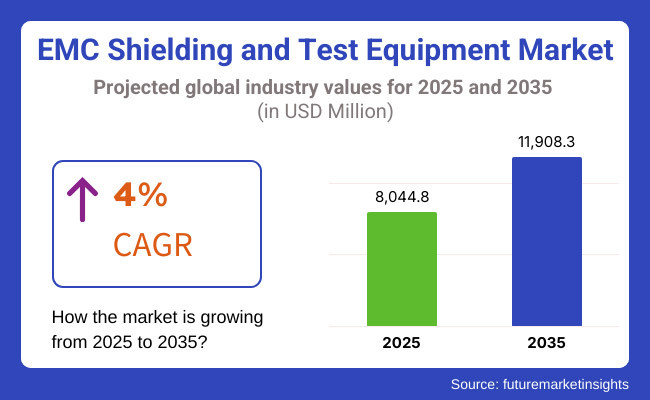

The EMC shielding and test equipment market is expected to grow from USD 8.04 billion in 2025 to USD 11.91 billion by 2035, registering a CAGR of 4.0% over the forecast period. This growth is fueled by rising demand for automotive electronics, the proliferation of 5G and IoT technologies, and stringent electromagnetic interference regulations.

The United States leads as the largest market due to high adoption of advanced electronics and stringent electromagnetic interference regulations. Meanwhile, the Asia-Pacific region is expected to be the fastest-growing market from 2025 to 2035, driven by rapid industrialization, increasing demand for automotive electronics, and widespread deployment of 5G and IoT technologies. Key contributing countries include the USA, China, Germany, Japan, and South Korea.

The market is experiencing growth driven by increasing integration of electronics in automotive, telecom, and medical sectors, along with rising concerns over electromagnetic interference (EMI) affecting device performance. The growing adoption of 5G networks and IoT devices is further propelling demand for advanced shielding and testing solutions.

However, high costs of sophisticated test equipment and complex regulatory compliance in different regions may restrain market expansion. Key trends include the development of AI-powered testing systems and lightweight, flexible shielding materials. Market participants are focusing on innovation, enhancing product efficiency, and expanding their presence in emerging markets to capitalize on growth opportunities.

The market is expected to see significant advancements with increased use of AI-driven testing technologies and innovative lightweight shielding materials. Growth will be fueled by expanding demand in emerging markets, particularly in Asia-Pacific, driven by industrialization and technology adoption.

Stricter regulatory standards will encourage the development of more effective EMI solutions. Additionally, rising applications in electric vehicles, renewable energy, and 5G communications will open new opportunities. Overall, the market will become more competitive and dynamic, with companies focusing on innovation and geographic expansion to capture future growth.

The EMC shielding and test equipment market is segmented based on type, vertical, application, and region. By type, the market is divided into EMC shielding and EMC test equipment. Vertically, it includes consumer electronics, telecom & IT, automotive, healthcare, aerospace, and others, which comprise industrial manufacturing, defense, and energy sectors.

By application, the market covers consumer appliances and electronics, automotive, military and aerospace, it and telecommunication, medical, railways, renewable energy, and industrial. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East and Africa.

The EMC shielding and test equipment market is segmented into two primary product types such as EMC shielding and EMC test equipment. Among these, EMC Shielding is projected to be the most lucrative segment over the forecast period, expected to grow at a CAGR of approximately 4.8%, outperforming the overall market CAGR of 4.0%. This segment’s growth is quantitatively supported by increasing incorporation of electronics in automotive, telecom, and consumer electronics sectors, which drive the demand for effective EMI protection.

The global automotive electronics market alone is underscoring the critical need for shielding solutions that maintain device performance and regulatory compliance. Moreover, the shift towards miniaturized and highly integrated devices intensifies the shielding requirements, further accelerating this segment’s growth. Conversely, the EMC Test Equipment segment is anticipated to witness more moderate growth, slightly below the overall market CAGR.

Factors contributing to this muted growth include high capital expenditure barriers and slower regulatory enforcement in emerging economies. The technological advancements in testing equipment offer incremental growth opportunities, the segment’s expansion is more dependent on regulatory landscapes and capital investment cycles, making it less robust compared to EMC shielding.

| Type Segment | CAGR (2025 to 2035) |

|---|---|

| EMC Shielding | 4.8% |

The EMC shielding and test equipment market is segmented into consumer electronics, telecom & it, automotive, healthcare, aerospace, and others. The others category primarily includes industrial manufacturing, defense, energy, and transportation sectors, which also rely on EMC solutions but to a lesser extent compared to core verticals. Among these verticals, the automotive segment is projected to be the most lucrative, expected to grow at a CAGR of approximately 5.2%, outpacing the overall market CAGR of 4.0%.

This robust growth is quantitatively supported by the rapid adoption of advanced driver-assistance systems (ADAS), electric vehicles (EVs), and increasing electronic content per vehicle. The global automotive electronics market, valued in hundreds of billions USD, significantly driving the demand for EMC shielding to ensure safety and compliance with stringent EMI regulations. Additionally, the shift toward autonomous and connected vehicles requires highly reliable electromagnetic compatibility, further elevating shielding requirements.

Other verticals like consumer electronics and telecom & IT also contribute significantly which face challenges such as price sensitivity and rapid technology cycles, limiting sustained growth. Healthcare and aerospace verticals are more niche, driven by specialized applications and regulatory demands, leading to steady with comparatively slower expansion.

| Vertical Segment | CAGR (2025 to 2035) |

|---|---|

| Automotive | 5.2% |

The automotive application segment stands out as the most lucrative, projected to grow at a CAGR of approximately 5.3%. This is primarily driven by the increasing electronic content per vehicle, especially in electric vehicles (EVs) and autonomous driving systems. The global automotive electronics market, expanding steadily and often cited in the hundreds of billions USD, has significantly increased demand for effective EMC shielding and rigorous test equipment.

The complexity of modern vehicles, with dozens of interconnected electronic modules, sensors, and communication systems, necessitates robust shielding solutions to prevent electromagnetic interference that could compromise vehicle safety and performance. Other application segments, such as consumer appliances and electronics, and IT and telecommunication, contribute significantly to the market which are characterized by shorter product lifecycles, rapid technological obsolescence, and intense price pressures, which moderate their growth trajectories.

Military and aerospace applications offer steady demand backed by high reliability, durability, and regulatory compliance requirements, with the niche nature and longer product cycles temper overall market growth. Similarly, medical, railways, renewable energy, and industrial sectors generate consistent demand driven by safety-critical operations and regulatory mandates, yet these segments experience slower growth rates compared to the automotive vertical.

| Application Segment | CAGR (2025 to 2035) |

|---|---|

| Automotive | 5.3% |

High Cost of EMC Testing and Complex Regulatory Compliance

One of the primary challenges facing the EMC shielding and test equipment market is that EMC test equipment and compliance certification are prohibitively expensive. Many small and medium-sized electronics manufacturers have budget constraints for spending on shielding solutions, anechoic chambers, and real-time spectrum analyzers.

Moreover, the complex worldwide regulatory requirements like FCC (USA), CE (Europe), CISPR (International), and MIL-STD (Military) call for manufacturers to face multiple test procedures and the compliance specifications of a nation by nation basis, leading to higher operational complexities.

AI-Driven EMC Testing, Smart Shielding Materials, and 5G Expansion

Despite obstacles, the EMC shielding and test equipment market offers tremendous growth prospects. Growth is being fueled by the advent of AI-enabled EMC testing solutions, where machine learning algorithms drive signal analysis optimization, interference detection, and automated compliance verification.

It also includes the introduction of smart shield materials, which are self-healing conductive coatings, graphene-based EMI barriers, and flexible lightweight shield films, thereby opening up avenues for applications in wearable technology, flexible displays, and future generations of medical devices.

Furthermore, the rollout of 5G networks and growing RF interference issues are generating need for next-generation shielding solutions in telecom base stations, satellite communications, and data centers. Development of EMC shielding for smart home devices, AI-based appliances, and industrial IoT is also propelling innovation in miniaturized EMC protection technologies with higher performance.

The United States market for EMC shielding and test equipment is expanding slowly with rising requirements for electromagnetic compatibility (EMC) solutions within the aerospace, defense, and automotive industries and increasing regulation demands. The Federal Communications Commission (FCC) and National Institute of Standards and Technology (NIST) are enforcing stringent EMC compliance standards on electronic products and communication equipment.

The use of advanced shielding materials, AI-based EMC testing, and automated compliance testing solutions is growing across sectors. Moreover, expansion in 5G infrastructure, electric vehicles (EVs), and military-grade EMC protection systems is also driving market demand further.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

United Kingdom EMC shielding and test equipment market is increasing due to increased R&D spending, increased consumer electronics demand for EMI shielding, and severe compliance requirements of healthcare and automotive sectors. UK Office of Communications (Ofcom) and Health and Safety Executive (HSE) control EMC emissions to ensure electromagnetic safety and device reliability.

Increased demand for hybrid EMC shielding material, intelligent test laboratories, and artificial intelligence (AI)-powered electromagnetic field (EMF) test equipment is transforming the industry. Furthermore, demand for lighter, eco-friendly shielding material is pushing innovation within the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.8% |

European Union's EMC shielding and test equipment market is growing steadily due to tight EU electromagnetic emission rules, increased automotive demand for EMC solutions, and high-speed communications technology take-up. European Telecommunications Standards Institute (ETSI) and the European Committee for Electrotechnical Standardization (CENELEC) mandate electronics and industrial equipment conformity to EMC standards.

Germany, France, and Italy are dominating EMC testing equipment, high-performance shielding materials, and EMI-resistant automotive parts. Besides that, research on graphene-based EMI shielding and intelligent testing chambers is also contributing further to the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.0% |

The Japanese market for EMC shielding and test equipment is also expanding as demand for electromagnetic shielding grows in robotics, consumer electronics and high-speed rail systems. The Ministry of Internal Affairs and Communications (MIC) and Japan Electrical Manufacturers' Association (JEMA) have strict rules on EMC compliance for all sectors.

High-performance advanced materials for EMC shield, miniature design, automated anechoic room equipment and EMC test technologies using artificial intelligence are being focused on by Japanese companies. Besides that, progress in semiconductor manufacture and quantum computers is giving rise to a whole new set of ultra-low-frequency EMI shielded products needed by quantum computing.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

The South Korean EMC shielding and test equipment market is growing very fast, driven by increasing semiconductor manufacturing, deployment of 5G networks, and government-backed programs for state-of-the-art EMC compliance. The South Korean Radio Research Agency (RRA) and Korea Testing Laboratory (KTL) oversee EMC standards for consumer, automotive, and aerospace use.

The expansion of IoT-enabled products, AI-driven EMC testing technologies, and ultra-lightweight shielding composites is boosting the market scenario. In addition, investment in self-healing EMI shielding materials and automated compliance testing facilities is fueling innovation even further.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.3% |

The EMC shielding and test equipment market is expanding due to increasing demand for electromagnetic interference (EMI) protection in electronics, rising regulatory compliance requirements, and progress in 5G, IoT, and automotive electronics. Driven by the universal requirements for EMC (Electromagnetic Compatibility) conformity, electronic circuits that grow increasingly complex, and the need to supply reliable solutions even in critical fields like aerospace, defense and healthcare.

Generally companies focus high-performance shield materials, accurately-sized EMC testing chambers, and knowledge-based, AI-driven EMC analysis tools in areas such as signal integrity enhancement, interference suppression, and product certification. The market includes major test equipment suppliers, shielding material suppliers, and regulatory compliance solution providers, all of whom are advancing the field with innovations in RF shielding, hybrid EMI materials, and real-time EMC monitoring tools.

Keysight Technologies Inc. (18-22%)

Keysight leads the EMC test equipment market, offering state-of-the-art RF and EMI measurement solutions with AI-driven analytics for regulatory compliance testing.

Rohde & Schwarz GmbH & Co. KG (12-16%)

Rohde & Schwarz specializes in EMC test and measurement solutions, integrating real-time spectral analysis and automated compliance verification tools.

Teseq (AMETEK, Inc.) (10-14%)

Teseq is known for its EMI/EMC test generators, immunity analyzers, and RF shielding enclosures, ensuring high-precision interference testing.

ETS-Lindgren (ESCO Technologies) (8-12%)

ETS-Lindgren provides fully integrated EMC test chambers and shielding solutions, catering to automotive, aerospace, and medical industries.

Laird Performance Materials (6-10%)

Laird develops high-performance EMI shielding materials, focusing on conductive foams, ferrite absorbers, and flexible shielding tapes.

Other Key Players (30-40% Combined)

Several electromagnetic shielding specialists, regulatory compliance service providers, and test equipment manufacturers contribute to advancements in shielding materials, automated EMC testing, and RF isolation technologies. These include:

The overall market size for the EMC shielding and test equipment market was USD 8.04 billion in 2025.

The EMC shielding and test equipment market is expected to reach USD 11.91 billion in 2035.

Rising electromagnetic interference (EMI) concerns, increasing adoption of 5G and IoT devices, and stringent regulatory requirements for electronic device compliance will drive market growth.

The USA, China, Germany, Japan, and South Korea are key contributors.

EMC Shielding are expected to dominate in the EMC Shielding and Test Equipment Market.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Vertical, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Vertical, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Vertical, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 30: Europe Market Volume (Units) Forecast by Vertical, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 38: Asia Pacific Market Volume (Units) Forecast by Vertical, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Asia Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 44: MEA Market Volume (Units) Forecast by Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 46: MEA Market Volume (Units) Forecast by Vertical, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: MEA Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Vertical, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Vertical, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Vertical, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Vertical, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Vertical, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Vertical, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 86: Europe Market Volume (Units) Analysis by Vertical, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 90: Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Europe Market Attractiveness by Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Vertical, 2023 to 2033

Figure 95: Europe Market Attractiveness by Application, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Units) Analysis by Vertical, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Vertical, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 130: MEA Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 134: MEA Market Volume (Units) Analysis by Vertical, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 138: MEA Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: MEA Market Attractiveness by Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by Vertical, 2023 to 2033

Figure 143: MEA Market Attractiveness by Application, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

EV EMC Battery Filter Market Size and Share Forecast Outlook 2025 to 2035

Electrical Shielding Tape Market

Optical EMI Shielding Adapters Market Size and Share Forecast Outlook 2025 to 2035

Aircraft EMI Shielding Market Size and Share Forecast Outlook 2025 to 2035

Metallic Static Shielding Bags Market

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market – Advanced Agricultural Machinery 2024-2034

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pavers Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tennis Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Galley Equipment Market Analysis and Forecast by Fit, Application, and Region through 2035

Garage Equipment Market Growth – Trends & Forecast 2024-2034

Sorting Equipment Market Size and Share Forecast Outlook 2025 to 2035

General Equipment Rental Services Market Size and Share Forecast Outlook 2025 to 2035

Bagging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA