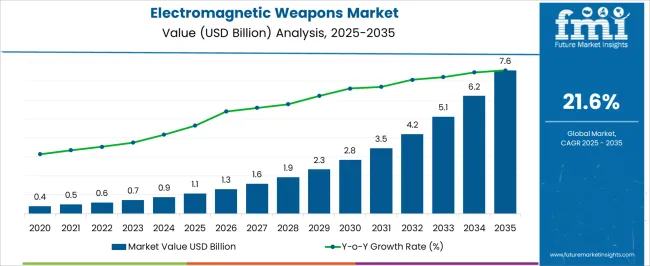

The electromagnetic weapons market is projected to grow from USD 1.1 billion in 2025 to USD 7.6 billion in 2035, reflecting a CAGR of 21.6%. During the early adoption phase (2020–2024), growth was gradual, rising from USD 0.4 billion to USD 1.1 billion as defense agencies and research institutions began testing prototypes and assessing operational feasibility. This period focused on validating performance, integrating systems with existing defense platforms, and exploring tactical applications.

By 2025, the market will reach USD 1.1 billion, marking a transition point where broader adoption is feasible, driven by strategic interest and initial deployments in specialized military programs. From 2025 to 2035, the market enters a scaling phase (2025–2030) and later consolidation (2030–2035). By 2030, the market will exceed USD 2.3 billion, fueled by wider adoption in naval, aerial, and ground defense systems and the expansion of production capabilities. During the consolidation phase, growth continues toward USD 7.6 billion by 2035 as leading defense contractors establish dominance and smaller players integrate or exit. The 21.6% CAGR highlights rapid expansion, reflecting a market shift from experimental deployment to broader operational integration, with electromagnetic weapons becoming a more established component of modern defense strategies.

| Metric | Value |

|---|---|

| Electromagnetic Weapons Market Estimated Value in (2025 E) | USD 1.1 billion |

| Electromagnetic Weapons Market Forecast Value in (2035 F) | USD 7.6 billion |

| Forecast CAGR (2025 to 2035) | 21.6% |

The electromagnetic weapons market is influenced by several broader sectors, each contributing to its growth. The defense and military systems market drives roughly 35%, as the scale of national defense budgets and strategic programs determines adoption potential. Advanced weapon systems account for 20%, providing platforms and integration opportunities for electromagnetic applications. Radar and communication systems contribute 15%, offering necessary support infrastructure for targeting, guidance, and monitoring.

Research and development in defense technology represents 10%, enabling testing, prototyping, and evaluation of new electromagnetic solutions. Aerospace and naval platforms influence about 7%, as these weapons are increasingly integrated into ships, aircraft, and drones. Electronic components and power systems account for 5%, supplying the energy and circuitry needed for reliable operation. Simulation and training services contribute 5%, helping personnel understand operational use and tactical deployment. The cybersecurity and electronic countermeasure sectors comprise 3%, supporting the safe and effective deployment against electronic threats.

The Electromagnetic Weapons market is experiencing steady growth driven by the increasing focus on advanced defense technologies and modern warfare strategies. The current market scenario reflects a significant adoption of high-energy directed systems that are capable of precise, rapid, and scalable engagement in military operations. Growth has been influenced by global modernization programs in defense forces, rising security threats, and the need for rapid-response weapon systems that reduce collateral damage while enhancing operational efficiency.

Technological advancements, including integration with real-time sensors, adaptive targeting algorithms, and autonomous control systems, have accelerated the deployment of electromagnetic weapon systems. Additionally, ongoing investment in research and development, coupled with government initiatives for strategic defense modernization, supports the market expansion.

The future outlook of this market is expected to be shaped by continued innovation in directed energy technologies, including particle beam systems and other emerging electromagnetic solutions, offering enhanced lethality, accuracy, and tactical flexibility As defense strategies evolve toward software-defined targeting and automated engagement, the Electromagnetic Weapons market is poised for substantial long-term growth.

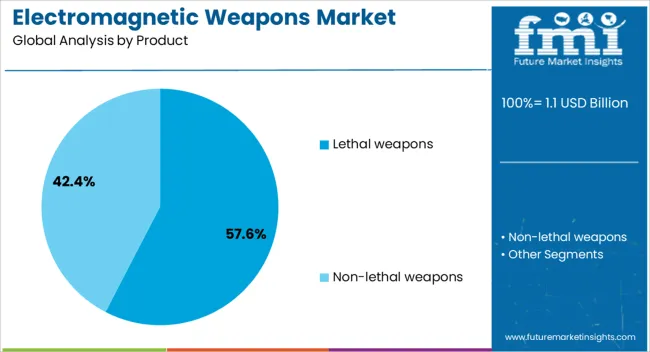

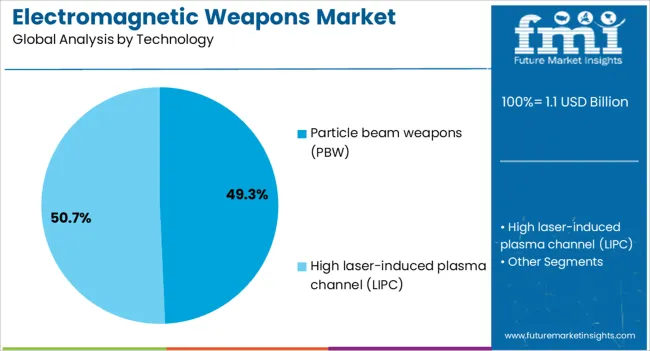

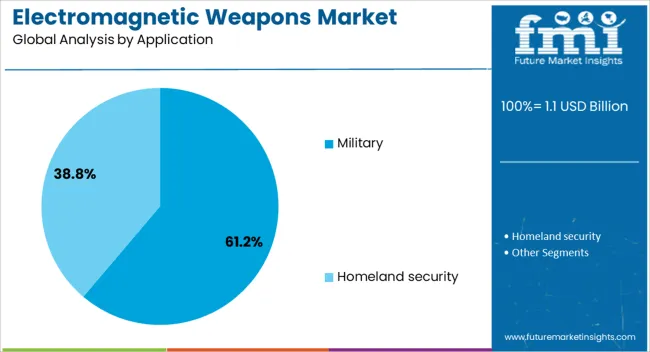

The electromagnetic weapons market is segmented by product, technology, application, platform, and geographic regions. By product, electromagnetic weapons market is divided into Lethal weapons and Non-lethal weapons. In terms of technology, electromagnetic weapons market is classified into Particle beam weapons (PBW) and High laser-induced plasma channel (LIPC). Based on application, electromagnetic weapons market is segmented into Military and Homeland security. By platform, electromagnetic weapons market is segmented into Land, Airborne, and Naval. Regionally, the electromagnetic weapons industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The lethal weapons product segment is projected to hold 57.60% of the Electromagnetic Weapons market revenue share in 2025, making it the leading product type. This dominance is being driven by the increasing demand for weapon systems capable of neutralizing high-value targets with precision and efficiency. Lethal weapons are preferred for critical military operations where operational effectiveness and rapid response are essential.

Growth in this segment has been supported by defense modernization programs that prioritize high-energy systems, which can deliver superior firepower and strategic advantage. The segment has benefited from ongoing innovations that allow energy output and targeting precision to be enhanced through software-defined control and adaptive targeting algorithms.

Additionally, integration with autonomous platforms and real-time battlefield data has reinforced the attractiveness of lethal electromagnetic weapons in modern combat scenarios. The high scalability, precision targeting, and capability to minimize collateral impact have made this product segment a preferred choice for military applications, and these factors are expected to continue supporting its market leadership through 2035.

The particle beam weapons technology segment is expected to account for 49.30% of the Electromagnetic Weapons market revenue share in 2025, establishing it as the leading technology type. This position has been achieved due to its ability to deliver highly focused energy to neutralize targets at long distances with exceptional precision. Adoption has been reinforced by technological advancements in beam control, energy modulation, and power efficiency, allowing particle beam systems to be deployed in a variety of combat and defensive scenarios.

The segment has also been supported by increased investment in research and development aimed at improving targeting accuracy, system reliability, and deployment flexibility. Particle beam weapons offer significant advantages in operational scenarios requiring rapid engagement and minimized collateral damage, which has driven their preference among military planners.

The scalability and adaptability of particle beam systems, including compatibility with software-defined targeting and sensor fusion, have reinforced their market dominance. As military operations increasingly emphasize high-precision, low-footprint solutions, this technology segment is anticipated to maintain a leading share of the market through 2035.

The military application segment is anticipated to hold 61.20% of the Electromagnetic Weapons market revenue in 2025, representing the largest end-use category. This dominance is driven by the critical role electromagnetic weapons play in modern defense strategies, where rapid and precise engagement is essential for strategic advantage. Growth has been supported by increasing adoption of advanced defense platforms, including ground, air, and naval systems that integrate high-energy directed weapons for offensive and defensive operations.

The segment benefits from investment in cutting-edge targeting technologies, sensor networks, and command and control systems that enhance operational effectiveness. Military operations increasingly rely on software-defined control to optimize energy output, engagement speed, and precision targeting, making electromagnetic weapons highly compatible with current defense strategies.

Additionally, the emphasis on reducing collateral damage, improving mission success rates, and extending operational range has accelerated adoption. With global defense modernization programs prioritizing energy-based weapon systems, the military application segment is expected to maintain its leadership position and continue driving overall market growth in the coming decade.

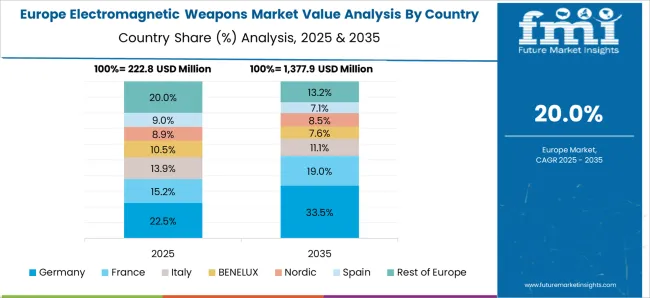

The electromagnetic weapons market is growing due to increasing defense modernization, advanced battlefield requirements, and rising interest in directed-energy technologies. North America and Europe lead with high-investment programs integrating electromagnetic weapons into naval, ground, and aerial platforms. Asia-Pacific demonstrates rapid growth with emerging defense budgets and military modernization initiatives. Manufacturers differentiate through power output, range, precision targeting, mobility, and platform integration. Regional variations in regulatory frameworks, defense priorities, and technological infrastructure influence adoption, procurement strategies, and competitive positioning globally.

Electromagnetic weapons adoption is strongly influenced by power output and operational range. North America and Europe prioritize high-power, long-range systems for naval ships, military aircraft, and armored vehicles, enabling precise targeting of drones, missiles, and electronic systems at significant distances. Asia-Pacific markets focus on medium-range systems for localized defense applications and tactical deployment, balancing cost and mobility. Differences in power and range affect mission capability, system scalability, and battlefield utility. Leading suppliers provide high-output, platform-integrated weapons for advanced militaries, while regional producers focus on cost-effective, deployable solutions. Power output contrasts shape adoption patterns, operational efficiency, and competitive positioning across global defense sectors.

Electromagnetic weapons require seamless integration with military platforms for effective deployment. North America and Europe emphasize integration with naval vessels, fighter jets, and ground combat systems, ensuring compatibility with existing power grids, targeting systems, and command-and-control networks. Asia-Pacific adoption focuses on tactical vehicles and smaller naval or aerial platforms to optimize mobility and local defense capabilities. Differences in mobility and integration affect installation complexity, operational flexibility, and deployment readiness. Suppliers offering modular, platform-compatible electromagnetic systems gain premium adoption, while regional manufacturers provide simplified, mobile units. Platform integration contrasts drive adoption, operational versatility, and competitiveness in modern defense applications globally.

Defense procurement policies and regulatory frameworks significantly impact electromagnetic weapons adoption. Europe and North America enforce stringent compliance for testing, safety, and military authorization, favoring large defense contractors and advanced R&D programs. Asia-Pacific regulations vary; developed nations follow strict defense acquisition protocols, while emerging markets implement flexible local guidelines to encourage domestic production. Differences in policy affect procurement timelines, project approvals, and technology transfer. Suppliers offering fully compliant, certified weapons systems gain higher adoption, while regional producers focus on cost-efficient, locally approved solutions. Regulatory contrasts shape market access, adoption rates, and strategic positioning in the global defense sector.

Advances in energy storage, capacitors, and pulse power technologies determine electromagnetic weapon effectiveness. North America and Europe invest in highly efficient, rapid-discharge systems to maximize destructive potential while minimizing operational energy consumption. Asia-Pacific markets adopt energy-efficient systems suitable for mobile deployment or budget-constrained projects. Differences in energy efficiency and technological sophistication affect operational endurance, system reliability, and lifecycle costs. Leading suppliers integrate advanced energy management, cooling, and pulse control technologies, while regional players focus on robust, simplified systems. Technological and energy efficiency contrasts shape adoption, operational effectiveness, and long-term competitiveness across global military applications.

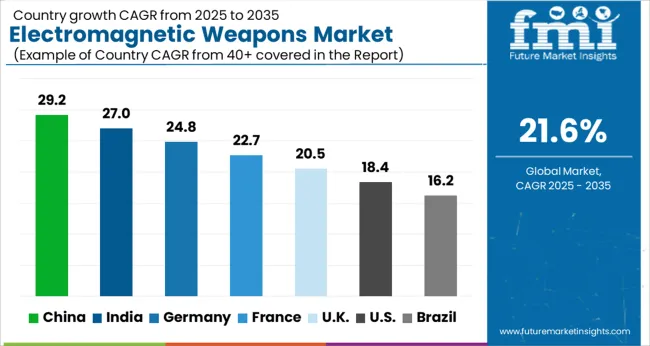

| Country | CAGR |

|---|---|

| China | 29.2% |

| India | 27.0% |

| Germany | 24.8% |

| France | 22.7% |

| UK | 20.5% |

| USA | 18.4% |

| Brazil | 16.2% |

The global electromagnetic weapons market was projected to grow at a 21.6% CAGR through 2035, driven by demand in defense, military, and strategic applications. Among BRICS nations, China recorded 29.2% growth as large-scale manufacturing and deployment facilities were commissioned and compliance with defense and safety standards was enforced, while India at 27.0% growth saw expansion of production units to meet rising regional defense requirements. In the OECD region, Germany at 24.8% maintained substantial output under strict industrial and regulatory frameworks, while the United Kingdom at 20.5% relied on moderate-scale operations for military and strategic applications. The USA, expanding at 18.4%, remained a mature market with steady demand across defense and tactical segments, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The electromagnetic weapons market in China is growing at a CAGR of 29.2% driven by increasing investment in defense technologies and advanced weapon systems. Military and defense agencies are adopting electromagnetic weapons for electronic warfare, non lethal disabling of enemy equipment, and precision targeting. Research and development in high power electromagnetic pulse generators, directed energy systems, and associated control technologies are accelerating innovation. China’s focus on modernizing its armed forces and enhancing strategic defense capabilities is supporting adoption. Defense contractors and technology suppliers are collaborating to develop next generation electromagnetic weapon systems. Government funding and strategic military programs are key factors driving market expansion. China is emerging as a major global player in the development and deployment of electromagnetic weapon technologies due to high defense expenditure and technology focus.

Electromagnetic weapons market is expanding at a CAGR of 27.0% in India supported by growing focus on advanced defense capabilities and strategic modernization programs. The military is adopting electromagnetic weapons for electronic warfare, communications disruption, and precision targeting applications. Research and development in high power electromagnetic pulse systems, energy directed weapons, and control mechanisms is boosting technological adoption. Government defense agencies are funding projects to strengthen national security and enhance combat readiness. Collaborations between domestic manufacturers and international defense technology partners are contributing to innovation and faster deployment. India’s emphasis on strengthening its defense infrastructure and modernizing military operations is driving growth in the electromagnetic weapons market.

Electromagnetic weapons market in Germany is growing at a CAGR of 24.8% driven by the adoption of advanced military technologies and electronic warfare systems. Defense agencies are investing in directed energy weapons, electromagnetic pulse systems, and associated control technologies for strategic and tactical applications. Research in high precision targeting and safe deployment of electromagnetic systems is advancing rapidly. German defense contractors are collaborating with technology partners to deliver innovative solutions. Government initiatives supporting national security, cyber warfare capabilities, and modernization of armed forces are boosting market adoption. Germany remains a key European market due to high investment in defense technologies, advanced R&D infrastructure, and strategic emphasis on electronic warfare systems.

The United Kingdom market is expanding at a CAGR of 20.5% with growing adoption of electromagnetic weapons for defense and electronic warfare applications. Military agencies are integrating high power electromagnetic pulse generators, directed energy systems, and precision targeting solutions into operations. Research and development in safe deployment, energy efficiency, and system integration is accelerating technology adoption. Defense contractors are collaborating with technology providers to improve system performance and operational readiness. Government programs promoting modernization of armed forces, strategic defense, and electronic warfare capabilities are driving market growth. The United Kingdom continues to see steady adoption due to focus on advanced weaponry and strengthening national defense capabilities.

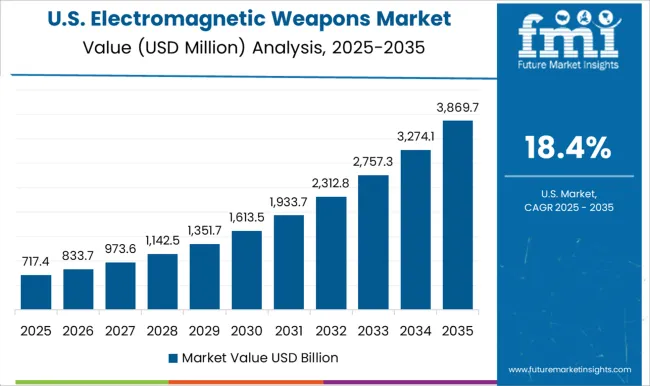

The United States market is growing at a CAGR of 18.4% supported by high defense spending, research in directed energy systems, and adoption of advanced electronic warfare technologies. Military and defense agencies are integrating electromagnetic pulse weapons, non lethal disabling systems, and precision targeting solutions. Manufacturers are focusing on high performance, energy efficient, and safe electromagnetic weapon systems. Collaboration between defense contractors, research institutions, and government agencies is driving innovation. The US emphasis on modernizing armed forces, strengthening electronic warfare capabilities, and maintaining technological superiority is supporting market growth. Advanced R&D infrastructure and significant defense budgets make the United States a key market for electromagnetic weapons globally.

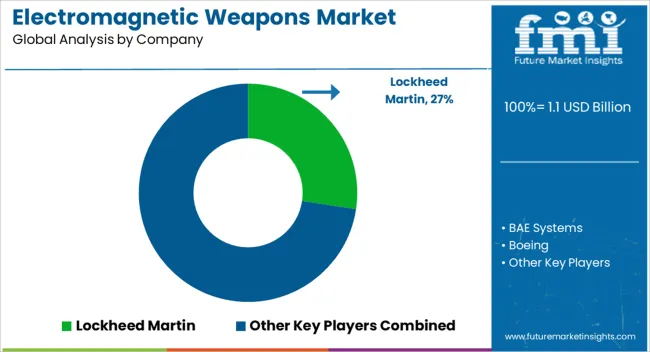

The electromagnetic weapons market is witnessing rapid growth driven by defense modernization programs, the need for advanced non-kinetic weaponry, and the growing emphasis on precision and speed in military operations. Key players dominating this market include Lockheed Martin, BAE Systems, Boeing, Elbit Systems, General Atomics, Honeywell, L3Harris Technologies, Northrop Grumman, QinetiQ, Rafael Advanced Defense Systems, Raytheon Technologies, Rheinmetall, and Thales. These companies are spearheading the development of high-energy electromagnetic systems, including directed-energy weapons, railguns, and electromagnetic pulse devices, designed to enhance defense capabilities while reducing collateral damage. Lockheed Martin and BAE Systems are at the forefront of producing advanced electromagnetic systems integrated into naval, air, and ground defense platforms. These systems offer superior accuracy, rapid response times, and scalability across multiple platforms. Boeing and Northrop Grumman focus on directed-energy technologies, employing electromagnetic pulses for disabling enemy electronics and providing tactical battlefield advantages. Elbit Systems and Rafael Advanced Defense Systems specialize in both offensive and defensive electromagnetic solutions, including counter-drone technologies, vehicle-mounted electromagnetic systems, and laser-based defense mechanisms. Companies such as General Atomics, L3Harris Technologies, and Raytheon Technologies are heavily investing in R&D to enhance energy efficiency, output power, and miniaturization of electromagnetic weapons for portability and broader deployment. QinetiQ, Rheinmetall, and Thales focus on system integration, providing modular and adaptable electromagnetic solutions for global defense customers. The market growth is fueled by rising defense budgets, technological advancements in power storage and pulse generation, and the increasing importance of electronic warfare capabilities. These leading suppliers continue to innovate and collaborate with defense agencies worldwide to deliver cutting-edge electromagnetic weapon systems, ensuring strategic superiority and advanced protection in modern combat scenarios.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| Product | Lethal weapons and Non-lethal weapons |

| Technology | Particle beam weapons (PBW) and High laser-induced plasma channel (LIPC) |

| Application | Military and Homeland security |

| Platform | Land, Airborne, and Naval |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lockheed Martin, BAE Systems, Boeing, Elbit Systems, General Atomics, Honeywell, L3Harris Technologies, Northrop Grumman, QinetiQ, Rafael Advanced Defense Systems, Raytheon Technologies, Rheinmetall, and Thales |

| Additional Attributes | Dollar sales vary by weapon type, including directed energy weapons, electromagnetic pulse (EMP) systems, and railguns; by application, such as defense, aerospace, and naval operations; by end-use, spanning military forces, defense contractors, and government research facilities; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising defense budgets, modernization programs, and demand for advanced warfare technologies. |

The global electromagnetic weapons market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the electromagnetic weapons market is projected to reach USD 7.6 billion by 2035.

The electromagnetic weapons market is expected to grow at a 21.6% CAGR between 2025 and 2035.

The key product types in electromagnetic weapons market are lethal weapons and non-lethal weapons.

In terms of technology, particle beam weapons (pbw) segment to command 49.3% share in the electromagnetic weapons market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electromagnetic NDT Market Size and Share Forecast Outlook 2025 to 2035

Electromagnetic Clutch System Market

AC Electromagnetic Brakes Market Size and Share Forecast Outlook 2025 to 2035

DC Electromagnetic Brakes Market Size and Share Forecast Outlook 2025 to 2035

EMC Electromagnetic Compatibility Test Laboratory Market Size and Share Forecast Outlook 2025 to 2035

Pulse Electromagnetic Field Therapy Devices Market Size and Share Forecast Outlook 2025 to 2035

Smart Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Automatic Weapons Market Size and Share Forecast Outlook 2025 to 2035

Anti Drone Weapons Market Size and Share Forecast Outlook 2025 to 2035

Hypersonic Weapons Market Size and Share Forecast Outlook 2025 to 2035

Directed Energy Weapons Market Size and Share Forecast Outlook 2025 to 2035

Naval Based Remote Weapons Station Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA