The impact resistant glass market is experiencing significant growth, fueled by increased investments in infrastructure development, stringent building safety codes, and rising demand for durable architectural materials. This glass type offers superior strength, shatter resistance, and security, making it ideal for construction, automotive, and defense applications.

The market benefits from urbanization trends and expanding adoption in high-rise buildings and public infrastructure projects requiring enhanced occupant safety. Technological advancements in lamination processes and interlayer materials have improved optical clarity and impact absorption.

Growing focus on energy-efficient and noise-reducing glass solutions is also contributing to market expansion. With government regulations mandating safety compliance and consumer preference for high-durability materials, the impact resistant glass market is positioned for sustained long-term growth..

| Metric | Value |

|---|---|

| Impact Resistant Glass Market Estimated Value in (2025 E) | USD 3.7 billion |

| Impact Resistant Glass Market Forecast Value in (2035 F) | USD 8.4 billion |

| Forecast CAGR (2025 to 2035) | 8.6% |

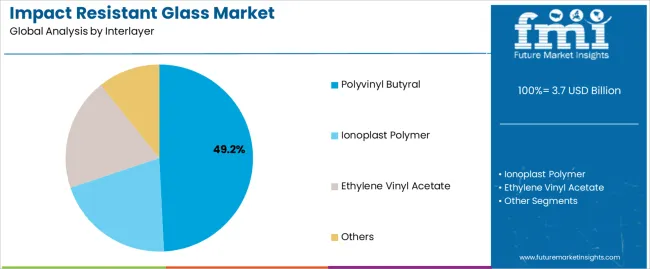

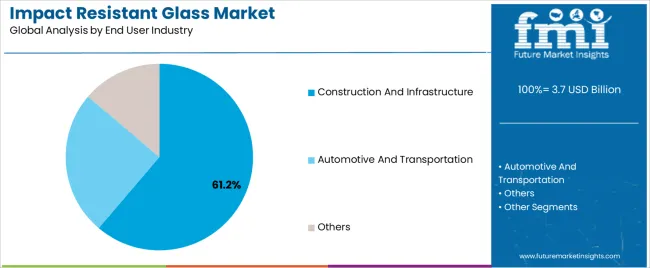

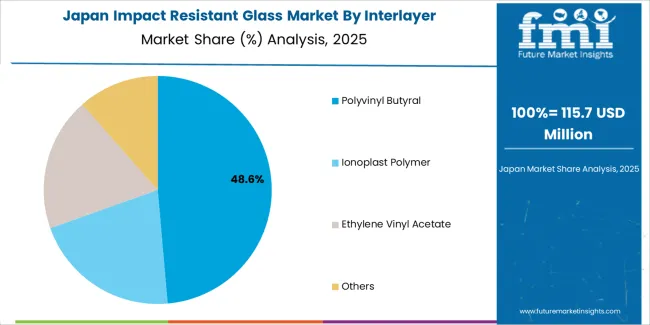

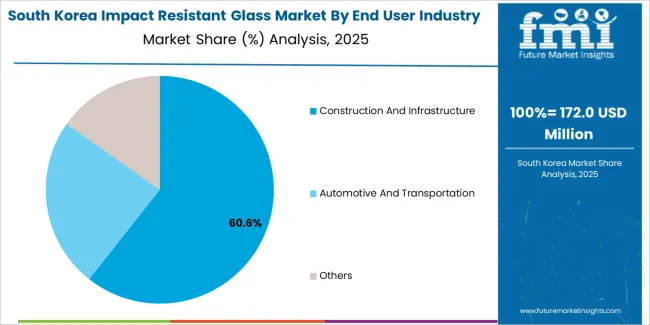

The market is segmented by Interlayer and End User Industry and region. By Interlayer, the market is divided into Polyvinyl Butyral, Ionoplast Polymer, Ethylene Vinyl Acetate, and Others. In terms of End User Industry, the market is classified into Construction And Infrastructure, Automotive And Transportation, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polyvinyl butyral segment leads the interlayer category, accounting for approximately 49.2% share of the impact resistant glass market. This dominance is attributed to PVB’s excellent adhesion, flexibility, and optical transparency, making it the most widely used material in laminated safety glass.

Its superior bonding capability ensures that broken glass remains adhered to the interlayer, reducing injury risks. Widespread use in automotive windshields, architectural glazing, and structural facades has reinforced its market position.

Manufacturers continue to enhance PVB formulations for improved UV resistance and sound insulation, expanding application versatility. With sustained demand in construction and automotive industries, the polyvinyl butyral segment is expected to maintain its leadership in the foreseeable future..

The construction and infrastructure segment dominates the end-user industry category with approximately 61.2% share, supported by growing investments in commercial and residential buildings emphasizing safety and energy efficiency. Impact resistant glass is increasingly utilized in facades, windows, and skylights to ensure structural security and occupant protection.

Urbanization, rising disposable incomes, and stringent building codes have further strengthened demand. Architects and developers are favoring laminated and tempered glass solutions for their ability to withstand environmental stress and potential impacts without fragmentation.

With the construction sector undergoing modernization and a shift toward sustainable building materials, the construction and infrastructure segment is expected to continue driving overall market growth in the coming years..

The scope for impact resistant glass rose at a 10.2% CAGR between 2020 and 2025. The global market is anticipated to grow at a moderate CAGR of 8.6% over the forecast period 2025 to 2035.

The market witnessed steady growth, during the period, driven by factors such as increasing urbanization, rising construction activities, stringent safety regulations, and growing awareness about the benefits of impact resistant glass in various applications.

Technological advancements, such as improvements in glass manufacturing processes, the development of innovative coatings, and the integration of smart glass technologies, contributed to the expansion of the market.

Demand for impact resistant glass surged across sectors including construction, automotive, retail, hospitality, and healthcare, fueled by safety concerns, aesthetic preferences, and regulatory compliance requirements.

Market players focused on product innovation, customization, and strategic partnerships to differentiate their offerings, expand market share, and address emerging customer needs.

The market forecast 2025 to 2035 anticipates robust growth in the market, driven by several key factors. Continued urbanization and infrastructure development in emerging economies, leading to increased demand for impact resistant glass in commercial and residential construction projects. Rising awareness about safety, security, and energy efficiency, driving the adoption of impact resistant glass in buildings, vehicles, and infrastructure.

Stringent building codes, regulations, and sustainability standards mandating the use of safety glass solutions in construction and renovation projects. Technological advancements enabling the development of high performance impact resistant glass products with enhanced strength, durability, and thermal insulation properties.

Impact resistant glass products with energy efficient properties are gaining popularity among consumers and businesses. The focus on sustainability and energy conservation is driving the adoption of energy efficient glazing solutions, which offer thermal insulation and reduce the reliance on artificial heating and cooling systems.

Impact resistant glass tends to be more expensive than traditional glass products due to the additional manufacturing processes and specialized materials required to enhance its durability and strength.

The higher costs associated with impact resistant glass may deter budget conscious consumers and businesses from adopting these solutions, particularly in price sensitive markets.

The below table showcases revenues in terms of the top 5 leading countries, spearheaded by Korea and the United Kingdom. The countries are expected to lead the market through 2035.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 9.0% |

| China | 8.9% |

| The United Kingdom | 9.6% |

| Japan | 8.8% |

| Korea | 11.3% |

The impact resistant glass market in the United States expected to expand at a CAGR of 9.0% through 2035. The country has well established building codes and regulations that emphasize safety and resilience in construction.

The adoption of impact resistant glass is driven by building codes in hurricane prone regions such as Florida, where impact resistant glazing is mandated for certain buildings to mitigate damage from hurricanes and severe storms.

The United States is susceptible to a variety of natural disasters, including hurricanes, tornadoes, earthquakes, and wildfires. There is a heightened awareness of the importance of impact resistant glass in protecting buildings and occupants from damage and injury during extreme weather events.

The impact resistant glass market in the United Kingdom is anticipated to expand at a CAGR of 9.6% through 2035. The country has a significant stock of older buildings that require renovation, refurbishment, and retrofitting to meet contemporary safety and performance standards.

Impact resistant glass can be retrofitted to existing structures to improve safety, security, and energy efficiency without compromising architectural integrity or historical significance.

Safety and security are paramount considerations for building occupants and property owners in the United Kingdom. Impact resistant glass provides enhanced protection against intruders, burglars, and vandalism, offering peace of mind for homeowners, businesses, and public institutions.

Impact resistant glass trends in China are taking a turn for the better. An 8.9% CAGR is forecast for the country from 2025 to 2035. Technological innovations in glass manufacturing processes have led to the development of advanced impact resistant glass products with improved strength, clarity, and performance characteristics.

Chinese glass manufacturers invest in research and development to enhance product quality, durability, and aesthetic appeal to meet the evolving demands of the market.

Impact resistant glass is widely used in the automotive and transportation sectors for vehicle windows, windshields, and other glazing applications. The rapid expansion of the automotive industry in China, coupled with increasing consumer demand for safety features and comfort, drives the demand for impact resistant glass products in automobile manufacturing.

The impact resistant glass market in Japan is poised to expand at a CAGR of 8.8% through 2035. Japanese consumers prioritize quality, reliability, and durability when selecting building materials for residential and commercial properties.

Impact resistant glass is perceived as a premium building material that offers superior safety, security, and longevity compared to conventional glass products, driving its adoption in architectural and interior design applications.

Japan is a leading producer of automotive vehicles and components, driving innovation in automotive glazing technologies. Impact resistant glass is used in vehicle windows, windshields, and sunroofs to improve occupant safety, visibility, and crashworthiness in automobiles. The demand for impact resistant glass in the automotive sector contributes to market growth in Japan.

The impact resistant glass market in Korea is anticipated to expand at a CAGR of 11.3% through 2035.Safety and security concerns are paramount in the Korean society, driving the demand for impact resistant glass in residential, commercial, and public buildings.

Impact resistant glass provides protection against break ins, forced entry attempts, and vandalism, enhancing the safety and security of occupants and assets.

The luxury real estate market in Korea caters to affluent consumers seeking high end residential properties, penthouses, and luxury condominiums with premium amenities and state of the art features. Impact resistant glass adds value to luxury properties by offering exclusivity, prestige, and superior performance in terms of safety, security, and comfort.

The below table highlights how polyvinyl butyral segment is projected to lead the market in terms of interlayer, and is expected to account for a CAGR of 8.3% through 2035. Based on end user industry, the construction and infrastructure segment is expected to account for a CAGR of 8.1% through 2035.

| Category | CAGR from 2025 to 2035 |

|---|---|

| Polyvinyl Butyral | 8.3% |

| Construction and Infrastructure | 8.1% |

Based on interlayer, the polyvinyl butyral segment is expected to continue dominating the impact resistant glass market. Polyvinyl butyral is known for its excellent impact resistance properties, making it an ideal interlayer material for impact resistant glass. PVB helps hold glass fragments together upon impact, reducing the risk of shattering and enhancing safety in buildings, vehicles, and other applications.

The use of polyvinyl butyral interlayers significantly improves the safety and security of glass structures by providing resistance to forced entry, vandalism, and natural disasters such as hurricanes and earthquakes. There is a growing demand for impact resistant glass featuring polyvinyl butyral interlayers, as safety regulations and building codes become more stringent.

In terms of end user industry, the construction and infrastructure segment is expected to continue dominating the impact resistant glass market. Increasingly stringent safety regulations and building codes mandate the use of impact resistant glass in construction projects, particularly in high rise buildings, commercial structures, and public infrastructure.

Impact resistant glass helps mitigate the risk of glass breakage, injuries, and property damage during natural disasters, accidents, and forced entry attempts.

Rapid urbanization, population growth, and infrastructure development drive the demand for impact resistant glass in urban centers, transportation hubs, and public facilities. There is a growing need for resilient building materials, including impact resistant glass, to enhance safety, durability, and sustainability in construction projects.

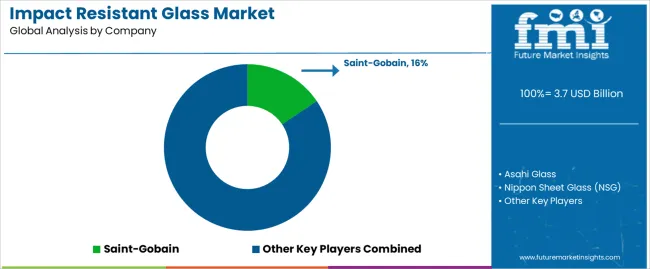

The competitive landscape of the impact resistant glass market is characterized by the presence of numerous global, regional, and local players competing based on product innovation, technological advancements, pricing strategies, distribution networks, and market positioning.

The market is dynamic and evolving, driven by changing consumer preferences, regulatory requirements, and technological innovations in glass manufacturing and processing.

Company Portfolio

| Attribute | Details |

|---|---|

| Estimated Market Size in 2025 | USD 3.7 billion |

| Projected Market Valuation in 2035 | USD 8.4 billion |

| Value-based CAGR 2025 to 2035 | 8.6% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Market Segments Covered | Interlayer, End User Industry, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, France, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Asahi Glass; Nippon Sheet Glass (NSG); Saint-Gobain; Guardian Industries; Fuyao Glass Industry Group; Central Glass; Sisecam Group; Taiwan Glass; Vitro, S.A.B. De C.V.; CGS Holding Co., Ltd.; Cardinal Glass Industries; Euroglas GmbH |

The global impact resistant glass market is estimated to be valued at USD 3.7 billion in 2025.

The market size for the impact resistant glass market is projected to reach USD 8.4 billion by 2035.

The impact resistant glass market is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key product types in impact resistant glass market are polyvinyl butyral, ionoplast polymer, ethylene vinyl acetate and others.

In terms of end user industry, construction and infrastructure segment to command 61.2% share in the impact resistant glass market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Impact Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Impact Soil Tester Market Size and Share Forecast Outlook 2025 to 2035

Impact Modifier Market Growth & Trends 2018-2028

High Impact Corrugated Boxes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Automatic Impact Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

PVC-M High Impact Resistant Water Supply Pipe Market Size and Share Forecast Outlook 2025 to 2035

Automotive Door Impact Bars Market

Automotive Crash Impact Simulator Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

On Purpose Technologies Market Growth - Trends & Forecast 2025 to 2035

Resistant Starch Market Analysis by Product Type, Source, End Use and Region Through 2035

PD1 Resistant Head and Neck Cancer Market Size and Share Forecast Outlook 2025 to 2035

Oil Resistant Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Oil-Resistant Packaging Providers

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Fire Resistant Cable Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Fire-resistant Paint Market Size and Share Forecast Outlook 2025 to 2035

Slip Resistant Shoes Market Insights - Trends & Forecast 2025 to 2035

Heat Resistant LED Light Market Analysis by End Use Industry, Material, and Region: Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA