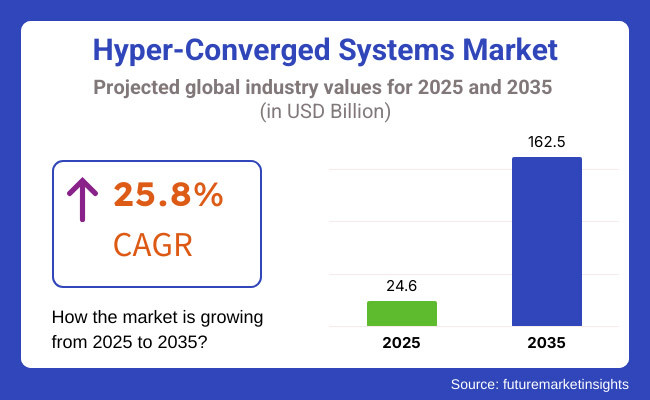

The hyper-converged systems market is expected to grow at a high rate between 2025 and 2035, based on the rising need for scalable and efficient IT infrastructure. It is anticipated that it will go from USD 24.6 billion in 2025 to USD 162.5 billion in 2035, with a CAGR of 25.8% during the forecast period. Hyper-converged infrastructure (HCI) has been adopted by businesses in numerous industries to transform their operation, improve data protection and management.

With a single, software-defined platform, hyper-converged infrastructure integrates software-defined computing, storage, and networking as a whole. Combining better performance with easier scalability than traditional IT architectures, hyper-converged systems enable themselves to support hybrid clouds, edge computing, and virtualized workloads.

HCI solutions are poised to become the foundation of the next generation of data centers, with less reliance on individual hardware components and centralized management. Companies are using hyper-converged infrastructure to maximize their IT resources, streamline operations, and standardize backend data management.

The industry's development prospects are reliant on a variety of factors. The promotion of cloud-native applications and widespread deployment of software-only based infrastructure is driving demand for HCI solutions. Cost-effective, high-performance, scale-out data center solutions are what companies are now looking for as HCI becomes the new thing as far as IT modernization goes.

The rapid growth in hybrid-cloud deployments and edge computing is providing a further impetus. Additionally, advances in automation facilities of hyper-converged systems are leading these also to advanced features as artificial intelligence (AI) or machine learning (ML) improve. This allows companies to excel at workload management and resource utilization. Although the HCI industry is growing rapidly, there are a number of challenges ahead. The large front–end costs related to introducing HCI solutions are a stumbling block for many small-business proprietors and corporate employees.

Additionally, the bottleneck for data workloads that are exponentially growing presents scalability limitations in some HCI architectures. Integration difficulties with existing IT infrastructures and possible vendor lock-in issues act to discourage broad adoption. Software-defined environments and cloud data storage security threats are also some of the greatest challenges that organizations adopting hyper-converged systems face.

Besides introducing HCI solutions, they are accompanied by strict demand management and regular maintenance. Several future trends and opportunities are expected.

The growing emphasis on AI-powered automation and predictive analysis will enhance the performance and efficiency of HCI. Edge computing is also driving the demand for small-scale, scalable HCI solutions that can provide real-time data processing.

The combination of containerized workloads with Kubernetes-orchestrated management improves the portability and manageability of cloud-native applications as well. Moreover, further expansion in 5G links looks set to dramatically raise the need for HCI infrastructure in distributed IT environments. As long as the IT industry is centered on agility, scalability, and low cost, there will be a continued growth in the years to come.

The IDaaS market is expanding rapidly as a result of the increasing incidences of cyber threats, the gradual uptake of cloud-based solutions, and the stringent regulatory demands. The providers of the service to, first and foremost, enhance security, target on multi-factor authentication (MFA), single sign-on (SSO) and adaptive authentication delivery. Enterprises pursue the easy-to-scale and affordable solution that blends in the current IT environment and identity management streamlining.

-market-players.jpg)

IT managers mainly maintain workforce and customer identities by means of automation, compliance and role-based access control (RBAC). Users are on demand for easy sign-in, high-level security, and trust in the privacy of their data when they are utilizing different applications on different devices.

The primary determinants of purchasing decisions include compliance with the global data protection laws (GDPR, CCPA), easy-to-installment, compatibility with third party apps, and the use of AI for the detection of threats. In the -a-zero-trust eroding environment, digital identities and the use of IDaaS to mitigate the risk of unauthorized access are gaining prompter necessity as organizations migrate to-cloud.

Contract & Deals Analysis – Identity as a Service (IDaaS) Market

| Company | Contract Value (USD Million) |

|---|---|

| Okta, Inc. | Approximately 110 - 120 |

| Microsoft Azure Active Directory (Entra ID) | Approximately 100 - 110 |

| Ping Identity | Approximately 90 - 100 |

| IBM Security Verify | Approximately 80 - 9 |

From 2020 to 2024, the industry experienced impressive growth rate as cloud computing was embraced and individuals began working from their homes. Secure authentication and multi-factor authentication (MFA) were at the forefront of organizations' lists to protect users' data. Regulatory compliance, such as GDPR and CCPA, also spurred IDaaS adoption, particularly for banking, healthcare, and government institutions.

However, integration problems with legacy infrastructure and third-party ownership of data were concerns for widespread adoption. From 2025 to 2035, there will be a continued expansion as AI-driven identity verification, decentralized Identity, and password-less authentication go mainstream. Self-sovereign identity (SSI) solutions will gain grip. Enhanced biometric authentication capabilities will improve the quality of security. Adaptive authentication and zero-trust security frameworks will gain traction among businesses, with ongoing identity verification to combat evolving cyber threats.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| AI-enhanced IDaaS solutions improved real-time identity verification, reducing identity fraud in banking, healthcare, and e-commerce. | AI-powered, self-learning identity platforms autonomously detect anomalies, dynamically adjust authentication levels, and provide biometric-based fraud prevention for ultra-secure transactions. |

| Organizations shifted to multi-factor authentication (MFA), including facial recognition, fingerprint scans, and behavioral biometrics. | AI-born IDaaS environments do away with passwords altogether, using continuous authentication, behavioral AI, and decentralized biometric identity frameworks for frictionless access control. |

| Companies experimented with blockchain-based identity solutions to provide users with greater control over their digital identities. | AI-enabled decentralized identity (DID) networks give users verifiable credentials, privacy-preserving authentication, and identity portability across metaverse and Web3 applications. |

| Organizations adopted zero-trust security frameworks, imposing stringent identity authentication for all users and devices. | AI-based, context-aware IDaaS solutions dynamically manage user permissions in real-time risk analysis, providing frictionless, adaptive access control in hybrid workspaces. |

| The expansion of interconnected devices grew the demand for identity management in IoT ecosystems. | IDaaS solutions with AI ensure real-time, decentralized identity authentication of IoT devices to secure smart cities, autonomous systems, and industrial edge networks. |

| Businesses adopted cloud-based IDaaS solutions to incorporate authentication across multi-cloud and hybrid environments. | AI-tuned, multi-cloud identity management orchestrates access policies on its own to ensure frictionless authentication across public, private, and edge computing platforms. |

| Companies tested digital avatars and virtual identity solutions for secure online authentication. | AI-infused, metaverse-native identity solutions offer decentralized, interoperable authentication, which allows real-time trust verification and fraud detection in immersive virtual environments. |

| Businesses favored energy-efficient authentication mechanisms to streamline cloud-based identity services. | AI-based, carbon-aware IDaaS solutions utilize blockchain-based energy-efficient authentication, cutting down on computation overhead while being ultra-secure for identity verification. |

The Identity-as-a-Service (IDaaS) market has a concern about the threat of cyber-attacks, regulatory non-compliance, technology failure, absence of competition, and customer adoption issues.

The greatest risk with security is that IDaaS solutions contain sensitive user credentials, multi-factor authentication (MFA), and access management. The risks, such as data breaches, identity fraud, and API vulnerabilities, can result in extensive financial and reputational losses. The key to mitigating these threats is the implementation of zero-trust security models, AI-powered fraud detection, and ongoing monitoring.

Technological disruptive phones such as biometric authentication, decentralized identity (blockchain-based identity management), and AI-powered identity verification pose a threat to traditional IDaaS models. Continuous innovation will be a prerequisite for the providers to back up the latest authentication methods and incorporate changes in the IT ecosystem

The competitive pressure by established brands such as Okta, Microsoft Azure AD, IBM Security Verify, and Google Cloud Identity has led to the lowering of product prices and the search for other differentiating features. New players must present large-scale, feature-rich, and cheap solutions in order to be able to obtain a percent share in the industry.

Customer adoption problems are wreaking havoc as firms are changing the environment from on-perm identity management (IAM) to cloud-based IDaaS. Fear of integration complexity, data migration, and vendor lock-in can decelerate acceptance. Utilizing hybrid IAM solutions, API-driven integrations, and creating better user experiences would indirectly boost the adoption rate.

Single Sign-On (SSO): Reducing Identity Management Complexity

Single Sign-On (SSO) technology revolutionizes identity management through convenient access to various applications with simple authentication. Organizations use SSO-sourced IDaaS solutions for easier convenience, security, and password-malady vulnerability eradication.

With increasing demand for SSO solutions, industries are implementing centralized authentication protocols for simplified access, automated compliance, and enhanced user experience. Companies invest in advanced SSO solutions to counter login convenience, protect against credential-based attacks, and offer secure access in digital spaces.

Public Cloud Deployment: Facilitating Scalable IDaaS Solutions

Public cloud Identity-as-a-Service (IDaaS) solutions revolutionize business security with elastic, cost-effective, install-and-go identity management. Companies increasingly use public cloud IDaaS to secure remote access, optimize operational effectiveness, and safeguard data.

With the popularity of cloud identity solutions, organizations use AI-powered automation, real-time protection against threats, and dynamic security controls. Organizations implement public cloud Identity to enhance cybersecurity, reduce compliance complexity, and enable secure authentication across global networks.

The United States Identity-as-a-Service (IDaaS) market is expanding rapidly, driven by increasing demand for secure authentication, identity governance, and cloud-based access management. The U.S. enterprise sector is leveraging IDaaS platforms to enhance cybersecurity, prevent data breaches, and comply with stringent regulatory requirements. With ongoing investments in AI-powered identity verification, zero-trust security frameworks, and multi-factor authentication (MFA), the demand for IDaaS solutions continues to grow. In 2024, the U.S. corporate and government sectors invested over USD 15 billion in cloud-based identity management solutions.

Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 10.8% |

China’s Identity-as-a-Service market is growing due to rapid advancements in digital identity solutions, increasing adoption of biometric authentication, and government-backed initiatives promoting data security and cyber resilience. As one of the world’s largest technology markets, China is witnessing a surge in demand for IDaaS solutions across financial services, e-commerce, and enterprise IT. The government’s focus on digital security and data sovereignty has further fueled market growth. In 2024, China invested USD 18 billion in AI-powered identity management and access control solutions.

Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 11.2% |

Germany’s Identity-as-a-Service market is accelerating due to its strong regulatory environment, increasing adoption of GDPR-compliant identity management solutions, and growing emphasis on secure enterprise authentication. As one of Europe’s leading IT hubs, Germany is investing in IDaaS for workforce identity verification, cloud security, and privileged access management. The country’s focus on secure, AI-driven identity governance has also driven adoption in businesses and public institutions.

Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 9.9% |

Japan’s Identity-as-a-Service market is expanding due to innovations in biometric authentication, increased adoption of AI-powered identity verification, and advancements in cloud-based identity security. The country’s technology sector is leveraging IDaaS platforms for secure workforce authentication, compliance management, and digital transformation. Japan’s leadership in AI-powered identity analytics and cyber resilience has accelerated adoption across industries.

Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.2% |

India's Identity-as-a-Service market is witnessing rapid growth, fueled by increasing investments in cloud security, rising demand for digital authentication solutions, and government-led initiatives promoting secure digital identity frameworks. With programs such as ‘Digital India’ and the expansion of AI-driven cybersecurity, India is experiencing high demand for IDaaS platforms in banking, e-commerce, and public services. The rise of domestic cybersecurity startups and government-driven biometric authentication projects is further driving market expansion.

Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 11.5% |

Australia’s Identity-as-a-Service market is steadily growing due to increasing investments in cybersecurity, digital identity management, and secure enterprise authentication solutions. Australian enterprises, including financial institutions, healthcare providers, and government agencies, are adopting IDaaS platforms for identity governance, fraud prevention, and compliance management. The country’s commitment to cloud-first security strategies and digital identity protection is driving demand for advanced IDaaS solutions.

Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Australia | 10.1% |

The IDaaS market is extremely competitive due to increasing cloud-based identity management, cybersecurity compliance, and frictionless authentication demands. IDaaS platforms allow companies to authenticate identities securely, control access, and minimize data breaches while providing scalability and cost-effectiveness.

Top tech vendors like Microsoft Azure AD, Okta Inc., and IBM Security Verify control the market through AI-based security, multi-cloud integration, and zero-trust models. Companies continuously work on conducting their research. They partner with other companies to strengthen their position in the industry.

As companies emphasize zero-trust security architectures, dynamic authentication, and identity governance, competition becomes sharper. Vendors differentiate based on AI, biometric authentication, and risk-based access controls to meet evolving enterprise security needs.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Microsoft Azure AD | 20-25% |

| Okta Inc. | 15-20% |

| IBM Security Verify | 10-15% |

| Google Cloud Identity | 8-12% |

| Ping Identity | 5-10% |

| ForgeRock | 4-8% |

| Other Companies (combined) | 30-38% |

| Company Name | Key Offerings/Activities |

|---|---|

| Microsoft Azure AD | Cloud-based identity as well as access management that has zero-trust security integration. |

| Okta Inc. | AI-driven identity verification, multi-factor authentication, and workforce IAM solutions. |

| IBM Security Verify | Enterprise identity governance, AI-powered risk assessment, and seamless user authentication. |

| Google Cloud Identity | Cloud-native identity and access management with strong Google ecosystem integration. |

| Ping Identity | Secure single sign-on (SSO), adaptive authentication, and zero-trust security frameworks. |

| ForgeRock | Scalable digital identity solutions for enterprises, IoT, and customer IAM. |

Key Company Insights

Microsoft Azure AD (20-25%) – Microsoft has Azure Active Directory, offering enterprise-grade identity management, zero-trust architecture, and AI-powered security monitoring.

Okta Inc. (15-20%) – Expertise in cloud identity verification, multi-factor authentication, and adaptive access management for organizations from multiple industries.

IBM Security Verify (10-15%) – Risk-based authentication that uses AI to drive enterprise security.

Google Cloud Identity (8-12%) – Offers good identity and ability to manage access, utilizing AI-driven security and deep integration with Google Cloud services.

Ping Identity (5-10%) – Emphasizes secure single sign-on (SSO), adaptive authentication, and zero-trust security models to improve identity protection.

ForgeRock (4-8%) – Provides scalable identity solutions that are for enterprise applications, IoT ecosystems, and customer identity management.

Other Key Players (30-38% Combined)

The remaining share is distributed among various global and regional IDaaS technology providers, including:

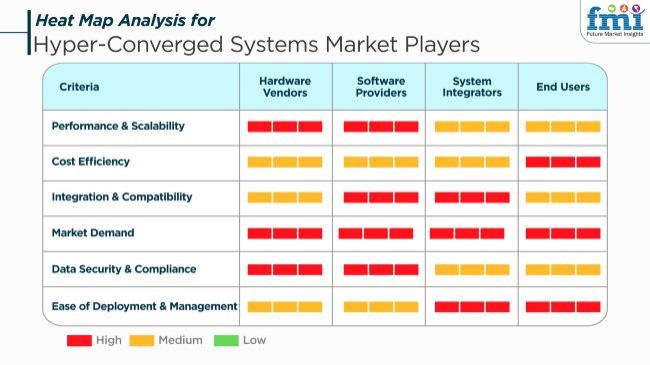

The growth of the hyper-converged systems industry is notable following the high demand for scalable software-defined infrastructure and cloud-based solutions. Hardware vendors prioritize the supply of systems characterized by high performance, energy efficiency, and small sizes, while software companies augment the features of virtualization, automation, and AI-driven management.

The system integrators of the software follow the priorities of seamless integration, security, and disaster recovery solutions to the public to the enterprise IT sector. The target for the end-users are companies and data centers that are looking for high-performance, easy-to-manage solutions that cut down costs for the IT division, simplify operations, and strengthen data security.

The main reasons for the purchasing decision include scalability, compatibility with existing IT infrastructure, security compliance, and operational efficiency. As companies are moving towards hybrid and multi-cloud infrastructures, we expect hyper-converged alternatives that include AI-driven automation, increased security, and simplified management to grow considerably in various sectors.

Contract & Deals Analysis

| Company | Contract/Development Details |

|---|---|

| Nutanix Inc. | Nutanix landed a multi-year deal with a top-tier financial institution to offer hyper-converged infrastructure (HCI) solutions, delivering greater data center agility and scalability. |

| Dell Technologies | Dell Technologies signed a deal with an international healthcare provider to implement hyper-converged infrastructure for high-performance, secure electronic medical records (EMR) storage and management. |

| Hewlett Packard Enterprise (HPE) | HPE broadened its portfolio of hyper-converged solutions by entering into a strategic alliance with a leading cloud services provider with a focus on hybrid cloud optimization and workload automation. |

| Cisco Systems | Cisco made an announcement of a partnership with a leading telecom operator to deploy hyper-converged infrastructure for edge computing and 5G network optimization. |

Between 2020 and 2024, the market for hyper-converged systems was growing gradually because organizations wanted scalable, software-defined infrastructure. The trend was driven by HCI adoption through the availability of simpler IT management, cost reduction, and flexibility in the workload. Banking, healthcare, and retail sectors have recently adopted hyper-converged infrastructure (HCI) mainly for cloud deployment and virtual desktop infrastructure (VDI). However, high initial investment and the issue of interoperability with legacy applications hampered the emergence of some other areas.

Vendors have responded by enhancing the flexibility and scalability of initial offerings by using automation, artificial intelligence-based workload optimization, and hybrid cloud adoption. This has made the industry to grow again between the years of 2025 and 2035 as multi-cloud architecture based on hybrid AI and edge computing revolutionizes the requirements for IT infrastructure. More specifically, the growing spread of network 5G and the reach of IoT will lead sites to have high-performance computing distributed components.

HCI will thus be the main enabler of fluid edge-to-core connectivity. In the same way, that would create a need for energy-efficient, environmentally-sensitive hyper-converged products leveraging advanced cooling methods and greener hardware design to reduce carbon outputs from data centers in customers' constraints.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Companies embraced hyper-converged infrastructure (HCI) to meet changing data protection regulations (GDPR, CCPA) and data sovereignty needs. | AI-powered compliance automation in HCI provides real-time regulatory compliance, facilitating secure, decentralized data management and sovereign cloud deployment. |

| AI-powered HCI solutions optimized workload allocation, making easy scaling of workloads in enterprise data centers. | AI-native hyper-converged infrastructure provides real-time adaptive computing for AI-powered edge workloads and autonomous applications with automated resource management. |

| Organizations deployed HCI to integrate private and public cloud infrastructures into a single pane of glass for simplified hybrid cloud management. | AI-powered, self-optimizing hyper-converged infrastructure provides real-time multi-cloud orchestration, ensuring intelligent workload migration, cost optimization, and security. |

| Companies transitioned from hardware-centric to software-defined hyper-converged infrastructure to increase scalability. | Software-defined HCI powered by AI dynamically adapts to workload demands, enabling self-healing infrastructure. |

| AI and deep learning applications drove demand for GPU-based hyper-converged solutions to improve computational performance. | AI-driven, FPGA and quantum-computing-enabled HCI accelerates next-generation AI model training, delivering high-performance computing (HPC) at an enterprise scale. |

| HCI usage expanded into remote and edge environments, allowing for industrial IoT (IIoT), retail, and 5G infrastructure. | AI-tuned, edge-native HCI solutions autonomously execute real-time analytics to support ultra-low latency workloads in smart cities, autonomous vehicles, and industrial automation. |

| Hyper-converged security architectures with encryption and AI-based anomaly detection were deployed by enterprises to resist cyber threats. | AI-based, self-learning HCI security solutions detect and neutralize cyber threats preemptively, based on quantum-resistant encryption and real-time threat intelligence. |

| Companies implemented combined HCI backup solutions to increase disaster recovery and business continuity planning. | AI-driven, self-healing disaster recovery systems in HCI automate backup optimization, enabling instant failover, data resiliency, and autonomous recovery from cyber incidents. |

| Businesses explored composable infrastructure within HCI to improve flexibility and hardware utilization. | AI-powered composable HCI dynamically reconfigures compute, storage, and network resources on demand, enabling fully autonomous, intent-based infrastructure management. |

Hyper-converged infrastructure (HCI) has many risks, which include technological obsolescence, cybersecurity vulnerabilities, integration difficulties, supply chain disruptions, and a high competition. Moving to cloud-native architectures, edge computing, and AI-driven automation technological obsolescence is a major concern for HCI providers. In a situation when HCI providers fail to compete with their rivals due to an old version of hardware and insufficient software-defined storage instead of the required hybrid cloud deployment support, they lose market shares.

HCI's reliance on virtualization, software-defined networking (SDN), and hybrid cloud environments makes it most often the target of cybersecurity attacks. Vulnerabilities in hypervisors, APIs, or orchestration tools can expose critical data to malicious attacks. Zero-trust security frameworks, which should be deployed along with real-time monitoring and encryption, are some of the tools that can help one reduce risk.

Integration becomes a challenging issue when HCI is introduced to legacy IT structures. Companies might hit a wall when relocating workloads,taking into account the need for it to be compatible with the already existing applications and to manage the hybrid infrastructure. The way to resolve this is for the vendors to integrate the software properly, automate the tasks without errors, and provide professional assistance.

Supply chain disruptions such as chip shortages, geopolitical tensions, and hardware dependencies are a matter of the past because companies have found ways to produce SSDs, GPUs, and processors that are crucial among others. Setting up diverse suppliers` networks and distributed factories will help manage this issue.

The competition is getting intense, as Dell EMC, Nutanix, HPE, VMware, and Cisco are increasing their HCI offerings. AI-driven load optimization, cloud-native capabilities, and increased scalability are the areas of the company that can be developed in order to stay competitive.

HCI is also becoming a game-changer in theVirtualization and VDI domain because it simplifies how we handle virtual desktops and applications. This sectoris projected to hold approximately 40% of the market share by 2025. The increasing use of working from home, cloud computing, and business continuity planning has driven the needfor Virtual Desktop Infrastructure (VDI).

Businesses use HCI-based VDI solutions to create seamless, high-performance, and secure virtualization environments. The major playersin virtualization who are shaping the space are Nutanix, VMware (Broadcom), Dell Technologies, and Microsoft, with offerings such as VMware Horizon, Nutanix AHV, Microsoft's Azure Stack HCI, etc., instrumental in increasing virtualization advantages.

As enterprises across the globe modernize their IT infrastructure, the Data CenterConsolidation segment is witnessing tremendous growth. We expect this segment to maintain around 60% of the industry share by 2025 as IT solutions becomescalable and cost-efficient. Hyper-converged infrastructure was developed to help organizations reduce their dependence on hardware, both to scaleout and to scale down, in a bid to avoid costly data center environments.

Transitioning to optimized legacy infrastructure, hyper-converged infrastructure (HCI), and infrastructure as aservice (IaaS) revolutionizes data analytics, with leading HCI solutions from HPE, Cisco, Lenovo, and Scale Computing such as HPE SimpliVity, Cisco HyperFlex, and Lenovo ThinkAgile HX.

The BFSI (Banking, Financial Services, and Insurance) sector of the economy has also been waking up to the concept of HCI and is working towardsharnessing its power to adapt to real-time data analytics, fraud detection, regulatory compliance, and transaction security.

This segment is expected to represent around 30% of the marketby 2025. Cloud-based banking,AI-driven risk management, and digital payment systems are among a host of services being adopted by financial institutions, which need secure, high-performance infrastructure to handle them all. Organizations like Dell Technologies, VMware, HPE,and IBM have started building industry-specific HCI solutions for the BFSI Industry, including PCI DSS and GDPR compliance, strong security, and performance for tragic banking workloads.

The government sector continues to be a major contributor, with a penetration of around 25-28% of the total industry by 2025. Across the globe, governments are now focusing their investmentson digital transformation, cyber security, e-governance, and smart city projects that all rely on advanced IT infrastructure. With HCI solutions in place, government agencies can securewhile adhering to national security regulations.

Top-class vendors such as Cisco,Nutanix, Microsoft, and Oracle have specialized HCI solutions catered to federal and public sector requirements. Some of the prominent solutions used in this segment include Cisco's defense-specific solutions,Nutanix's government-optimized HCI platforms, Microsoft Azure Stack HCI, and Oracle's hyper-converged database solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| The USA | 9.5% |

| China | 10.2% |

| Germany | 8.8% |

| Japan | 9.1% |

| India | 10.4% |

| Australia | 8.9% |

The USA industry for Hyper-Converged Systems is expanding with companies making continuous investments in scale-out IT infrastructure, cloud deployment, and economic data center solutions. The technology industry continues to adopt hyper-converged infrastructure (HCI) to optimize workload consolidation, simplify IT, and enhance disaster recovery.

With data management through artificial intelligence, hybrid cloud environments, and edge computing leading the trend, companies and government agencies have made significant investments. Private and USA government spend over USD 15 billion in 2024 on hyper-converged infrastructure development. FMI predicts the USAto expand at 9.5% CAGR during the forecast period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Accelerating adoption of enterprise cloud and hybrid IT approaches | Organizations adopt HCI to attain elastic and agile cloud architectures. |

| Improvements in AI-Driven data management and automation | AI platforms enhance workload deployment, performance analysis, and resource utilization. |

| Higher adoption in government, healthcare, and financial services | HCI offerings boost security, compliance, and business efficiency in mission-critical sectors. |

China is expanding with the most recent trends in data center transformation, extensive use of hybrid cloud, and state-led digital transformation initiatives. Among the world's biggest cloud computing markets, China also witnesses rising business for hyper-converged systems in enterprise IT, e-commerce, and AI-based data analytics. Government emphasis on indigenous technology strength and cybersecurity is also driving market growth.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Government support for cloud-first and digital transformation strategies | Policies facilitate data center consolidation and secure adoption of cloud computing. |

| Growth of big data processing and AI in corporate IT | Greater adoption of hyper-converged solutions to support business intelligence and AI-based analytics. |

| Increased need for scalable and secure IT Infrastructure | Adoption of HCI across telecommunication, manufacturing, and banking sectors improves the efficiency of operations. |

The German hyper-converged systems market is accelerating as companies significantly focus on edge computing, IT automation, and GDPR-compliant data processing. As one of the major technology hubs of Europe, Germany is embracing HCI solutions for security and real-time data analysis. Industry 4.0 has created the highest demand for hyper-converged systems to implement intelligent manufacturing and digital supply chain management in Germany. FMI estimates that the German market will grow at 8.8% CAGR during the forecast period.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| Strong business and industry IT adoption | German companies use HCI to enhance automation, data protection, and digital operations. |

| Growing need for compliance-friendly and secure data storage solutions | HCI enables organizations to meet regulatory needs and cloud security solutions. |

| Enhancements in AI-Powered IT Infrastructure Management | Companies are adopting AI-driven HCI to fuel predictive insights and workload optimization. |

Japan's hyper-converged systems market is expanding with higher high-performance computing, AI data centers, and IT infrastructure automation, fuelling adoption expansion. HCI is applied in the technology sector to manage cloud-native applications, real-time analytics, and IT optimization through artificial intelligence. Japan's knowledge in networking and semiconductor technology also fuels increased adoption across industries.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| AI in IT Operations and Edge Computing | Japan leads with AI-driven HCI solutions for managing real-time data processing. |

| Smart manufacturing and digital transformation growth | Automotive and industrial verticals are driving requirements for automated IT environments. |

| Cloud-native and hybrid IT infrastructure development | Firms deploy HCI to enable easy cloud integration and workload mobility. |

India's hyper-converged systems market is growing robustly as expenditure in cloud computing, cost-effective IT solutions, and digital infrastructure initiatives is increasing. Government policies such as 'Digital India' and the proliferation of AI-powered enterprise IT have increased demand for hyper-converged solutions across healthcare, banking, and smart cities. Cloud service providers and local data centers also fuel market growth. In 2024, India invested USD 12 billion in HCI and cloud infrastructure. FMI estimates the Indian market to attain a growth rate of 10.4% CAGR during the forecast period.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Government Programs on Cloud Adoption and Digital Infrastructure | Policies drive IT modernization and hyper-converged deployments. |

| BFSI and healthcare IT infrastructure development | Increasing adoption of HCI for secure financial transactions and AI-based diagnostics. |

| Increased demand for low-cost, scalable IT Solutions | Startups and businesses embrace AI-based hyper-converged platforms. |

Australia's hyper-converged systems market grows as enterprises double down infrastructure spending in cloud, security, and AI-driven automated IT. Healthcare organizations, banks, and governments leverage HCI platforms to ensure maximum workload consolidation, disaster recovery, and instant analytics. Increased digitalization and secure utilization of the cloud drive the digital economy and IT transformation alignment across Australia.

Growth Factors in Australia

| Key Drivers | Details |

|---|---|

| Government alignment of digital economy and IT transformation | Policies also encourage safe, scalable IT platforms. |

| Escalation in AI-focused IT Operations and cloud management | Businesses use AI-based automation for cloud planning. |

| Increased usage of edge computing and decentralized IT Platforms | HCI usage maximizes low-latency information processing and far-end IT control. |

The hyper-converged systems market is growing at a fast rate, as the demand for simplified IT infrastructure, easy-to-manage platforms, and economical data center offerings increases. Hyper-converged infrastructure (HCI) solutions are being adopted across industries by organizations to integrate computing, storage, and networking functions, enhancing scalability and operational efficiency. As enterprises are adopting cloud-native applications and hybrid cloud environments, hyper-converged infrastructure gives infrastructure management a software-defined methodology.

There are some vendors like Dell Technologies, Nutanix Inc., and Hewlett Packard Enterprise (HPE) who are taking full advantage of this. They are providing AI-powered workload optimization, multi-cloud support, and in-built security frameworks. The competitive dynamics are also influenced by something new constantly coming up in software-defined storage (SDS) and virtualization technologies.

Firms are making themselves different from other players. For this, they focus mainly on scalability, AI-driven performance boosts, and easy integration with current IT environments. With businesses expecting greater efficiency, lower total cost of ownership (TCO), and deployment flexibility, vendors are ramping up investments in R&D, strategic alliances, and international expansion to solidify their position in dynamic market.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Dell Technologies | 20-25% |

| Nutanix Inc. | 15-20% |

| Hewlett Packard Enterprise (HPE) | 10-15% |

| Cisco Systems | 8-12% |

| VMware Inc. | 5-10% |

| Lenovo Group | 4-8% |

| Other Companies (combined) | 30-38% |

| Company Name | Key Offerings/Activities |

|---|---|

| Dell Technologies | VxRail and VxFlex hyper-converged infrastructure solutions with AI-driven optimization. |

| Nutanix Inc. | Software-defined HCI solutions for multi-cloud environments and enterprise scalability. |

| Hewlett Packard Enterprise (HPE) | SimpliVity HCI solutions, AI-based workload optimization, and integrated security. |

| Cisco Systems | HyperFlex solutions with better automation. |

| VMware Inc. | vSAN-based hyper-converged solutions for private and hybrid cloud deployments. |

| Lenovo Group | ThinkAgile HCI solutions designed for enterprise workloads and cloud-native applications. |

Key Company Insights

Dell Technologies (20-25%) – Dell Technologies offers VxRail and VxFlex offerings, providing AI-powered optimization and seamless scale for enterprise IT environments.

Nutanix Inc. (15-20%) – Nutanix is a software-defined hyper-converged infrastructure (HCI) expert, allowing enterprises to effectively manage multi-cloud environments.

Hewlett Packard Enterprise (HPE) (10-15%) – HPE works mainly on SimpliVity HCI offerings. It uses AI-driven workload management and security integration to perform at an optimal level.

Cisco Systems (8-12%) – Cisco offers HyperFlex solutions, combining software-defined networking (SDN) and automation to simplify data center management.

VMware Inc. (5-10%) – VMware provides vSAN-based hyper-converged infrastructure. The deployment in private and hybrid clouds is very flexible.

Lenovo Group (4-8%) – Lenovo offers ThinkAgile HCI solutions, intended for enterprise scale, cloud-native applications, and performance optimization.

Other Key Players (30-38% Combined) – The remaining market share is distributed among various global and regional hyper-converged system providers, including:

By component, the market is segmented into hyper-converged infrastructure appliances, server virtualization software, and services.

By enterprise size, the market is segmented into hyper-converged systems for large enterprises and hyper-converged systems for SMEs.

By application, the market is segmented into virtualization and VDI, data center consolidation, remote offices/branch offices (ROBO), backup and DR, and others.

By industry, the market is segmented into BFSI, government, IT and telecom, healthcare, energy and utilities, manufacturing, and others.

By region, the market is segmented into North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa (MEA).

The industry is slated to reach USD 24.6 billion in 2025.

The industry is predicted to reach USD 162.5 billion by 2035.

India, slated to grow at a CAGR of 10.4% during the forecast period, is poised for the fastest growth.

Some of the major key players include Dell Technologies, Nutanix Inc., Hewlett Packard Enterprise (HPE), and Cisco Systems.

AI-powered hyper-converged systems are being widely used.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 18: Europe Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 21: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 23: South Asia Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 24: South Asia Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 25: South Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 30: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 31: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Oceania Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 33: Oceania Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 34: Oceania Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 35: Oceania Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 36: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: MEA Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 38: MEA Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 39: MEA Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 40: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Component, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Component, 2023 to 2033

Figure 22: Global Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 23: Global Market Attractiveness by Application , 2023 to 2033

Figure 24: Global Market Attractiveness by End User, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Component, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Application , 2023 to 2033

Figure 29: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 46: North America Market Attractiveness by Component, 2023 to 2033

Figure 47: North America Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 48: North America Market Attractiveness by Application , 2023 to 2033

Figure 49: North America Market Attractiveness by End User, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Component, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Application , 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Component, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Application , 2023 to 2033

Figure 74: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 78: Europe Market Value (US$ Million) by Application , 2023 to 2033

Figure 79: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 80: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 85: Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 86: Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 87: Europe Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 88: Europe Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 89: Europe Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 90: Europe Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 93: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 94: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 95: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 96: Europe Market Attractiveness by Component, 2023 to 2033

Figure 97: Europe Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 98: Europe Market Attractiveness by Application , 2023 to 2033

Figure 99: Europe Market Attractiveness by End User, 2023 to 2033

Figure 100: Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 102: South Asia Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 103: South Asia Market Value (US$ Million) by Application , 2023 to 2033

Figure 104: South Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 105: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: South Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 110: South Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 111: South Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 112: South Asia Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 113: South Asia Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 114: South Asia Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 115: South Asia Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 116: South Asia Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 117: South Asia Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 118: South Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 119: South Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 120: South Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 121: South Asia Market Attractiveness by Component, 2023 to 2033

Figure 122: South Asia Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 123: South Asia Market Attractiveness by Application , 2023 to 2033

Figure 124: South Asia Market Attractiveness by End User, 2023 to 2033

Figure 125: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 127: East Asia Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) by Application , 2023 to 2033

Figure 129: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 130: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 137: East Asia Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 138: East Asia Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 139: East Asia Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 140: East Asia Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 141: East Asia Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 142: East Asia Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 143: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Component, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 148: East Asia Market Attractiveness by Application , 2023 to 2033

Figure 149: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: Oceania Market Value (US$ Million) by Component, 2023 to 2033

Figure 152: Oceania Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) by Application , 2023 to 2033

Figure 154: Oceania Market Value (US$ Million) by End User, 2023 to 2033

Figure 155: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: Oceania Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 160: Oceania Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 161: Oceania Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 162: Oceania Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 165: Oceania Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 166: Oceania Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 167: Oceania Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 168: Oceania Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 169: Oceania Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 170: Oceania Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 171: Oceania Market Attractiveness by Component, 2023 to 2033

Figure 172: Oceania Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 173: Oceania Market Attractiveness by Application , 2023 to 2033

Figure 174: Oceania Market Attractiveness by End User, 2023 to 2033

Figure 175: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 176: MEA Market Value (US$ Million) by Component, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 178: MEA Market Value (US$ Million) by Application , 2023 to 2033

Figure 179: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 180: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: MEA Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 185: MEA Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 186: MEA Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 187: MEA Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 188: MEA Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 189: MEA Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 190: MEA Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 191: MEA Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 192: MEA Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 193: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 194: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 195: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 196: MEA Market Attractiveness by Component, 2023 to 2033

Figure 197: MEA Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 198: MEA Market Attractiveness by Application , 2023 to 2033

Figure 199: MEA Market Attractiveness by End User, 2023 to 2033

Figure 200: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Hi-Fi Systems Market Size and Share Forecast Outlook 2025 to 2035

Cough systems Market

Backpack Systems Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Systems Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Catheter Systems Market

Reporter Systems Market

Aerostat Systems Market

Cryogenic Systems Market Size and Share Forecast Outlook 2025 to 2035

Air Brake Systems Market Growth & Demand 2025 to 2035

Metrology Systems Market

Fluid Bed Systems Market

Cognitive Systems Spending Market Report – Growth & Forecast 2016-2026

Nurse Call Systems Market Insights - Size, Share & Forecast 2025 to 2035

Excitation Systems Market Analysis – Growth, Demand & Forecast 2025 to 2035

Fire Alarm Systems Market by Solution by Application & Region Forecast till 2035

Ultrasound Systems Market Growth – Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA