The LED light market is undergoing sustained expansion, driven by rising demand for energy-efficient lighting and global regulatory shifts favoring sustainable technologies. Reports from public energy agencies and lighting manufacturers have pointed to increasing replacement of traditional lighting systems with LEDs across residential, commercial, and industrial settings.

Significant improvements in luminous efficacy, durability, and reduced energy consumption have made LEDs a preferred solution among utilities and large-scale infrastructure projects. Government initiatives offering subsidies and phasing out incandescent lighting have accelerated adoption in both developed and emerging markets.

Additionally, technological advancements in smart lighting systems and integration with IoT platforms have expanded the value proposition of LED solutions beyond basic illumination. Global climate targets and corporate sustainability goals have further spurred the transition toward low-energy lighting in commercial operations. Moving forward, the market is expected to maintain its growth momentum as LED luminaries capture a larger share of lighting upgrades, e-commerce platforms drive product accessibility, and industrial applications lead demand due to infrastructure modernization and energy efficiency mandates.

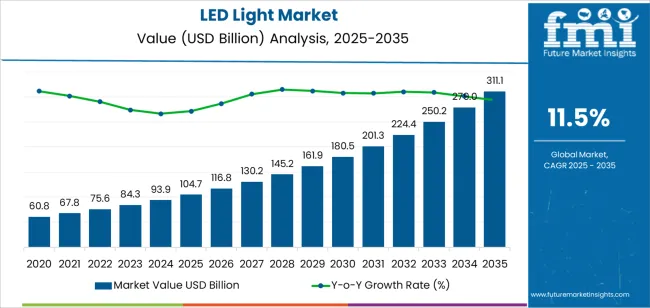

| Metric | Value |

|---|---|

| LED Light Market Estimated Value in (2025 E) | USD 104.7 billion |

| LED Light Market Forecast Value in (2035 F) | USD 311.1 billion |

| Forecast CAGR (2025 to 2035) | 11.5% |

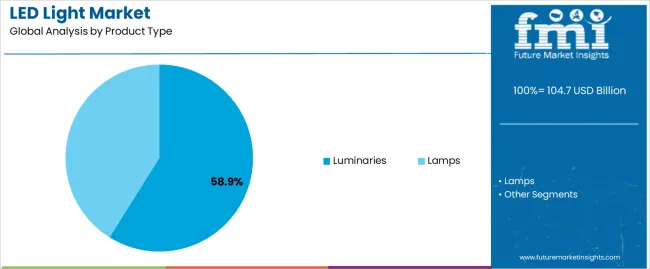

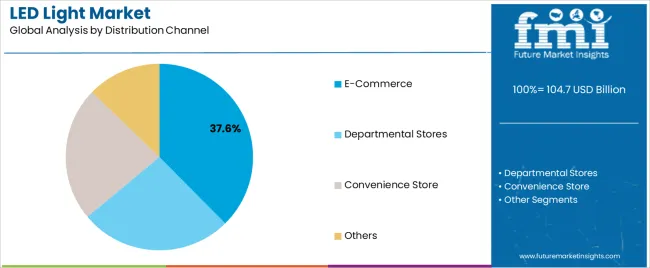

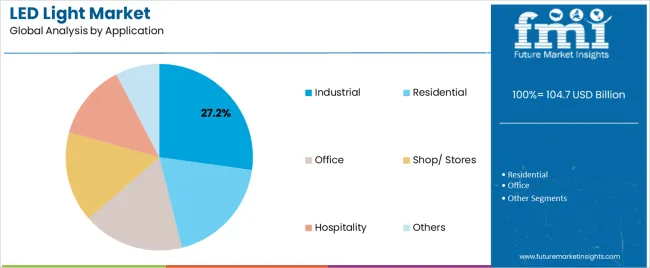

The market is segmented by Product Type, Distribution Channel, and Application and region. By Product Type, the market is divided into Luminaries and Lamps. In terms of Distribution Channel, the market is classified into E‑Commerce, Departmental Stores, Convenience Store, and Others. Based on Application, the market is segmented into Industrial, Residential, Office, Shop/ Stores, Hospitality, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Luminaries segment is projected to account for 58.9% of the LED light market revenue in 2025, holding its position as the leading product category. This dominance has been supported by widespread adoption of integrated lighting solutions that combine LED sources with housing and optics, offering higher efficiency, simplified installation, and aesthetic flexibility.

Industry bulletins and product portfolios from leading lighting manufacturers have emphasized the growing demand for complete luminaire systems across commercial and industrial installations. Upgrades in public lighting infrastructure, large-scale construction projects, and smart city initiatives have also favored the adoption of luminaries due to their advanced control features and energy-saving potential.

Furthermore, architectural lighting requirements and regulatory compliance with energy codes have pushed the market towards ready-to-install luminaire products over retrofit bulbs. As commercial developers and facility managers prioritize long-term cost savings and minimal maintenance, the Luminaries segment is expected to remain the core growth driver in the LED light market.

The E-Commerce segment is projected to contribute 37.6% of the LED light market revenue in 2025, making it the dominant distribution channel. Growth in this segment has been driven by shifting consumer behavior favoring digital purchasing channels, alongside increased online visibility of LED brands and product variants.

Lighting manufacturers have expanded their online presence through direct-to-consumer websites, third-party marketplaces, and retail partnerships, enabling broader geographic reach and lower distribution costs. E-commerce platforms have allowed customers to access detailed product specifications, certifications, and reviews, facilitating informed purchasing decisions.

Additionally, the growing penetration of mobile commerce and digital payments has made online platforms more accessible, particularly in emerging economies. Logistics advancements and the availability of installation support services have also made e-commerce a viable option for bulk and commercial purchases. As convenience, variety, and competitive pricing continue to influence buying decisions, the E-Commerce segment is expected to lead LED lighting distribution globally.

The Industrial segment is projected to represent 27.2% of the LED light market revenue in 2025, positioning it as the leading application category. Growth in this segment has been underpinned by the urgent need for energy efficiency, safety, and operational reliability across manufacturing, warehousing, and logistics facilities.

Industrial environments demand high-intensity lighting with minimal maintenance requirements, making LED solutions highly attractive due to their longevity, reduced heat output, and resistance to vibration. Industry reports and facility management insights have highlighted the growing use of high-bay and explosion-proof LED fixtures in heavy-duty operations.

Moreover, LED retrofitting has become a key strategy for industrial operators to lower energy costs and comply with increasingly strict energy consumption regulations. The integration of sensor-based and automated lighting systems has further enhanced the functionality of industrial LEDs, supporting real-time control and energy optimization. As industries move towards sustainability goals and smart factory models, the Industrial segment is expected to sustain strong adoption of advanced LED lighting solutions.

One significant barrier to the widespread adoption of LED lighting is the high initial investment required. Although LEDs offer cost savings over time through reduced energy consumption and maintenance, the upfront costs can be prohibitive for some consumers and businesses. This can slow down the transition from traditional lighting systems to LED solutions.

While LED technology has advanced considerably, there are still technical challenges that need to be addressed. Issues such as color consistency, heat dissipation, and the performance of LEDs in extreme temperatures can affect their reliability and lifespan. These technical limitations may deter some potential users from making the switch to LED lighting.

Although LEDs are generally considered environmentally friendly, their production involves certain materials that can be harmful if not properly managed. Concerns about the environmental impact of manufacturing and disposing of LEDs, especially regarding rare earth elements and other hazardous materials, can pose regulatory and reputational challenges for manufacturers.

The integration of LEDs with smart technology is a significant trend. Smart lighting systems, which can be controlled remotely via smartphones or automated through sensors, are gaining popularity. This trend is driven by the growing interest in smart homes and buildings, enhancing convenience and energy efficiency.

Beyond smart homes, connected lighting solutions are being implemented in smart cities and commercial buildings. These systems use IoT (Internet of Things) technology to manage and optimize lighting based on real-time data, improving energy efficiency and reducing operational costs.

With increasing awareness of environmental issues, energy-efficient and sustainable lighting solutions are in high demand. LEDs are at the forefront of this trend due to their low energy consumption and long lifespan. Companies are also focusing on developing LEDs with improved efficiency and lower environmental impact.

Continuous advancements in LED technology are enhancing performance and expanding applications. Innovations such as miniaturized LEDs, micro-LEDs, and OLEDs (organic LEDs) are opening new possibilities in lighting design and functionality, from consumer electronics to automotive lighting.

The LED light market is ripe with opportunities driven by technological advancements, sustainability initiatives, and evolving consumer preferences. The automotive industry continues to adopt LED lighting for both interior and exterior applications. Opportunities abound in developing advanced LED headlights, tail lights, and interior ambient lighting systems that enhance safety, aesthetics, and energy efficiency.

LEDs are increasingly used in health and well-being applications, such as horticultural lighting for plant growth and circadian rhythm lighting in healthcare settings. These specialized applications are benefiting from the precise control and efficiency of LED technology.

The global push towards sustainable and green building practices offers opportunities for LED lighting manufacturers. LEDs align with LEED (Leadership in Energy and Environmental Design) certification standards and other green building certifications, making them an attractive choice for new construction and renovations.

Continuous innovation in LED technology, such as the development of tunable and color-changing LEDs, presents opportunities to create new and differentiated products. This can cater to niche markets and specialized applications, further driving market growth.

The LED light market in the United States has seen significant growth and transformation in recent years. The government has been actively promoting energy-efficient lighting solutions to reduce energy consumption and carbon emissions. Initiatives such as Energy Star certification and the Energy Independence and Security Act have spurred the adoption of LED lighting in commercial, industrial, and residential sectors.

The integration of LED lights with smart technology, including sensors, controls, and IoT (Internet of Things) platforms, is a growing trend in the United States market. Smart lighting offers benefits such as energy savings, customization, and remote management, driving its adoption in smart homes, offices, and cities.

Cree is a prominent player in the United States LED lighting industry, known for its innovations in LED technology. The company has been focusing on expanding its product portfolio with high-performance LEDs for various applications, including automotive, horticulture, and general lighting.

The United Kingdom has been focusing on energy efficiency and sustainability, driving the adoption of LED lighting solutions. Government initiatives like the Energy Savings Opportunity Scheme (ESOS) and Carbon Reduction Commitment (CRC) Energy Efficiency Scheme encourage businesses to invest in energy-saving technologies, including LED lights.

Urban development projects, including street lighting upgrades, public building renovations, and infrastructure modernization, are driving the demand for LED lighting solutions. Local authorities and municipalities are increasingly investing in energy-efficient lighting to reduce operational costs and environmental impact.

LEDVANCE is a leading provider of LED lighting solutions in the United Kingdom, offering a wide range of products for residential, commercial, and industrial use. The company's recent developments include the introduction of tunable white LED luminaires, energy-saving LED bulbs, and smart lighting controls tailored to modern lighting requirements.

China has emerged as a global leader in LED manufacturing and exports. The country's robust manufacturing capabilities, technological expertise, and competitive pricing have fueled its dominance in the global LED market. Chinese LED companies have expanded their presence in international markets, leveraging opportunities in emerging economies and infrastructure projects.

The demand for smart lighting solutions integrated with IoT technology is on the rise in China. Smart LED lighting systems offer features like remote control, automation, energy management, and data analytics, enhancing user experience and energy efficiency. The growing smart home and smart city initiatives present lucrative opportunities for market growth.

FSL is a prominent player in the Chinese LED lighting industry, offering a wide range of LED luminaires for indoor and outdoor applications. The company's recent developments focus on energy-efficient LED fixtures, decorative lighting designs, and smart lighting systems compatible with IoT platforms. FSL's emphasis on product quality and design aesthetics appeals to both domestic and international markets.

LED lamps are at the forefront due to their significantly lower energy consumption compared to traditional lighting sources, making them a top choice for energy-conscious consumers and businesses. With reduced carbon footprint and no hazardous materials like mercury, LED lamps align with sustainability goals, appealing to environmentally conscious markets.

The extended lifespan of LED lamps, often exceeding 25,000 hours, outshines conventional bulbs, reducing replacement frequency and maintenance costs. While initial investment might be higher, the long-term cost savings from energy efficiency and reduced maintenance make LED lamps a financially wise choice.

LED lights offer significant energy savings in outdoor environments, such as streets, parking lots, and outdoor facilities, where lighting is required for extended periods. LED lights provide better visibility and color rendering, improving safety and security in outdoor areas, thus gaining favor in urban planning and infrastructure projects.

LED lights produce less light pollution and emit lower levels of CO2, aligning with sustainability goals and regulations for outdoor lighting. Government initiatives, standards, and incentives promoting energy-efficient outdoor lighting solutions contribute to the growth of the LED light market in the outdoor segment.

In the competitive landscape of the LED light market, companies are employing strategic partnerships and collaborations to enhance their product offerings and expand market reach. A key focus lies on energy efficiency, with heavy investments in research and development to develop LED lighting solutions meeting regulatory standards and appealing to environmentally conscious consumers.

The market is highly fragmented, with intense competition and constant innovation among small, medium, and large players. Brand building, marketing campaigns, and regulatory compliance are essential strategies for creating brand awareness, building customer trust, and ensuring market credibility in this dynamic and competitive landscape.

Industry Updates

Based on product type, the market is bifurcated into lamps and luminaries.

LED lights are sold through modern trade, departmental stores, convenience store, eCommerce, and other retail format.

LED lights find application in residential, office, industrial, shop/ stores, hospitality, outdoor, and architectural settings.

A regional analysis has been conducted across key countries of North America, Latin America, Europe, Asia Pacific, and the Middle East and Africa.

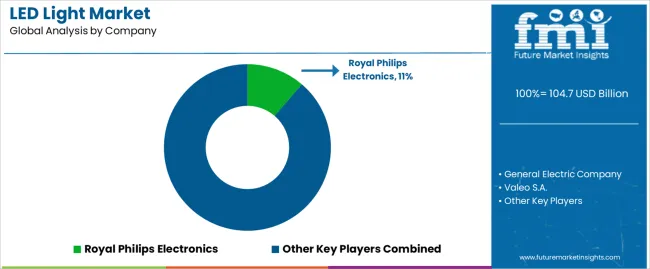

The global led light market is estimated to be valued at USD 104.7 billion in 2025.

The market size for the led light market is projected to reach USD 311.1 billion by 2035.

The led light market is expected to grow at a 11.5% CAGR between 2025 and 2035.

The key product types in led light market are luminaries and lamps.

In terms of distribution channel, e‑commerce segment to command 37.6% share in the led light market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

LED Light Tower Market Size and Share Forecast Outlook 2025 to 2035

LED Light Bar Market Analysis - Trends, Growth & Forecast 2025 to 2035

LED Lighting Controllers Market

LED Backlight Driver Market Size and Share Forecast Outlook 2025 to 2035

LED Backlight Display Driver ICs Market – Growth & Forecast 2025 to 2035

LED Neon Lights Market Size and Share Forecast Outlook 2025 to 2035

LED Grow Lights Market Analysis by Product, Installation Type, Application and Region Through 2035

LED and OLED lighting Products and Display Market – Growth & Forecast 2034

LED Displays, Lighting and Fixtures Market Size and Share Forecast Outlook 2025 to 2035

LED Driver for Lighting Market Analysis – Growth & Forecast 2025 to 2035

LED Modules and Light Engines Market Size and Share Forecast Outlook 2025 to 2035

LED Loading Dock Light Market Size and Share Forecast Outlook 2025 to 2035

OLED Lightening Panels Market

Africa LED & OLED Market Report – Growth & Forecast 2016-2026

Outdoor LED Lighting Market Size and Share Forecast Outlook 2025 to 2035

Heat Resistant LED Light Market Analysis by End Use Industry, Material, and Region: Forecast for 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Light Emitting Diode (LED) Backlight Display Market Size and Share Forecast Outlook 2025 to 2035

Chip-On-Board (COB) Light Emitting Diode (LED) Market Analysis and Forecast 2025 to 2035, By Application and Region

High-Brightness Light-Emitting Diodes (LED) Headlamps Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA