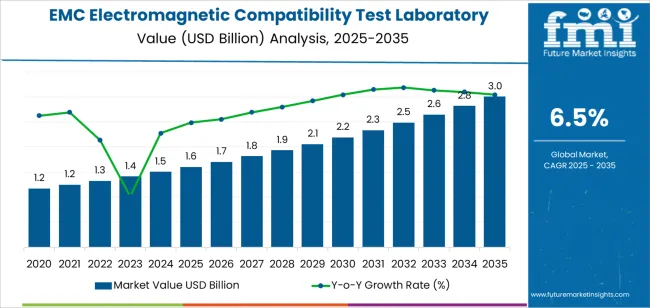

The global EMC electromagnetic compatibility test laboratory market is valued at USD 1.6 billion in 2025 and is projected to reach USD 2.9 billion by 2035, recording a CAGR of 6.5%. The EMC electromagnetic compatibility test laboratory market is set to generate an absolute dollar opportunity of USD 1.3 billion during the forecast period. Based on the rolling CAGR analysis, growth is driven by the proliferation of electronic devices, stricter global compliance requirements, and the increasing complexity of electromagnetic environments across the industrial, automotive, and communication sectors.

EMC testing laboratories provide essential services for validating that electronic equipment functions reliably without causing or experiencing electromagnetic interference. The demand is rising as manufacturers adopt higher-frequency circuits, wireless connectivity, and electric drive systems. Facilities are expanding their testing capabilities to include automotive EMC validation, 5G communication modules, and aerospace-grade components.

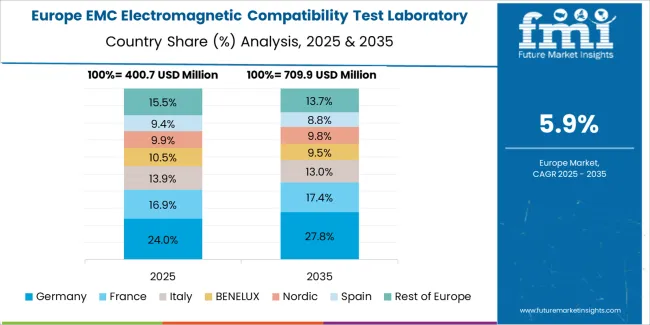

North America and Europe maintain established testing networks supported by stringent certification frameworks such as FCC, CISPR, and CE. Asia Pacific exhibits rapid growth, led by China, Japan, and South Korea, where large-scale electronics production and export-oriented manufacturing drive testing volumes. Through 2035, continued investment in semi-anechoic chambers, automation of measurement systems, and global accreditation programs will define operational efficiency and competitiveness within the EMC test laboratory market.

Between 2025 and 2030, the EMC Electromagnetic Compatibility Test Laboratory Market is projected to grow from USD 1.6 billion to USD 2.1 billion, creating an absolute dollar opportunity of USD 0.5 billion, which represents 45.5% of the decade’s total market expansion. Growth during this period will be fueled by the rapid evolution of electronic devices, increasing regulatory requirements for EMC certification, and rising demand from industries such as automotive, aerospace, telecommunications, and consumer electronics. The shift toward electric and autonomous vehicles will further accelerate the need for advanced EMC testing infrastructure, as manufacturers ensure compliance with complex electromagnetic interference standards.

From 2030 to 2035, the market is forecast to expand from USD 2.1 billion to USD 2.9 billion, resulting in an absolute dollar opportunity of USD 0.8 billion, accounting for 54.5% of the decade’s total growth. This phase will be defined by the proliferation of connected technologies, including 5G, IoT, and smart manufacturing systems, all requiring extensive EMC validation. The increasing integration of AI-driven testing equipment and automated data analysis tools will enhance operational efficiency in test laboratories. Strategic partnerships between regulatory bodies, equipment manufacturers, and testing service providers will play a critical role in expanding global EMC compliance capabilities.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.6 billion |

| Market Forecast Value (2035) | USD 2.9 billion |

| Forecast CAGR (2025–2035) | 6.5% |

The EMC electromagnetic compatibility test laboratory market is expanding as electronic device manufacturers face stringent regulatory requirements governing emission and immunity performance. Compliance with standards such as CISPR, IEC, and FCC mandates thorough testing to ensure devices operate without interfering with other electronic systems. Laboratories offering full-spectrum EMC testing services—covering conducted, radiated, and electrostatic discharge evaluations—play a crucial role in product certification across consumer electronics, automotive, aerospace, and telecommunications industries. The rapid proliferation of wireless devices and electric vehicles intensifies testing demand as systems grow more electronically dense and cross-interference risks increase.

Growth is further supported by the global shift toward pre-compliance and R&D-level testing, enabling manufacturers to identify design vulnerabilities early in development cycles. Test facilities invest in advanced shielded chambers, broadband antennas, and automated measurement systems to improve accuracy and reduce turnaround times. Regional expansion of accredited laboratories in Asia-Pacific, Europe, and North America aligns with local production growth and regulatory harmonization. High setup costs and the need for skilled electromagnetic engineers remain barriers to market entry, leading many manufacturers to outsource compliance testing. Continuous advancements in radiofrequency environments, 5G infrastructure, and electric mobility maintain strong long-term demand for specialized EMC testing services worldwide.

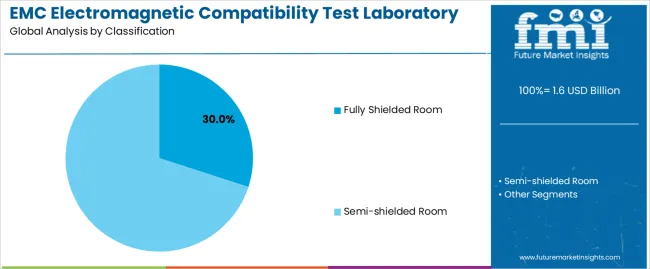

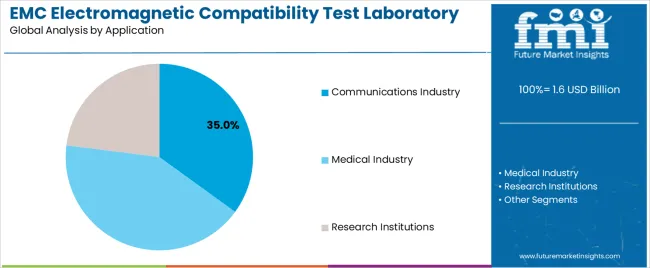

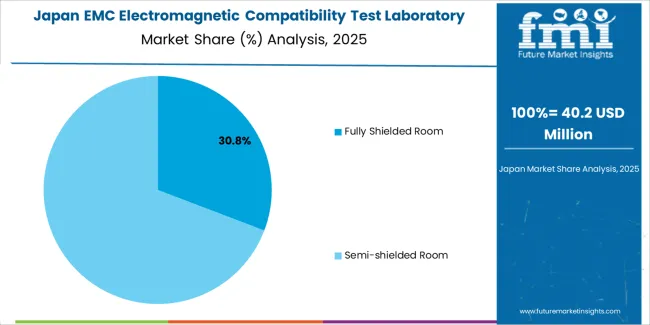

The EMC electromagnetic compatibility test laboratory market is segmented by classification, application, and region. By classification, the market is divided into fully shielded rooms and semi-shielded rooms. Based on application, it is categorized into the communications industry, medical industry, and research institutions. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These segments define testing environment types, end-use applications, and regional patterns of compliance and certification infrastructure development.

The fully shielded room segment accounts for approximately 30.0% of the global EMC electromagnetic compatibility test laboratory market in 2025, representing the leading classification category. This dominance reflects the extensive use of fully shielded environments in certification testing requiring complete electromagnetic isolation and low ambient interference levels. Fully shielded rooms are designed with multi-layer conductive materials and waveguide components that ensure precise measurement of emission and immunity characteristics for electronic and communication equipment.

The segment’s leadership is reinforced by increasing regulatory emphasis on compliance with international EMC standards such as IEC, CISPR, and FCC. Manufacturers and certification bodies rely on fully shielded rooms to validate product conformity in pre-compliance and final testing stages. Adoption is particularly strong in laboratories serving high-frequency communication, automotive electronics, and defense-related testing applications. Continuous improvements in shielding effectiveness, modular room design, and absorber materials enhance measurement precision and operational flexibility. Fully shielded rooms remain the industry benchmark for electromagnetic testing reliability and are integral to maintaining global certification standards in both public and private testing facilities.

The communications industry segment represents about 35.0% of the total EMC electromagnetic compatibility test laboratory market in 2025, making it the largest application category. This leadership is supported by the growing volume of communication devices and systems requiring electromagnetic emission and immunity testing before market release. Wireless technologies, including mobile communication, satellite transmission, and radar systems, necessitate controlled testing environments to ensure compliance with regional and international electromagnetic standards.

Demand is reinforced by the rapid expansion of 5G infrastructure, radio frequency components, and IoT-enabled devices, which increase the complexity of electromagnetic interaction testing. The segment benefits from continuous laboratory investments in advanced testing equipment capable of evaluating broadband emissions, antenna performance, and electronic susceptibility under standardized conditions. Laboratories serving communication manufacturers in East Asia and North America account for a substantial share of market activity due to concentrated production and certification operations. The communications industry continues to dominate market demand as regulatory frameworks evolve alongside technological innovation, requiring reliable and repeatable EMC testing for electronic communication systems and integrated circuit assemblies worldwide.

The EMC electromagnetic compatibility test laboratory market is expanding as electronic devices proliferate across industries and regulatory compliance becomes increasingly stringent. Enterprises and manufacturers require certified facilities to validate that their products do not emit or suffer unacceptable electromagnetic interference. Growth is propelled by sectors such as automotive, telecommunications and medical devices that rely on EMC testing for global market access. Constraints persist in the form of high capital expenditure for lab upgrades and skilled personnel shortages. Laboratory operators and service providers respond with advanced test chambers, digital monitoring and location diversification to capture broader demand.

The rise of 5G networks, electric vehicles and Internet of Things (IoT) devices has elevated the complexity of electromagnetic environments, pushing manufacturers to secure EMC compliance early in their development cycle. Lab buyers and test-service purchasers value a USP of rapid-turn-around accredited testing including pre-compliance and full-compliance services that enables quicker time-to-market and reduces redesign risk. As such, investment in high-frequency chambers and multi-standard test capabilities is becoming a differentiator for laboratories aiming to serve diverse, global clients.

Growth is curtailed by the substantial cost of establishing and maintaining EMC laboratories, including shielded chambers, precision instrumentation and certification accreditation. Smaller manufacturers may defer testing or opt for limited in-house capabilities. An additional barrier is the shortage of trained technicians and engineers who can interpret complex EMC results and navigate evolving standards. For laboratories targeting mid-market OEMs, a USP lies in offering flexible pricing and modular test packages that lower entry cost and broaden accessibility for smaller firms competing in regulated markets.

Laboratories increasingly adopt digital technologies such as real-time monitoring, remote access and automated test sequence management to improve efficiency and throughput. Modular test-lab setups and on-site portable test systems also support emerging markets where local infrastructure is limited. A USP for lab operators serving global industries is the ability to deliver multi-geography test coverage with consistent quality and rapid service via digital client portals.

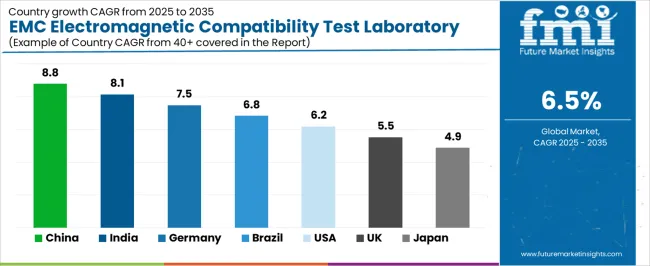

| Country | CAGR (%) |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| Brazil | 6.8% |

| USA | 6.2% |

| UK | 5.5% |

| Japan | 4.9% |

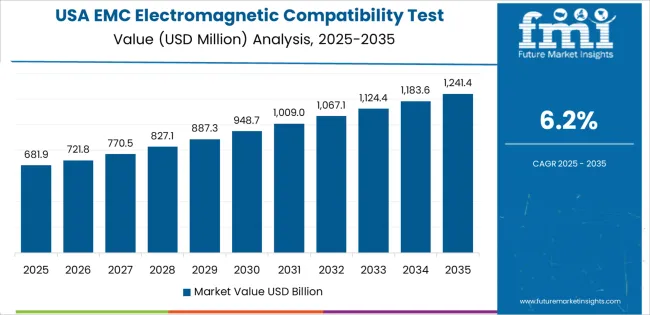

The EMC Electromagnetic Compatibility Test Laboratory Market is expanding rapidly worldwide, with China leading at an 8.8% CAGR through 2035, driven by accelerated electronics manufacturing, strict compliance standards, and growing R&D infrastructure. India follows at 8.1%, supported by rising domestic electronics production, government-backed quality assurance initiatives, and increasing export testing requirements. Germany grows at 7.5%, reflecting leadership in automotive and industrial testing technologies. Brazil records 6.8%, fueled by expansion in telecommunications and consumer electronics certification. The USA, at 6.2%, continues to innovate in test automation and high-frequency EMC applications, while the UK (5.5%) and Japan (4.9%) emphasize precision measurement, laboratory modernization, and international standard alignment to strengthen compliance testing capabilities.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

China is experiencing strong growth in the EMC test laboratory market, projected to expand at a CAGR of 8.8% through 2035. Rapid industrial automation and electronic manufacturing expansion are driving the need for compliance testing facilities. The government’s investment in advanced laboratory infrastructure supports certification for automotive, telecom, and aerospace applications. Domestic firms are enhancing testing capacity with shielded chambers, broadband antennas, and advanced signal analysis equipment. International accreditation and export-oriented testing services further enhance China’s competitiveness in global compliance markets.

India is witnessing rapid development in the EMC test laboratory market, growing at a CAGR of 8.1%, driven by expansion in electronics manufacturing and government-led standardization programs. The country’s push toward domestic production under “Make in India” is creating strong demand for certification and compliance facilities. Laboratories are upgrading to handle complex testing for IoT, defense, and automotive electronics. Partnerships between public research institutions and private labs are accelerating capacity enhancement and technological capability across major industrial regions.

Across Germany, the EMC test laboratory market is advancing at a CAGR of 7.5%, supported by engineering precision, strict regulatory frameworks, and a highly developed industrial ecosystem. Laboratories focus on meeting European CE and automotive EMC standards while expanding capabilities in RF shielding and emission testing. The country’s strong automotive, aerospace, and industrial electronics sectors maintain continuous demand for high-accuracy testing. Integration of automation and digital control systems ensures consistency and repeatability in complex test environments.

Brazil is observing consistent growth in the EMC test laboratory market, forecast to increase at a CAGR of 6.8% through 2035. Expansion in telecommunications, automotive, and consumer electronics sectors continues to support laboratory investment. National standardization programs are encouraging domestic testing rather than international outsourcing. Local firms are adopting high-frequency analyzers and modular shielded chambers to improve performance. Strategic collaboration with accredited international laboratories ensures compliance with ISO and IEC standards, enhancing reliability and global alignment.

In the United States, the EMC test laboratory market is expanding at a CAGR of 6.2%, supported by regulatory requirements from the FCC and Department of Defense for product certification. Demand for testing spans medical devices, aerospace systems, and electronic consumer goods. Laboratories are investing in multi-chamber facilities and advanced simulation tools to meet increasing complexity. Growth in electric vehicles and defense electronics continues to reinforce demand for electromagnetic compatibility testing and validation across high-performance sectors.

Across the United Kingdom, the EMC test laboratory market is advancing at a CAGR of 5.5%, supported by technological progress and harmonization with international standards. Laboratories are upgrading test systems to meet automotive, telecom, and medical device certification requirements. Expansion of private compliance centers complements the activities of established research laboratories. The country’s participation in global regulatory frameworks enables continuous alignment with European and international EMC standards, maintaining reliability and technical credibility.

Japan is growing steadily in the EMC test laboratory market, projected to expand at a CAGR of 4.9% through 2035. Continuous innovation in precision testing and electronic design validation sustains market consistency. Domestic laboratories emphasize low-noise chamber environments, broadband antenna arrays, and high-speed digital analysis tools. Demand from automotive electronics, robotics, and advanced manufacturing applications supports long-term laboratory utilization. Regulatory stability and international accreditation maintain Japan’s global standing in electromagnetic compatibility testing services.

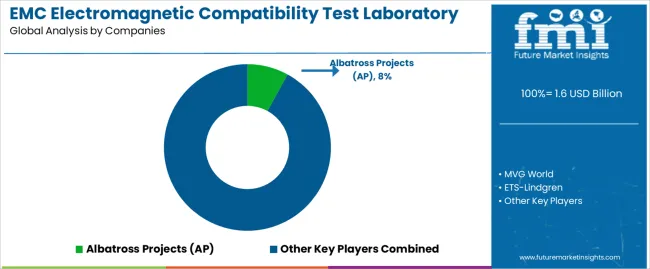

The global EMC electromagnetic compatibility test laboratory market exhibits moderate consolidation, shaped by established shielding system manufacturers and specialized test solution providers. Albatross Projects (AP) maintains a leading position through turnkey EMC laboratory design, integration of shielded rooms, and compliance testing infrastructure. MVG World and ETS-Lindgren follow closely, providing comprehensive EMC testing solutions that combine chambers, antennas, and measurement systems for automotive, aerospace, and electronics industries. Magnetic Shields and SOLIANI EMC specialize in precision-engineered enclosures and modular shielding materials to support consistent test accuracy. NTD and Faraday Pty Ltd contribute expertise in test chamber installation and field measurement systems. EMshield GmbH and National Shielding strengthen regional markets through localized service networks and customized test environments.

Europe EMC Products and Holland Shielding Systems provide standardized and bespoke shielding solutions for research laboratories and industrial applications, emphasizing structural precision and RF attenuation performance. Equipto Electronics and Pepro focus on portable shielding and equipment housing for on-site EMC evaluation. VARAY LABORIX and RA Mayes Company deliver custom test room fabrication and field certification services. DCR, HBTE Tech, and LISUN enhance competitiveness through advanced EMC instrumentation, automated test systems, and calibration support. Competition in this market centers on electromagnetic isolation efficiency, compliance with CISPR and IEC standards, and scalability of laboratory infrastructure. Strategic differentiation depends on precision engineering, installation reliability, and integration of hybrid testing technologies supporting 5G, automotive electronics, and aerospace certification programs.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type (Classification) | Fully Shielded Room, Semi-Shielded Room |

| Application | Communications Industry, Medical Industry, Research Institutions |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, USA, Germany, Brazil, UK, Japan, and 40+ countries |

| Key Companies Profiled | Albatross Projects (AP), MVG World, ETS-Lindgren, Magnetic Shields, SOLIANI EMC, EMshield GmbH, National Shielding, Europe EMC Products, Holland Shielding Systems, Equipto Electronics, Pepro, VARAY LABORIX, RA Mayes Company, DCR, HBTE Tech, LISUN |

| Additional Attributes | Dollar sales by classification and application categories; demand analysis for fully and semi-shielded testing rooms; regional adoption across 5G, automotive, and defense sectors; investment trends in laboratory automation; competitive benchmarking among global and regional test providers; integration of automated test sequencing, digital monitoring, and RF measurement precision; infrastructure cost structures; regulatory alignment with IEC, CISPR, and FCC standards; and market outlook for pre-compliance and full-compliance EMC testing. |

The global EMC electromagnetic compatibility test laboratory market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the EMC electromagnetic compatibility test laboratory market is projected to reach USD 3.0 billion by 2035.

The EMC electromagnetic compatibility test laboratory market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in EMC electromagnetic compatibility test laboratory market are fully shielded room and semi-shielded room.

In terms of application, communications industry segment to command 35.0% share in the EMC electromagnetic compatibility test laboratory market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

EMC Shielding and Test Equipment Market - Size, Share, and Forecast from 2025 to 2035

EV EMC Battery Filter Market Size and Share Forecast Outlook 2025 to 2035

Electromagnetic Weapons Market Size and Share Forecast Outlook 2025 to 2035

Electromagnetic NDT Market Size and Share Forecast Outlook 2025 to 2035

Electromagnetic Clutch System Market

AC Electromagnetic Brakes Market Size and Share Forecast Outlook 2025 to 2035

DC Electromagnetic Brakes Market Size and Share Forecast Outlook 2025 to 2035

Pulse Electromagnetic Field Therapy Devices Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Information System Market Forecast and Outlook 2025 to 2035

Laboratory Centrifuge & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Shakers Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Washers Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Rockers and Shakers Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Filtration Devices Market Size and Share Forecast Outlook 2025 to 2035

Laboratory and Medical Scale Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Furnaces Market Analysis - Size, Share, and Forecast 2025 to 2035

Laboratory Supplies Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Benchtop Automation Market Growth – Trends & Forecast 2025 to 2035

Laboratory Balances and Scales Market Growth - Industry Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA