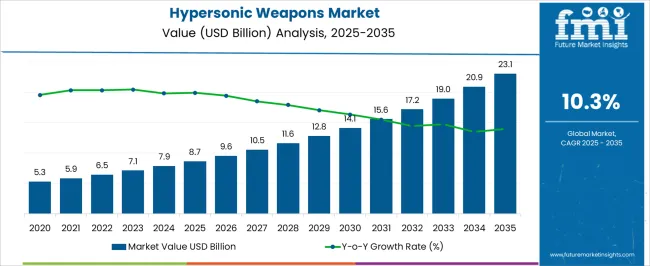

The global hypersonic weapons market is projected to reach USD 8.7 billion in 2025 and is anticipated to climb to USD 23.1 billion by 2035, registering a CAGR of 10.3% during this period. The year-on-year (YoY) growth trajectory reveals a consistent upward pattern, with the market expected to expand from USD 5.3 billion to USD 5.9 billion in the first phase, marking a YoY rise of around 11.3%. This pace is set to continue as the market moves to USD 6.5 billion and USD 7.1 billion in the following years, reflecting YoY growth rates of nearly 10.2% and 9.2% respectively.

As the industry advances to USD 7.9 billion and USD 8.7 billion, the growth momentum strengthens, indicating YoY gains of about 11% each year. Progressing further, the jump from USD 9.6 billion to USD 10.5 billion shows an increase of 9.4%, while the leap from USD 10.5 billion to USD 11.6 billion stands at 10.5%. The mid-phase years witness a significant acceleration, with USD 12.8 billion to USD 14.1 billion growing by 10.2%, and USD 14.1 billion to USD 15.6 billion marking a 10.6% jump.

The later stage maintains this trajectory, with the market expected to rise from USD 15.6 billion to USD 17.2 billion (10.2% YoY), then USD 17.2 billion to USD 19.0 billion (10.5%), USD 19.0 billion to USD 20.9 billion (10%), and finally USD 20.9 billion to USD 23.1 billion (10.5%). This steady acceleration underscores the heightened defense spending, strategic national security initiatives, and intensified R&D programs driving demand for hypersonic weapon systems, positioning the market on a strong growth curve throughout the forecast period.

| Metric | Value |

|---|---|

| Hypersonic Weapons Market Estimated Value in (2025 E) | USD 8.7 billion |

| Hypersonic Weapons Market Forecast Value in (2035 F) | USD 23.1 billion |

| Forecast CAGR (2025 to 2035) | 10.3% |

The hypersonic weapons market is closely influenced by five interconnected parent markets that collectively drive its adoption and long-term expansion. The largest contributor is the defense and strategic missile systems market, which accounts for about 40% share, as hypersonic weapons are primarily developed to enhance national defense capabilities, enable rapid global strike potential, and counter evolving missile defense systems. The aerospace and advanced propulsion systems sector contributes around 25%, as hypersonic weapon development relies heavily on cutting-edge propulsion technologies, high-temperature materials, and aerothermal research originating from aerospace programs. The military research and development market holds close to 15% influence, supported by increasing government investments in classified programs, prototype testing, and collaborative defense research initiatives aimed at achieving speed, maneuverability, and survivability.

The space and high-altitude technology market adds nearly 12%, as shared advancements in re-entry vehicles, thermal shielding, and guidance systems have directly benefited the performance of hypersonic platforms. The precision-guided munitions and advanced weaponry sector contributes close to 8%, as hypersonic systems are integrated into broader strategies focused on enhancing accuracy, lethality, and strike efficiency. The distribution of market influence shows that defense and aerospace domains form the backbone of this market’s trajectory, while specialized R&D and cross-sector technological exchanges sustain its pace of innovation and competitive edge.

The hypersonic weapons market is undergoing rapid development, driven by rising geopolitical tensions, increasing defense budgets, and technological advancements in aerospace and propulsion systems. The ability of hypersonic weapons to travel at speeds exceeding Mach 5 while maintaining high maneuverability makes them a strategic priority for military modernization programs worldwide.

Leading nations are intensifying investments in hypersonic research and deployment as part of deterrence strategies, emphasizing the need for superior speed, precision, and penetration capabilities against advanced air defense systems. The future outlook remains strong as defense contractors collaborate with government agencies to accelerate testing and integration across various military platforms.

Continued innovation in thermal protection systems, guidance technology, and launch integration is expected to reinforce market expansion. The market's growth is further supported by shifting global security dynamics and the urgency to counter emerging threats with next-generation strike capabilities.

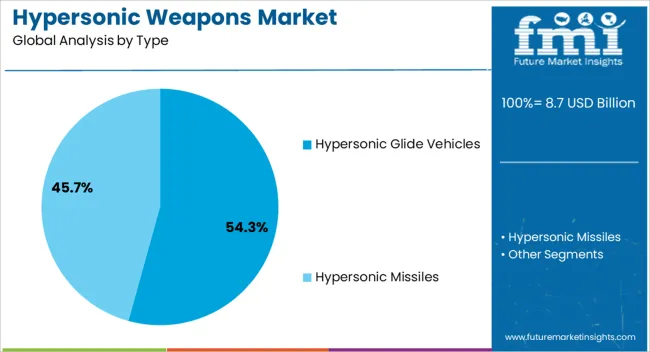

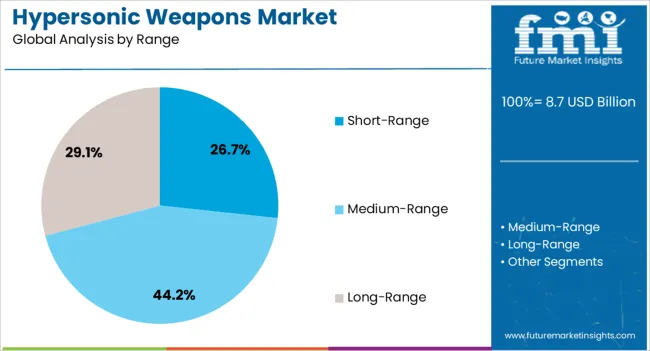

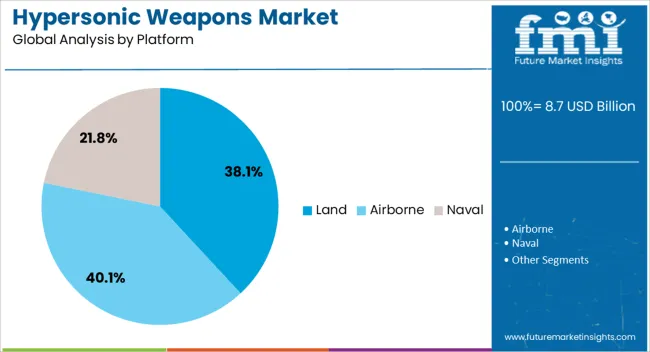

The hypersonic weapons market is segmented by type, range, platform, and geographic regions. By type, hypersonic weapons market is divided into Hypersonic Glide Vehicles and Hypersonic Missiles. In terms of range, hypersonic weapons market is classified into Short-Range, Medium-Range, and Long-Range. Based on platform, hypersonic weapons market is segmented into Land, Airborne, and Naval. Regionally, the hypersonic weapons industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hypersonic glide vehicles segment accounts for a commanding 54% share within the type category, establishing its dominance due to its strategic advantages in speed, stealth, and trajectory unpredictability. These systems are designed to be launched atop ballistic missiles and then glide through the atmosphere at hypersonic speeds, allowing them to evade traditional radar detection and missile defense systems.

Their ability to adjust flight paths mid-course makes them particularly effective for precision strikes in contested environments. Development efforts in this segment have gained significant momentum, with multiple programs being pursued simultaneously by major defense powers.

Investments in advanced materials and navigation systems are accelerating the operational readiness of these platforms. As global militaries seek asymmetric capabilities that can deliver rapid and decisive results, the demand for hypersonic glide vehicles is expected to intensify, solidifying their role as a cornerstone in future defense arsenals.

The short-range segment leads the range category with a 27% market share, reflecting its strategic utility for regional deterrence and tactical operations. These systems offer quicker deployment and reduced time-to-target, making them ideal for high-intensity conflict scenarios and defensive posturing in sensitive border areas.

The development of short-range hypersonic weapons is often prioritized due to lower complexity and faster integration timelines compared to long-range counterparts. Nations are increasingly focused on deploying these weapons for theater-level engagements where rapid response and mobility are critical.

Additionally, the relatively compact design of short-range systems supports easier integration with existing military infrastructure. As emphasis on fast-strike capabilities and close-range superiority grows, the short-range segment is expected to maintain a key role in national defense strategies and operational planning.

The land segment dominates the platform category with a 38% market share, attributed to the operational flexibility and deployment ease it offers for hypersonic weapon systems. Land-based platforms allow for rapid deployment, easier maintenance, and greater integration with command-and-control networks, making them a preferred choice for military planners.

The ability to position and reposition launchers within strategic regions enhances deterrence and allows for dynamic response strategies. Development programs around mobile land-based launch systems are expanding, with emphasis on survivability, rapid launch capability, and logistical efficiency.

Moreover, land platforms reduce reliance on air and naval assets, enabling distributed and autonomous operational capabilities. As military doctrines evolve to prioritize versatility and responsiveness, the land segment is expected to remain central to hypersonic weapons deployment strategies.

The hypersonic weapons market is being shaped by four main dynamics: rising defense budgets, strategic partnerships, material and propulsion enhancements, and evolving security doctrines. Countries are investing heavily to gain a competitive advantage in this domain, while defense firms are forming alliances to pool resources and reduce risk. Progress in materials and propulsion is enabling faster, longer-range systems with improved survivability. Changing security perceptions are pushing nations to prioritize hypersonic weaponry in military strategies. These factors together are accelerating market growth, encouraging innovation, and reshaping global defense priorities as countries strive to maintain strategic superiority.

Global defense budgets have been rising as nations seek to strengthen their military capabilities. Many countries have prioritized the development and acquisition of Hypersonic Weapons to enhance their deterrence strategies. Geopolitical tensions have prompted governments to allocate substantial funding toward research, testing, and deployment of these systems. Defense departments are forming long-term programs to ensure steady progress in hypersonic projects. This trend has created opportunities for defense contractors to secure multi-year contracts. Such large-scale funding commitments indicate that the market is likely to experience consistent growth, as more nations race to establish advanced strike capabilities and maintain a competitive edge over potential adversaries.

Defense companies are increasingly collaborating with government agencies to accelerate hypersonic weapon development. Joint ventures and strategic alliances allow firms to share resources, expertise, and infrastructure while reducing development costs and risks. Defense contractors often partner with aerospace firms, material suppliers, and propulsion specialists to create effective solutions. International collaborations between allied nations are also becoming common to fast-track weapon development and ensure compatibility within defense networks. These partnerships enhance innovation cycles and allow for faster transition from prototype to deployment stages. The cooperative approach is strengthening the global defense ecosystem, which fuels further investment and pushes more players to enter the hypersonic weapons market.

Continuous improvements in materials science and propulsion technologies are driving the effectiveness of hypersonic weapons. Lightweight composites, heat-resistant alloys, and advanced ceramics are being used to withstand the extreme thermal and aerodynamic stresses experienced at high speeds. Enhanced propulsion systems like scramjets and solid-fuel boosters are being integrated to achieve sustained hypersonic velocities. These technical improvements are increasing the operational range, speed, and maneuverability of the weapons, making them harder to detect and intercept. Such developments are making hypersonic weapons a preferred choice for strategic military applications. The drive to overcome engineering challenges has intensified competition among leading defense contractors and research institutions worldwide.

Changing threat landscapes are reshaping military doctrines and influencing procurement priorities. Nations perceive hypersonic weapons as vital to maintaining credible deterrence against emerging rivals. The ability of these weapons to penetrate missile defense systems has heightened their strategic value. Military planners are increasingly incorporating hypersonic strike options into operational strategies to ensure rapid response capabilities. This shift in security thinking has led to accelerated development timelines and prioritized funding allocations. Governments are revising defense policies to incorporate these capabilities, indicating their central role in future combat scenarios. The growing perception of hypersonic weapons as game-changing assets is reshaping global defense strategies and market dynamics.

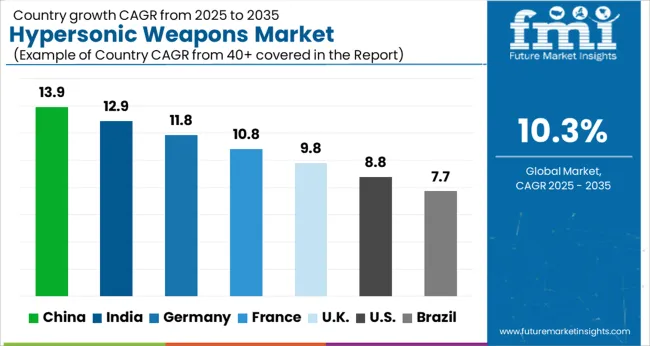

| Country | CAGR |

|---|---|

| China | 13.9% |

| India | 12.9% |

| Germany | 11.8% |

| France | 10.8% |

| UK | 9.8% |

| USA | 8.8% |

| Brazil | 7.7% |

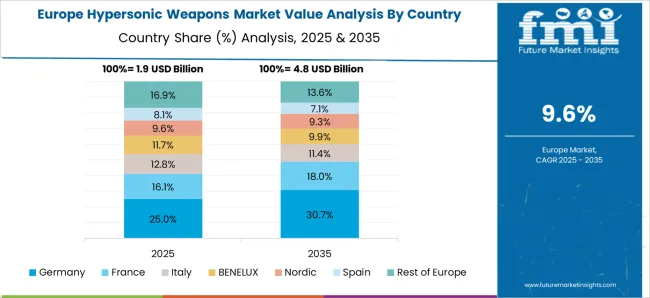

The global hypersonic weapons market is projected to grow at a CAGR of 10.3% between 2025 and 2035. China leads the expansion with an anticipated 13.9% CAGR, followed by India at 12.9% and Germany at 11.8%. France is expected to grow at 10.8%, while United Kingdom shows growth at 9.8%. United States follows with 8.8%, and Brazil at 7.7%. Growth is driven by intensive defense modernization programs, increased military budgets, and ongoing research into high-speed missile systems. Asian markets such as China and India are accelerating production through government-backed defense initiatives, while European countries like Germany, France, and the United Kingdom are focusing on collaborative development projects and advanced propulsion systems. The United States continues to expand efforts through extensive testing and integration of hypersonic technologies into existing defense frameworks. The analysis covers over 40 countries, with the leading markets detailed below.

The hypersonic weapons market in China is projected to grow at a CAGR of 13.9% between 2025 and 2035. Significant state funding and centralized procurement are driving rapid maturation of propulsion, guidance, and sensor subsystems that are required for routine operational deployment. Large-scale test ranges and dedicated flight test programs are being used to shorten the fielding cycle for boost glide and air-breathing hypersonic concepts. Supply chain specialization has been encouraged through targeted investment in high-temperature materials, precision manufacturing, and advanced avionics suppliers that support integrated weapons production. Operational concepts are being developed to embed hypersonic strike options within theater-level deterrence and anti-access strategies. Export controls and geopolitical posture are shaping partner selection and potential overseas sales, but a sizable domestic defense industrial base is being cultivated to support both production and iterative upgrades. Integration pathways with command-and-control networks are being prioritized so that survivable employment options can be enabled under contested electronic conditions.

The hypersonic weapons market in India is projected to grow at a CAGR of 12.9% between 2025 and 2035. Indigenous research organizations and government laboratories have been positioned to lead propulsion and guidance development while strategic partnerships with foreign suppliers are used to accelerate capability maturation. Programmatic emphasis has been placed on dual-path approaches that pursue both boost-glide and scramjet-enabled cruise concepts for flexible mission sets. Defense procurement cycles are being adapted to permit faster transition of laboratory prototypes into limited production runs so that operational feedback can be incorporated into subsequent blocks. Private sector aerospace firms and system integrators are being engaged more broadly to expand manufacturing capacity and to reduce single-vendor dependencies. Regional security dynamics have strengthened political support for accelerated timelines, which has driven incremental budget increases and prioritized test range expansion. Industrial cooperation with allied nations is being used to access niche subsystems while domestic suppliers are being conditioned to meet defense quality standards.

The hypersonic weapons market in Germany is projected to grow at a CAGR of 11.8% between 2025 and 2035. Development emphasis has been placed on technologies that enable integration with allied air and missile defense architectures while counter-hypersonic sensing and tracking capabilities are being financed in parallel. Collaborative programs with regional partners are being used to share R&D burden and to harmonize standards for propulsion and thermal protection subsystems. A strong supplier network in advanced materials and precision propulsion components is being leveraged to support both national programs and pan-European efforts. Industrial strategy has been oriented toward modular subsystems that can be integrated into existing launchers or airborne platforms so that procurement can be staged across multiple capability increments. Export licensing regimes and interoperability requirements are being navigated to enable cooperative deployments with partner forces.

The hypersonic weapons market in the UK is projected to grow at a CAGR of 9.8% between 2025 and 2035. Investment priorities have been set to ensure that emerging strike and interception options can be integrated within naval and air platforms that are central to national defense posture. Long-standing primes and specialized suppliers have been tasked with maturing scramjet flight demonstrators, high-speed guidance suites, and thermal protection technologies that are essential for operational reliability. Collaborative arrangements with allied partners have been used to access flight-test ranges and specialized telemetry support while domestic engineering teams focus on systems integration and mission planning. Procurement planning has been designed to permit iterative deliveries so that lessons from each test campaign inform subsequent blocks. Emphasis on survivable command-and-control links and hardened datalinks has been seen as necessary to enable effective employment in contested environments.

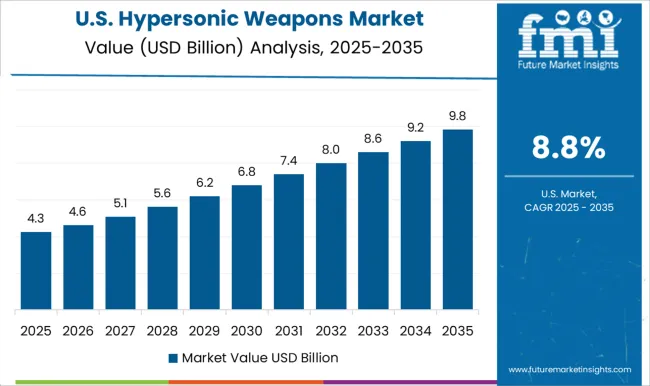

The hypersonic weapons market in the United States is projected to grow at a CAGR of 8.8% between 2025 and 2035. A broad defense research and acquisition enterprise is being mobilized to transition multiple hypersonic concepts into operational use while maintaining a parallel focus on defensive countermeasures. Large defense primes and a deep supplier base are supporting concurrent programs that span boost-glide vehicles, air-breathing cruise designs, and associated intercept capabilities. Funding has been allocated to expand flight-test cadence, telemetry capabilities, and representative test ranges that are needed to de-risk high-speed flight regimes. Acquisition pathways are being structured to permit rapid prototyping followed by block upgrades to incorporate lessons learned.

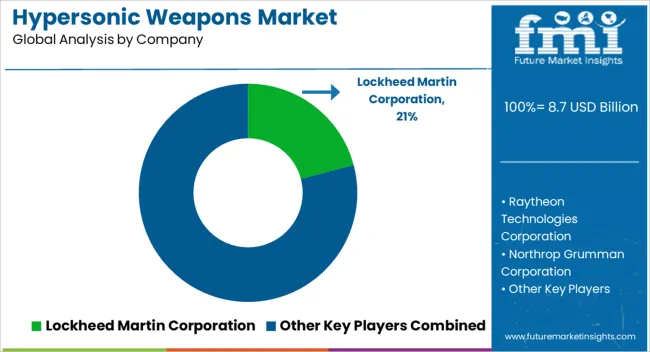

Competition in the hypersonic weapons market is shaped by propulsion capability, thermal management, guidance precision, and integration into existing strike platforms. Leadership is held by Lockheed Martin Corporation, which maintains long-running programs in both hypersonic glide vehicles and air-breathing cruise systems for the United States Department of Defense. Raytheon Technologies Corporation and Northrop Grumman Corporation dominate through their combined expertise in propulsion modules, thermal protection systems, and integration with missile defense architectures, while L3Harris Technologies and Leidos extend competition with secure systems engineering and mission software packages. Thales Group and BAE Systems contribute by leveraging advanced sensor technologies, avionics, and guidance control systems for European and allied defense contracts. Firms outside the defense sector in the provided list are unlikely to participate directly, as this market requires classified design facilities, secure manufacturing lines, and government contracting experience. Strategies revolve around flight test validation, scalable production, and integration with command-and-control infrastructure. Suppliers highlight features such as sustained Mach 5+ performance, precision strike accuracy, thermal shielding endurance, and compatibility with existing launch platforms. Prime contractors promote full-spectrum solutions from propulsion design to mission software, ensuring readiness for operational deployment. Partnerships with national defense agencies and allied procurement bodies are increasingly emphasized to secure long-term program funding.

Differentiation is achieved through demonstrating operational flight tests, fieldable prototypes, and the ability to scale production under export control compliance, which addresses both domestic procurement and allied defense demand. Product literature emphasizes range capability, strike accuracy, and platform adaptability. Technical documentation details parameters such as propulsion cycle efficiency, thermal protection performance, guidance precision under extreme velocities, and survivability against missile defense systems. Specialized formats, including boost-glide vehicles, scramjet-powered cruise missiles, and modular propulsion stages, are marketed for specific mission profiles. Companies also highlight compatibility with networked command systems and multi-domain operational doctrines to appeal to major defense agencies. Service offerings such as lifecycle maintenance, mission planning support, and software assurance packages are positioned as differentiators, enabling broader adoption across defense programs, allied forces, and strategic deterrence initiatives.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.7 Billion |

| Type | Hypersonic Glide Vehicles and Hypersonic Missiles |

| Range | Short-Range, Medium-Range, and Long-Range |

| Platform | Land, Airborne, and Naval |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lockheed Martin Corporation, Raytheon Technologies Corporation, Northrop Grumman Corporation, L3Harris Technologies, Leidos, Thales Group, and BAE Systems |

| Additional Attributes | Dollar sales, share, competitive landscape, government defense budgets, procurement trends, key contracts, technology adoption rates, export regulations, regional demand hotspots, pricing benchmarks. |

The global hypersonic weapons market is estimated to be valued at USD 8.7 billion in 2025.

The market size for the hypersonic weapons market is projected to reach USD 23.1 billion by 2035.

The hypersonic weapons market is expected to grow at a 10.3% CAGR between 2025 and 2035.

The key product types in hypersonic weapons market are hypersonic glide vehicles and hypersonic missiles.

In terms of range, short-range segment to command 26.7% share in the hypersonic weapons market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Automatic Weapons Market Size and Share Forecast Outlook 2025 to 2035

Anti Drone Weapons Market Size and Share Forecast Outlook 2025 to 2035

Electromagnetic Weapons Market Size and Share Forecast Outlook 2025 to 2035

Directed Energy Weapons Market Size and Share Forecast Outlook 2025 to 2035

Naval Based Remote Weapons Station Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA