The global gauss meter market also will keep on growing at a consistent rate during 2025 to 2035 with the rising use of magnetic field measurement in various industries such as electronics, automotive, aerospace, medicine, and manufacturing. Magnetometer or gauss meter is a highly sensitive measuring instrument that is used to measure magnetic field strength and direction.

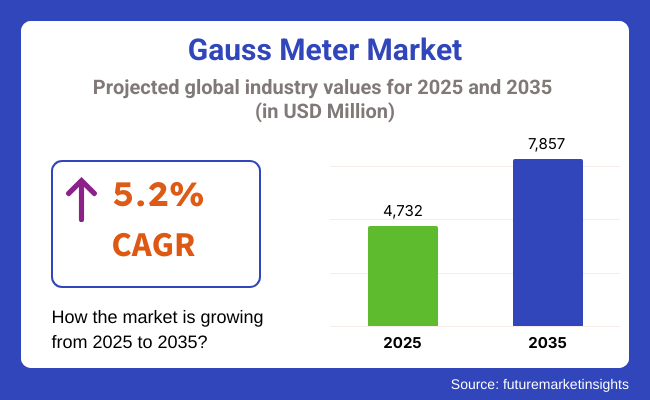

Their sole purpose of research, calibration, and quality assurance has also been overstressed with the increasing complexity in electronic components and the requirement for precise analysis of magnetic fields. The global market for gauss meters is at an estimated value of USD 4,732 million as of 2025 and is likely to increase to USD 7,857 million by 2035, with a CAGR of 5.2%.

The market also benefits from innovations in digital gauss meters, 3-axis probes, and data logging capability, with growing magnetic field monitoring demands in magnetic resonance imaging (MRI) suites, motor assembly lines, and electric vehicle (EV) assembly lines. Battery-driven, miniaturized, and wireless gauss meters are also increasing user-friendly functionality for field and laboratory applications.

North America leads the gauss meter market due to its strong aerospace, defence, and electronics manufacturing industries, particularly in the USA Growing uses of gauss meters in EV production, magnetic sensor calibration, and scientific R&D fuel demand, and emerging applications in medical device design further enhance market penetration.

Europe is firm with demand, especially in Germany, the UK, and France, where vehicle technology, MRI safety standards, and environmental field testing are top. Workplace safety regulations and quality control protocols are leading the use of precision gauss meters in industries and labs.

Asia-Pacific is the most dynamic market region due to rapid industrialization and booming electronics industry in China, Japan, South Korea, and India. Increased focus on electric motor efficiency, semiconductor production, and magnetic material growth is creating need for precise, high-sensitivity gauss meters with features and digital interfaces.

Challenges: Calibration Complexity, Price Sensitivity, and Limited Awareness

Threats to the market for gauss meters include calibration and complexity of precision maintenance, particularly in multi-axis or high-resolution units. Cost sensitivity in cost-conscious industries and lack of knowledge about magnetic interference risk in new markets can similarly prevent broader implementation. Maintenance and training of operators remain issues for small-scale use.

Opportunities: EV Expansion, Magnetic Safety Compliance, and IoT Integration

Main opportunities in growing electric vehicle and renewable energy spaces, where the magnetic field monitor plays a vital role in motor qualification and safety testing, abound. Magnetic shielding qualification, radiation shielding, and MRI room qualification are opening medical uses to new vistas. Involvement of Bluetooth, real-time analysis, and IoT-compatible gauss meters is also aiding further field data and remote diagnosis.

Between 2020 and 2024, sales of Gauss meters increased as application in EV powertrain calibration, EMF exposure tests, and automated factory maintenance increased. There was a move towards digital and away from analog meters and increased interest in USB-powered, battery-powered instruments. Availability of sensors was impacted by supply chain issues and resulted in some products being introduced late.

Between 2025 and 2035, the market for gauss meters will transform with the advent of AI-calibrated calibration, remote field mapping, and auto-probe test diagnosis. Greater connectivity to smartphones and cloud ecosystems will enable predictive maintenance of industrial magnetic systems. With magnetic technologies increasingly enabling next-generation transportation, energy, and healthcare infrastructure, gauss meters will be ubiquitous tools in quality, safety, and innovation processes.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Adoption driven by workplace safety standards, EMI compliance, and magnetic field exposure limits (ICNIRP, OSHA). |

| Consumer Trends | Growing concern over electromagnetic pollution in residential and industrial environments. |

| Industry Adoption | Widely used in automotive testing labs, power stations, and electronics manufacturing. |

| Supply Chain and Sourcing | Sourced hall-effect and fluxgate sensors from USA, Germany, and Japan. |

| Market Competition | Led by Lake Shore, FW Bell, Alpha Lab, and Hirst Magnetics with analog-digital hybrid products. |

| Market Growth Drivers | Driven by need for electromagnetic compliance testing and magnetic field mapping in heavy machinery. |

| Sustainability and Environmental Impact | Emphasis on electromagnetic hygiene in sensitive zones like schools and clinics. |

| Integration of Smart Technologies | Use of digital data logging and USB connectivity for lab-based field studies. |

| Advancements in Equipment Design | Traditional handheld devices with limited range and basic LCD display. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Tighter international directives on magnetic emissions from EVs, medical devices, and semiconductor fabs increase gauss meter calibration demand. |

| Consumer Trends | Broader awareness of magnetic safety in consumer electronics, smart home devices, and high-frequency antennas accelerates usage. |

| Industry Adoption | Expanded use in EV charging infrastructure, space tech calibration, quantum computing facilities, and hospital MRI shielding validation. |

| Supply Chain and Sourcing | Shift toward nano-Tesla resolution sensors, local sensor module production, and on-demand microcontroller-based probe kits. |

| Market Competition | Emergence of AI-integrated gauss meters and portable 3-axis scanning units from startups focused on next-gen R&D and predictive diagnostics. |

| Market Growth Drivers | Boosted by magnetics in medical robotics, aerospace, superconducting tech, and rapid EV ecosystem scale-up. |

| Sustainability and Environmental Impact | Development of ultra-low power handheld meters and recyclable casing for industrial use in green-certified infrastructure projects. |

| Integration of Smart Technologies | AI-driven magnetic anomaly detection, wireless IoT-enabled sensors, and real-time field strength mapping via AR interfaces. |

| Advancements in Equipment Design | Introduction of Bluetooth-enabled multi-range gauss meters with OLED displays, modular probes, and cloud-based calibration syncing. |

The USA gauss meter market is expanding with increased applications in aerospace, defence, and automotive industries. EV makers such as Tesla are investing in magnetic field testing for battery packs and motor systems. NASA and private space ventures also employ high-precision meters for spacecraft shielding design and satellite payload testing.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

In the UK, demand for gauss meters is being led by innovation in magnetic nanotech, robotics, and quantum devices. Universities and national labs like Rutherford Appleton are deploying advanced field mapping tools. Compliance with EU-adjacent magnetic safety and EMC norms drives steady commercial and industrial adoption.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.4% |

Across the EU, strict electromagnetic interference (EMI) regulations for railways, medical imaging, and power substations foster high gauss meter usage. Germany and France are leading with demand from automotive OEMs and semiconductor cleanrooms. EU-funded smart grid initiatives also include field strength monitoring requirements.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.1% |

Japan’s high-tech sectors, particularly robotics and superconductors, rely heavily on gauss meters for R&D and quality control. Companies like Hitachi and Fujitsu integrate real-time field calibration into AI robotics and magnetic storage systems. The country’s rigorous safety regulations for public infrastructure also support steady market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.5% |

South Korea is scaling up its gauss meter applications across its growing EV and consumer electronics segments. Samsung and LG use them in smart device magnet testing, while Seoul’s urban smart grid projects rely on magnetic field mapping tools to ensure EMI compliance and grid reliability.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.3% |

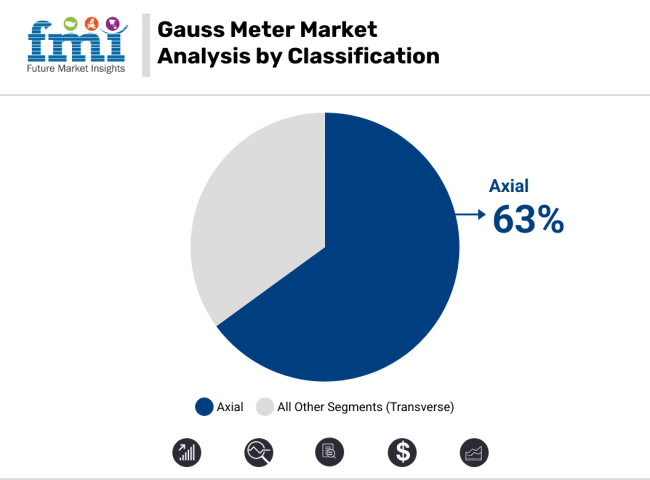

Axial Gauss meters will lead the market in 2025 with a projected 63% market share. Their demand is being propelled to a significant extent by use in inline quality monitoring and magnetic field measurement in production lines. Axial Gauss meters facilitate improved use in cylindrical magnets and long-shape components, particularly in motor production and sensor calibration. Lake Shore Cryotronics, for example, has increased its sales of axial Gauss meters for precision laboratory and production applications.

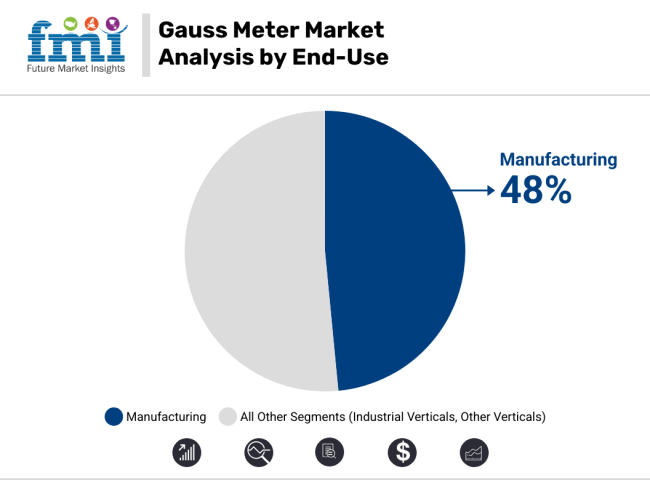

The manufacturing sector will hold 48% of the overall Gauss meter market in 2025. With industries looking for the highest level of automation and quality, measurement devices such as Gauss meters are no longer a choice. They assist in ensuring accurate positioning and strength of magnets in motor assemblies, transformers, and inductors. FW Bell and Hirst Magnetic Instruments, among others, have been receiving upgraded orders from OEMs dealing in electric motors and magnetic assemblies.

Gauss Meter market is witnessing robust growth, as the growing need for accurate measurements of magnetic fields across applications in the electronics, automotive, aerospace, and healthcare segments is on a rise. Evolution in sensor technology and miniaturization of electronic devices have further fueled the utilization of Gauss meters, allowing more accuracy and comfort in measurement.

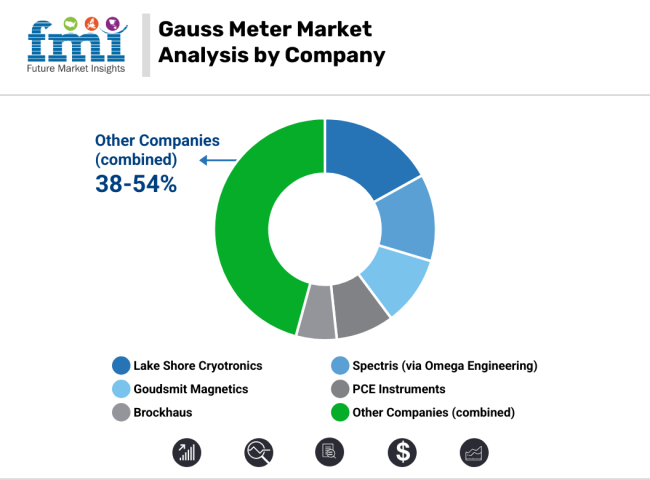

Market Share Analysis by Company

| Company Name | Key Offerings/Activities |

|---|---|

| Lake Shore Cryotronics | In 2024, launched the Model 8600 Series VSM Gauss meters with increased sensitivity for high-level material study. In 2025, added portable Gauss meters with real-time data logging to their product offerings. |

| Spectris (Omega Engineering) | In 2024, introduced a new line of handheld Gauss meters with wireless connectivity to enable remote monitoring. In 2025, concentrated on incorporating IoT features into their products to facilitate harmonious connection with industrial systems. |

| Goudsmit Magnetics | Developed Gauss meters to be used in quality control in automotive production in 2024. In 2025, collaborated with European automakers to deploy magnetic field measurement technology in electric vehicle assembly lines. |

| PCE Instruments | In 2024, launched the PCE-MFM 3500, a Gauss meter optimized for laboratory use with high accuracy demands. In 2025, increased their network of distributors in Asia to support the surge in demand for the region. |

| Brockhaus | In 2024, launched a range of Gauss meters designed for application in the renewable energy industry, specifically in the production of wind turbines. In 2025, partnered with research centers to create future-generation magnetic measurement technology. |

Key Company Insights

Lake Shore Cryotronics (15-20%)

Lake Shore Cryotronics leads the pack in high-precision Gauss meters designed for use in scientific research and industry. Its unshakable resolve for innovation with sensor technology is responsible for the building of their brand name synonymous with precision and dependability.

Spectris (Omega Engineering) (10-15%)

Spectris, along with its subsidiary Omega Engineering, provides a large assortment of Gauss meters that are reputed to have simple-to-use interfaces and integration options. Its focus on connectivity and IoT integration makes it a competitive player in the changing world of industry.

Goudsmit Magnetics (8-12%)

Goudsmit Magnetics is expert in providing magnetic solutions for the automotive industry, with Gauss meters for enabling quality control within manufacturing processes. Their partnerships with vehicle manufacturers are a demonstration of industry-focused solution provider orientation.

PCE Instruments (5-10%)

PCE Instruments serves laboratory and industrial needs, offering precise and affordable Gauss meters. Their recent thrust into Asian markets is an indicator of their worldwide distribution policy.

Brockhaus (3-7%)

Brockhaus is specialized in solutions for the renewable energy business, manufacturing Gauss meters that aid wind turbine production and maintenance. Their collaborations with research institutions reveal their commitment to the development of measurement technologies.

Other Key Players (38-54% Combined)

The overall market size for the Gauss meter market was approximately USD 4,732 million in 2025.

The Gauss meter market is projected to reach approximately USD 7,857 million by 2035.

The increasing need for precise magnetic field measurements in electronics manufacturing, industrial automation, and research applications fuels the Gauss meter market during the forecast period.

The top 5 countries driving the development of the Gauss meter market are the United States, China, Germany, Japan, and India.

On the basis of type, portable Gauss meters are expected to command a significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2032

Table 2: Global Market Volume (Units) Forecast by Region, 2017 to 2032

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 4: Global Market Volume (Units) Forecast by Product Type, 2017 to 2032

Table 5: Global Market Value (US$ Million) Forecast by Axis Type, 2017 to 2032

Table 6: Global Market Volume (Units) Forecast by Axis Type, 2017 to 2032

Table 7: Global Market Value (US$ Million) Forecast by Modularity, 2017 to 2032

Table 8: Global Market Volume (Units) Forecast by Modularity, 2017 to 2032

Table 9: Global Market Value (US$ Million) Forecast by Middle East and Africa Surfing Direction, 2017 to 2032

Table 10: Global Market Volume (Units) Forecast by Middle East and Africa Surfing Direction, 2017 to 2032

Table 11: Global Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 12: Global Market Volume (Units) Forecast by Application, 2017 to 2032

Table 13: North America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 14: North America Market Volume (Units) Forecast by Country, 2017 to 2032

Table 15: North America Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 16: North America Market Volume (Units) Forecast by Product Type, 2017 to 2032

Table 17: North America Market Value (US$ Million) Forecast by Axis Type, 2017 to 2032

Table 18: North America Market Volume (Units) Forecast by Axis Type, 2017 to 2032

Table 19: North America Market Value (US$ Million) Forecast by Modularity, 2017 to 2032

Table 20: North America Market Volume (Units) Forecast by Modularity, 2017 to 2032

Table 21: North America Market Value (US$ Million) Forecast by Middle East and Africa Surfing Direction, 2017 to 2032

Table 22: North America Market Volume (Units) Forecast by Middle East and Africa Surfing Direction, 2017 to 2032

Table 23: North America Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 24: North America Market Volume (Units) Forecast by Application, 2017 to 2032

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 26: Latin America Market Volume (Units) Forecast by Country, 2017 to 2032

Table 27: Latin America Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 28: Latin America Market Volume (Units) Forecast by Product Type, 2017 to 2032

Table 29: Latin America Market Value (US$ Million) Forecast by Axis Type, 2017 to 2032

Table 30: Latin America Market Volume (Units) Forecast by Axis Type, 2017 to 2032

Table 31: Latin America Market Value (US$ Million) Forecast by Modularity, 2017 to 2032

Table 32: Latin America Market Volume (Units) Forecast by Modularity, 2017 to 2032

Table 33: Latin America Market Value (US$ Million) Forecast by Middle East and Africa Surfing Direction, 2017 to 2032

Table 34: Latin America Market Volume (Units) Forecast by Middle East and Africa Surfing Direction, 2017 to 2032

Table 35: Latin America Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 36: Latin America Market Volume (Units) Forecast by Application, 2017 to 2032

Table 37: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 38: Europe Market Volume (Units) Forecast by Country, 2017 to 2032

Table 39: Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 40: Europe Market Volume (Units) Forecast by Product Type, 2017 to 2032

Table 41: Europe Market Value (US$ Million) Forecast by Axis Type, 2017 to 2032

Table 42: Europe Market Volume (Units) Forecast by Axis Type, 2017 to 2032

Table 43: Europe Market Value (US$ Million) Forecast by Modularity, 2017 to 2032

Table 44: Europe Market Volume (Units) Forecast by Modularity, 2017 to 2032

Table 45: Europe Market Value (US$ Million) Forecast by Middle East and Africa Surfing Direction, 2017 to 2032

Table 46: Europe Market Volume (Units) Forecast by Middle East and Africa Surfing Direction, 2017 to 2032

Table 47: Europe Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 48: Europe Market Volume (Units) Forecast by Application, 2017 to 2032

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 50: East Asia Market Volume (Units) Forecast by Country, 2017 to 2032

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 52: East Asia Market Volume (Units) Forecast by Product Type, 2017 to 2032

Table 53: East Asia Market Value (US$ Million) Forecast by Axis Type, 2017 to 2032

Table 54: East Asia Market Volume (Units) Forecast by Axis Type, 2017 to 2032

Table 55: East Asia Market Value (US$ Million) Forecast by Modularity, 2017 to 2032

Table 56: East Asia Market Volume (Units) Forecast by Modularity, 2017 to 2032

Table 57: East Asia Market Value (US$ Million) Forecast by Middle East and Africa Surfing Direction, 2017 to 2032

Table 58: East Asia Market Volume (Units) Forecast by Middle East and Africa Surfing Direction, 2017 to 2032

Table 59: East Asia Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 60: East Asia Market Volume (Units) Forecast by Application, 2017 to 2032

Table 61: South Asia & Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 62: South Asia & Pacific Market Volume (Units) Forecast by Country, 2017 to 2032

Table 63: South Asia & Pacific Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 64: South Asia & Pacific Market Volume (Units) Forecast by Product Type, 2017 to 2032

Table 65: South Asia & Pacific Market Value (US$ Million) Forecast by Axis Type, 2017 to 2032

Table 66: South Asia & Pacific Market Volume (Units) Forecast by Axis Type, 2017 to 2032

Table 67: South Asia & Pacific Market Value (US$ Million) Forecast by Modularity, 2017 to 2032

Table 68: South Asia & Pacific Market Volume (Units) Forecast by Modularity, 2017 to 2032

Table 69: South Asia & Pacific Market Value (US$ Million) Forecast by Middle East and Africa Surfing Direction, 2017 to 2032

Table 70: South Asia & Pacific Market Volume (Units) Forecast by Middle East and Africa Surfing Direction, 2017 to 2032

Table 71: South Asia & Pacific Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 72: South Asia & Pacific Market Volume (Units) Forecast by Application, 2017 to 2032

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 74: Middle East and Africa Market Volume (Units) Forecast by Country, 2017 to 2032

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 76: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2017 to 2032

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Axis Type, 2017 to 2032

Table 78: Middle East and Africa Market Volume (Units) Forecast by Axis Type, 2017 to 2032

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Modularity, 2017 to 2032

Table 80: Middle East and Africa Market Volume (Units) Forecast by Modularity, 2017 to 2032

Table 81: Middle East and Africa Market Value (US$ Million) Forecast by Middle East and Africa Surfing Direction, 2017 to 2032

Table 82: Middle East and Africa Market Volume (Units) Forecast by Middle East and Africa Surfing Direction, 2017 to 2032

Table 83: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 84: Middle East and Africa Market Volume (Units) Forecast by Application, 2017 to 2032

Figure 1: Global Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 2: Global Market Value (US$ Million) by Axis Type, 2022 to 2032

Figure 3: Global Market Value (US$ Million) by Modularity,

2022 to 2032

Figure 4: Global Market Value (US$ Million) by Middle East and Africa Surfing Direction, 2022 to 2032

Figure 5: Global Market Value (US$ Million) by Application, 2022 to 2032

Figure 6: Global Market Value (US$ Million) by Region, 2022 to 2032

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2017 to 2032

Figure 8: Global Market Volume (Units) Analysis by Region, 2017 to 2032

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 11: Global Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 12: Global Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 13: Global Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 14: Global Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 15: Global Market Value (US$ Million) Analysis by Axis Type, 2017 to 2032

Figure 16: Global Market Volume (Units) Analysis by Axis Type, 2017 to 2032

Figure 17: Global Market Value Share (%) and BPS Analysis by Axis Type, 2022 to 2032

Figure 18: Global Market Y-o-Y Growth (%) Projections by Axis Type, 2022 to 2032

Figure 19: Global Market Value (US$ Million) Analysis by Modularity, 2017 to 2032

Figure 20: Global Market Volume (Units) Analysis by Modularity, 2017 to 2032

Figure 21: Global Market Value Share (%) and BPS Analysis by Modularity, 2022 to 2032

Figure 22: Global Market Y-o-Y Growth (%) Projections by Modularity, 2022 to 2032

Figure 23: Global Market Value (US$ Million) Analysis by Middle East and Africa Surfing Direction, 2017 to 2032

Figure 24: Global Market Volume (Units) Analysis by Middle East and Africa Surfing Direction, 2017 to 2032

Figure 25: Global Market Value Share (%) and BPS Analysis by Middle East and Africa Surfing Direction, 2022 to 2032

Figure 26: Global Market Y-o-Y Growth (%) Projections by Middle East and Africa Surfing Direction, 2022 to 2032

Figure 27: Global Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 28: Global Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 29: Global Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 30: Global Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 31: Global Market Attractiveness by Product Type, 2022 to 2032

Figure 32: Global Market Attractiveness by Axis Type, 2022 to 2032

Figure 33: Global Market Attractiveness by Modularity, 2022 to 2032

Figure 34: Global Market Attractiveness by Middle East and Africa Surfing Direction, 2022 to 2032

Figure 35: Global Market Attractiveness by Application, 2022 to 2032

Figure 36: Global Market Attractiveness by Region, 2022 to 2032

Figure 37: North America Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 38: North America Market Value (US$ Million) by Axis Type, 2022 to 2032

Figure 39: North America Market Value (US$ Million) by Modularity, 2022 to 2032

Figure 40: North America Market Value (US$ Million) by Middle East and Africa Surfing Direction, 2022 to 2032

Figure 41: North America Market Value (US$ Million) by Application, 2022 to 2032

Figure 42: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 44: North America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 47: North America Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 48: North America Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 49: North America Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 50: North America Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 51: North America Market Value (US$ Million) Analysis by Axis Type, 2017 to 2032

Figure 52: North America Market Volume (Units) Analysis by Axis Type, 2017 to 2032

Figure 53: North America Market Value Share (%) and BPS Analysis by Axis Type, 2022 to 2032

Figure 54: North America Market Y-o-Y Growth (%) Projections by Axis Type, 2022 to 2032

Figure 55: North America Market Value (US$ Million) Analysis by Modularity, 2017 to 2032

Figure 56: North America Market Volume (Units) Analysis by Modularity, 2017 to 2032

Figure 57: North America Market Value Share (%) and BPS Analysis by Modularity, 2022 to 2032

Figure 58: North America Market Y-o-Y Growth (%) Projections by Modularity, 2022 to 2032

Figure 59: North America Market Value (US$ Million) Analysis by Middle East and Africa Surfing Direction, 2017 to 2032

Figure 60: North America Market Volume (Units) Analysis by Middle East and Africa Surfing Direction, 2017 to 2032

Figure 61: North America Market Value Share (%) and BPS Analysis by Middle East and Africa Surfing Direction, 2022 to 2032

Figure 62: North America Market Y-o-Y Growth (%) Projections by Middle East and Africa surfing Direction, 2022 to 2032

Figure 63: North America Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 64: North America Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 65: North America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 66: North America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 67: North America Market Attractiveness by Product Type, 2022 to 2032

Figure 68: North America Market Attractiveness by Axis Type, 2022 to 2032

Figure 69: North America Market Attractiveness by Modularity, 2022 to 2032

Figure 70: North America Market Attractiveness by Middle East and Africa Surfing Direction, 2022 to 2032

Figure 71: North America Market Attractiveness by Application, 2022 to 2032

Figure 72: North America Market Attractiveness by Country, 2022 to 2032

Figure 73: Latin America Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 74: Latin America Market Value (US$ Million) by Axis Type, 2022 to 2032

Figure 75: Latin America Market Value (US$ Million) by Modularity, 2022 to 2032

Figure 76: Latin America Market Value (US$ Million) by Middle East and Africa Surfing Direction, 2022 to 2032

Figure 77: Latin America Market Value (US$ Million) by Application, 2022 to 2032

Figure 78: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 80: Latin America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 83: Latin America Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 84: Latin America Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 87: Latin America Market Value (US$ Million) Analysis by Axis Type, 2017 to 2032

Figure 88: Latin America Market Volume (Units) Analysis by Axis Type, 2017 to 2032

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Axis Type, 2022 to 2032

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Axis Type, 2022 to 2032

Figure 91: Latin America Market Value (US$ Million) Analysis by Modularity, 2017 to 2032

Figure 92: Latin America Market Volume (Units) Analysis by Modularity, 2017 to 2032

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Modularity, 2022 to 2032

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Modularity, 2022 to 2032

Figure 95: Latin America Market Value (US$ Million) Analysis by Middle East and Africa Surfing Direction, 2017 to 2032

Figure 96: Latin America Market Volume (Units) Analysis by Middle East and Africa Surfing Direction, 2017 to 2032

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Middle East and Africa Surfing Direction, 2022 to 2032

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Middle East and Africa surfing Direction, 2022 to 2032

Figure 99: Latin America Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 100: Latin America Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 103: Latin America Market Attractiveness by Product Type, 2022 to 2032

Figure 104: Latin America Market Attractiveness by Axis Type, 2022 to 2032

Figure 105: Latin America Market Attractiveness by Modularity, 2022 to 2032

Figure 106: Latin America Market Attractiveness by Middle East and Africa Surfing Direction, 2022 to 2032

Figure 107: Latin America Market Attractiveness by Application, 2022 to 2032

Figure 108: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 109: Europe Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 110: Europe Market Value (US$ Million) by Axis Type, 2022 to 2032

Figure 111: Europe Market Value (US$ Million) by Modularity, 2022 to 2032

Figure 112: Europe Market Value (US$ Million) by Middle East and Africa Surfing Direction, 2022 to 2032

Figure 113: Europe Market Value (US$ Million) by Application, 2022 to 2032

Figure 114: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 115: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 116: Europe Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 117: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 118: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 119: Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 120: Europe Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 121: Europe Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 122: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 123: Europe Market Value (US$ Million) Analysis by Axis Type, 2017 to 2032

Figure 124: Europe Market Volume (Units) Analysis by Axis Type, 2017 to 2032

Figure 125: Europe Market Value Share (%) and BPS Analysis by Axis Type, 2022 to 2032

Figure 126: Europe Market Y-o-Y Growth (%) Projections by Axis Type, 2022 to 2032

Figure 127: Europe Market Value (US$ Million) Analysis by Modularity, 2017 to 2032

Figure 128: Europe Market Volume (Units) Analysis by Modularity, 2017 to 2032

Figure 129: Europe Market Value Share (%) and BPS Analysis by Modularity, 2022 to 2032

Figure 130: Europe Market Y-o-Y Growth (%) Projections by Modularity, 2022 to 2032

Figure 131: Europe Market Value (US$ Million) Analysis by Middle East and Africa Surfing Direction, 2017 to 2032

Figure 132: Europe Market Volume (Units) Analysis by Middle East and Africa Surfing Direction, 2017 to 2032

Figure 133: Europe Market Value Share (%) and BPS Analysis by Middle East and Africa Surfing Direction, 2022 to 2032

Figure 134: Europe Market Y-o-Y Growth (%) Projections by Middle East and Africa Surfing Direction, 2022 to 2032

Figure 135: Europe Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 136: Europe Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 137: Europe Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 138: Europe Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 139: Europe Market Attractiveness by Product Type, 2022 to 2032

Figure 140: Europe Market Attractiveness by Axis Type, 2022 to 2032

Figure 141: Europe Market Attractiveness by Modularity, 2022 to 2032

Figure 142: Europe Market Attractiveness by Middle East and Africa Surfing Direction, 2022 to 2032

Figure 143: Europe Market Attractiveness by Application, 2022 to 2032

Figure 144: Europe Market Attractiveness by Country, 2022 to 2032

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 146: East Asia Market Value (US$ Million) by Axis Type, 2022 to 2032

Figure 147: East Asia Market Value (US$ Million) by Modularity, 2022 to 2032

Figure 148: East Asia Market Value (US$ Million) by Middle East and Africa Surfing Direction, 2022 to 2032

Figure 149: East Asia Market Value (US$ Million) by Application, 2022 to 2032

Figure 150: East Asia Market Value (US$ Million) by Country, 2022 to 2032

Figure 151: East Asia Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 152: East Asia Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 153: East Asia Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 154: East Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 155: East Asia Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 156: East Asia Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 159: East Asia Market Value (US$ Million) Analysis by Axis Type, 2017 to 2032

Figure 160: East Asia Market Volume (Units) Analysis by Axis Type, 2017 to 2032

Figure 161: East Asia Market Value Share (%) and BPS Analysis by Axis Type, 2022 to 2032

Figure 162: East Asia Market Y-o-Y Growth (%) Projections by Axis Type, 2022 to 2032

Figure 163: East Asia Market Value (US$ Million) Analysis by Modularity, 2017 to 2032

Figure 164: East Asia Market Volume (Units) Analysis by Modularity, 2017 to 2032

Figure 165: East Asia Market Value Share (%) and BPS Analysis by Modularity, 2022 to 2032

Figure 166: East Asia Market Y-o-Y Growth (%) Projections by Modularity, 2022 to 2032

Figure 167: East Asia Market Value (US$ Million) Analysis by Middle East and Africa Surfing Direction, 2017 to 2032

Figure 168: East Asia Market Volume (Units) Analysis by Middle East and Africa Surfing Direction, 2017 to 2032

Figure 169: East Asia Market Value Share (%) and BPS Analysis by Middle East and Africa Surfing Direction, 2022 to 2032

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by Middle East and Africa surfing Direction, 2022 to 2032

Figure 171: East Asia Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 172: East Asia Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 173: East Asia Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 174: East Asia Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 175: East Asia Market Attractiveness by Product Type, 2022 to 2032

Figure 176: East Asia Market Attractiveness by Axis Type, 2022 to 2032

Figure 177: East Asia Market Attractiveness by Modularity, 2022 to 2032

Figure 178: East Asia Market Attractiveness by Middle East and Africa Surfing Direction, 2022 to 2032

Figure 179: East Asia Market Attractiveness by Application, 2022 to 2032

Figure 180: East Asia Market Attractiveness by Country, 2022 to 2032

Figure 181: South Asia & Pacific Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 182: South Asia & Pacific Market Value (US$ Million) by Axis Type, 2022 to 2032

Figure 183: South Asia & Pacific Market Value (US$ Million) by Modularity, 2022 to 2032

Figure 184: South Asia & Pacific Market Value (US$ Million) by Middle East and Africa Surfing Direction, 2022 to 2032

Figure 185: South Asia & Pacific Market Value (US$ Million) by Application, 2022 to 2032

Figure 186: South Asia & Pacific Market Value (US$ Million) by Country, 2022 to 2032

Figure 187: South Asia & Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 188: South Asia & Pacific Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 189: South Asia & Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 190: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 191: South Asia & Pacific Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 192: South Asia & Pacific Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 193: South Asia & Pacific Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 194: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 195: South Asia & Pacific Market Value (US$ Million) Analysis by Axis Type, 2017 to 2032

Figure 196: South Asia & Pacific Market Volume (Units) Analysis by Axis Type, 2017 to 2032

Figure 197: South Asia & Pacific Market Value Share (%) and BPS Analysis by Axis Type, 2022 to 2032

Figure 198: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Axis Type, 2022 to 2032

Figure 199: South Asia & Pacific Market Value (US$ Million) Analysis by Modularity, 2017 to 2032

Figure 200: South Asia & Pacific Market Volume (Units) Analysis by Modularity, 2017 to 2032

Figure 201: South Asia & Pacific Market Value Share (%) and BPS Analysis by Modularity, 2022 to 2032

Figure 202: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Modularity, 2022 to 2032

Figure 203: South Asia & Pacific Market Value (US$ Million) Analysis by Middle East and Africa Surfing Direction, 2017 to 2032

Figure 204: South Asia & Pacific Market Volume (Units) Analysis by Middle East and Africa Surfing Direction, 2017 to 2032

Figure 205: South Asia & Pacific Market Value Share (%) and BPS Analysis by Middle East and Africa Surfing Direction, 2022 to 2032

Figure 206: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Middle East and Africa surfing Direction, 2022 to 2032

Figure 207: South Asia & Pacific Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 208: South Asia & Pacific Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 209: South Asia & Pacific Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 210: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 211: South Asia & Pacific Market Attractiveness by Product Type, 2022 to 2032

Figure 212: South Asia & Pacific Market Attractiveness by Axis Type, 2022 to 2032

Figure 213: South Asia & Pacific Market Attractiveness by Modularity, 2022 to 2032

Figure 214: South Asia & Pacific Market Attractiveness by Middle East and Africa Surfing Direction, 2022 to 2032

Figure 215: South Asia & Pacific Market Attractiveness by Application, 2022 to 2032

Figure 216: South Asia & Pacific Market Attractiveness by Country, 2022 to 2032

Figure 217: Middle East and Africa Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 218: Middle East and Africa Market Value (US$ Million) by Axis Type, 2022 to 2032

Figure 219: Middle East and Africa Market Value (US$ Million) by Modularity, 2022 to 2032

Figure 220: Middle East and Africa Market Value (US$ Million) by Middle East and Africa Surfing Direction, 2022 to 2032

Figure 221: Middle East and Africa Market Value (US$ Million) by Application, 2022 to 2032

Figure 222: Middle East and Africa Market Value (US$ Million) by Country, 2022 to 2032

Figure 223: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 224: Middle East and Africa Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 225: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 226: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 227: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 228: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 229: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 230: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 231: Middle East and Africa Market Value (US$ Million) Analysis by Axis Type, 2017 to 2032

Figure 232: Middle East and Africa Market Volume (Units) Analysis by Axis Type, 2017 to 2032

Figure 233: Middle East and Africa Market Value Share (%) and BPS Analysis by Axis Type, 2022 to 2032

Figure 234: Middle East and Africa Market Y-o-Y Growth (%) Projections by Axis Type, 2022 to 2032

Figure 235: Middle East and Africa Market Value (US$ Million) Analysis by Modularity, 2017 to 2032

Figure 236: Middle East and Africa Market Volume (Units) Analysis by Modularity, 2017 to 2032

Figure 237: Middle East and Africa Market Value Share (%) and BPS Analysis by Modularity, 2022 to 2032

Figure 238: Middle East and Africa Market Y-o-Y Growth (%) Projections by Modularity, 2022 to 2032

Figure 239: Middle East and Africa Market Value (US$ Million) Analysis by Middle East and Africa Surfing Direction, 2017 to 2032

Figure 240: Middle East and Africa Market Volume (Units) Analysis by Middle East and Africa Surfing Direction, 2017 to 2032

Figure 241: Middle East and Africa Market Value Share (%) and BPS Analysis by Middle East and Africa Surfing Direction, 2022 to 2032

Figure 242: Middle East and Africa Market Y-o-Y Growth (%) Projections by Middle East and Africa surfing Direction, 2022 to 2032

Figure 243: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 244: Middle East and Africa Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 245: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 246: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 247: Middle East and Africa Market Attractiveness by Product Type, 2022 to 2032

Figure 248: Middle East and Africa Market Attractiveness by Axis Type, 2022 to 2032

Figure 249: Middle East and Africa Market Attractiveness by Modularity, 2022 to 2032

Figure 250: Middle East and Africa Market Attractiveness by Middle East and Africa Surfing Direction, 2022 to 2032

Figure 251: Middle East and Africa Market Attractiveness by Application, 2022 to 2032

Figure 252: Middle East and Africa Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Degaussing System Market Growth – Trends & Forecast 2024-2034

Metering Pump Market Size and Share Forecast Outlook 2025 to 2035

Metered Dose Squeeze Dispenser Market Size and Share Forecast Outlook 2025 to 2035

The Metered Dose Inhalers Market is Segmented by Type, and End User from 2025 to 2035

Cemetery Software Market Size and Share Forecast Outlook 2025 to 2035

Ammeters Market Size and Share Forecast Outlook 2025 to 2035

Diameter Signaling Market Size and Share Forecast Outlook 2025 to 2035

Odometer Market Trends – Growth & Forecast 2025 to 2035

pH Meter Market Growth – Trends & Forecast 2019-2027

Bolometer Market Size and Share Forecast Outlook 2025 to 2035

Barometer Market Size and Share Forecast Outlook 2025 to 2035

Ohm Meter Market Size and Share Forecast Outlook 2025 to 2035

Durometer Market Size and Share Forecast Outlook 2025 to 2035

Ergometers Market Size and Share Forecast Outlook 2025 to 2035

Rheometers Market Size and Share Forecast Outlook 2025 to 2035

LCR Meters Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gas Meters Market Growth - Trends & Forecast 2025 to 2035

AI-Secured Perimeters – Advanced Intrusion Detection Solutions

Manometers Market

Pyrometer Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA