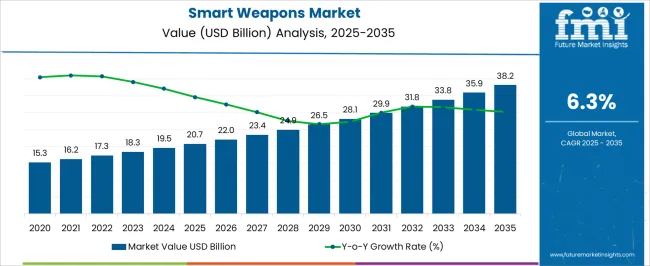

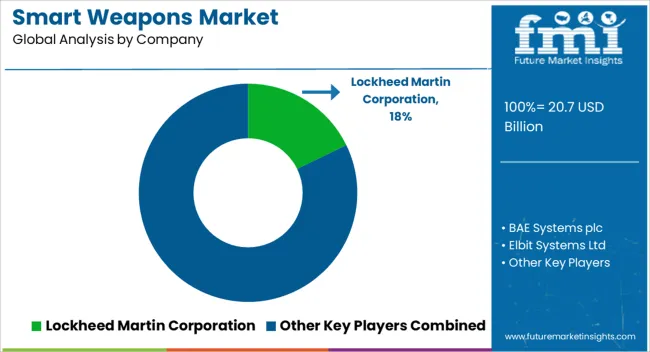

The smart weapons market is projected to expand from USD 20.7 billion in 2025 to USD 38.2 billion by 2035, advancing at a compound annual growth rate (CAGR) of 6.3%. Between 2025 and 2030, the market is expected to rise from USD 20.7 billion to USD 28.1 billion, following a clear and steady upward curve. This early phase of growth is being driven by rising investments in defense modernization programs and the adoption of precision-guided munitions across multiple regions.

The demand is particularly strong for missile systems, guided projectiles, and smart bombs designed to improve accuracy and reduce collateral impact. The curve indicates stability in expansion, shaped by strategic procurement cycles and long-term contracts in the defense sector. From 2030 to 2035, the smart weapons market is projected to continue its upward trajectory, increasing from USD 28.1 billion to USD 38.2 billion. The second half of the growth curve highlights sustained adoption of advanced targeting systems, electronic warfare tools, and smart artillery by both developed and emerging defense markets. The gradual slope of the curve signals balanced, predictable growth rather than volatile spikes, reflecting consistent demand for defense upgrades and global military readiness.

Opportunities are expected to intensify as nations prioritize strategic deterrence, interoperability, and enhanced battlefield performance. The curve shape demonstrates a reliable trajectory, showing how steady procurement patterns and rising defense budgets will support long-term growth opportunities for manufacturers and suppliers.

| Metric | Value |

|---|---|

| Smart Weapons Market Estimated Value in (2025 E) | USD 20.7 billion |

| Smart Weapons Market Forecast Value in (2035 F) | USD 38.2 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The smart weapons market represents a rapidly expanding segment across broader defense and security domains, with its share varying depending on the scope of each market. Within the defense and military equipment market, smart weapons account for about 12%, reflecting their rising importance as armed forces transition toward precision-based systems. In the precision-guided munitions market, their contribution is dominant at nearly 45%, since smart weapons form the backbone of guided missiles, bombs, and artillery shells used for targeted strikes.

Within the aerospace and defense electronics market, smart weapons represent close to 7%, as their reliance on advanced navigation, sensors, and control systems ties them to the broader electronics ecosystem. In the homeland security and strategic defense market, smart weapons contribute about 10%, given their growing use in counter-terrorism, border security, and anti-drone operations. Finally, within the global arms and ammunition market, smart weapons account for approximately 15%, highlighting their growing share compared to conventional unguided weapons.

These percentages show that smart weapons are highly influential within precision-focused and electronics-driven domains, while maintaining moderate shares in the wider defense and arms markets. Their strong presence in precision-guided munitions demonstrates their centrality to modern combat strategies, while their moderate footprint in broader defense equipment underscores both their specialization and the steady transition from traditional to smart weaponry across global military forces.

The smart weapons market is advancing rapidly, driven by growing defense modernization efforts, rising geopolitical tensions, and increasing investments in precision-guided systems. Governments across the globe are prioritizing next-generation weaponry that enables higher targeting accuracy and reduced collateral damage.

This shift is supported by advancements in electronics, guidance systems, and AI-based targeting algorithms. Furthermore, the increasing need for interoperability across land, air, and naval forces is pushing for the integration of smart weapons into multi-domain operations.

With rising defense budgets in both developed and emerging economies, procurement of smart munitions and advanced strike systems is expected to accelerate over the coming decade.

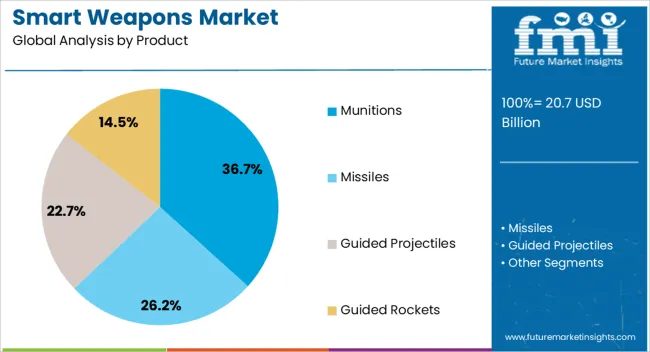

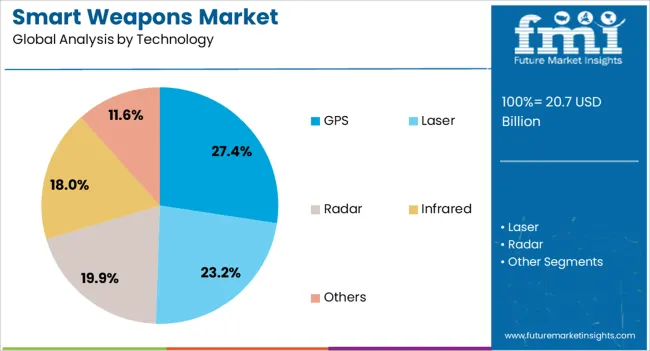

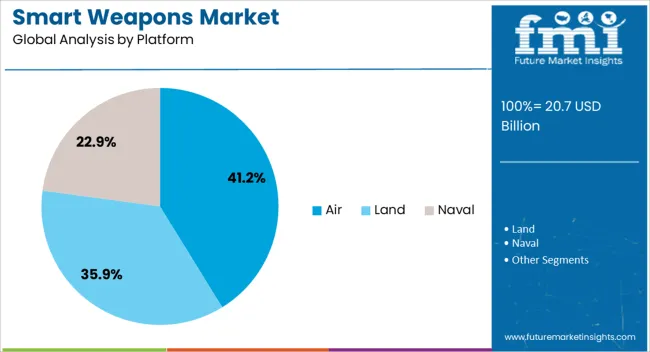

The smart weapons market is segmented by product, technology, platform, and geographic regions. By product, smart weapons market is divided into Munitions, Missiles, Guided Projectiles, Guided Rockets, and Precision Guided Firearms. In terms of technology, smart weapons market is classified into GPS, Laser, Radar, Infrared, and Others. Based on platform, smart weapons market is segmented into Air, Land, and Naval. Regionally, the smart weapons industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Munitions are projected to hold the dominant share of 36.70% in the smart weapons market by 2025. Their high share is driven by widespread deployment of precision-guided bombs, missiles, and artillery shells in active combat and deterrent operations.

Smart munitions reduce logistics burdens, minimize risks to ground forces, and improve mission success rates through exact target elimination. Their increasing use across both tactical and strategic scenarios makes them a central component in modernized arsenals.

Adoption is further supported by advancements in guidance technologies and modular payload configurations, which enhance lethality and adaptability in diverse terrains and threat environments.

GPS-based smart weapons are expected to capture 27.40% of the market by 2025, leading the technology segment. The dominance of GPS stems from its effectiveness in providing real-time, satellite-based precision guidance even in complex or denied environments.

Compared to older systems, GPS-enabled weapons offer improved strike accuracy, which is crucial for minimizing civilian impact and mission errors. Widespread GPS satellite availability and compatibility with various weapon platforms make it a preferred guidance method.

As more military strategies rely on coordinated and remote targeting, GPS-enabled systems are anticipated to remain the backbone of smart strike capabilities.

Air-based deployment is forecast to command 41.20% of the smart weapons market share in 2025, making it the leading platform segment. This leadership is due to the operational flexibility, extended range, and precision capabilities provided by air-launched systems such as smart missiles, guided bombs, and drones.

Air forces worldwide are prioritizing upgrades to their airborne strike capabilities, supported by stealth aircraft and unmanned systems. Smart weapons deployed from air platforms enable rapid response in conflict zones and strategic targeting with minimal exposure to risk.

With increasing investment in air superiority and force projection, this platform will continue to lead in smart weapon integrations.

The smart weapons market is expanding as defense agencies prioritize precision-guided systems to enhance tactical efficiency and strategic deterrence. Opportunities are rising in military modernization programs and joint ventures, while trends emphasize integration with network-centric and unmanned platforms. Challenges persist in high costs, export regulations, and countermeasure threats. In my opinion, long-term competitiveness will favor defense contractors that deliver cost-effective, adaptable, and compliant smart weapons, enabling them to remain essential assets in both conventional and asymmetric warfare strategies worldwide.

Demand for smart weapons has been reinforced by the global focus on precision warfare, minimizing collateral damage, and enhancing battlefield effectiveness. Defense agencies are prioritizing guided missiles, smart bombs, and advanced munitions capable of striking targets with accuracy under diverse conditions. Increasing geopolitical tensions and modernization programs have further intensified procurement of such systems. In my opinion, demand will remain strong as militaries seek advanced weaponry that ensures tactical superiority, cost-effective operations, and strategic deterrence across conventional and asymmetric warfare scenarios worldwide.

Opportunities are strengthening in regions undergoing military modernization, particularly Asia-Pacific, the Middle East, and Eastern Europe. Nations are allocating higher defense budgets to procure next-generation smart weapons that integrate seamlessly with existing platforms. Opportunities also exist in joint development programs between global defense contractors and local governments, aimed at building indigenous manufacturing capabilities. I believe companies that form strong alliances and provide cost-competitive solutions tailored to regional requirements will capture substantial opportunities, particularly as smaller nations expand their defense capacity and seek technologically advanced systems.

Trends indicate a transition toward network-centric warfare, where smart weapons are integrated with surveillance, reconnaissance, and command systems for greater battlefield coordination. Development of loitering munitions, stand-off missiles, and GPS-independent guidance technologies is also gaining traction. Another trend is the integration of smart weapons with unmanned platforms, expanding their operational scope. In my opinion, these trends reflect the broader evolution of modern warfare, where integration, connectivity, and adaptability are critical factors shaping the future deployment of advanced weapon systems worldwide.

Challenges remain in the form of high development and procurement costs, which limit access for smaller defense budgets. Strict regulatory controls on arms exports and international treaties constrain the global trade of smart weapons. Technological complexity also demands heavy investment in R&D, creating barriers for new entrants. Countermeasure technologies adopted by adversaries pose another layer of difficulty. In my assessment, overcoming these challenges requires strong government partnerships, sustained funding, and continuous innovation to ensure smart weapons remain effective and compliant with international defense protocols.

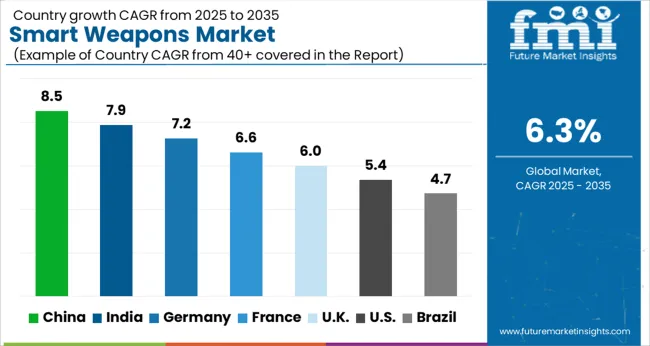

| Country | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

| USA | 5.4% |

| Brazil | 4.7% |

The global smart weapons market is projected to grow at a CAGR of 6.3% from 2025 to 2035. China leads with a growth rate of 8.5%, followed by India at 7.9%, and Germany at 7.2%. The United Kingdom records a growth rate of 6%, while the United States shows the slowest growth at 5.4%. Market expansion is supported by rising defense modernization programs, demand for precision strike capabilities, and integration of AI and networked systems into advanced weaponry. Emerging markets such as China and India are increasing procurement to strengthen defense capabilities, while developed markets like the USA, UK, and Germany focus on next-generation missile systems, unmanned platforms, and enhanced interoperability. This report includes insights on 40+ countries; the top markets are shown here for reference.

The smart weapons market in China is projected to grow at a CAGR of 8.5%. Expansion is fueled by the country’s large defense budget and emphasis on modernizing its armed forces. Investments are being directed toward precision-guided munitions, advanced missile systems, and autonomous weapon platforms. The development of AI-enabled targeting systems and hypersonic weapons further highlights China’s focus on enhancing military strength. Domestic manufacturing capacity, combined with strategic state funding and collaboration with defense research institutes, ensures steady market growth.

The smart weapons market in India is expected to grow at a CAGR of 7.9%. Rising geopolitical tensions and defense modernization programs are key growth drivers. India is investing in precision-guided munitions, surface-to-air missile systems, and advanced naval defense capabilities. Indigenous development under the “Make in India” initiative is being supported by collaborations with international defense firms. Growing interest in unmanned aerial vehicles (UAVs) and smart artillery is also shaping market demand. India’s strong focus on building domestic defense capabilities ensures continued expansion.

The smart weapons market in Germany is projected to grow at a CAGR of 7.2%. Germany’s role within NATO and its focus on defense modernization are fueling adoption of advanced weapon systems. Investments are being made in smart missile technology, electronic warfare tools, and UAVs. The German government’s emphasis on interoperability with NATO allies is accelerating demand for advanced targeting and communication systems. Strong industrial partnerships with European defense firms ensure innovation in precision-guided solutions and integrated weapon systems.

The smart weapons market in the UK is projected to grow at a CAGR of 6%. Demand is supported by military modernization projects and growing focus on electronic warfare and cyber-integrated defense systems. The UK is investing in advanced missile systems, UAVs, and precision-strike weapons to strengthen its air and naval defense capabilities. Collaborative programs with NATO allies and partnerships with global defense contractors are ensuring continuous technological progress. Growth is also supported by investments in AI-driven weapon systems and smart targeting platforms.

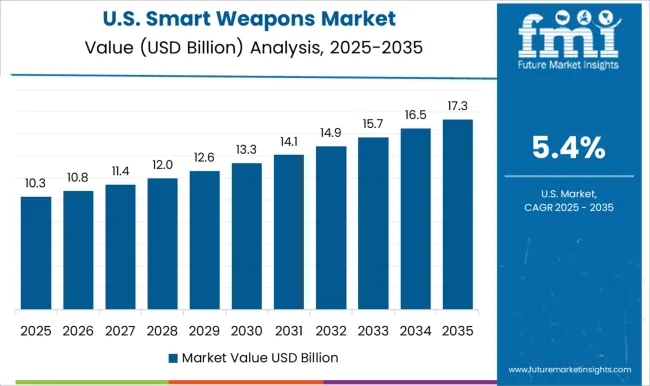

The smart weapons market in the USA is projected to grow at a CAGR of 5.4%. While growth is slower than in Asia, the USA remains the global leader in developing next-generation defense technologies. The Department of Defense continues to invest heavily in smart missile systems, hypersonic weapons, and UAVs. Integration of AI, network-centric systems, and cyber defense tools further strengthens USA capabilities. Strong presence of major defense contractors and innovation in precision strike technologies sustain global leadership, even as the market matures.

Competition in smart weapons is shaped by aerospace and defense leaders delivering precision, integration, and adaptability across modern battlefields. Lockheed Martin, Raytheon Technologies, and Northrop Grumman dominate with advanced missile systems, GPS-guided munitions, and networked strike solutions built into defense programs worldwide. Boeing and General Dynamics highlight platform integration, ensuring compatibility with air, land, and naval systems. European players such as BAE Systems, MBDA, Thales, Rheinmetall, Saab, and Leonardo emphasize collaborative development and NATO-focused interoperability, producing guided artillery shells, air-to-air missiles, and loitering munitions. Israeli innovators Elbit Systems and Israel Aerospace Industries differentiate with electro-optical targeting and drone-linked precision strike systems, while L3Harris Technologies and Textron target niche areas like guidance kits, fuzing technology, and unmanned weaponized platforms. This mix of scale, regional strength, and niche specialization underscores how competition remains intense across both procurement and aftermarket upgrades. Strategies revolve around digital targeting, cost-per-shot reduction, and modularity. Raytheon and Lockheed Martin emphasize hypersonic programs and long-range precision strike, positioning themselves at the forefront of next-generation deterrence. BAE Systems, MBDA, and Saab focus on cost-effective missile families designed for allied forces with scalable capabilities. Elbit and IAI market integrated smart weapon suites for drones and light aircraft, offering affordable precision to smaller militaries. L3Harris and Textron highlight add-on kits that convert unguided munitions into smart assets, expanding their customer base across emerging defense markets. Product brochures typically showcase seeker technology, strike accuracy, payload flexibility, and compatibility with targeting pods or C4ISR networks. Visuals emphasize real-time guidance, hit probability, and adaptability to multi-domain operations. By combining technical clarity with operational storytelling, these materials reinforce smart weapons as indispensable tools for defense modernization, projecting a narrative where precision, efficiency, and battlefield readiness converge.

| Item | Value |

|---|---|

| Quantitative Units | USD 20.7 Billion |

| Product | Munitions, Missiles, Guided Projectiles, Guided Rockets, and Precision Guided Firearms |

| Technology | GPS, Laser, Radar, Infrared, and Others |

| Platform | Air, Land, and Naval |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lockheed Martin Corporation, BAE Systems plc, Elbit Systems Ltd, General Dynamics Corporation, Israel Aerospace Industries Ltd, L3Harris Technologies Inc., Leonardo S.p.A, MBDA, Northrop Grumman Corporation, Raytheon Technologies Corporation, Rheinmetall AG, Saab AB, Textron Inc., Thales Group, and The Boeing Company |

| Additional Attributes | Dollar sales by product type (guided bombs, missiles, smart rifles, loitering munitions), Dollar sales by application (airborne, naval, land-based platforms), Trends in precision strike capabilities and autonomous targeting, Use in counterterrorism and strategic defense missions, Growth in AI-enabled and network-centric warfare systems, Regional procurement patterns across North America, Europe, and Asia-Pacific. |

The global smart weapons market is estimated to be valued at USD 20.7 billion in 2025.

The market size for the smart weapons market is projected to reach USD 38.2 billion by 2035.

The smart weapons market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in smart weapons market are munitions, _guided bombs, _target pods, missiles, _anti-tank missiles & standoff missiles, _air-to-air & air-to–surface missile, _anti-ship & anti-submarine missile, guided projectiles, _artillery shells, _mortar rounds, guided rockets, _anti-tank & tactical rockets, _air-to-air & air-to-surface, _anti-submarine, precision guided firearms, _small smart weapons, _shoulder fired weapons and _smart guns.

In terms of technology, gps segment to command 27.4% share in the smart weapons market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart School Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Wireless Smoke Detector Market Size and Share Forecast Outlook 2025 to 2035

Smart Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA