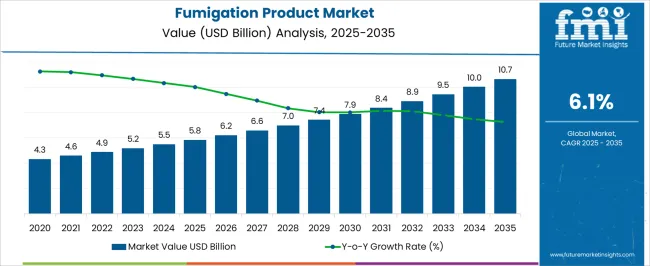

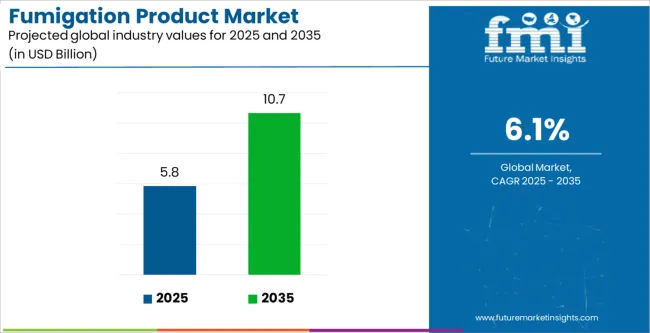

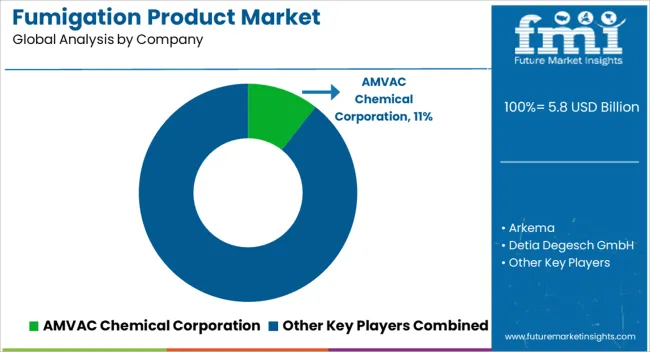

The Fumigation Product Market is estimated to be valued at USD 5.8 billion in 2025 and is projected to reach USD 10.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

| Metric | Value |

|---|---|

| Fumigation Product Market Estimated Value in (2025 E) | USD 5.8 billion |

| Fumigation Product Market Forecast Value in (2035 F) | USD 10.7 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

The fumigation product market is progressing steadily, underpinned by the rising need for effective pest management across agriculture, food storage, and commercial facilities. Industry publications and agricultural board reports have emphasized that the global demand for fumigation products has increased in line with the need to protect crop yields, ensure food security, and prevent post-harvest losses. Expanding trade in agricultural commodities has reinforced the importance of maintaining phytosanitary standards, thereby driving the use of fumigation solutions for storage and transport.

Advances in chemical formulations and application methods have improved efficiency, reduced residue risks, and aligned with stricter environmental and worker safety regulations. Furthermore, companies have invested in safer, controlled-release technologies to address resistance issues and enhance user safety.

With agricultural intensification and urban expansion, the future outlook for the fumigation product market remains positive, supported by increasing adoption in crop production, grain storage, and integrated pest management strategies aimed at sustainable practices.

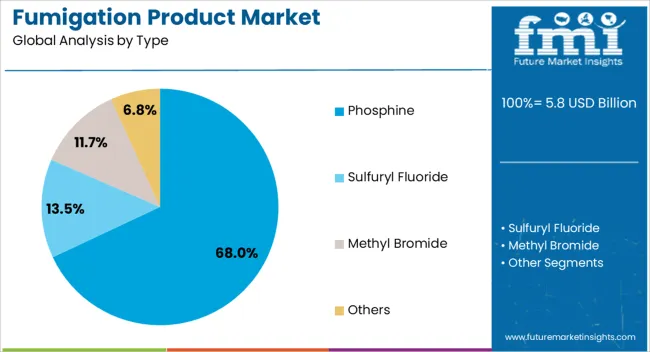

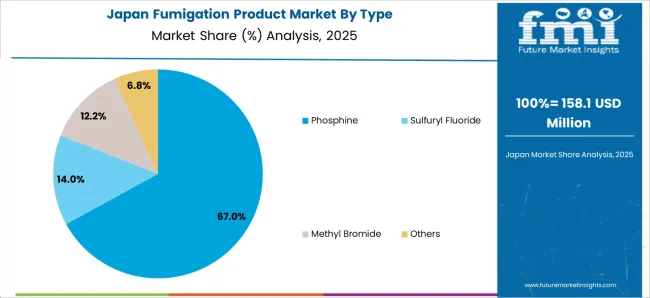

The Phosphine segment is projected to account for 68.0% of the fumigation product market revenue in 2025, sustaining its leadership as the preferred type. Its dominance has been driven by phosphine’s effectiveness in controlling a wide spectrum of pests, particularly in stored grains and other agricultural commodities.

Agricultural science journals have highlighted phosphine’s ability to penetrate deeply into storage facilities, ensuring comprehensive pest eradication without leaving significant residues. Regulatory approvals in multiple regions have further supported its widespread adoption, given its efficacy and relatively lower environmental impact compared to older fumigation agents.

Additionally, ease of application and compatibility with bulk storage systems have reinforced phosphine’s use in large-scale agricultural operations. While safety handling remains an important consideration, technological improvements in delivery methods have enhanced user protection, maintaining phosphine’s strong market presence.

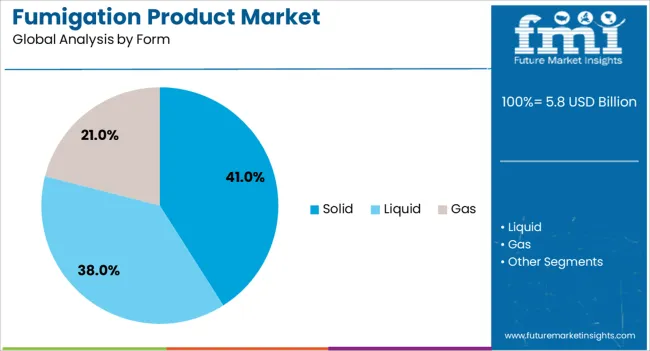

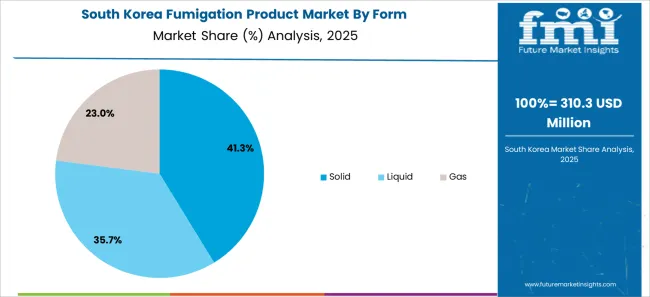

The Solid segment is projected to contribute 41.0% of the fumigation product market revenue in 2025, maintaining its position as the dominant form. Solid formulations, often in tablets, pellets, or sachets, have been favored for their convenience in handling, ease of transport, and controlled release of active ingredients.

These formulations provide longer shelf life and stability under varying storage conditions, making them suitable for widespread use in agriculture and commodity storage. Agricultural extension programs have reported high adoption of solid fumigants due to their practicality in application and reduced requirement for specialized equipment.

Furthermore, advancements in packaging and formulation technologies have improved safety by minimizing direct exposure risks during application. The ability of solid forms to deliver consistent performance in large storage environments has reinforced their preference, ensuring sustained demand in both developed and emerging markets.

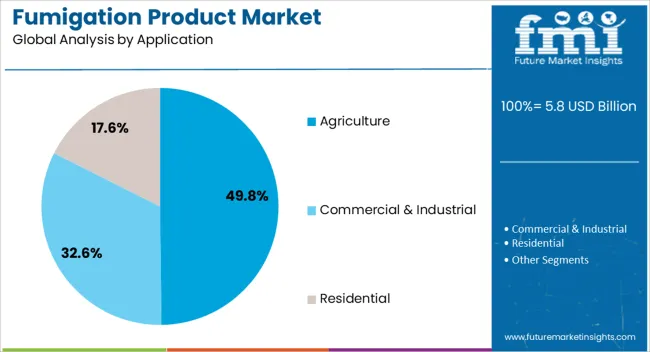

The Agriculture segment is projected to hold 49.8% of the fumigation product market revenue in 2025, solidifying its role as the leading application. This segment’s growth has been supported by the increasing need to safeguard crops and stored produce from pests that threaten food quality and yield.

Agricultural boards and international trade organizations have emphasized that effective fumigation practices are essential for compliance with export quality standards, particularly for cereals, pulses, and oilseeds. Rising global food demand has placed greater pressure on producers to reduce post-harvest losses, thereby driving fumigation adoption in storage silos, warehouses, and transport containers.

In addition, governments and cooperatives have promoted structured pest management programs that incorporate fumigation as a critical intervention. With the agriculture sector facing challenges of pest resistance and climate-related risks, fumigation remains a vital tool in integrated pest management strategies, ensuring reliable protection and supporting global food security initiatives.

With the help of numerous growth drivers, the fumigation product market size increased at a promising CAGR of 7.9% during the historical period. This helped the market reach USD 5.8 billion by 2025, which was measured at USD 4.3 billion in 2020.

The growing local production during the pandemic period gave traction to the rising demand for fumigation products. This helped major players in the fumigation product market find premium solutions to agriculture-related issues. The growing demand for disinfectants to maintain hygiene standards drove the fumigation product market growth rate.

| Historical CAGR from 2020 to 2025 | 7.9% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 6.2% |

The growing technology helped major players in the fumigation product market augment their products through innovation. Also, the demand will be generated to enhance the fragrance of disinfectants, driving the production. Consequently, this will govern the fumigation product market size.

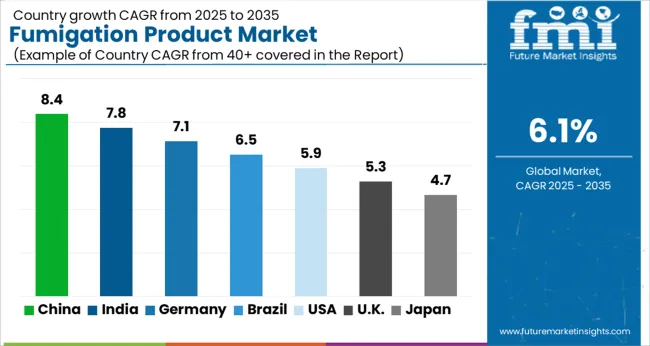

With regulatory policies and technological infrastructure, North America will be the largest contributor to the fumigation product market growth rate. Emerging markets and the growing agricultural sector in Asia-Pacific will govern the enlargement of the fumigation product market size through 2035.

Major players in the fumigation product market in Europe will benefit due to the strict food safety policies of different governments in the region.

The United States projects the fumigation product market size to progress at a CAGR of 6.5% through 2035. The consumer inclination in the country is changing, and people have started to rely more on eco-friendly alternatives. Further, the notable awareness regarding environmental deterioration drives consumers to choose sustainable solutions.

So, organic solutions and bio-based fumigation products will likely be preferred. Thus, these factors will help the fumigation product market size reach USD 10.7 billion by 2035.

The projected Chinese fumigation product market size by 2035 will be USD 1.6 billion.

China is one of the fastest-growing agricultural countries in the Asia-Pacific region. Due to this, the demand for pesticides, germicides, and disinfectants is constantly rising in the country.

The growing emphasis on food quality and security will be another market driver in the country. Hence, this will ensure the fumigation product market growth rate to pace at 6.9%.

The fumigation product market size in the United Kingdom will be enlarged at 7.5%, helping the market reach USD 0.41 billion by 2035.

The government regulation for food safety standards will likely be elevated. The policies for maintaining hygiene, food safety, and sanctity to be maintained in the hospitality sector will be stringent. These factors will drive the demand for fumigation products, fueling the market growth.

The Japanese fumigation product market growth rate will lift its valuation to USD 1.1 billion at a CAGR of 7.9%. Similar to the American population, the Japanese population shows a clear spike in environmental concerns and actions taken to reduce hazards.

Sustainable pest control methods are one of these initiatives, which will spur the demand for eco-friendly fumigation products. Alternative solutions, including pheromone traps and botanical extracts, will likely increase, driving the market.

The South Korean fumigation product market size will progress at the highest CAGR of 8.3%.

Non-chemical pest control practices are used extensively in the country. Apart from this, the growing attention to integrated pest management (IPM) practices creates more demand for alternative fumigation products.

Innovation will likely increase due to these rising demands, driving the market. However, the fumigation product market size will be the second-lowest, reaching USD 650 million.

Due to the widened usability of solid forms and odorless application of phosphine fumigation processes, major players in the fumigation product market use these two key segments to expand in the market.

| Category | Top Type- Phosphine |

|---|---|

| Market Share in 2025 | 68% |

| CAGR % 2025 to End of Forecast (2035) | 6% |

| Market Segment Drivers |

|

| Category | Top Form- Solid |

|---|---|

| Market Share in 2025 | 41% |

| CAGR % 2025 to End of Forecast (2035) | 5.8% |

| Market Segment Drivers |

|

Major players in the fumigation product market use different market expansion modes and strategies to gain a competitive niche in the market. Collaborations, partnerships, product launches, mergers, and acquisitions are key methods used to expand the fumigation product market.

New entrants might gain consumer attention through their innovative products. Further, an aggressive pricing strategy might enhance their market occupancy, delivering them a better competitive space in the market. This collective ecosystem accelerates the fumigation product market growth rate.

Key Market Developments

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 5.5 billion |

| Projected Market Valuation in 2035 | USD 10.1 billion |

| Value-based CAGR 2025 to 2035 | 6.2% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East and Africa |

| Key Market Segments Covered | Type, Form, Application, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key Companies Profiled | AMVAC Chemical Corporation; Arkema; Detia Degesch GmbH; Ecotec Fumigation; Intech Organics Ltd; LANXESS AG; Solvay S.A.; Draslovka Services Group; S.C. JOHNSON & SON INC.; Ensystex Australasia Pty Ltd. |

The global fumigation product market is estimated to be valued at USD 5.8 billion in 2025.

The market size for the fumigation product market is projected to reach USD 10.7 billion by 2035.

The fumigation product market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in fumigation product market are phosphine, sulfuryl fluoride, methyl bromide and others.

In terms of form, solid segment to command 41.0% share in the fumigation product market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fumigation Drone Market Size and Share Forecast Outlook 2025 to 2035

Fumigation Service Market Size and Share Forecast Outlook 2025 to 2035

Product Life-Cycle Management (PLM) IT Market Size and Share Forecast Outlook 2025 to 2035

Product Analytics Software Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Production Logistics Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

Product Design Verification And Validation Solution Market Size and Share Forecast Outlook 2025 to 2035

Production Printer Market - Growth, Demand & Forecast 2025 to 2035

Product Information Management Market Growth – Trends & Forecast 2024-2034

Product Dispensing Machinery Market

Product Cost Management Market

CBD Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

USA Products from Food Waste Market Growth – Trends, Demand & Outlook 2025-2035

Competitive Overview of CBD Product Packaging Market Share

Soda Production Machine Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Date Product Market Share

Teff Products Market

Dairy Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA