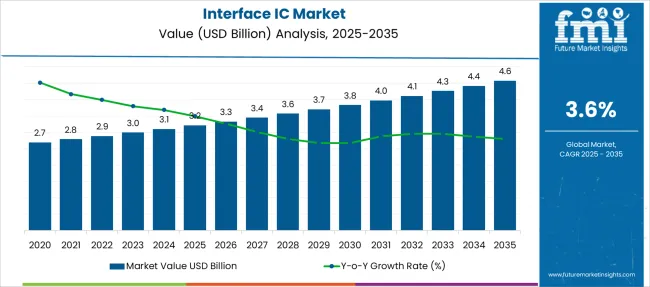

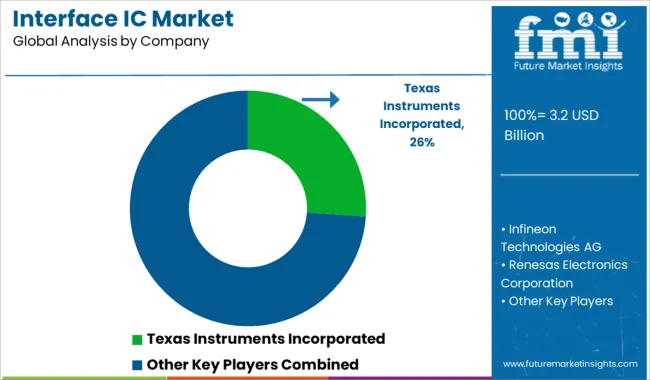

The Interface IC Market is estimated to be valued at USD 3.2 billion in 2025 and is projected to reach USD 4.6 billion by 2035, registering a compound annual growth rate (CAGR) of 3.6% over the forecast period.

| Metric | Value |

|---|---|

| Interface IC Market Estimated Value in (2025 E) | USD 3.2 billion |

| Interface IC Market Forecast Value in (2035 F) | USD 4.6 billion |

| Forecast CAGR (2025 to 2035) | 3.6% |

The interface IC market is experiencing significant growth, fueled by the increasing demand for efficient communication between various components in electronic devices. Advancements in consumer electronics, automotive systems, and industrial automation have led to greater integration needs, driving the adoption of interface ICs.

The rise of smart devices and IoT applications has further emphasized the importance of reliable and high-speed data transfer capabilities. Technological innovations have improved power efficiency and miniaturization, enabling the integration of interface ICs into compact devices.

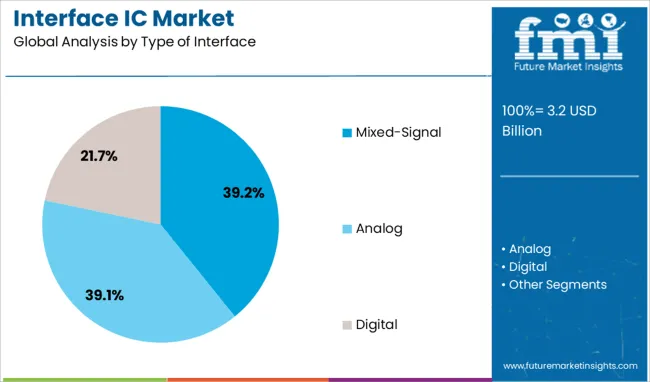

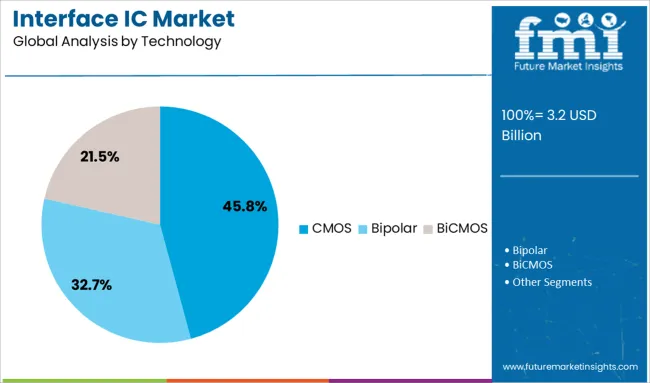

The shift toward mixed-signal processing has supported versatile interface requirements across analog and digital domains. Expansion in sectors such as telecommunications, computing, and automotive electronics is expected to sustain market momentum. Segmental growth is anticipated to be led by mixed-signal interface types, serial interface standards, and CMOS technology due to their efficiency and compatibility with modern electronic systems.

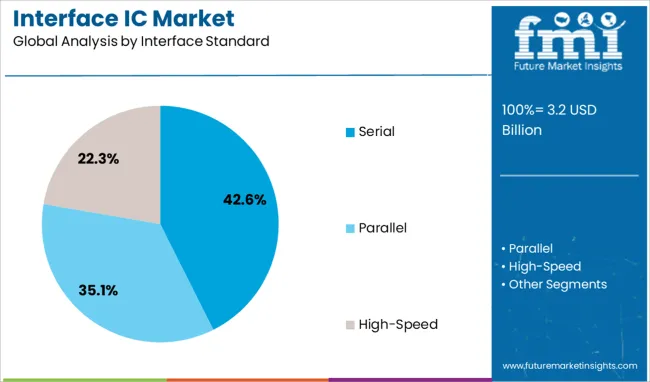

The interface IC market is segmented by type of interface, interface standard, technology, and end use and geographic regions. By type of interface, the interface market is divided into Mixed-Signal, Analog, and Digital. In terms of interface standards, the interface IC market is classified into Serial, Parallel, and High-Speed. Based on the technology of the interface, the IC market is segmented into CMOS, Bipolar, and BiCMOS. By end use of the interface, the market is segmented into Consumer electronics, Automotive, Industrial automation, Telecommunications, and Others. Regionally, the interface IC industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Mixed-Signal interface segment is projected to hold 39.2% of the interface IC market revenue in 2025, establishing itself as the leading interface type. This growth has been driven by the segment’s ability to handle both analog and digital signals, enabling seamless communication in complex electronic systems.

Mixed-signal ICs are essential in applications where precise signal processing and data conversion are required. The flexibility of these ICs to operate across multiple signal domains has made them preferable in consumer electronics, automotive sensors, and industrial controllers.

Their role in enhancing device performance while maintaining power efficiency has contributed to their adoption. As electronic systems continue to evolve toward greater integration, the Mixed-Signal segment is expected to retain its dominant position.

The Serial interface segment is expected to account for 42.6% of the market revenue in 2025, maintaining its position as the most widely used interface standard. Serial interfaces offer advantages in terms of reduced wiring complexity, cost-effectiveness, and support for high-speed data transmission over long distances.

These benefits have led to their widespread implementation in diverse applications including communication devices, automotive networks, and embedded systems. The adoption of serial protocols facilitates simplified system design and improved reliability.

The segment has also benefited from compatibility with emerging technologies and standards, further reinforcing its market leadership. With ongoing advancements and growing data transmission needs, the Serial interface segment is projected to sustain its market prominence.

The CMOS technology segment is projected to contribute 45.8% of the interface IC market revenue in 2025, securing its position as the leading technology type. CMOS technology offers low power consumption, high noise immunity, and excellent scalability, making it the preferred choice for interface IC fabrication.

The compatibility of CMOS with advanced semiconductor manufacturing processes has allowed for increased integration density and performance enhancements. Its widespread adoption across consumer electronics, telecommunications, and automotive industries has driven consistent demand.

Furthermore, CMOS-based ICs support the development of cost-effective and compact designs, aligning with the trend toward miniaturization in electronic devices. As innovation continues in semiconductor technologies, the CMOS segment is expected to maintain its leadership role in the interface IC market.

The interface IC market is growing due to demand from consumer electronics, automotive systems, and industrial automation, driven by connectivity and efficiency needs. Intense competition fosters innovation in high-bandwidth, low-power ICs with multi-protocol integration for diverse applications.

The interface IC market is witnessing strong demand driven by the widespread adoption of smartphones, tablets, and smart home devices. These ICs enable seamless connectivity between various components, ensuring efficient signal transmission for high-speed data transfer. Consumer preference for compact and multifunctional devices has fueled the integration of advanced interface solutions supporting HDMI, USB, and DisplayPort. Additionally, the surge in wearable devices and augmented reality platforms has intensified the need for low-power, high-efficiency interface ICs. Manufacturers are focusing on delivering products with enhanced compatibility to meet the evolving requirements of smart consumer electronics, reinforcing the market’s growth trajectory across both developed and emerging economies.

Automotive applications have emerged as a significant growth driver for interface IC adoption. With the increasing complexity of vehicle electronics, including infotainment systems, advanced driver-assistance systems (ADAS), and electric vehicle platforms, the demand for robust and reliable connectivity solutions is rising. Interface ICs ensure secure and high-speed communication between sensors, processors, and display modules, critical for real-time vehicle control and monitoring. Automakers are prioritizing solutions that can withstand harsh environments while supporting multiple protocols. This trend is shaping new opportunities for suppliers to develop automotive-grade ICs with extended temperature ranges, high durability, and compliance with stringent safety standards.

The industrial automation and control sector is increasingly leveraging interface ICs to achieve interoperability between complex systems. These ICs facilitate communication among programmable logic controllers (PLCs), sensors, and machinery, enhancing operational efficiency and real-time monitoring capabilities. As factories move toward highly connected and data-driven operations, demand for ICs that support industrial Ethernet, CAN, and other fieldbus protocols is escalating. Energy efficiency and high signal integrity are major considerations in these environments, creating opportunities for advanced interface solutions. Vendors are focusing on developing ICs that deliver robust performance under industrial conditions, meeting the needs of applications ranging from robotics to process automation.

The interface IC market is characterized by intense competition among established semiconductor manufacturers aiming to capture share through innovation and partnerships. Companies are investing in the development of ICs that support higher bandwidth, multi-protocol integration, and reduced power consumption. Strategic alliances with consumer electronics and automotive OEMs are common, ensuring early adoption of new products in high-growth sectors. Pricing strategies and regional manufacturing capabilities also influence competitive positioning. Additionally, advancements in packaging technology and miniaturization are enabling the creation of compact interface ICs tailored for portable devices. This competitive landscape highlights the importance of agility and customization to meet diverse application requirements globally.

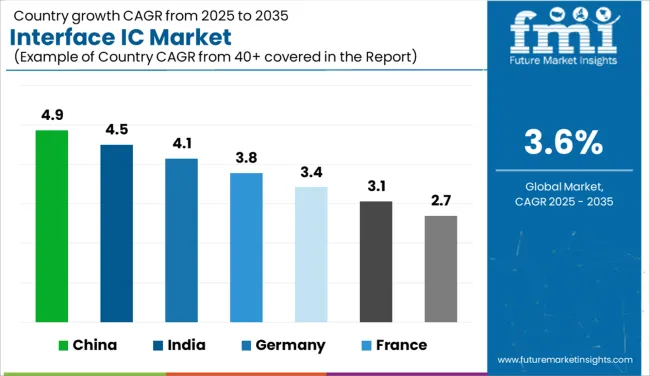

| Country | CAGR |

|---|---|

| China | 4.9% |

| India | 4.5% |

| Germany | 4.1% |

| France | 3.8% |

| UK | 3.4% |

| USA | 3.1% |

| Brazil | 2.7% |

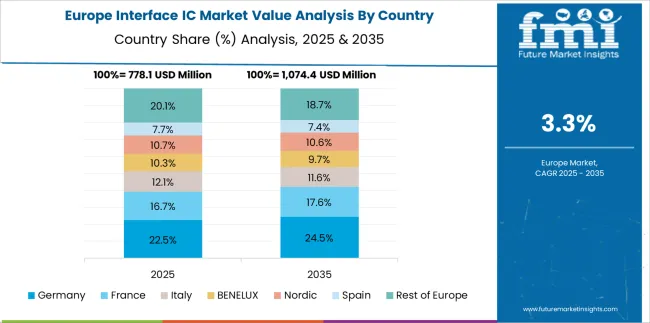

The interface IC market, projected to expand at a global CAGR of 3.6% between 2025 and 2035, shows varied growth across major economies. China leads with a 4.9% CAGR, supported by robust consumer electronics production and growing adoption of automotive electronics. India follows at 4.5%, driven by industrial automation and rising demand for smart devices across its expanding middle-class population. Germany posts a steady 4.1% CAGR, reflecting strong integration of interface ICs in automotive and industrial systems.

These regions are experiencing increased innovation in connectivity solutions for both consumer and industrial applications, reinforcing their strategic role in global semiconductor supply chains. The United Kingdom and the United States report comparatively moderate growth rates of 3.4% and 3.1%, respectively, driven by stable demand in sectors like IoT, automotive, and data centers. Growth in these markets is primarily tied to advancements in high-speed communication protocols and low-power IC design for next-generation devices.

While mature economies prioritize energy-efficient and high-performance solutions, emerging markets present opportunities for scaling cost-effective connectivity products. The interface IC segment continues to evolve globally, supported by diverse application areas ranging from consumer electronics to industrial automation. The analysis covers over 40 countries, with detailed insights on the top five highlighted here.

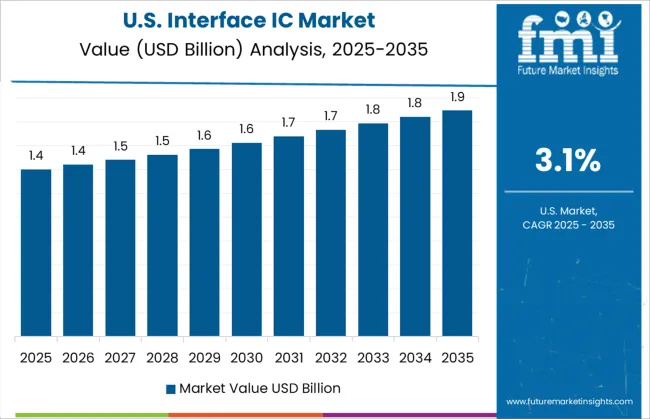

The CAGR for the interface IC market in the United States increased from nearly 2.7% in 2020–2024 to 3.1% during 2025–2035. This improvement is primarily driven by rising demand for advanced connectivity in IoT-enabled consumer electronics and automotive applications. Investments in electric vehicles and autonomous systems have further accelerated the requirement for high-speed, low-power IC solutions. Manufacturers are adopting interface ICs supporting multiple protocols like HDMI, USB, and LVDS for diverse applications, including infotainment and industrial automation. In addition, the USA sector’s emphasis on energy-efficient designs aligns with federal initiatives to modernize infrastructure and digital ecosystems, influencing greater integration of interface IC technology.

Germany witnessed a CAGR improvement from 3.6% in 2020–2024 to 4.1% in 2025–2035. This change is attributed to significant investments in automotive electronics, especially for electric and hybrid vehicles. The integration of advanced driver-assistance systems (ADAS) and digital dashboards has heightened demand for reliable interface IC solutions. Germany’s strong manufacturing ecosystem and Industry 4.0 adoption have also contributed to the rising deployment of ICs in automation and robotics. Vendors are focusing on producing automotive-grade ICs capable of withstanding harsh environments and meeting stringent EU safety compliance norms, making Germany a vital hub for interface IC production and development.

The CAGR in the United Kingdom moved from about 2.8% during 2020–2024 to 3.4% for 2025–2035, supported by increased integration of smart devices and connected home systems. Demand for energy-efficient interface solutions in consumer electronics and healthcare devices has surged due to strong adoption of telemedicine technologies. Government-backed digital transformation initiatives have promoted IoT device deployment across multiple sectors, creating a favorable environment for interface IC growth. The expansion of EV infrastructure has further encouraged automotive players to integrate high-performance connectivity ICs into advanced infotainment and control systems, strengthening market prospects across diverse applications in the UK

China’s interface IC market showed a significant jump in CAGR from 4.1% in 2020–2024 to 4.9% between 2025–2035. This growth is fueled by strong semiconductor manufacturing capabilities and escalating demand for advanced consumer electronics. Local OEMs are investing heavily in developing smart appliances and next-generation smartphones, which require efficient ICs for seamless connectivity. Rapid EV adoption and the expansion of 5G infrastructure have further accelerated the demand for high-bandwidth and multi-protocol IC solutions. Partnerships between Chinese firms and global chipmakers have enhanced supply chain resilience, ensuring cost-effective production and innovation for both domestic and export markets.

India’s CAGR surged from approximately 3.9% in 2020–2024 to 4.5% during 2025–2035. This increase is largely due to accelerated growth in consumer electronics manufacturing under government-led initiatives such as "Make in India." Rising penetration of smartphones, smart TVs, and wearables has fueled demand for advanced interface solutions. Industrial automation and the rollout of smart city projects have further contributed to market expansion. Semiconductor design hubs in India are focusing on low-power IC solutions tailored for portable devices, supported by increased foreign direct investment in chip design and assembly units. The shift toward local manufacturing to reduce import dependency has positioned India as a promising market.

The interface IC market is dominated by global semiconductor leaders who are consistently innovating to meet the growing demand for high-performance, energy-efficient solutions across automotive, industrial, and consumer electronics sectors. Texas Instruments Incorporated has established a strong presence through its comprehensive portfolio of interface ICs designed for automotive and industrial automation applications, leveraging advanced process technologies to enhance power efficiency.

Infineon Technologies AG continues to strengthen its market leadership by focusing on automotive-grade ICs and safety-compliant solutions for electric vehicles and ADAS systems, aligning with the global shift toward electrification. Renesas Electronics Corporation is investing in next-generation connectivity ICs tailored for IoT and automotive ecosystems, emphasizing compact designs and robust performance. Analog Devices, Inc. is widely recognized for its expertise in high-speed data transmission solutions, targeting communications and healthcare markets with precision-engineered IC products.

Microchip Technology Inc. complements the competitive landscape by providing versatile interface solutions optimized for embedded systems, consumer devices, and industrial automation platforms. These companies are actively pursuing strategic acquisitions, product line expansions, and partnerships with OEMs to strengthen their global distribution networks. Additionally, R&D investments are focused on creating multi-protocol, low-power interface ICs to cater to emerging applications in electric mobility, smart infrastructure, and connected ecosystems, reinforcing their positions as key enablers in the evolving semiconductor value chain.

In May 2024, Infineon Technologies AG launched a novel NFC I²C bridge tag for secure contactless device authentication, supporting IoT and interface IC markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.2 Billion |

| Type of Interface | Mixed-Signal, Analog, and Digital |

| Interface Standard | Serial, Parallel, and High-Speed |

| Technology | CMOS, Bipolar, and BiCMOS |

| End Use | Consumer electronics, Automotive, Industrial automation, Telecommunications, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Texas Instruments Incorporated, Infineon Technologies AG, Renesas Electronics Corporation, Analog Devices, Inc., and Microchip Technology Inc. |

| Additional Attributes | Dollar sales, share by product type and application, pricing trends, demand by end-user segments, key growth drivers, competitor strategies, regulatory standards, and emerging technology preferences to shape expansion and innovation plans. |

The global interface IC market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the interface IC market is projected to reach USD 4.6 billion by 2035.

The interface IC market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in interface IC market are mixed-signal, analog and digital.

In terms of interface standard, serial segment to command 42.6% share in the interface IC market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA