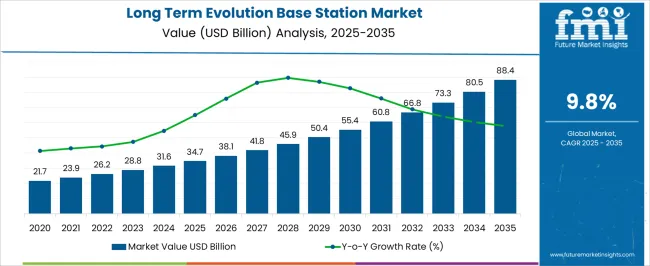

The long term evolution (LTE) base station market is projected to grow from USD 34.7 billion in 2025 to USD 88.4 billion by 2035, reflecting a compound annual growth rate (CAGR) of 9.8% over the ten years. The market expansion is being driven by the deployment of LTE infrastructure across urban and semi-urban areas, where telecom operators are prioritizing network capacity, coverage, and performance.

The year-on-year increase from USD 34.7 billion in 2025 to USD 50.4 billion by 2029 demonstrates that LTE base stations are being increasingly recognized as critical assets for mobile connectivity and data transmission efficiency. Equipment reliability, network scalability, and integration with existing communication infrastructure are being regarded as key factors influencing procurement decisions, positioning providers that emphasize robust performance and service continuity to capture substantial market share. By 2035, the LTE base station market is expected to reach USD 88.4 billion, highlighting that continuous deployment, network densification, and capacity upgrades are being adopted to accommodate growing data traffic and subscriber demand.

The ten-year growth comparison indicates that the market is being shaped by operators seeking high-performance equipment capable of supporting long-term operational efficiency. In this opinion, the CAGR of 9.8% reflects that the adoption of LTE base stations is being reinforced by the need for reliable network performance, latency reduction, and enhanced throughput. Providers prioritizing comprehensive service portfolios, end-to-end network management, and system resilience are likely to maintain a competitive advantage, establishing the LTE base station market as a strategically significant segment in global telecommunications infrastructure over the next decade.

| Metric | Value |

|---|---|

| Long Term Evolution Base Station Market Estimated Value in (2025 E) | USD 34.7 billion |

| Long Term Evolution Base Station Market Forecast Value in (2035 F) | USD 88.4 billion |

| Forecast CAGR (2025 to 2035) | 9.8% |

The LTE base station market commands a substantial share within its parent markets, reflecting its pivotal role in modern telecommunications infrastructure. Within the wireless telecom infrastructure market, LTE base stations constitute over 40%, underscoring their foundational importance in enabling mobile communication networks. In the mobile network equipment market, LTE base stations represent approximately 35%, highlighting their centrality in network deployment and expansion.

The telecommunications equipment market sees LTE base stations comprising around 30%, driven by their necessity in providing high-speed data services. In the 4G/LTE network deployment market, LTE base stations hold a dominant share, exceeding 60%, as they are integral to the establishment and enhancement of 4G networks. The base station antenna market has LTE base stations constituting about 25%, reflecting their essential role in facilitating wireless communication through effective signal transmission. These figures illustrate the significant influence of LTE base stations across various sectors, driven by their ability to support high-speed mobile broadband and accommodate increasing data traffic.

Despite challenges such as the ongoing rollout of 5G technologies, the LTE base station market continues to thrive, bolstered by the enduring demand for reliable and efficient mobile communication solutions. The market's growth trajectory is supported by factors such as continued investments in network infrastructure and the need for enhanced connectivity in both urban and rural areas.

The long term evolution (LTE) base station market is witnessing stable expansion, supported by ongoing network modernization, rising mobile data consumption, and increasing subscriber penetration. The current landscape is shaped by accelerated 4G deployments in developing regions and ongoing upgrades in mature markets to enhance coverage and capacity.

Market players are prioritizing investments in high-performance hardware, software optimization, and integration capabilities to ensure scalability and efficient spectrum utilization. Regulatory spectrum allocations and favorable government initiatives for digital infrastructure are further stimulating deployments.

Price competitiveness in equipment sourcing, coupled with advancements in antenna systems and signal processing, is enabling operators to meet quality-of-service targets while controlling capital expenditure Over the forecast period, continued urban densification, migration toward advanced LTE standards, and the coexistence of LTE with emerging 5G networks are expected to sustain market momentum, with strategic focus shifting toward energy efficiency, compact base station designs, and multi-technology integration to ensure long-term operational resilience.

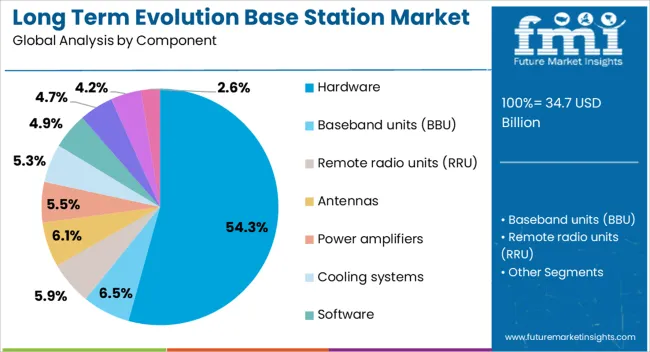

The long term evolution base station market is segmented by component, technology, provision, end use, and geographic regions. By component, long term evolution base station market is divided into Hardware, Baseband units (BBU), Remote radio units (RRU), Antennas, Power amplifiers, Cooling systems, Software, Base station controllers, Network management software, and Optimization tools.

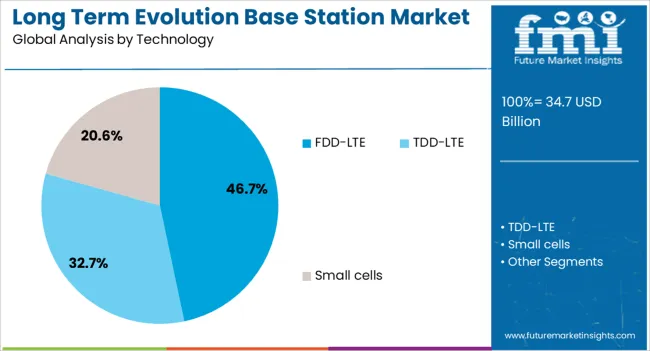

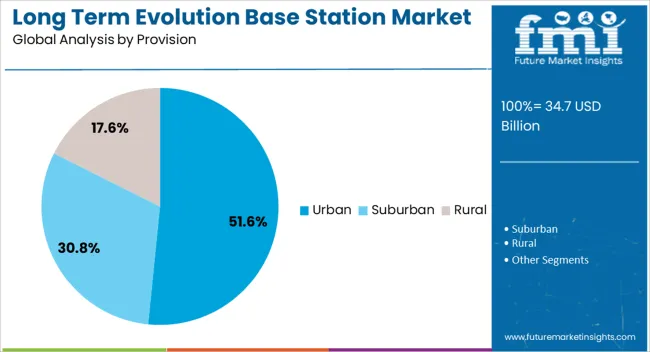

In terms of technology, long term evolution base station market is classified into FDD-LTE, TDD-LTE, and Small cells. Based on provision, long term evolution base station market is segmented into Urban, Suburban, and Rural. By end use, long term evolution base station market is segmented into Telecom operators, Residential & SOHO, Enterprise, and Government and public sector. Regionally, the long term evolution base station industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware segment, holding 54.30% of the component category, continues to lead due to its critical role in network infrastructure and performance delivery. Demand has been reinforced by the need for high-reliability transceivers, antennas, and signal processing units that ensure optimal coverage and capacity.

Technological improvements in radio frequency modules, power amplifiers, and cooling systems have enhanced operational efficiency, reducing downtime and extending equipment life cycles. Procurement strategies by telecom operators often prioritize hardware quality to ensure compliance with stringent network performance standards, especially in high-traffic areas.

Cost optimization is being achieved through modular designs and standardized components that simplify installation and maintenance As operators expand LTE coverage in both developed and emerging markets, the hardware segment is expected to maintain its dominance, supported by consistent capital investment in network upgrades and the integration of hardware platforms that are adaptable for future 5G evolution.

The FDD-LTE segment, representing 46.70% of the technology category, holds its leadership position due to widespread spectrum availability and its suitability for consistent voice and data services. This duplexing method allows simultaneous transmission and reception, making it a preferred choice for urban and suburban deployments where traffic demand is high.

The segment benefits from extensive ecosystem support, with mature chipset availability and proven interoperability across devices and networks. Deployment costs have been moderated by standardized network designs and compatibility with existing infrastructure, which reduces time-to-market for new rollouts.

Regulatory policies favoring efficient spectrum use have further strengthened adoption As operators aim to deliver higher quality-of-service levels and prepare for seamless 4G-5G coexistence, the FDD-LTE segment is projected to retain its strong market position, particularly in regions prioritizing network stability and service continuity.

The urban segment, accounting for 51.60% of the provision category, dominates due to concentrated population densities and high mobile data traffic. Operators in urban areas invest heavily in base station deployments to ensure seamless connectivity, reduce latency, and accommodate growing bandwidth requirements.

Infrastructure rollouts are strategically planned to optimize spectrum usage and enhance indoor and outdoor coverage, particularly in high-rise environments. Network densification through small cell integration and distributed antenna systems has been central to sustaining performance under heavy load conditions.

The segment’s growth is reinforced by continuous technological upgrades, public and private investment in smart city initiatives, and the adoption of advanced LTE features to meet evolving consumer expectations. Urban-focused deployment strategies will remain essential as cities continue to expand, supporting not only individual subscribers but also enterprise, IoT, and public service connectivity needs.

The LTE base station market is growing due to rising mobile data traffic, network expansion, and broadband demand. Opportunities exist in 5G transition, network densification, and smart city applications. Trends focus on energy-efficient, software-defined, and AI-enabled architectures, while high infrastructure costs and regulatory constraints pose challenges. Overall, the market is expected to expand steadily as operators invest in scalable, efficient, and high-performance LTE networks to meet growing connectivity needs worldwide.

The LTE base station market is witnessing strong demand due to exponential growth in mobile data traffic, smartphone penetration, and broadband connectivity needs. Operators are upgrading existing networks and expanding coverage to support 4G and hybrid LTE-5G deployments. Increased video streaming, cloud services, and IoT applications are driving the requirement for high-capacity, low-latency networks. Telecom providers are investing in scalable and energy-efficient base stations to ensure reliable coverage, network performance, and customer satisfaction. These factors collectively fuel sustained growth across developed and emerging regions.

Opportunities are emerging as operators deploy LTE base stations alongside 5G infrastructure for enhanced network densification. Small cells, macro cells, and heterogeneous networks are being integrated to improve capacity, coverage, and spectral efficiency. Rising investments in smart city projects, industrial IoT, and connected transportation systems create additional adoption avenues. Vendors offering multi-band, energy-efficient, and software-defined LTE solutions can capture premium segments. Expansion in rural and semi-urban areas, coupled with government initiatives to bridge digital divides, further enhances growth potential in the LTE base station market globally.

A notable trend is the adoption of energy-efficient, software-defined, and virtualized LTE base stations. Network function virtualization (NFV) and cloud-RAN technologies allow operators to optimize resources, reduce operational costs, and simplify network management. Integration with AI-driven analytics supports predictive maintenance, traffic optimization, and automated fault detection. Modular, flexible, and compact designs are increasingly deployed to meet urban densification requirements. These trends highlight a shift toward smarter, more adaptable LTE networks capable of supporting multi-technology operations while improving efficiency, sustainability, and user experience across diverse deployment scenarios.

The LTE base station market faces challenges due to high deployment costs, spectrum allocation issues, and stringent regulatory frameworks. Capital-intensive infrastructure investments, including towers, antennas, and backhaul networks, may limit adoption, especially in developing regions. Compliance with environmental, safety, and radiation standards adds complexity to planning and deployment. Additionally, network integration with legacy systems and coordination with multiple service providers may slow rollout timelines.

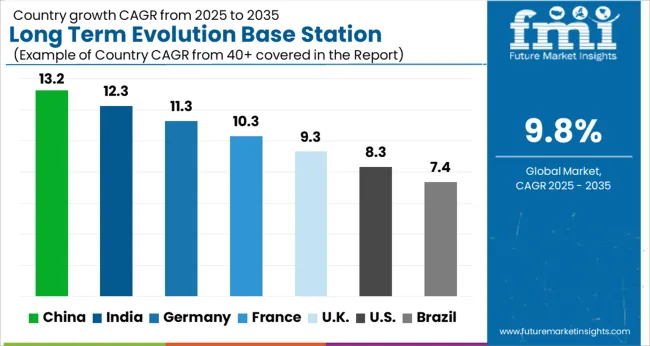

| Country | CAGR |

|---|---|

| China | 13.2% |

| India | 12.3% |

| Germany | 11.3% |

| France | 10.3% |

| UK | 9.3% |

| USA | 8.3% |

| Brazil | 7.4% |

The global long term evolution (LTE) base station market is projected to grow at a CAGR of 9.8% from 2025 to 2035. China leads with a growth rate of 13.2%, followed by India at 12.3% and France at 10.3%. The United Kingdom is expected to expand at 9.3%, while the United States shows steady growth at 8.3%. Rising demand for high-speed mobile connectivity, increasing smartphone penetration, and expansion of 4G networks drive global LTE base station deployment. Emerging markets such as China and India benefit from growing telecommunications infrastructure and government initiatives supporting digital connectivity. Mature markets including the USA, UK, and France focus on network densification, spectrum optimization, and advanced service offerings. Overall, enterprise and consumer demand for faster data and reliable mobile networks underpins LTE base station growth worldwide. This report includes insights on 40+ countries; the top markets are shown here for reference.

The long term evolution base station market in China is projected to grow at a CAGR of 13.2%. Deployment is driven by the rapid expansion of 4G networks and increasing smartphone penetration across urban and semi-urban areas. Telecommunications providers are investing heavily in base station infrastructure, network densification, and spectrum management to support growing mobile data traffic. The integration of IoT, smart city initiatives, and enterprise digitalization further accelerates LTE adoption. Government policies encouraging network modernization and digital connectivity enhance investment confidence. China’s proactive expansion of telecom infrastructure and strong domestic manufacturing capabilities position it as the leading growth market globally.

The long term evolution base station market in India is expected to grow at a CAGR of 12.3%. Expansion is fueled by increasing smartphone usage, rising mobile data consumption, and government-backed digital connectivity programs. Telecom operators are deploying additional LTE base stations to strengthen network coverage, improve speed, and reduce congestion. Investment in rural and semi-urban network infrastructure further supports adoption. The enterprise sector’s growing reliance on mobile data, IoT applications, and cloud services contributes to LTE base station demand. India’s combination of urbanization, digital initiatives, and telecom industry investments positions it as a key emerging market for LTE base station deployment.

The long term evolution base station market in France is projected to grow at a CAGR of 10.3%. Adoption is driven by urban and suburban network densification, increasing mobile data traffic, and consumer demand for high-speed connectivity. Telecom providers focus on upgrading legacy infrastructure, expanding 4G coverage, and integrating LTE with advanced network solutions. Growth in enterprise digital services, mobile commerce, and smart city applications supports base station deployment. Regulatory compliance for spectrum management and service quality ensures efficient network operations. France’s established telecom infrastructure and emphasis on connectivity improvements sustain steady LTE base station market growth.

The long term evolution base station market in the United Kingdom is forecast to grow at a CAGR of 9.3%. Adoption is supported by increasing consumer demand for faster mobile connectivity, 4G network coverage expansion, and rising mobile data traffic. Telecom operators are investing in infrastructure upgrades, advanced LTE equipment, and spectrum optimization to meet service requirements. Enterprise adoption of mobile solutions, cloud services, and IoT applications further drives base station deployment. While growth is moderate compared to China and India, the UK market benefits from mature telecommunications infrastructure, regulatory support, and rising digital adoption across urban centers.

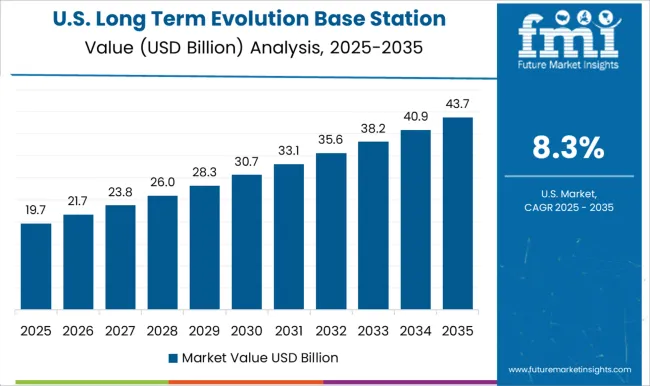

The long term evolution base station market in the United States is expected to expand at a CAGR of 8.3%. Deployment is driven by high mobile data consumption, rising smartphone penetration, and demand for seamless connectivity. Telecom providers focus on upgrading legacy networks, densifying LTE infrastructure, and integrating advanced service features. Growth in enterprise mobility, IoT adoption, and mobile commerce applications supports base station deployment. Regulatory frameworks ensure spectrum efficiency, service quality, and network reliability. Although growth is slower than in emerging markets, the USA market remains critical due to mature telecommunications infrastructure and strong enterprise reliance on high-speed mobile connectivity.

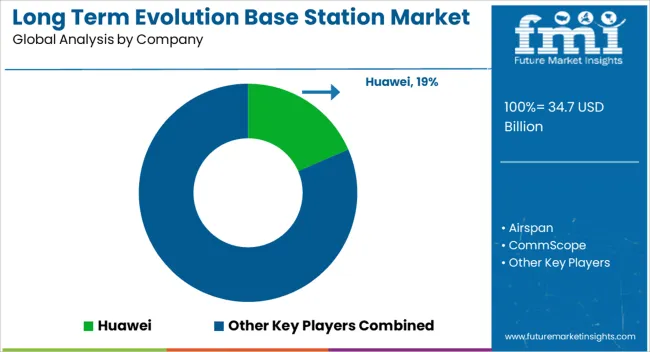

The long term evolution (LTE) base station market is being shaped by leading telecom equipment manufacturers and semiconductor providers focusing on high-capacity, low-latency, and energy-efficient network solutions. Huawei and Ericsson lead with advanced LTE base stations that support macro, micro, and small cell deployments, emphasizing reliability, scalability, and remote management capabilities. Nokia and NEC differentiate through modular and software-defined solutions, enabling operators to optimize network performance and reduce operational costs.

Samsung and ZTE focus on high-throughput, next-generation LTE platforms tailored for dense urban and high-traffic environments, highlighting energy efficiency and flexible deployment options. Other key players, including Airspan, CommScope, Motorola, and Qualcomm, provide integrated hardware and software solutions for LTE infrastructure, emphasizing interoperability, network security, and ease of deployment.

| Item | Value |

|---|---|

| Quantitative Units | USD 34.7 Billion |

| Component | Hardware, Baseband units (BBU), Remote radio units (RRU), Antennas, Power amplifiers, Cooling systems, Software, Base station controllers, Network management software, and Optimization tools |

| Technology | FDD-LTE, TDD-LTE, and Small cells |

| Provision | Urban, Suburban, and Rural |

| End Use | Telecom operators, Residential & SOHO, Enterprise, and Government and public sector |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Huawei, Airspan, CommScope, Ericsson, Motorola, NEC, Nokia, Qualcomm, Samsung, and ZTE |

| Additional Attributes | Dollar sales by base station type (macro, micro, pico, femto) and deployment mode (indoor, outdoor) are key metrics. Trends include rising demand for high-capacity, low-latency networks, adoption in urban and rural areas, and growth in 4G and hybrid 4G/5G deployments. Regional adoption, technological advancements, and network densification strategies are driving market growth. |

The global long term evolution base station market is estimated to be valued at USD 34.7 billion in 2025.

The market size for the long term evolution base station market is projected to reach USD 88.4 billion by 2035.

The long term evolution base station market is expected to grow at a 9.8% CAGR between 2025 and 2035.

The key product types in long-term evolution base station market are hardware, baseband units (BBU), remote radio units (RRU), antennas, power amplifiers, cooling systems, software, base station controllers, network management software and optimization tools.

In terms of technology, the FDD-LTE segment is expected to command a 46.7% share in the long-term evolution base station market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Long Wave Infrared Supercontinuum Laser Market Forecast and Outlook 2025 to 2035

Long-range Camera Market Forecast and Outlook 2025 to 2035

Long-Acting Beta-Agonists Market Size and Share Forecast Outlook 2025 to 2035

Long Haul Solutions Market Size and Share Forecast Outlook 2025 to 2035

Long-Acting Monoclonal Antibodies Market Insights – Trends & Forecast 2024-2034

Long Term Post-Acute Care Software Market Size and Share Forecast Outlook 2025 to 2035

Long-term Care Software Market Size and Share Forecast Outlook 2025 to 2035

Oblong Tub Lids Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of Oblong Tub Lids Product Providers

Oblong Jar Market

Oblong Container Market

EU Longevity Supplements Sales Analysis Size and Share Forecast Outlook 2025 to 2035

Curcuma Longa (Turmeric) Root Extract Market Size and Share Forecast Outlook 2025 to 2035

Complementary and Alternative Medicine for Anti Aging & Longetivity Market Size and Share Forecast Outlook 2025 to 2035

Terminal Brushing & Greasing Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Termite Bait Systems Market Size and Share Forecast Outlook 2025 to 2035

Terminal Sterilization Services Market Size and Share Forecast Outlook 2025 to 2035

Terminal Management System Market Size, Share, and Forecast 2025 to 2035

Termite Bait Products Market Trends - Growth & Forecast 2025 to 2035

Terminal Sterilization Market - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA